444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India home furnishing market represents one of the most dynamic and rapidly evolving sectors within the country’s retail landscape. This comprehensive market encompasses a diverse range of products including furniture, home décor items, textiles, lighting solutions, and various accessories that enhance residential and commercial spaces. Market dynamics indicate robust growth driven by increasing urbanization, rising disposable incomes, and evolving consumer preferences toward modern living spaces.

Consumer behavior patterns have shifted significantly in recent years, with Indian households increasingly investing in quality home furnishing products. The market demonstrates strong growth momentum with a projected CAGR of 12.5% over the forecast period, reflecting the sector’s resilience and adaptability to changing market conditions. Digital transformation has played a crucial role in market expansion, with online platforms capturing approximately 35% market share in urban areas.

Regional variations across India showcase distinct preferences and purchasing patterns, with metropolitan cities leading adoption of contemporary designs while tier-2 and tier-3 cities maintain preference for traditional aesthetics. The market’s evolution reflects broader socioeconomic changes, including nuclear family structures, increased women workforce participation, and growing awareness of interior design trends through digital media exposure.

The India home furnishing market refers to the comprehensive ecosystem of products, services, and retail channels dedicated to enhancing residential and commercial interior spaces across the Indian subcontinent. This market encompasses traditional furniture manufacturing, modern home décor solutions, textile products, lighting systems, and innovative space optimization products designed to meet diverse consumer preferences and cultural requirements.

Market scope extends beyond basic furniture to include sophisticated interior design solutions, smart home integration products, and sustainable furnishing alternatives. The sector represents a convergence of traditional Indian craftsmanship with contemporary design philosophies, creating unique product offerings that cater to both domestic and international markets. Value chain integration includes manufacturing, distribution, retail, and after-sales services, creating a comprehensive market ecosystem.

Cultural significance plays a vital role in market definition, as Indian consumers often seek products that reflect regional aesthetics, religious considerations, and family traditions while embracing modern functionality and design innovation.

Strategic market analysis reveals the India home furnishing market as a high-growth sector characterized by increasing consumer sophistication, technological integration, and evolving retail landscapes. The market benefits from favorable demographic trends, including a growing middle class, increasing urbanization rates, and rising household formation rates across major metropolitan areas.

Key growth drivers include the real estate sector’s expansion, government initiatives promoting housing development, and increasing consumer awareness of interior design importance. The market demonstrates strong resilience with organized retail penetration reaching approximately 28% of total market share, indicating significant opportunities for further formalization and growth.

Digital transformation has emerged as a critical success factor, with e-commerce platforms experiencing 45% year-over-year growth in home furnishing categories. This digital shift has enabled smaller manufacturers and artisans to access broader markets while providing consumers with enhanced product variety and competitive pricing options.

Market consolidation trends indicate increasing competition among established players while creating opportunities for innovative startups and niche market specialists. The sector’s evolution toward sustainable and eco-friendly products aligns with growing environmental consciousness among Indian consumers.

Consumer preference analysis reveals significant insights into purchasing behavior and market trends within the India home furnishing sector. The following key insights demonstrate market dynamics and growth opportunities:

Urbanization acceleration stands as the primary driver propelling the India home furnishing market forward. Rapid urban development creates consistent demand for residential furnishing solutions as millions of Indians migrate to cities seeking employment opportunities. This demographic shift generates substantial market demand across all product categories, from basic furniture to sophisticated home décor solutions.

Rising disposable incomes enable Indian households to allocate larger budgets toward home improvement and interior design projects. The expanding middle class demonstrates increasing willingness to invest in quality furnishing products that enhance living standards and reflect personal style preferences. Income growth patterns indicate sustained market expansion potential across multiple consumer segments.

Nuclear family trends contribute significantly to market growth as traditional joint family structures evolve toward smaller household units. This demographic transition creates increased demand for complete home furnishing solutions as new households require comprehensive furniture and décor packages. Household formation rates continue accelerating, particularly in urban areas.

Real estate sector growth provides fundamental market support through consistent housing development projects across major Indian cities. New residential projects create immediate demand for furnishing solutions, while commercial real estate expansion drives demand for office and hospitality furnishing products. Construction activity maintains strong correlation with home furnishing market performance.

Digital media influence shapes consumer preferences and purchasing decisions through exposure to international design trends and lifestyle content. Social media platforms and home improvement shows create aspirational demand for modern furnishing solutions, driving market evolution toward contemporary aesthetics and innovative product categories.

High product costs present significant barriers to market penetration, particularly among price-sensitive consumer segments. Quality home furnishing products often require substantial initial investments, limiting accessibility for lower-income households. Price elasticity remains a critical factor influencing purchase decisions across various market segments, creating challenges for premium product positioning.

Unorganized sector dominance creates competitive pressures for organized retailers and manufacturers. Traditional furniture makers and local craftsmen often provide similar products at lower prices, though potentially with limited quality assurance and after-sales support. This market fragmentation complicates brand building and market consolidation efforts.

Logistics and distribution challenges impact market efficiency, particularly for bulky furniture items requiring specialized transportation and handling. Last-mile delivery complications in congested urban areas and remote locations increase operational costs and customer service challenges. Supply chain optimization remains an ongoing concern for market participants.

Limited consumer awareness regarding product quality, design trends, and brand differentiation constrains market growth potential. Many consumers lack exposure to contemporary furnishing concepts and rely on traditional purchasing patterns. Education initiatives become necessary for market development and consumer sophistication.

Economic volatility affects consumer spending patterns on discretionary items like home furnishing products. Economic uncertainties can lead to delayed purchase decisions and reduced market demand during challenging periods. Market sensitivity to economic cycles requires strategic planning and flexible business models.

Tier-2 and tier-3 city expansion presents substantial growth opportunities as these markets demonstrate increasing purchasing power and exposure to modern lifestyle trends. These emerging markets offer less competitive environments and significant potential for market share capture. Geographic expansion strategies can unlock substantial revenue growth for established market players.

Sustainable product development creates differentiation opportunities as environmentally conscious consumers seek eco-friendly furnishing alternatives. Sustainable materials, renewable resources, and circular economy principles offer competitive advantages and align with global sustainability trends. Green product innovation can capture premium market segments and enhance brand positioning.

Technology integration opportunities include smart furniture, IoT-enabled home solutions, and augmented reality shopping experiences. These technological innovations can enhance customer engagement, improve operational efficiency, and create new revenue streams. Digital transformation enables market participants to reach broader audiences and optimize business operations.

Customization and personalization services address growing consumer demand for unique, tailored solutions that reflect individual preferences and space requirements. Mass customization capabilities can command premium pricing while building stronger customer relationships. Personalized offerings create competitive differentiation and customer loyalty.

Export market potential leverages India’s traditional craftsmanship and cost advantages to capture international market opportunities. Indian home furnishing products demonstrate strong appeal in global markets, particularly for handcrafted and artisanal items. International expansion can diversify revenue sources and reduce domestic market dependence.

Supply chain evolution demonstrates increasing sophistication as market participants invest in integrated manufacturing, distribution, and retail capabilities. Modern supply chain management enables better inventory control, reduced costs, and improved customer service levels. Operational efficiency improvements drive competitive advantages and profitability enhancement across the market ecosystem.

Consumer behavior shifts toward online research and omnichannel purchasing create new market dynamics requiring adaptive retail strategies. Traditional showroom models evolve to incorporate digital touchpoints and experiential elements that enhance customer engagement. Retail transformation reflects changing consumer expectations and technological capabilities.

Competitive intensity increases as both domestic and international players recognize India’s market potential and invest in expansion strategies. This competition drives innovation, improves product quality, and enhances customer service standards across the industry. Market maturation leads to consolidation trends and strategic partnerships.

Regulatory environment impacts market operations through quality standards, environmental regulations, and trade policies. Government initiatives supporting manufacturing and retail development create favorable conditions for market growth. Policy alignment with industry needs facilitates sustainable market expansion and investment attraction.

Technology adoption rates accelerate across all market segments, from manufacturing automation to customer relationship management systems. Digital technologies enable improved operational efficiency, better customer insights, and enhanced product development capabilities. Innovation cycles continue shortening as market participants embrace technological advancement.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive consumer surveys, industry expert interviews, and retail partner consultations across major Indian metropolitan areas. Data collection encompasses both quantitative metrics and qualitative insights to provide holistic market understanding.

Secondary research integration incorporates industry reports, government statistics, trade association data, and economic indicators to validate primary research findings. This multi-source approach ensures comprehensive market coverage and reduces potential bias in data interpretation. Information synthesis creates robust analytical foundations for market projections and strategic recommendations.

Market segmentation analysis examines consumer demographics, geographic variations, product categories, and price segments to identify distinct market opportunities and challenges. Segmentation insights enable targeted strategy development and resource allocation optimization. Analytical frameworks support strategic decision-making and market positioning strategies.

Trend analysis methodology combines historical data review with forward-looking indicators to identify emerging market patterns and growth trajectories. This temporal analysis provides context for current market conditions and supports reliable future projections. Predictive modeling enhances strategic planning capabilities and risk assessment processes.

Northern India markets demonstrate strong preference for traditional designs combined with modern functionality, reflecting the region’s cultural heritage and contemporary lifestyle aspirations. Delhi NCR leads market development with 22% regional market share, driven by high disposable incomes and cosmopolitan consumer preferences. Market characteristics include premium product demand and strong brand consciousness among urban consumers.

Western India regions showcase the highest market sophistication levels, with Mumbai and Pune leading adoption of international design trends and premium product categories. This region contributes approximately 28% of national market volume, reflecting strong economic development and consumer purchasing power. Innovation adoption rates exceed national averages across multiple product categories.

Southern India markets demonstrate balanced growth across traditional and contemporary product segments, with Bangalore and Chennai driving technology integration in home furnishing solutions. The region shows strong preference for sustainable and eco-friendly products, aligning with environmental consciousness trends. Regional preferences include natural materials and minimalist design aesthetics.

Eastern India development shows emerging market potential with Kolkata leading regional growth initiatives. While currently representing smaller market share, this region demonstrates strong growth momentum and increasing consumer sophistication. Market development opportunities exist across all product categories and price segments.

Tier-2 and tier-3 cities across all regions show accelerating market development with 18% annual growth rates in organized retail penetration. These markets present significant expansion opportunities for established players seeking geographic diversification and market share growth.

Market leadership reflects a diverse competitive environment with both established domestic players and international brands competing across various segments. The competitive landscape demonstrates increasing consolidation trends while maintaining opportunities for niche specialists and innovative startups.

Competitive strategies focus on product innovation, customer experience enhancement, and supply chain optimization to maintain market position and drive growth. Market differentiation occurs through design innovation, quality positioning, and customer service excellence.

Product category segmentation reveals distinct market dynamics and growth patterns across various home furnishing segments. Each category demonstrates unique consumer preferences, price sensitivity levels, and competitive characteristics that influence market strategies and positioning approaches.

By Product Type:

By Price Segment:

By Distribution Channel:

Furniture category analysis reveals strong demand for space-efficient and multifunctional designs reflecting urban living constraints and changing lifestyle patterns. Modular furniture gains popularity among younger consumers seeking flexibility and customization options. Storage solutions demonstrate particularly strong growth as urban apartments require efficient space utilization strategies.

Home textiles segment shows increasing sophistication with consumers seeking coordinated color schemes and premium fabric qualities. Seasonal demand patterns create opportunities for targeted marketing campaigns and inventory management optimization. Sustainable and organic textile options gain market traction among environmentally conscious consumers.

Lighting solutions category experiences transformation through LED technology adoption and smart home integration capabilities. Energy efficiency becomes a primary purchase criterion while decorative lighting gains importance in interior design schemes. This segment demonstrates strong correlation with real estate development cycles and renovation activities.

Kitchen and dining products reflect changing food consumption patterns and cooking preferences among Indian households. Premium cookware and specialized kitchen gadgets show strong growth as cooking becomes both necessity and hobby for urban consumers. Health-conscious trends drive demand for non-toxic and sustainable kitchen products.

Home décor accessories demonstrate the highest growth potential with impulse purchase characteristics and frequent replacement cycles. This category benefits from social media influence and seasonal gifting occasions. Artisanal and handcrafted items command premium pricing while supporting traditional craftsmanship preservation.

Manufacturers benefit from expanding market opportunities across diverse consumer segments and geographic regions. The growing market enables production scale economies, innovation investment, and brand building initiatives that enhance competitive positioning. Operational advantages include improved supply chain efficiency and technology integration capabilities.

Retailers gain from increasing consumer sophistication and willingness to invest in quality home furnishing products. Market growth supports retail expansion strategies, inventory diversification, and customer service enhancement initiatives. Digital transformation opportunities enable omnichannel retail strategies and improved customer engagement.

Consumers receive enhanced product variety, competitive pricing, and improved quality standards as market competition intensifies. Service improvements include better after-sales support, customization options, and convenient shopping experiences across multiple channels. Technology integration provides better product information and decision-making support.

Suppliers and vendors benefit from stable demand growth and opportunities for long-term partnership development with established market players. Supply chain integration creates efficiency improvements and cost optimization opportunities while supporting business growth and expansion plans.

Economic stakeholders gain from employment generation, skill development, and export potential within the home furnishing sector. The market contributes to GDP growth, tax revenues, and foreign exchange earnings through both domestic consumption and international trade activities. Industry development supports broader economic diversification and manufacturing sector strengthening.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable furnishing adoption emerges as a dominant trend with consumers increasingly prioritizing eco-friendly materials and manufacturing processes. This trend reflects growing environmental awareness and willingness to pay premium prices for sustainable products. Circular economy principles gain traction through furniture recycling, upcycling, and modular design approaches that extend product lifecycles.

Smart home integration transforms traditional furniture into technology-enabled solutions with IoT connectivity, wireless charging capabilities, and automated functionality. Connected furniture appeals particularly to tech-savvy urban consumers seeking convenience and modern lifestyle integration. This trend creates new product categories and premium pricing opportunities.

Minimalist design philosophy influences consumer preferences toward clean lines, neutral colors, and multifunctional furniture that maximizes space efficiency. This aesthetic trend aligns with urban living constraints and modern lifestyle preferences. Scandinavian and Japanese design influences gain popularity among Indian consumers seeking sophisticated simplicity.

Customization and personalization become standard expectations rather than premium services as consumers seek unique solutions reflecting individual style and space requirements. Mass customization technologies enable cost-effective personalization while maintaining manufacturing efficiency and competitive pricing structures.

Omnichannel retail evolution integrates online and offline shopping experiences through virtual showrooms, augmented reality visualization, and seamless purchase processes. Digital-physical integration enhances customer engagement and reduces purchase uncertainty for high-involvement products like furniture and home décor items.

Technology integration initiatives reshape manufacturing processes through automation, artificial intelligence, and data analytics implementation. Leading manufacturers invest in smart factory technologies that improve production efficiency, quality control, and customization capabilities. Industry 4.0 adoption enables responsive manufacturing and reduced time-to-market for new product introductions.

Strategic partnerships between manufacturers, retailers, and technology companies create comprehensive market solutions and enhanced customer experiences. These collaborations enable resource sharing, market access expansion, and innovation acceleration. Ecosystem development supports market growth and competitive advantage creation.

Sustainability initiatives drive industry-wide adoption of environmentally responsible practices including renewable materials, energy-efficient manufacturing, and waste reduction programs. Green certification programs gain importance as consumer awareness and regulatory requirements increase environmental compliance expectations.

Export market expansion strategies leverage India’s manufacturing advantages and design capabilities to capture international opportunities. Government support through trade promotion and quality certification programs facilitates global market access. International recognition of Indian home furnishing products enhances brand credibility and market positioning.

Investment attraction from both domestic and international investors supports market expansion, technology upgradation, and capacity enhancement initiatives. Capital infusion enables market participants to pursue aggressive growth strategies and competitive positioning improvements.

Market entry strategies should prioritize tier-2 and tier-3 cities where competition remains limited and consumer sophistication continues developing. New market entrants can establish strong positions through localized product offerings and competitive pricing strategies. Geographic expansion provides sustainable growth opportunities with lower market entry barriers.

Digital transformation investment becomes essential for long-term competitiveness as consumer behavior shifts toward online research and omnichannel purchasing. Companies should develop comprehensive digital strategies including e-commerce capabilities, social media marketing, and customer relationship management systems. Technology adoption enables market share capture and operational efficiency improvements.

Sustainability integration should become core business strategy rather than peripheral initiative as environmental consciousness influences purchase decisions. Companies investing early in sustainable practices gain competitive advantages and premium positioning opportunities. Environmental responsibility enhances brand reputation and customer loyalty development.

Partnership development with complementary businesses creates market synergies and resource optimization opportunities. Strategic alliances with real estate developers, interior designers, and technology companies expand market reach and service capabilities. Collaborative strategies accelerate growth while reducing individual investment requirements.

According to MarkWide Research analysis, companies should focus on customer experience enhancement through personalized services, quality assurance, and comprehensive after-sales support. Customer-centric approaches build brand loyalty and support premium pricing strategies in competitive market environments.

Market trajectory indicates sustained growth momentum driven by demographic advantages, economic development, and evolving consumer preferences. The India home furnishing market demonstrates resilience and adaptability that support long-term expansion prospects. Growth projections suggest continued market evolution toward organized retail and premium product segments.

Technology integration will accelerate across all market segments, from manufacturing automation to customer engagement platforms. Smart home trends and IoT adoption create new product categories while enhancing traditional furniture functionality. Innovation cycles continue shortening as market participants embrace technological advancement and digital transformation.

Sustainability imperatives will reshape industry practices and consumer expectations, driving demand for eco-friendly materials and circular economy solutions. Companies prioritizing environmental responsibility gain competitive advantages and regulatory compliance benefits. Green market segments demonstrate premium pricing potential and customer loyalty development opportunities.

Regional market development will expand beyond metropolitan areas as tier-2 and tier-3 cities demonstrate increasing purchasing power and lifestyle aspirations. This geographic expansion creates substantial growth opportunities for established players and new market entrants. Market democratization supports overall industry growth and development.

Export market potential leverages India’s manufacturing capabilities and design heritage to capture international opportunities. Government support and quality improvement initiatives enhance global competitiveness and market access. International expansion provides revenue diversification and growth acceleration opportunities for Indian home furnishing companies.

The India home furnishing market represents a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographic trends, economic development, and changing consumer preferences. Market analysis reveals strong fundamentals supporting sustained expansion across multiple product categories, price segments, and geographic regions.

Strategic opportunities exist for market participants willing to invest in technology integration, sustainability initiatives, and customer experience enhancement. The market’s evolution toward organized retail, digital transformation, and premium product segments creates competitive advantages for forward-thinking companies. Market leadership requires comprehensive strategies addressing consumer needs, operational efficiency, and innovation capabilities.

Future success depends on adaptability to changing market conditions, consumer preferences, and technological advancement. Companies embracing digital transformation, sustainability principles, and customer-centric approaches position themselves for long-term growth and competitive advantage. The India home furnishing market offers compelling opportunities for sustainable business development and value creation across the entire industry ecosystem.

What is Home Furnishing?

Home furnishing refers to the various products and materials used to decorate and furnish residential spaces, including furniture, textiles, and decorative items.

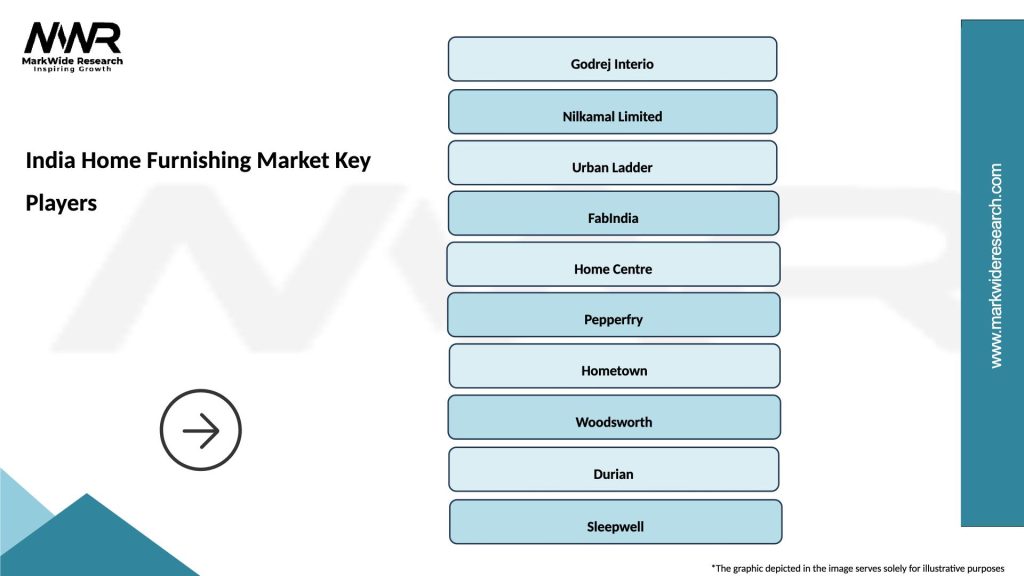

What are the key players in the India Home Furnishing Market?

Key players in the India Home Furnishing Market include companies like Godrej Interio, IKEA India, and Nilkamal, among others.

What are the main drivers of growth in the India Home Furnishing Market?

The growth of the India Home Furnishing Market is driven by increasing urbanization, rising disposable incomes, and a growing interest in home decor among consumers.

What challenges does the India Home Furnishing Market face?

Challenges in the India Home Furnishing Market include intense competition, fluctuating raw material prices, and changing consumer preferences.

What opportunities exist in the India Home Furnishing Market?

Opportunities in the India Home Furnishing Market include the expansion of e-commerce platforms, increasing demand for sustainable products, and the rise of smart home technologies.

What trends are shaping the India Home Furnishing Market?

Trends in the India Home Furnishing Market include a shift towards minimalistic designs, the incorporation of eco-friendly materials, and the growing popularity of customized furniture solutions.

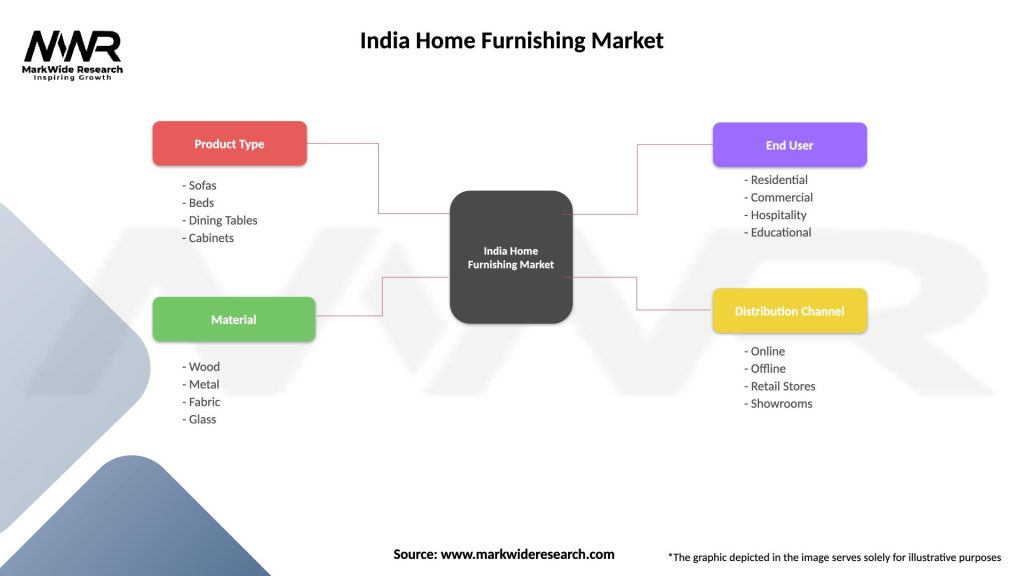

India Home Furnishing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Sofas, Beds, Dining Tables, Cabinets |

| Material | Wood, Metal, Fabric, Glass |

| End User | Residential, Commercial, Hospitality, Educational |

| Distribution Channel | Online, Offline, Retail Stores, Showrooms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Home Furnishing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at