444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India herbicide market represents one of the most dynamic and rapidly evolving segments within the country’s agricultural chemicals industry. Agricultural modernization across India has significantly increased the demand for effective weed management solutions, positioning herbicides as essential tools for farmers seeking to maximize crop yields and optimize farming efficiency. The market encompasses a diverse range of chemical formulations designed to control unwanted vegetation that competes with crops for nutrients, water, and sunlight.

Market dynamics indicate robust growth driven by increasing agricultural mechanization, rising labor costs, and growing awareness about the benefits of chemical weed control. The sector has witnessed substantial adoption of selective herbicides that target specific weed species while preserving crop plants, alongside non-selective herbicides used for total vegetation control in non-crop areas. With agriculture contributing significantly to India’s economy and employing a large portion of the population, the herbicide market plays a crucial role in supporting food security and agricultural productivity.

Regional distribution shows concentrated demand in major agricultural states including Punjab, Haryana, Uttar Pradesh, Maharashtra, and Karnataka, where intensive farming practices and high-value crop cultivation drive herbicide adoption. The market experiences seasonal fluctuations aligned with cropping patterns, with peak demand occurring during pre-planting and early growth stages of major crops including wheat, rice, cotton, sugarcane, and soybeans.

The India herbicide market refers to the comprehensive ecosystem of chemical weed control products, including their development, manufacturing, distribution, and application across the country’s diverse agricultural landscape. This market encompasses various herbicide categories designed to manage unwanted plant growth that interferes with crop production and agricultural operations.

Herbicides function through different modes of action, including inhibiting photosynthesis, disrupting protein synthesis, preventing cell division, or interfering with specific enzymatic processes essential for plant growth. The market includes both pre-emergence herbicides applied before weed germination and post-emergence herbicides used after weeds have sprouted, providing farmers with flexible weed management strategies tailored to specific crop requirements and weed pressure scenarios.

Market participants include multinational agrochemical companies, domestic manufacturers, distributors, retailers, and end-users comprising farmers, agricultural cooperatives, and commercial farming enterprises. The sector operates within a regulatory framework established by the Central Insecticides Board and Registration Committee, ensuring product safety, efficacy, and environmental compliance while supporting sustainable agricultural practices.

Strategic analysis reveals the India herbicide market as a high-growth sector experiencing significant transformation driven by agricultural modernization, changing farming practices, and evolving weed resistance patterns. The market benefits from strong government support for agricultural development, increasing crop intensification, and growing adoption of integrated pest management practices that incorporate chemical weed control as a key component.

Key market drivers include rising labor costs making manual weeding economically unviable, increasing awareness about herbicide benefits among farmers, expansion of commercial farming operations, and development of new herbicide formulations with improved efficacy and safety profiles. The sector shows particular strength in glyphosate-based products, which account for approximately 35% market share due to their broad-spectrum effectiveness and cost-efficiency.

Competitive landscape features both established multinational companies and emerging domestic players, with market leadership determined by product portfolio breadth, distribution network strength, technical support capabilities, and pricing strategies. Innovation focuses on developing herbicides with novel modes of action, reduced environmental impact, and enhanced selectivity for specific crop-weed combinations, positioning the market for sustained growth and technological advancement.

Market intelligence indicates several critical insights shaping the India herbicide sector’s trajectory and competitive dynamics:

Agricultural transformation serves as the primary catalyst driving India’s herbicide market expansion, with multiple interconnected factors contributing to sustained demand growth. Labor scarcity in rural areas has emerged as a critical driver, as traditional manual weeding becomes increasingly expensive and difficult to organize, particularly during peak agricultural seasons when labor demand across multiple crops creates competition and wage inflation.

Mechanization trends significantly influence herbicide adoption, as farmers investing in tractors, harvesters, and other machinery seek complementary technologies that maximize their equipment utilization and operational efficiency. The integration of precision agriculture practices, including GPS-guided spraying systems and variable rate application technologies, enhances herbicide effectiveness while reducing input costs and environmental impact.

Crop intensification driven by population growth and food security concerns necessitates higher yields per unit area, making effective weed management essential for achieving production targets. Government initiatives supporting agricultural modernization, including subsidies for farm inputs and promotion of best practices, create favorable conditions for herbicide market expansion. Additionally, climate change impacts alter weed species composition and growth patterns, requiring adaptive management strategies that often incorporate herbicide solutions for effective control.

Regulatory challenges pose significant constraints on the India herbicide market, with stringent registration requirements, safety assessments, and environmental impact evaluations creating barriers to new product introductions and market entry. Resistance development in weed populations threatens the long-term effectiveness of existing herbicide chemistries, requiring continuous investment in research and development of new modes of action and resistance management strategies.

Environmental concerns regarding herbicide residues in soil, water, and food products generate public scrutiny and regulatory pressure, potentially limiting usage in sensitive areas or crops destined for export markets with strict residue limits. Knowledge gaps among farmers regarding proper herbicide selection, application timing, and resistance management practices can lead to suboptimal results and contribute to resistance development.

Economic constraints affecting smallholder farmers, including limited access to credit and price volatility of agricultural commodities, can restrict herbicide purchases despite their proven benefits. Infrastructure limitations in rural areas, including inadequate storage facilities and transportation networks, create challenges for herbicide distribution and quality maintenance. Additionally, counterfeit products in the market undermine farmer confidence and legitimate manufacturer revenues while potentially causing crop damage and environmental harm.

Innovation opportunities abound in the India herbicide market, particularly in developing products tailored to local crop varieties, weed species, and farming conditions. Biological herbicides represent an emerging segment with significant potential, as environmentally conscious farmers and regulatory bodies increasingly favor sustainable alternatives to synthetic chemicals. The integration of digital agriculture technologies creates opportunities for precision herbicide application, reducing input costs while improving efficacy and environmental safety.

Market expansion into underserved regions and crops presents substantial growth potential, particularly in eastern and northeastern states where herbicide adoption remains relatively low despite significant agricultural activity. Export opportunities for Indian herbicide manufacturers are expanding as domestic production capabilities improve and international markets seek cost-effective solutions from reliable suppliers.

Partnership opportunities with agricultural cooperatives, farmer producer organizations, and government extension services can facilitate market penetration and farmer education initiatives. Value-added services including technical support, application training, and integrated pest management consulting create differentiation opportunities for market participants. The growing organic farming segment, while challenging for synthetic herbicides, opens opportunities for bio-based and naturally derived weed control solutions that align with organic certification requirements.

Supply chain dynamics in the India herbicide market reflect complex interactions between raw material availability, manufacturing capacity, distribution networks, and end-user demand patterns. Raw material sourcing challenges, particularly for active ingredients imported from China and other countries, create price volatility and supply security concerns that influence market stability and competitive positioning.

Seasonal demand fluctuations require sophisticated inventory management and production planning, with manufacturers building capacity to meet peak season requirements while managing working capital efficiently during low-demand periods. Regulatory dynamics continuously shape market conditions through new product approvals, label modifications, and safety reassessments that can significantly impact product availability and market share distribution.

Competitive dynamics intensify as domestic manufacturers expand capabilities and challenge established multinational companies through competitive pricing and localized product development. Technology transfer and licensing agreements facilitate market entry for international companies while providing domestic partners with access to advanced formulations and manufacturing processes. Market consolidation trends through mergers and acquisitions reshape competitive landscapes and create opportunities for operational synergies and market expansion.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings regarding the India herbicide market. Primary research involves extensive interviews with key stakeholders including herbicide manufacturers, distributors, retailers, farmers, agricultural experts, and regulatory officials to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, academic studies, trade association data, and company financial statements to validate primary findings and provide historical context for market developments. Quantitative analysis utilizes statistical methods to identify correlations, trends, and patterns in market data, while qualitative assessment provides deeper understanding of market dynamics and stakeholder perspectives.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews to clarify findings, and employing triangulation methods to ensure consistency and accuracy. Market modeling techniques incorporate various scenarios and assumptions to project future market conditions and identify potential risks and opportunities. MarkWide Research methodology emphasizes rigorous data collection and analysis standards to deliver actionable insights for market participants and stakeholders.

Northern India dominates the herbicide market with approximately 40% regional share, driven by intensive wheat and rice cultivation in Punjab, Haryana, and Uttar Pradesh. These states benefit from advanced agricultural infrastructure, high mechanization levels, and strong extension services that promote herbicide adoption. Punjab leads in per-hectare herbicide consumption due to labor scarcity and intensive cropping systems requiring effective weed management solutions.

Western India represents a significant market segment with 25% regional share, concentrated in Maharashtra and Gujarat where cotton, sugarcane, and horticultural crops drive herbicide demand. The region’s commercial farming orientation and higher income levels support premium product adoption and innovative application technologies. Maharashtra’s diverse cropping patterns create demand for specialized herbicides tailored to specific crop-weed combinations.

Southern India accounts for 20% market share with Karnataka, Andhra Pradesh, and Tamil Nadu leading consumption in rice, cotton, and plantation crops. The region shows growing adoption of selective herbicides and integrated weed management practices. Eastern India represents an emerging market with 15% share, where increasing awareness and agricultural development programs drive gradual herbicide adoption in West Bengal, Bihar, and Odisha’s rice-based farming systems.

Market leadership in India’s herbicide sector features a diverse mix of multinational corporations and domestic manufacturers competing across different segments and price points:

Competitive strategies emphasize product differentiation through formulation improvements, technical support services, farmer education programs, and strategic partnerships with distribution channels to enhance market reach and customer loyalty.

By Chemistry:

By Crop Type:

By Application Method:

Selective herbicides demonstrate the strongest growth trajectory with 12% annual expansion as farmers increasingly adopt precision agriculture practices requiring targeted weed control without crop damage. This category benefits from continuous innovation in chemistry and formulation technology, enabling development of highly specific products for particular crop-weed combinations. Cereal-specific herbicides dominate this segment, with rice and wheat applications driving the majority of demand.

Non-selective herbicides maintain stable market position with consistent demand for land preparation, fallow field management, and non-crop area maintenance. Glyphosate-based products lead this category due to their broad-spectrum activity, cost-effectiveness, and established safety profile, though resistance concerns drive interest in alternative chemistries and tank-mix strategies.

Bio-herbicides represent an emerging category with significant growth potential as environmental regulations tighten and consumer preferences shift toward sustainable agriculture. While currently representing a small market share, this segment shows 25% annual growth driven by organic farming expansion and integrated pest management adoption. Formulation innovations including encapsulated products, slow-release formulations, and adjuvant systems enhance herbicide performance while addressing environmental and safety concerns.

Farmers benefit from herbicide adoption through significant labor cost savings, improved crop yields, and enhanced operational efficiency. Weed control effectiveness enables farmers to achieve higher productivity per unit area while reducing physical labor requirements and operational complexity. Time savings from herbicide use allow farmers to focus on other critical farm management activities including nutrient management, pest monitoring, and harvest planning.

Manufacturers gain from growing market demand, opportunities for product innovation, and potential for premium pricing on specialized formulations. Research and development investments in new herbicide chemistries and formulations create competitive advantages and intellectual property assets. Strong distribution networks and technical support capabilities enhance customer loyalty and market share retention.

Distributors and retailers benefit from steady product demand, attractive margins, and opportunities to provide value-added services including technical advice and application support. Government stakeholders achieve agricultural productivity goals, food security objectives, and rural economic development through effective weed management technologies. Environmental benefits include reduced soil erosion from cultivation, lower fuel consumption from reduced tillage, and improved water use efficiency through reduced weed competition.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture adoption emerges as a transformative trend reshaping herbicide application practices through GPS-guided spraying systems, variable rate technology, and drone-based applications. These technologies enable farmers to optimize herbicide usage, reduce input costs, and minimize environmental impact while maintaining effective weed control. Digital platforms connecting farmers with technical experts and application services facilitate better decision-making and improved outcomes.

Resistance management becomes increasingly critical as weed populations develop tolerance to commonly used herbicides, driving demand for products with novel modes of action and integrated management strategies. Tank-mixing practices gain popularity as farmers combine multiple herbicides or add adjuvants to enhance efficacy and delay resistance development.

Sustainable agriculture trends influence herbicide selection toward products with improved environmental profiles, reduced persistence, and lower toxicity to non-target organisms. Bio-herbicide development accelerates as companies invest in naturally derived active ingredients and biological control agents. Formulation innovations focus on improving application convenience, reducing drift potential, and enhancing crop safety through advanced delivery systems and protective technologies.

Regulatory developments significantly impact market dynamics through new product registrations, label modifications, and safety reassessments affecting product availability and usage patterns. Recent approvals of new herbicide chemistries expand farmer options for resistance management and specialized applications, while restriction announcements for certain products create market shifts and substitution opportunities.

Manufacturing investments by both domestic and international companies expand production capacity and improve cost competitiveness. Technology partnerships between Indian manufacturers and global companies facilitate knowledge transfer and product development capabilities. Distribution network expansion through digital platforms and rural retail development improves market access and customer service capabilities.

Research collaborations between companies, universities, and government institutions advance herbicide science and develop solutions tailored to Indian agricultural conditions. MWR analysis indicates increasing focus on developing herbicides specifically for tropical crops and conditions prevalent in Indian agriculture. Sustainability initiatives drive development of environmentally friendly formulations and application technologies that align with global environmental standards and consumer preferences.

Market participants should prioritize investment in research and development of herbicides with novel modes of action to address growing resistance concerns and maintain long-term market viability. Strategic partnerships with agricultural cooperatives and farmer producer organizations can enhance market penetration and provide valuable feedback for product development initiatives.

Distribution strategy optimization through digital platforms and direct-to-farmer sales channels can improve margins while providing better customer service and technical support. Regulatory compliance capabilities should be strengthened to navigate complex approval processes and maintain market access for existing and new products.

Sustainability initiatives including development of bio-based herbicides and environmentally friendly formulations position companies for future market requirements and consumer preferences. Education programs targeting farmers about proper herbicide selection, application techniques, and resistance management create market demand while promoting responsible usage practices. Geographic expansion into underserved regions requires tailored product portfolios and distribution strategies adapted to local farming conditions and economic constraints.

Long-term prospects for the India herbicide market remain highly positive, supported by continued agricultural modernization, increasing crop intensification, and growing recognition of herbicides as essential tools for sustainable farming. Market evolution will be shaped by technological advances in precision agriculture, development of resistance-breaking chemistries, and integration of biological control methods with chemical solutions.

Growth projections indicate sustained expansion at approximately 9.2% CAGR over the next five years, driven by increasing adoption in underserved regions, development of new crop-specific formulations, and expansion of commercial farming operations. Innovation focus will shift toward environmentally sustainable products, precision application technologies, and integrated pest management solutions that combine multiple control methods.

Regulatory evolution will likely emphasize environmental safety, residue management, and resistance prevention, creating opportunities for companies with advanced research capabilities and sustainable product portfolios. MarkWide Research projects that successful market participants will be those investing in innovation, building strong distribution networks, and developing comprehensive farmer support programs that enhance product effectiveness and customer loyalty. Digital transformation of agriculture will create new opportunities for herbicide optimization and precision application, fundamentally changing how farmers approach weed management in their operations.

The India herbicide market stands at a pivotal juncture of unprecedented growth and transformation, driven by agricultural modernization, technological innovation, and evolving farming practices across the country’s diverse agricultural landscape. Market fundamentals remain strong with increasing recognition of herbicides as essential tools for achieving food security, managing labor constraints, and optimizing agricultural productivity in an era of intensifying competition for land and resources.

Strategic opportunities abound for market participants willing to invest in innovation, sustainability, and farmer-centric solutions that address the unique challenges of Indian agriculture. The convergence of precision agriculture technologies, environmental consciousness, and regulatory evolution creates a dynamic environment where success depends on adaptability, technical expertise, and deep understanding of local market conditions. Future market leaders will be those companies that successfully balance innovation with affordability, sustainability with effectiveness, and global expertise with local market knowledge to serve India’s diverse and evolving agricultural sector.

What is Herbicide?

Herbicides are chemical substances used to control or eliminate unwanted plants, commonly known as weeds. They play a crucial role in agriculture by enhancing crop yield and quality through effective weed management.

What are the key players in the India Herbicide Market?

Key players in the India Herbicide Market include companies like Bayer CropScience, Syngenta, and UPL Limited, which are known for their innovative herbicide solutions and extensive distribution networks, among others.

What are the growth factors driving the India Herbicide Market?

The India Herbicide Market is driven by factors such as the increasing adoption of modern agricultural practices, the rising demand for food security, and the growing awareness of the benefits of herbicides in enhancing crop productivity.

What challenges does the India Herbicide Market face?

Challenges in the India Herbicide Market include regulatory hurdles, the emergence of herbicide-resistant weed species, and environmental concerns regarding chemical usage, which can impact market growth.

What opportunities exist in the India Herbicide Market?

Opportunities in the India Herbicide Market include the development of bio-based herbicides, advancements in precision agriculture technologies, and increasing investments in research and development for sustainable farming practices.

What trends are shaping the India Herbicide Market?

Trends in the India Herbicide Market include the shift towards integrated pest management, the rise of digital agriculture tools, and the growing preference for environmentally friendly herbicide formulations.

India Herbicide Market

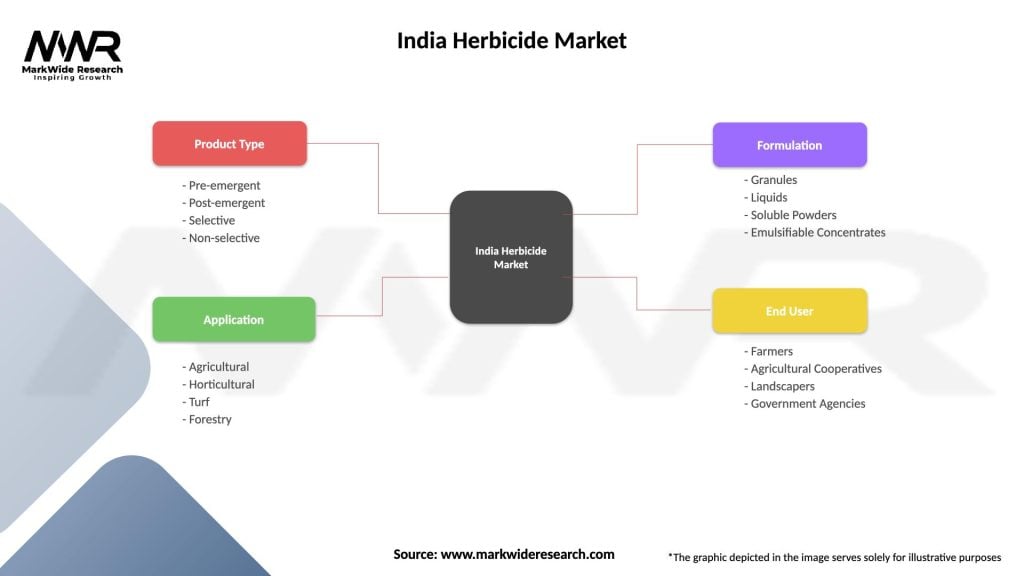

| Segmentation Details | Description |

|---|---|

| Product Type | Pre-emergent, Post-emergent, Selective, Non-selective |

| Application | Agricultural, Horticultural, Turf, Forestry |

| Formulation | Granules, Liquids, Soluble Powders, Emulsifiable Concentrates |

| End User | Farmers, Agricultural Cooperatives, Landscapers, Government Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Herbicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at