444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India health insurance market represents one of the fastest-growing segments within the country’s financial services sector, driven by increasing healthcare awareness, rising medical costs, and supportive government initiatives. Market dynamics indicate substantial expansion potential as penetration rates remain relatively low compared to developed economies, creating significant opportunities for insurers and stakeholders.

Healthcare expenditure in India continues to rise, with out-of-pocket expenses accounting for a substantial portion of total healthcare spending. This trend has accelerated the adoption of health insurance products across urban and rural populations. Digital transformation initiatives have further enhanced market accessibility, enabling insurers to reach previously underserved segments through innovative distribution channels and simplified claim processes.

Regulatory support from the Insurance Regulatory and Development Authority of India (IRDAI) has fostered market growth through progressive policies encouraging product innovation and market expansion. The sector demonstrates robust growth potential, with industry projections indicating a compound annual growth rate (CAGR) of 18-20% over the next five years, driven by demographic shifts, urbanization, and increasing health consciousness among consumers.

The India health insurance market refers to the comprehensive ecosystem of insurance products, services, and stakeholders that provide financial protection against medical expenses for individuals and groups across the Indian subcontinent. This market encompasses various insurance products including individual health policies, family floater plans, group mediclaim policies, and specialized coverage options designed to address diverse healthcare needs.

Health insurance products in India typically cover hospitalization expenses, pre and post-hospitalization costs, day-care procedures, and increasingly, outpatient treatments and preventive healthcare services. The market includes both private insurance companies and public sector insurers, operating under regulatory frameworks established by IRDAI to ensure consumer protection and market stability.

Market participants include standalone health insurers, general insurance companies offering health products, life insurers with health portfolios, third-party administrators, healthcare providers, and digital platforms facilitating insurance distribution and claims management. This ecosystem serves millions of policyholders while continuously evolving to address changing healthcare needs and consumer preferences.

India’s health insurance landscape presents exceptional growth opportunities driven by demographic advantages, increasing healthcare awareness, and supportive regulatory environment. The market benefits from a large, young population with growing disposable income and heightened health consciousness, particularly accelerated by recent global health events.

Key growth drivers include rising healthcare costs, expanding middle-class population, government initiatives promoting insurance adoption, and technological innovations enhancing customer experience. Digital distribution channels have emerged as significant growth catalysts, with online sales contributing approximately 25-30% of new policy acquisitions for leading insurers.

Market segmentation reveals strong demand across individual, family, and group insurance categories, with increasing preference for comprehensive coverage options including outpatient benefits and wellness programs. The sector demonstrates resilience and adaptability, with insurers continuously innovating product offerings to meet evolving consumer needs while maintaining competitive pricing strategies.

Future prospects remain highly favorable, supported by government healthcare initiatives, increasing corporate employee benefits adoption, and growing awareness of financial protection against medical emergencies. Industry consolidation and strategic partnerships are expected to drive operational efficiencies and market expansion in coming years.

Market penetration analysis reveals significant growth potential, with health insurance coverage reaching only a fraction of India’s population compared to developed markets. This presents substantial opportunities for market expansion through targeted product development and distribution strategies.

Rising healthcare costs represent the primary driver propelling health insurance adoption across India. Medical inflation consistently outpaces general inflation, making health insurance essential for financial protection against unexpected medical expenses. Hospital treatment costs have increased substantially, particularly for specialized treatments and advanced medical procedures.

Government initiatives significantly contribute to market expansion through schemes like Ayushman Bharat, which has increased health insurance awareness and acceptance among previously uninsured populations. These programs demonstrate the value of health coverage while creating a foundation for private insurance market growth.

Demographic transitions drive sustained market demand as India’s growing middle class seeks comprehensive healthcare protection. Urbanization trends concentrate populations in areas with higher healthcare costs, necessitating insurance coverage. Nuclear family structures increasingly replace joint family systems, creating demand for individual and family health insurance policies.

Corporate adoption of employee health benefits continues expanding as companies recognize the importance of workforce health and wellness. Employers increasingly offer comprehensive health insurance as part of competitive compensation packages, driving group insurance segment growth.

Digital transformation enables insurers to reach broader audiences through online platforms, mobile applications, and digital marketing strategies. Technology improvements in claims processing, policy management, and customer service enhance overall customer experience and satisfaction levels.

Low insurance awareness remains a significant challenge, particularly in rural and semi-urban areas where understanding of insurance concepts and benefits requires extensive education efforts. Many potential customers lack knowledge about policy terms, coverage benefits, and claims procedures, limiting market penetration.

Affordability concerns constrain market growth as premium costs may seem prohibitive for lower-income segments despite the long-term financial benefits of health insurance coverage. Price sensitivity affects product adoption rates, requiring insurers to develop affordable options without compromising essential coverage.

Complex policy terms and exclusions create customer confusion and skepticism about insurance products. Lengthy policy documents, technical language, and numerous exclusions may discourage potential customers from purchasing coverage or lead to dissatisfaction during claims processes.

Claims settlement challenges occasionally result in customer dissatisfaction and negative market perception. Delayed claim processing, documentation requirements, and settlement disputes can impact customer trust and brand reputation, affecting overall market growth.

Regulatory compliance costs impose operational burdens on insurers, particularly smaller companies with limited resources. Compliance requirements, while necessary for consumer protection, may increase operational costs and affect pricing strategies.

Rural market expansion presents enormous growth potential as insurance penetration in rural areas remains significantly lower than urban markets. Targeted product development, simplified processes, and innovative distribution channels can unlock this vast untapped market segment.

Technology integration offers opportunities to enhance customer experience through artificial intelligence, machine learning, and data analytics. Telemedicine integration and digital health platforms can create comprehensive healthcare ecosystems that add value beyond traditional insurance coverage.

Product customization enables insurers to address specific demographic needs, lifestyle requirements, and regional preferences. Specialized products for seniors, women, children, and specific disease categories can capture niche market segments while commanding premium pricing.

Partnership opportunities with healthcare providers, pharmaceutical companies, and wellness platforms can create integrated service offerings that differentiate insurers in competitive markets. Strategic alliances can enhance customer value propositions while reducing operational costs.

Micro-insurance products designed for low-income segments can expand market reach while fulfilling social responsibility objectives. Simple, affordable products with streamlined processes can serve previously excluded populations while building long-term customer relationships.

Competitive intensity continues increasing as new entrants join the market while existing players expand their health insurance portfolios. This competition drives innovation, improves customer service standards, and leads to more competitive pricing strategies across the industry.

Customer expectations evolve rapidly, demanding seamless digital experiences, faster claim settlements, and comprehensive coverage options. Insurers must continuously adapt their service delivery models to meet these changing expectations while maintaining operational efficiency.

Regulatory evolution shapes market dynamics through policy changes, new guidelines, and consumer protection measures. Recent regulatory initiatives have simplified policy terms, standardized certain products, and enhanced transparency requirements, benefiting consumers while challenging insurers to adapt quickly.

Technology disruption transforms traditional insurance operations through automation, digital platforms, and data-driven decision making. Insurtech companies introduce innovative solutions that challenge established players while creating opportunities for collaboration and market expansion.

Healthcare ecosystem integration becomes increasingly important as insurers seek to provide holistic health solutions rather than just financial protection. Partnerships with hospitals, diagnostic centers, and wellness providers create comprehensive value propositions that enhance customer loyalty and satisfaction.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into India’s health insurance market dynamics. Primary research involves extensive interviews with industry executives, insurance professionals, healthcare providers, and policyholders across different demographic segments and geographic regions.

Secondary research encompasses analysis of regulatory filings, company annual reports, industry publications, and government statistics to validate primary findings and identify market trends. Data triangulation techniques ensure consistency and accuracy across different information sources.

Quantitative analysis includes statistical modeling, trend analysis, and market sizing exercises using available industry data and proprietary research findings. Survey methodologies capture consumer preferences, buying behaviors, and satisfaction levels across different market segments.

Qualitative research provides deeper insights into market dynamics, competitive strategies, and future opportunities through focus group discussions, expert interviews, and case study analysis. This approach reveals underlying market drivers and potential challenges not apparent through quantitative methods alone.

Market validation processes involve cross-referencing findings with industry experts, regulatory authorities, and market participants to ensure accuracy and relevance of research conclusions and recommendations.

Western India leads the health insurance market with approximately 35-40% market share, driven by high urbanization rates, established healthcare infrastructure, and strong economic activity in states like Maharashtra, Gujarat, and Rajasthan. Mumbai and Pune serve as major insurance hubs with significant corporate presence driving group insurance adoption.

Northern India represents the second-largest market segment, accounting for roughly 25-30% of total market share. Delhi NCR region demonstrates high insurance penetration while states like Punjab and Haryana show growing adoption rates supported by increasing prosperity and health awareness.

Southern India exhibits strong growth potential with approximately 20-25% market share, led by technology centers in Bangalore, Chennai, and Hyderabad. The region benefits from high literacy rates, established healthcare systems, and growing IT sector employment driving insurance demand.

Eastern India presents significant growth opportunities despite currently holding around 10-15% market share. West Bengal and Odisha show increasing insurance adoption while other eastern states offer substantial untapped potential for market expansion.

Rural markets across all regions demonstrate low penetration rates but enormous growth potential as awareness increases and distribution channels expand. Government initiatives and mobile technology adoption facilitate rural market development across different geographic regions.

Market leadership remains distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment encourages continuous innovation and customer-centric service improvements.

Competitive strategies focus on product differentiation, digital transformation, customer service excellence, and strategic partnerships with healthcare providers and distribution channels.

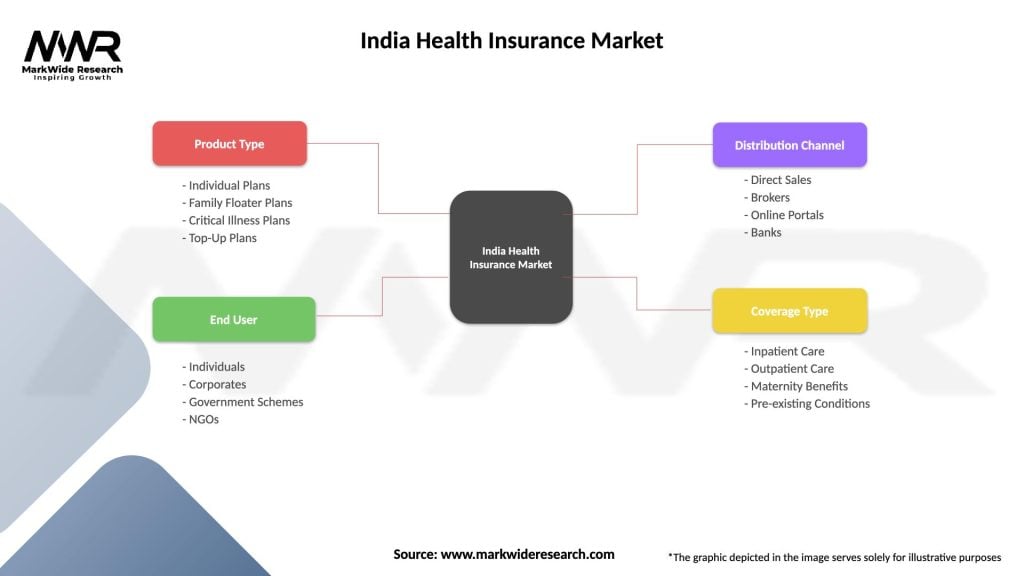

By Product Type: The market segments into individual health insurance, family floater policies, group mediclaim, senior citizen plans, critical illness coverage, and specialized products addressing specific health conditions or demographics.

By Coverage Type: Segmentation includes comprehensive health insurance, basic hospitalization coverage, outpatient benefits, maternity coverage, preventive healthcare, and wellness programs integrated with insurance products.

By Distribution Channel: Market channels encompass direct sales, agent networks, bancassurance partnerships, online platforms, corporate tie-ups, and emerging digital distribution models leveraging technology platforms.

By Customer Segment: Primary segments include individual consumers, families, corporate employees, senior citizens, rural populations, and specialized demographic groups requiring tailored insurance solutions.

By Premium Range: Market segmentation spans budget-friendly basic plans, mid-range comprehensive coverage, and premium products offering extensive benefits and superior service levels to address different affordability levels.

Individual Health Insurance: This category demonstrates steady growth as personal health awareness increases and individuals seek comprehensive coverage independent of employer-provided benefits. Products in this segment offer flexibility and portability while addressing specific individual health needs and preferences.

Family Floater Policies: Popular among middle-class families, these products provide cost-effective coverage for entire families under single policies. Family floater adoption rates show consistent growth with approximately 40-45% of retail health insurance sales in this category.

Group Health Insurance: Corporate segment drives significant volume with employers increasingly offering health benefits to attract and retain talent. This category benefits from economies of scale and simplified administration while providing extensive coverage to large employee populations.

Senior Citizen Plans: Specialized products addressing elderly healthcare needs show strong growth potential as India’s aging population increases. These plans typically offer higher sum insured options and coverage for age-related health conditions.

Critical Illness Coverage: Growing awareness of lifestyle diseases drives demand for specialized critical illness insurance providing lump-sum benefits for major health conditions like cancer, heart disease, and stroke.

Insurance Companies benefit from expanding market opportunities, diversified revenue streams, and long-term customer relationships that provide stable premium income and cross-selling opportunities across different insurance products and financial services.

Healthcare Providers gain from increased patient volumes, assured payment mechanisms, and reduced bad debt through insurance coverage. Partnerships with insurers create referral opportunities and enable participation in wellness programs that enhance patient care quality.

Policyholders receive financial protection against medical expenses, access to quality healthcare networks, and peace of mind regarding unexpected health emergencies. Insurance coverage enables better healthcare decision-making without financial constraints.

Employers utilize health insurance benefits to attract talent, improve employee satisfaction, and demonstrate corporate social responsibility while potentially reducing absenteeism and improving workforce productivity through better employee health.

Government benefits from reduced burden on public healthcare systems, increased formal sector participation, and improved overall population health outcomes through private sector healthcare financing mechanisms.

Technology Partners find opportunities in digital transformation initiatives, claims processing automation, customer engagement platforms, and data analytics solutions that enhance operational efficiency and customer experience.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Approach: Insurers increasingly adopt digital platforms for policy sales, customer service, and claims processing. Mobile applications and online portals enhance customer convenience while reducing operational costs and improving service efficiency.

Wellness Integration: Health insurance products increasingly incorporate wellness programs, preventive healthcare benefits, and lifestyle management services. This trend reflects growing focus on proactive health management rather than reactive treatment coverage.

Customization and Personalization: Insurers develop tailored products addressing specific demographic needs, geographic requirements, and individual health profiles. Personalized pricing models based on health data and lifestyle factors gain traction among tech-savvy consumers.

Telemedicine Integration: Insurance policies increasingly cover telemedicine consultations and digital health services, particularly accelerated by recent global health events that highlighted the importance of remote healthcare access.

Cashless Treatment Expansion: Network hospital partnerships expand to provide cashless treatment facilities across more locations, improving customer convenience and satisfaction while reducing claim processing complexity.

AI and Data Analytics: Advanced technologies enable better risk assessment, fraud detection, and customer service automation. Claims processing efficiency improves significantly through AI implementation, with processing times reduced by 60-70% for routine claims.

Regulatory Reforms: IRDAI introduces progressive regulations simplifying policy terms, standardizing certain products, and enhancing consumer protection measures. Recent guidelines on health insurance portability and standardized exclusions benefit consumers while challenging insurers to adapt quickly.

Technology Partnerships: Insurance companies form strategic alliances with technology providers, healthcare platforms, and fintech companies to enhance service delivery and create integrated health ecosystems that provide comprehensive value to customers.

Product Innovations: Insurers launch innovative products including pay-as-you-go health insurance, usage-based pricing models, and specialized coverage for emerging health risks like mental health and lifestyle diseases.

Market Consolidation: Strategic mergers and acquisitions reshape the competitive landscape as companies seek scale advantages, expanded distribution networks, and enhanced technological capabilities to compete effectively in evolving markets.

Government Initiatives: Public sector health insurance schemes expand coverage while creating awareness about insurance benefits, indirectly supporting private market growth through increased consumer education and acceptance.

International Partnerships: Foreign insurance companies and reinsurers increase participation in Indian markets through joint ventures, technology transfers, and capital investments that bring global expertise to local operations.

Market Entry Strategies: New entrants should focus on niche segments or underserved geographic markets rather than competing directly with established players in saturated urban markets. MarkWide Research analysis indicates that specialized products addressing specific demographic needs offer better differentiation opportunities.

Digital Transformation Priority: Companies must prioritize technology investments in customer-facing platforms, claims processing automation, and data analytics capabilities. Digital transformation initiatives should focus on improving customer experience while reducing operational costs.

Rural Market Development: Insurers should develop simplified products, innovative distribution channels, and local partnership strategies to penetrate rural markets effectively. Mobile technology and agent network expansion remain critical for rural market success.

Customer Education Initiatives: Comprehensive customer education programs addressing insurance concepts, policy benefits, and claims procedures can significantly improve market penetration and customer satisfaction levels across different demographic segments.

Partnership Strategies: Strategic partnerships with healthcare providers, wellness platforms, and technology companies can create differentiated value propositions while reducing operational costs and improving customer engagement.

Regulatory Compliance: Companies should maintain proactive regulatory compliance strategies and engage constructively with regulatory authorities to shape policy development while ensuring consumer protection and market stability.

Growth Trajectory: The India health insurance market demonstrates exceptional long-term growth potential driven by demographic advantages, increasing health awareness, and supportive regulatory environment. Market expansion is expected to continue at robust rates with projected CAGR of 18-22% over the next decade.

Technology Integration: Advanced technologies including artificial intelligence, machine learning, and blockchain will revolutionize insurance operations, customer experience, and risk management. Digital platforms will become primary distribution channels, particularly for younger demographics.

Product Evolution: Health insurance products will evolve toward comprehensive health management solutions incorporating preventive care, wellness programs, and integrated healthcare services. Personalized insurance products based on individual health data and lifestyle factors will gain significant market acceptance.

Market Maturation: As the market matures, competition will intensify, leading to improved customer service standards, innovative product offerings, and more competitive pricing strategies. Market consolidation may occur as companies seek scale advantages and operational efficiencies.

Regulatory Evolution: Continued regulatory reforms will enhance consumer protection, simplify policy terms, and promote market transparency. MWR projections suggest that regulatory changes will generally favor consumer interests while maintaining market stability and growth momentum.

Healthcare Integration: Insurance companies will increasingly integrate with healthcare ecosystems, forming partnerships with hospitals, diagnostic centers, and wellness providers to create comprehensive health solutions that extend beyond traditional insurance coverage.

India’s health insurance market stands at a pivotal juncture with unprecedented growth opportunities driven by demographic advantages, increasing healthcare awareness, and technological innovations. The market’s transformation from a nascent industry to a critical component of India’s healthcare financing system reflects changing consumer attitudes and supportive regulatory frameworks.

Key success factors for market participants include digital transformation capabilities, customer-centric product development, effective distribution strategies, and strategic partnerships that enhance value propositions. Companies that successfully navigate regulatory requirements while maintaining operational efficiency and customer satisfaction will capture significant market share in this expanding sector.

Future prospects remain highly favorable as low insurance penetration rates, growing middle-class population, and increasing health consciousness create sustained demand for health insurance products. The market’s evolution toward comprehensive health management solutions rather than simple financial protection indicates maturation and sophistication that benefits all stakeholders.

Strategic imperatives for industry participants include embracing technology-driven solutions, developing affordable products for diverse market segments, and building robust healthcare partnerships that create integrated service offerings. Success in India’s health insurance market requires long-term commitment, continuous innovation, and deep understanding of local market dynamics and consumer preferences.

What is Health Insurance?

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. It can also provide coverage for preventive care, hospitalization, and other health-related services.

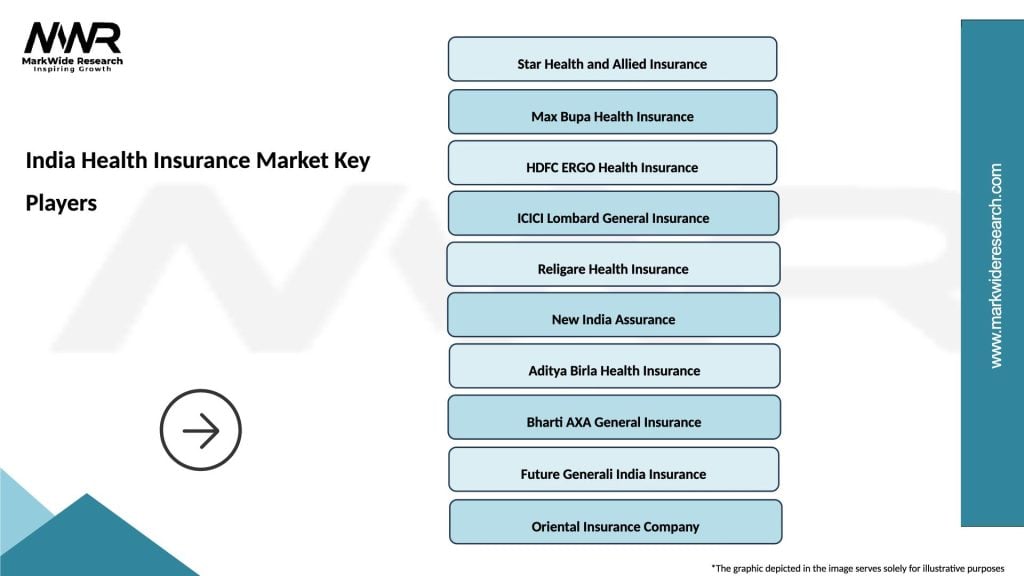

What are the key players in the India Health Insurance Market?

Key players in the India Health Insurance Market include companies like Star Health and Allied Insurance, Max Bupa Health Insurance, and HDFC ERGO Health Insurance, among others.

What are the main drivers of growth in the India Health Insurance Market?

The growth of the India Health Insurance Market is driven by factors such as increasing healthcare costs, a growing middle class, and rising awareness about health insurance benefits among consumers.

What challenges does the India Health Insurance Market face?

Challenges in the India Health Insurance Market include regulatory hurdles, a lack of awareness in rural areas, and the prevalence of fraudulent claims, which can impact the overall growth and sustainability of the market.

What opportunities exist in the India Health Insurance Market?

Opportunities in the India Health Insurance Market include the expansion of digital health services, the introduction of innovative insurance products, and the potential for increased penetration in underserved regions.

What trends are shaping the India Health Insurance Market?

Trends in the India Health Insurance Market include the rise of telemedicine, personalized health plans, and the integration of technology in policy management, which are enhancing customer experience and operational efficiency.

India Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Family Floater Plans, Critical Illness Plans, Top-Up Plans |

| End User | Individuals, Corporates, Government Schemes, NGOs |

| Distribution Channel | Direct Sales, Brokers, Online Portals, Banks |

| Coverage Type | Inpatient Care, Outpatient Care, Maternity Benefits, Pre-existing Conditions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Health Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at