444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India gas insulated switchgear (GIS) market refers to the market for a type of switchgear that uses a gas, such as sulfur hexafluoride (SF6), to insulate and protect electrical equipment. GIS offers numerous advantages over conventional air-insulated switchgear, including compactness, enhanced reliability, and better environmental performance. This market overview provides a comprehensive analysis of the India gas insulated switchgear market, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Gas insulated switchgear (GIS) refers to a type of switchgear that utilizes a gas as the insulation medium, replacing the traditional air-insulated switchgear. It is designed to enhance the reliability and efficiency of power systems by isolating electrical equipment in a gas-tight enclosure. GIS systems are commonly used in substations, power generation plants, and industries to control and protect electrical equipment such as circuit breakers, transformers, and disconnect switches.

Executive Summary

The India gas insulated switchgear market has been experiencing steady growth due to the increasing demand for reliable and efficient electrical infrastructure. The market is driven by the growing need for energy and the development of smart grids. The COVID-19 pandemic has had a moderate impact on the market, with temporary disruptions in the supply chain and project delays. However, the market is expected to recover in the post-pandemic period and witness significant growth in the coming years.

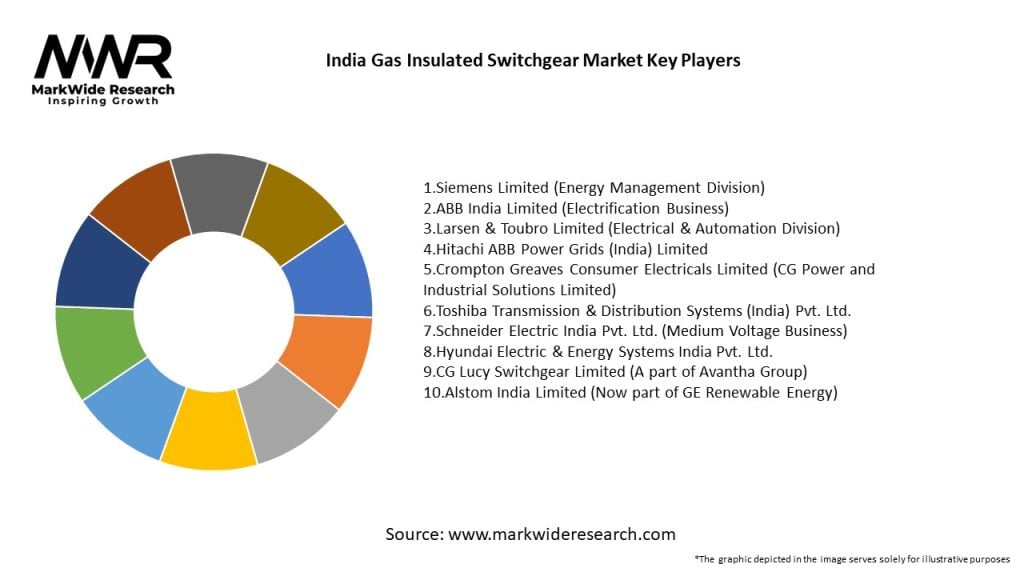

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the India gas insulated switchgear market. First, the increasing demand for reliable and efficient electrical infrastructure is propelling the adoption of GIS systems. As the demand for electricity continues to rise, there is a need for advanced switchgear solutions that can enhance the reliability and stability of power systems. GIS systems offer compactness and better performance compared to conventional switchgear, making them an attractive choice for various applications.

Second, the development of smart grids in India is creating significant opportunities for the gas insulated switchgear market. Smart grids incorporate advanced technologies to improve the efficiency, reliability, and sustainability of electricity distribution. GIS systems play a crucial role in smart grids by providing accurate monitoring, control, and protection of electrical equipment. The integration of GIS systems with smart grid infrastructure is expected to drive the demand for gas insulated switchgear in the coming years.

Market Restraints

Despite the growth prospects, the India gas insulated switchgear market faces certain challenges and restraints. One of the major restraints is the high initial investment required for the installation of GIS systems. Compared to air-insulated switchgear, GIS systems involve higher costs due to the need for specialized equipment and the use of gas as the insulating medium. This can deter some end-users from adopting GIS systems, especially in cost-sensitive markets.

Another restraint is the environmental impact associated with SF6 gas, which is commonly used in GIS systems. SF6 is a potent greenhouse gas with a high global warming potential. Although GIS systems are designed to minimize SF6 emissions, the handling and disposal of SF6 gas remain a concern. Regulatory authorities and environmental organizations are imposing stricter regulations on the use of SF6, which may impact the market growth of gas insulated switchgear.

Market Opportunities

The India gas insulated switchgear market offers several opportunities for industry players and stakeholders. First, the increasing focus on renewable energy sources presents significant opportunities for GIS systems. Renewable energy projects, such as solar and wind power, require reliable and efficient electrical infrastructure for grid integration. GIS systems can facilitate the seamless integration of renewable energy sources into the existing power grid, providing enhanced control and protection capabilities.

Additionally, the ongoing infrastructure development projects in India, such as metro rail networks and smart cities, provide lucrative opportunities for the gas insulated switchgear market. These projects demand reliable and compact electrical equipment to meet the increasing power requirements. GIS systems, with their compact design and high performance, are well-suited for such infrastructure projects.

Market Dynamics

The India gas insulated switchgear market is characterized by intense competition among market players. The market is fragmented, with several domestic and international companies offering GIS solutions. To gain a competitive edge, companies are focusing on product innovations, partnerships, and strategic acquisitions.

Regional Analysis

The India gas insulated switchgear market is divided into several regions, including North India, South India, East India, and West India. The demand for GIS systems varies across these regions based on factors such as industrial development, infrastructure projects, and power consumption. North India is a key market for gas insulated switchgear, driven by the presence of major industrial hubs and power generation facilities. South India is also witnessing significant growth due to the development of smart cities and infrastructure projects.

Competitive Landscape

Leading Companies in the India Gas Insulated Switchgear Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

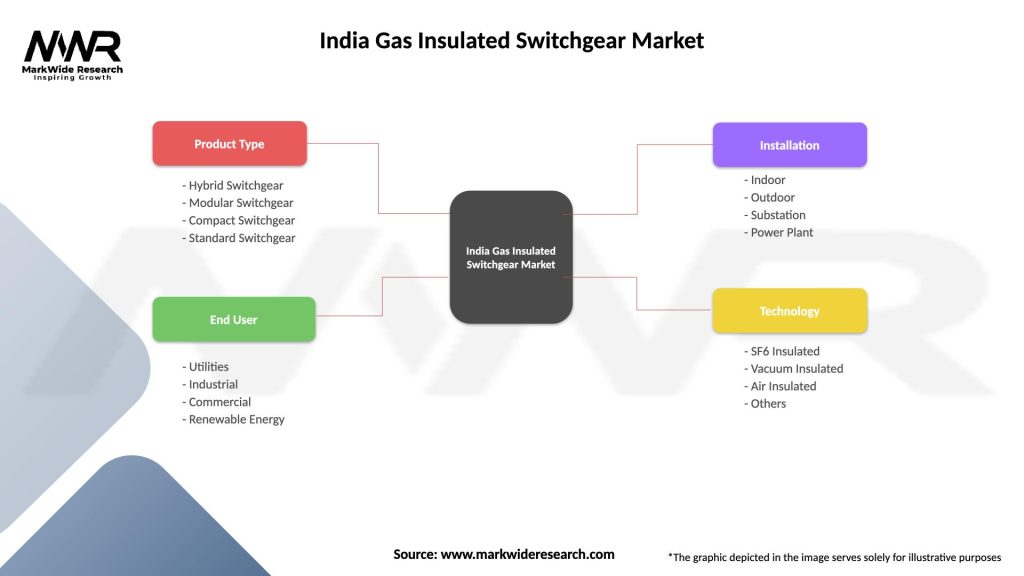

Segmentation

The India gas insulated switchgear market can be segmented based on voltage rating, installation, end-user, and application. Based on voltage rating, the market can be classified into up to 36 kV, 36-72.5 kV, and above 72.5 kV. On the basis of installation, the market can be categorized into indoor and outdoor installations. The end-users of gas insulated switchgear include power transmission and distribution utilities, industrial and manufacturing enterprises, and infrastructure and transportation. Applications of GIS systems include substations, power generation plants, and industries.

Category-wise Insights

1. Voltage Rating:

2. Installation:

3. End-User:

4. Application:

Key Benefits for Industry Participants and Stakeholders

The India gas insulated switchgear market provides several benefits for industry participants and stakeholders. These include:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The India gas insulated switchgear market is witnessing several key trends that are shaping its growth and development. These trends include:

COVID-19 Impact

The COVID-19 pandemic had a moderate impact on the India gas insulated switchgear market. During the initial phase of the pandemic, the market experienced temporary disruptions in the supply chain due to lockdown measures and restrictions on movement. Project delays and cancellations also affected the demand for GIS systems, particularly in the construction and infrastructure sectors.

However, as the situation stabilized and economic activities resumed, the market started to recover. The increasing investments in infrastructure projects, government initiatives for economic recovery, and the growing focus on reliable power supply are driving the demand for GIS systems. The market is expected to witness significant growth in the post-pandemic period as the economy recovers and industrial activities regain momentum.

Key Industry Developments

The India gas insulated switchgear market has witnessed several key industry developments in recent years. These developments include:

Analyst Suggestions

Based on the analysis of the India gas insulated switchgear market, analysts suggest the following strategies for industry participants:

Future Outlook

The future outlook for the India gas insulated switchgear market is positive. The market is expected to witness significant growth driven by factors such as the increasing demand for reliable power infrastructure, the development of smart grids, and the focus on renewable energy sources. The ongoing infrastructure development projects and government initiatives for economic recovery will further contribute to market growth.

Conclusion

The India gas insulated switchgear market is experiencing steady growth, fueled by the need for reliable and efficient electrical infrastructure. The market offers significant opportunities for industry participants and stakeholders, driven by factors such as the development of smart grids, the demand for renewable energy infrastructure, and ongoing infrastructure projects. However, challenges related to high initial investment and environmental concerns associated with SF6 gas need to be addressed. By focusing on research and development, embracing digital transformation, and collaborating with utilities and infrastructure developers, companies can position themselves for success in the evolving market.

What is Gas Insulated Switchgear?

Gas Insulated Switchgear (GIS) refers to a compact and efficient electrical switchgear technology that uses gas as an insulating medium. It is widely used in substations and industrial applications due to its ability to operate in limited spaces and harsh environments.

What are the key players in the India Gas Insulated Switchgear Market?

Key players in the India Gas Insulated Switchgear Market include Siemens, Schneider Electric, ABB, and GE, among others. These companies are known for their innovative solutions and extensive product portfolios in the electrical equipment sector.

What are the growth factors driving the India Gas Insulated Switchgear Market?

The India Gas Insulated Switchgear Market is driven by the increasing demand for reliable and efficient power distribution systems, urbanization leading to the need for compact solutions, and government initiatives promoting renewable energy integration.

What challenges does the India Gas Insulated Switchgear Market face?

Challenges in the India Gas Insulated Switchgear Market include high initial installation costs, the complexity of maintenance, and competition from alternative technologies such as air-insulated switchgear.

What opportunities exist in the India Gas Insulated Switchgear Market?

Opportunities in the India Gas Insulated Switchgear Market include the expansion of smart grid technologies, increasing investments in renewable energy projects, and the modernization of aging electrical infrastructure.

What trends are shaping the India Gas Insulated Switchgear Market?

Trends in the India Gas Insulated Switchgear Market include the adoption of digital technologies for monitoring and control, the development of eco-friendly insulating gases, and the growing preference for modular and scalable switchgear solutions.

India Gas Insulated Switchgear Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hybrid Switchgear, Modular Switchgear, Compact Switchgear, Standard Switchgear |

| End User | Utilities, Industrial, Commercial, Renewable Energy |

| Installation | Indoor, Outdoor, Substation, Power Plant |

| Technology | SF6 Insulated, Vacuum Insulated, Air Insulated, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Gas Insulated Switchgear Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at