444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India gaming headset market represents one of the most dynamic and rapidly expanding segments within the country’s consumer electronics landscape. Gaming enthusiasts across India are increasingly investing in high-quality audio equipment to enhance their gaming experiences, driving unprecedented demand for specialized gaming headsets. The market encompasses a diverse range of products, from budget-friendly options for casual gamers to premium professional-grade headsets designed for competitive esports athletes.

Market dynamics indicate robust growth driven by the surge in mobile gaming, PC gaming adoption, and the emergence of India as a significant player in the global esports ecosystem. The market is experiencing a compound annual growth rate (CAGR) of approximately 15.2%, reflecting the strong consumer appetite for immersive gaming audio solutions. Urban centers like Mumbai, Delhi, Bangalore, and Hyderabad are leading the adoption curve, while tier-2 and tier-3 cities are showing remarkable growth potential.

Technology integration has become a defining characteristic of the Indian gaming headset market, with manufacturers incorporating advanced features such as 7.1 surround sound, noise cancellation, RGB lighting, and wireless connectivity. The market caters to diverse gaming platforms including PC, console, and mobile gaming, with mobile gaming headsets representing the largest segment due to India’s smartphone-first gaming culture.

The India gaming headset market refers to the comprehensive ecosystem of specialized audio equipment designed specifically for gaming applications within the Indian subcontinent. This market encompasses the manufacturing, distribution, retail, and consumption of gaming headsets that provide enhanced audio experiences for various gaming platforms and genres.

Gaming headsets in the Indian context represent more than just audio peripherals; they serve as essential tools for competitive gaming, social interaction, and immersive entertainment experiences. The market includes wired and wireless headsets, ranging from basic stereo models to sophisticated multi-channel audio systems with integrated microphones, customizable sound profiles, and platform-specific optimizations.

Market participants include international brands, domestic manufacturers, online retailers, brick-and-mortar stores, and gaming cafes that collectively serve India’s diverse gaming community. The market’s scope extends beyond hardware to include software integration, customer support services, and the broader gaming ecosystem that supports India’s growing digital entertainment industry.

Strategic analysis of the India gaming headset market reveals a sector characterized by rapid technological advancement, increasing consumer sophistication, and expanding market accessibility. The market has evolved from a niche segment serving hardcore PC gamers to a mainstream category addressing diverse gaming preferences across multiple platforms and price points.

Key growth drivers include the proliferation of affordable high-speed internet, the rise of mobile gaming as a dominant entertainment medium, and increasing disposable income among India’s young demographic. Consumer behavior patterns show a growing preference for feature-rich headsets that offer versatility across gaming, entertainment, and communication applications.

Market segmentation reveals distinct consumer categories, from casual mobile gamers seeking affordable options to professional esports players demanding premium performance characteristics. The market demonstrates strong regional variations, with metropolitan areas showing preference for premium products while emerging markets prioritize value-oriented solutions.

Competitive landscape features a mix of established international brands and emerging domestic players, creating a dynamic environment that benefits consumers through competitive pricing and continuous innovation. The market’s trajectory suggests sustained growth potential supported by India’s expanding digital infrastructure and evolving gaming culture.

Market intelligence reveals several critical insights that define the current state and future direction of India’s gaming headset sector:

Primary growth catalysts propelling the India gaming headset market include several interconnected factors that create a favorable environment for sustained expansion. Digital infrastructure development has emerged as a fundamental driver, with improved internet connectivity and reduced data costs making online gaming more accessible to broader population segments.

Esports ecosystem growth represents another significant driver, as India’s competitive gaming scene continues to mature and attract mainstream attention. The success of Indian esports teams in international competitions has elevated gaming from a casual hobby to a legitimate career path, driving demand for professional-grade gaming equipment including high-performance headsets.

Smartphone gaming revolution has democratized gaming access across India, with mobile games becoming the primary gaming platform for millions of users. This trend has created substantial demand for mobile-optimized gaming headsets that enhance the smartphone gaming experience while maintaining portability and affordability.

Disposable income growth among India’s middle class has enabled increased spending on gaming peripherals and entertainment technology. Young professionals and students represent key consumer segments with growing purchasing power and strong preferences for gaming-related products.

Social gaming trends have transformed gaming from a solitary activity to a social experience, increasing the importance of clear communication through quality headsets. Multiplayer games and streaming culture have made gaming headsets essential tools for social interaction and content creation.

Market limitations present ongoing challenges that could potentially constrain growth in the India gaming headset sector. Price sensitivity remains a primary constraint, as a significant portion of the target demographic operates within tight budget constraints, limiting adoption of premium gaming headsets with advanced features.

Infrastructure limitations in rural and semi-urban areas continue to restrict market penetration, despite ongoing improvements in digital connectivity. Power supply inconsistencies and limited high-speed internet access in certain regions create barriers to gaming adoption and, consequently, gaming headset demand.

Cultural perceptions of gaming as a non-productive activity persist in some segments of Indian society, potentially limiting parental support for gaming-related purchases among younger consumers. Educational priorities often take precedence over entertainment expenses in Indian households, affecting discretionary spending on gaming accessories.

Quality concerns regarding budget gaming headsets have created consumer skepticism, particularly around durability and performance consistency. After-sales service limitations for international brands in tier-2 and tier-3 cities present additional barriers to adoption.

Import dependencies for premium components result in price volatility and supply chain vulnerabilities that can affect market stability. Currency fluctuations and trade policies impact pricing strategies for international brands operating in the Indian market.

Emerging opportunities within the India gaming headset market present substantial potential for growth and innovation. Tier-2 and tier-3 city expansion represents the most significant opportunity, as improving digital infrastructure and rising disposable incomes create new consumer bases with substantial growth potential.

Product localization offers opportunities for manufacturers to develop India-specific gaming headsets that address local preferences, climate considerations, and price points. Vernacular language support and culturally relevant gaming content integration could drive adoption in regional markets.

Educational gaming integration presents opportunities to position gaming headsets as learning tools, potentially overcoming cultural resistance while expanding the addressable market. Corporate gaming and team-building applications offer new market segments beyond traditional consumer gaming.

Subscription and rental models could address price sensitivity concerns while providing access to premium gaming headsets for budget-conscious consumers. Gaming cafe partnerships offer opportunities for bulk sales and brand exposure in key urban markets.

Technology integration opportunities include artificial intelligence-powered audio optimization, health monitoring features, and integration with emerging technologies like augmented reality and virtual reality gaming platforms.

Market forces shaping the India gaming headset landscape reflect the complex interplay between consumer behavior, technological advancement, and competitive pressures. Supply chain dynamics have evolved significantly, with manufacturers establishing local assembly operations to reduce costs and improve market responsiveness.

Consumer preferences continue to shift toward wireless solutions, with wireless headset adoption growing at approximately 22% annually. This trend reflects broader technology adoption patterns and consumer desire for convenience and mobility in gaming accessories.

Competitive intensity has increased substantially as both international and domestic brands compete for market share through aggressive pricing strategies and feature differentiation. Brand loyalty remains relatively low, creating opportunities for new entrants while challenging established players to maintain market position.

Distribution channel evolution has favored online platforms, which now dominate gaming headset sales through competitive pricing, extensive product selection, and convenient delivery options. Omnichannel strategies are becoming essential for brands seeking to maximize market reach and customer engagement.

Seasonal demand patterns show significant spikes during festival seasons, back-to-school periods, and major gaming events, requiring sophisticated inventory management and marketing strategies from market participants.

Comprehensive research approach employed in analyzing the India gaming headset market incorporates multiple data collection methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions with gaming enthusiasts across different demographic segments.

Secondary research encompasses analysis of industry reports, company financial statements, government statistics, and trade association data to provide comprehensive market context. Market observation through retail channel analysis, online platform monitoring, and gaming event participation provides real-time market intelligence.

Data validation processes include cross-referencing multiple sources, statistical analysis of survey responses, and expert consultation to ensure research findings accurately represent market conditions. Quantitative analysis employs statistical modeling to project market trends and identify growth patterns.

Geographic coverage includes major metropolitan areas, tier-2 cities, and emerging markets to capture regional variations in consumer behavior and market dynamics. Temporal analysis tracks market evolution over multiple years to identify sustainable trends versus temporary fluctuations.

Geographic distribution of the India gaming headset market reveals distinct regional characteristics that influence consumer preferences, pricing strategies, and distribution approaches. Northern India, anchored by Delhi NCR, represents a significant market segment with strong preference for premium gaming peripherals and early adoption of new technologies.

Western India, particularly Mumbai and Pune, demonstrates robust market growth driven by the region’s technology industry concentration and higher disposable incomes. Maharashtra and Gujarat show strong adoption rates for gaming headsets across multiple price segments, with regional market share of approximately 28%.

Southern India leads in gaming headset adoption, with Bangalore, Hyderabad, and Chennai serving as major consumption centers. The region’s IT industry presence and young professional demographic create favorable conditions for gaming peripheral sales, contributing approximately 35% of national market volume.

Eastern India shows emerging potential, with Kolkata leading regional adoption while smaller cities demonstrate growing interest in gaming accessories. Western Bengal and Odisha represent untapped opportunities for market expansion.

Tier-2 and tier-3 cities across all regions show accelerating growth rates, often exceeding metropolitan area growth due to improving digital infrastructure and increasing gaming awareness. Rural market penetration remains limited but shows potential for future expansion as connectivity improves.

Market competition in the India gaming headset sector features a diverse mix of international brands, domestic manufacturers, and emerging players competing across multiple price segments and feature categories. Established international brands maintain strong market positions through brand recognition, product quality, and comprehensive distribution networks.

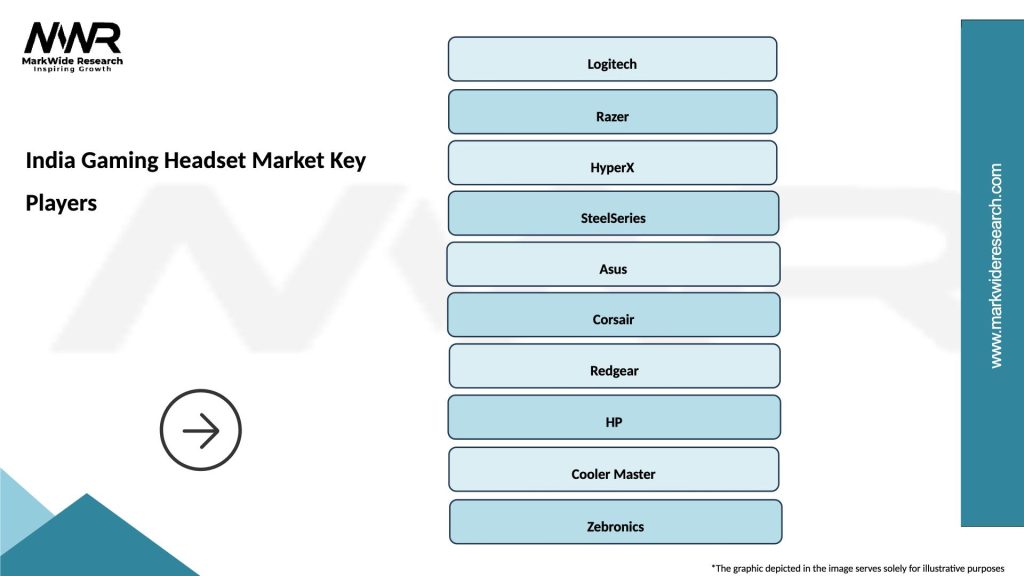

Key market participants include:

Competitive strategies vary significantly, with international brands emphasizing product quality and brand prestige while domestic players compete primarily on pricing and local market understanding. Innovation focus areas include wireless technology, battery life optimization, and mobile gaming compatibility.

Market segmentation analysis reveals distinct consumer categories and product classifications that define the India gaming headset market structure. Platform-based segmentation shows clear preferences aligned with India’s gaming ecosystem characteristics.

By Platform:

By Connectivity:

By Price Range:

Detailed category analysis provides deeper understanding of specific market segments and their unique characteristics within the India gaming headset landscape. Mobile gaming headsets represent the largest and fastest-growing category, driven by India’s mobile-first gaming culture and smartphone ubiquity.

Wireless gaming headsets show exceptional growth potential, with adoption rates increasing by approximately 25% annually as consumers prioritize convenience and mobility. Battery life optimization and quick charging capabilities have become critical differentiators in this category.

Budget gaming headsets maintain strong market presence due to price-conscious consumer behavior, with manufacturers focusing on essential gaming features while maintaining affordability. Value engineering approaches help brands deliver acceptable gaming performance at accessible price points.

Professional gaming headsets serve the growing esports community and content creators who require superior audio quality, durability, and advanced features. This category shows strong growth correlation with India’s expanding competitive gaming ecosystem.

Multi-platform compatibility has emerged as a crucial category requirement, with consumers preferring headsets that work seamlessly across gaming devices, smartphones, and computers. Universal compatibility reduces the need for multiple headsets and provides better value proposition.

Industry participants in the India gaming headset market enjoy numerous advantages from the sector’s dynamic growth and evolving consumer preferences. Manufacturers benefit from expanding market opportunities, diverse consumer segments, and increasing acceptance of gaming as mainstream entertainment.

Brand recognition opportunities abound as gaming culture becomes more prominent in Indian society, allowing companies to build strong consumer relationships and brand loyalty. Product innovation drives competitive differentiation while meeting evolving consumer needs for enhanced gaming experiences.

Retailers and distributors benefit from strong consumer demand, healthy profit margins, and growing market accessibility through online and offline channels. E-commerce platforms particularly benefit from the tech-savvy gaming demographic’s preference for online shopping and product research.

Gaming ecosystem stakeholders including game developers, streaming platforms, and esports organizations benefit from improved gaming experiences that gaming headsets provide, leading to increased user engagement and retention.

Economic benefits extend to employment generation in manufacturing, retail, customer service, and related sectors. Technology transfer and local manufacturing initiatives contribute to India’s electronics manufacturing capabilities and export potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the India gaming headset market reflect broader technological advancement and changing consumer behavior patterns. Wireless technology adoption continues accelerating, with consumers increasingly preferring cord-free gaming experiences that provide greater mobility and convenience.

Customization and personalization trends are gaining momentum, with gaming headsets offering customizable RGB lighting, interchangeable components, and personalized sound profiles. Software integration allows users to fine-tune audio settings and create gaming-specific audio configurations.

Health and comfort focus has emerged as a significant trend, with manufacturers emphasizing ergonomic designs, breathable materials, and features that reduce gaming fatigue during extended play sessions. Blue light filtering and hearing protection features address growing health consciousness among gamers.

Cross-platform compatibility has become essential, with consumers expecting seamless functionality across gaming consoles, PCs, smartphones, and tablets. Universal connectivity solutions reduce the need for multiple headsets while maximizing product utility.

Sustainable manufacturing practices are gaining importance as environmentally conscious consumers seek eco-friendly gaming accessories. Recyclable materials and sustainable packaging are becoming competitive differentiators in the premium segment.

Recent industry developments highlight the dynamic nature of India’s gaming headset market and the continuous innovation driving sector growth. Local manufacturing initiatives have gained momentum as international brands establish assembly operations in India to reduce costs and improve market responsiveness.

Partnership announcements between gaming headset manufacturers and popular mobile games have created co-branded products and marketing opportunities. Esports sponsorships and team partnerships have become common strategies for building brand credibility within the competitive gaming community.

Technology integration developments include the introduction of artificial intelligence-powered audio optimization, spatial audio capabilities, and integration with voice assistants. 5G network rollout is expected to enhance wireless gaming headset performance and enable new features.

Distribution channel expansion has seen gaming headset brands establishing exclusive partnerships with major e-commerce platforms and retail chains. Gaming cafe partnerships provide product trial opportunities and bulk sales channels for manufacturers.

Investment activities in the gaming ecosystem, including venture capital funding for gaming startups and infrastructure development, create favorable conditions for gaming peripheral market growth.

Strategic recommendations for market participants in the India gaming headset sector emphasize the importance of understanding local market dynamics and consumer preferences. MarkWide Research analysis suggests that successful market penetration requires balanced approaches combining competitive pricing with essential gaming features.

Product development strategies should prioritize mobile gaming compatibility, wireless connectivity, and multi-platform functionality to address India’s diverse gaming ecosystem. Localization efforts including regional language support and climate-appropriate designs can provide competitive advantages.

Distribution strategy optimization should leverage India’s growing e-commerce infrastructure while maintaining selective physical retail presence in key markets. Omnichannel approaches that integrate online and offline touchpoints can maximize market reach and customer engagement.

Pricing strategies must carefully balance feature sets with affordability requirements, potentially through tiered product portfolios that serve different consumer segments. Value proposition communication should emphasize practical benefits and gaming performance improvements.

Partnership opportunities with gaming content creators, esports teams, and educational institutions can build brand credibility and expand market reach. Community engagement through gaming events and online forums can strengthen brand relationships with target consumers.

Long-term projections for the India gaming headset market indicate sustained growth driven by fundamental demographic and technological trends. Market expansion is expected to continue as gaming culture becomes increasingly mainstream and digital infrastructure improvements reach broader geographic areas.

Technology evolution will likely focus on enhanced wireless capabilities, improved battery life, and integration with emerging gaming platforms including virtual reality and augmented reality applications. Artificial intelligence integration may enable personalized audio experiences and adaptive sound optimization.

Consumer sophistication is expected to increase, with buyers becoming more knowledgeable about gaming headset features and performance characteristics. This trend may drive demand for higher-quality products and more specialized gaming audio solutions.

Market consolidation may occur as successful brands expand their presence while smaller players struggle to compete on price and features. Domestic manufacturing capabilities are likely to improve, potentially reducing dependence on imports and enabling more competitive pricing.

Regional expansion into tier-2 and tier-3 cities presents the most significant growth opportunity, with MWR projecting that these markets could represent over 40% of total market volume within the next five years. Rural market penetration remains a longer-term opportunity dependent on infrastructure development and economic growth.

The India gaming headset market represents a compelling growth opportunity characterized by strong demographic tailwinds, evolving consumer preferences, and continuous technological advancement. Market fundamentals remain robust, supported by India’s young population, growing gaming culture, and improving digital infrastructure that enables broader gaming adoption.

Strategic success in this market requires understanding of local consumer behavior, price sensitivity, and platform preferences that distinguish India from other gaming markets globally. Companies that can effectively balance feature innovation with affordability while building strong distribution networks are positioned to capture significant market share.

Future growth will likely be driven by continued expansion into emerging markets, technological innovation in wireless and mobile gaming solutions, and the maturation of India’s esports ecosystem. Market participants who invest in local market understanding, product localization, and community engagement strategies are best positioned to benefit from the sector’s continued evolution and expansion opportunities.

What is Gaming Headset?

Gaming headsets are specialized audio devices designed for immersive gaming experiences, featuring high-quality sound, noise cancellation, and often a built-in microphone for communication. They are used by gamers to enhance gameplay and communication during multiplayer sessions.

What are the key players in the India Gaming Headset Market?

Key players in the India Gaming Headset Market include companies like Logitech, Razer, and HyperX, which are known for their innovative designs and high-performance audio products. These companies focus on catering to the needs of gamers with features like surround sound and customizable settings, among others.

What are the growth factors driving the India Gaming Headset Market?

The growth of the India Gaming Headset Market is driven by the increasing popularity of online gaming, the rise of esports, and advancements in audio technology. Additionally, the growing number of gamers and the demand for high-quality audio experiences contribute to market expansion.

What challenges does the India Gaming Headset Market face?

The India Gaming Headset Market faces challenges such as intense competition among brands, price sensitivity among consumers, and the rapid pace of technological advancements. These factors can impact profit margins and require companies to continuously innovate.

What opportunities exist in the India Gaming Headset Market?

Opportunities in the India Gaming Headset Market include the potential for growth in the mobile gaming segment and the increasing demand for wireless headsets. Additionally, partnerships with gaming platforms and influencers can enhance brand visibility and reach.

What trends are shaping the India Gaming Headset Market?

Trends shaping the India Gaming Headset Market include the rise of wireless technology, the integration of augmented reality features, and the growing emphasis on ergonomic designs. These trends reflect the evolving preferences of gamers for comfort and advanced functionalities.

India Gaming Headset Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wired Headsets, Wireless Headsets, Over-Ear Headsets, In-Ear Headsets |

| Technology | Bluetooth, Noise Cancellation, Surround Sound, Voice Recognition |

| End User | Casual Gamers, Professional Gamers, Streamers, Esports Teams |

| Distribution Channel | Online Retail, Offline Retail, Direct Sales, Third-Party Marketplaces |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Gaming Headset Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at