444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Full Truck Load (FTL) transport market represents a cornerstone of the nation’s logistics infrastructure, serving as the primary mode for bulk cargo movement across the subcontinent. This comprehensive transportation segment encompasses dedicated truck services where entire vehicle capacity is utilized by a single shipper, offering cost-effective solutions for large-volume freight movement. The market demonstrates robust growth momentum with an estimated compound annual growth rate of 8.5% to 10.2% driven by expanding manufacturing sectors, e-commerce proliferation, and infrastructure development initiatives.

Market dynamics reveal significant transformation as traditional transport operators embrace digital platforms and technology-driven solutions. The integration of GPS tracking, route optimization software, and mobile applications has revolutionized operational efficiency, reducing transit times by approximately 15-20% while enhancing cargo visibility. Major industrial corridors including the Golden Quadrilateral and dedicated freight corridors have substantially improved connectivity, supporting the market’s expansion across tier-2 and tier-3 cities.

Regional distribution shows concentrated activity in key manufacturing hubs with Maharashtra, Gujarat, Tamil Nadu, and Karnataka accounting for nearly 45% of total FTL movements. The market serves diverse industry verticals including automotive, pharmaceuticals, textiles, chemicals, and consumer goods, each contributing to the segment’s resilience and growth potential.

The India Full Truck Load transport market refers to the comprehensive ecosystem of logistics services where entire truck capacity is dedicated to a single customer’s cargo shipment, providing point-to-point transportation solutions across the country’s extensive road network infrastructure.

FTL transportation distinguishes itself from Less Than Truck Load (LTL) services by offering exclusive vehicle utilization, enabling faster delivery times, reduced handling risks, and cost advantages for bulk shipments. This model particularly benefits manufacturers, distributors, and large retailers requiring dedicated capacity for time-sensitive or high-value cargo movements.

Service characteristics include direct routing without intermediate stops, customized loading and unloading schedules, and enhanced security protocols. The market encompasses various truck configurations from standard 9-ton vehicles to multi-axle heavy-duty transporters capable of handling specialized cargo requirements including oversized machinery, hazardous materials, and temperature-controlled goods.

Market leadership in India’s FTL transport sector reflects the country’s position as a manufacturing powerhouse and consumption-driven economy. The segment benefits from government initiatives promoting road infrastructure development, digitalization of logistics processes, and regulatory reforms streamlining interstate transportation procedures.

Technology adoption has accelerated significantly with approximately 60% of organized FTL operators implementing digital platforms for load matching, fleet management, and customer engagement. This technological transformation addresses traditional challenges including empty return trips, inefficient route planning, and limited cargo visibility throughout the transportation cycle.

Competitive landscape features a mix of established logistics companies, regional transport operators, and emerging technology-enabled platforms. The market’s fragmented nature presents consolidation opportunities as customers increasingly prefer integrated service providers offering end-to-end logistics solutions with transparent pricing and reliable service quality.

Growth drivers include expanding manufacturing base, rising consumer spending, infrastructure improvements, and government policy support through initiatives like the Goods and Services Tax (GST) implementation and National Logistics Policy framework.

Strategic insights reveal fundamental shifts in India’s FTL transport market driven by evolving customer expectations and technological capabilities:

Manufacturing sector expansion serves as the primary catalyst for FTL transport demand, with India’s industrial production growth directly correlating with freight movement requirements. The government’s Make in India initiative and Production Linked Incentive schemes have attracted significant investments in manufacturing, creating sustained demand for bulk transportation services.

E-commerce proliferation has fundamentally transformed logistics requirements, with online retailers requiring efficient last-mile connectivity and reverse logistics capabilities. The sector’s growth has driven demand for dedicated transportation services, particularly for high-value electronics, fashion, and consumer durables.

Infrastructure development through projects like Bharatmala and Sagarmala has significantly improved road connectivity and reduced transportation costs. The completion of dedicated freight corridors is expected to enhance cargo movement efficiency by approximately 25-30% while reducing fuel consumption and transit times.

Digital transformation initiatives have revolutionized traditional transportation practices through mobile applications, GPS tracking, and automated load matching systems. These technological advances have improved asset utilization rates and reduced empty running, contributing to overall market efficiency.

Regulatory reforms including GST implementation have eliminated interstate barriers and simplified documentation requirements, making long-distance transportation more viable and cost-effective for businesses across various industry verticals.

Fragmented market structure poses significant challenges with numerous small operators lacking standardized service quality and technology adoption. This fragmentation leads to pricing inconsistencies, service reliability issues, and difficulty in establishing long-term customer relationships.

Infrastructure bottlenecks continue to impact operational efficiency despite ongoing development projects. Congested urban areas, inadequate parking facilities, and limited last-mile connectivity in remote regions create operational challenges and increase transportation costs.

Regulatory compliance requirements including vehicle fitness certificates, driver licensing, and environmental norms create administrative burdens for operators, particularly smaller players lacking dedicated compliance teams and resources.

Fuel price volatility significantly impacts operational costs and profitability margins, with diesel price fluctuations directly affecting transportation rates and customer pricing strategies. This volatility makes long-term contract pricing challenging for both operators and customers.

Driver shortage has emerged as a critical constraint with an estimated shortage of qualified commercial vehicle drivers affecting service reliability and expansion capabilities. This challenge is compounded by stringent licensing requirements and limited training infrastructure.

Technology integration presents substantial opportunities for market transformation through artificial intelligence, Internet of Things (IoT), and blockchain technologies. These innovations can optimize route planning, enhance cargo security, and provide transparent supply chain visibility to customers.

Green logistics initiatives offer competitive advantages as environmental consciousness increases among customers and regulatory bodies. Adoption of electric vehicles, alternative fuels, and carbon-neutral transportation solutions can differentiate service providers and access premium market segments.

Value-added services including warehousing integration, customs clearance, and supply chain consulting can enhance revenue streams and customer retention. Comprehensive logistics solutions addressing end-to-end requirements present significant growth opportunities.

Regional expansion into underserved markets, particularly in eastern and northeastern states, offers untapped potential as industrial development and infrastructure improvements create new transportation demand.

Specialized transportation segments including pharmaceutical cold chain, automotive parts, and hazardous materials present higher-margin opportunities requiring specialized equipment and expertise.

Demand-supply equilibrium in India’s FTL transport market reflects complex interactions between industrial production cycles, seasonal variations, and infrastructure capacity constraints. Peak demand periods during festival seasons and agricultural harvests create temporary capacity shortages, leading to rate fluctuations and service availability challenges.

Competitive dynamics showcase ongoing consolidation as organized players acquire smaller operators to expand geographical coverage and service capabilities. This consolidation trend is driven by customer preferences for reliable, technology-enabled service providers offering transparent pricing and consistent service quality.

Pricing mechanisms have evolved from traditional negotiation-based models to dynamic pricing systems incorporating fuel costs, route optimization, and demand-supply factors. Digital platforms enable real-time price discovery and competitive bidding, increasing market transparency and efficiency.

Service differentiation has become crucial as customers seek value beyond basic transportation, including real-time tracking, flexible scheduling, and integrated logistics solutions. Operators investing in technology and customer service capabilities are gaining market share and premium pricing power.

Regulatory evolution continues shaping market dynamics through policy initiatives promoting digitalization, environmental compliance, and safety standards. These regulations create compliance costs but also opportunities for technology-enabled operators to gain competitive advantages.

Comprehensive market analysis employs multi-faceted research approaches combining primary and secondary data sources to provide accurate insights into India’s FTL transport market dynamics. The methodology encompasses quantitative analysis of market trends, competitive positioning, and growth projections alongside qualitative assessment of industry challenges and opportunities.

Primary research involves extensive interviews with industry stakeholders including transport operators, logistics service providers, technology vendors, and end-user customers across various industry verticals. This direct engagement provides real-time market insights and validates secondary research findings.

Secondary research utilizes government statistics, industry reports, regulatory filings, and published studies to establish market baselines and historical trends. Data sources include Ministry of Road Transport and Highways, Central Statistics Office, and industry associations providing comprehensive market coverage.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert consultations, and statistical analysis techniques. The research methodology maintains objectivity while providing actionable insights for market participants and stakeholders.

Western India dominates the FTL transport market with Maharashtra and Gujarat collectively accounting for approximately 35% of national freight movements. This region benefits from established industrial infrastructure, major ports, and extensive manufacturing clusters spanning automotive, chemicals, pharmaceuticals, and textiles sectors.

Northern India represents significant market potential driven by the National Capital Region’s consumption demand and Punjab’s agricultural produce transportation requirements. The region’s strategic location as a gateway to international markets through land borders enhances its logistics importance.

Southern India showcases robust growth with Karnataka, Tamil Nadu, and Andhra Pradesh emerging as key manufacturing and technology hubs. The region’s IT sector growth and automotive industry expansion create sustained demand for specialized transportation services.

Eastern India presents emerging opportunities as infrastructure development and industrial investments increase freight generation. West Bengal’s strategic location and Odisha’s mining activities contribute to regional transportation demand.

Central India serves as a crucial transit corridor connecting major industrial regions, with Madhya Pradesh and Chhattisgarh offering cost-effective logistics solutions and strategic geographical positioning for nationwide distribution networks.

Market leadership in India’s FTL transport sector features diverse players ranging from traditional transport companies to technology-enabled logistics platforms:

Competitive strategies emphasize technology adoption, network expansion, and service diversification to capture market share and improve profitability margins in this highly competitive segment.

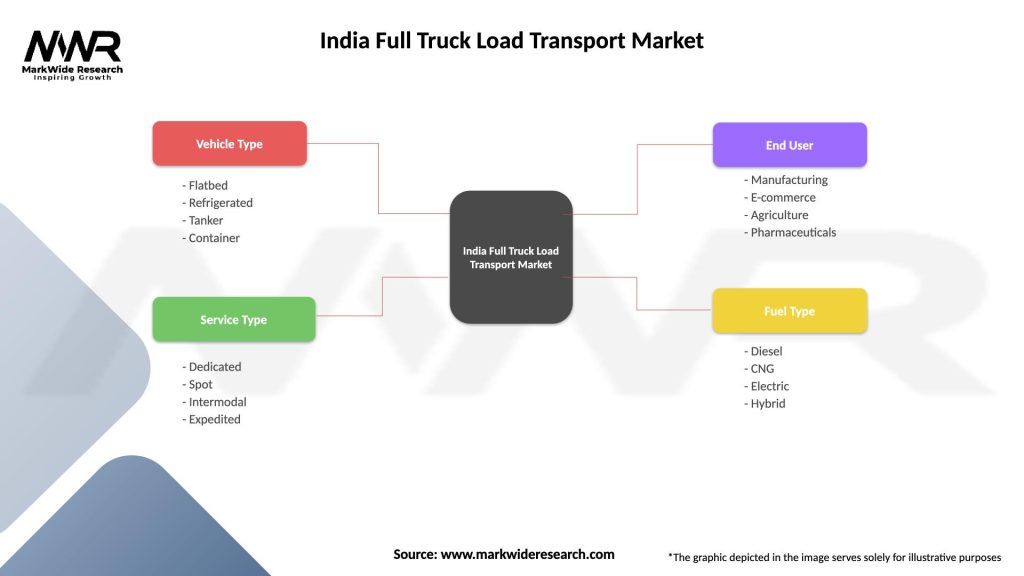

By Vehicle Type:

By End-User Industry:

By Service Type:

Automotive sector represents the largest FTL market segment, accounting for approximately 25-30% of total freight movements. This category benefits from India’s position as a global automotive manufacturing hub, with major OEMs requiring reliable transportation for components, finished vehicles, and aftermarket parts distribution.

Consumer goods segment demonstrates consistent growth driven by rising disposable incomes and changing consumption patterns. FMCG companies, electronics manufacturers, and fashion retailers rely heavily on FTL services for efficient distribution to retail networks across urban and rural markets.

Industrial goods category encompasses chemicals, textiles, and machinery transportation, requiring specialized handling capabilities and compliance with safety regulations. This segment offers higher margins due to technical expertise requirements and specialized equipment needs.

Agricultural products transportation presents seasonal demand patterns with peak requirements during harvest seasons. The segment benefits from government initiatives promoting food grain distribution and cold chain infrastructure development for perishable commodities.

E-commerce logistics has emerged as a high-growth category with unique requirements including reverse logistics, cash-on-delivery handling, and flexible delivery scheduling. This segment drives innovation in last-mile connectivity and technology adoption.

Shippers and Customers:

Transport Operators:

Economic Impact:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital platform adoption has accelerated significantly with technology-enabled load matching, real-time tracking, and automated billing systems transforming traditional transportation practices. MarkWide Research indicates that digital platform penetration has increased by approximately 40-45% among organized FTL operators over the past three years.

Sustainability initiatives are gaining prominence as customers and regulatory bodies emphasize environmental responsibility. Operators are investing in fuel-efficient vehicles, alternative fuel technologies, and carbon offset programs to meet evolving market expectations and regulatory requirements.

Integrated logistics solutions represent a key trend as customers seek comprehensive service providers offering end-to-end supply chain management. This trend drives consolidation and partnership formation among transport operators, warehouse providers, and technology companies.

Data analytics utilization enables predictive maintenance, route optimization, and demand forecasting, improving operational efficiency and customer service quality. Advanced analytics help operators reduce costs while enhancing service reliability and customer satisfaction.

Customer-centric services including flexible scheduling, real-time visibility, and proactive communication have become essential differentiators in the competitive market landscape. Operators investing in customer experience capabilities are gaining market share and premium pricing power.

Infrastructure investments through the Bharatmala project and dedicated freight corridors are transforming transportation efficiency and connectivity. The Eastern and Western Dedicated Freight Corridors are expected to reduce transportation costs by 20-25% while improving cargo movement speed and reliability.

Regulatory reforms including the Motor Vehicle Amendment Act and revised axle load norms have modernized transportation regulations while promoting safety and efficiency. These changes enable higher payload capacity and improved vehicle utilization rates.

Technology partnerships between traditional transport companies and technology providers are creating innovative solutions for fleet management, customer engagement, and operational optimization. These collaborations accelerate digital transformation across the industry.

Financial sector engagement through specialized lending products, insurance solutions, and fintech partnerships is improving access to capital for fleet expansion and technology adoption. This financial support enables smaller operators to compete effectively with larger players.

International expansion by Indian logistics companies into neighboring markets demonstrates growing capabilities and ambitions beyond domestic operations. These expansions leverage India’s competitive advantages in technology and operational expertise.

Technology investment should be prioritized by FTL operators to remain competitive in the evolving market landscape. Implementation of GPS tracking, mobile applications, and data analytics platforms can improve operational efficiency while enhancing customer satisfaction and retention.

Service diversification into value-added logistics services including warehousing, packaging, and supply chain consulting can increase revenue streams and customer stickiness. Operators should evaluate opportunities for vertical integration and strategic partnerships.

Sustainability initiatives including fuel-efficient vehicles, alternative fuel adoption, and carbon footprint reduction programs can provide competitive advantages and access to environmentally conscious customer segments.

Regional expansion strategies should focus on underserved markets with growing industrial activity and infrastructure development. Eastern and northeastern states present significant opportunities for market penetration and network expansion.

Talent development programs addressing driver shortages and technical skill gaps are essential for sustainable growth. Investment in training infrastructure and employee development can improve service quality while reducing operational challenges.

Financial management strategies should address fuel price volatility through hedging mechanisms, dynamic pricing models, and operational efficiency improvements. Effective cost management is crucial for maintaining profitability in competitive market conditions.

Market expansion prospects remain robust with projected growth rates of 8-10% annually driven by manufacturing sector development, infrastructure improvements, and technology adoption. The market is expected to benefit from government initiatives promoting domestic manufacturing and export competitiveness.

Technology transformation will continue reshaping the industry with artificial intelligence, IoT integration, and autonomous vehicle technologies creating new operational paradigms. Early adopters of these technologies are likely to gain significant competitive advantages and market share.

Consolidation trends are expected to accelerate as customers prefer dealing with reliable, technology-enabled service providers offering comprehensive logistics solutions. This consolidation will improve market efficiency while creating opportunities for strategic partnerships and acquisitions.

Infrastructure development through dedicated freight corridors, port connectivity projects, and urban logistics hubs will significantly enhance transportation efficiency and reduce costs. These improvements will support market growth while improving service quality standards.

Regulatory evolution toward digitalization, environmental compliance, and safety standards will create both challenges and opportunities for market participants. Companies investing in compliance capabilities and sustainable practices are positioned for long-term success.

MWR analysis suggests that the India FTL transport market will continue evolving toward technology-enabled, customer-centric service models with emphasis on sustainability and operational efficiency. Market leaders will be those successfully balancing traditional transportation expertise with modern technology capabilities and customer service excellence.

India’s Full Truck Load transport market stands at a transformative juncture, characterized by robust growth potential, technological innovation, and evolving customer expectations. The market’s fundamental strengths including large domestic demand, infrastructure development, and government policy support create a favorable environment for sustained expansion and modernization.

Key success factors for market participants include technology adoption, service quality enhancement, operational efficiency improvement, and customer relationship management. Companies successfully integrating these elements while maintaining cost competitiveness are positioned to capture significant market opportunities and achieve sustainable growth.

Future market dynamics will be shaped by continued digitalization, sustainability initiatives, infrastructure development, and regulatory evolution. The industry’s transformation from traditional transportation services toward integrated logistics solutions reflects changing customer needs and competitive requirements in India’s evolving economy.

Strategic positioning for long-term success requires balanced investment in technology, infrastructure, human resources, and customer service capabilities. The India FTL transport market offers substantial opportunities for companies prepared to adapt to changing market conditions while maintaining operational excellence and customer focus in this dynamic and competitive landscape.

What is Full Truck Load Transport?

Full Truck Load Transport refers to the shipping method where an entire truck is dedicated to a single shipment, allowing for efficient and timely delivery of goods. This method is commonly used for large shipments that require a full truck’s capacity, making it ideal for businesses in manufacturing, retail, and logistics.

What are the key players in the India Full Truck Load Transport Market?

Key players in the India Full Truck Load Transport Market include companies like Gati Ltd, Blue Dart Express, and Mahindra Logistics. These companies provide a range of logistics services, including full truck load transport, catering to various industries such as e-commerce, automotive, and consumer goods, among others.

What are the growth factors driving the India Full Truck Load Transport Market?

The growth of the India Full Truck Load Transport Market is driven by increasing demand for efficient logistics solutions, the expansion of e-commerce, and the rise in manufacturing activities. Additionally, government initiatives to improve infrastructure and logistics networks are further supporting market growth.

What challenges does the India Full Truck Load Transport Market face?

The India Full Truck Load Transport Market faces challenges such as fluctuating fuel prices, regulatory hurdles, and traffic congestion. These factors can impact operational efficiency and increase transportation costs for logistics providers.

What opportunities exist in the India Full Truck Load Transport Market?

Opportunities in the India Full Truck Load Transport Market include the adoption of technology for route optimization and tracking, as well as the potential for expansion into underserved regions. Additionally, the growing focus on sustainability in logistics presents avenues for eco-friendly transport solutions.

What trends are shaping the India Full Truck Load Transport Market?

Trends shaping the India Full Truck Load Transport Market include the increasing use of digital platforms for freight booking and management, the rise of electric and alternative fuel vehicles, and a shift towards integrated logistics solutions. These trends are enhancing efficiency and reducing the environmental impact of transportation.

India Full Truck Load Transport Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Flatbed, Refrigerated, Tanker, Container |

| Service Type | Dedicated, Spot, Intermodal, Expedited |

| End User | Manufacturing, E-commerce, Agriculture, Pharmaceuticals |

| Fuel Type | Diesel, CNG, Electric, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Full Truck Load Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at