444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India full service restaurants market represents one of the most dynamic and rapidly evolving segments within the country’s hospitality and food service industry. This comprehensive market encompasses establishments that provide complete dining experiences, including table service, diverse menu offerings, and enhanced customer amenities. Market dynamics indicate robust growth driven by urbanization, rising disposable incomes, and changing consumer preferences toward experiential dining.

Consumer behavior patterns have shifted significantly, with Indian diners increasingly seeking premium dining experiences that combine quality cuisine with exceptional service standards. The market demonstrates remarkable resilience and adaptability, particularly following the pandemic-induced transformations that reshaped operational models and customer expectations. Growth trajectories suggest sustained expansion at approximately 12.5% CAGR through the forecast period, reflecting strong underlying demand fundamentals.

Regional distribution shows concentrated activity in metropolitan areas, with tier-1 cities accounting for nearly 65% market share while tier-2 and tier-3 cities demonstrate accelerating adoption rates. The market encompasses various formats including casual dining, fine dining, family restaurants, and specialty cuisine establishments, each catering to distinct consumer segments and occasions.

The India full service restaurants market refers to the comprehensive ecosystem of dining establishments that provide complete table service experiences, including seated dining, menu-based ordering, professional service staff, and enhanced ambiance. These establishments differentiate themselves from quick service restaurants through personalized service delivery, extended dining durations, and comprehensive hospitality offerings.

Full service restaurants typically feature trained waitstaff, diverse menu portfolios, alcoholic beverage service capabilities, and sophisticated operational infrastructure designed to create memorable dining experiences. The market encompasses various subcategories including casual dining chains, independent restaurants, fine dining establishments, family restaurants, and themed dining concepts that cater to different consumer preferences and price points.

Operational characteristics include table reservations, customized service delivery, extensive menu options, professional kitchen operations, and integrated technology platforms for enhanced customer engagement. These establishments focus on creating differentiated value propositions through cuisine quality, service excellence, ambiance design, and overall customer experience optimization.

Market fundamentals demonstrate exceptional strength across multiple dimensions, with the India full service restaurants sector experiencing unprecedented growth momentum driven by demographic shifts, economic prosperity, and evolving lifestyle preferences. Consumer spending patterns indicate increased allocation toward dining experiences, with approximately 18% annual growth in per-capita restaurant expenditure among urban populations.

Technology integration has emerged as a critical differentiator, with establishments leveraging digital platforms for reservations, ordering, payment processing, and customer relationship management. The market benefits from favorable regulatory environments, infrastructure development, and increasing foreign investment in hospitality ventures. Competitive dynamics feature both established chains and innovative independent operators competing through service excellence, menu innovation, and customer experience enhancement.

Strategic positioning varies significantly across market segments, with premium establishments focusing on experiential dining while value-oriented concepts emphasize accessibility and convenience. The market demonstrates strong resilience to economic fluctuations, supported by diverse consumer bases and adaptable operational models that accommodate changing market conditions.

Consumer preferences have evolved dramatically, creating numerous opportunities for market participants to develop innovative concepts and service delivery models. The following insights highlight critical market dynamics:

Economic prosperity serves as the primary catalyst for market expansion, with rising disposable incomes enabling increased consumer spending on dining experiences. Urbanization trends create concentrated consumer bases in metropolitan areas, supporting sustainable restaurant operations and encouraging new market entrants to establish presence in high-density locations.

Lifestyle transformation represents another significant driver, as Indian consumers increasingly embrace dining out as social activity, celebration venue, and convenience solution. Working population dynamics contribute substantially, with dual-income households and extended working hours creating demand for restaurant dining as alternative to home cooking.

Cultural evolution toward experiential consumption drives premium segment growth, with consumers seeking memorable experiences beyond basic food consumption. Tourism development supports market expansion through increased domestic and international visitor traffic, creating opportunities for specialized dining concepts and regional cuisine establishments.

Technology enablement facilitates operational efficiency and customer engagement, with digital platforms reducing operational costs while enhancing service delivery capabilities. Infrastructure development in transportation, telecommunications, and urban planning creates favorable environments for restaurant establishment and customer accessibility.

Operational complexity presents significant challenges for market participants, particularly regarding staff training, inventory management, and quality consistency across multiple locations. Regulatory compliance requirements create administrative burdens and operational costs, especially for establishments serving alcoholic beverages or operating in multiple jurisdictions.

Real estate costs in prime locations limit accessibility for new market entrants and pressure profit margins for existing operators. Labor shortage issues affect service quality and operational efficiency, particularly for skilled positions requiring specialized training and experience.

Economic sensitivity impacts consumer spending during economic downturns, affecting discretionary dining expenditure and forcing establishments to adapt pricing strategies. Competition intensity from both organized and unorganized sectors creates pricing pressures and requires continuous innovation to maintain market position.

Supply chain vulnerabilities affect ingredient availability and cost stability, particularly for establishments requiring specialized or imported ingredients. Health and safety regulations impose operational requirements that increase compliance costs and complexity, especially following enhanced protocols implemented during recent health crises.

Geographic expansion into tier-2 and tier-3 cities presents substantial growth opportunities, with emerging markets demonstrating strong consumer demand and limited competition from established players. Format innovation enables market participants to develop unique concepts that address specific consumer needs and preferences.

Technology integration offers numerous opportunities for operational optimization, customer engagement enhancement, and new revenue stream development through digital platforms and delivery services. Franchise development provides scalable growth models that leverage local market knowledge while maintaining brand consistency.

Specialty cuisine segments create differentiation opportunities, particularly for authentic regional cuisines, international concepts, and health-focused dining options. Corporate partnerships with offices, hotels, and event venues generate stable revenue streams and reduce marketing costs.

Sustainability initiatives appeal to environmentally conscious consumers while potentially reducing operational costs through waste reduction and energy efficiency measures. Experience enhancement through entertainment integration, themed concepts, and interactive dining creates premium pricing opportunities and customer loyalty.

Competitive forces shape market evolution through continuous innovation, service enhancement, and operational efficiency improvements. Consumer expectations continue rising, demanding higher service standards, menu variety, and overall experience quality from restaurant operators.

Technology disruption transforms traditional operational models, with digital platforms enabling new service delivery methods and customer interaction channels. Supply chain optimization becomes increasingly critical for cost management and quality consistency, particularly as ingredient costs fluctuate and availability varies.

Regulatory evolution affects operational requirements, with food safety standards, labor regulations, and licensing procedures influencing establishment operations and expansion strategies. Market consolidation trends emerge as successful operators acquire smaller establishments or develop franchise networks to achieve scale economies.

Consumer behavior shifts toward health consciousness, sustainability awareness, and experiential consumption create both challenges and opportunities for market participants. Economic cycles influence consumer spending patterns, requiring operational flexibility and strategic adaptability from restaurant operators.

Comprehensive analysis employs multiple research methodologies to ensure accurate market assessment and reliable insights for stakeholders. Primary research includes extensive interviews with restaurant operators, industry executives, suppliers, and consumers across various market segments and geographic regions.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and financial disclosures from publicly listed companies. Market surveys capture consumer preferences, spending patterns, and satisfaction levels across different restaurant categories and price segments.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Quantitative analysis utilizes statistical modeling to project market trends, growth rates, and segment performance indicators.

Qualitative assessment examines market dynamics, competitive positioning, and strategic implications through expert interviews and industry observation. Regional analysis considers local market conditions, cultural preferences, and economic factors affecting restaurant operations in different geographic areas.

Northern India demonstrates strong market presence with 35% regional market share, driven by Delhi NCR’s concentration of corporate offices, affluent consumers, and diverse dining preferences. Market characteristics include high competition intensity, premium pricing capabilities, and strong demand for international cuisine concepts.

Western India accounts for approximately 30% market share, with Mumbai and Pune leading growth through financial sector prosperity and cosmopolitan consumer preferences. Regional dynamics favor upscale dining concepts, business entertainment venues, and innovative cuisine offerings that cater to sophisticated palates.

Southern India represents 25% market share with Bangalore, Chennai, and Hyderabad driving technology sector-fueled growth. Consumer preferences emphasize authentic regional cuisines alongside international options, creating opportunities for both traditional and fusion concepts.

Eastern India maintains 10% market share with Kolkata leading cultural dining traditions and emerging modern concepts. Growth potential remains significant as economic development accelerates and consumer preferences evolve toward experiential dining.

Market leadership features diverse participants ranging from established chains to innovative independent operators, each competing through distinct value propositions and operational strategies. The competitive environment demonstrates healthy dynamics with opportunities for various business models and market positioning approaches.

By Service Type:

By Price Range:

By Location Type:

Casual Dining Category dominates market share through broad consumer appeal and operational scalability. Growth drivers include affordable pricing, consistent quality, and convenient locations that attract regular customer visits. Innovation trends focus on menu diversification, technology integration, and service efficiency improvements.

Fine Dining Segment demonstrates premium growth potential with 15% annual expansion driven by affluent consumer segments seeking exceptional experiences. Competitive advantages include chef expertise, ingredient quality, service excellence, and ambiance sophistication that justify premium pricing strategies.

Family Restaurant Category benefits from multi-generational dining trends and celebration occasions. Market positioning emphasizes comfortable environments, diverse menu options, and child-friendly amenities that encourage repeat visits and longer dining durations.

Specialty Cuisine Segment captures growing consumer interest in authentic and international dining experiences. Success factors include cuisine authenticity, cultural ambiance, and specialized preparation techniques that create differentiated value propositions.

Restaurant Operators benefit from expanding market opportunities, diverse revenue streams, and scalable business models that enable sustainable growth. Operational advantages include technology-enabled efficiency improvements, supply chain optimization opportunities, and customer data insights for strategic decision-making.

Investors gain access to resilient business models with predictable cash flows and expansion potential across geographic markets. Investment benefits include portfolio diversification, inflation protection through pricing flexibility, and long-term growth prospects supported by demographic trends.

Suppliers enjoy stable demand patterns and partnership opportunities with established restaurant chains. Supply chain benefits include volume commitments, payment reliability, and collaborative product development initiatives that drive mutual growth.

Consumers benefit from increased dining options, improved service standards, and competitive pricing through market competition. Experience enhancements include convenient locations, diverse cuisine options, and technology-enabled services that improve overall satisfaction.

Employment Generation creates opportunities across skill levels, from entry-level positions to management roles. Career development pathways include hospitality training, culinary arts, and business management opportunities within growing organizations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation accelerates across all market segments, with establishments implementing comprehensive technology solutions for ordering, payment, customer management, and operational optimization. Mobile integration becomes essential for customer engagement and service delivery efficiency.

Sustainability Focus gains prominence as consumers increasingly consider environmental impact in dining decisions. Green practices include waste reduction, energy efficiency, sustainable sourcing, and eco-friendly packaging that appeal to environmentally conscious consumers.

Health and Wellness trends influence menu development and preparation methods, with establishments offering nutritional information, organic ingredients, and health-focused options. Dietary accommodation includes vegetarian, vegan, gluten-free, and other specialized dietary requirements.

Experience Enhancement through entertainment integration, interactive dining concepts, and social media-worthy presentations creates differentiation opportunities. Ambiance innovation includes themed environments, live entertainment, and unique design elements that encourage social sharing.

Delivery Integration expands beyond traditional dine-in services, with establishments developing comprehensive omnichannel strategies that include takeout, delivery, and catering services to maximize revenue opportunities.

Technology Adoption accelerates with MarkWide Research indicating widespread implementation of point-of-sale systems, customer relationship management platforms, and inventory management solutions across market participants. Digital payment integration becomes standard practice, enhancing transaction efficiency and customer convenience.

Expansion Strategies focus on tier-2 and tier-3 cities, with established players developing franchise models and regional partnerships to penetrate emerging markets. Format diversification includes cloud kitchens, food courts, and hybrid concepts that optimize operational efficiency.

Menu Innovation emphasizes fusion cuisines, health-conscious options, and locally-sourced ingredients that appeal to evolving consumer preferences. Seasonal offerings and limited-time promotions create excitement and encourage repeat visits.

Partnership Development includes collaborations with food delivery platforms, payment processors, and technology providers that enhance operational capabilities and market reach. Supply chain optimization through direct sourcing and vendor consolidation improves cost efficiency and quality consistency.

Market Entry Strategy should prioritize thorough location analysis, consumer preference research, and competitive landscape assessment before establishment. Differentiation focus becomes critical in saturated markets, requiring unique value propositions that address specific consumer needs.

Technology Investment represents essential infrastructure for competitive positioning and operational efficiency. Digital platform integration should encompass customer engagement, operational management, and data analytics capabilities that drive strategic decision-making.

Staff Development requires continuous investment in training, retention programs, and performance management systems that ensure consistent service quality. Operational excellence depends on skilled workforce capabilities and effective management systems.

Financial Management should emphasize cash flow optimization, cost control measures, and strategic pricing that balances competitiveness with profitability. Growth financing requires careful planning and sustainable expansion strategies that maintain operational quality.

Brand Building through consistent quality delivery, customer engagement, and marketing initiatives creates long-term competitive advantages. Customer loyalty programs and community engagement enhance retention rates and word-of-mouth marketing effectiveness.

Growth projections indicate sustained market expansion with MWR forecasting continued momentum driven by urbanization, income growth, and lifestyle evolution. Market maturation in tier-1 cities will drive expansion into emerging markets with significant growth potential.

Technology integration will deepen across all operational aspects, with artificial intelligence, automation, and data analytics becoming standard tools for competitive advantage. Customer experience enhancement through personalization and predictive service delivery will differentiate successful operators.

Sustainability initiatives will transition from optional practices to essential operational requirements as consumer awareness and regulatory requirements evolve. Environmental responsibility will influence supplier selection, operational procedures, and brand positioning strategies.

Format evolution will continue with hybrid concepts, experience-focused establishments, and technology-enabled service delivery models gaining market share. Operational efficiency improvements through automation and process optimization will become increasingly important for profitability.

Market consolidation trends may emerge as successful operators acquire smaller establishments or develop franchise networks to achieve scale economies and market dominance in specific regions or segments.

The India full service restaurants market presents exceptional opportunities for growth and innovation, supported by strong demographic trends, economic prosperity, and evolving consumer preferences toward experiential dining. Market fundamentals demonstrate resilience and adaptability, with successful operators leveraging technology, operational excellence, and customer-centric strategies to achieve sustainable competitive advantages.

Strategic success requires comprehensive understanding of local market dynamics, consumer preferences, and operational requirements that vary significantly across geographic regions and market segments. Investment in technology, staff development, and customer experience enhancement will determine long-term market positioning and profitability outcomes.

Future growth will favor operators who successfully balance operational efficiency with experience quality, while adapting to changing consumer expectations and market conditions. The market’s continued evolution toward premiumization, sustainability, and technology integration creates both challenges and opportunities for industry participants committed to excellence and innovation.

What is Full Service Restaurants?

Full Service Restaurants are dining establishments that provide a complete meal experience, including table service, a diverse menu, and often a bar. They cater to various customer preferences, offering cuisines ranging from local to international.

What are the key players in the India Full Service Restaurants Market?

Key players in the India Full Service Restaurants Market include major chains like Barbeque Nation, Mainland China, and Haldiram’s. These companies are known for their extensive menus and unique dining experiences, among others.

What are the growth factors driving the India Full Service Restaurants Market?

The growth of the India Full Service Restaurants Market is driven by increasing disposable incomes, changing consumer lifestyles, and a growing preference for dining out. Additionally, the rise of food delivery services has expanded customer reach.

What challenges does the India Full Service Restaurants Market face?

The India Full Service Restaurants Market faces challenges such as high operational costs, intense competition, and fluctuating food prices. These factors can impact profitability and sustainability for restaurant operators.

What opportunities exist in the India Full Service Restaurants Market?

Opportunities in the India Full Service Restaurants Market include the expansion of online food delivery platforms and the growing trend of health-conscious dining. Additionally, there is potential for innovative dining concepts that cater to evolving consumer preferences.

What trends are shaping the India Full Service Restaurants Market?

Trends shaping the India Full Service Restaurants Market include the rise of experiential dining, the incorporation of technology for enhanced customer service, and a focus on sustainability practices. These trends reflect changing consumer expectations and market dynamics.

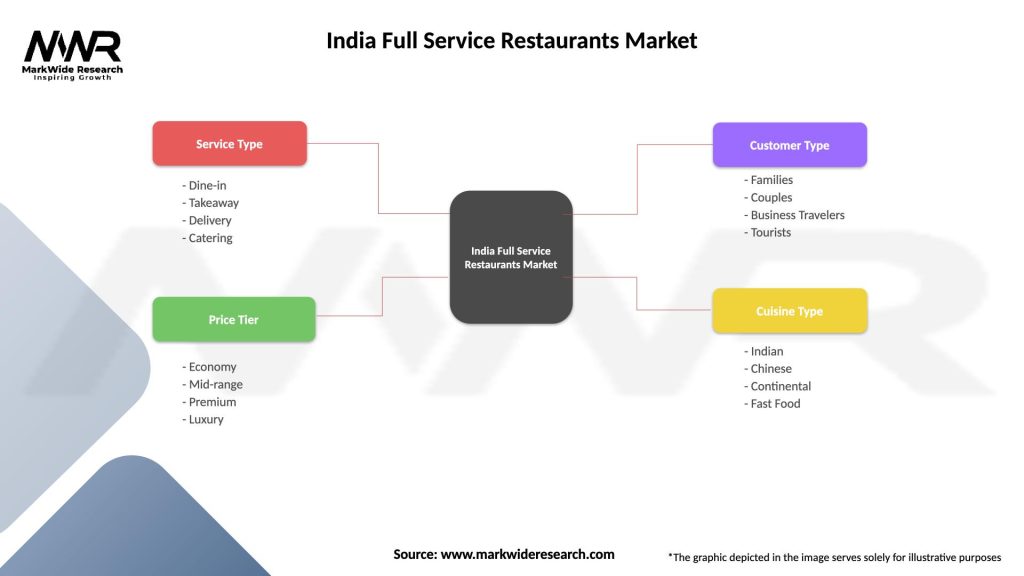

India Full Service Restaurants Market

| Segmentation Details | Description |

|---|---|

| Service Type | Dine-in, Takeaway, Delivery, Catering |

| Price Tier | Economy, Mid-range, Premium, Luxury |

| Customer Type | Families, Couples, Business Travelers, Tourists |

| Cuisine Type | Indian, Chinese, Continental, Fast Food |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Full Service Restaurants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at