444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India food service market represents one of the most dynamic and rapidly evolving sectors in the country’s economy, encompassing restaurants, cafes, quick service restaurants, cloud kitchens, and institutional catering services. Market dynamics indicate unprecedented growth driven by changing consumer preferences, urbanization, and technological integration. The sector has witnessed remarkable transformation with the emergence of organized retail chains, digital ordering platforms, and innovative dining concepts that cater to India’s diverse culinary landscape.

Consumer behavior has shifted significantly toward convenience-oriented dining solutions, with online food delivery experiencing growth rates of approximately 25-30% annually. The market encompasses traditional full-service restaurants, quick service restaurants (QSRs), casual dining establishments, fine dining venues, and the rapidly expanding cloud kitchen segment. Regional variations in food preferences and dining habits create unique opportunities across different geographical markets, from metropolitan cities to tier-2 and tier-3 urban centers.

Technology adoption has become a critical differentiator, with digital payment systems, mobile ordering applications, and delivery aggregator platforms reshaping the industry landscape. The integration of artificial intelligence, data analytics, and customer relationship management systems has enabled food service providers to enhance operational efficiency and customer experience. Investment flows into the sector have increased substantially, with both domestic and international players recognizing the immense potential of India’s food service ecosystem.

The India food service market refers to the comprehensive ecosystem of businesses involved in preparing, serving, and delivering food and beverages to consumers outside their homes. This market encompasses various segments including full-service restaurants, limited-service establishments, cafeterias, catering services, food trucks, cloud kitchens, and institutional food service providers serving schools, hospitals, corporate offices, and other organizations.

Market participants range from small independent operators to large multinational chains, each contributing to the diverse food service landscape. The sector includes both organized and unorganized segments, with the organized segment gaining significant traction due to standardization, quality assurance, and brand recognition. Service delivery models have evolved to include dine-in experiences, takeaway services, home delivery, and hybrid concepts that combine multiple service formats.

Technological integration has redefined market boundaries, enabling virtual restaurants, ghost kitchens, and app-based food delivery services to emerge as significant market segments. The market also encompasses ancillary services such as food aggregator platforms, payment processing systems, supply chain management, and customer engagement technologies that support the broader food service ecosystem.

Strategic analysis reveals that India’s food service market stands at a transformational juncture, driven by demographic shifts, technological advancement, and evolving consumer preferences. The market demonstrates robust growth potential with increasing disposable income, urbanization rates exceeding 35%, and a growing young population that prioritizes convenience and experiential dining. Digital transformation has accelerated market evolution, with online food delivery platforms capturing approximately 40-45% of urban food service transactions.

Competitive landscape features intense rivalry among established players and emerging disruptors, with market consolidation occurring through strategic acquisitions and partnerships. International brands continue expanding their presence while domestic players leverage local market knowledge and cultural preferences. Investment activity remains strong, particularly in technology-enabled food service models and sustainable dining concepts.

Growth drivers include rising nuclear family structures, increasing women workforce participation, and changing lifestyle patterns that favor dining out and food delivery services. The market benefits from India’s rich culinary heritage, diverse regional cuisines, and growing acceptance of international food concepts. Regulatory environment has become more supportive with simplified licensing procedures and food safety standardization initiatives.

Market segmentation reveals distinct growth patterns across different service categories and geographical regions. The following insights highlight critical market dynamics:

Consumer demographics indicate that millennials and Gen-Z consumers drive market demand, with preferences for Instagram-worthy presentations, sustainable practices, and personalized dining experiences. Spending patterns show increased frequency of food service usage with moderate per-transaction values, indicating market democratization across income segments.

Demographic transformation serves as the primary catalyst for market expansion, with India’s young population increasingly embracing dining out culture and convenience-oriented food solutions. Urbanization trends create concentrated demand centers where food service businesses can achieve operational efficiency and market penetration. The growing middle class with enhanced purchasing power drives demand for diverse dining experiences and premium food offerings.

Lifestyle changes significantly impact market dynamics, as nuclear families, dual-income households, and busy professional schedules increase reliance on food service providers. Women workforce participation has risen substantially, reducing time available for home cooking and increasing demand for convenient meal solutions. The cultural shift toward viewing dining out as entertainment and social activity rather than necessity expands market opportunities.

Technology adoption accelerates market growth through improved accessibility, convenience, and operational efficiency. Mobile applications, digital payment systems, and GPS-enabled delivery services have eliminated traditional barriers to food service access. Social media influence drives discovery of new restaurants and food trends, with visual platforms creating viral marketing opportunities for food service providers.

Infrastructure development supports market expansion through improved transportation networks, commercial real estate availability, and supply chain connectivity. Government initiatives promoting ease of doing business, simplified licensing procedures, and food safety standardization create favorable operating conditions for market participants.

Operational challenges pose significant constraints for food service providers, including high real estate costs in prime locations, labor shortage issues, and complex regulatory compliance requirements. Cost pressures from ingredient price volatility, fuel costs, and rental expenses impact profitability margins, particularly for small and medium-sized operators. The fragmented supply chain creates inefficiencies and quality control challenges that affect service consistency.

Competition intensity leads to market saturation in certain segments and geographical areas, resulting in pricing pressures and reduced profit margins. Consumer price sensitivity limits premium pricing strategies, especially in price-conscious market segments. The proliferation of food delivery platforms, while expanding market reach, also increases commission costs and reduces direct customer relationships.

Regulatory complexities create compliance burdens, with varying state-level regulations, licensing requirements, and food safety standards. Infrastructure limitations in tier-2 and tier-3 cities constrain market expansion opportunities, including inadequate delivery logistics and payment system penetration. The seasonal nature of certain food service segments creates revenue volatility and planning challenges.

Quality control issues and food safety concerns can damage brand reputation and consumer confidence, particularly affecting smaller operators with limited quality assurance capabilities. Cultural and regional preferences require significant localization efforts, increasing operational complexity for national and international chains.

Tier-2 and tier-3 city expansion presents substantial growth opportunities as urbanization spreads and disposable income increases in smaller cities. Untapped market segments include health-focused dining concepts, ethnic cuisine specialization, and experiential dining formats that combine food service with entertainment. The growing corporate catering market offers stable revenue streams with predictable demand patterns.

Technology-enabled innovations create opportunities for virtual restaurants, AI-powered personalization, and automated food preparation systems. Sustainability initiatives appeal to environmentally conscious consumers, including zero-waste restaurants, locally sourced ingredients, and eco-friendly packaging solutions. The integration of food service with retail concepts, such as grocery-restaurant hybrids, opens new market possibilities.

Franchise expansion opportunities exist for successful local concepts to scale nationally and for international brands to enter untapped geographical markets. Delivery infrastructure development enables market penetration in previously inaccessible areas, particularly with the emergence of hyperlocal delivery models. The growing demand for specialized dietary options, including vegan, gluten-free, and keto-friendly menus, creates niche market opportunities.

Partnership opportunities with technology companies, real estate developers, and financial institutions can accelerate market expansion and operational efficiency. Government support for food processing and restaurant industries through policy initiatives and financial incentives creates favorable conditions for market growth and innovation.

Supply and demand equilibrium in India’s food service market reflects complex interactions between consumer preferences, operational capabilities, and competitive positioning. Demand patterns show strong correlation with economic indicators, seasonal variations, and cultural events that influence dining behavior. The market demonstrates resilience through diversified service offerings and adaptive business models that respond to changing consumer needs.

Competitive dynamics feature both collaboration and rivalry, with food delivery platforms serving as intermediaries that connect restaurants with consumers while creating new competitive pressures. Market consolidation occurs through strategic acquisitions, particularly as larger players seek to expand geographical presence and service capabilities. The emergence of dark kitchens and virtual restaurants has disrupted traditional competitive boundaries.

Price dynamics reflect regional variations, service quality differentiation, and competitive positioning strategies. Value perception increasingly encompasses factors beyond price, including convenience, quality, ambiance, and brand reputation. The market shows elasticity in response to economic conditions, with consumers adjusting dining frequency and spending patterns based on disposable income changes.

Innovation cycles drive market evolution through menu development, service format experimentation, and technology integration. Consumer feedback loops enabled by digital platforms accelerate product development and service improvement processes. According to MarkWide Research analysis, market dynamics indicate increasing convergence between traditional dining and digital-first food service models.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes structured interviews with industry stakeholders, consumer surveys across different demographic segments, and focus group discussions to understand behavioral patterns and preferences. Field research involves direct observation of food service operations and consumer interactions across various market segments.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and academic studies related to food service trends and consumer behavior. Data triangulation methods validate findings through cross-referencing multiple information sources and analytical approaches. Quantitative analysis includes statistical modeling of market trends, growth projections, and segment performance metrics.

Market segmentation analysis utilizes demographic, geographic, psychographic, and behavioral variables to identify distinct consumer groups and market opportunities. Competitive intelligence gathering involves monitoring competitor activities, pricing strategies, and market positioning approaches. Technology-enabled research tools, including social media sentiment analysis and online review mining, provide real-time market insights.

Expert consultation with industry veterans, culinary professionals, and business strategists enriches analytical perspectives and validates market observations. Longitudinal studies track market evolution over extended periods to identify sustainable trends versus temporary fluctuations. Quality assurance protocols ensure research methodology adherence and data integrity throughout the analysis process.

Northern India demonstrates strong market presence with Delhi NCR serving as a major hub for food service innovation and international brand entry. Market characteristics include diverse cuisine preferences, high disposable income levels, and strong adoption of food delivery services. The region shows approximately 30-35% market share in organized food service segments, driven by metropolitan concentration and cultural openness to dining experiences.

Western India leads market development with Mumbai and Pune representing mature food service markets with sophisticated consumer preferences. Commercial activity concentration creates strong demand for corporate catering and quick service options. The region demonstrates innovation leadership in food service concepts and technology adoption, with approximately 35-40% of total market activity.

Southern India exhibits strong regional cuisine preferences alongside growing acceptance of national and international food concepts. Technology adoption rates are particularly high, with Bangalore and Hyderabad leading in food delivery platform usage. The region contributes approximately 25-30% of organized food service market share, with strong growth in tier-2 cities.

Eastern India shows emerging market potential with Kolkata leading regional development and growing interest in modern food service concepts. Cultural preferences for traditional dining experiences create unique market dynamics. Western region markets demonstrate gradual modernization with increasing chain restaurant presence and delivery service adoption, representing significant untapped potential for organized food service providers.

Market leadership features a diverse mix of domestic and international players competing across different service segments and price points. The competitive environment demonstrates both intense rivalry and collaborative partnerships, particularly in technology integration and supply chain optimization.

Emerging players include cloud kitchen operators, regional cuisine specialists, and technology-enabled food service platforms that challenge traditional competitive boundaries. Strategic partnerships between restaurants and delivery platforms create new competitive dynamics and market access opportunities. The competitive landscape continues evolving through innovation, market expansion, and consumer preference adaptation.

Service format segmentation reveals distinct market characteristics and growth patterns across different food service categories. Market distribution varies significantly based on service model, price positioning, and target consumer demographics.

By Service Type:

By Cuisine Type:

By Location:

Quick Service Restaurant category demonstrates exceptional growth momentum driven by convenience, affordability, and standardized quality. Consumer preferences favor familiar menu items, quick service delivery, and consistent pricing across locations. The segment benefits from strong franchise models, efficient operations, and technology integration that enhances customer experience and operational efficiency.

Casual dining segment focuses on experiential value proposition, combining quality food with ambiance and service excellence. Market positioning targets families, social groups, and celebration dining occasions. The category shows resilience through menu innovation, themed concepts, and integration of entertainment elements that differentiate from quick service alternatives.

Cloud kitchen category represents the most dynamic growth segment, leveraging technology and operational efficiency to serve delivery-focused consumers. Business model advantages include lower real estate costs, scalability, and ability to serve multiple brand concepts from single locations. The segment attracts entrepreneur interest and investor funding due to attractive unit economics and market expansion potential.

Fine dining segment emphasizes premium positioning through culinary excellence, service quality, and sophisticated ambiance. Target demographics include affluent consumers, business entertainment, and special occasion dining. The category demonstrates resilience through unique value propositions, chef-driven concepts, and exclusive dining experiences that justify premium pricing.

Street food modernization creates hybrid concepts that combine traditional flavors with modern service standards and hygiene practices. Market opportunity exists in elevating street food concepts while maintaining affordability and authenticity that appeals to diverse consumer segments.

Restaurant operators benefit from expanding market opportunities, diverse revenue streams, and technology-enabled operational efficiencies. Market growth provides scalability potential for successful concepts while technology integration reduces operational costs and improves customer engagement. Access to delivery platforms expands market reach beyond traditional geographical constraints.

Investors and franchisees gain from attractive return potential in a growing market with diverse investment opportunities across different service segments and price points. Franchise models provide proven business systems, brand recognition, and ongoing support that reduce entrepreneurial risks. The market offers portfolio diversification opportunities through different food service concepts and geographical markets.

Technology providers benefit from increasing demand for digital solutions, including point-of-sale systems, delivery platforms, customer relationship management, and operational analytics. Innovation opportunities exist in artificial intelligence, automation, and data analytics applications that enhance food service efficiency and customer experience.

Suppliers and vendors gain from market expansion that increases demand for ingredients, equipment, packaging, and support services. Supply chain optimization opportunities emerge through technology integration and direct partnerships with food service operators. The market provides stable demand patterns and growth potential for specialized food service suppliers.

Consumers benefit from increased dining options, improved convenience, competitive pricing, and enhanced service quality driven by market competition. Technology integration provides better accessibility, personalization, and convenience in food service access and ordering processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping the food service landscape with artificial intelligence, machine learning, and data analytics driving personalized customer experiences and operational optimization. Contactless service models have gained permanent adoption, including QR code menus, mobile ordering, and contactless payment systems that enhance safety and convenience.

Health and wellness focus influences menu development with increasing demand for organic ingredients, plant-based options, and nutritionally balanced meals. Sustainability initiatives gain importance as consumers prioritize environmentally responsible dining choices, including zero-waste practices, locally sourced ingredients, and eco-friendly packaging.

Hyperlocal delivery expands market reach through specialized logistics networks that serve previously inaccessible areas with faster delivery times. Ghost kitchen proliferation continues as operators seek cost-effective expansion models that maximize delivery efficiency while minimizing real estate expenses.

Experience-driven dining concepts combine food service with entertainment, social media integration, and interactive elements that create memorable customer experiences. Fusion cuisine innovation blends traditional Indian flavors with international cooking techniques and presentation styles, appealing to adventurous consumers.

Subscription and loyalty programs enhance customer retention through personalized offers, exclusive access, and reward systems that encourage repeat visits. Voice ordering technology and smart kitchen equipment integration streamline operations and improve service efficiency.

Strategic partnerships between food service operators and technology companies accelerate digital transformation and operational efficiency improvements. Acquisition activity increases as established players seek to expand market presence, acquire technology capabilities, and consolidate market position. International brands continue entering the Indian market through joint ventures and franchise partnerships.

Investment rounds in food technology startups and cloud kitchen operators demonstrate strong investor confidence in market growth potential. Regulatory developments include simplified licensing procedures, food safety standardization, and digital payment facilitation that support market expansion. Government initiatives promoting food processing and restaurant industries create favorable operating conditions.

Infrastructure development includes expansion of delivery networks, payment system penetration, and commercial real estate availability that supports market growth. Supply chain innovations improve ingredient sourcing, quality control, and cost management through technology integration and direct farmer partnerships.

Sustainability initiatives gain momentum with industry-wide adoption of eco-friendly practices, waste reduction programs, and sustainable sourcing policies. Workforce development programs address skill shortages through training initiatives, certification programs, and career development opportunities in food service operations.

MWR data indicates that industry consolidation accelerates through strategic mergers and acquisitions that create stronger market players with enhanced competitive capabilities.

Market entry strategies should prioritize tier-2 and tier-3 cities where competition remains moderate and consumer acceptance of organized food service concepts continues growing. Technology investment in delivery capabilities, customer engagement platforms, and operational analytics provides competitive advantages and operational efficiency improvements.

Menu localization remains critical for success, requiring deep understanding of regional preferences, dietary restrictions, and cultural sensitivities. Partnership strategies with delivery platforms, payment providers, and technology companies can accelerate market penetration and operational capabilities.

Brand positioning should emphasize unique value propositions that differentiate from competitors while maintaining relevance to target consumer segments. Operational excellence in food quality, service consistency, and customer experience creates sustainable competitive advantages in crowded markets.

Financial planning must account for initial investment requirements, working capital needs, and market development timelines that vary significantly across different geographical markets. Regulatory compliance strategies should anticipate varying state-level requirements and evolving food safety standards.

Sustainability integration into business operations appeals to environmentally conscious consumers while potentially reducing operational costs through waste reduction and energy efficiency. Talent development investments in training and retention programs address skill shortages while improving service quality and operational consistency.

Market trajectory indicates continued robust growth driven by demographic advantages, technological advancement, and evolving consumer preferences toward convenience and experiential dining. Growth projections suggest the market will maintain strong momentum with compound annual growth rates exceeding 12-15% over the next five years, supported by expanding urban populations and rising disposable incomes.

Technology integration will deepen with artificial intelligence, automation, and data analytics becoming standard operational tools that enhance efficiency and customer personalization. Market consolidation is expected to continue as successful operators scale operations and acquire smaller competitors to strengthen market position.

Geographic expansion into tier-2 and tier-3 cities will accelerate as infrastructure development and consumer awareness increase market accessibility. Service innovation will focus on hybrid concepts that combine multiple service formats, sustainability initiatives, and health-conscious menu options that address evolving consumer priorities.

International expansion opportunities for Indian food service concepts will grow as global appreciation for Indian cuisine increases and diaspora populations expand. Investment activity will remain strong, particularly in technology-enabled food service models and sustainable dining concepts that demonstrate scalability and profitability potential.

According to MarkWide Research projections, the market will experience structural transformation toward organized, technology-enabled, and sustainability-focused food service providers that can adapt to changing consumer expectations while maintaining operational efficiency and profitability.

India’s food service market represents one of the most compelling growth opportunities in the global food industry, driven by favorable demographics, technological advancement, and cultural evolution toward modern dining experiences. Market fundamentals remain strong with expanding urban populations, rising disposable incomes, and increasing acceptance of organized food service concepts across diverse consumer segments.

Strategic positioning for success requires understanding of local preferences, technology integration, operational excellence, and sustainable business practices that resonate with environmentally conscious consumers. Market participants who can effectively combine authentic culinary experiences with modern service delivery and digital engagement will capture disproportionate market share in this dynamic environment.

Future success will depend on adaptability to changing consumer preferences, regulatory compliance, and continuous innovation in service delivery models. The market offers substantial opportunities for both domestic and international players who can navigate competitive challenges while building sustainable competitive advantages through differentiation and operational excellence. Long-term outlook remains highly positive, with India’s food service market positioned to become a significant contributor to the country’s economic growth and employment generation in the coming decade.

What is India Food Service?

India Food Service refers to the sector that encompasses all businesses involved in preparing and serving food outside the home, including restaurants, cafes, catering services, and food delivery services.

What are the key players in the India Food Service Market?

Key players in the India Food Service Market include companies like Zomato, Swiggy, and Domino’s Pizza, which are significant in the online food delivery and restaurant sectors, among others.

What are the main drivers of growth in the India Food Service Market?

The main drivers of growth in the India Food Service Market include the increasing urbanization, changing consumer lifestyles, and a growing preference for dining out and food delivery services.

What challenges does the India Food Service Market face?

Challenges in the India Food Service Market include intense competition, fluctuating food prices, and regulatory hurdles that can impact operational efficiency and profitability.

What opportunities exist in the India Food Service Market?

Opportunities in the India Food Service Market include the expansion of cloud kitchens, the rise of health-conscious dining options, and the increasing adoption of technology for food delivery and customer engagement.

What trends are shaping the India Food Service Market?

Trends shaping the India Food Service Market include the growing popularity of plant-based foods, the integration of technology in ordering and delivery processes, and a focus on sustainability in food sourcing and packaging.

India Food Service Market

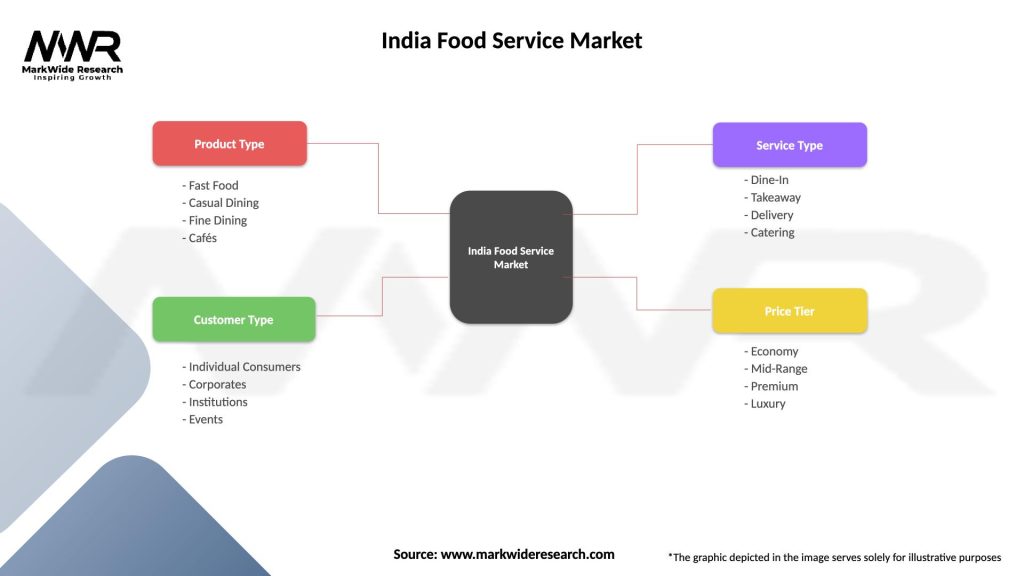

| Segmentation Details | Description |

|---|---|

| Product Type | Fast Food, Casual Dining, Fine Dining, Cafés |

| Customer Type | Individual Consumers, Corporates, Institutions, Events |

| Service Type | Dine-In, Takeaway, Delivery, Catering |

| Price Tier | Economy, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Food Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at