444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India food packaging market represents one of the most dynamic and rapidly evolving sectors within the country’s industrial landscape. Market dynamics indicate substantial growth driven by changing consumer preferences, urbanization, and the expanding food processing industry. The sector encompasses diverse packaging solutions including flexible packaging, rigid containers, and innovative sustainable materials designed to preserve food quality and extend shelf life.

Growth trajectories demonstrate remarkable expansion with the market experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This growth is primarily attributed to increasing disposable income, rising demand for convenience foods, and the proliferation of organized retail chains across urban and semi-urban areas. The market’s evolution reflects India’s transformation from traditional packaging methods to modern, technology-driven solutions.

Regional distribution shows significant concentration in major metropolitan areas, with 65% of market activity centered around Delhi, Mumbai, Bangalore, and Chennai. However, emerging markets in tier-2 and tier-3 cities are demonstrating accelerated adoption rates, contributing to the overall market expansion. The sector’s resilience during economic fluctuations underscores its essential role in India’s food supply chain infrastructure.

The India food packaging market refers to the comprehensive ecosystem of materials, technologies, and services designed to contain, protect, and preserve food products throughout the supply chain from production to consumption. This market encompasses primary packaging that directly contacts food, secondary packaging for distribution and retail display, and tertiary packaging for transportation and logistics.

Packaging solutions within this market include flexible films, rigid containers, bottles, cans, cartons, and specialized barrier materials. The sector integrates traditional packaging methods with advanced technologies such as modified atmosphere packaging, active packaging systems, and smart packaging solutions that monitor food freshness and safety.

Market participants range from multinational corporations to local manufacturers, serving diverse segments including dairy products, beverages, snacks, ready-to-eat meals, and fresh produce. The market’s scope extends beyond mere containment to include branding, marketing, and consumer engagement through innovative packaging designs and functionality.

Strategic analysis reveals the India food packaging market as a cornerstone of the country’s food processing and retail sectors. The market demonstrates robust fundamentals supported by demographic trends, economic growth, and evolving consumer behavior patterns. Key performance indicators show consistent expansion across multiple packaging categories with flexible packaging maintaining the largest market share.

Technological advancement drives market evolution with increasing adoption of sustainable materials and smart packaging solutions. The sector benefits from government initiatives promoting food processing and export capabilities, creating favorable conditions for continued growth. Investment flows into the sector have increased by 23% annually, reflecting investor confidence in long-term growth prospects.

Market consolidation trends indicate strategic partnerships between packaging manufacturers and food processors, enhancing supply chain efficiency and innovation capabilities. The competitive landscape features both established players and emerging companies focusing on niche segments and specialized packaging solutions.

Market intelligence reveals several critical insights shaping the India food packaging landscape:

Demographic transformation serves as a primary catalyst for market expansion. India’s growing middle class, increasing urbanization rates, and changing lifestyle patterns create sustained demand for packaged food products. Nuclear family structures and working women demographics drive preference for convenient, ready-to-consume food options requiring sophisticated packaging solutions.

Economic factors including rising disposable income and improved purchasing power enable consumers to invest in premium packaged foods. The expanding organized retail sector, including supermarkets, hypermarkets, and convenience stores, necessitates standardized packaging formats that ensure product quality and brand differentiation.

Technological innovation accelerates market growth through development of advanced packaging materials and processes. Innovations in barrier properties, shelf-life extension, and food safety features create new market opportunities. Government initiatives supporting food processing industries and export promotion schemes provide additional growth momentum.

Supply chain modernization drives demand for efficient packaging solutions that reduce food wastage and improve logistics efficiency. The cold chain infrastructure development across India creates opportunities for specialized packaging designed for temperature-sensitive products.

Cost pressures represent significant challenges for market participants, particularly regarding raw material price volatility and energy costs. Petroleum-based packaging materials face price fluctuations that impact profit margins and pricing strategies. Small and medium-scale food processors often struggle with packaging cost optimization while maintaining quality standards.

Environmental concerns create regulatory and consumer pressure for sustainable packaging alternatives. Traditional plastic packaging faces increasing scrutiny regarding environmental impact, necessitating investment in eco-friendly alternatives that may carry higher initial costs. Waste management infrastructure limitations in many regions complicate packaging material selection and disposal.

Technical challenges include maintaining food safety standards across diverse climatic conditions and extended supply chains. Quality consistency requirements demand sophisticated manufacturing processes and quality control systems that increase operational complexity and costs.

Regulatory compliance involves navigating complex food safety regulations, labeling requirements, and environmental standards that vary across states and product categories. Market fragmentation with numerous small players creates pricing pressure and limits economies of scale for packaging manufacturers.

Sustainable packaging presents substantial growth opportunities as environmental consciousness increases among consumers and regulators. Biodegradable materials, recyclable packaging, and reduced plastic alternatives offer competitive advantages and align with global sustainability trends. Companies investing in green packaging technologies position themselves for long-term market leadership.

Smart packaging integration creates opportunities for value-added solutions including freshness indicators, temperature monitoring, and anti-counterfeiting features. Digital connectivity through QR codes and NFC technology enables enhanced consumer engagement and supply chain transparency.

Export market expansion offers significant growth potential as Indian food products gain international recognition. Premium packaging designed for export markets commands higher margins and establishes brand credibility in global markets. MarkWide Research indicates substantial opportunities in Middle Eastern and Southeast Asian markets.

Rural market penetration represents untapped potential with improving infrastructure and increasing rural income levels. Customized packaging solutions for regional food preferences and distribution challenges create niche market opportunities.

Competitive dynamics within the India food packaging market reflect intense competition across multiple dimensions including price, quality, innovation, and service capabilities. Market leaders leverage economies of scale and technological capabilities to maintain competitive advantages while emerging players focus on specialized segments and innovative solutions.

Supply chain integration trends show increasing collaboration between packaging manufacturers and food processors to optimize packaging solutions and reduce total cost of ownership. Vertical integration strategies enable better quality control and cost management while horizontal partnerships expand market reach and capabilities.

Innovation cycles accelerate as companies invest in research and development to address evolving consumer needs and regulatory requirements. Technology adoption rates vary across market segments with premium brands leading in advanced packaging solutions while cost-sensitive segments focus on basic functionality.

Regulatory environment continues evolving with stricter food safety standards and environmental regulations shaping market dynamics. Compliance costs create barriers for smaller players while established companies leverage regulatory expertise as competitive advantages.

Comprehensive analysis of the India food packaging market employs multiple research methodologies to ensure accuracy and reliability of insights. Primary research includes extensive interviews with industry executives, packaging manufacturers, food processors, and retail partners across different market segments and geographical regions.

Secondary research incorporates analysis of industry reports, government publications, trade association data, and company financial statements. Market surveys capture consumer preferences, purchasing behavior, and brand perception across diverse demographic segments and geographical locations.

Quantitative analysis utilizes statistical modeling to project market trends, growth rates, and segment performance. Qualitative assessment provides contextual understanding of market dynamics, competitive strategies, and emerging opportunities through expert interviews and focus group discussions.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification. Market intelligence gathering includes monitoring of regulatory changes, technological developments, and competitive activities to maintain current and relevant insights.

Northern India dominates the food packaging market with 35% regional market share, driven by the presence of major food processing hubs in Delhi, Punjab, and Haryana. The region benefits from strong agricultural production, established manufacturing infrastructure, and proximity to major consumer markets. Government initiatives supporting food processing and export promotion create favorable business conditions.

Western India accounts for 30% of market activity with Maharashtra and Gujarat leading in packaging innovation and manufacturing capabilities. The region’s industrial infrastructure, port connectivity, and financial centers support market growth. Mumbai’s position as a commercial hub facilitates access to international markets and advanced technologies.

Southern India represents 25% of the market with strong growth in Karnataka, Tamil Nadu, and Andhra Pradesh. The region’s IT industry growth drives demand for convenient food packaging while traditional food processing industries adopt modern packaging solutions. Export orientation in southern states creates demand for premium packaging materials.

Eastern India shows emerging potential with 10% current market share but accelerating growth rates. West Bengal and Odisha demonstrate increasing adoption of modern packaging solutions driven by urbanization and industrial development. Infrastructure improvements and government support programs enhance market accessibility and growth prospects.

Market leadership in the India food packaging sector features a mix of multinational corporations and domestic companies competing across different segments and price points. The competitive environment emphasizes innovation, cost efficiency, and customer service capabilities.

Competitive strategies include capacity expansion, technological upgrades, strategic partnerships, and market diversification. Innovation focus drives development of sustainable materials, smart packaging features, and customized solutions for specific food categories.

By Material Type:

By Application:

By End-User:

Flexible packaging maintains market leadership due to cost advantages, versatility, and consumer convenience. Technological advances in barrier properties and printing capabilities enhance product appeal and functionality. The segment benefits from growing demand for snack foods, ready-to-eat meals, and portion-controlled packaging.

Rigid packaging serves premium market segments requiring superior protection and shelf appeal. Glass containers experience renewed interest for premium food products and health-conscious consumers. Plastic containers dominate dairy and beverage applications with innovations in lightweight and recyclable materials.

Sustainable packaging emerges as a critical category with bio-based materials and recyclable options gaining market traction. Paper-based packaging experiences growth in dry food applications and e-commerce deliveries. Compostable packaging addresses environmental concerns while meeting food safety requirements.

Smart packaging represents the future category with integrated sensors, indicators, and digital connectivity. Active packaging systems extend shelf life and maintain food quality through controlled release of preservatives or oxygen scavengers. Intelligent packaging provides real-time information about product condition and authenticity.

Food manufacturers benefit from advanced packaging solutions that extend product shelf life, reduce waste, and enhance brand differentiation. Cost optimization through efficient packaging design and materials reduces overall production costs while maintaining quality standards. Market expansion opportunities arise from packaging innovations that enable entry into new geographical markets and consumer segments.

Retailers and distributors gain advantages through improved product presentation, reduced handling costs, and enhanced inventory management. Supply chain efficiency improvements through optimized packaging dimensions and durability reduce logistics costs and product damage. Consumer satisfaction increases through convenient packaging formats and clear product information.

Consumers benefit from improved food safety, extended freshness, and convenient packaging formats that fit modern lifestyles. Portion control and resealable packaging options support health and wellness trends. Environmental benefits from sustainable packaging align with growing ecological consciousness.

Packaging manufacturers experience growth opportunities through innovation and market expansion. Technology investments in advanced materials and processes create competitive advantages and premium pricing opportunities. Partnership opportunities with food brands enable collaborative innovation and long-term business relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability revolution drives fundamental changes in packaging material selection and design philosophy. Circular economy principles influence packaging development with emphasis on recyclability, biodegradability, and reduced environmental impact. Consumer awareness regarding environmental issues creates market demand for sustainable packaging alternatives.

Digital integration transforms packaging from passive containers to interactive communication platforms. QR codes and NFC technology enable consumer engagement, product authentication, and supply chain transparency. Smart sensors provide real-time information about product freshness and storage conditions.

Convenience packaging responds to changing lifestyle patterns and urbanization trends. Portion control, resealable features, and microwave-safe materials cater to busy consumers seeking convenient food solutions. On-the-go packaging formats support mobile consumption patterns and snacking trends.

Premiumization trends drive demand for high-quality packaging that enhances product perception and brand value. Aesthetic appeal through advanced printing, embossing, and unique shapes differentiates products in competitive markets. Luxury packaging experiences growth in premium food segments and gift markets.

Technological breakthroughs in packaging materials include development of advanced barrier films, active packaging systems, and biodegradable polymers. Manufacturing innovations improve production efficiency and enable customization capabilities for diverse food applications.

Strategic partnerships between packaging manufacturers and food brands accelerate innovation and market penetration. Acquisition activities consolidate market players and create synergies in technology and distribution capabilities. MWR analysis indicates increasing foreign investment in Indian packaging companies.

Regulatory developments include updated food safety standards, plastic waste management rules, and labeling requirements. Government initiatives supporting food processing and export promotion create favorable conditions for packaging industry growth.

Infrastructure investments in cold chain logistics and modern retail formats drive demand for specialized packaging solutions. E-commerce growth necessitates packaging innovations for online food delivery and direct-to-consumer sales channels.

Investment priorities should focus on sustainable packaging technologies and smart packaging capabilities to capture emerging market opportunities. Companies investing in biodegradable materials and recyclable packaging solutions position themselves advantageously for long-term growth as environmental regulations strengthen.

Market expansion strategies should target tier-2 and tier-3 cities where urbanization and income growth create new demand for packaged foods. Customization capabilities for regional food preferences and local distribution requirements offer competitive advantages in emerging markets.

Technology adoption recommendations include investment in digital printing, smart packaging sensors, and automated production systems. Operational efficiency improvements through technology integration reduce costs and improve quality consistency.

Partnership strategies with food processors, retail chains, and technology providers accelerate innovation and market access. Collaborative approaches to sustainability challenges and regulatory compliance create shared value and competitive advantages.

Growth projections indicate sustained expansion of the India food packaging market driven by demographic trends, economic development, and evolving consumer preferences. Market evolution toward sustainable and intelligent packaging solutions creates opportunities for innovation-focused companies.

Technology integration will accelerate with artificial intelligence and Internet of Things applications in packaging design and supply chain management. Predictive analytics will optimize packaging performance and reduce waste throughout the food supply chain.

Regulatory landscape will continue evolving with stricter environmental standards and food safety requirements. Compliance capabilities will become critical competitive factors as regulations harmonize across states and align with international standards.

Market consolidation trends will continue with strategic mergers and acquisitions creating larger, more capable companies. Global integration will increase as Indian packaging companies expand internationally and foreign companies invest in Indian operations. MarkWide Research projects continued robust growth with increasing sophistication in packaging solutions and materials.

The India food packaging market stands at a transformative juncture with substantial growth opportunities driven by demographic changes, economic development, and technological innovation. Market fundamentals remain strong with increasing urbanization, rising disposable income, and evolving consumer preferences supporting sustained demand for advanced packaging solutions.

Sustainability imperatives and regulatory developments will reshape the competitive landscape, favoring companies that invest in eco-friendly materials and circular economy principles. Technology integration through smart packaging and digital connectivity will create new value propositions and competitive advantages.

Strategic success in this dynamic market requires balancing cost efficiency with innovation, sustainability with functionality, and local preferences with global standards. Companies that successfully navigate these challenges while investing in future technologies and sustainable practices will capture the significant opportunities presented by India’s expanding food packaging market.

What is Food Packaging?

Food packaging refers to the process of enclosing food products to protect them from contamination, spoilage, and damage. It also serves to provide information about the product and enhance its shelf life.

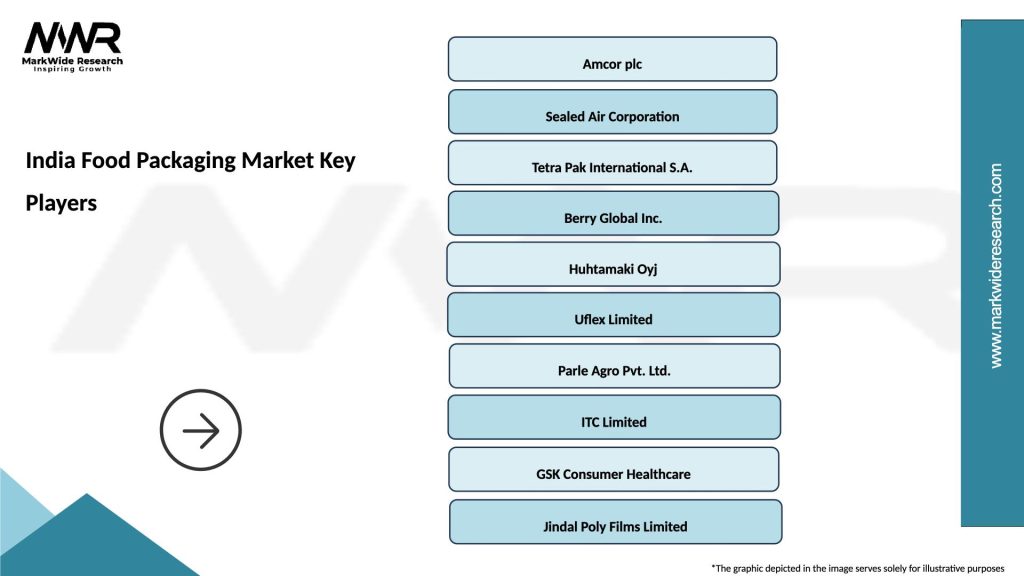

What are the key players in the India Food Packaging Market?

Key players in the India Food Packaging Market include Amcor Limited, Uflex Limited, and Huhtamaki PPL, among others. These companies are known for their innovative packaging solutions and extensive distribution networks.

What are the main drivers of the India Food Packaging Market?

The main drivers of the India Food Packaging Market include the growing demand for convenience foods, increasing consumer awareness regarding food safety, and the rise of e-commerce in food delivery services.

What challenges does the India Food Packaging Market face?

The India Food Packaging Market faces challenges such as stringent regulations regarding packaging materials, environmental concerns related to plastic waste, and the need for sustainable packaging solutions.

What opportunities exist in the India Food Packaging Market?

Opportunities in the India Food Packaging Market include the development of biodegradable packaging materials, the expansion of the organic food sector, and innovations in smart packaging technologies.

What trends are shaping the India Food Packaging Market?

Trends shaping the India Food Packaging Market include the increasing use of eco-friendly materials, the adoption of advanced printing technologies, and the growing popularity of personalized packaging solutions.

India Food Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Flexible Packaging, Rigid Packaging, Semi-Rigid Packaging, Vacuum Packaging |

| Material | Plastic, Paper, Metal, Glass |

| End User | Food & Beverage, Dairy, Bakery, Confectionery |

| Technology | Printing, Coating, Laminating, Sealing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Food Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at