444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India food color industry market represents a dynamic and rapidly expanding sector within the broader food additives landscape. Food coloring agents have become essential components in India’s diverse culinary ecosystem, spanning traditional sweets, processed foods, beverages, and bakery products. The market encompasses both natural food colors derived from plant sources and synthetic food colors manufactured through chemical processes.

Market dynamics indicate robust growth driven by increasing consumer demand for visually appealing food products, expanding food processing industries, and rising disposable incomes across urban and semi-urban populations. The industry serves multiple segments including confectionery manufacturers, beverage companies, dairy processors, and traditional sweet makers who rely on vibrant colors to enhance product appeal.

Regional distribution shows concentrated activity in major manufacturing hubs like Maharashtra, Gujarat, Tamil Nadu, and Karnataka, where established food processing clusters drive consistent demand. The market demonstrates significant growth potential with expanding retail networks, increasing export opportunities, and growing awareness about food presentation aesthetics among Indian consumers.

The India food color industry market refers to the comprehensive ecosystem of manufacturers, suppliers, and distributors involved in producing and commercializing coloring agents specifically designed for food and beverage applications within the Indian subcontinent. This market encompasses natural colorants extracted from fruits, vegetables, and other organic sources, as well as synthetic food dyes created through controlled chemical synthesis processes.

Food colors serve the primary purpose of enhancing visual appeal, maintaining consistent appearance, and meeting consumer expectations for product aesthetics. The industry includes various forms such as liquid food colors, powder formulations, gel-based colorants, and specialized emulsions designed for specific food applications.

Regulatory compliance forms a crucial aspect of this market, with products required to meet stringent safety standards established by the Food Safety and Standards Authority of India (FSSAI). The industry operates within established guidelines that govern permitted colorants, usage levels, and labeling requirements to ensure consumer safety and product quality.

India’s food color industry demonstrates remarkable resilience and growth trajectory, supported by expanding food processing sectors and evolving consumer preferences for visually attractive food products. The market benefits from diverse application segments including traditional sweets, modern confectionery, beverages, dairy products, and processed foods that collectively drive sustained demand.

Key market drivers include rapid urbanization, increasing disposable incomes, growing food service industry, and rising export potential for Indian food products. The sector shows balanced growth between natural and synthetic color segments, with natural colors gaining momentum due to health-conscious consumer trends and clean label preferences.

Competitive landscape features both established multinational corporations and emerging domestic players who compete through product innovation, cost optimization, and specialized formulations. The industry demonstrates strong fundamentals with consistent demand patterns, established supply chains, and growing integration with modern food processing technologies.

Future prospects remain highly positive, driven by expanding food processing capacity, increasing per capita food consumption, and growing emphasis on food presentation quality across various consumer segments throughout India.

Strategic market analysis reveals several critical insights that shape the India food color industry landscape:

Expanding food processing industry serves as the primary catalyst for food color market growth in India. The sector benefits from government initiatives promoting food processing, establishment of food parks, and increasing private investments in modern manufacturing facilities. Processed food consumption continues rising across urban and rural markets, creating sustained demand for coloring agents.

Consumer lifestyle changes significantly impact market dynamics, with busy urban populations increasingly relying on packaged foods, ready-to-eat products, and convenience foods that require appealing visual presentation. Social media influence and food photography trends further amplify the importance of vibrant, photogenic food products.

Festival and celebration culture in India drives substantial seasonal demand for food colors, particularly during major festivals like Diwali, Holi, and regional celebrations where colorful sweets and traditional foods play central roles. This cultural significance ensures consistent baseline demand throughout the year.

Export market expansion creates additional growth opportunities as Indian food products gain international recognition. Global demand for authentic Indian flavors and traditional sweets drives export-oriented food manufacturers to invest in high-quality coloring solutions that meet international standards.

Regulatory compliance challenges present significant obstacles for food color manufacturers, particularly smaller players who struggle with stringent testing requirements, documentation standards, and periodic regulatory updates. Compliance costs can be substantial, especially for companies seeking to maintain certifications across multiple product lines.

Health consciousness trends among consumers create market headwinds for synthetic food colors, with growing segments preferring natural alternatives or color-free products. Negative publicity surrounding artificial additives influences purchasing decisions, particularly among educated urban consumers and health-focused demographics.

Raw material price volatility affects both natural and synthetic color manufacturers, with natural colors particularly susceptible to agricultural commodity price fluctuations and seasonal availability constraints. Supply chain disruptions can significantly impact production costs and profit margins.

Quality control requirements demand substantial investments in testing equipment, laboratory facilities, and skilled personnel. Batch-to-batch consistency challenges, particularly for natural colors, require sophisticated manufacturing processes and quality assurance systems that increase operational complexity.

Natural food color segment presents exceptional growth opportunities as consumer preferences shift toward clean label products and organic alternatives. Plant-based colorants derived from turmeric, beetroot, spirulina, and other natural sources offer significant market potential for innovative manufacturers.

Export market development provides substantial expansion opportunities, particularly in Southeast Asian, Middle Eastern, and Western markets where Indian food products enjoy growing popularity. International certification achievements can unlock premium market segments and higher value propositions.

Technology advancement opportunities include development of microencapsulation techniques, improved stability formulations, and specialized delivery systems that enhance color performance in various food applications. Innovation investments can create competitive advantages and market differentiation.

E-commerce channel development offers direct-to-consumer opportunities, particularly for specialized colors, artisanal products, and small-batch formulations. Digital marketing strategies can effectively reach niche customer segments and build brand loyalty among professional bakers, confectioners, and home cooking enthusiasts.

Supply-demand equilibrium in the India food color industry reflects complex interactions between production capacity, consumption patterns, and seasonal variations. Demand fluctuations typically peak during festival seasons, wedding seasons, and summer months when beverage consumption increases significantly.

Competitive intensity varies across different market segments, with synthetic colors experiencing price-based competition while natural colors command premium pricing due to processing complexity and limited supply sources. Market consolidation trends favor companies with strong regulatory compliance records and established distribution networks.

Innovation cycles drive market evolution, with manufacturers continuously developing new shades, improved stability characteristics, and application-specific formulations. Customer collaboration increasingly influences product development, with food manufacturers seeking customized color solutions for specific applications.

Regulatory environment changes create both challenges and opportunities, with stricter standards potentially eliminating non-compliant players while creating market share opportunities for established manufacturers. International harmonization of food safety standards facilitates export market access for compliant Indian manufacturers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India food color industry market. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, food processors, and regulatory experts across different geographic regions.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and regulatory filings to establish market baselines and identify trends. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market insights.

Quantitative analysis utilizes statistical modeling techniques to project market trends, growth patterns, and segment performance. Qualitative assessment incorporates expert opinions, industry observations, and market intelligence to provide contextual understanding of market dynamics.

Market segmentation analysis examines various dimensions including product type, application, distribution channel, and geographic region to provide granular insights into market structure and opportunities. Competitive intelligence gathering ensures comprehensive understanding of market landscape and competitive positioning.

Western India dominates the food color industry landscape, with Maharashtra and Gujarat hosting major manufacturing facilities and serving as primary production hubs. Mumbai and Pune regions benefit from established chemical industry infrastructure, skilled workforce availability, and proximity to major food processing centers. The region accounts for approximately 35% market share in national production capacity.

Southern India represents a rapidly growing market segment, with Tamil Nadu and Karnataka emerging as significant consumption centers driven by expanding food processing industries and strong export orientation. Bangalore and Chennai serve as key distribution hubs, while traditional food manufacturing in these states creates consistent demand for natural coloring agents.

Northern India demonstrates substantial market potential, particularly in Uttar Pradesh, Punjab, and Delhi regions where large-scale food processing operations and traditional sweet manufacturing drive demand. Festival season consumption peaks significantly in these regions, creating seasonal demand surges that influence production planning.

Eastern India shows emerging opportunities, with West Bengal and Odisha developing food processing capabilities and increasing consumption of packaged foods. Regional preferences for specific colors and traditional applications create niche market opportunities for specialized manufacturers.

Market leadership in India’s food color industry features a diverse mix of international corporations, established domestic players, and emerging regional manufacturers. The competitive environment demonstrates healthy competition across different market segments and price points.

Competitive strategies include product innovation, cost optimization, distribution network expansion, and strategic partnerships with food manufacturers. Market differentiation occurs through specialized formulations, technical support services, and regulatory compliance excellence.

Product type segmentation divides the India food color industry market into distinct categories based on source and manufacturing processes:

By Source:

By Form:

By Application:

Natural food colors category demonstrates exceptional growth momentum, driven by increasing health consciousness and clean label trends among Indian consumers. Turmeric-based colors dominate the yellow segment, while beetroot and carrot extracts serve red color applications. Market penetration reaches approximately 28% share in premium food segments.

Synthetic food colors category maintains market leadership through cost advantages and performance consistency. Tartrazine, Sunset Yellow, and other certified synthetic colors provide reliable solutions for mass-market applications. Despite health concerns, this category retains strong market position in price-sensitive segments.

Specialty colors category includes metallic effects, pearlescent finishes, and thermochromic colors that create unique visual experiences. Premium applications in high-end confectionery and artisanal food products drive demand for these innovative solutions, though market share remains relatively small.

Organic certified colors represent the fastest-growing category segment, with annual growth rates significantly exceeding overall market averages. Export-oriented food manufacturers increasingly specify organic colors to meet international market requirements and consumer preferences.

Food manufacturers benefit from access to diverse color solutions that enhance product appeal, enable brand differentiation, and meet specific application requirements. Consistent quality and reliable supply chains support production planning and inventory management efficiency.

Retailers and distributors gain from growing market demand, expanding product categories, and increasing consumer willingness to pay premium prices for visually appealing food products. Market growth creates opportunities for business expansion and improved profit margins.

Consumers enjoy enhanced food experiences through visually attractive products, improved variety in food choices, and increasing availability of natural color alternatives. Quality improvements in color stability and safety standards provide better value propositions.

Regulatory authorities benefit from industry compliance improvements, enhanced food safety standards, and reduced health risks through better quality control measures. Industry cooperation facilitates effective regulation implementation and monitoring.

Export markets gain access to high-quality Indian food color products that meet international standards, supporting trade relationships and economic development. Technology transfer and knowledge sharing enhance global food industry capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement significantly influences food color industry trends, with manufacturers increasingly developing natural alternatives and transparent labeling practices. Consumer awareness about ingredient origins drives demand for plant-based colorants and organic certifications.

Sustainable sourcing practices gain prominence as companies implement responsible procurement strategies for natural color raw materials. Environmental consciousness among consumers and regulatory bodies encourages adoption of eco-friendly manufacturing processes and packaging solutions.

Customization trends drive development of application-specific color solutions tailored to unique food manufacturing requirements. Technical collaboration between color suppliers and food manufacturers results in innovative formulations and improved performance characteristics.

Digital transformation impacts industry operations through automated manufacturing processes, quality control systems, and supply chain management technologies. Data analytics applications improve production efficiency and customer service capabilities.

Premiumization trends create market opportunities for high-quality, specialty colors that command higher prices and profit margins. Artisanal food movement drives demand for unique colors and effects that differentiate premium products in competitive markets.

Regulatory framework strengthening through FSSAI updates and international harmonization efforts improves industry standards and consumer confidence. Compliance requirements drive market consolidation as smaller players struggle with regulatory costs while established manufacturers benefit from competitive advantages.

Technology investments by leading manufacturers focus on improving color stability, developing new extraction methods, and creating innovative delivery systems. Research partnerships between industry players and academic institutions accelerate innovation and product development timelines.

Capacity expansion projects across major manufacturing hubs indicate industry confidence in long-term growth prospects. Strategic acquisitions and partnerships enable companies to expand product portfolios, geographic reach, and technical capabilities.

Export market development initiatives supported by government trade promotion programs help Indian manufacturers access international markets. Quality certifications and international standard compliance facilitate market entry and customer acceptance in global markets.

Sustainability initiatives include development of biodegradable packaging, waste reduction programs, and renewable energy adoption in manufacturing facilities. Corporate social responsibility programs enhance brand reputation and stakeholder relationships.

Investment priorities should focus on natural color development capabilities, advanced extraction technologies, and quality assurance systems that ensure regulatory compliance and customer satisfaction. MarkWide Research analysis indicates that companies investing in natural color portfolios achieve higher growth rates and premium market positioning.

Market expansion strategies should emphasize geographic diversification, application segment development, and export market penetration. Distribution network strengthening through strategic partnerships and digital channel development can improve market reach and customer service capabilities.

Innovation investments in microencapsulation technologies, stability improvement methods, and application-specific formulations can create competitive advantages and market differentiation. Customer collaboration programs should focus on understanding specific application requirements and developing customized solutions.

Regulatory compliance excellence should be prioritized through investment in quality control systems, documentation processes, and staff training programs. Proactive compliance strategies can prevent market access issues and support export market development initiatives.

Sustainability integration across operations, supply chains, and product development can enhance brand reputation and meet evolving customer expectations. Environmental stewardship programs should address packaging, waste management, and energy efficiency improvements.

Long-term growth prospects for India’s food color industry remain highly positive, supported by expanding food processing capacity, increasing consumer sophistication, and growing export opportunities. Market evolution will likely favor companies with strong natural color capabilities, advanced technologies, and comprehensive regulatory compliance.

Natural color segment is projected to experience the highest growth rates, driven by health consciousness trends and clean label preferences. MWR projections suggest natural colors could achieve 15-20% annual growth over the next five years, significantly outpacing synthetic alternatives.

Technology advancement will continue driving industry transformation through improved extraction methods, enhanced stability formulations, and innovative delivery systems. Digitalization trends will impact manufacturing processes, quality control, and customer relationship management across the industry.

Export market development presents substantial growth opportunities as Indian food products gain international recognition and acceptance. Quality improvements and international certification achievements will facilitate market access and premium positioning in global markets.

Market consolidation trends may accelerate as regulatory requirements increase and competition intensifies. Strategic partnerships and acquisitions will likely shape industry structure, with successful companies achieving scale advantages and market leadership positions.

India’s food color industry market demonstrates exceptional growth potential and strategic importance within the broader food processing ecosystem. The sector benefits from diverse application segments, expanding domestic consumption, and increasing export opportunities that collectively support sustained market development.

Market dynamics favor companies with strong natural color capabilities, advanced manufacturing technologies, and comprehensive regulatory compliance. The industry’s evolution toward premium, health-conscious products creates opportunities for innovation and market differentiation while maintaining strong fundamentals in traditional applications.

Strategic success factors include investment in natural color development, technology advancement, quality assurance systems, and market expansion initiatives. Companies that effectively balance innovation with operational excellence while maintaining regulatory compliance will achieve competitive advantages and market leadership positions in this dynamic and growing industry.

What is Food Color?

Food color refers to substances used to impart color to food and beverages, enhancing their visual appeal. These colors can be derived from natural sources or synthesized chemically, and they play a crucial role in the food industry by influencing consumer preferences and perceptions.

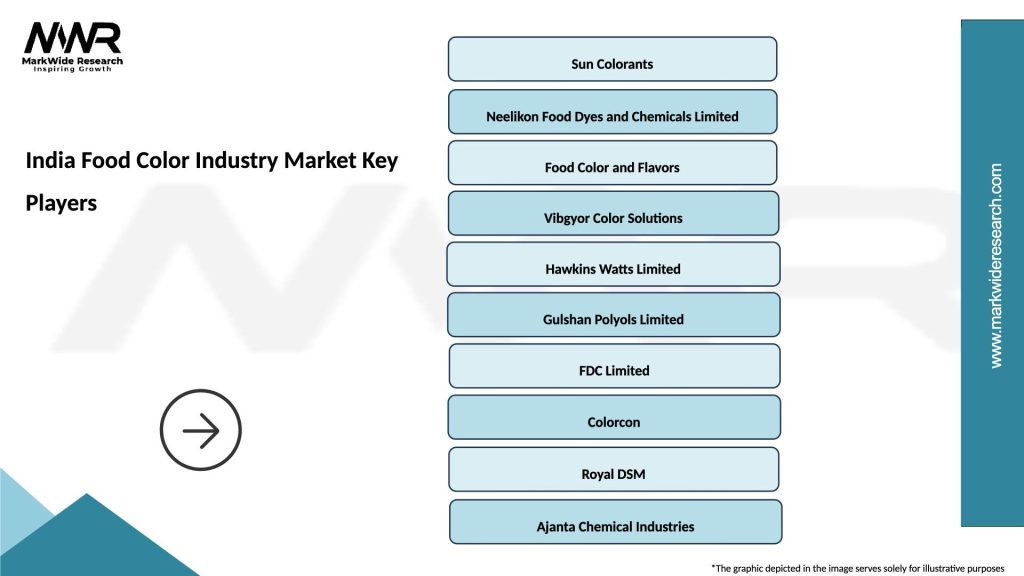

What are the key players in the India Food Color Industry Market?

Key players in the India Food Color Industry Market include companies like Synthite Industries, Jeco Group, and BNG Foods, which are known for their diverse range of food color products. These companies focus on innovation and quality to meet the growing demand for food coloring solutions among others.

What are the growth factors driving the India Food Color Industry Market?

The growth of the India Food Color Industry Market is driven by increasing consumer demand for visually appealing food products, the rise of processed foods, and the growing trend towards natural food colors. Additionally, the expansion of the food and beverage sector contributes significantly to this growth.

What challenges does the India Food Color Industry Market face?

The India Food Color Industry Market faces challenges such as regulatory compliance regarding food safety, the high cost of natural colorants, and competition from synthetic alternatives. These factors can impact the market dynamics and the adoption of certain food color products.

What opportunities exist in the India Food Color Industry Market?

Opportunities in the India Food Color Industry Market include the increasing demand for organic and natural food colors, innovations in color technology, and the expansion of the food processing industry. These trends present avenues for growth and product development.

What trends are shaping the India Food Color Industry Market?

Trends shaping the India Food Color Industry Market include a shift towards clean label products, the use of plant-based colorants, and advancements in color formulation technologies. These trends reflect changing consumer preferences and a focus on health and sustainability.

India Food Color Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Colors, Synthetic Colors, Lake Colors, Food Grade Dyes |

| Application | Beverages, Bakery Products, Dairy Products, Confectionery |

| End User | Food Manufacturers, Beverage Producers, Confectionery Makers, Restaurants |

| Form | Liquid, Powder, Gel, Granular |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Food Color Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at