444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India fitness ring market represents a rapidly expanding segment within the country’s broader fitness and wellness industry. Fitness rings, also known as resistance rings or exercise rings, have gained tremendous popularity among Indian consumers seeking convenient and effective home workout solutions. The market encompasses various types of fitness rings including resistance bands formed into circular shapes, smart fitness rings with digital tracking capabilities, and traditional exercise rings designed for strength training and rehabilitation.

Market dynamics indicate robust growth driven by increasing health consciousness, urbanization, and the rising adoption of home fitness equipment. The COVID-19 pandemic significantly accelerated demand as consumers shifted toward home-based workout routines. MarkWide Research analysis reveals that the fitness ring segment is experiencing substantial growth with a projected CAGR of 12.5% over the forecast period. This growth trajectory reflects the increasing integration of fitness technology with traditional exercise equipment.

Consumer preferences are evolving toward multifunctional fitness equipment that offers convenience, portability, and effectiveness. The market includes both traditional resistance rings and innovative smart fitness rings that incorporate sensors, connectivity features, and digital coaching capabilities. Regional adoption varies significantly, with metropolitan areas showing 65% higher adoption rates compared to rural regions, primarily due to higher disposable incomes and greater awareness of fitness trends.

The India fitness ring market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of circular fitness equipment designed for exercise, strength training, and wellness activities across the Indian subcontinent. Fitness rings represent versatile exercise tools that combine the functionality of resistance bands with the ergonomic benefits of circular design, enabling users to perform a wide range of exercises targeting different muscle groups.

Market scope includes various product categories ranging from basic resistance rings made from latex or fabric materials to sophisticated smart fitness rings equipped with sensors, Bluetooth connectivity, and companion mobile applications. These devices serve multiple purposes including strength training, rehabilitation, flexibility improvement, and cardiovascular conditioning. The market also encompasses related accessories, replacement parts, and digital services that enhance the user experience.

Industry definition extends beyond physical products to include digital platforms, fitness applications, and subscription services that complement fitness ring usage. The market serves diverse consumer segments including fitness enthusiasts, rehabilitation patients, elderly individuals seeking low-impact exercise options, and professional athletes incorporating rings into their training regimens.

Market performance in the India fitness ring sector demonstrates exceptional growth potential driven by fundamental shifts in consumer behavior and lifestyle preferences. The convergence of traditional fitness equipment with modern technology has created new opportunities for market expansion and product innovation. Key growth drivers include increasing health awareness, rising disposable incomes, and the growing popularity of home fitness solutions.

Competitive landscape features a mix of international brands, domestic manufacturers, and emerging startups focusing on smart fitness technology. Market leaders are investing heavily in product development, particularly in areas such as sensor integration, mobile app connectivity, and personalized fitness coaching. Consumer adoption is accelerating across urban centers, with 45% of users reporting regular usage within six months of purchase.

Technology integration represents a significant trend, with smart fitness rings incorporating features such as motion tracking, heart rate monitoring, and AI-powered workout recommendations. The market is witnessing increased collaboration between hardware manufacturers and software developers to create comprehensive fitness ecosystems. Distribution channels are diversifying beyond traditional retail to include e-commerce platforms, fitness centers, and direct-to-consumer sales models.

Consumer behavior analysis reveals several critical insights shaping the India fitness ring market landscape. The following key insights demonstrate the market’s evolution and growth potential:

Market maturity varies significantly across different product segments, with traditional resistance rings showing steady demand while smart fitness rings represent the fastest-growing category. Consumer education and awareness campaigns are proving effective in driving adoption rates and expanding market reach.

Health consciousness surge represents the primary driver propelling the India fitness ring market forward. Increasing awareness of lifestyle-related health issues, combined with growing emphasis on preventive healthcare, has created substantial demand for accessible fitness solutions. Urban lifestyle changes and sedentary work patterns have heightened the need for convenient exercise options that can be easily integrated into busy schedules.

Digital transformation in the fitness industry has significantly contributed to market growth. The integration of smart technology with traditional fitness equipment appeals to tech-savvy consumers who value data-driven insights and personalized workout experiences. Mobile app ecosystems surrounding fitness rings provide additional value through guided workouts, progress tracking, and community features that enhance user engagement and retention.

Affordability and accessibility factors make fitness rings attractive alternatives to expensive gym memberships and bulky exercise equipment. The compact nature of fitness rings addresses space constraints common in Indian urban housing, while their versatility enables comprehensive workout routines. Government initiatives promoting fitness and wellness, including the Fit India Movement, have created a supportive environment for fitness equipment adoption.

Celebrity endorsements and social media influence have played crucial roles in popularizing fitness rings among younger demographics. Influencer marketing campaigns showcasing creative workout routines and success stories have driven viral adoption patterns across social media platforms.

Price sensitivity remains a significant constraint in the India fitness ring market, particularly for premium smart fitness rings with advanced features. Many potential consumers, especially in tier-2 and tier-3 cities, perceive high-end fitness rings as luxury items rather than essential fitness tools. Economic disparities across different regions and income segments limit market penetration in price-conscious consumer segments.

Product durability concerns affect consumer confidence, particularly regarding resistance rings made from latex or rubber materials that may degrade over time. Quality inconsistencies among lower-priced products have created skepticism about long-term value, leading some consumers to delay purchase decisions or opt for alternative fitness solutions.

Limited awareness about proper usage techniques and potential benefits constrains market growth in certain demographic segments. Many consumers lack understanding of how to effectively incorporate fitness rings into their exercise routines, leading to underutilization and eventual abandonment. Educational gaps regarding the versatility and effectiveness of fitness rings compared to traditional gym equipment persist in many markets.

Competition from alternatives including yoga mats, dumbbells, and other home fitness equipment creates market fragmentation. Seasonal usage patterns result in inconsistent demand, with many consumers viewing fitness rings as temporary solutions rather than long-term fitness investments.

Rural market penetration presents substantial growth opportunities as internet connectivity improves and e-commerce platforms expand their reach. Untapped demographics in smaller cities and towns represent significant potential for market expansion, particularly through affordable product variants and localized marketing strategies.

Corporate wellness programs offer promising opportunities for bulk sales and B2B market development. Companies increasingly recognize the importance of employee health and wellness, creating demand for portable fitness solutions that can be used in office environments or provided as employee benefits. Partnership opportunities with healthcare providers, physiotherapy clinics, and rehabilitation centers could expand market reach into therapeutic applications.

Technology advancement continues to create new product categories and features that can command premium pricing. AI integration, advanced biometric monitoring, and virtual reality compatibility represent emerging opportunities for product differentiation and market expansion. The development of ecosystem approaches combining hardware, software, and services offers potential for recurring revenue models.

Export potential exists for Indian manufacturers to serve international markets, particularly in Southeast Asia and Africa where similar demographic and economic patterns exist. Manufacturing localization initiatives could reduce costs and improve accessibility while supporting domestic industry development.

Supply chain evolution in the India fitness ring market reflects broader trends toward digitization and direct-to-consumer sales models. Traditional distribution channels through sports goods retailers are being complemented by e-commerce platforms that offer greater product variety and competitive pricing. Inventory management has become more sophisticated with data-driven demand forecasting and just-in-time delivery systems.

Competitive intensity is increasing as new entrants recognize the market potential and existing players expand their product portfolios. Innovation cycles are accelerating, with companies introducing new features and improvements at regular intervals to maintain competitive advantage. Price competition remains intense in the basic product segments while premium smart rings compete primarily on features and user experience.

Consumer engagement patterns show strong correlation between product quality, customer support, and long-term satisfaction. Companies investing in comprehensive customer education, responsive support services, and community building are achieving higher retention rates and positive word-of-mouth marketing. Seasonal fluctuations continue to influence demand patterns, with peak sales periods requiring careful inventory planning and marketing coordination.

Regulatory environment remains relatively favorable with minimal restrictions on fitness equipment imports and sales. However, increasing focus on product safety standards and quality certifications may impact market dynamics, particularly for imported products and lower-priced alternatives.

Comprehensive market analysis for the India fitness ring market employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included extensive surveys of consumers, retailers, manufacturers, and industry experts across major Indian cities. In-depth interviews with key stakeholders provided qualitative insights into market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, government statistics, trade publications, and company financial statements. Data triangulation methods were employed to validate findings across multiple sources and ensure consistency of market estimates and projections. Market sizing calculations utilized bottom-up and top-down approaches to cross-verify results.

Consumer behavior studies included online surveys, focus group discussions, and observational research to understand usage patterns, preferences, and decision-making factors. Retail channel analysis involved visits to physical stores, e-commerce platform monitoring, and sales data analysis to understand distribution patterns and pricing strategies.

Technology assessment included evaluation of product features, performance specifications, and innovation trends across different fitness ring categories. Competitive intelligence gathering involved analysis of company strategies, product launches, marketing campaigns, and market positioning approaches to understand competitive dynamics.

Northern India represents the largest regional market for fitness rings, driven by high urban population density and strong purchasing power in cities like Delhi, Gurgaon, and Noida. Market penetration in this region reaches approximately 35% of the total national market, with premium smart fitness rings showing particularly strong adoption rates among affluent consumers.

Western India, anchored by Mumbai, Pune, and Ahmedabad, demonstrates robust growth in both traditional and smart fitness ring segments. The region’s strong IT industry presence and health-conscious population contribute to 28% market share nationally. Corporate wellness programs in this region show higher adoption rates compared to other areas.

Southern India exhibits strong growth potential with Bangalore, Chennai, and Hyderabad leading adoption rates. The region’s tech-savvy population shows particular interest in smart fitness rings with advanced features. Regional market share stands at approximately 25% with consistent year-over-year growth.

Eastern India represents an emerging market with Kolkata and Bhubaneswar showing increasing interest in fitness rings. While currently accounting for 12% of the national market, the region demonstrates strong growth potential as awareness and disposable incomes increase. Price-sensitive segments dominate this market with basic resistance rings showing higher sales volumes.

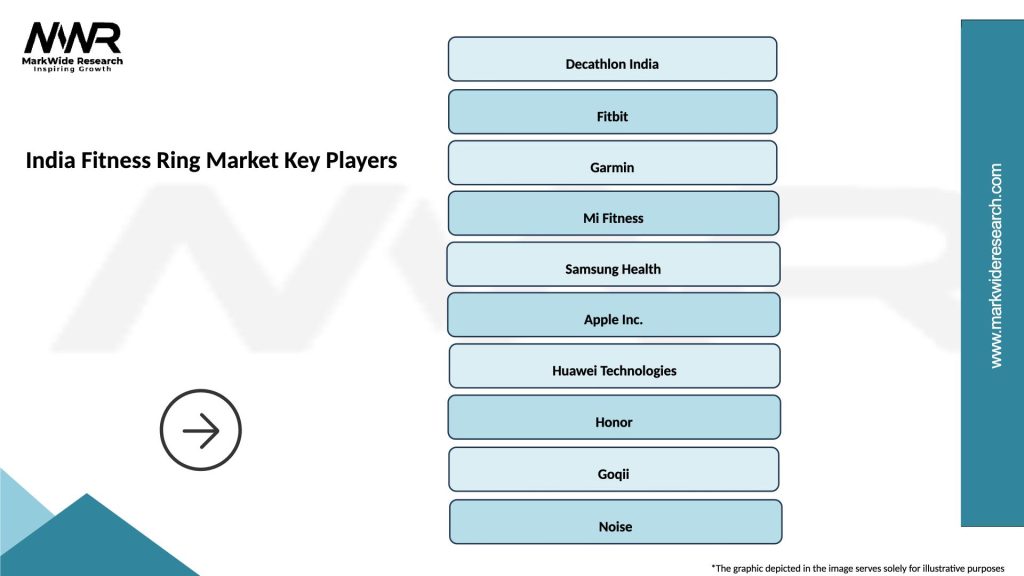

Market leadership in the India fitness ring sector is distributed among several key players, each focusing on different market segments and competitive strategies. The competitive environment includes international brands, domestic manufacturers, and innovative startups developing smart fitness solutions.

Competitive strategies vary significantly across market segments, with premium brands focusing on technology innovation and user experience while value-oriented players compete primarily on price and accessibility. Market consolidation trends suggest potential for mergers and acquisitions as companies seek to expand their market presence and technological capabilities.

Product-based segmentation reveals distinct market categories with varying growth patterns and consumer preferences. The India fitness ring market can be segmented across multiple dimensions to understand specific market dynamics and opportunities.

By Product Type:

By Material:

By Distribution Channel:

Traditional resistance rings continue to dominate market volume due to their affordability and simplicity. This category appeals to budget-conscious consumers and those seeking basic fitness solutions without technological complexity. Market share for traditional rings remains stable at approximately 60% of total volume, though revenue share is lower due to competitive pricing.

Smart fitness rings represent the fastest-growing category with annual growth rates exceeding 25%. These products command premium pricing and higher profit margins while offering enhanced user engagement through mobile apps and digital coaching. Technology adoption is driving category expansion, particularly among younger demographics and urban consumers.

Adjustable resistance rings occupy a middle-ground position, offering versatility without the complexity of smart features. This category appeals to serious fitness enthusiasts who want customizable workout intensity but prefer mechanical adjustments over digital controls. Market positioning focuses on professional and semi-professional users.

Therapeutic rings serve specialized medical and rehabilitation markets with specific design requirements and quality standards. While representing a smaller market segment, this category offers stable demand and premium pricing opportunities. Healthcare partnerships and professional endorsements drive adoption in this segment.

Manufacturers benefit from the India fitness ring market through multiple value creation opportunities. Scalable production models allow for efficient manufacturing processes that can adapt to varying demand levels. The relatively simple design of basic fitness rings enables cost-effective production while smart rings offer opportunities for premium pricing and higher margins.

Retailers and distributors gain advantages through product portability, minimal storage requirements, and strong consumer demand. Inventory turnover rates for fitness rings typically exceed those of larger fitness equipment, improving cash flow and reducing carrying costs. The growing market provides opportunities for both specialized fitness retailers and general sporting goods stores.

Consumers benefit from convenient, affordable fitness solutions that can be used anywhere without requiring significant space or setup time. Cost-effectiveness compared to gym memberships and larger exercise equipment makes fitness rings accessible to broader demographic segments. The versatility of fitness rings enables comprehensive workout routines targeting multiple muscle groups.

Healthcare providers can leverage fitness rings for patient rehabilitation programs and preventive care initiatives. Therapeutic applications include physical therapy, elderly fitness programs, and injury recovery protocols. The low-impact nature of ring exercises makes them suitable for patients with various health conditions and mobility limitations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart technology integration represents the most significant trend shaping the India fitness ring market. IoT connectivity, mobile app integration, and AI-powered coaching features are becoming standard expectations rather than premium add-ons. Consumers increasingly value data-driven insights about their fitness progress and personalized workout recommendations.

Sustainability focus is driving demand for eco-friendly materials and manufacturing processes. Biodegradable materials and recyclable packaging are becoming important differentiators, particularly among environmentally conscious urban consumers. Companies are investing in sustainable production methods and promoting environmental benefits in their marketing strategies.

Customization and personalization trends are influencing product development with adjustable resistance levels, personalized sizing options, and custom color schemes. User-centric design approaches focus on individual preferences and specific fitness goals rather than one-size-fits-all solutions.

Community building around fitness ring usage is emerging through social media platforms, mobile apps, and virtual workout sessions. Social fitness features enable users to share progress, participate in challenges, and connect with other fitness enthusiasts, creating stronger brand loyalty and user engagement.

Hybrid fitness models combining physical products with digital services are gaining traction. Subscription services offering workout content, nutrition guidance, and progress tracking complement hardware sales and create recurring revenue opportunities.

Product innovation continues to drive industry evolution with manufacturers introducing advanced features and improved designs. Recent developments include rings with built-in heart rate monitors, temperature sensors, and advanced motion tracking capabilities. Material science advances have enabled the development of more durable and comfortable ring designs that maintain elasticity over extended use periods.

Strategic partnerships between hardware manufacturers and software developers are creating comprehensive fitness ecosystems. Collaboration initiatives with fitness influencers, healthcare providers, and corporate wellness programs are expanding market reach and credibility. These partnerships often result in co-branded products and integrated service offerings.

Manufacturing localization efforts by international brands are reducing costs and improving supply chain efficiency. Make in India initiatives are encouraging domestic production capabilities while reducing dependence on imports. Several companies have established or expanded manufacturing facilities within India to serve both domestic and export markets.

Digital marketing evolution has transformed how companies reach and engage with consumers. Influencer partnerships, social media campaigns, and content marketing strategies are proving more effective than traditional advertising approaches. Companies are investing heavily in digital presence and online community building.

Regulatory developments include discussions about quality standards and safety certifications for fitness equipment. MWR analysis suggests that upcoming regulations may favor established brands with robust quality control processes while potentially impacting lower-priced alternatives.

Market entry strategies should focus on differentiation through technology integration and superior user experience rather than competing solely on price. New entrants should consider partnerships with established distribution channels and invest in consumer education to build market awareness and credibility.

Product development priorities should emphasize durability, user comfort, and smart features that provide genuine value to consumers. Innovation focus areas include battery life improvement for smart rings, enhanced sensor accuracy, and seamless mobile app integration. Companies should also consider developing ecosystem approaches that combine hardware, software, and services.

Distribution strategy recommendations include multi-channel approaches that leverage both online and offline retail channels. E-commerce optimization is crucial given the growing importance of online sales, while maintaining physical retail presence helps build consumer confidence through product demonstration and trial opportunities.

Marketing approaches should emphasize education and demonstration of product benefits rather than focusing solely on features. Content marketing strategies that provide workout guidance, success stories, and community building opportunities tend to be more effective than traditional advertising approaches.

Geographic expansion should prioritize tier-2 cities where fitness awareness is growing but competition remains limited. Rural market entry requires careful consideration of price sensitivity and distribution challenges but offers substantial long-term potential.

Market trajectory for the India fitness ring market remains strongly positive with sustained growth expected across all major segments. Technology advancement will continue driving premium segment expansion while basic product categories maintain steady demand through improved accessibility and awareness.

Consumer behavior evolution suggests increasing sophistication in product selection criteria with greater emphasis on quality, durability, and integrated digital services. Health consciousness trends are expected to remain strong, supported by government initiatives and growing awareness of lifestyle-related health issues.

Innovation pipeline includes developments in materials science, sensor technology, and artificial intelligence integration. Next-generation products may incorporate advanced biometric monitoring, predictive health analytics, and seamless integration with broader health and wellness ecosystems.

Market consolidation is likely as successful companies expand their market presence through acquisitions and strategic partnerships. Competitive dynamics will increasingly favor companies with strong technology capabilities, comprehensive distribution networks, and effective customer engagement strategies.

Export opportunities for Indian manufacturers are expected to grow as production capabilities mature and quality standards improve. Regional expansion into Southeast Asian and African markets presents significant potential for companies that have successfully established themselves in the domestic market.

The India fitness ring market represents a dynamic and rapidly evolving sector with substantial growth potential driven by fundamental shifts in consumer behavior, technology advancement, and health consciousness. Market fundamentals remain strong with diverse opportunities across traditional and smart product segments, multiple distribution channels, and expanding geographic markets.

Success factors for market participants include focus on product quality, technology integration, consumer education, and comprehensive distribution strategies. Companies that can effectively balance affordability with innovation while building strong brand recognition and customer loyalty are positioned for long-term success. Strategic positioning should emphasize the unique value proposition of fitness rings as convenient, effective, and accessible fitness solutions.

The market’s future depends on continued innovation, expanding consumer awareness, and the ability of industry participants to adapt to evolving consumer preferences and technological capabilities. Sustainable growth requires investment in quality, customer service, and market development initiatives that build long-term value for all stakeholders in the India fitness ring ecosystem.

What is Fitness Ring?

Fitness Rings are wearable devices designed to monitor and track various health and fitness metrics, such as heart rate, activity levels, and sleep patterns. They are increasingly popular among fitness enthusiasts and health-conscious individuals in India.

What are the key players in the India Fitness Ring Market?

Key players in the India Fitness Ring Market include companies like Fitbit, Xiaomi, and Garmin, which offer a range of fitness tracking devices. These companies are known for their innovative features and user-friendly designs, among others.

What are the growth factors driving the India Fitness Ring Market?

The growth of the India Fitness Ring Market is driven by increasing health awareness, a rise in fitness activities, and the growing adoption of wearable technology among consumers. Additionally, the integration of advanced features like heart rate monitoring and GPS tracking is attracting more users.

What challenges does the India Fitness Ring Market face?

The India Fitness Ring Market faces challenges such as high competition among brands, the need for continuous innovation, and concerns regarding data privacy and security. These factors can impact consumer trust and market growth.

What opportunities exist in the India Fitness Ring Market?

Opportunities in the India Fitness Ring Market include expanding into untapped rural markets, developing more affordable models, and integrating health monitoring features that cater to specific demographics, such as seniors or fitness beginners.

What trends are shaping the India Fitness Ring Market?

Trends in the India Fitness Ring Market include the increasing popularity of smart health monitoring features, the rise of fitness apps that sync with wearable devices, and a growing focus on personalized health insights. These trends are influencing consumer preferences and product development.

India Fitness Ring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Rings, Fitness Trackers, Health Monitors, Sleep Trackers |

| Technology | Bluetooth, NFC, GPS, Heart Rate Monitoring |

| End User | Fitness Enthusiasts, Health-Conscious Individuals, Athletes, Casual Users |

| Distribution Channel | Online Retail, Specialty Stores, Fitness Centers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Fitness Ring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at