444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India fertilizer industry market stands as one of the most critical agricultural support sectors in the world’s largest democracy, serving over 600 million farmers across diverse agro-climatic zones. This expansive market encompasses the production, distribution, and consumption of essential plant nutrients including nitrogen, phosphorus, and potassium-based fertilizers that fuel India’s agricultural productivity. The industry operates through a complex ecosystem of manufacturing facilities, distribution networks, and government policy frameworks designed to ensure food security for the nation’s growing population.

Market dynamics in India’s fertilizer sector are characterized by substantial government involvement through subsidies, price controls, and strategic policy interventions. The industry demonstrates remarkable resilience with consistent growth patterns, driven by increasing agricultural mechanization, crop intensification practices, and the adoption of precision farming techniques. Growth rates in fertilizer consumption have maintained steady momentum at approximately 3.2% annually, reflecting the sector’s fundamental importance to India’s agricultural transformation.

Regional distribution across India reveals significant variations in fertilizer consumption patterns, with states like Uttar Pradesh, Maharashtra, and Punjab leading in absolute consumption volumes. The market structure includes both public sector undertakings and private companies, creating a competitive landscape that balances accessibility with innovation. Technology adoption rates in modern fertilizer application methods have increased by 28% over recent years, indicating the industry’s evolution toward more efficient and sustainable practices.

The India fertilizer industry market refers to the comprehensive ecosystem encompassing the production, import, distribution, and retail of chemical and organic fertilizers designed to enhance soil fertility and crop productivity across India’s agricultural landscape. This market includes manufacturers of nitrogen-based fertilizers like urea, phosphatic fertilizers such as diammonium phosphate, potassic fertilizers including muriate of potash, and emerging segments like bio-fertilizers and specialty nutrients.

Industry scope extends beyond traditional chemical fertilizers to include organic alternatives, micronutrients, and customized fertilizer blends tailored to specific soil conditions and crop requirements. The market operates within a regulatory framework that includes government subsidies, import policies, and quality control mechanisms designed to ensure farmer accessibility while maintaining product standards. Value chain integration encompasses raw material sourcing, manufacturing processes, logistics networks, and retail distribution through cooperative societies, private dealers, and direct-to-farmer channels.

India’s fertilizer industry represents a cornerstone of the nation’s agricultural infrastructure, supporting food security initiatives and rural economic development through comprehensive nutrient supply chains. The market demonstrates robust fundamentals with diversified product portfolios spanning traditional chemical fertilizers, organic alternatives, and innovative specialty products designed for precision agriculture applications.

Key performance indicators reveal sustained growth momentum driven by increasing agricultural productivity demands, government policy support, and technological advancement in fertilizer application methods. The industry benefits from strategic government interventions including subsidy mechanisms that ensure farmer affordability while encouraging domestic production capabilities. Market penetration rates across rural India have reached 78%, indicating widespread adoption and accessibility of fertilizer products.

Competitive dynamics feature a balanced mix of public sector enterprises and private companies, fostering innovation while maintaining market stability. The sector’s evolution toward sustainable practices includes growing emphasis on bio-fertilizers, precision application technologies, and integrated nutrient management systems that optimize crop yields while minimizing environmental impact.

Strategic insights into India’s fertilizer industry reveal several transformative trends reshaping market dynamics and growth trajectories:

Primary growth drivers propelling India’s fertilizer industry forward include fundamental demographic and economic factors that create sustained demand for agricultural productivity enhancement. The nation’s expanding population, projected to reach peak levels in coming decades, necessitates increased food production capabilities that directly translate to higher fertilizer consumption requirements.

Agricultural modernization initiatives across rural India are accelerating fertilizer adoption through mechanization programs, irrigation infrastructure development, and crop diversification strategies. Government schemes promoting scientific farming practices have resulted in 42% increased adoption of balanced fertilization techniques among smallholder farmers. Income growth in rural areas enables farmers to invest in higher-quality fertilizers and precision application technologies.

Climate change adaptation strategies require enhanced soil fertility management to maintain crop yields under varying weather conditions. The push toward higher cropping intensity and multiple harvests per year creates additional fertilizer demand cycles. Export market opportunities for agricultural products incentivize farmers to optimize crop quality and yields through strategic fertilizer use, while government support for agricultural exports further stimulates market growth.

Significant challenges facing India’s fertilizer industry include complex regulatory environments, environmental concerns, and economic constraints that can limit market expansion and operational efficiency. Subsidy burden on government finances creates policy uncertainties that affect long-term industry planning and investment decisions.

Environmental regulations increasingly restrict certain fertilizer types and application methods, requiring industry adaptation to more sustainable practices. Soil degradation concerns and groundwater contamination issues associated with excessive chemical fertilizer use are driving regulatory scrutiny and consumer preference shifts toward organic alternatives. Raw material import dependency exposes the industry to global price volatility and supply chain disruptions.

Infrastructure limitations in rural areas can impede efficient distribution and storage of fertilizer products, particularly in remote agricultural regions. Farmer education gaps regarding optimal fertilizer application techniques result in inefficient usage patterns and reduced product effectiveness. Credit accessibility challenges for smallholder farmers can limit their ability to purchase adequate quantities of fertilizers during critical agricultural seasons.

Emerging opportunities in India’s fertilizer industry span technological innovation, market expansion, and sustainable development initiatives that promise significant growth potential. The bio-fertilizer segment presents substantial opportunities as environmental awareness increases and government policies favor organic farming practices.

Digital agriculture integration offers opportunities for precision fertilizer application systems, soil testing services, and customized nutrient management solutions. Market penetration in northeastern states and tribal areas remains below national averages, presenting expansion opportunities for companies willing to invest in infrastructure development and farmer education programs.

Export market development for specialty fertilizers and organic products can leverage India’s manufacturing capabilities and cost advantages. The growing demand for micronutrient fertilizers addresses soil deficiency issues while commanding premium pricing. Technology partnerships with international companies can bring advanced fertilizer formulations and application technologies to Indian markets. Value-added services including soil testing, crop advisory, and precision agriculture consulting create additional revenue streams while enhancing farmer relationships.

Complex market dynamics in India’s fertilizer industry reflect the interplay between government policies, agricultural cycles, global commodity markets, and technological advancement. Seasonal demand patterns create significant fluctuations in consumption, with peak requirements during kharif and rabi sowing seasons driving inventory management challenges and supply chain optimization needs.

Price dynamics are heavily influenced by government subsidy policies, international raw material costs, and domestic production capacity utilization rates. The industry experiences capacity utilization rates averaging 85% during peak seasons, indicating robust demand while highlighting potential supply constraints. Competition intensity varies across product segments, with commodity fertilizers facing price-based competition while specialty products compete on efficacy and service quality.

Regulatory dynamics continue evolving with environmental protection measures, quality standards, and import policy adjustments affecting market operations. Technology adoption rates are accelerating as digital platforms enable better farmer engagement and precision agriculture practices. Supply chain dynamics are being transformed through logistics optimization, warehouse automation, and direct-to-farmer distribution models that reduce costs while improving service levels.

Comprehensive research methodology employed in analyzing India’s fertilizer industry market incorporates multiple data collection approaches, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights. Primary research involves extensive interviews with industry stakeholders including manufacturers, distributors, farmers, and government officials to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of government publications, industry reports, trade association data, and academic studies to establish market baselines and historical trends. Quantitative analysis utilizes statistical modeling techniques to project market growth patterns, demand forecasting, and competitive positioning assessments. Qualitative research methods include focus group discussions with farmers, expert interviews with industry leaders, and case study analysis of successful market interventions.

Data validation processes involve cross-referencing multiple sources, conducting field visits to manufacturing facilities and distribution centers, and employing triangulation techniques to verify research findings. Market segmentation analysis utilizes demographic, geographic, and behavioral criteria to identify distinct market segments and their unique characteristics. Trend analysis incorporates historical data patterns, current market indicators, and forward-looking assessments to provide comprehensive market intelligence.

Regional market dynamics across India reveal significant variations in fertilizer consumption patterns, agricultural practices, and growth opportunities that reflect diverse agro-climatic conditions and farming systems. Northern India, comprising states like Punjab, Haryana, and Uttar Pradesh, represents the highest consumption region with 35% market share, driven by intensive wheat-rice cropping systems and high agricultural productivity levels.

Western India including Maharashtra, Gujarat, and Rajasthan demonstrates strong growth in specialty fertilizer adoption, particularly for cash crops like cotton, sugarcane, and horticultural products. This region shows 22% market share with increasing preference for precision agriculture techniques and customized nutrient solutions. Southern India encompasses major agricultural states like Andhra Pradesh, Karnataka, and Tamil Nadu, accounting for 28% market share with diverse cropping patterns including rice, millets, and plantation crops.

Eastern India presents significant growth opportunities with 12% current market share but substantial potential for expansion through infrastructure development and farmer education programs. Northeastern states represent emerging markets with unique requirements for organic and bio-fertilizer products suited to their traditional farming practices and environmental conditions. Central India shows balanced growth across various fertilizer categories with increasing adoption of integrated nutrient management practices.

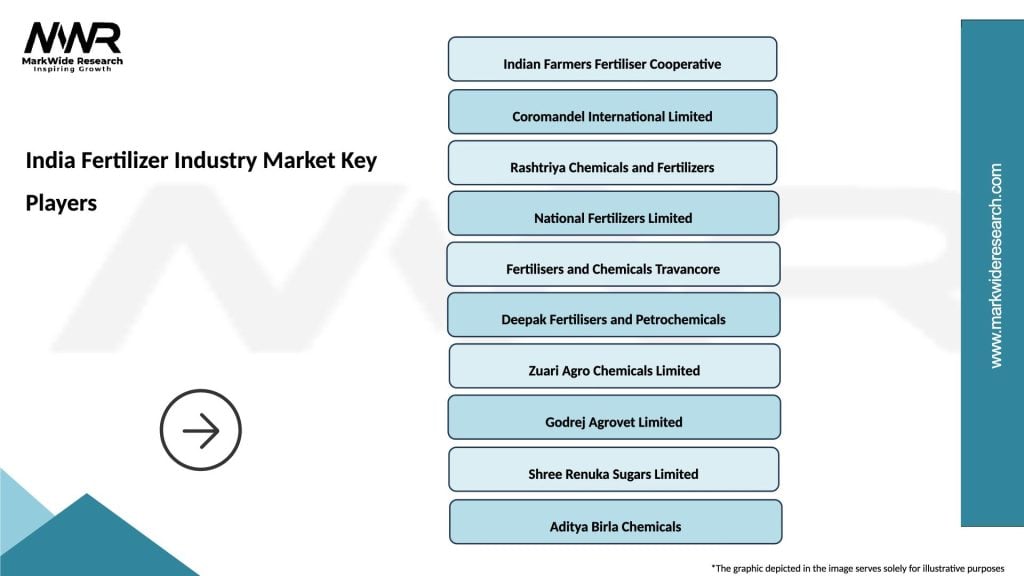

India’s fertilizer industry features a diverse competitive landscape encompassing public sector enterprises, private companies, and cooperative organizations that serve different market segments and geographic regions. Market leadership is distributed among several key players with distinct competitive advantages and strategic positioning.

Competitive strategies focus on product innovation, distribution network expansion, farmer education programs, and technology integration to differentiate offerings and build market share. Strategic partnerships and joint ventures are increasingly common as companies seek to leverage complementary strengths and expand market reach.

Market segmentation in India’s fertilizer industry reveals distinct categories based on product type, application method, crop type, and geographic distribution patterns that enable targeted marketing strategies and product development initiatives.

By Product Type:

By Application Method:

By Crop Type:

Detailed category analysis reveals distinct growth patterns, market dynamics, and opportunities across different fertilizer segments in India’s agricultural landscape.

Nitrogenous Fertilizers Category: Dominates market consumption with urea accounting for the largest share due to government subsidies and farmer familiarity. Growth rates remain stable at 2.8% annually with increasing focus on efficiency enhancement through coating technologies and slow-release formulations. Import dependency for raw materials creates price volatility challenges while domestic production capacity expansion continues.

Phosphatic Fertilizers Category: Shows strong growth potential driven by soil testing initiatives revealing widespread phosphorus deficiencies. DAP consumption has increased by 15% over recent years as farmers recognize its importance for root development and crop establishment. Single super phosphate maintains relevance in traditional farming systems while complex phosphatic fertilizers gain traction in commercial agriculture.

Bio-fertilizers Category: Represents the fastest-growing segment with 18% annual growth driven by organic farming initiatives and environmental consciousness. Government support through subsidies and promotion schemes accelerates adoption among progressive farmers. Quality concerns and storage challenges remain key issues requiring industry attention and regulatory oversight.

Micronutrient Fertilizers Category: Emerging as a high-value segment addressing specific soil deficiencies and crop quality requirements. Premium pricing enables higher margins while specialized application methods require enhanced farmer education and technical support services.

Industry participants in India’s fertilizer market enjoy numerous strategic advantages and opportunities that create value for manufacturers, distributors, farmers, and supporting ecosystem players.

For Manufacturers:

For Distributors and Retailers:

For Farmers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping India’s fertilizer industry reflect technological advancement, sustainability imperatives, and evolving agricultural practices that create new opportunities and challenges for market participants.

Digital Agriculture Integration: Precision farming technologies are revolutionizing fertilizer application through GPS-guided systems, variable rate application, and real-time soil monitoring. Mobile applications provide farmers with customized fertilizer recommendations based on soil testing results and crop requirements. Data analytics enable predictive modeling for optimal fertilizer timing and dosage recommendations.

Sustainability Focus: Organic fertilizer adoption is accelerating with 25% growth in bio-fertilizer consumption driven by environmental awareness and government promotion. Integrated nutrient management practices combine chemical and organic fertilizers for balanced soil health. Carbon footprint reduction initiatives are driving development of more efficient production processes and transportation methods.

Customization Trend: Soil-specific fertilizers tailored to regional deficiencies and crop requirements are gaining popularity among progressive farmers. Micronutrient blending addresses specific nutritional needs while slow-release formulations improve efficiency and reduce application frequency. Crop-specific products optimize nutrition for different agricultural systems and growing conditions.

Supply Chain Innovation: Direct-to-farmer distribution models reduce intermediary costs while improving service quality. Warehouse automation and logistics optimization enhance efficiency and reduce delivery timeframes. Digital payment systems facilitate transactions and improve financial inclusion for rural farmers.

Recent industry developments in India’s fertilizer sector demonstrate dynamic evolution through technological innovation, policy reforms, and strategic business initiatives that shape market trajectories and competitive landscapes.

Manufacturing Expansion: Major companies are investing in new production facilities and capacity expansion projects to meet growing demand and reduce import dependency. Technology upgrades in existing plants improve efficiency and environmental compliance while reducing production costs. Strategic partnerships with international technology providers bring advanced manufacturing processes to Indian operations.

Product Innovation: Development of nano-fertilizers and smart fertilizers with controlled-release mechanisms represents cutting-edge advancement in product technology. Bio-fertilizer research focuses on developing more effective microbial strains and application methods. Customized blending facilities enable production of region-specific and crop-specific fertilizer formulations.

Digital Transformation: Implementation of enterprise resource planning systems improves operational efficiency and supply chain management. Customer relationship management platforms enhance farmer engagement and service delivery. IoT integration in manufacturing processes enables real-time monitoring and quality control.

Sustainability Initiatives: Companies are investing in renewable energy for manufacturing operations and implementing waste reduction programs. Water conservation projects and emission reduction initiatives align with environmental regulations and corporate responsibility goals. Circular economy approaches include recycling programs and byproduct utilization.

Strategic recommendations from MarkWide Research analysis indicate several key focus areas for industry participants seeking to optimize their market position and capitalize on emerging opportunities in India’s fertilizer sector.

Technology Investment Priorities: Companies should prioritize investments in precision agriculture technologies and digital platforms that enable customized fertilizer recommendations and application guidance. Research and development in bio-fertilizers and specialty products can create competitive differentiation while addressing sustainability concerns. Automation initiatives in manufacturing and distribution can improve efficiency and reduce operational costs.

Market Expansion Strategies: Geographic expansion into underserved regions, particularly northeastern states and tribal areas, presents significant growth opportunities. Product portfolio diversification into organic and specialty fertilizers can capture premium market segments. Value-added services including soil testing, crop advisory, and precision agriculture consulting create additional revenue streams while strengthening farmer relationships.

Partnership and Collaboration: Strategic alliances with technology companies, research institutions, and agricultural service providers can accelerate innovation and market penetration. Cooperative partnerships with farmer organizations and self-help groups improve rural market access and customer loyalty. International collaborations can bring advanced technologies and expand export opportunities.

Sustainability Integration: Environmental compliance and sustainability initiatives should be integrated into core business strategies rather than treated as separate initiatives. Circular economy approaches can reduce costs while improving environmental performance. Stakeholder engagement with farmers, regulators, and communities builds trust and social license to operate.

Future prospects for India’s fertilizer industry appear robust with multiple growth drivers supporting sustained expansion and evolution toward more sustainable and efficient agricultural input systems. Market growth is projected to maintain steady momentum with 4.2% annual growth driven by agricultural modernization, population growth, and food security imperatives.

Technology transformation will accelerate with digital agriculture adoption reaching 60% penetration among commercial farmers within the next five years. Precision fertilizer application technologies will become mainstream as costs decrease and farmer awareness increases. Bio-fertilizer market share is expected to reach 15% of total fertilizer consumption as organic farming practices expand and government support continues.

Policy evolution will likely focus on subsidy rationalization and direct benefit transfer mechanisms that improve efficiency while maintaining farmer support. Environmental regulations will become more stringent, driving innovation in sustainable fertilizer technologies and application methods. Quality standards and certification requirements will strengthen to ensure product efficacy and safety.

Market structure changes may include increased consolidation through mergers and acquisitions as companies seek scale advantages and operational synergies. International expansion opportunities will grow as Indian companies leverage manufacturing capabilities and cost advantages in global markets. Value chain integration will deepen as companies seek to control costs and improve customer relationships through comprehensive service offerings.

Innovation focus will shift toward smart fertilizers, precision application technologies, and integrated nutrient management systems that optimize crop productivity while minimizing environmental impact. Research collaboration between industry and academic institutions will accelerate development of next-generation fertilizer technologies and application methods.

India’s fertilizer industry market stands at a pivotal juncture where traditional agricultural practices meet modern technology and sustainability imperatives. The sector demonstrates remarkable resilience and growth potential, supported by fundamental drivers including population growth, agricultural modernization, and government policy support that ensure continued market expansion.

Market dynamics reveal a complex ecosystem where public and private sector participants collaborate to serve diverse farmer needs across varied agro-climatic conditions. The industry’s evolution toward precision agriculture, sustainable practices, and technology integration positions it well for future challenges while maintaining its critical role in India’s food security framework.

Strategic opportunities abound for companies willing to invest in innovation, sustainability, and farmer-centric solutions that address emerging market needs. The convergence of digital technologies, environmental consciousness, and agricultural productivity requirements creates fertile ground for transformative business models and value creation.

Long-term success in India’s fertilizer industry will depend on balancing traditional strengths with innovative approaches that meet evolving farmer expectations, regulatory requirements, and sustainability goals. Companies that successfully navigate this transformation while maintaining operational excellence and customer focus will capture the most significant opportunities in this essential agricultural input sector.

What is Fertilizer?

Fertilizer refers to any organic or inorganic material added to soil or plants to supply essential nutrients that promote growth. In the context of the India Fertilizer Industry, it includes various types such as nitrogenous, phosphatic, and potassic fertilizers used in agriculture.

What are the key players in the India Fertilizer Industry Market?

Key players in the India Fertilizer Industry Market include companies like Indian Farmers Fertiliser Cooperative (IFFCO), National Fertilizers Limited (NFL), and Tata Chemicals, among others.

What are the growth factors driving the India Fertilizer Industry Market?

The growth of the India Fertilizer Industry Market is driven by increasing agricultural production, rising demand for food due to population growth, and government initiatives to enhance fertilizer availability and affordability.

What challenges does the India Fertilizer Industry Market face?

The India Fertilizer Industry Market faces challenges such as fluctuating raw material prices, environmental regulations, and the need for sustainable practices in fertilizer production and usage.

What opportunities exist in the India Fertilizer Industry Market?

Opportunities in the India Fertilizer Industry Market include the development of bio-fertilizers, advancements in precision agriculture technologies, and increasing investments in sustainable farming practices.

What trends are shaping the India Fertilizer Industry Market?

Trends shaping the India Fertilizer Industry Market include a shift towards organic fertilizers, the adoption of digital farming solutions, and a growing emphasis on sustainable agricultural practices.

India Fertilizer Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Urea, DAP, NPK, Potash |

| Application | Agriculture, Horticulture, Landscaping, Turf Management |

| End User | Farmers, Cooperatives, Distributors, Retailers |

| Packaging Type | Bags, Bulk, Drums, Pallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Fertilizer Industry Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at