444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Events & Exhibition Market represents a dynamic, experience-driven segment of the broader business events ecosystem, encompassing trade shows, exhibitions, conferences, fairs, expos, and corporate gatherings. With India’s rapid economic expansion, growing corporate activity, and rising interest in business networking platforms, this market has emerged as a pivotal avenue for industry engagement, brand visibility, and cross-sector collaboration. Events and exhibitions serve as platforms where businesses showcase innovations, connect with buyers, and build strategic alliances, stimulating trade and investment conversations across sectors.

Market activity in India is influenced by a confluence of factors including expansion of key industries such as technology, healthcare, education, and manufacturing. These sectors increasingly rely on events to demonstrate new products, foster professional community growth, and unlock business opportunities. India’s focus on positioning itself as a global business hub has led to a proliferation of international and domestic expos, illustrating the country’s role as a host for high-scale events.

Digital transformation has also reshaped the India Events & Exhibition Market, with hybrid event solutions integrating virtual participation alongside in-person attendance. This flexibility enhances accessibility and supports broader audience engagement. Industry observers note that hybrid events have become mainstream, contributing to resilience and adaptability in the face of shifting audience expectations and logistical considerations. The evolving nature of business interactions underscores the strategic importance of events and exhibitions as catalysts for knowledge exchange and commercial engagement.

The India Events & Exhibition Market refers to the ecosystem of professional gatherings that bring together stakeholders from industry, government, academia, and consumer communities for knowledge sharing, business networking, and product showcasing purposes. This market includes trade fairs, conferences, expos, seminars, business conventions, and themed exhibitions that are organized within India across diverse sectors to facilitate commercial engagement and community building.

The India Events & Exhibition Market is characterized by robust activity across sectors driven by demand for face-to-face engagement, professional networking, product launches, and knowledge forums. Business events and exhibitions remain essential components of corporate growth strategies as companies seek visibility, partnerships, and market intelligence. The market demonstrates resilience and innovation, particularly in its integration of digital formats and hybrid engagement models.

Key drivers of market growth include increased corporate participation, sector-specific expos that address emerging themes like technology adoption and sustainability, and growing demand for specialized event services. Event organizers are leveraging digital tools to enhance engagement, expand reach beyond physical borders, and offer flexible participation options. According to industry analysis, hybrid participation models have contributed to more than 40% increase in total audience engagement across key Indian exhibitions, underlining the strategic impact of digital augmentation in events.

According to MarkWide Research, the India Events & Exhibition Market continues to evolve as an intersection between commerce, innovation, and professional interaction, underscoring its increasing role in business growth and sector advancement.

Key market insights highlight the multifaceted nature of the India Events & Exhibition Market and its response to changing business dynamics.

Market drivers catalyzing growth in the India Events & Exhibition Market are broadly linked to business networking needs, innovation showcasing, and knowledge dissemination. Companies increasingly utilize events to launch products, demonstrate technology, and engage with potential customers and partners. This trend has gained momentum as enterprises recognize the strategic value of experiential engagement.

Corporate participation is a major force driving market expansion. Businesses across sectors view events and exhibitions as platforms to enhance brand visibility, generate leads, and secure strategic alliances. In segments such as information technology and healthcare, specialized expos attract focused industry attention and sustained engagement.

Government support for infrastructure development, tourism promotion, and trade facilitation has also strengthened event hosting capabilities. Policies that encourage foreign investment and business collaboration have contributed to higher levels of event activity, especially in major cities and emerging regional centers.

Market restraints in the India Events & Exhibition Market include logistical challenges, cost considerations, and regulatory constraints. Large-scale events require meticulous planning, coordination with local authorities, and compliance with safety regulations, which can contribute to elevated organizational overheads. In some cases, rising service costs such as venue rentals, logistics support, and technology integration can influence participation decisions, particularly for smaller enterprises.

Health and safety concerns remain a consideration, especially for in-person events, requiring organizers to implement comprehensive safety protocols. While hybrid formats mitigate some of these concerns, physical events still demand resources for effective crowd management, sanitation, and compliance with public health standards.

Event saturation in certain segments can also pose challenges, with similar expos competing for audience attention. In such contexts, differentiation through unique thematic focus or enhanced participant experience becomes crucial.

Market opportunities in the India Events & Exhibition Market are abundant as digital enhancements, thematic specialization, and regional diversification unfold. The rise of sector-specific expos focused on technology innovation, sustainability solutions, and professional skills development presents opportunities for niche event organizers to create high-value engagements.

Regional expansion represents another avenue for opportunity. Tier-2 and tier-3 cities with emerging business ecosystems are increasingly hosting localized events that foster community engagement and business growth beyond metropolitan centers. These regional hubs support localized industry clusters and provide emerging businesses with platforms to engage partners and customers in their own backyard.

Service innovation is creating new value streams within the market. Event technology solutions that facilitate personalized matchmaking, real-time audience analytics, and immersive experiences are opening up differentiated service offerings, benefiting both organizers and participants.

Market dynamics within the India Events & Exhibition Market reflect the interplay of shifting audience preferences, technological integration, and value-driven event experiences. Digital amplification through hybrid formats has expanded event reach, allowing remote participation alongside physical attendance. This flexibility has increased overall engagement and provided organizers with rich data on audience behavior.

Service evolution is also shaping market dynamics, as providers offer end-to-end event solutions including digital registration systems, lead-generation tools, interactive exhibitor platforms, and post-event analytics. These enhancements contribute to a more comprehensive understanding of event performance and participant interests.

Participant behavior has evolved as well, with attendees seeking actionable insights, networking opportunities, and immersive experiences rather than passive attendance. Events that deliver high engagement and measurable outcomes are attracting higher levels of repeat participation.

The research methodology applied to analyze the India Events & Exhibition Market combines primary interviews, industry surveys, and secondary data analysis. Primary research includes inputs from event organizers, exhibitors, attendees, industry associations, and service providers to capture firsthand perspectives on trends, challenges, and opportunities within the market.

Secondary research includes review of industry publications, regulatory frameworks, trade data, and sector reports. Data verification and trend analysis are conducted through triangulation, ensuring comprehensive coverage and balanced insights.

According to MarkWide Research, this blended research approach yields a nuanced understanding of market behavior and sector dynamics, supporting strategic decision-making without relying on absolute monetary valuations.

Regional analysis of the India Events & Exhibition Market reveals differentiated activity across states and urban centers. Metropolitan hubs such as Delhi, Mumbai, Bengaluru, and Chennai continue to host large-scale expos and industry conventions, leveraging well-developed infrastructure and connectivity.

Western and Southern India account for a significant share of event activity, driven by strong corporate presence, diversified industry participation, and advanced exhibition facilities. These regions attract national and international exhibitors, particularly for technology, healthcare, and manufacturing expos.

Emerging regional centers in Central and Eastern India are witnessing increased event activity, with localized expos that cater to small and medium enterprise (SME) segments and sector-specific communities. These regional events support business growth in localized ecosystems and diversify market participation.

The competitive landscape of the India Events & Exhibition Market encompasses event organizers, venue operators, technology providers, and service partners. Competition is shaped by the ability to deliver innovative experiences, secure high-profile partnerships, and leverage digital solutions for enhanced engagement.

Market segmentation of the India Events & Exhibition Market reflects the variety of formats, end-use sectors, and participation modes that define the market structure.

Category-wise insights indicate that trade shows and sector-specific exhibitions remain dominant due to their commercial focus and high engagement potential. These events attract exhibitors seeking business leads and industry professionals looking for networking and learning opportunities.

Conferences and knowledge forums are increasingly valued for insights on industry trends, regulatory developments, and professional growth. Hybrid participation options have significantly boosted attendance figures by enabling remote engagement for professionals who cannot travel.

Key benefits offered by the India Events & Exhibition Market extend to organizers, exhibitors, attendees, and service partners. Organizers generate revenue through sponsorships, partnerships, and ticket sales, while exhibitors gain exposure to targeted audiences and business opportunities. Attendees benefit from direct access to industry experts, product showcases, and networking platforms that support professional growth.

Stakeholders such as sponsors and service providers also benefit from brand visibility, relationship building, and access to high-value audiences. Hybrid event formats further enhance reach, enabling stakeholders to maximize engagement across physical and virtual dimensions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market key trends include the rise of hybrid event platforms, thematic specialization, and enhanced engagement strategies. Digital event solutions that support real-time interaction, networking matchmaking, and analytics are becoming mainstream, elevating the participant experience. Personalized event journeys, such as curated session paths and targeted interactions, are gaining traction.

Collaborative event formats that integrate community-led initiatives and professional learning modules are also emerging, supporting deeper engagement and knowledge transfer. Sustainability practices such as carbon-neutral event planning and responsible resource use are influencing event design and execution, aligning with broader industry expectations for environmental stewardship.

Key industry developments in the India Events & Exhibition Market include expansion of venue infrastructure, strategic partnerships between organizers and technology providers, and launch of specialized expo series. Event technology solutions such as mobile engagement apps, virtual networking lounges, and interactive exhibitor interfaces are enhancing market offerings.

Analyst suggestions for stakeholders in the India Events & Exhibition Market emphasize continued investment in hybrid engagement, data-driven audience insights, and differentiated event themes. Organizers should prioritize technology adoption that supports seamless interaction, real-time analytics, and personalized experiences to enhance value for participants.

Strategic collaboration between exhibitors, sponsors, and industry associations can amplify reach and create integrated event ecosystems that deliver higher commercial impact. Investments in regional event hubs and partnerships with local business communities will support market penetration beyond major metropolitan centers.

Focus on quality content and sector specialization will help distinguish events and attract targeted audiences who seek actionable insights and high-value connections.

The future outlook for the India Events & Exhibition Market remains positive, supported by evolving business engagement models, continued adoption of hybrid formats, and sustained demand for professional networking platforms. As businesses prioritize experiential interaction and knowledge exchange, events and exhibitions will continue to serve as strategic conduits for commercial growth, sector collaboration, and industry innovation.

Engagement trends suggest that hybrid and digital enhancements will further expand audience reach and participation diversity. Advanced analytics and personalized experience design are expected to create deeper participant insights, strengthening organizer capabilities and sponsor value propositions.

Regional diversification and thematic specialization will contribute to market resilience, supporting sustained activity across multiple industry verticals. Stakeholders who embrace innovation, prioritize participant value, and leverage emerging technologies are well positioned to benefit from expanding opportunities in the India Events & Exhibition Market.

The India Events & Exhibition Market stands at the intersection of commerce, professional engagement, and experiential interaction. As businesses and sectors seek platforms to connect, showcase innovations, and engage with diverse audiences, events and exhibitions have established themselves as essential components of growth strategies.

Market evolution is shaped by hybrid engagement models, technological advancements, and diversified event formats that attract broad participation from domestic and international stakeholders. While operational and cost challenges exist, service innovation and strategic collaborations mitigate these constraints and support long-term resilience.

Looking ahead, the India Events & Exhibition Market is poised for sustained expansion as hybrid participation, technology integration, and sector-specific themes continue to enhance value for participants. The market’s ability to facilitate networking, learning, and commercial engagement underscores its enduring relevance in India’s business landscape.

What is India Events & Exhibition?

India Events & Exhibition refers to the organized gatherings, trade shows, and exhibitions held across various sectors in India, showcasing products, services, and innovations to facilitate networking and business opportunities.

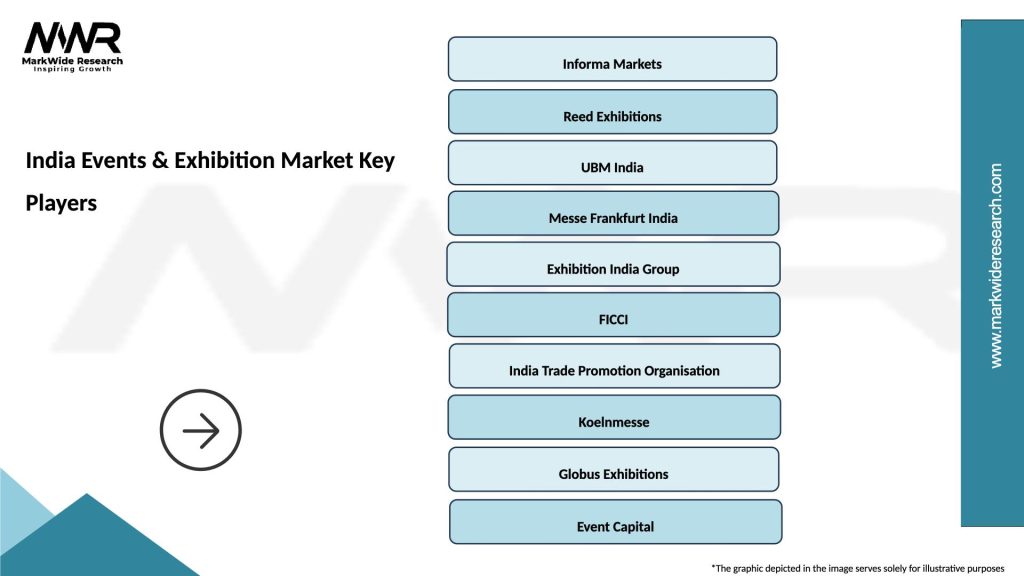

What are the key players in the India Events & Exhibition Market?

Key players in the India Events & Exhibition Market include Informa Markets, Messe Frankfurt, and Reed Exhibitions, among others. These companies are known for organizing large-scale events and exhibitions across diverse industries.

What are the growth factors driving the India Events & Exhibition Market?

The growth of the India Events & Exhibition Market is driven by increasing urbanization, a rise in disposable incomes, and the growing importance of face-to-face interactions in business. Additionally, sectors like technology and tourism are significantly contributing to market expansion.

What challenges does the India Events & Exhibition Market face?

The India Events & Exhibition Market faces challenges such as fluctuating economic conditions, competition from virtual events, and regulatory hurdles. These factors can impact attendance and the overall success of events.

What opportunities exist in the India Events & Exhibition Market?

Opportunities in the India Events & Exhibition Market include the increasing adoption of hybrid event formats, the rise of niche exhibitions, and the potential for international collaborations. These trends can enhance engagement and broaden audience reach.

What trends are shaping the India Events & Exhibition Market?

Trends shaping the India Events & Exhibition Market include the integration of technology for enhanced attendee experiences, sustainability initiatives, and a focus on personalized marketing strategies. These trends are redefining how events are planned and executed.

India Events & Exhibition Market

| Segmentation Details | Description |

|---|---|

| Event Type | Trade Shows, Conferences, Seminars, Expositions |

| Industry Vertical | Technology, Healthcare, Education, Manufacturing |

| Service Type | Event Management, Venue Rental, Catering, Logistics |

| Customer Type | Corporates, Startups, Government, NGOs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Events & Exhibition Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at