444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Engineering Research and Development (ER&D) Services Market represents one of the most dynamic and rapidly evolving sectors in the country’s technology landscape. Engineering research and development services encompass a comprehensive range of activities including product design, prototyping, testing, validation, and lifecycle management across diverse industries. India has emerged as a global hub for ER&D services, leveraging its vast pool of skilled engineers, cost-effective operations, and advanced technological infrastructure.

Market dynamics indicate robust growth driven by increasing digitalization, rising demand for innovative products, and the growing trend of outsourcing complex engineering tasks. The sector demonstrates remarkable expansion with a compound annual growth rate (CAGR) of 12.8%, positioning India as a preferred destination for global enterprises seeking high-quality engineering solutions. Key industries driving this growth include automotive, aerospace, telecommunications, healthcare, and consumer electronics.

Strategic advantages of India’s ER&D market include access to world-class engineering talent, established research institutions, government support for innovation, and strong intellectual property protection frameworks. The market benefits from increasing investments in emerging technologies such as artificial intelligence, Internet of Things, and advanced manufacturing processes, creating substantial opportunities for service providers and stakeholders.

The India Engineering Research and Development (ER&D) Services Market refers to the comprehensive ecosystem of engineering services that encompass research, design, development, testing, and validation activities conducted by Indian companies for domestic and international clients. ER&D services involve the application of engineering principles and methodologies to create innovative products, improve existing solutions, and develop cutting-edge technologies across various industrial sectors.

Core components of ER&D services include conceptual design, detailed engineering, prototyping, simulation and modeling, testing and validation, manufacturing support, and product lifecycle management. These services span multiple disciplines including mechanical engineering, electrical engineering, software development, embedded systems, and materials science, providing end-to-end solutions for complex engineering challenges.

Service delivery models in the Indian ER&D market range from traditional outsourcing arrangements to strategic partnerships, joint ventures, and captive development centers. The market encompasses both pure-play ER&D service providers and diversified technology companies offering specialized engineering capabilities to global clients seeking cost-effective and high-quality engineering solutions.

India’s ER&D services market stands as a cornerstone of the country’s technology-driven economic growth, demonstrating exceptional resilience and expansion across multiple industry verticals. The sector has evolved from a cost-arbitrage model to a value-driven ecosystem focused on innovation, intellectual property creation, and strategic partnerships with global technology leaders.

Market penetration across key industries shows automotive and aerospace sectors accounting for 35% of total market share, followed by telecommunications and electronics contributing significantly to overall growth. The increasing adoption of digital technologies and Industry 4.0 principles has accelerated demand for specialized ER&D services, particularly in areas such as connected devices, autonomous systems, and smart manufacturing solutions.

Competitive landscape features a mix of large multinational corporations, established Indian IT services companies, and specialized boutique firms offering niche engineering capabilities. The market benefits from strong government initiatives promoting research and development, including tax incentives, infrastructure development, and skill enhancement programs that support sustained growth and innovation.

Future prospects remain highly favorable, with emerging technologies such as electric vehicles, renewable energy systems, and advanced healthcare devices creating new opportunities for Indian ER&D service providers to establish leadership positions in high-growth market segments.

Strategic positioning of India’s ER&D services market reveals several critical insights that define its competitive advantage and growth trajectory. The following key insights highlight the market’s fundamental characteristics and development patterns:

Primary growth drivers propelling India’s ER&D services market encompass a combination of domestic factors and global trends that create favorable conditions for sustained expansion. Digital transformation initiatives across industries have emerged as the most significant driver, with organizations seeking innovative engineering solutions to modernize their operations and products.

Increasing complexity of modern products and systems requires specialized engineering expertise that Indian service providers are uniquely positioned to deliver. The growing demand for connected devices, smart systems, and IoT-enabled products has created substantial opportunities for ER&D service providers to develop cutting-edge solutions for global clients.

Cost optimization pressures faced by multinational corporations continue to drive outsourcing of engineering activities to India, where companies can access high-quality services at competitive rates. The maturation of India’s engineering ecosystem, combined with improved infrastructure and communication technologies, has made offshore ER&D services increasingly attractive to global enterprises.

Government initiatives supporting innovation and research activities, including the “Make in India” campaign and various technology promotion schemes, have created a conducive environment for ER&D services growth. These initiatives provide financial incentives, infrastructure support, and regulatory frameworks that encourage both domestic and international investments in engineering research and development activities.

Significant challenges facing India’s ER&D services market include talent retention issues, intellectual property concerns, and increasing competition from other emerging markets. Skilled workforce attrition remains a persistent challenge, with experienced engineers frequently moving between companies or relocating to developed markets, creating continuity issues for long-term projects.

Intellectual property protection concerns continue to influence client decisions regarding the outsourcing of critical engineering activities to India. Despite improvements in legal frameworks and enforcement mechanisms, some multinational corporations remain cautious about sharing sensitive technical information and proprietary technologies with offshore service providers.

Infrastructure limitations in certain regions of India pose challenges for establishing world-class ER&D facilities. Issues related to power supply reliability, internet connectivity, and transportation infrastructure can impact service delivery quality and client satisfaction, particularly for projects requiring sophisticated equipment and testing facilities.

Regulatory complexities and bureaucratic processes can slow down project implementation and increase operational costs for ER&D service providers. Compliance with multiple regulatory requirements, both domestic and international, adds complexity to service delivery and can impact competitiveness in global markets.

Emerging opportunities in India’s ER&D services market are primarily driven by technological advancement and evolving industry requirements. Electric vehicle development presents substantial opportunities as global automotive manufacturers accelerate their transition to sustainable transportation solutions, requiring specialized engineering expertise in battery technology, power electronics, and vehicle integration systems.

Renewable energy sector growth creates significant demand for ER&D services in solar panel design, wind turbine optimization, energy storage systems, and smart grid technologies. Indian service providers are well-positioned to capitalize on the global shift toward clean energy solutions through innovative engineering and cost-effective development approaches.

Healthcare technology advancement offers promising opportunities in medical device development, telemedicine solutions, and digital health platforms. The COVID-19 pandemic has accelerated demand for innovative healthcare technologies, creating new market segments for ER&D service providers with relevant expertise and capabilities.

Aerospace and defense modernization programs present long-term opportunities for Indian ER&D companies to participate in advanced technology development projects. Government initiatives promoting indigenous defense manufacturing and space exploration create substantial demand for specialized engineering services and innovative solutions.

Complex market dynamics shape the evolution of India’s ER&D services sector, influenced by technological trends, client expectations, and competitive pressures. Digital transformation acceleration has fundamentally altered service delivery models, with increasing emphasis on cloud-based collaboration, virtual prototyping, and remote engineering capabilities that enable seamless global project execution.

Client relationship evolution demonstrates a shift from traditional vendor-customer arrangements to strategic partnerships focused on innovation and value creation. According to MarkWide Research analysis, companies are increasingly seeking long-term collaborations that leverage India’s engineering capabilities for competitive advantage rather than simple cost reduction.

Technology convergence across industries creates new requirements for multidisciplinary engineering expertise, driving ER&D service providers to develop integrated capabilities spanning mechanical, electrical, software, and systems engineering. This convergence enables the development of sophisticated products such as autonomous vehicles, smart manufacturing systems, and connected healthcare devices.

Competitive intensity continues to increase as more players enter the market and existing companies expand their service portfolios. Success factors include technical excellence, innovation capabilities, client relationship management, and the ability to deliver complex projects on time and within budget while maintaining high quality standards.

Comprehensive research methodology employed for analyzing India’s ER&D services market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of findings. Primary research activities include structured interviews with industry executives, client surveys, and expert consultations to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research components encompass analysis of industry reports, company financial statements, government publications, and academic research papers to establish market context and validate primary research findings. Data triangulation techniques ensure consistency and reliability of information across multiple sources and perspectives.

Quantitative analysis methods include statistical modeling, trend analysis, and market sizing calculations based on available data points and industry benchmarks. Qualitative research techniques such as focus group discussions and in-depth interviews provide contextual understanding of market dynamics and stakeholder perspectives.

Market validation processes involve cross-referencing findings with industry experts, conducting peer reviews, and applying sensitivity analysis to test the robustness of conclusions and projections. This rigorous approach ensures that research outcomes accurately reflect market realities and provide actionable insights for stakeholders.

Regional distribution of India’s ER&D services market reveals significant concentration in major technology hubs, with distinct characteristics and specializations across different geographical areas. Bangalore emerges as the leading ER&D destination, accounting for approximately 28% of total market activity, driven by its established technology ecosystem, skilled workforce availability, and strong infrastructure supporting complex engineering projects.

Hyderabad and Pune collectively represent 35% of market share, offering competitive advantages in aerospace, automotive, and telecommunications sectors. These cities benefit from government support, educational institutions, and established industrial clusters that facilitate ER&D service delivery across multiple domains.

Chennai’s automotive corridor specializes in automotive ER&D services, leveraging proximity to major manufacturing facilities and supplier networks. The region demonstrates particular strength in mechanical engineering, product design, and manufacturing process optimization, serving both domestic and international automotive clients.

Delhi NCR region focuses on telecommunications, defense, and aerospace ER&D services, benefiting from government proximity and established relationships with public sector enterprises. Emerging locations such as Kochi, Bhubaneswar, and Coimbatore are developing specialized capabilities in niche engineering domains, contributing to market diversification and growth.

Competitive environment in India’s ER&D services market features a diverse mix of players ranging from large multinational corporations to specialized boutique firms, each offering unique capabilities and market positioning strategies. Market leadership is distributed among several key categories of service providers:

Competitive differentiation strategies include technology specialization, industry focus, innovation capabilities, and strategic partnerships with global technology leaders and research institutions.

Market segmentation of India’s ER&D services reveals multiple dimensions that define service categories, industry applications, and technology domains. Service-based segmentation encompasses various engineering disciplines and delivery models that address specific client requirements and project complexities.

By Service Type:

By Industry Vertical:

Automotive sector dominates India’s ER&D services market, driven by global automotive manufacturers’ increasing focus on electric vehicles, autonomous driving technologies, and connected car solutions. Engineering services in this category include powertrain development, vehicle integration, safety systems design, and software development for advanced driver assistance systems.

Aerospace and defense category demonstrates strong growth potential, supported by government initiatives promoting indigenous manufacturing and technology development. Key focus areas include aircraft design, avionics systems, satellite technology, and defense electronics, with increasing emphasis on advanced materials and manufacturing processes.

Telecommunications segment benefits from 5G network deployment and increasing demand for network infrastructure optimization. Service offerings encompass network equipment design, protocol development, testing and validation, and system integration services for telecommunications equipment manufacturers and service providers.

Healthcare technology category shows accelerating growth driven by digital health adoption and medical device innovation. Engineering services include medical device design, regulatory compliance support, clinical trial support, and digital health platform development, addressing the growing demand for innovative healthcare solutions.

Significant advantages accrue to various stakeholders participating in India’s ER&D services market, creating value propositions that support sustained growth and development. Client organizations benefit from access to world-class engineering talent, cost-effective service delivery, and accelerated time-to-market for new products and technologies.

Service providers gain opportunities to develop specialized capabilities, build long-term client relationships, and participate in cutting-edge technology development projects. The market enables companies to scale operations efficiently, access global markets, and establish leadership positions in high-growth technology segments.

Engineering professionals benefit from exposure to advanced technologies, international project experience, and career development opportunities in diverse industry sectors. The market provides platforms for continuous learning, skill enhancement, and professional growth in emerging technology domains.

Government and economic stakeholders realize benefits through job creation, foreign exchange earnings, technology transfer, and industrial development. The ER&D services sector contributes to India’s positioning as a global technology hub and supports broader economic development objectives through innovation and entrepreneurship promotion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration represents the most significant trend reshaping India’s ER&D services market, with companies increasingly adopting cloud-based collaboration tools, virtual prototyping, and digital twin technologies. Remote engineering capabilities have become essential, enabling service providers to deliver complex projects without geographical constraints while maintaining high quality standards.

Artificial intelligence integration is transforming traditional engineering processes, with AI-powered design optimization, predictive maintenance, and automated testing becoming standard practice. Machine learning applications in engineering design and analysis are enabling faster iteration cycles and improved product performance across multiple industry sectors.

Sustainability focus is driving demand for green engineering solutions, with clients increasingly seeking ER&D services that support environmental objectives and regulatory compliance. Circular economy principles are influencing product design approaches, creating opportunities for service providers with expertise in sustainable engineering practices.

Industry 4.0 adoption continues to accelerate, with smart manufacturing, IoT integration, and cyber-physical systems creating new requirements for specialized engineering services. Connected product development has become a key differentiator, requiring multidisciplinary expertise spanning hardware, software, and systems engineering domains.

Strategic acquisitions and partnerships have characterized recent industry developments, with major ER&D service providers expanding their capabilities through targeted acquisitions of specialized engineering firms. Technology investments in advanced simulation tools, testing equipment, and digital collaboration platforms have enhanced service delivery capabilities and client satisfaction levels.

Government initiatives including the National Mission on Interdisciplinary Cyber-Physical Systems and various innovation promotion schemes have created favorable conditions for ER&D services growth. Policy support for emerging technologies and startup ecosystem development has fostered innovation and entrepreneurship in the engineering services sector.

International expansion efforts by Indian ER&D companies have resulted in establishment of global delivery centers and strategic partnerships with international technology leaders. MWR data indicates that 62% of leading ER&D companies have established international operations to better serve global clients and access specialized talent pools.

Technology center establishments by multinational corporations in India continue to grow, with companies setting up dedicated ER&D facilities to leverage local talent and cost advantages. These developments strengthen India’s position as a global ER&D hub and create additional opportunities for local service providers and engineering professionals.

Strategic recommendations for stakeholders in India’s ER&D services market emphasize the importance of continuous capability development, technology adoption, and client relationship management. Service providers should focus on developing specialized expertise in emerging technology domains while maintaining excellence in traditional engineering disciplines.

Investment priorities should include advanced simulation and modeling tools, digital collaboration platforms, and specialized testing facilities that enable delivery of complex engineering projects. Talent development initiatives including continuous training programs, certification schemes, and industry-academia partnerships are essential for maintaining competitive advantage.

Client engagement strategies should emphasize value creation, innovation, and long-term partnership development rather than purely cost-based competition. Intellectual property development and protection capabilities should be strengthened to address client concerns and enable participation in high-value engineering projects.

Market expansion opportunities in emerging sectors such as electric vehicles, renewable energy, and healthcare technology should be pursued through strategic investments and capability development. International market penetration strategies should focus on establishing local presence and building relationships with key clients in target markets.

Long-term prospects for India’s ER&D services market remain highly favorable, supported by continued global demand for engineering innovation and India’s strengthening position as a technology hub. Market growth trajectory is expected to accelerate with increasing adoption of emerging technologies and expanding client base across diverse industry sectors.

Technology evolution will continue to drive market transformation, with artificial intelligence, quantum computing, and advanced materials creating new opportunities for specialized engineering services. MarkWide Research projects that companies investing in these emerging technology capabilities will capture significant market share growth over the next decade.

Industry consolidation trends are likely to continue, with larger service providers acquiring specialized firms to expand their capability portfolios and market reach. Strategic partnerships between Indian companies and international technology leaders will become increasingly important for accessing advanced technologies and global markets.

Regulatory environment improvements and government support for innovation will continue to enhance market attractiveness and competitiveness. Infrastructure development initiatives and skill enhancement programs will address current market constraints and support sustained growth in the ER&D services sector.

India’s Engineering Research and Development Services Market represents a dynamic and rapidly evolving sector that has established itself as a critical component of the global technology ecosystem. The market demonstrates exceptional growth potential driven by increasing demand for innovative engineering solutions, digital transformation initiatives, and the country’s strategic advantages in talent availability and cost competitiveness.

Key success factors for market participants include continuous capability development, technology adoption, and strategic client relationship management. The sector’s evolution from a cost-arbitrage model to a value-driven innovation ecosystem positions Indian ER&D service providers for sustained growth and global leadership in emerging technology domains.

Future opportunities in electric vehicles, renewable energy, healthcare technology, and advanced manufacturing present substantial potential for market expansion and value creation. The combination of government support, industry investment, and technological advancement creates a favorable environment for continued growth and development of India’s ER&D services market, reinforcing its position as a global hub for engineering innovation and excellence.

What is Engineering Research And Development (ER&D) Services?

Engineering Research And Development (ER&D) Services encompass a range of activities aimed at developing new products and improving existing ones. These services are crucial for industries such as automotive, aerospace, and electronics, where innovation and efficiency are key.

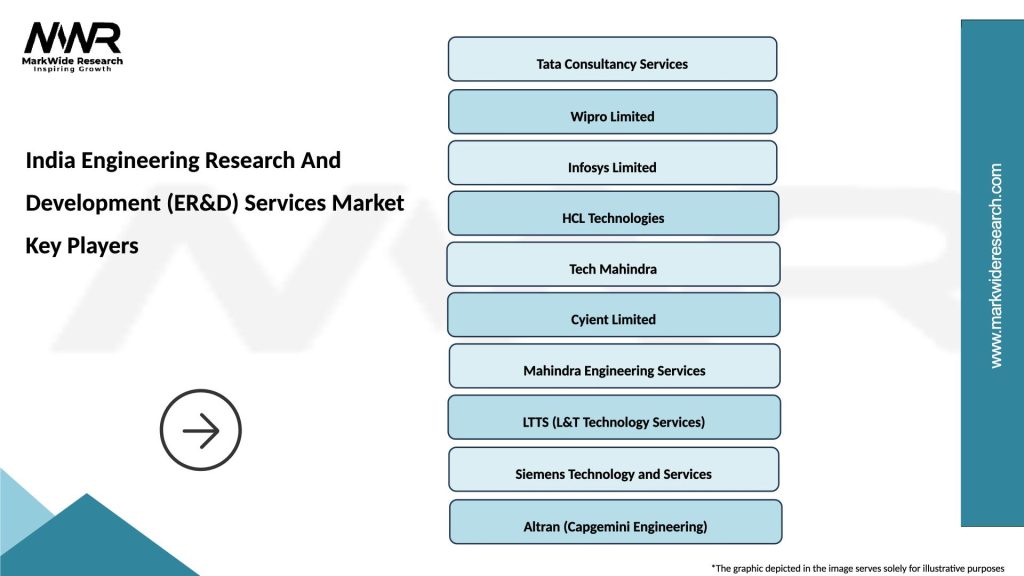

What are the key players in the India Engineering Research And Development (ER&D) Services Market?

Key players in the India Engineering Research And Development (ER&D) Services Market include Tata Consultancy Services, Wipro, and Infosys, among others. These companies provide a variety of services, including product design, software development, and testing.

What are the main drivers of growth in the India Engineering Research And Development (ER&D) Services Market?

The main drivers of growth in the India Engineering Research And Development (ER&D) Services Market include the increasing demand for innovative products, the need for cost-effective solutions, and the rapid technological advancements in sectors like automotive and telecommunications.

What challenges does the India Engineering Research And Development (ER&D) Services Market face?

The India Engineering Research And Development (ER&D) Services Market faces challenges such as a shortage of skilled labor, intense competition among service providers, and the need to keep pace with rapidly changing technologies.

What opportunities exist in the India Engineering Research And Development (ER&D) Services Market?

Opportunities in the India Engineering Research And Development (ER&D) Services Market include the expansion of digital transformation initiatives, the rise of smart manufacturing, and the growing emphasis on sustainability in product development.

What trends are shaping the India Engineering Research And Development (ER&D) Services Market?

Trends shaping the India Engineering Research And Development (ER&D) Services Market include the adoption of artificial intelligence and machine learning in design processes, increased collaboration between companies and startups, and a focus on enhancing customer experience through innovative solutions.

India Engineering Research And Development (ER&D) Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Product Engineering, Process Engineering, Design Services, Testing Services |

| End User | Aerospace, Automotive OEMs, Consumer Electronics, Telecommunications |

| Technology | Artificial Intelligence, Internet of Things, Cloud Computing, Big Data Analytics |

| Application | Embedded Systems, Software Development, Prototyping, Quality Assurance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Engineering Research And Development (ER&D) Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at