444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Engineering, Procurement, and Construction Management (EPCM) market represents a dynamic and rapidly evolving sector that serves as the backbone of the country’s infrastructure development initiatives. This comprehensive market encompasses integrated project management services that combine engineering design, procurement coordination, and construction oversight under unified management frameworks. Market dynamics indicate robust growth driven by massive infrastructure investments, industrial expansion, and government-led development programs across multiple sectors including power generation, oil and gas, petrochemicals, and urban infrastructure.

Growth trajectories in the Indian EPCM market demonstrate exceptional momentum, with the sector experiencing a compound annual growth rate of 8.2% over recent years. This expansion reflects India’s strategic focus on becoming a global manufacturing hub while simultaneously addressing critical infrastructure gaps. Key market drivers include the government’s ambitious infrastructure spending plans, increasing foreign direct investment in industrial projects, and the growing complexity of modern engineering projects that require specialized management expertise.

Regional distribution shows concentrated activity in industrial corridors, with western and southern regions accounting for approximately 65% of total EPCM project value. The market’s evolution reflects India’s transition toward more sophisticated project delivery models, emphasizing integrated solutions that optimize cost, schedule, and quality outcomes. Technology integration has become increasingly important, with digital project management tools and advanced engineering software driving operational efficiency improvements of 25-30% across major projects.

The Engineering, Procurement, and Construction Management (EPCM) market refers to a comprehensive project delivery model where specialized firms provide integrated management services covering the entire project lifecycle from initial design through final commissioning. EPCM services encompass detailed engineering design, strategic procurement management, construction oversight, and project coordination, offering clients a single point of accountability for complex industrial and infrastructure projects.

Core components of EPCM services include front-end engineering design (FEED), detailed engineering execution, vendor selection and procurement strategy, construction management and supervision, commissioning support, and project controls implementation. Service providers act as the owner’s representative, managing multiple contractors and suppliers while ensuring adherence to technical specifications, budget constraints, and schedule requirements. This model differs from traditional Engineering, Procurement, and Construction (EPC) contracts by maintaining the owner’s direct contractual relationships with major suppliers and contractors.

Value proposition centers on risk optimization, cost transparency, and enhanced project control for owners who prefer to retain greater oversight of their capital investments. EPCM advantages include improved cost visibility, reduced markup on procurement, enhanced quality control, and greater flexibility in project execution strategies, making it particularly attractive for complex, high-value industrial projects.

Market fundamentals for India’s EPCM sector demonstrate exceptional strength, driven by unprecedented infrastructure investment commitments and industrial expansion initiatives. The sector benefits from India’s strategic positioning as a global manufacturing destination, supported by favorable government policies, skilled workforce availability, and increasing foreign investment flows. Growth momentum remains robust across multiple end-use sectors, with power generation, petrochemicals, and urban infrastructure leading demand generation.

Competitive dynamics reflect a mix of established international players and emerging domestic capabilities, creating a diverse ecosystem of service providers. Market leaders have invested significantly in digital transformation initiatives, advanced project management methodologies, and specialized sector expertise to differentiate their offerings. Technology adoption has accelerated, with Building Information Modeling (BIM) implementation reaching 40% of major projects, driving improved collaboration and reduced rework costs.

Future prospects appear exceptionally promising, supported by India’s commitment to infrastructure modernization, renewable energy expansion, and industrial development. Key growth catalysts include smart city initiatives, renewable energy projects, industrial corridor development, and increasing private sector participation in infrastructure projects. The market’s evolution toward more sophisticated service delivery models positions India as an increasingly attractive destination for complex EPCM projects.

Strategic insights reveal several critical factors shaping the Indian EPCM market’s trajectory and competitive landscape:

Primary growth drivers propelling the Indian EPCM market forward encompass both macroeconomic factors and sector-specific catalysts that create sustained demand for integrated project management services. Government infrastructure initiatives represent the most significant driver, with massive investment commitments across transportation, power generation, urban development, and industrial infrastructure creating unprecedented project opportunities.

Industrial expansion serves as another critical driver, particularly in sectors such as petrochemicals, pharmaceuticals, steel, and cement where companies are establishing new manufacturing facilities or modernizing existing operations. Foreign direct investment flows have accelerated, bringing international companies that prefer EPCM delivery models for their Indian operations. Renewable energy development has emerged as a major growth catalyst, with solar and wind projects requiring specialized engineering and construction management expertise.

Technology advancement drives demand for more sophisticated project management approaches, as modern industrial facilities incorporate complex automation, digitalization, and environmental control systems. Urbanization trends create sustained demand for infrastructure projects including water treatment, waste management, and smart city development initiatives. Economic growth supports increased industrial activity and infrastructure investment, while regulatory improvements facilitate faster project approvals and execution.

Significant challenges constrain the Indian EPCM market’s growth potential, requiring strategic attention from industry participants and policymakers. Skilled workforce shortages represent a primary constraint, particularly for specialized engineering disciplines and experienced project managers capable of handling complex, large-scale projects. Regulatory complexities continue to create delays and uncertainties, despite recent improvements in approval processes and policy frameworks.

Financial constraints affect both service providers and project owners, with limited access to long-term financing and working capital challenges impacting project execution capabilities. Land acquisition difficulties create significant delays and cost escalations for infrastructure projects, particularly in densely populated areas. Environmental clearance processes can extend project timelines substantially, creating scheduling and cost pressures for EPCM service providers.

Technology gaps persist in certain specialized areas, requiring continued investment in capability development and international partnerships. Quality control challenges emerge from the involvement of multiple contractors and suppliers, requiring enhanced coordination and oversight capabilities. Currency fluctuations impact projects with significant imported equipment components, creating financial risk management challenges for both service providers and project owners.

Emerging opportunities in the Indian EPCM market present substantial growth potential for service providers who can effectively capitalize on evolving market dynamics and client requirements. Renewable energy expansion offers exceptional opportunities, with India’s commitment to achieving 500 GW renewable capacity by 2030 creating massive demand for specialized EPCM services in solar, wind, and energy storage projects.

Smart infrastructure development represents another significant opportunity, as cities across India invest in intelligent transportation systems, smart grids, and digital infrastructure requiring sophisticated engineering and project management capabilities. Industrial corridor development creates opportunities for integrated EPCM services across multiple projects within designated industrial zones, enabling economies of scale and specialized expertise development.

Digital transformation opportunities include developing advanced project management platforms, implementing artificial intelligence for project optimization, and creating integrated digital twin capabilities for complex facilities. International expansion potential exists for Indian EPCM companies to leverage their cost advantages and technical capabilities in other emerging markets. Sustainability consulting services are increasingly in demand as companies seek to integrate environmental considerations and circular economy principles into their project development strategies.

Complex market dynamics shape the competitive landscape and growth trajectory of India’s EPCM sector, reflecting the interplay between demand drivers, supply capabilities, and external factors. Demand-supply dynamics currently favor service providers, with project demand exceeding available specialized capabilities in certain sectors, particularly renewable energy and advanced manufacturing.

Competitive intensity varies significantly across market segments, with established international players dominating large-scale industrial projects while domestic companies compete effectively in infrastructure and smaller industrial applications. Price competition remains intense, driving service providers to focus on value-added services, technological differentiation, and operational efficiency improvements to maintain margins.

Technology disruption is reshaping traditional service delivery models, with digital project management tools, advanced modeling software, and data analytics capabilities becoming essential competitive differentiators. Client expectations continue to evolve, with increasing demands for integrated sustainability solutions, accelerated project delivery, and enhanced cost transparency. Regulatory dynamics influence market structure through policy changes affecting project approvals, environmental requirements, and local content mandates.

Comprehensive research methodology employed for analyzing the Indian EPCM market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, project managers, government officials, and end-user representatives across key sectors to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, project databases, and regulatory documents to establish market size, growth trends, and competitive dynamics. Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and regional distribution patterns based on historical data and identified growth drivers.

Qualitative assessment involves expert interviews, focus group discussions, and case study analysis to understand market nuances, competitive strategies, and emerging trends that may not be captured through quantitative methods alone. Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research findings accurately reflect market realities and provide reliable insights for strategic decision-making.

Regional market distribution across India reveals distinct patterns reflecting industrial concentration, infrastructure development priorities, and economic activity levels. Western India dominates the EPCM market with approximately 40% market share, driven by Maharashtra and Gujarat’s industrial base, port infrastructure, and petrochemical complexes. Major projects in this region include refinery expansions, chemical manufacturing facilities, and renewable energy installations.

Southern India accounts for roughly 25% of market activity, with Karnataka, Tamil Nadu, and Andhra Pradesh leading in technology sector projects, automotive manufacturing, and infrastructure development. Key growth areas include IT infrastructure, pharmaceutical manufacturing, and renewable energy projects, particularly solar installations in Tamil Nadu and Karnataka.

Northern India represents approximately 20% of the market, with significant activity in power generation, transportation infrastructure, and industrial development around Delhi NCR and Punjab. Eastern India accounts for 15% of market share, primarily driven by steel, mining, and port development projects in West Bengal, Odisha, and Jharkhand. Emerging regions include northeastern states where infrastructure development initiatives are creating new opportunities for EPCM service providers.

Competitive dynamics in the Indian EPCM market reflect a diverse ecosystem of international corporations, domestic engineering companies, and specialized service providers competing across different market segments and project types. Market leaders have established strong positions through technical expertise, project execution capabilities, and long-term client relationships.

Leading companies in the Indian EPCM market include:

Competitive strategies focus on technological differentiation, sector specialization, strategic partnerships, and geographic expansion to capture market opportunities and enhance service delivery capabilities.

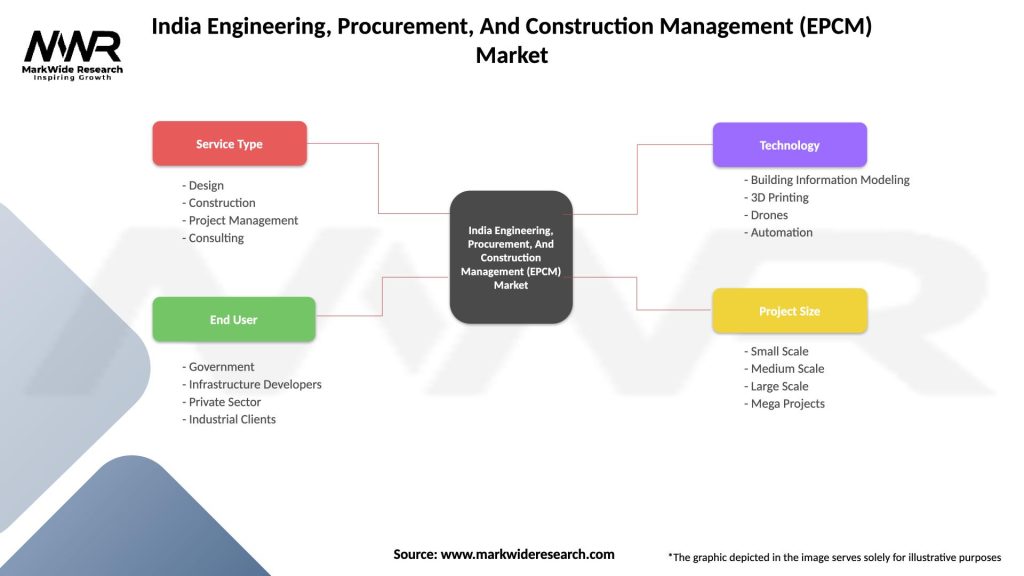

Market segmentation analysis reveals distinct categories based on service type, end-use sector, project size, and delivery model, each exhibiting unique growth patterns and competitive dynamics.

By Service Type:

By End-Use Sector:

By Project Value:

Detailed category analysis provides specific insights into performance trends, growth drivers, and competitive dynamics across major EPCM market segments.

Power Sector EPCM: This category dominates market activity with thermal power modernization and renewable energy expansion driving sustained demand. Key trends include increasing focus on efficiency improvements, environmental compliance, and grid integration capabilities. Technology integration emphasizes advanced control systems, emissions monitoring, and digital asset management platforms.

Petrochemical EPCM: Represents high-value, complex projects requiring specialized expertise in process engineering, safety systems, and environmental controls. Growth drivers include capacity expansions, product diversification, and technology upgrades to meet evolving market demands. Service differentiation focuses on process optimization, sustainability integration, and advanced automation capabilities.

Infrastructure EPCM: Encompasses diverse project types from transportation systems to water treatment facilities, each requiring specialized engineering and management approaches. Smart infrastructure initiatives drive demand for integrated technology solutions and advanced project management capabilities. Sustainability considerations increasingly influence design decisions and construction methodologies.

Manufacturing EPCM: Covers industrial facility development across multiple sectors, with emphasis on operational efficiency, quality systems, and regulatory compliance. Industry 4.0 integration drives demand for advanced automation, data analytics, and digital manufacturing capabilities within EPCM service delivery.

Comprehensive benefits accrue to various stakeholders participating in India’s EPCM market, creating value through improved project outcomes, risk mitigation, and operational efficiency enhancements.

For Project Owners:

For EPCM Service Providers:

For the Economy:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends are reshaping the Indian EPCM market, driving evolution in service delivery models, technology adoption, and client expectations. Digital transformation represents the most significant trend, with advanced project management platforms adoption reaching 45% among major service providers. Building Information Modeling (BIM) implementation has accelerated, improving project visualization, coordination, and reducing design conflicts.

Sustainability integration has become a critical trend, with clients increasingly demanding environmental impact assessments, carbon footprint optimization, and circular economy principles in project design. Modular construction approaches are gaining traction, enabling faster project delivery and improved quality control through off-site fabrication and assembly techniques.

Data analytics and artificial intelligence applications are emerging as competitive differentiators, enabling predictive maintenance, risk assessment, and project optimization capabilities. Collaborative delivery models emphasize integrated project teams, early contractor involvement, and shared risk-reward structures to improve project outcomes. Remote project management capabilities have expanded significantly, enabling efficient oversight of distributed project teams and international collaboration.

Specialized sector focus is increasing, with service providers developing deep expertise in specific industries such as renewable energy, pharmaceuticals, or data centers to differentiate their offerings and command premium pricing.

Significant industry developments are shaping the competitive landscape and growth trajectory of India’s EPCM market through strategic initiatives, technological advancements, and regulatory changes.

Strategic Partnerships: Major EPCM companies are forming alliances with technology providers, specialized contractors, and international partners to enhance service capabilities and market reach. Recent collaborations focus on digital transformation, renewable energy expertise, and advanced manufacturing technologies.

Technology Investments: Leading service providers are investing heavily in digital project management platforms, artificial intelligence capabilities, and advanced modeling software to improve project delivery efficiency and client value proposition. Innovation centers are being established to develop next-generation EPCM solutions and methodologies.

Capacity Expansion: Both domestic and international EPCM companies are expanding their Indian operations through new office establishments, workforce augmentation, and specialized capability development. Regional expansion strategies focus on emerging industrial corridors and renewable energy development zones.

Regulatory Developments: Government initiatives to streamline project approvals, improve environmental clearance processes, and promote digital infrastructure are creating more favorable operating conditions for EPCM service providers. Policy support for renewable energy and industrial development continues to drive market opportunities.

Strategic recommendations for EPCM market participants focus on capability development, technology adoption, and market positioning to capitalize on growth opportunities while addressing competitive challenges. MarkWide Research analysis indicates that companies should prioritize digital transformation initiatives to remain competitive in an increasingly technology-driven market environment.

Technology Investment: Service providers should accelerate adoption of advanced project management platforms, BIM capabilities, and data analytics tools to improve operational efficiency and client value delivery. Digital twin technology implementation can provide significant competitive advantages in complex industrial projects.

Sector Specialization: Developing deep expertise in high-growth sectors such as renewable energy, pharmaceuticals, and data centers can enable premium pricing and reduced competition intensity. Specialized capabilities in sustainability consulting and smart infrastructure development represent emerging opportunities.

Partnership Strategies: Strategic alliances with technology providers, international partners, and specialized contractors can enhance service capabilities and market access. Joint ventures with global leaders can provide access to advanced technologies and international project opportunities.

Talent Development: Investing in workforce training, certification programs, and specialized skill development is essential for maintaining service quality and competitive positioning. Digital skills and project management certifications are particularly important for future growth.

Future prospects for India’s EPCM market appear exceptionally promising, supported by sustained infrastructure investment, industrial expansion, and evolving client requirements for integrated project management services. Market growth is projected to maintain strong momentum with an expected compound annual growth rate of 8.5% over the next five years, driven by renewable energy expansion, smart infrastructure development, and industrial modernization initiatives.

Renewable energy projects are expected to represent the fastest-growing segment, with solar, wind, and energy storage installations requiring specialized EPCM expertise. Government commitments to achieving carbon neutrality and renewable energy targets will sustain long-term demand in this sector. Smart city initiatives and digital infrastructure development will create new opportunities for technology-integrated EPCM services.

Technology evolution will continue reshaping service delivery models, with artificial intelligence, machine learning, and advanced analytics becoming standard capabilities for leading service providers. MWR projections suggest that companies investing in digital transformation will achieve 20-25% efficiency improvements compared to traditional approaches.

International expansion opportunities will emerge as Indian EPCM companies leverage their cost advantages and technical capabilities to compete in other emerging markets. Sustainability focus will intensify, with environmental considerations becoming integral to all project development decisions and creating demand for specialized consulting services.

The India Engineering, Procurement, and Construction Management (EPCM) market stands at a pivotal juncture, characterized by exceptional growth opportunities, evolving client requirements, and transformative technological developments. Market fundamentals remain robust, supported by massive infrastructure investment commitments, industrial expansion initiatives, and government policy support for economic development and modernization.

Competitive dynamics favor service providers who can effectively integrate advanced technologies, develop specialized sector expertise, and deliver superior project outcomes through innovative service delivery models. Digital transformation has emerged as a critical success factor, with leading companies leveraging advanced project management platforms, data analytics, and collaborative technologies to differentiate their offerings and improve operational efficiency.

Growth trajectory appears sustainable over the long term, driven by India’s commitment to infrastructure modernization, renewable energy expansion, and industrial competitiveness enhancement. Strategic positioning in high-growth sectors such as renewable energy, smart infrastructure, and advanced manufacturing will be essential for capturing market opportunities and achieving competitive advantage. The India EPCM market represents a compelling opportunity for both domestic and international service providers who can adapt to evolving market requirements while delivering exceptional value to their clients through integrated project management excellence.

What is Engineering, Procurement, And Construction Management?

Engineering, Procurement, And Construction Management (EPCM) refers to a project delivery method where the contractor is responsible for the design, procurement, and construction of a project. This approach is commonly used in large-scale infrastructure projects, including energy, transportation, and industrial facilities.

What are the key players in the India Engineering, Procurement, And Construction Management (EPCM) Market?

Key players in the India Engineering, Procurement, And Construction Management (EPCM) Market include Larsen & Toubro, Tata Projects, and Shapoorji Pallonji Group, among others. These companies are known for their expertise in managing complex projects across various sectors.

What are the growth factors driving the India Engineering, Procurement, And Construction Management (EPCM) Market?

The growth of the India Engineering, Procurement, And Construction Management (EPCM) Market is driven by increasing infrastructure development, government initiatives to boost the construction sector, and rising investments in renewable energy projects. These factors contribute to a robust demand for EPCM services.

What challenges does the India Engineering, Procurement, And Construction Management (EPCM) Market face?

The India Engineering, Procurement, And Construction Management (EPCM) Market faces challenges such as regulatory hurdles, project delays due to land acquisition issues, and fluctuations in material costs. These factors can impact project timelines and budgets.

What opportunities exist in the India Engineering, Procurement, And Construction Management (EPCM) Market?

Opportunities in the India Engineering, Procurement, And Construction Management (EPCM) Market include the growing demand for smart city projects, advancements in construction technology, and increased focus on sustainable building practices. These trends are likely to shape the future of the market.

What trends are shaping the India Engineering, Procurement, And Construction Management (EPCM) Market?

Trends in the India Engineering, Procurement, And Construction Management (EPCM) Market include the adoption of digital technologies like Building Information Modeling (BIM), a shift towards modular construction, and an emphasis on sustainability. These innovations are enhancing project efficiency and reducing environmental impact.

India Engineering, Procurement, And Construction Management (EPCM) Market

| Segmentation Details | Description |

|---|---|

| Service Type | Design, Construction, Project Management, Consulting |

| End User | Government, Infrastructure Developers, Private Sector, Industrial Clients |

| Technology | Building Information Modeling, 3D Printing, Drones, Automation |

| Project Size | Small Scale, Medium Scale, Large Scale, Mega Projects |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Engineering, Procurement, And Construction Management (EPCM) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at