444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India EMR (Electronic Medical Records) market represents one of the most rapidly evolving segments within the country’s healthcare technology landscape. Digital transformation in healthcare has accelerated significantly, driven by government initiatives, increasing healthcare awareness, and the growing need for efficient patient data management systems. The market encompasses comprehensive software solutions that enable healthcare providers to digitally store, manage, and access patient medical records, treatment histories, and clinical data.

Healthcare digitization in India has gained unprecedented momentum, particularly following the COVID-19 pandemic, which highlighted the critical importance of accessible and integrated medical record systems. The market is experiencing robust growth with a projected CAGR of 12.5% over the forecast period, reflecting the increasing adoption of digital health technologies across urban and rural healthcare facilities.

Government support through initiatives like the National Digital Health Mission (NDHM) and Ayushman Bharat Digital Mission has created a favorable regulatory environment for EMR adoption. These programs aim to establish a comprehensive digital health ecosystem, making electronic medical records an integral component of India’s healthcare infrastructure transformation.

The India EMR (Electronic Medical Records) market refers to the comprehensive ecosystem of digital healthcare solutions that enable medical practitioners, hospitals, clinics, and healthcare institutions to electronically capture, store, manage, and share patient health information. Electronic Medical Records represent a digital version of traditional paper charts, containing patient medical history, diagnoses, medications, treatment plans, immunization dates, allergies, radiology images, and laboratory test results.

EMR systems in the Indian context encompass cloud-based and on-premise software platforms designed to streamline healthcare workflows, improve patient care quality, reduce medical errors, and enhance operational efficiency. These systems integrate various healthcare processes including patient registration, appointment scheduling, billing, clinical documentation, prescription management, and regulatory compliance reporting.

Market participants include software developers, healthcare technology companies, system integrators, and service providers offering customized EMR solutions tailored to Indian healthcare requirements, regulatory standards, and diverse linguistic needs across different states and regions.

Market dynamics in the India EMR sector reflect a transformative period characterized by accelerated digital adoption, supportive government policies, and increasing healthcare infrastructure investments. The market demonstrates strong growth potential driven by the expanding healthcare sector, rising patient volumes, and the critical need for efficient data management systems.

Key growth drivers include government digitization initiatives contributing to approximately 35% of market expansion, increasing healthcare expenditure, growing awareness of digital health benefits, and the need for interoperable healthcare systems. The market benefits from favorable regulatory frameworks, technology advancement, and increasing smartphone and internet penetration across urban and rural areas.

Competitive landscape features both international technology giants and domestic software companies developing India-specific EMR solutions. Market leaders focus on creating user-friendly interfaces, multilingual support, integration capabilities, and cost-effective deployment models suitable for diverse healthcare settings ranging from large hospital chains to small clinics.

Future prospects indicate sustained growth momentum supported by ongoing healthcare reforms, increasing private sector participation, and the government’s commitment to establishing a unified digital health ecosystem that will significantly boost EMR adoption rates across all healthcare segments.

Strategic insights reveal several critical factors shaping the India EMR market landscape:

Government digitization initiatives serve as the primary catalyst for EMR market growth in India. The National Digital Health Mission, Ayushman Bharat Digital Mission, and various state-level healthcare digitization programs have created a supportive ecosystem for electronic medical record adoption. These initiatives provide funding support, technical guidelines, and regulatory frameworks that encourage healthcare institutions to implement digital record-keeping systems.

Healthcare infrastructure expansion across India drives significant demand for EMR solutions. The growing number of hospitals, clinics, diagnostic centers, and healthcare facilities requires efficient patient data management systems. New healthcare establishments increasingly adopt EMR systems from inception, while existing facilities upgrade from paper-based records to digital platforms to improve operational efficiency and patient care quality.

Rising healthcare awareness among patients and providers contributes to EMR adoption. Patients increasingly expect digital healthcare services, online appointment booking, digital prescriptions, and easy access to their medical records. Healthcare providers recognize that EMR systems enhance patient satisfaction, improve care coordination, and enable better clinical outcomes through comprehensive patient data availability.

Operational efficiency requirements drive healthcare institutions to implement EMR systems that streamline administrative processes, reduce paperwork, minimize medical errors, and improve workflow management. EMR solutions enable faster patient registration, automated billing, efficient appointment scheduling, and seamless communication between different departments within healthcare facilities.

High implementation costs present significant barriers for smaller healthcare facilities and independent practitioners. EMR system deployment requires substantial initial investments in software licenses, hardware infrastructure, staff training, and ongoing maintenance. Many small clinics and rural healthcare centers struggle to justify these expenses, particularly when operating with limited budgets and uncertain return on investment timelines.

Technical infrastructure limitations in certain regions of India constrain EMR adoption. Inadequate internet connectivity, unreliable power supply, and limited IT support services in rural and semi-urban areas create challenges for implementing and maintaining electronic medical record systems. These infrastructure gaps particularly affect government healthcare facilities and primary health centers in remote locations.

Resistance to change among healthcare professionals, particularly older practitioners, slows EMR adoption rates. Many doctors and nurses accustomed to paper-based record-keeping express concerns about learning new technologies, changing established workflows, and potential disruptions to patient care during transition periods. This resistance requires comprehensive training programs and change management strategies.

Data security concerns regarding patient privacy and information protection create hesitation among healthcare providers considering EMR implementation. Cybersecurity threats, data breach incidents, and regulatory compliance requirements generate apprehension about storing sensitive medical information in digital formats, particularly among institutions lacking robust IT security infrastructure.

Rural healthcare digitization presents enormous growth opportunities for EMR providers. The government’s focus on improving healthcare access in rural areas through telemedicine initiatives, mobile health units, and primary health center upgrades creates demand for affordable, user-friendly EMR solutions designed for resource-constrained environments. Companies developing simplified, offline-capable EMR systems can capture significant market share in underserved regions.

Artificial intelligence integration offers substantial opportunities for EMR enhancement. Healthcare providers increasingly seek intelligent systems that provide clinical decision support, predictive analytics, automated documentation, and diagnostic assistance. EMR solutions incorporating AI capabilities for pattern recognition, treatment recommendations, and risk assessment can command premium pricing and drive market differentiation.

Interoperability development creates opportunities for companies specializing in healthcare data integration and standardization. As healthcare institutions adopt various EMR systems, the need for seamless data exchange between different platforms becomes critical. Companies offering interoperability solutions, data migration services, and integration platforms can capitalize on this growing demand.

Specialized healthcare segments represent untapped opportunities for customized EMR solutions. Specialty clinics, dental practices, mental health facilities, and alternative medicine practitioners require tailored EMR systems addressing their specific workflow requirements, documentation needs, and regulatory compliance obligations. Niche EMR solutions can achieve higher adoption rates and customer loyalty in these specialized markets.

Technology evolution continuously reshapes the India EMR market landscape. Cloud computing adoption has accelerated, with approximately 60% of new EMR implementations utilizing cloud-based architectures for improved scalability, reduced infrastructure costs, and enhanced accessibility. Mobile technology integration enables healthcare professionals to access patient records through smartphones and tablets, improving care delivery flexibility and efficiency.

Regulatory environment plays a crucial role in market dynamics. The Digital Information Security in Healthcare Act (DISHA) and Personal Data Protection Bill establish frameworks for healthcare data management, influencing EMR system design and implementation requirements. Compliance with these regulations drives demand for EMR solutions with robust security features, audit trails, and data governance capabilities.

Competitive intensity has increased significantly as both international and domestic companies compete for market share. Global EMR vendors adapt their solutions for Indian market requirements, while local companies leverage their understanding of regional needs, languages, and healthcare practices. This competition drives innovation, improves product quality, and reduces pricing, benefiting healthcare providers and patients.

Partnership strategies emerge as key market dynamics, with EMR vendors collaborating with healthcare institutions, system integrators, and technology partners to expand market reach and enhance solution capabilities. These partnerships facilitate knowledge transfer, accelerate implementation timelines, and improve customer support services across diverse geographic regions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India EMR market. Primary research involves extensive interviews with healthcare administrators, IT decision-makers, EMR vendors, government officials, and industry experts across different regions and healthcare segments. These interviews provide firsthand insights into market trends, challenges, opportunities, and future prospects.

Secondary research encompasses analysis of government reports, healthcare statistics, industry publications, company financial statements, and regulatory documents. This research provides quantitative data on market size, growth rates, adoption trends, and competitive positioning. Healthcare industry databases, medical association reports, and technology research publications contribute valuable market intelligence.

Market segmentation analysis examines EMR adoption patterns across different healthcare facility types, geographic regions, and technology deployment models. This analysis identifies growth opportunities, market gaps, and emerging trends that influence strategic decision-making for market participants and stakeholders.

Validation processes ensure data accuracy through triangulation of multiple sources, expert review panels, and statistical verification methods. MarkWide Research employs rigorous quality control measures to maintain research integrity and provide reliable market intelligence for strategic planning and investment decisions.

Northern India leads EMR adoption with approximately 28% market share, driven by the concentration of major healthcare institutions, government hospitals, and private hospital chains in Delhi, Punjab, Haryana, and Uttar Pradesh. The region benefits from better IT infrastructure, higher healthcare spending, and strong government support for digitization initiatives. Major corporate hospitals and medical colleges in this region serve as early adopters and reference sites for EMR implementations.

Western India accounts for significant market share, particularly in Maharashtra, Gujarat, and Rajasthan, where industrial growth has supported healthcare infrastructure development. Mumbai and Pune emerge as major EMR implementation hubs, with numerous healthcare facilities adopting advanced digital systems. The region’s pharmaceutical industry concentration creates demand for integrated EMR solutions supporting clinical research and drug development activities.

Southern India demonstrates strong EMR adoption rates, especially in Karnataka, Tamil Nadu, Andhra Pradesh, and Kerala. Bangalore’s position as India’s IT capital facilitates technology adoption in healthcare, while Chennai and Hyderabad host major hospital chains implementing comprehensive EMR systems. The region’s high literacy rates and technology acceptance contribute to successful EMR deployments.

Eastern and Northeastern India represent emerging markets with growing EMR adoption potential. West Bengal, Odisha, and northeastern states are gradually implementing digital healthcare initiatives supported by central government programs. These regions offer significant growth opportunities for affordable EMR solutions designed for resource-constrained environments and smaller healthcare facilities.

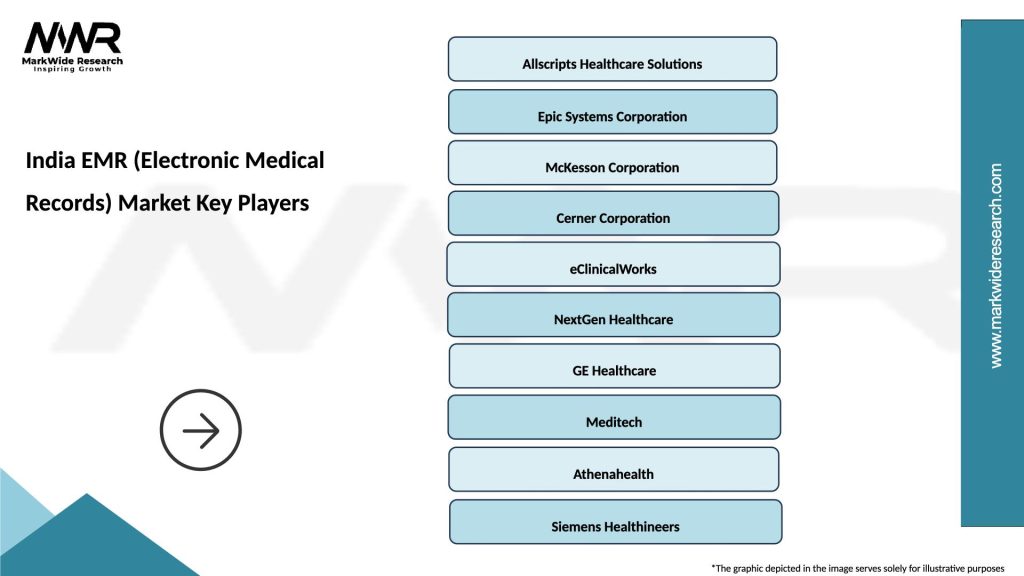

Market leadership in the India EMR sector is distributed among several key players offering diverse solutions for different healthcare segments:

Competitive strategies include product localization, strategic partnerships with healthcare institutions, competitive pricing models, and comprehensive support services. Companies invest in research and development to enhance their solutions with AI capabilities, mobile accessibility, and improved user experiences.

By Deployment Model:

By End User:

By Application:

Hospital EMR Systems represent the most sophisticated category, requiring comprehensive functionality for complex healthcare environments. These systems must support multiple departments, specialties, and user types while maintaining high performance and reliability. Hospital EMR implementations typically involve extensive customization, integration with existing systems, and comprehensive training programs. The category experiences steady growth driven by hospital expansion and modernization initiatives.

Clinic EMR Solutions focus on simplicity, affordability, and ease of use for smaller healthcare practices. These systems emphasize streamlined workflows, quick implementation, and minimal training requirements. The category benefits from the growing number of independent practices and specialty clinics seeking to digitize their operations. Cloud-based deployment models dominate this category due to lower upfront costs and reduced IT infrastructure requirements.

Specialty EMR Systems cater to specific medical disciplines such as cardiology, orthopedics, dermatology, and mental health. These solutions incorporate specialty-specific templates, workflows, and reporting capabilities that address unique documentation and compliance requirements. The category demonstrates strong growth potential as healthcare providers recognize the benefits of specialized EMR systems over generic solutions.

Mobile EMR Applications represent an emerging category addressing the need for healthcare mobility and remote access. These solutions enable healthcare professionals to access patient records, update documentation, and manage workflows through smartphones and tablets. The category gains traction particularly among younger healthcare professionals and practices emphasizing patient engagement and accessibility.

Healthcare Providers benefit significantly from EMR implementation through improved operational efficiency, reduced administrative burden, and enhanced patient care quality. EMR systems eliminate paper-based record keeping, reduce storage costs, and enable instant access to patient information from multiple locations. Healthcare professionals can make more informed clinical decisions with comprehensive patient histories, medication lists, and test results readily available.

Patients experience improved healthcare services through EMR adoption, including reduced waiting times, fewer medical errors, and better care coordination between different healthcare providers. EMR systems enable patients to access their medical records online, schedule appointments digitally, and receive electronic prescriptions. The improved accuracy and completeness of medical records lead to better diagnosis and treatment outcomes.

Healthcare Administrators achieve significant operational improvements through EMR systems, including streamlined billing processes, automated reporting, and improved regulatory compliance. EMR solutions provide valuable analytics and insights for operational optimization, resource allocation, and strategic planning. Administrative costs decrease through reduced paperwork, improved workflow efficiency, and automated routine tasks.

Government and Regulatory Bodies benefit from EMR adoption through improved healthcare data collection, better population health monitoring, and enhanced regulatory compliance. EMR systems facilitate public health surveillance, epidemic tracking, and healthcare quality measurement. Digital health records support evidence-based policy making and healthcare resource allocation decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first adoption emerges as a dominant trend, with healthcare organizations increasingly preferring cloud-based EMR solutions over traditional on-premise deployments. This shift is driven by reduced infrastructure costs, improved scalability, and enhanced accessibility. Cloud EMR solutions enable healthcare providers to access patient records from multiple locations, support remote work capabilities, and benefit from automatic software updates and maintenance.

Mobile-responsive design becomes essential for EMR systems as healthcare professionals increasingly use smartphones and tablets for clinical activities. EMR vendors focus on developing responsive interfaces optimized for mobile devices, enabling point-of-care documentation, bedside access to patient records, and improved workflow efficiency. Mobile EMR capabilities particularly benefit home healthcare services and ambulatory care settings.

Artificial intelligence integration transforms EMR functionality through intelligent features such as clinical decision support, automated documentation, predictive analytics, and diagnostic assistance. AI-powered EMR systems help healthcare providers identify potential health risks, suggest treatment protocols, and improve clinical outcomes. Natural language processing capabilities enable voice-to-text documentation and automated coding for billing purposes.

Interoperability focus drives EMR development toward seamless data exchange between different healthcare systems, laboratories, pharmacies, and insurance providers. Healthcare organizations demand EMR solutions that support standard protocols like HL7 FHIR, enabling comprehensive patient data sharing and care coordination across multiple providers and facilities.

National Digital Health Mission implementation represents the most significant industry development, establishing a comprehensive framework for healthcare digitization across India. The mission creates unique health IDs for citizens, standardizes healthcare data formats, and promotes EMR adoption through policy support and funding mechanisms. This initiative accelerates EMR implementation across government healthcare facilities and encourages private sector participation.

Strategic partnerships between EMR vendors and healthcare institutions have increased significantly, with companies forming alliances to accelerate implementation, provide comprehensive support services, and develop customized solutions. These partnerships often include technology transfer, training programs, and ongoing maintenance agreements that ensure successful EMR deployments and user adoption.

Regulatory compliance enhancements drive EMR system improvements to meet evolving data protection and healthcare quality requirements. EMR vendors invest in security features, audit capabilities, and compliance reporting tools to address regulatory mandates and healthcare accreditation standards. These developments improve system reliability and build trust among healthcare providers.

Innovation in user experience focuses on simplifying EMR interfaces, reducing documentation burden, and improving workflow efficiency. EMR companies invest in user research, interface design, and usability testing to create more intuitive systems that healthcare professionals can adopt quickly and use effectively without extensive training.

MarkWide Research recommends that EMR vendors prioritize affordability and simplicity to capture the vast market of small healthcare practices and rural facilities. Developing entry-level EMR solutions with essential functionality, flexible pricing models, and minimal infrastructure requirements can significantly expand market reach and accelerate adoption rates across diverse healthcare settings.

Investment in local partnerships emerges as a critical success factor for EMR companies operating in India. Collaborating with local system integrators, healthcare consultants, and technology partners provides valuable market insights, implementation expertise, and ongoing support capabilities. These partnerships enable EMR vendors to navigate regional variations, language requirements, and specific healthcare practices effectively.

Focus on training and support services becomes essential for successful EMR implementations. Healthcare providers require comprehensive training programs, user documentation, and ongoing technical support to achieve successful EMR adoption. Companies that invest in robust support infrastructure and change management services achieve higher customer satisfaction and retention rates.

Emphasis on data security and privacy protection builds trust and confidence among healthcare providers considering EMR adoption. EMR vendors should implement robust cybersecurity measures, obtain relevant certifications, and provide transparent information about data protection practices. Building strong security reputations becomes increasingly important as healthcare data breaches gain public attention.

Market expansion is projected to continue at an accelerated pace, with EMR adoption reaching approximately 75% of healthcare facilities by 2028. Government digitization initiatives, increasing healthcare investments, and growing technology acceptance among healthcare professionals will drive sustained market growth. The expansion will be particularly pronounced in tier-2 and tier-3 cities where healthcare infrastructure development is accelerating.

Technology advancement will reshape EMR capabilities through artificial intelligence, machine learning, and advanced analytics integration. Future EMR systems will provide predictive insights, automated clinical documentation, and intelligent decision support that significantly enhance healthcare quality and efficiency. Voice recognition, natural language processing, and automated coding will become standard features in advanced EMR platforms.

Interoperability achievement will become a reality as standardization efforts mature and healthcare organizations recognize the benefits of seamless data exchange. Future EMR systems will seamlessly integrate with laboratory systems, imaging platforms, pharmacy networks, and insurance providers, creating comprehensive healthcare ecosystems that improve patient care coordination and operational efficiency.

Rural healthcare transformation will accelerate through mobile EMR solutions, telemedicine integration, and government support programs. EMR systems designed for resource-constrained environments will enable digital healthcare delivery in remote areas, supporting the government’s universal healthcare coverage objectives and improving health outcomes for underserved populations.

The India EMR (Electronic Medical Records) market stands at a transformative juncture, characterized by unprecedented growth opportunities, supportive government policies, and increasing healthcare digitization awareness. Market dynamics reflect a mature ecosystem ready for widespread EMR adoption across diverse healthcare settings, from large hospital chains to small rural clinics.

Strategic factors including government initiatives, technology advancement, and changing healthcare delivery models create a favorable environment for sustained market expansion. The combination of policy support through the National Digital Health Mission, increasing healthcare investments, and growing technology acceptance among healthcare professionals establishes a strong foundation for continued EMR market growth.

Future success in the India EMR market will depend on companies’ ability to address local requirements, provide affordable solutions, and deliver comprehensive support services. Organizations that focus on user experience, data security, and seamless integration capabilities while maintaining competitive pricing will capture significant market share in this rapidly evolving landscape.

The India EMR market represents not just a technology adoption trend but a fundamental transformation of healthcare delivery that will improve patient outcomes, enhance operational efficiency, and support India’s vision of accessible, quality healthcare for all citizens.

What is Electronic Medical Records?

Electronic Medical Records (EMR) are digital versions of patients’ paper charts, designed to streamline the management of patient data, enhance the quality of care, and improve the efficiency of healthcare providers.

What are the key players in the India EMR (Electronic Medical Records) Market?

Key players in the India EMR (Electronic Medical Records) Market include companies like Allscripts Healthcare Solutions, Cerner Corporation, and eClinicalWorks, among others.

What are the main drivers of growth in the India EMR (Electronic Medical Records) Market?

The growth of the India EMR (Electronic Medical Records) Market is driven by factors such as the increasing adoption of digital health solutions, government initiatives promoting healthcare digitization, and the rising demand for efficient patient management systems.

What challenges does the India EMR (Electronic Medical Records) Market face?

Challenges in the India EMR (Electronic Medical Records) Market include concerns over data privacy and security, the high cost of implementation, and resistance to change from traditional paper-based systems.

What opportunities exist in the India EMR (Electronic Medical Records) Market?

Opportunities in the India EMR (Electronic Medical Records) Market include the potential for integration with telemedicine services, advancements in artificial intelligence for data analysis, and the growing emphasis on personalized medicine.

What trends are shaping the India EMR (Electronic Medical Records) Market?

Trends in the India EMR (Electronic Medical Records) Market include the shift towards cloud-based solutions, the incorporation of mobile access for healthcare providers, and the increasing use of data analytics to improve patient outcomes.

India EMR (Electronic Medical Records) Market

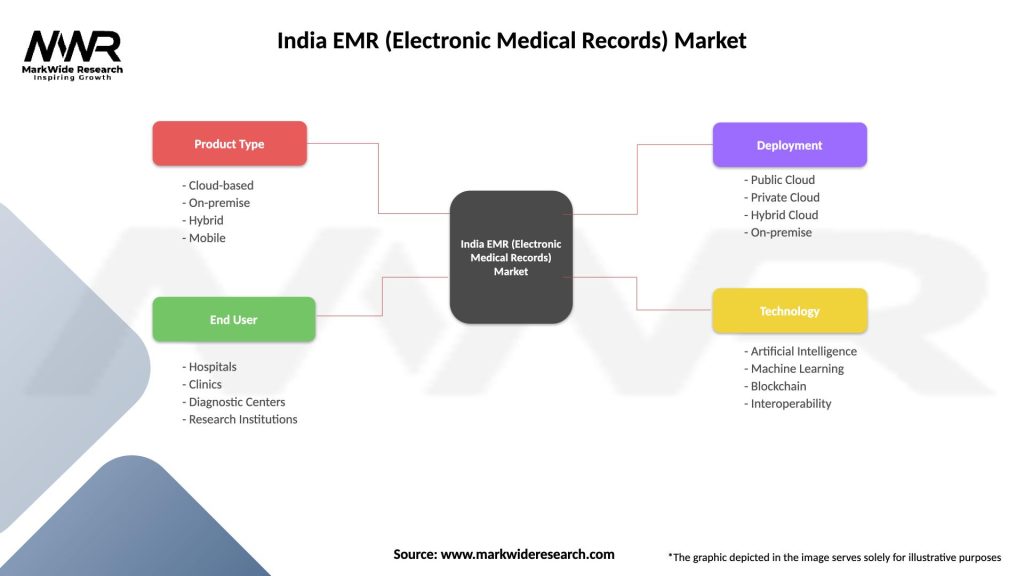

| Segmentation Details | Description |

|---|---|

| Product Type | Cloud-based, On-premise, Hybrid, Mobile |

| End User | Hospitals, Clinics, Diagnostic Centers, Research Institutions |

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, On-premise |

| Technology | Artificial Intelligence, Machine Learning, Blockchain, Interoperability |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India EMR (Electronic Medical Records) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at