444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

India has emerged as a fascinating destination for culinary enthusiasts, attracting travelers from all over the world. Culinary tourism refers to the exploration of local food and beverages as a significant part of travel experiences. It involves indulging in regional delicacies, understanding diverse cooking techniques, and immersing oneself in the cultural heritage associated with food. The India culinary tourism market has witnessed remarkable growth in recent years, as it offers a rich tapestry of flavors, spices, and traditions.

Meaning

Electronic gadgets have become an integral part of our daily lives, ranging from smartphones and tablets to laptops and cameras. With the growing reliance on these devices, the need for protection against potential risks and damages has also increased. This has given rise to the India Electronic Gadget Insurance Market, which provides coverage and financial security to gadget owners in case of theft, accidental damage, breakdown, or other unforeseen events.

Executive Summary

The India Electronic Gadget Insurance Market has witnessed significant growth in recent years, driven by the increasing adoption of electronic devices and the rising awareness among consumers regarding the importance of gadget protection. This market offers various insurance policies that cater to the diverse needs of individuals and businesses, ensuring peace of mind and financial stability.

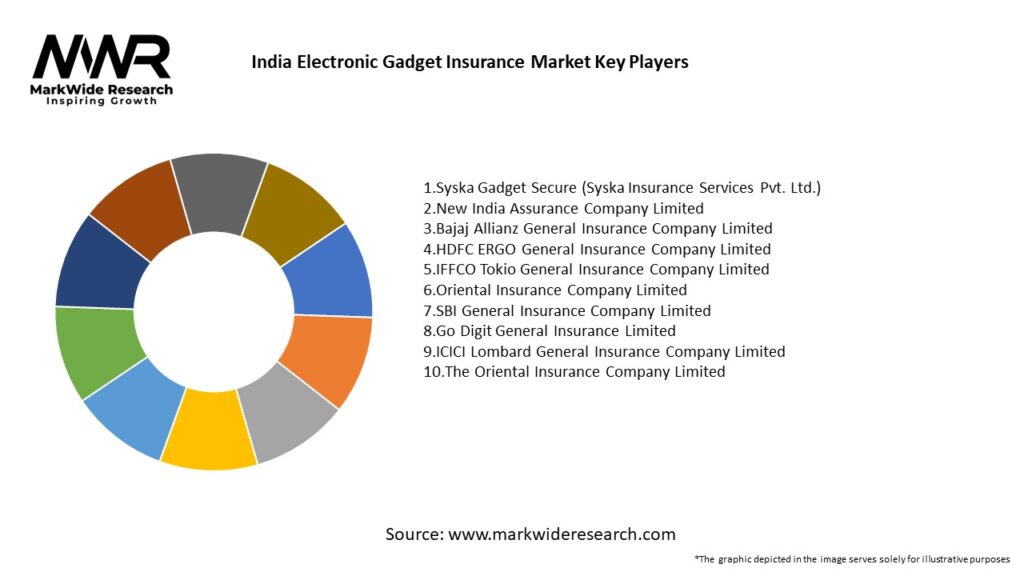

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India Electronic Gadget Insurance Market is characterized by intense competition among insurance providers. The market is witnessing a trend of partnerships and collaborations between insurance companies, device manufacturers, and retailers to enhance customer reach and deliver comprehensive insurance solutions. Additionally, the market is driven by technological advancements, consumer awareness, and changing preferences towards online purchasing channels.

Regional Analysis

The India Electronic Gadget Insurance Market exhibits a strong presence across major regions, including metropolitan cities such as Mumbai, Delhi, Bangalore, and Chennai. These regions have a higher concentration of gadget owners and a greater demand for insurance coverage. However, there is also significant potential for market growth in tier-II and tier-III cities, as the adoption of electronic gadgets continues to increase in these regions.

Competitive Landscape

Leading Companies in the India Electronic Gadget Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

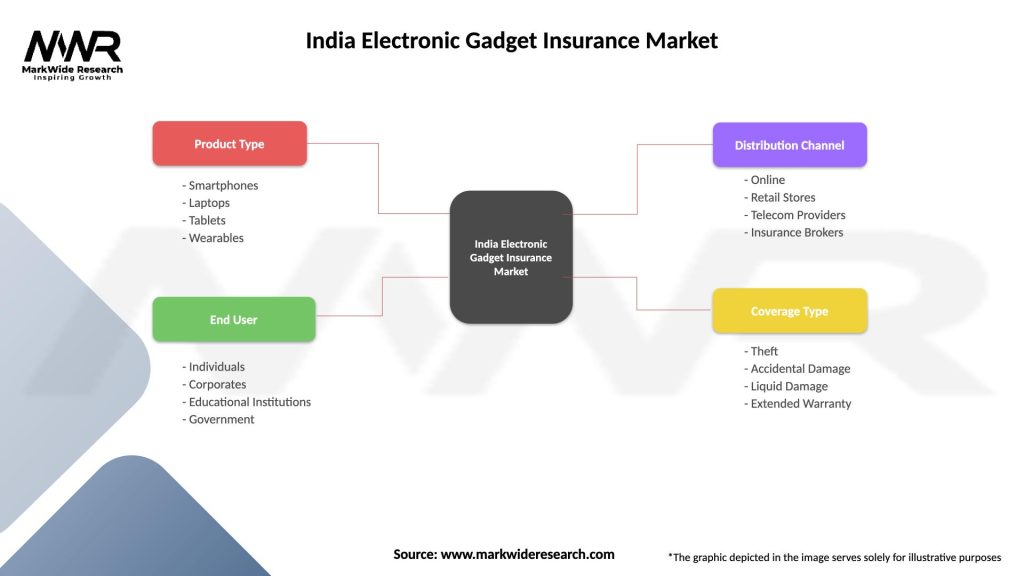

The India Electronic Gadget Insurance Market can be segmented based on gadget type, coverage type, end-user, and distribution channel.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the India Electronic Gadget Insurance Market. The lockdowns and restrictions imposed during the pandemic led to increased reliance on electronic gadgets for remote work, online education, and entertainment. This resulted in a surge in gadget sales and subsequently drove the demand for insurance coverage. The pandemic also accelerated the shift towards online distribution channels as consumers sought contactless purchasing options. However, the economic uncertainties and financial constraints faced by individuals during the pandemic affected the affordability and willingness to invest in insurance policies.

Key Industry Developments

Analyst Suggestions

Future Outlook

The India Electronic Gadget Insurance Market is poised for substantial growth in the coming years. With the increasing adoption of electronic gadgets, rising awareness of gadget protection, and advancements in technology, the demand for insurance coverage is expected to rise. As insurance providers adapt to changing customer preferences, offer personalized policies, and leverage technology for enhanced services, the market will witness increased competition and innovation. The expansion of online distribution channels and strategic partnerships will play a crucial role in reaching a wider customer base. However, addressing price sensitivity, improving customer awareness, and simplifying claim settlement procedures will be key challenges for industry participants.

Conclusion

The India Electronic Gadget Insurance Market presents a promising landscape for insurance providers, device manufacturers, and retailers. The growing adoption of electronic gadgets and the increasing awareness of the need for gadget protection are driving the demand for insurance coverage. By offering comprehensive and customized policies, leveraging technological advancements, and expanding distribution channels, insurance providers can tap into the immense potential of this market. As the gadget landscape continues to evolve and consumer preferences change, staying customer-centric and adaptable will be essential for sustained success in this competitive market.

What is Electronic Gadget Insurance?

Electronic Gadget Insurance provides coverage for various electronic devices against risks such as theft, accidental damage, and mechanical breakdown. This type of insurance is designed to protect consumers’ investments in gadgets like smartphones, laptops, and tablets.

What are the key players in the India Electronic Gadget Insurance Market?

Key players in the India Electronic Gadget Insurance Market include companies like Bajaj Allianz, HDFC ERGO, and ICICI Lombard, which offer specialized insurance products for electronic devices. These companies focus on providing comprehensive coverage options tailored to consumer needs, among others.

What are the growth factors driving the India Electronic Gadget Insurance Market?

The growth of the India Electronic Gadget Insurance Market is driven by increasing smartphone penetration, rising consumer awareness about gadget protection, and the growing trend of online shopping. Additionally, the surge in electronic device usage in daily life contributes to the demand for insurance.

What challenges does the India Electronic Gadget Insurance Market face?

The India Electronic Gadget Insurance Market faces challenges such as a lack of awareness among consumers regarding the benefits of insurance and the complexity of policy terms. Additionally, the prevalence of counterfeit products can complicate claims processes.

What opportunities exist in the India Electronic Gadget Insurance Market?

Opportunities in the India Electronic Gadget Insurance Market include the potential for innovative insurance products that cater to emerging technologies like wearables and smart home devices. Furthermore, partnerships with electronic retailers can enhance distribution channels and consumer reach.

What trends are shaping the India Electronic Gadget Insurance Market?

Trends shaping the India Electronic Gadget Insurance Market include the rise of digital insurance platforms that simplify the purchasing process and the increasing customization of policies to meet specific consumer needs. Additionally, the integration of IoT technology in devices is influencing coverage options.

India Electronic Gadget Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smartphones, Laptops, Tablets, Wearables |

| End User | Individuals, Corporates, Educational Institutions, Government |

| Distribution Channel | Online, Retail Stores, Telecom Providers, Insurance Brokers |

| Coverage Type | Theft, Accidental Damage, Liquid Damage, Extended Warranty |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Electronic Gadget Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at