444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India electric vehicle battery separator market represents a critical component in the nation’s rapidly evolving electric mobility ecosystem. Battery separators serve as essential safety barriers between the positive and negative electrodes in lithium-ion batteries, preventing short circuits while allowing ionic conductivity. India’s commitment to achieving 30% electric vehicle penetration by 2030 has created unprecedented demand for high-performance battery separators across automotive, two-wheeler, and commercial vehicle segments.

Market dynamics indicate robust growth driven by government initiatives, declining battery costs, and increasing environmental awareness among consumers. The sector benefits from India’s position as a global manufacturing hub, with domestic production capabilities expanding rapidly to meet growing demand. Technological advancements in separator materials, including ceramic-coated and microporous polyethylene variants, are enhancing battery safety and performance characteristics.

Regional distribution shows concentrated activity in states like Gujarat, Tamil Nadu, and Maharashtra, where automotive manufacturing clusters and supportive industrial policies create favorable conditions for battery separator production. The market experiences strong growth momentum with projected expansion at a compound annual growth rate exceeding 25% through the forecast period, reflecting India’s transition toward sustainable transportation solutions.

The India electric vehicle battery separator market refers to the domestic industry focused on manufacturing, distributing, and supplying specialized membrane materials used in electric vehicle battery systems. These separators are thin, porous films that physically separate the positive and negative electrodes while permitting ion flow during charging and discharging cycles.

Battery separators play crucial roles in ensuring battery safety, preventing thermal runaway, and maintaining optimal electrochemical performance. In the Indian context, this market encompasses various separator technologies including polyethylene, polypropylene, and advanced ceramic-coated variants specifically designed for electric vehicle applications. The market includes both domestic manufacturing capabilities and import activities to meet growing demand from India’s expanding electric vehicle industry.

Market scope extends across multiple vehicle categories including electric two-wheelers, passenger cars, commercial vehicles, and energy storage systems. The definition encompasses the entire value chain from raw material processing to finished separator production, quality testing, and distribution to battery manufacturers and electric vehicle original equipment manufacturers operating in India.

India’s electric vehicle battery separator market demonstrates exceptional growth potential as the country accelerates its transition toward electric mobility. The market benefits from strong government support through policies like the Production Linked Incentive scheme and Faster Adoption and Manufacturing of Electric Vehicles program, creating favorable conditions for domestic separator manufacturing.

Key market drivers include rapidly expanding electric vehicle adoption, declining lithium-ion battery costs, and increasing focus on battery safety standards. The two-wheeler segment represents the largest application area, accounting for approximately 60% of separator demand, followed by passenger vehicles and commercial applications. Technological innovation focuses on developing heat-resistant, high-porosity separators that enhance battery performance and safety characteristics.

Competitive landscape features a mix of international players establishing local manufacturing facilities and emerging domestic companies developing indigenous separator technologies. The market faces challenges including raw material import dependencies and the need for advanced manufacturing capabilities, while opportunities exist in export potential and integration with global supply chains.

Strategic market insights reveal several critical factors shaping the India electric vehicle battery separator landscape:

Primary market drivers propelling India’s electric vehicle battery separator market include comprehensive government support through policy frameworks and financial incentives. The Faster Adoption and Manufacturing of Electric Vehicles scheme provides substantial subsidies for electric vehicle purchases, directly increasing demand for battery separators. State governments offer additional incentives including reduced registration fees, road tax exemptions, and dedicated charging infrastructure development.

Environmental consciousness among Indian consumers drives electric vehicle adoption, particularly in urban areas experiencing severe air pollution challenges. Rising fuel costs and increasing awareness of climate change impacts motivate consumers to consider electric alternatives, creating sustained demand for battery separator technologies. Corporate sustainability initiatives encourage fleet operators and logistics companies to transition toward electric commercial vehicles.

Technological advancements in battery separator materials enhance performance characteristics while reducing costs, making electric vehicles more attractive to price-sensitive Indian consumers. Improvements in separator porosity, thermal stability, and ionic conductivity contribute to better battery performance and longer vehicle range. Manufacturing scale economies achieved through increased production volumes drive down separator costs, supporting broader electric vehicle market adoption.

Significant market restraints include heavy dependence on imported raw materials for separator manufacturing, creating supply chain vulnerabilities and cost fluctuations. India imports approximately 85% of separator raw materials including specialized polymers and additives, exposing domestic manufacturers to currency exchange risks and international supply disruptions. Limited domestic polymer production capabilities constrain the development of fully integrated separator manufacturing ecosystems.

High capital investment requirements for establishing advanced separator manufacturing facilities pose barriers for new market entrants. The technology-intensive nature of separator production demands sophisticated equipment, clean room facilities, and specialized technical expertise that require substantial financial commitments. Quality certification processes for automotive applications involve lengthy testing and validation procedures that delay market entry for new products.

Competition from established international suppliers with proven track records and existing relationships with battery manufacturers creates challenges for domestic separator producers. Technical complexity in developing separators that meet stringent automotive safety and performance standards requires significant research and development investments. Limited availability of skilled technical personnel familiar with separator manufacturing processes constrains industry expansion capabilities.

Substantial market opportunities emerge from India’s ambitious electric vehicle targets and supportive policy environment. The government’s commitment to achieving 30% electric vehicle penetration by 2030 creates long-term demand visibility for separator manufacturers. Export potential to neighboring countries and global markets offers significant growth opportunities for cost-competitive Indian separator producers.

Technology development opportunities exist in creating indigenous separator solutions tailored to Indian operating conditions including high temperatures and varied charging infrastructure. Collaboration with research institutions and international technology partners can accelerate the development of advanced separator materials. Vertical integration opportunities allow separator manufacturers to expand into related battery component production, creating comprehensive supply chain capabilities.

Strategic partnerships with electric vehicle manufacturers and battery producers offer opportunities for long-term supply agreements and joint product development initiatives. The growing energy storage market for renewable energy applications provides additional demand sources for battery separators beyond automotive applications. Government incentive programs for manufacturing localization create favorable conditions for establishing domestic separator production facilities.

Market dynamics in India’s electric vehicle battery separator sector reflect the interplay between rapid demand growth and evolving supply chain capabilities. Demand-side factors include accelerating electric vehicle adoption rates, particularly in the two-wheeler segment where electric variants achieve cost parity with conventional vehicles. Urban mobility patterns increasingly favor electric solutions due to lower operating costs and environmental benefits.

Supply-side dynamics involve the gradual development of domestic manufacturing capabilities while managing import dependencies for critical raw materials. MarkWide Research analysis indicates that domestic separator production capacity is expanding rapidly to meet growing demand, with several new manufacturing facilities planned across key industrial states. Technology transfer agreements with international partners accelerate the development of local technical capabilities.

Competitive dynamics feature increasing collaboration between separator manufacturers and battery producers to optimize product specifications and ensure supply chain reliability. Price pressures from cost-conscious electric vehicle manufacturers drive continuous efficiency improvements in separator production processes. Quality requirements become increasingly stringent as electric vehicle safety standards evolve and consumer expectations rise.

Comprehensive research methodology employed for analyzing India’s electric vehicle battery separator market combines primary and secondary research approaches to ensure data accuracy and market insight depth. Primary research involves extensive interviews with key industry stakeholders including separator manufacturers, battery producers, electric vehicle manufacturers, and technology suppliers operating in the Indian market.

Secondary research encompasses analysis of government policy documents, industry reports, trade statistics, and regulatory filings to understand market structure and growth trends. Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market projections. Quantitative analysis utilizes statistical modeling techniques to project market growth rates and segment performance.

Market segmentation analysis examines separator demand across different vehicle categories, technology types, and regional markets to identify growth opportunities and competitive dynamics. Competitive intelligence gathering involves monitoring company announcements, capacity expansion plans, and technology development initiatives. Trend analysis identifies emerging patterns in separator technology evolution and market demand characteristics.

Regional market distribution across India shows concentrated activity in key automotive manufacturing states. Gujarat leads separator manufacturing development with approximately 35% market share, benefiting from established automotive clusters, port connectivity, and supportive state policies. The state hosts several major separator manufacturing facilities and attracts significant foreign investment in battery component production.

Tamil Nadu represents another crucial market region with strong automotive manufacturing presence and growing electric vehicle production capabilities. The state accounts for roughly 25% of separator demand, driven by major automotive manufacturers transitioning to electric vehicle production. Maharashtra contributes approximately 20% of market activity, leveraging its position as India’s automotive hub and proximity to major battery manufacturers.

Northern states including Haryana and Uttar Pradesh show emerging opportunities as electric vehicle manufacturing expands beyond traditional automotive centers. Karnataka demonstrates growing importance due to its technology sector strength and increasing focus on electric mobility solutions. Regional policy variations create different growth dynamics, with states offering varying levels of incentives for separator manufacturing and electric vehicle adoption.

Competitive landscape in India’s electric vehicle battery separator market features a diverse mix of international players and emerging domestic companies. Key market participants include:

Competitive strategies focus on technology localization, cost optimization, and building relationships with Indian battery and electric vehicle manufacturers. Market consolidation trends emerge as companies seek scale advantages and comprehensive product portfolios.

Market segmentation analysis reveals distinct patterns across multiple dimensions in India’s electric vehicle battery separator market:

By Material Type:

By Vehicle Type:

By Application:

Electric two-wheeler segment dominates separator demand due to rapid adoption rates and favorable economics compared to conventional vehicles. This category benefits from lower battery capacity requirements, making electric variants cost-competitive with internal combustion engine alternatives. Separator specifications for two-wheelers focus on cost optimization while maintaining safety and performance standards suitable for urban commuting applications.

Passenger car segment shows accelerating growth as electric vehicle model availability expands and charging infrastructure develops. Premium separator technologies including ceramic-coated variants gain traction in this segment due to higher safety requirements and performance expectations. MWR data indicates that passenger car separator demand is projected to grow at the fastest rate among all vehicle categories.

Commercial vehicle applications represent emerging opportunities as logistics companies and fleet operators evaluate electric alternatives for urban delivery operations. Heavy-duty separator requirements in this segment demand enhanced durability and thermal management capabilities. Energy storage applications provide additional growth avenues as India expands renewable energy capacity and requires grid-scale battery systems.

Separator manufacturers benefit from India’s large domestic market potential and cost-competitive manufacturing environment. Long-term demand visibility from government electric vehicle targets provides investment confidence for capacity expansion decisions. Technology localization opportunities allow manufacturers to develop products specifically tailored to Indian operating conditions and cost requirements.

Battery producers gain access to locally manufactured separators, reducing supply chain risks and import dependencies. Collaborative development opportunities with separator manufacturers enable optimization of battery performance and cost characteristics. Quality assurance through local supplier relationships enhances battery reliability and customer satisfaction.

Electric vehicle manufacturers benefit from improved separator supply chain reliability and potential cost reductions through domestic sourcing. Technical support from local separator suppliers facilitates faster product development and problem resolution. Government stakeholders achieve policy objectives including manufacturing localization, employment generation, and reduced import dependencies through separator industry development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology advancement trends focus on developing next-generation separator materials with enhanced safety and performance characteristics. Ceramic-coated separators gain increasing adoption due to superior thermal stability and safety features, particularly in high-performance electric vehicle applications. Nanofiber separator technologies emerge as potential game-changers offering improved porosity and ionic conductivity.

Manufacturing localization trends accelerate as companies establish domestic production facilities to serve the growing Indian market. Vertical integration strategies become more common as separator manufacturers expand into related battery component production. Sustainability trends drive development of recyclable separator materials and environmentally friendly manufacturing processes.

Digital transformation trends include implementation of Industry 4.0 technologies in separator manufacturing, enabling improved quality control and production efficiency. Supply chain digitization enhances transparency and reliability in separator procurement and distribution. Collaborative innovation trends involve partnerships between separator manufacturers, battery producers, and research institutions to accelerate technology development.

Recent industry developments highlight significant investments in separator manufacturing capacity across India. Several international companies announced plans to establish local production facilities, with combined investment commitments exceeding substantial amounts. Technology transfer agreements between global separator leaders and Indian companies accelerate domestic capability development.

Government initiatives include the launch of specialized incentive schemes for battery component manufacturing, providing financial support for separator production facilities. Quality certification programs developed by Indian standards organizations ensure separator products meet international automotive requirements. Research collaborations between academic institutions and industry players focus on developing indigenous separator technologies.

Strategic partnerships between separator manufacturers and electric vehicle companies create long-term supply agreements and joint development programs. Capacity expansion announcements from existing manufacturers indicate confidence in market growth prospects. Export initiatives by Indian separator producers target neighboring countries and cost-sensitive global markets.

Strategic recommendations for separator manufacturers include prioritizing technology localization to reduce import dependencies and enhance cost competitiveness. Investment focus should emphasize advanced manufacturing capabilities and quality control systems to meet stringent automotive requirements. Partnership strategies with battery producers and electric vehicle manufacturers can secure long-term demand and enable collaborative product development.

Market entry strategies for new participants should consider establishing manufacturing facilities in states offering favorable industrial policies and proximity to automotive clusters. Technology acquisition through licensing agreements or joint ventures can accelerate capability development and market entry timelines. Quality certification should be prioritized early in the development process to ensure market acceptance.

Risk mitigation strategies include diversifying raw material supply sources and developing alternative material formulations to reduce import dependencies. MarkWide Research recommends that companies invest in research and development capabilities to stay competitive in the rapidly evolving separator technology landscape. Export market development can provide additional revenue streams and reduce dependence on domestic market fluctuations.

Future market prospects for India’s electric vehicle battery separator market remain highly positive, driven by sustained government support and accelerating electric vehicle adoption. Demand projections indicate continued strong growth with separator requirements expected to increase at a compound annual growth rate exceeding 25% through the next decade. Technology evolution will focus on advanced materials offering enhanced safety, performance, and cost-effectiveness.

Manufacturing landscape transformation will see increased domestic production capabilities reducing import dependencies and creating export opportunities. Supply chain localization efforts will extend to raw material production, creating more integrated and resilient separator manufacturing ecosystems. Innovation acceleration through research collaborations and technology partnerships will drive development of next-generation separator solutions.

Market maturation will bring increased competition, driving continuous improvements in product quality and cost efficiency. Regulatory evolution will establish more stringent safety and performance standards, favoring manufacturers with advanced technical capabilities. Global integration of Indian separator manufacturers into international supply chains will create additional growth opportunities and technology transfer benefits.

India’s electric vehicle battery separator market stands at a pivotal juncture with exceptional growth potential driven by ambitious government policies, rapidly expanding electric vehicle adoption, and increasing focus on manufacturing localization. The market benefits from strong fundamentals including large domestic demand, cost-competitive manufacturing environment, and supportive policy frameworks that create favorable conditions for separator industry development.

Key success factors for market participants include technology localization, quality excellence, strategic partnerships, and continuous innovation in separator materials and manufacturing processes. The transition from import dependency to domestic manufacturing capabilities represents both a significant challenge and substantial opportunity for companies operating in this space. Collaborative approaches between separator manufacturers, battery producers, and electric vehicle companies will be essential for creating robust and competitive supply chains.

Long-term market outlook remains highly positive with sustained growth expected across all vehicle segments and emerging applications in energy storage systems. The successful development of India’s separator manufacturing capabilities will contribute significantly to the country’s electric vehicle ecosystem development and broader sustainable transportation objectives. Strategic investments in technology, manufacturing capacity, and talent development will determine the competitive positioning of market participants in this dynamic and rapidly evolving industry.

What is Electric Vehicle Battery Separator?

Electric Vehicle Battery Separator refers to a critical component in lithium-ion batteries that prevents short circuits by separating the anode and cathode while allowing the flow of ions. These separators are essential for the performance and safety of electric vehicle batteries.

What are the key players in the India Electric Vehicle Battery Separator Market?

Key players in the India Electric Vehicle Battery Separator Market include companies like Asahi Kasei, Toray Industries, and Celgard, which are known for their advanced separator technologies and contributions to the electric vehicle sector, among others.

What are the growth factors driving the India Electric Vehicle Battery Separator Market?

The growth of the India Electric Vehicle Battery Separator Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation solutions. Additionally, the rising focus on reducing carbon emissions is propelling market expansion.

What challenges does the India Electric Vehicle Battery Separator Market face?

The India Electric Vehicle Battery Separator Market faces challenges such as high manufacturing costs, the need for continuous innovation in separator materials, and competition from alternative battery technologies. These factors can hinder market growth and adoption.

What opportunities exist in the India Electric Vehicle Battery Separator Market?

Opportunities in the India Electric Vehicle Battery Separator Market include the potential for developing new materials that enhance battery performance, the expansion of electric vehicle infrastructure, and increasing investments in renewable energy sources. These factors can significantly boost market prospects.

What trends are shaping the India Electric Vehicle Battery Separator Market?

Trends shaping the India Electric Vehicle Battery Separator Market include the shift towards solid-state batteries, innovations in separator coatings for improved safety, and the growing emphasis on recycling and sustainability in battery production. These trends are crucial for the future of electric vehicle technology.

India Electric Vehicle Battery Separator Market

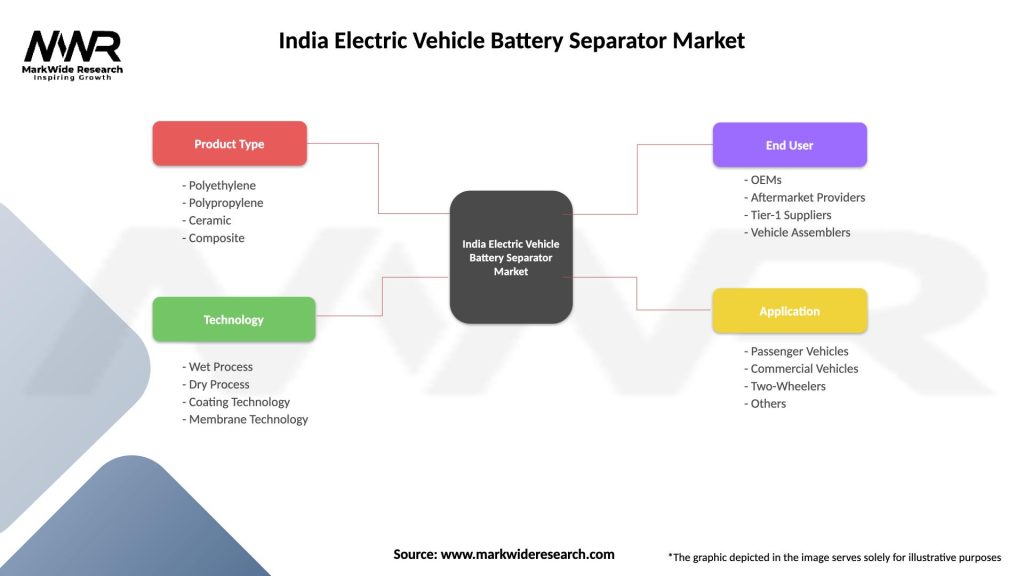

| Segmentation Details | Description |

|---|---|

| Product Type | Polyethylene, Polypropylene, Ceramic, Composite |

| Technology | Wet Process, Dry Process, Coating Technology, Membrane Technology |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Vehicle Assemblers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Electric Vehicle Battery Separator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at