444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India electric vehicle battery materials market represents a transformative segment within the country’s rapidly evolving automotive and energy storage ecosystem. India’s commitment to sustainable transportation and energy independence has positioned the electric vehicle battery materials sector as a critical component of the nation’s industrial strategy. The market encompasses essential raw materials including lithium compounds, cobalt sulfate, nickel sulfate, graphite, and various cathode and anode materials required for manufacturing high-performance electric vehicle batteries.

Market dynamics indicate robust growth potential driven by government initiatives, increasing electric vehicle adoption, and strategic investments in domestic manufacturing capabilities. The sector is experiencing significant momentum with a projected CAGR of 28.5% through the forecast period, reflecting India’s ambitious electrification goals and growing demand for locally sourced battery materials. Manufacturing localization efforts are gaining traction as the country seeks to reduce dependence on imports while building a comprehensive supply chain ecosystem.

Regional distribution shows concentrated activity in key industrial states, with Gujarat, Maharashtra, and Tamil Nadu emerging as primary hubs for battery material processing and manufacturing. The market benefits from India’s strategic geographical position, abundant mineral resources in certain regions, and increasing foreign direct investment in the clean energy sector. Technology partnerships with international players are accelerating knowledge transfer and capacity building initiatives across the value chain.

The India electric vehicle battery materials market refers to the comprehensive ecosystem of raw materials, processed chemicals, and specialized components required for manufacturing lithium-ion batteries specifically designed for electric vehicles within the Indian market. This sector encompasses the entire supply chain from mineral extraction and chemical processing to advanced material synthesis and component manufacturing.

Key materials within this market include lithium carbonate and lithium hydroxide for cathode production, various nickel and cobalt compounds for enhanced energy density, natural and synthetic graphite for anode applications, and specialized electrolytes and separators for optimal battery performance. The market also covers recycling technologies and secondary material recovery systems that support circular economy principles in battery manufacturing.

Strategic importance extends beyond simple material supply, encompassing technology development, quality assurance, cost optimization, and supply chain security. The market represents India’s efforts to establish energy independence while supporting the global transition toward sustainable transportation solutions through domestic manufacturing capabilities and innovation-driven growth strategies.

India’s electric vehicle battery materials market stands at a pivotal juncture, characterized by unprecedented growth opportunities and strategic government support. The sector is experiencing transformational changes driven by ambitious national electrification targets, substantial policy incentives, and increasing private sector investments in manufacturing infrastructure. Market penetration of electric vehicles is accelerating demand for locally sourced battery materials, creating opportunities for domestic players and international partnerships.

Government initiatives including the Production Linked Incentive (PLI) scheme for battery manufacturing and the National Mission on Transformative Mobility have catalyzed significant investments in the battery materials ecosystem. The market benefits from 65% cost reduction potential through domestic manufacturing compared to imported alternatives, making local production increasingly attractive for battery manufacturers and automotive companies.

Supply chain development remains a critical focus area, with companies investing in integrated manufacturing facilities that cover multiple stages of the battery materials value chain. The market is witnessing emergence of strategic partnerships between Indian companies and global technology leaders, facilitating knowledge transfer and accelerating the development of advanced battery material technologies suited for Indian market conditions.

Future prospects indicate strong growth momentum supported by increasing electric vehicle adoption, expanding charging infrastructure, and growing awareness of environmental sustainability. The market is positioned to become a significant contributor to India’s manufacturing sector while supporting the country’s climate commitments and energy security objectives through reduced dependence on imported battery materials.

Market transformation in India’s electric vehicle battery materials sector reveals several critical insights that shape industry dynamics and future growth trajectories. The following key insights provide comprehensive understanding of market fundamentals and strategic opportunities:

Government policy support serves as the primary catalyst driving India’s electric vehicle battery materials market growth. The comprehensive policy framework including the National Electric Mobility Mission Plan, FAME II scheme, and PLI incentives creates a conducive environment for domestic manufacturing investments. These initiatives provide financial incentives, regulatory clarity, and long-term market visibility that encourage both domestic and international players to establish manufacturing facilities in India.

Rising electric vehicle adoption across passenger cars, commercial vehicles, and two-wheelers is creating substantial demand for battery materials. The market benefits from increasing consumer acceptance of electric vehicles driven by environmental awareness, government incentives, and improving charging infrastructure. Corporate fleet electrification initiatives and last-mile delivery applications are particularly driving demand for specialized battery chemistries and materials.

Energy security concerns and the strategic imperative to reduce dependence on imported battery materials are motivating investments in domestic production capabilities. India’s goal of achieving energy independence by 2047 includes significant emphasis on localizing critical battery material supply chains. The market benefits from growing recognition that battery materials represent a strategic resource requiring domestic production capabilities.

Cost competitiveness of domestic manufacturing is improving due to economies of scale, government incentives, and optimization of supply chain logistics. Manufacturing cost advantages including lower labor costs, competitive energy prices, and proximity to growing demand centers make India an attractive destination for battery material production. The market is experiencing increasing interest from global players seeking cost-effective manufacturing locations.

Raw material import dependency represents a significant constraint for India’s electric vehicle battery materials market. The country lacks substantial domestic reserves of critical materials including lithium, cobalt, and high-grade nickel, necessitating reliance on imports from geographically concentrated sources. This dependency creates supply chain vulnerabilities, price volatility risks, and potential disruptions that could impact domestic manufacturing operations.

Technology gaps in advanced battery material processing and manufacturing present challenges for achieving international quality standards and cost competitiveness. While India has strong chemical processing capabilities, specialized knowledge in battery-grade material production, quality control systems, and advanced manufacturing processes requires significant technology transfer and skill development investments.

Infrastructure limitations including specialized transportation, storage, and handling facilities for battery materials create operational challenges and additional costs. The market requires specialized infrastructure for handling hazardous chemicals, maintaining material purity, and ensuring quality preservation throughout the supply chain. Logistics infrastructure development remains a critical requirement for efficient market operations.

Environmental compliance and regulatory requirements for battery material manufacturing create additional operational complexities and costs. Stringent environmental standards, waste management requirements, and safety regulations necessitate significant investments in pollution control systems and compliance infrastructure. The market faces challenges in balancing rapid growth with environmental sustainability requirements.

Strategic mineral exploration and development of domestic lithium resources present significant opportunities for reducing import dependency. Recent discoveries of lithium reserves in Jammu and Kashmir and ongoing exploration activities in other regions could potentially transform India’s position in the global battery materials supply chain. The market opportunity includes development of integrated mining and processing facilities that support domestic battery manufacturing.

Recycling and circular economy initiatives offer substantial opportunities for creating sustainable material supply chains while addressing environmental concerns. As India’s electric vehicle fleet grows, the market for battery recycling and material recovery will expand significantly. Advanced recycling technologies can recover valuable materials including lithium, cobalt, and nickel, creating secondary supply sources and reducing import dependency.

Export market development represents a major opportunity as India builds manufacturing capabilities that exceed domestic demand. The country’s strategic location, competitive manufacturing costs, and growing technical expertise position it as a potential supplier to regional markets including Southeast Asia, Middle East, and Africa. Export opportunities could significantly enhance the scale and profitability of domestic manufacturing operations.

Technology innovation and development of next-generation battery materials suited for Indian conditions present opportunities for market leadership. Research into sodium-ion batteries, solid-state electrolytes, and alternative cathode chemistries could position India as a technology leader while reducing dependence on scarce raw materials. Innovation opportunities include development of materials optimized for Indian climate conditions and usage patterns.

Supply-demand dynamics in India’s electric vehicle battery materials market are characterized by rapidly growing demand outpacing domestic supply capabilities, creating opportunities for capacity expansion and new market entrants. The market is experiencing a transition from import-dependent supply chains toward domestic manufacturing, with capacity utilization rates expected to reach 75% by 2028 as new facilities become operational.

Competitive dynamics are evolving as traditional chemical companies expand into battery materials while new specialized players enter the market. The landscape includes established Indian chemical manufacturers leveraging existing capabilities, international battery material companies establishing local operations, and startup companies focusing on innovative material technologies. Market consolidation trends are emerging as companies seek scale advantages and integrated supply chain capabilities.

Pricing dynamics reflect the complex interplay between global commodity prices, domestic manufacturing costs, government incentives, and competitive pressures. The market is experiencing price volatility due to raw material cost fluctuations, but long-term trends indicate price stabilization as domestic production scales up and supply chains mature. Cost reduction initiatives including process optimization and economies of scale are driving competitive pricing strategies.

Innovation dynamics are accelerating as companies invest in research and development to improve material performance, reduce costs, and develop sustainable production processes. The market benefits from increasing collaboration between industry players, research institutions, and government agencies to advance battery material technologies. Patent activity and technology licensing agreements are increasing as companies seek competitive advantages through innovation.

Comprehensive market analysis for India’s electric vehicle battery materials sector employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework encompasses quantitative data collection, qualitative insights gathering, and analytical modeling to provide accurate market intelligence and strategic insights for industry stakeholders.

Primary research activities include structured interviews with industry executives, government officials, technology experts, and end-user representatives across the battery materials value chain. Survey methodologies capture market trends, investment plans, technology preferences, and strategic priorities from key market participants. Field research includes facility visits, technology assessments, and supply chain analysis to understand operational realities and market dynamics.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, patent databases, and trade statistics to establish market baselines and identify trends. Data triangulation methods ensure accuracy and reliability of market estimates through cross-validation of multiple information sources and analytical approaches.

Analytical methodologies include market sizing models, competitive analysis frameworks, technology assessment matrices, and scenario planning tools. The research incorporates economic modeling, supply chain analysis, and policy impact assessments to provide comprehensive market understanding. Forecasting models utilize statistical analysis, trend extrapolation, and expert judgment to project future market developments and growth trajectories.

Western India dominates the electric vehicle battery materials market with Gujarat and Maharashtra accounting for approximately 45% market share due to established chemical processing infrastructure, port connectivity, and government support for industrial development. Gujarat’s chemical industrial clusters provide synergies for battery material manufacturing, while Maharashtra benefits from proximity to automotive manufacturing hubs and skilled workforce availability.

Southern India represents a rapidly growing market segment with Tamil Nadu, Karnataka, and Andhra Pradesh emerging as significant players in battery materials production. The region benefits from strong automotive industry presence, established chemical manufacturing capabilities, and supportive state government policies. Tamil Nadu is particularly attractive due to its port infrastructure and existing chemical processing expertise.

Northern India shows growing potential with Uttar Pradesh and Haryana developing battery material manufacturing capabilities supported by government incentives and proximity to major automotive markets. The region benefits from large domestic market access and developing industrial infrastructure. Policy support from state governments is encouraging investments in battery material processing facilities.

Eastern India presents emerging opportunities with West Bengal and Odisha leveraging mineral resources and industrial infrastructure for battery materials production. The region’s advantages include access to raw materials, competitive manufacturing costs, and developing transportation infrastructure. Strategic location provides access to both domestic and potential export markets in Southeast Asia.

Market leadership in India’s electric vehicle battery materials sector is distributed among established chemical companies, emerging specialized players, and international manufacturers establishing local operations. The competitive landscape reflects diverse strategies including vertical integration, technology partnerships, and capacity expansion initiatives.

Strategic partnerships are increasingly common as companies seek to combine complementary capabilities, share technology risks, and accelerate market entry. International collaborations bring advanced technology and quality standards while domestic partnerships provide market access and regulatory expertise.

By Material Type: The market segmentation reveals diverse material categories each serving specific battery chemistry requirements and performance characteristics. Cathode materials including lithium iron phosphate (LFP), nickel manganese cobalt (NMC), and nickel cobalt aluminum (NCA) represent the largest segment due to their critical role in determining battery performance and cost.

By Application: Market segmentation by application reflects the diverse electric vehicle ecosystem and varying battery requirements across different vehicle categories and usage patterns.

Cathode Materials Category dominates market demand with lithium iron phosphate (LFP) gaining significant traction due to cost advantages and safety characteristics suitable for Indian market conditions. The segment benefits from growing preference for LFP chemistry in commercial vehicles and cost-sensitive applications. NMC materials maintain strong demand for passenger vehicles requiring higher energy density and longer driving ranges.

Anode Materials Category shows increasing sophistication with growing demand for synthetic graphite and silicon-enhanced materials to improve battery performance. The segment is experiencing technology evolution toward higher capacity materials that support fast charging requirements. Natural graphite remains important for cost-sensitive applications while advanced materials gain market share in premium segments.

Electrolyte Materials Category focuses on safety and performance optimization with increasing demand for advanced electrolyte formulations that support high-temperature operation and fast charging. The segment benefits from growing emphasis on battery safety and thermal management in Indian climate conditions. Solid-state electrolytes represent emerging opportunities for next-generation battery technologies.

Processing Equipment Category encompasses specialized machinery and systems required for battery material production including mixing equipment, coating systems, and quality control instruments. The segment supports the broader battery materials ecosystem by enabling domestic manufacturing capabilities and quality assurance processes.

Manufacturing Companies benefit from significant cost reduction opportunities through domestic sourcing of battery materials, reduced logistics costs, and elimination of import duties. The market provides access to growing electric vehicle demand while supporting vertical integration strategies that enhance supply chain control and margin optimization. Quality assurance and customization capabilities improve through direct supplier relationships and collaborative development programs.

Electric Vehicle Manufacturers gain supply chain security, cost predictability, and technical support through domestic battery materials suppliers. The market enables faster product development cycles, customized material specifications, and reduced working capital requirements through shorter supply chains. Strategic partnerships with material suppliers facilitate innovation and technology development aligned with specific vehicle requirements.

Government Stakeholders achieve multiple policy objectives including industrial development, employment generation, technology advancement, and energy security through a robust domestic battery materials sector. The market supports Make in India initiatives while contributing to climate goals and reducing trade deficits. Tax revenue generation and industrial ecosystem development provide additional economic benefits.

Investment Community benefits from attractive growth opportunities in a strategically important sector with strong government support and growing market demand. The market offers diversification opportunities across the clean energy value chain while supporting ESG investment objectives. Long-term growth potential and multiple exit opportunities make the sector attractive for various investment strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Localization and Self-Reliance represents the dominant trend driving India’s electric vehicle battery materials market development. Companies are increasingly focusing on domestic manufacturing capabilities and supply chain localization to reduce import dependency and achieve cost competitiveness. This trend is supported by government policies and reflects strategic priorities for energy security and industrial development.

Technology Partnerships and Collaboration are becoming essential for accessing advanced battery material technologies and accelerating market development. Indian companies are forming strategic alliances with international technology leaders to acquire expertise in specialized processing techniques, quality control systems, and advanced material formulations. Knowledge transfer through joint ventures and licensing agreements is facilitating rapid capability building.

Sustainability and Circular Economy initiatives are gaining prominence as environmental concerns and resource scarcity drive interest in battery recycling and sustainable material sourcing. Companies are investing in recycling technologies and closed-loop supply chains that recover valuable materials from end-of-life batteries. This trend supports both environmental objectives and supply chain security goals.

Quality and Performance Focus is intensifying as electric vehicle manufacturers demand higher performance standards and reliability from battery materials. The market is experiencing increasing emphasis on quality certification, performance testing, and supply chain traceability. Companies are investing in advanced quality control systems and international standard compliance to meet evolving customer requirements.

Major Investment Announcements have characterized recent industry developments with several companies committing substantial capital for battery materials manufacturing facilities. Tata Chemicals announced significant investments in lithium processing capabilities while Exide Industries expanded into advanced battery materials production. These investments reflect growing confidence in market potential and long-term demand sustainability.

Technology Licensing Agreements have accelerated as Indian companies seek to acquire advanced battery material processing technologies. Recent partnerships include collaborations with international technology providers for cathode material production, electrolyte manufacturing, and quality control systems. MarkWide Research analysis indicates that technology partnerships are becoming critical success factors for market participants.

Government Policy Updates continue to shape market development with recent modifications to PLI scheme guidelines and import duty structures. The government has introduced additional incentives for battery recycling infrastructure and expanded support for research and development activities. Regulatory clarity on quality standards and environmental compliance requirements has improved investment confidence.

Capacity Expansion Projects are underway across multiple companies as demand projections support significant scale-up of manufacturing capabilities. Several facilities are expected to become operational within the next two years, substantially increasing domestic production capacity. Integrated manufacturing approaches that combine multiple material processing steps are becoming common development strategies.

Strategic Focus Areas for market participants should prioritize technology acquisition, quality system development, and supply chain integration to achieve sustainable competitive advantages. Companies should invest in advanced processing technologies that enable production of battery-grade materials meeting international quality standards. Vertical integration strategies that encompass multiple stages of the materials value chain can provide cost advantages and supply chain control.

Partnership Strategies should emphasize collaboration with international technology leaders, domestic raw material suppliers, and end-user customers to build comprehensive market capabilities. Joint ventures with global battery material companies can accelerate technology transfer while partnerships with mining companies can secure raw material supplies. Customer partnerships with electric vehicle manufacturers enable customized product development and long-term supply agreements.

Investment Priorities should focus on quality infrastructure, environmental compliance systems, and research and development capabilities that support long-term market leadership. Companies should prioritize investments in analytical laboratories, pilot production facilities, and environmental management systems that enable sustainable operations. Digital technologies for process optimization and quality control can provide operational advantages.

Risk Management strategies should address supply chain vulnerabilities, technology obsolescence risks, and regulatory compliance requirements through diversified sourcing, continuous innovation, and proactive compliance management. Companies should develop contingency plans for raw material supply disruptions and maintain flexibility to adapt to evolving battery technologies. Environmental compliance and safety management systems require ongoing investment and attention.

Market growth trajectory for India’s electric vehicle battery materials sector indicates sustained expansion driven by accelerating electric vehicle adoption, government policy support, and increasing manufacturing capabilities. The market is projected to experience robust growth with compound annual growth rates exceeding 25% through the next decade, reflecting the fundamental transformation of India’s transportation sector and energy storage requirements.

Technology evolution will drive market development toward advanced materials including high-nickel cathodes, silicon anodes, and solid-state electrolytes that offer improved performance and safety characteristics. The market will benefit from ongoing research and development investments that adapt global battery technologies to Indian market conditions and requirements. Next-generation materials including sodium-ion and alternative battery chemistries may create new market segments.

Supply chain maturation will enhance market stability and cost competitiveness as domestic manufacturing capabilities expand and integrate across the value chain. The development of recycling infrastructure will create secondary material supply sources while supporting circular economy objectives. MWR projections indicate that domestic production could meet 80% of market demand by 2030 through planned capacity expansions and technology development initiatives.

Export opportunities will emerge as India develops surplus manufacturing capacity and establishes quality credentials in international markets. The country’s strategic location and cost competitiveness position it as a potential supplier to regional markets including Southeast Asia and the Middle East. Global supply chain diversification trends may create additional export opportunities as international companies seek alternative sourcing locations.

India’s electric vehicle battery materials market represents a transformational opportunity that aligns strategic national objectives with growing commercial demand and technological advancement. The market benefits from strong government support, expanding domestic demand, and increasing manufacturing capabilities that position India as an emerging player in the global battery materials ecosystem. Strategic investments in technology, infrastructure, and supply chain development are creating a foundation for sustained market growth and international competitiveness.

Market fundamentals remain robust with accelerating electric vehicle adoption, supportive policy frameworks, and growing private sector investments driving sustained demand for battery materials. The sector’s evolution from import dependency toward domestic manufacturing reflects broader economic objectives while creating opportunities for innovation, employment generation, and industrial development. Long-term prospects indicate continued growth supported by India’s commitment to sustainable transportation and energy independence.

Success factors for market participants include technology acquisition, quality system development, supply chain integration, and strategic partnerships that enable competitive positioning in a rapidly evolving market. Companies that invest in advanced capabilities, maintain operational excellence, and adapt to changing market requirements are positioned to capture significant opportunities in India’s expanding electric vehicle battery materials sector. The market’s future development will depend on continued collaboration between government, industry, and research institutions to address challenges while capitalizing on emerging opportunities.

What is Electric Vehicle Battery Materials?

Electric Vehicle Battery Materials refer to the various components and substances used in the production of batteries for electric vehicles, including lithium, cobalt, nickel, and graphite, which are essential for energy storage and performance.

What are the key players in the India Electric Vehicle Battery Materials Market?

Key players in the India Electric Vehicle Battery Materials Market include companies like Tata Chemicals, Reliance Industries, and Ather Energy, which are involved in the production and supply of battery materials, among others.

What are the main drivers of the India Electric Vehicle Battery Materials Market?

The main drivers of the India Electric Vehicle Battery Materials Market include the increasing demand for electric vehicles, government initiatives promoting clean energy, and advancements in battery technology that enhance performance and reduce costs.

What challenges does the India Electric Vehicle Battery Materials Market face?

Challenges in the India Electric Vehicle Battery Materials Market include supply chain disruptions, fluctuating raw material prices, and the environmental impact of mining and processing battery materials.

What opportunities exist in the India Electric Vehicle Battery Materials Market?

Opportunities in the India Electric Vehicle Battery Materials Market include the potential for innovation in recycling technologies, the development of alternative materials, and the expansion of local manufacturing capabilities to meet rising demand.

What trends are shaping the India Electric Vehicle Battery Materials Market?

Trends shaping the India Electric Vehicle Battery Materials Market include the shift towards sustainable sourcing of materials, the integration of artificial intelligence in battery management systems, and the growing focus on energy density improvements in battery design.

India Electric Vehicle Battery Materials Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel Manganese Cobalt, Lead-acid, Solid-state |

| Material | Lithium, Cobalt, Graphite, Manganese |

| End User | OEMs, Fleet Operators, Charging Infrastructure, Aftermarket Providers |

| Technology | Fast Charging, Battery Management Systems, Energy Density, Thermal Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

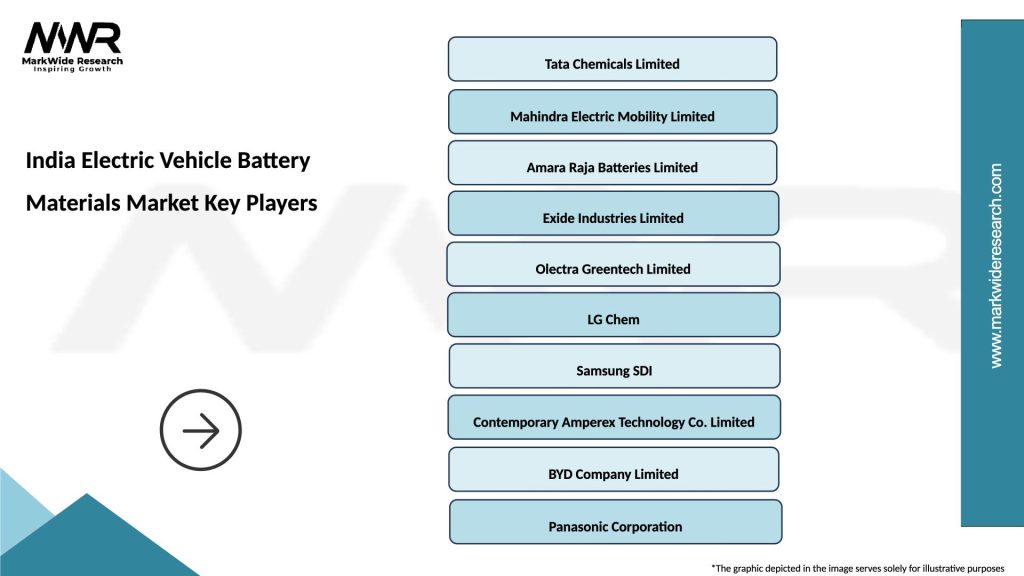

Leading companies in the India Electric Vehicle Battery Materials Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at