444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India electric vegetable choppers market represents a rapidly expanding segment within the country’s kitchen appliance industry, driven by urbanization, changing lifestyle patterns, and increasing demand for time-saving cooking solutions. Electric vegetable choppers have emerged as essential kitchen appliances in Indian households, offering convenience and efficiency in food preparation processes. The market demonstrates robust growth potential with a projected CAGR of 8.2% over the forecast period, reflecting the strong consumer preference for automated kitchen solutions.

Market dynamics indicate significant transformation in Indian cooking habits, particularly among urban consumers who prioritize convenience without compromising on traditional cooking methods. The increasing penetration of electric kitchen appliances across tier-1 and tier-2 cities has created substantial opportunities for vegetable chopper manufacturers. Consumer awareness regarding time-efficient cooking solutions continues to drive market expansion, with approximately 65% of urban households showing interest in automated food preparation equipment.

Regional distribution shows concentrated demand in metropolitan areas, with northern and western regions accounting for significant market share due to higher disposable incomes and modern kitchen adoption rates. The market benefits from diverse product offerings ranging from basic chopping functions to multi-functional units capable of slicing, dicing, and grinding various vegetables and ingredients.

The India electric vegetable choppers market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of electrically powered kitchen appliances specifically designed for chopping, slicing, dicing, and processing vegetables and other food ingredients. These devices utilize electric motors and specialized cutting mechanisms to automate traditional manual chopping processes, offering enhanced speed, consistency, and convenience for food preparation tasks.

Electric vegetable choppers represent a category of small kitchen appliances that combine traditional Indian cooking requirements with modern technology solutions. The market includes various product types ranging from compact single-function choppers to comprehensive food processing units with multiple attachments and capabilities. Market participants include domestic manufacturers, international brands, and emerging startups focused on innovative kitchen automation solutions.

Market expansion in the India electric vegetable choppers segment reflects broader trends toward kitchen modernization and cooking convenience. The industry demonstrates strong growth momentum driven by urbanization, rising disposable incomes, and evolving consumer preferences for time-saving appliances. Key market drivers include increasing working population, nuclear family structures, and growing awareness of kitchen automation benefits.

Competitive landscape features a mix of established appliance manufacturers and specialized kitchen equipment brands, each targeting different consumer segments through varied product offerings and pricing strategies. The market shows 42% preference for multi-functional units over single-purpose choppers, indicating consumer desire for versatile kitchen solutions. Distribution channels span traditional retail outlets, modern trade formats, and rapidly growing e-commerce platforms.

Future prospects remain highly positive with anticipated market expansion driven by continued urbanization, kitchen modernization trends, and increasing consumer acceptance of electric cooking appliances. Innovation focus centers on enhanced functionality, improved safety features, and energy-efficient designs that align with contemporary consumer expectations and environmental consciousness.

Consumer behavior analysis reveals significant insights into purchasing patterns and usage preferences within the India electric vegetable choppers market:

Urbanization acceleration serves as a primary catalyst for electric vegetable chopper adoption across Indian markets. The rapid expansion of urban populations, particularly in tier-1 and tier-2 cities, creates substantial demand for time-saving kitchen appliances. Working professionals increasingly seek efficient food preparation solutions that align with busy lifestyles while maintaining traditional cooking preferences.

Demographic shifts toward nuclear family structures contribute significantly to market growth, as smaller households prioritize convenience and efficiency in daily cooking routines. Women’s workforce participation continues expanding, creating demand for appliances that reduce food preparation time without compromising meal quality. The growing trend of dual-income households provides increased purchasing power for modern kitchen equipment.

Technology awareness among Indian consumers has reached unprecedented levels, with 78% of urban households expressing openness to adopting electric kitchen appliances. Social media influence and cooking shows promote awareness of modern kitchen solutions, driving consumer interest in automated food preparation equipment. Health consciousness trends encourage home cooking, creating demand for efficient vegetable processing solutions.

Infrastructure development including reliable electricity supply and improved retail networks facilitates market expansion across previously underserved regions. Government initiatives promoting domestic manufacturing and kitchen modernization indirectly support market growth through favorable policies and consumer incentives.

Price sensitivity remains a significant constraint for market expansion, particularly among middle and lower-middle-class consumers who constitute substantial portions of the Indian market. Initial investment costs for quality electric vegetable choppers can be prohibitive for price-conscious households, limiting market penetration in certain demographic segments.

Traditional cooking preferences present cultural barriers to adoption, as many Indian consumers maintain strong attachments to manual food preparation methods passed down through generations. Skepticism regarding electric appliances’ ability to replicate traditional chopping techniques and textures creates resistance among conservative consumer segments.

Maintenance concerns including cleaning complexity, spare parts availability, and repair services create hesitation among potential buyers. Power consumption worries, particularly in regions with high electricity costs or unreliable supply, influence purchasing decisions negatively. Kitchen space constraints in smaller urban homes limit adoption of larger multi-functional units.

Quality variations among available products create consumer confusion and trust issues, particularly with lower-priced alternatives that may compromise on durability and performance. Limited awareness in rural and semi-urban areas restricts market expansion beyond metropolitan regions.

Rural market penetration presents enormous growth opportunities as electrification improves and disposable incomes rise in smaller towns and villages. Government initiatives promoting rural development and kitchen modernization create favorable conditions for market expansion beyond traditional urban centers. Tier-3 and tier-4 cities demonstrate increasing openness to modern kitchen appliances, representing untapped market potential.

Product innovation opportunities include development of culturally adapted designs that cater specifically to Indian cooking requirements and preferences. Smart technology integration through IoT connectivity and app-based controls appeals to tech-savvy younger demographics. Energy-efficient models addressing environmental concerns and operational cost considerations present competitive advantages.

E-commerce expansion enables manufacturers to reach previously inaccessible markets while reducing distribution costs and improving customer engagement. Subscription models and financing options can address price sensitivity concerns while expanding market accessibility. Partnership opportunities with kitchen designers, home appliance retailers, and cooking influencers create new marketing and distribution channels.

Export potential to neighboring countries with similar cooking cultures offers additional revenue streams for Indian manufacturers. Corporate gifting and bulk sales to hospitality sectors represent emerging market segments with substantial growth potential.

Supply chain evolution within the India electric vegetable choppers market reflects broader changes in appliance manufacturing and distribution networks. Domestic manufacturing capabilities have strengthened significantly, with local producers developing competitive products that challenge international brands while offering better price points and service support.

Consumer preferences continue shifting toward multi-functional appliances that offer comprehensive food processing capabilities beyond basic chopping functions. Design innovations focus on compact form factors suitable for smaller Indian kitchens while maintaining powerful performance capabilities. Safety standards have become increasingly important, with consumers prioritizing products that meet international safety certifications.

Seasonal demand patterns show increased sales during festival seasons and wedding periods when households invest in kitchen upgrades. Regional preferences vary significantly, with northern markets favoring robust units capable of processing harder vegetables, while southern regions prefer versatile models suitable for diverse cooking styles. Price competition intensifies as more manufacturers enter the market, benefiting consumers through improved features and competitive pricing.

Technology integration trends include development of quieter motors, improved blade designs, and enhanced safety mechanisms that address common consumer concerns. After-sales service networks expansion becomes crucial for brand differentiation and customer retention in competitive market conditions.

Comprehensive market analysis for the India electric vegetable choppers market employs multi-faceted research approaches combining primary and secondary data collection methods. Primary research includes extensive consumer surveys, retailer interviews, and manufacturer consultations to gather real-time market insights and trend identification.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market foundations and historical trend analysis. Data triangulation methods ensure accuracy and reliability of findings through cross-verification of information from multiple sources.

Regional analysis involves state-wise market assessment considering demographic factors, economic indicators, and cultural preferences that influence product adoption rates. Consumer behavior studies utilize focus groups and in-depth interviews to understand purchasing motivations, usage patterns, and satisfaction levels.

Market sizing methodologies employ bottom-up and top-down approaches, analyzing production data, import-export statistics, and retail sales information. Competitive intelligence gathering includes monitoring of product launches, pricing strategies, and marketing campaigns across major market participants.

Northern India demonstrates the highest market penetration rates for electric vegetable choppers, with states like Delhi, Punjab, and Haryana leading adoption due to higher disposable incomes and modern kitchen preferences. The region shows 35% market share nationally, driven by urbanization and changing lifestyle patterns among affluent households.

Western region including Maharashtra, Gujarat, and Rajasthan represents the second-largest market segment, accounting for approximately 28% market share. Mumbai and Pune serve as key consumption centers with strong demand for premium multi-functional units. The region benefits from established retail networks and high consumer awareness levels.

Southern states particularly Karnataka, Tamil Nadu, and Andhra Pradesh show rapid market growth with 22% collective market share. Bangalore and Chennai lead urban adoption while smaller cities demonstrate increasing interest in electric kitchen appliances. The region’s tech-savvy population drives demand for innovative features and smart connectivity options.

Eastern region including West Bengal and Odisha represents emerging market opportunities with growing urban populations and improving economic conditions. Kolkata serves as the primary market center with expanding retail presence of major appliance brands. The region shows 15% market share with significant growth potential as infrastructure development continues.

Market leadership in the India electric vegetable choppers segment features a diverse mix of domestic and international manufacturers competing across different price segments and feature categories. Established players leverage brand recognition, distribution networks, and after-sales service capabilities to maintain competitive positions.

Competitive strategies include product differentiation through unique features, aggressive pricing, expanded distribution channels, and targeted marketing campaigns. Innovation focus centers on safety enhancements, energy efficiency improvements, and user-friendly designs that address specific Indian market requirements.

Product type segmentation reveals distinct market categories based on functionality and target applications:

By Functionality:

By Capacity:

By Price Range:

By Distribution Channel:

Basic choppers category dominates volume sales due to affordability and simplicity, appealing to first-time buyers and price-conscious consumers. These units typically feature single-speed motors and basic chopping blades, offering essential functionality without complex features. Market share for basic choppers represents approximately 45% of total unit sales, though revenue contribution remains lower due to competitive pricing.

Multi-functional processors command premium pricing and higher profit margins while serving consumers seeking comprehensive food preparation solutions. These units integrate multiple attachments and variable speed controls, addressing diverse cooking requirements. Premium segment growth shows 12% annual increase as consumers upgrade from basic models to feature-rich alternatives.

Compact designs gain popularity in urban markets where kitchen space constraints influence purchasing decisions. Manufacturers focus on optimizing functionality within smaller form factors, utilizing efficient motor designs and innovative blade configurations. Space-saving models account for 38% of urban sales, reflecting practical considerations in modern Indian homes.

Safety-enhanced models with improved locking mechanisms, non-slip bases, and automatic shut-off features address consumer concerns about appliance safety. Safety-certified products demonstrate 25% higher consumer preference rates compared to standard models, indicating growing awareness of safety importance.

Manufacturers benefit from expanding market opportunities driven by urbanization and lifestyle changes across Indian demographics. Production scaling advantages emerge as demand increases, enabling cost optimization and improved profit margins through economies of scale. Innovation opportunities allow manufacturers to differentiate products and command premium pricing through unique features and superior performance.

Retailers gain from high-margin product categories that generate substantial revenue per square foot of retail space. Cross-selling opportunities with complementary kitchen appliances enhance overall transaction values and customer relationships. Brand partnerships with established manufacturers provide marketing support and customer trust advantages.

Consumers receive significant time savings and convenience improvements in daily food preparation routines. Consistency benefits include uniform chopping results and reduced manual effort, particularly valuable for individuals with physical limitations or busy lifestyles. Hygiene advantages through reduced direct food contact and easier cleaning processes appeal to health-conscious consumers.

Distributors experience growing demand across multiple market segments, enabling portfolio diversification and risk mitigation. E-commerce integration opportunities expand market reach while reducing traditional distribution costs and inventory requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as a significant trend with manufacturers incorporating IoT capabilities and smartphone app controls into electric vegetable choppers. Connected appliances appeal to tech-savvy consumers seeking integrated kitchen ecosystems and remote operation capabilities. Voice control compatibility with popular virtual assistants gains traction among premium segment buyers.

Sustainability focus drives development of energy-efficient models with reduced power consumption and environmentally friendly materials. Eco-conscious consumers increasingly prioritize appliances that align with environmental values while maintaining performance standards. Recyclable packaging and sustainable manufacturing processes become important brand differentiation factors.

Customization trends include modular designs allowing consumers to add or remove attachments based on specific cooking requirements. Personalized solutions cater to diverse regional cooking styles and individual preferences, enhancing user satisfaction and brand loyalty. Color and design variations enable consumers to match appliances with kitchen aesthetics and personal style preferences.

Health-focused features such as BPA-free materials, easy-clean surfaces, and antimicrobial coatings address growing health consciousness among Indian consumers. Nutritional preservation technologies that minimize nutrient loss during food processing appeal to health-aware demographics. Portion control features support healthy eating habits and meal planning requirements.

Manufacturing expansion initiatives by major appliance companies include establishment of new production facilities and capacity enhancement projects across India. Local production strategies reduce import dependence while improving cost competitiveness and market responsiveness. Technology partnerships between Indian manufacturers and international companies facilitate knowledge transfer and innovation acceleration.

Product launches featuring advanced safety mechanisms, improved motor efficiency, and enhanced user interfaces demonstrate industry commitment to continuous innovation. MarkWide Research analysis indicates significant investment in research and development activities focused on addressing specific Indian market requirements and preferences.

Distribution network expansion includes strengthening of retail partnerships and development of exclusive brand stores in key metropolitan markets. E-commerce integration strategies involve enhanced online presence, digital marketing campaigns, and direct-to-consumer sales channels. Service network development ensures comprehensive after-sales support and customer satisfaction maintenance.

Regulatory compliance improvements include adoption of international safety standards and quality certifications that enhance consumer confidence and market credibility. Industry associations work toward establishing standardized testing protocols and performance benchmarks for electric vegetable choppers.

Market penetration strategies should focus on addressing price sensitivity through value-engineered products that maintain essential functionality while achieving competitive pricing. Manufacturers should consider developing entry-level models specifically designed for price-conscious consumers without compromising safety and basic performance requirements.

Rural market development requires tailored approaches including simplified product designs, local language marketing materials, and distribution partnerships with rural retailers. Demonstration programs and hands-on experience opportunities can help overcome cultural resistance and build consumer confidence in electric appliances.

Innovation focus should prioritize features that address specific Indian cooking requirements such as processing of traditional vegetables, spice grinding capabilities, and easy maintenance procedures. Cultural adaptation of product designs and marketing messages enhances consumer acceptance and brand resonance.

Digital marketing strategies should leverage social media platforms, cooking influencers, and online recipe communities to build awareness and demonstrate product benefits. Content marketing featuring cooking tips, recipe ideas, and time-saving techniques can drive consumer engagement and purchase consideration.

Partnership opportunities with kitchen designers, home appliance retailers, and cooking schools create additional marketing channels and consumer touchpoints. Corporate partnerships for bulk sales to hospitality sectors and employee welfare programs represent untapped revenue opportunities.

Market expansion prospects remain highly positive with continued urbanization, rising disposable incomes, and evolving consumer lifestyles driving sustained demand growth. Penetration rates in tier-2 and tier-3 cities are expected to increase significantly as infrastructure development and economic growth continue. MWR projections indicate robust market growth with expanding consumer base and increasing product adoption rates.

Technology advancement will likely focus on artificial intelligence integration, predictive maintenance capabilities, and enhanced user interfaces that simplify operation while expanding functionality. Smart home integration becomes increasingly important as consumers seek connected kitchen ecosystems and automated cooking assistance.

Sustainability initiatives will drive development of more energy-efficient models, recyclable materials, and circular economy approaches to product lifecycle management. Environmental regulations may influence design requirements and manufacturing processes, creating opportunities for innovative companies to gain competitive advantages.

Market consolidation trends may emerge as successful manufacturers acquire smaller players to expand market share and distribution capabilities. International expansion opportunities for Indian manufacturers include neighboring countries with similar cooking cultures and demographic profiles.

Consumer sophistication will continue increasing, driving demand for premium features, superior build quality, and comprehensive after-sales support. Brand loyalty becomes crucial as consumers develop preferences based on performance, reliability, and service experiences.

The India electric vegetable choppers market represents a dynamic and rapidly evolving segment within the country’s kitchen appliance industry, characterized by strong growth potential and diverse opportunities for market participants. Urbanization trends, changing lifestyle patterns, and increasing consumer acceptance of kitchen automation drive sustained market expansion across multiple demographic segments.

Key success factors include addressing price sensitivity through value-engineered solutions, developing culturally adapted products that meet specific Indian cooking requirements, and building comprehensive distribution networks that reach both urban and emerging rural markets. Innovation leadership in safety features, energy efficiency, and user-friendly designs provides competitive differentiation opportunities.

Market challenges such as cultural resistance to electric appliances and intense price competition require strategic approaches focused on consumer education, demonstration programs, and value proposition communication. Future growth depends on successful navigation of these challenges while capitalizing on emerging opportunities in rural markets, technology integration, and export potential.

The India electric vegetable choppers market is well-positioned for continued expansion, supported by favorable demographic trends, improving economic conditions, and evolving consumer preferences toward convenience and efficiency in food preparation processes.

What is Electric Vegetable Choppers?

Electric vegetable choppers are kitchen appliances designed to automate the chopping, slicing, and dicing of vegetables. They are popular for their efficiency and ability to save time in meal preparation.

What are the key players in the India Electric Vegetable Choppers Market?

Key players in the India Electric Vegetable Choppers Market include brands like Philips, Bajaj Electricals, and Prestige, which offer a range of electric choppers with various features and capacities, among others.

What are the growth factors driving the India Electric Vegetable Choppers Market?

The growth of the India Electric Vegetable Choppers Market is driven by increasing urbanization, a rise in the number of working professionals, and a growing preference for convenience in cooking. Additionally, the trend towards healthy eating is boosting demand for fresh vegetable preparation.

What challenges does the India Electric Vegetable Choppers Market face?

Challenges in the India Electric Vegetable Choppers Market include competition from manual chopping tools, concerns over product durability, and the need for consumer education on the benefits of electric choppers. These factors can hinder market growth.

What opportunities exist in the India Electric Vegetable Choppers Market?

Opportunities in the India Electric Vegetable Choppers Market include the introduction of innovative features such as smart technology integration and multifunctional appliances. Additionally, expanding e-commerce platforms provide a wider reach to consumers.

What trends are shaping the India Electric Vegetable Choppers Market?

Trends in the India Electric Vegetable Choppers Market include the increasing demand for compact and portable designs, as well as the rise of eco-friendly materials in product manufacturing. Consumers are also leaning towards appliances that offer ease of cleaning and maintenance.

India Electric Vegetable Choppers Market

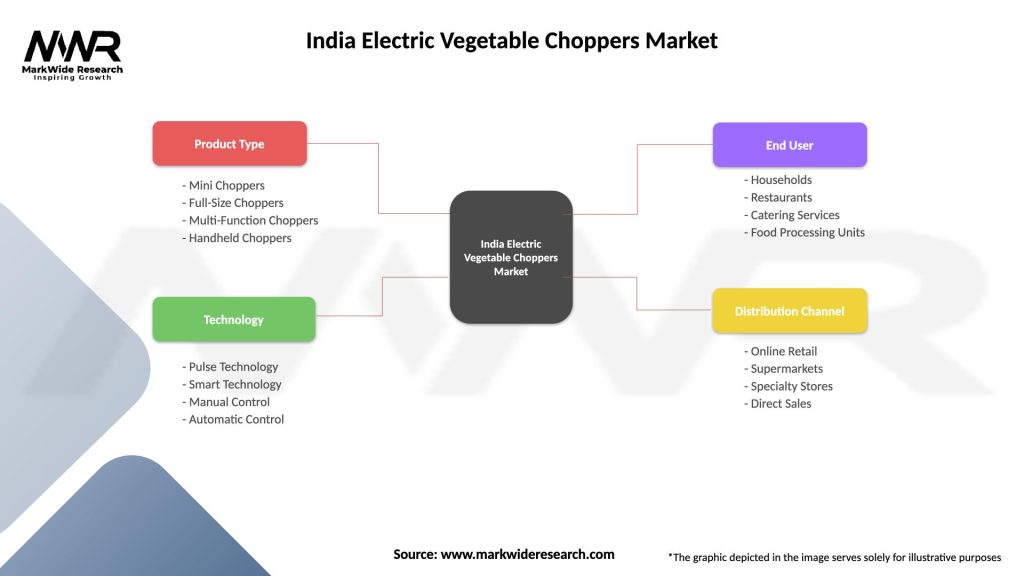

| Segmentation Details | Description |

|---|---|

| Product Type | Mini Choppers, Full-Size Choppers, Multi-Function Choppers, Handheld Choppers |

| Technology | Pulse Technology, Smart Technology, Manual Control, Automatic Control |

| End User | Households, Restaurants, Catering Services, Food Processing Units |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Electric Vegetable Choppers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at