444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India electric hydraulic power steering market represents a rapidly evolving segment within the country’s automotive industry, driven by increasing demand for enhanced vehicle performance and fuel efficiency. Electric hydraulic power steering (EHPS) systems combine the benefits of traditional hydraulic steering with electric motor assistance, providing superior control and reduced energy consumption compared to conventional hydraulic systems.

Market dynamics indicate substantial growth potential as Indian automotive manufacturers increasingly adopt advanced steering technologies to meet consumer expectations and regulatory requirements. The system operates by using an electric motor to drive the hydraulic pump only when steering assistance is needed, resulting in 15-20% improvement in fuel efficiency compared to traditional constant-flow hydraulic systems.

Regional adoption varies significantly across India, with major automotive manufacturing hubs in Tamil Nadu, Maharashtra, and Haryana leading the implementation of EHPS technology. The market encompasses passenger vehicles, commercial vehicles, and two-wheelers, with passenger cars representing the largest application segment at approximately 68% market share.

Technological advancement continues to drive market expansion as manufacturers integrate sophisticated control algorithms and sensor technologies to enhance steering responsiveness and driver comfort. The growing emphasis on vehicle electrification and autonomous driving capabilities further accelerates demand for advanced steering systems that can seamlessly integrate with electronic vehicle control systems.

The India electric hydraulic power steering market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and implementation of electric hydraulic power steering systems specifically within the Indian automotive sector. These systems represent an intermediate technology between traditional hydraulic power steering and fully electric power steering solutions.

EHPS technology utilizes an electric motor to operate the hydraulic pump on-demand, eliminating the continuous engine load associated with conventional belt-driven hydraulic systems. This intelligent approach reduces parasitic losses while maintaining the familiar steering feel that drivers expect from hydraulic systems, making it an attractive transitional technology for emerging markets like India.

System components include electric motors, hydraulic pumps, electronic control units, pressure sensors, and sophisticated software algorithms that optimize steering assistance based on vehicle speed, steering input, and driving conditions. The integration of these components creates a responsive steering system that adapts to various driving scenarios while maximizing energy efficiency.

Market expansion in India’s electric hydraulic power steering sector reflects the country’s broader automotive industry transformation toward more efficient and technologically advanced vehicle systems. The convergence of regulatory pressures for improved fuel economy, consumer demand for enhanced driving experiences, and manufacturer focus on cost-effective solutions drives sustained market growth.

Key growth drivers include increasing vehicle production volumes, rising consumer awareness of fuel efficiency benefits, and government initiatives promoting cleaner automotive technologies. The market benefits from India’s position as a major automotive manufacturing hub, with both domestic and international OEMs investing in advanced steering technologies to serve local and export markets.

Competitive landscape features a mix of global technology suppliers and emerging Indian manufacturers, creating a dynamic environment for innovation and cost optimization. Strategic partnerships between international steering system specialists and Indian automotive companies facilitate technology transfer and localization initiatives that support market development.

Future prospects remain highly positive, with projected growth rates of 12-15% annually as the technology gains broader acceptance across vehicle segments and price points. The transition toward electric and hybrid vehicles further enhances long-term market potential as EHPS systems provide an ideal stepping stone toward fully electric steering solutions.

Strategic insights reveal several critical factors shaping the India electric hydraulic power steering market landscape:

Market maturation indicators suggest increasing sophistication in customer requirements, with emphasis on system reliability, maintenance requirements, and integration capabilities with emerging vehicle technologies. The growing importance of software-defined vehicle architectures creates new opportunities for EHPS system differentiation through advanced control algorithms and connectivity features.

Regulatory compliance serves as a primary market driver, with Indian government initiatives promoting fuel efficiency improvements and emission reductions across the automotive sector. The implementation of Bharat Stage VI emission norms and Corporate Average Fuel Economy (CAFE) regulations compels manufacturers to adopt technologies like EHPS that contribute to overall vehicle efficiency improvements.

Consumer awareness regarding fuel costs and environmental impact increasingly influences purchasing decisions, creating demand for vehicles equipped with efficiency-enhancing technologies. Rising fuel prices in India make the 15-20% fuel savings offered by EHPS systems particularly attractive to cost-conscious consumers and commercial vehicle operators.

Manufacturing competitiveness drives adoption as Indian automotive companies seek to differentiate their products in increasingly competitive domestic and export markets. EHPS technology provides manufacturers with a cost-effective means to offer advanced features while maintaining competitive pricing structures.

Infrastructure development supports market growth through improved road networks that enable higher vehicle speeds and more demanding driving conditions where advanced steering systems provide significant benefits. The expansion of highway networks and urban infrastructure creates environments where EHPS advantages become more apparent to drivers.

Technology ecosystem development facilitates market expansion through the availability of supporting technologies, skilled workforce, and supply chain capabilities necessary for EHPS implementation. India’s growing automotive electronics sector provides essential components and expertise required for successful system integration.

Cost sensitivity remains a significant market restraint, particularly in India’s price-conscious automotive market where consumers often prioritize initial purchase price over long-term operating benefits. The additional cost of EHPS systems compared to conventional steering can limit adoption in entry-level vehicle segments that represent a substantial portion of the Indian market.

Technical complexity creates challenges for smaller automotive manufacturers and service providers who may lack the expertise and infrastructure necessary to properly implement and maintain EHPS systems. The integration of electronic and hydraulic components requires specialized knowledge and diagnostic equipment that may not be readily available across India’s diverse automotive service network.

Supply chain dependencies pose risks as many critical EHPS components still require importation, creating vulnerability to currency fluctuations, trade disruptions, and supply chain delays. The limited domestic production capacity for specialized electronic components and high-precision hydraulic parts constrains market development and increases system costs.

Market education requirements slow adoption as many consumers and even some automotive professionals remain unfamiliar with EHPS technology benefits and operation. The need for comprehensive training programs and awareness campaigns represents an ongoing investment requirement for market participants.

Infrastructure limitations in certain regions of India may not fully utilize EHPS capabilities, reducing the perceived value proposition for consumers in areas with predominantly low-speed urban driving or poor road conditions where advanced steering assistance provides limited benefits.

Electric vehicle integration presents substantial opportunities as India’s electric mobility initiatives gain momentum. EHPS systems provide an ideal bridge technology for manufacturers transitioning from conventional to fully electric vehicles, offering compatibility with both internal combustion engines and electric powertrains while preparing infrastructure for future EPS adoption.

Export market development offers significant growth potential as Indian manufacturers leverage cost advantages and growing technical capabilities to serve regional markets in Southeast Asia, Africa, and Latin America. The establishment of India as a global automotive manufacturing hub creates opportunities for EHPS system exports alongside vehicle exports.

Commercial vehicle expansion represents an underserved market segment with substantial growth potential as fleet operators increasingly recognize the operational cost benefits of EHPS technology. The growing e-commerce and logistics sectors in India drive demand for more efficient commercial vehicles equipped with advanced steering systems.

Technology localization initiatives supported by government policies create opportunities for domestic companies to develop indigenous EHPS capabilities through joint ventures, technology transfer agreements, and research and development investments. The “Make in India” initiative specifically encourages local automotive technology development.

Aftermarket services present emerging opportunities as the installed base of EHPS-equipped vehicles grows, creating demand for specialized maintenance, repair, and upgrade services. The development of comprehensive aftermarket support networks can generate recurring revenue streams for market participants.

Supply-demand equilibrium in the India electric hydraulic power steering market reflects the complex interplay between automotive production volumes, technology adoption rates, and component availability. Current market dynamics indicate growing demand that occasionally outpaces local supply capabilities, creating opportunities for both domestic and international suppliers to expand their presence in the Indian market.

Competitive intensity continues to increase as more players enter the market, driving innovation and cost reduction initiatives. The presence of established global suppliers alongside emerging Indian companies creates a dynamic competitive environment that benefits end customers through improved product offerings and competitive pricing.

Technology evolution accelerates market dynamics as manufacturers continuously improve EHPS system performance, reliability, and cost-effectiveness. The integration of advanced sensors, control algorithms, and connectivity features creates differentiation opportunities while raising the overall technology bar for market participants.

Value chain optimization efforts focus on reducing system costs while maintaining performance standards through strategic sourcing, manufacturing process improvements, and component standardization initiatives. MarkWide Research analysis indicates that successful value chain optimization can reduce EHPS system costs by 20-25% over a three-year period.

Market consolidation trends emerge as smaller suppliers either partner with larger companies or exit the market due to increasing technical and financial requirements for successful EHPS development and production. This consolidation creates opportunities for remaining players to gain market share and achieve economies of scale.

Primary research methodologies employed in analyzing the India electric hydraulic power steering market include comprehensive interviews with automotive manufacturers, steering system suppliers, technology developers, and industry experts across the Indian automotive ecosystem. Direct engagement with market participants provides insights into current challenges, future plans, and technology development priorities.

Secondary research encompasses analysis of industry reports, government publications, automotive production statistics, trade data, and technology patent filings to establish market trends and competitive landscape dynamics. This approach ensures comprehensive coverage of market factors that may not be apparent through primary research alone.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and employing statistical analysis techniques to ensure data accuracy and reliability. The validation process helps eliminate potential biases and ensures that market insights reflect actual industry conditions.

Market modeling techniques utilize historical data, current market indicators, and future trend projections to develop comprehensive market forecasts and scenario analyses. These models account for various factors including regulatory changes, technology evolution, and economic conditions that influence market development.

Expert consultation involves engagement with automotive industry specialists, technology researchers, and market analysts to validate findings and gain additional perspectives on market dynamics and future trends. This collaborative approach enhances the depth and accuracy of market analysis.

Northern India represents a significant market region centered around the National Capital Region (NCR) and Haryana’s automotive manufacturing clusters. The region benefits from proximity to major automotive OEMs and a well-developed supplier ecosystem, contributing approximately 28% of national EHPS market activity. Key factors include strong government support for automotive technology development and access to skilled technical workforce.

Western India dominates the market landscape with Maharashtra and Gujarat leading in automotive production and EHPS adoption. The region accounts for 35% of market share due to the presence of major automotive manufacturers, established supply chains, and proximity to major ports for component imports and vehicle exports. The concentration of automotive research and development facilities further strengthens the region’s market position.

Southern India emerges as a rapidly growing market region, with Tamil Nadu and Karnataka driving adoption through their strong automotive manufacturing base and technology focus. The region contributes 32% of market activity and benefits from a skilled workforce, supportive government policies, and proximity to major automotive export markets. The presence of global automotive technology centers enhances regional capabilities.

Eastern India represents an emerging market opportunity with growing automotive manufacturing activity in West Bengal and Odisha. While currently accounting for 5% of market share, the region shows potential for growth as infrastructure development and industrial policy initiatives attract automotive investments.

Regional coordination efforts focus on technology sharing, supply chain optimization, and workforce development initiatives that benefit the overall Indian EHPS market. Interstate collaboration on automotive policies and infrastructure development supports market expansion across all regions.

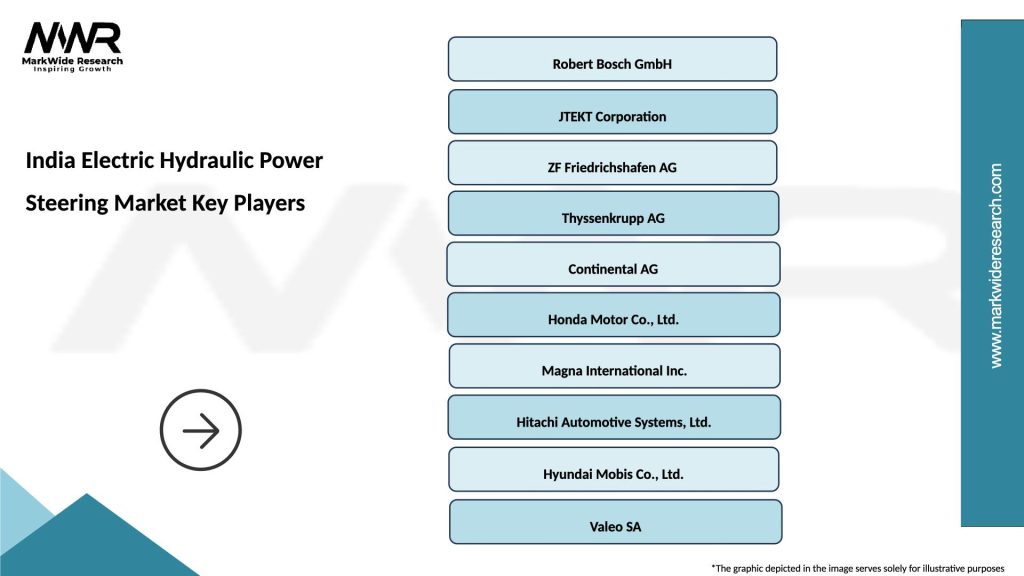

Market leadership in India’s electric hydraulic power steering sector features a diverse mix of global technology suppliers and emerging domestic players, creating a dynamic competitive environment that drives innovation and market development.

Competitive strategies focus on technology localization, cost optimization, and strategic partnerships with Indian automotive manufacturers. Companies invest heavily in local research and development capabilities while building comprehensive supply chains to serve both domestic and export markets.

Innovation initiatives drive competitive differentiation through advanced control algorithms, improved system integration capabilities, and enhanced reliability features. The focus on software-defined steering systems creates new opportunities for competitive advantage through superior performance and functionality.

By Vehicle Type:

By Technology Type:

By Application:

By Price Segment:

Passenger Vehicle Category demonstrates the strongest market adoption with premium and luxury car segments leading EHPS implementation. The category benefits from consumer willingness to pay for enhanced driving comfort and fuel efficiency, with adoption rates reaching 85% in premium segments. Mid-segment vehicles increasingly adopt EHPS as manufacturers seek differentiation and efficiency improvements.

Commercial Vehicle Category shows accelerating adoption driven by total cost of ownership considerations rather than comfort features. Fleet operators recognize the fuel savings potential of EHPS systems, particularly in long-haul trucking applications where fuel efficiency improvements of 8-12% translate to significant operational cost reductions.

Two-Wheeler Category represents an emerging opportunity as premium motorcycle manufacturers explore EHPS integration for high-performance and touring applications. The category faces unique technical challenges related to weight, packaging, and cost constraints that require specialized engineering solutions.

Electric Vehicle Category across all vehicle types presents the highest growth potential as EHPS systems provide ideal compatibility with electric powertrains while preparing the market for eventual transition to fully electric steering systems. The category benefits from government incentives and growing consumer acceptance of electric mobility.

Export Category gains importance as Indian manufacturers leverage cost advantages and growing technical capabilities to serve international markets. MWR data indicates that Indian-manufactured EHPS systems increasingly compete in regional export markets, contributing to overall market expansion.

Automotive Manufacturers benefit from EHPS adoption through improved vehicle fuel efficiency ratings, enhanced customer satisfaction, and competitive differentiation in increasingly crowded market segments. The technology enables manufacturers to meet regulatory requirements while offering tangible customer benefits that justify premium pricing.

Component Suppliers gain access to a growing market opportunity with potential for long-term partnerships and technology development collaboration. The EHPS market provides suppliers with opportunities to develop specialized expertise and establish strong relationships with automotive OEMs.

Fleet Operators realize significant operational cost benefits through reduced fuel consumption and improved vehicle reliability. The fuel savings of 8-15% provided by EHPS systems translate directly to improved profitability for commercial vehicle operations, particularly in high-mileage applications.

Consumers experience enhanced driving comfort, improved fuel economy, and reduced environmental impact through EHPS-equipped vehicles. The technology provides immediate benefits in terms of steering ease and long-term benefits through reduced fuel costs and lower emissions.

Service Providers develop new revenue streams through specialized EHPS maintenance and repair services. The growing installed base of EHPS-equipped vehicles creates ongoing demand for skilled technicians and specialized diagnostic equipment.

Government Stakeholders achieve policy objectives related to fuel efficiency improvements, emission reductions, and automotive industry development through EHPS adoption. The technology supports broader goals of energy security and environmental protection while strengthening the domestic automotive industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification Integration emerges as a dominant trend with EHPS systems increasingly designed for compatibility with hybrid and electric vehicle architectures. This trend reflects the broader automotive industry shift toward electrification and positions EHPS as a bridge technology toward fully electric steering systems.

Software-Defined Steering gains prominence as manufacturers integrate advanced control algorithms and connectivity features into EHPS systems. The trend toward software-defined vehicles creates opportunities for enhanced functionality, remote diagnostics, and over-the-air updates that improve system performance throughout vehicle lifecycle.

Localization Acceleration drives increased domestic content in EHPS systems through strategic partnerships, technology transfer initiatives, and local manufacturing investments. This trend supports cost reduction objectives while building indigenous capabilities for long-term market sustainability.

Performance Optimization focuses on continuous improvement in system efficiency, reliability, and integration capabilities. Manufacturers invest in advanced materials, improved manufacturing processes, and enhanced control systems to deliver superior performance while reducing costs.

Connectivity Integration enables EHPS systems to communicate with other vehicle systems and external infrastructure, supporting advanced driver assistance systems and autonomous driving capabilities. This trend positions EHPS as an integral component of intelligent vehicle architectures.

Sustainability Focus drives development of more environmentally friendly EHPS systems through improved energy efficiency, recyclable materials, and reduced environmental impact throughout the product lifecycle. This trend aligns with broader automotive industry sustainability initiatives.

Manufacturing Expansion initiatives by major EHPS suppliers include establishment of new production facilities and expansion of existing operations in India. These investments reflect confidence in long-term market growth and commitment to serving both domestic and export markets from Indian manufacturing bases.

Technology Partnerships between global EHPS specialists and Indian automotive companies facilitate knowledge transfer and capability development. Recent partnerships focus on joint development programs, technology localization initiatives, and shared manufacturing arrangements that benefit all participants.

Research and Development investments by both multinational corporations and Indian companies accelerate innovation in EHPS technology. New R&D centers and expanded engineering capabilities support development of India-specific solutions and next-generation steering technologies.

Regulatory Developments include updated automotive standards and certification requirements that impact EHPS system design and implementation. Recent regulatory changes emphasize safety, efficiency, and environmental performance standards that influence technology development priorities.

Market Consolidation activities involve strategic acquisitions, joint ventures, and partnership agreements that reshape the competitive landscape. These developments create stronger market participants with enhanced capabilities and broader market reach.

Export Initiatives by Indian EHPS manufacturers target regional markets in Southeast Asia, Africa, and Latin America. These initiatives leverage India’s cost advantages and growing technical capabilities to establish presence in international markets.

Technology Investment recommendations emphasize the importance of continuous R&D spending to maintain competitive position and develop next-generation EHPS capabilities. Companies should focus on software development, system integration, and advanced materials to differentiate their offerings in an increasingly competitive market.

Market Positioning strategies should emphasize total cost of ownership benefits rather than initial purchase price to overcome price sensitivity in the Indian market. Educational initiatives that demonstrate long-term value proposition can accelerate adoption across vehicle segments.

Supply Chain Optimization efforts should focus on increasing local content while maintaining quality and performance standards. Strategic partnerships with Indian component suppliers can reduce costs and improve supply chain resilience while supporting government localization objectives.

Capacity Planning recommendations suggest gradual expansion aligned with market growth projections to avoid overcapacity while ensuring ability to meet increasing demand. Flexible manufacturing approaches can accommodate market volatility and changing technology requirements.

Partnership Development strategies should prioritize long-term relationships with automotive OEMs and key suppliers to ensure stable market position and collaborative technology development. Strategic alliances can provide access to new markets and technologies while sharing development costs and risks.

Export Market Development initiatives should leverage India’s cost advantages and growing capabilities to establish presence in regional markets. MarkWide Research analysis suggests that Indian EHPS manufacturers can capture significant market share in emerging markets through competitive pricing and appropriate technology solutions.

Market expansion prospects remain highly positive with projected growth rates of 12-15% annually driven by increasing vehicle production, technology adoption, and regulatory support for efficiency improvements. The transition toward electric and hybrid vehicles provides additional growth catalysts as EHPS systems offer ideal compatibility with electrified powertrains.

Technology evolution will focus on enhanced integration capabilities, improved efficiency, and advanced connectivity features that support autonomous driving and vehicle-to-infrastructure communication. The development of software-defined steering systems creates opportunities for continuous improvement and feature enhancement throughout vehicle lifecycle.

Market maturation indicators suggest increasing sophistication in customer requirements and competitive differentiation based on performance, reliability, and total cost of ownership rather than initial price alone. This maturation benefits established players with proven technology and comprehensive support capabilities.

Regional expansion opportunities extend beyond India’s domestic market as manufacturers leverage local capabilities to serve export markets in Asia, Africa, and Latin America. The establishment of India as a global automotive manufacturing hub creates natural synergies for EHPS system exports alongside vehicle exports.

Industry transformation toward electric mobility and autonomous driving creates long-term opportunities for EHPS technology as a bridge toward fully electric steering systems. The compatibility of EHPS with various powertrain technologies positions it favorably for the transitional period in automotive industry evolution.

The India electric hydraulic power steering market represents a dynamic and rapidly evolving sector within the country’s automotive industry, characterized by strong growth potential, increasing technology adoption, and expanding applications across vehicle segments. The market benefits from favorable regulatory environment, growing consumer awareness, and India’s position as a major automotive manufacturing hub.

Key success factors for market participants include continuous technology innovation, strategic partnerships with automotive OEMs, effective cost management, and development of comprehensive service capabilities. The ability to balance performance benefits with cost considerations remains critical for success in India’s price-sensitive automotive market.

Future prospects remain highly encouraging with sustained growth expected across all vehicle segments, driven by regulatory requirements, consumer preferences, and technology advancement. The integration of EHPS systems with emerging vehicle technologies creates additional opportunities for market expansion and differentiation.

Strategic positioning for long-term success requires focus on technology localization, supply chain optimization, and development of India-specific solutions that address local market requirements while maintaining global quality standards. The market offers substantial opportunities for companies that can effectively navigate the complex dynamics of India’s automotive sector while delivering superior value to customers and stakeholders.

What is Electric Hydraulic Power Steering?

Electric Hydraulic Power Steering refers to a steering system that combines hydraulic assistance with electric control, enhancing vehicle maneuverability and responsiveness. This technology is increasingly used in modern vehicles for improved driving comfort and safety.

What are the key players in the India Electric Hydraulic Power Steering Market?

Key players in the India Electric Hydraulic Power Steering Market include Bosch, ZF Friedrichshafen AG, and JTEKT Corporation, among others. These companies are known for their innovative steering solutions and significant contributions to automotive technology.

What are the growth factors driving the India Electric Hydraulic Power Steering Market?

The growth of the India Electric Hydraulic Power Steering Market is driven by increasing vehicle production, rising consumer demand for fuel-efficient vehicles, and advancements in automotive technology. Additionally, the push for enhanced safety features in vehicles is contributing to market expansion.

What challenges does the India Electric Hydraulic Power Steering Market face?

The India Electric Hydraulic Power Steering Market faces challenges such as high manufacturing costs and the complexity of integrating advanced technologies into existing vehicle designs. Additionally, competition from alternative steering systems can hinder market growth.

What opportunities exist in the India Electric Hydraulic Power Steering Market?

Opportunities in the India Electric Hydraulic Power Steering Market include the growing trend towards electric vehicles and the increasing focus on autonomous driving technologies. These trends are likely to drive demand for advanced steering systems that enhance vehicle performance.

What trends are shaping the India Electric Hydraulic Power Steering Market?

Trends shaping the India Electric Hydraulic Power Steering Market include the integration of smart technologies for better vehicle control and the development of lightweight materials to improve efficiency. Additionally, the shift towards sustainability in automotive design is influencing steering system innovations.

India Electric Hydraulic Power Steering Market

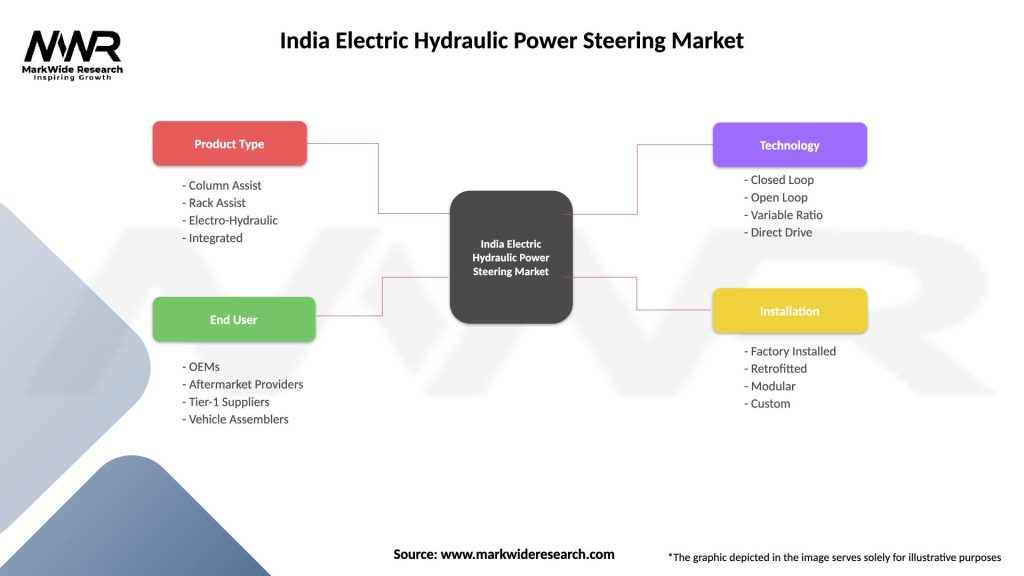

| Segmentation Details | Description |

|---|---|

| Product Type | Column Assist, Rack Assist, Electro-Hydraulic, Integrated |

| End User | OEMs, Aftermarket Providers, Tier-1 Suppliers, Vehicle Assemblers |

| Technology | Closed Loop, Open Loop, Variable Ratio, Direct Drive |

| Installation | Factory Installed, Retrofitted, Modular, Custom |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Electric Hydraulic Power Steering Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at