444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India ecommerce packaging material market has emerged as a critical component of the nation’s rapidly expanding digital commerce ecosystem. With the country experiencing unprecedented growth in online retail activities, the demand for specialized packaging solutions has intensified significantly. E-commerce packaging materials encompass a diverse range of products including corrugated boxes, bubble wrap, protective films, adhesive tapes, and sustainable packaging alternatives designed specifically for online retail shipments.

Market dynamics indicate robust expansion driven by increasing internet penetration, smartphone adoption, and changing consumer shopping behaviors. The sector is experiencing a compound annual growth rate (CAGR) of 18.5%, reflecting the accelerating shift toward digital commerce platforms. Key market drivers include the proliferation of e-commerce platforms, rising consumer expectations for product safety during transit, and growing emphasis on sustainable packaging solutions.

Regional distribution shows concentrated demand in metropolitan areas and tier-1 cities, with emerging opportunities in tier-2 and tier-3 markets as digital infrastructure expands. The market encompasses various material types, from traditional corrugated cardboard to innovative biodegradable alternatives, catering to diverse product categories and shipping requirements across the e-commerce spectrum.

The India ecommerce packaging material market refers to the comprehensive ecosystem of packaging products, materials, and solutions specifically designed and manufactured for online retail shipments within the Indian subcontinent. This market encompasses all packaging components used to protect, contain, and deliver products sold through digital commerce platforms, from initial packaging at fulfillment centers to final delivery at customer doorsteps.

Ecommerce packaging materials include primary packaging that directly contains products, secondary packaging for protection during transit, and tertiary packaging for bulk shipments. The market covers various material categories including paper-based products, plastic films, cushioning materials, adhesives, and emerging sustainable alternatives. Specialized requirements distinguish e-commerce packaging from traditional retail packaging, emphasizing durability, cost-effectiveness, branding opportunities, and environmental considerations.

Market scope extends beyond basic protective functions to include value-added services such as custom printing, tamper-evident features, and smart packaging technologies that enhance customer experience and brand recognition in the competitive online marketplace.

India’s ecommerce packaging material market represents one of the fastest-growing segments within the country’s packaging industry, driven by the exponential expansion of online retail activities. The market has witnessed transformative growth as digital commerce platforms continue to penetrate deeper into Indian consumer markets, creating unprecedented demand for specialized packaging solutions.

Key growth indicators demonstrate the market’s robust trajectory, with online retail adoption rates increasing by 35% annually across urban and semi-urban regions. The sector benefits from favorable demographic trends, including a young, tech-savvy population increasingly comfortable with online shopping experiences. Market segmentation reveals diverse opportunities across product categories, material types, and regional markets.

Competitive landscape features a mix of established packaging manufacturers adapting to e-commerce requirements and specialized providers focusing exclusively on online retail solutions. Innovation drives market evolution, with companies investing in sustainable materials, smart packaging technologies, and automated packaging systems to meet evolving customer and regulatory demands.

Future prospects remain highly favorable, supported by continued digitalization initiatives, expanding logistics infrastructure, and growing consumer acceptance of online shopping across diverse product categories and geographic regions throughout India.

Strategic market insights reveal several critical trends shaping the India ecommerce packaging material landscape:

Market maturation is evident through the development of specialized packaging solutions for different product categories, improved supply chain integration, and enhanced focus on customer experience optimization throughout the packaging and delivery process.

Primary market drivers propelling the India ecommerce packaging material market include the fundamental transformation of retail consumption patterns across the country. The rapid digitalization of commerce, accelerated by recent global events, has created sustained demand for specialized packaging solutions designed specifically for online retail environments.

E-commerce platform expansion continues to drive market growth, with major platforms investing heavily in logistics infrastructure and fulfillment capabilities. The proliferation of marketplace models, direct-to-consumer brands, and social commerce initiatives has diversified packaging requirements across multiple channels and product categories.

Consumer behavior evolution represents another significant driver, as Indian consumers increasingly expect professional packaging that ensures product safety, reflects brand values, and provides convenient unboxing experiences. Rising disposable incomes and changing lifestyle preferences support continued growth in online shopping frequency and order values.

Government initiatives promoting digital India, improved logistics infrastructure, and favorable policies for e-commerce development create an enabling environment for market expansion. Investment in transportation networks, warehousing facilities, and last-mile delivery capabilities directly supports packaging material demand growth across diverse geographic regions.

Market restraints affecting the India ecommerce packaging material sector include significant cost pressures arising from intense competition among e-commerce platforms and the constant need to optimize operational expenses. Price sensitivity among Indian consumers creates downward pressure on packaging costs, challenging manufacturers to balance quality, functionality, and affordability.

Raw material volatility poses ongoing challenges, with fluctuating prices for paper, plastic resins, and other essential packaging materials impacting profit margins and pricing strategies. Supply chain disruptions, whether due to global events or domestic factors, can significantly affect material availability and cost structures.

Environmental regulations and sustainability requirements, while driving innovation, also create compliance costs and operational complexities. The transition toward eco-friendly materials often involves higher initial costs and technical challenges in maintaining packaging performance standards.

Infrastructure limitations in certain regions, including inadequate transportation networks and storage facilities, can limit market expansion opportunities and increase logistics costs. Quality control challenges across diverse supplier networks and varying regional standards can impact overall market efficiency and customer satisfaction levels.

Significant market opportunities exist within the India ecommerce packaging material sector, particularly in the development of innovative sustainable packaging solutions that address environmental concerns while maintaining cost-effectiveness. The growing consumer awareness regarding environmental impact creates demand for biodegradable, recyclable, and reusable packaging alternatives.

Technology integration opportunities include the development of smart packaging solutions incorporating IoT sensors, temperature monitoring, and tamper-evident features that enhance product security and provide valuable supply chain data. These advanced packaging technologies can command premium pricing while delivering enhanced value to e-commerce platforms and consumers.

Geographic expansion presents substantial opportunities as internet penetration and e-commerce adoption accelerate in tier-2 and tier-3 cities. These emerging markets often lack established packaging infrastructure, creating opportunities for companies to establish early market presence and build customer relationships.

Specialized packaging segments offer growth potential, including temperature-controlled packaging for pharmaceuticals and perishables, anti-static packaging for electronics, and luxury packaging for premium products. Market penetration rates in these specialized segments remain below 25%, indicating significant expansion potential for innovative packaging solutions.

Market dynamics within the India ecommerce packaging material sector reflect the complex interplay between rapid demand growth, evolving customer expectations, and operational challenges inherent in serving a diverse and geographically dispersed market. The sector experiences cyclical demand patterns aligned with seasonal shopping trends, festival periods, and promotional events that drive significant volume fluctuations.

Supply chain dynamics involve intricate relationships between raw material suppliers, packaging manufacturers, e-commerce platforms, and logistics providers. The integration of these stakeholders determines overall market efficiency and responsiveness to changing demand patterns. Capacity utilization rates across the industry average 78%, indicating healthy demand levels while maintaining flexibility for growth.

Competitive dynamics feature intense rivalry among packaging suppliers seeking to secure long-term contracts with major e-commerce platforms. Price competition remains significant, though companies increasingly differentiate through service quality, innovation capabilities, and sustainability credentials.

Regulatory dynamics continue evolving as government policies address environmental concerns, waste management requirements, and quality standards. These regulatory changes create both challenges and opportunities for market participants willing to invest in compliance and innovation initiatives.

Comprehensive research methodology employed for analyzing the India ecommerce packaging material market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. The research approach combines primary data collection through industry interviews, surveys, and expert consultations with extensive secondary research covering industry reports, government publications, and company financial statements.

Primary research activities include structured interviews with key industry stakeholders including packaging manufacturers, e-commerce platform executives, logistics providers, and end-user companies. Survey methodologies capture quantitative data regarding market trends, pricing patterns, and customer preferences across different geographic regions and market segments.

Secondary research sources encompass industry associations, government statistical databases, trade publications, and company annual reports to validate primary findings and provide comprehensive market context. Data triangulation techniques ensure consistency and reliability across multiple information sources.

Analytical frameworks include market sizing methodologies, competitive positioning analysis, trend identification techniques, and forecasting models that account for various market variables and scenarios. Quality assurance processes validate data accuracy and ensure research findings meet professional standards for market intelligence reporting.

Regional market distribution across India reveals significant concentration in metropolitan areas and established commercial centers, with Mumbai and Delhi NCR accounting for approximately 45% of total market demand. These regions benefit from mature e-commerce ecosystems, advanced logistics infrastructure, and high consumer adoption rates for online shopping across diverse product categories.

Western India leads market development, driven by the presence of major e-commerce companies, manufacturing hubs, and port facilities that support both domestic and international trade activities. The region demonstrates strong demand for premium packaging solutions and innovative materials that cater to diverse industry requirements.

Southern India represents a rapidly growing market segment, with cities like Bangalore, Chennai, and Hyderabad showing 22% annual growth rates in e-commerce packaging demand. The region’s technology sector concentration drives demand for specialized packaging solutions for electronics and high-value products.

Northern and Eastern regions present emerging opportunities as digital infrastructure expands and consumer adoption increases. These markets often require cost-effective packaging solutions adapted to local preferences and logistics capabilities, creating opportunities for regional suppliers and customized product offerings.

Competitive landscape within the India ecommerce packaging material market features a diverse mix of established packaging manufacturers, specialized e-commerce packaging providers, and emerging innovative companies targeting specific market segments. The market structure includes both large-scale manufacturers serving multiple industries and focused players dedicated exclusively to e-commerce requirements.

Market leaders include:

Competitive strategies emphasize innovation in sustainable materials, cost optimization, service quality enhancement, and strategic partnerships with major e-commerce platforms. Companies invest in research and development, manufacturing capacity expansion, and technology integration to maintain competitive advantages in this rapidly evolving market.

Market segmentation of the India ecommerce packaging material sector reveals multiple classification approaches based on material type, application, end-user industry, and geographic distribution. This segmentation provides insights into market dynamics, growth opportunities, and competitive positioning across different market categories.

By Material Type:

By Application:

Category-wise analysis reveals distinct market characteristics and growth patterns across different packaging material segments within the India ecommerce market. Each category demonstrates unique demand drivers, competitive dynamics, and innovation opportunities that shape overall market development.

Corrugated packaging category maintains market leadership through versatility, cost-effectiveness, and recyclability advantages. This segment benefits from established manufacturing infrastructure, standardized sizing options, and proven performance across diverse product categories. Innovation focus includes lightweight designs, enhanced printing capabilities, and sustainable material compositions.

Flexible packaging category shows rapid growth driven by demand for protective films, bubble wrap, and specialized barrier materials. This segment serves high-value electronics, pharmaceuticals, and perishable goods requiring advanced protection during transit. Technology integration includes smart films with temperature indicators and tamper-evident features.

Sustainable packaging category emerges as a high-growth segment responding to environmental concerns and regulatory requirements. Biodegradable materials, recycled content packaging, and reusable solutions attract premium pricing while addressing corporate sustainability goals and consumer preferences for environmentally responsible options.

Specialty packaging category includes customized solutions for specific industries or applications, commanding higher margins through specialized functionality and performance characteristics tailored to unique customer requirements and market niches.

Industry participants in the India ecommerce packaging material market realize multiple strategic benefits through engagement in this rapidly expanding sector. Revenue diversification opportunities allow traditional packaging manufacturers to reduce dependence on cyclical industries while accessing high-growth e-commerce segments with different demand patterns and customer requirements.

E-commerce platforms benefit from specialized packaging solutions that enhance customer satisfaction, reduce product damage rates, and strengthen brand recognition through customized packaging designs. Cost optimization through efficient packaging reduces shipping expenses and improves overall logistics economics.

Logistics providers gain operational efficiencies through standardized packaging formats, improved space utilization, and reduced handling complexity. Advanced packaging solutions with tracking capabilities enhance supply chain visibility and customer service quality.

End consumers benefit from improved product protection, enhanced unboxing experiences, and growing availability of sustainable packaging options that align with environmental values. Convenience factors include easy-open designs, reusable packaging, and clear product identification features.

Environmental stakeholders benefit from industry innovation in sustainable materials, waste reduction initiatives, and circular economy approaches that minimize packaging environmental impact while maintaining functional performance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping the India ecommerce packaging material market, with companies increasingly adopting eco-friendly materials and circular economy principles. Consumer awareness regarding environmental impact drives demand for biodegradable, recyclable, and minimal packaging solutions that reduce waste while maintaining product protection standards.

Smart packaging integration emerges as a key trend, incorporating QR codes, RFID tags, and IoT sensors that provide supply chain visibility, authentication capabilities, and enhanced customer engagement opportunities. These technologies enable real-time tracking, temperature monitoring, and interactive brand experiences that differentiate products in competitive markets.

Customization and personalization trends reflect growing demand for branded packaging solutions that enhance customer experience and strengthen brand recognition. Digital printing technologies enable cost-effective customization even for smaller order quantities, supporting direct-to-consumer brands and seasonal promotional campaigns.

Automation adoption accelerates across packaging operations, with companies investing in automated packaging systems, robotic handling equipment, and AI-powered optimization tools. Efficiency improvements of up to 35% are achievable through automation, reducing labor costs while improving consistency and speed of packaging operations.

Collaborative partnerships between packaging suppliers, e-commerce platforms, and logistics providers create integrated solutions that optimize total cost of ownership while improving service quality and customer satisfaction across the entire supply chain.

Recent industry developments highlight the dynamic nature of the India ecommerce packaging material market, with significant investments in manufacturing capacity, technology innovation, and strategic partnerships reshaping competitive dynamics and market structure.

Capacity expansion initiatives by major packaging manufacturers include new production facilities specifically designed for e-commerce requirements, featuring advanced manufacturing technologies and sustainable material processing capabilities. These investments support growing demand while improving operational efficiency and product quality standards.

Technology partnerships between packaging companies and technology providers accelerate development of smart packaging solutions, automated packaging systems, and data analytics capabilities that enhance supply chain visibility and operational optimization opportunities.

Sustainability initiatives include major commitments to reduce packaging waste, increase recycled content utilization, and develop innovative biodegradable materials. MarkWide Research indicates that companies investing in sustainable packaging solutions achieve 15% higher customer retention rates compared to traditional packaging providers.

Strategic acquisitions and joint ventures enable companies to expand geographic reach, access new technologies, and strengthen customer relationships across different market segments. These consolidation activities create larger, more capable organizations better positioned to serve major e-commerce platforms and compete in global markets.

Strategic recommendations for industry participants focus on building sustainable competitive advantages through innovation, operational excellence, and customer-centric approaches that address evolving market requirements and emerging opportunities within the India ecommerce packaging material sector.

Investment priorities should emphasize sustainable packaging technologies, automation capabilities, and digital integration that enhance operational efficiency while meeting environmental and customer experience requirements. Companies should allocate resources toward research and development activities that create differentiated product offerings and competitive advantages.

Market expansion strategies should target tier-2 and tier-3 cities where e-commerce adoption continues accelerating, requiring localized approaches that address regional preferences, cost sensitivities, and infrastructure limitations. Partnership strategies with regional logistics providers and e-commerce platforms can facilitate market entry and growth.

Operational optimization through supply chain integration, quality management systems, and customer service excellence creates sustainable competitive advantages that support premium pricing and long-term customer relationships. MWR analysis suggests that companies achieving operational excellence standards realize 12% higher profit margins compared to industry averages.

Innovation focus areas should include smart packaging technologies, sustainable materials development, and customization capabilities that address specific customer requirements while creating barriers to competitive entry and supporting premium market positioning strategies.

Future market prospects for the India ecommerce packaging material sector remain highly favorable, supported by continued digitalization trends, expanding internet infrastructure, and evolving consumer shopping behaviors that favor online retail channels across diverse product categories and geographic regions.

Growth trajectory projections indicate sustained expansion at compound annual growth rates exceeding 16% over the next five years, driven by increasing e-commerce penetration, rising consumer expectations for packaging quality, and growing emphasis on sustainable packaging solutions that address environmental concerns.

Technology evolution will continue transforming the market through smart packaging innovations, automated manufacturing processes, and data-driven optimization tools that enhance efficiency, reduce costs, and improve customer experiences. Integration of artificial intelligence and machine learning capabilities will enable predictive analytics and personalized packaging solutions.

Sustainability imperatives will increasingly influence market development, with regulatory requirements, corporate commitments, and consumer preferences driving adoption of eco-friendly materials and circular economy approaches. Companies successfully navigating this transition will capture premium market segments and build long-term competitive advantages.

Market maturation will create opportunities for consolidation, specialization, and value-added services that differentiate successful companies from commodity suppliers. Strategic partnerships, vertical integration, and international expansion will become increasingly important for maintaining growth and profitability in competitive market conditions.

The India ecommerce packaging material market represents a dynamic and rapidly expanding sector that plays a crucial role in supporting the country’s digital commerce transformation. With robust growth fundamentals driven by increasing internet penetration, smartphone adoption, and evolving consumer preferences, the market offers significant opportunities for industry participants willing to invest in innovation, sustainability, and operational excellence.

Market evolution continues accelerating through technology integration, sustainability initiatives, and expanding geographic reach that extends e-commerce benefits to previously underserved regions. The sector’s ability to adapt to changing customer requirements while maintaining cost competitiveness positions it favorably for continued growth and development.

Strategic success factors include commitment to sustainable packaging solutions, investment in advanced manufacturing technologies, and development of customer-centric approaches that enhance brand value and operational efficiency. Companies that successfully balance these priorities while maintaining competitive pricing will capture the greatest opportunities in this expanding market.

Long-term prospects remain highly positive, supported by India’s demographic advantages, improving digital infrastructure, and government initiatives promoting digital commerce development. The India ecommerce packaging material market is well-positioned to continue its growth trajectory while contributing to the broader transformation of retail commerce throughout the Indian subcontinent.

What is Ecommerce Packaging Material?

Ecommerce Packaging Material refers to the various materials used to package products sold online, ensuring they are protected during transit. This includes boxes, bubble wrap, tape, and biodegradable materials, among others.

What are the key players in the India Ecommerce Packaging Material Market?

Key players in the India Ecommerce Packaging Material Market include companies like UFP Technologies, PackTech, and Amcor, which provide a range of packaging solutions tailored for ecommerce needs, among others.

What are the main drivers of the India Ecommerce Packaging Material Market?

The main drivers of the India Ecommerce Packaging Material Market include the rapid growth of online shopping, increasing consumer demand for sustainable packaging solutions, and the need for efficient logistics and supply chain management.

What challenges does the India Ecommerce Packaging Material Market face?

Challenges in the India Ecommerce Packaging Material Market include rising raw material costs, environmental concerns regarding plastic waste, and the need for innovation to meet diverse packaging requirements.

What opportunities exist in the India Ecommerce Packaging Material Market?

Opportunities in the India Ecommerce Packaging Material Market include the growing trend towards eco-friendly packaging, advancements in smart packaging technologies, and the expansion of ecommerce platforms requiring customized packaging solutions.

What trends are shaping the India Ecommerce Packaging Material Market?

Trends shaping the India Ecommerce Packaging Material Market include the increasing adoption of sustainable materials, the rise of minimalistic packaging designs, and the integration of technology for enhanced user experience and tracking.

India Ecommerce Packaging Material Market

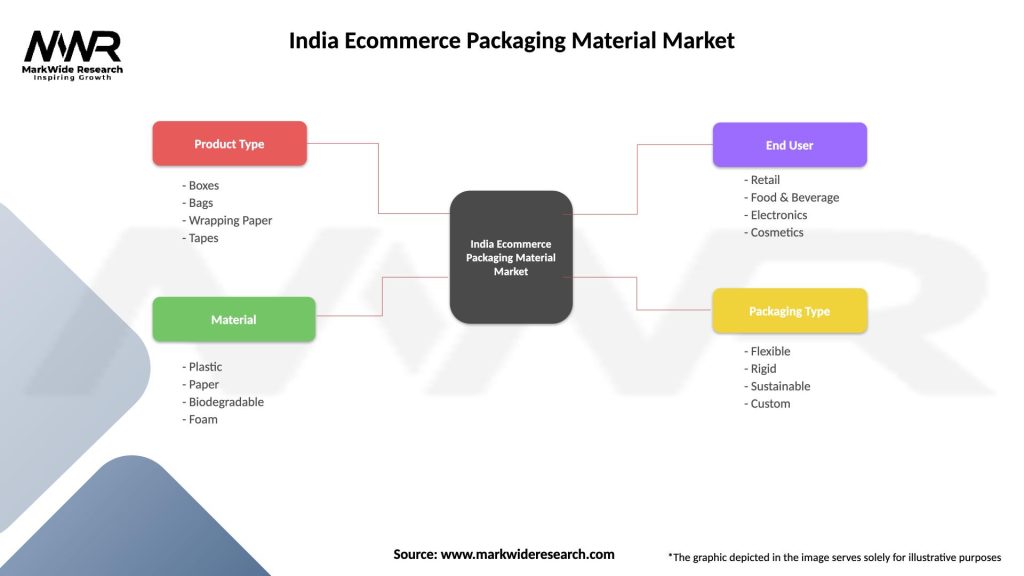

| Segmentation Details | Description |

|---|---|

| Product Type | Boxes, Bags, Wrapping Paper, Tapes |

| Material | Plastic, Paper, Biodegradable, Foam |

| End User | Retail, Food & Beverage, Electronics, Cosmetics |

| Packaging Type | Flexible, Rigid, Sustainable, Custom |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Ecommerce Packaging Material Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at