444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India drug delivery devices market is experiencing significant growth and is expected to witness substantial expansion in the coming years. Drug delivery devices play a crucial role in the healthcare industry by facilitating the administration of medications to patients. These devices ensure accurate dosing and targeted drug delivery, thereby improving patient compliance and treatment outcomes.

Meaning

Drug delivery devices are designed to deliver therapeutic substances such as drugs, vaccines, or biologics to a specific site within the body. They can be categorized into various types, including inhalers, injectors, infusion pumps, and transdermal patches. These devices offer advantages such as controlled release, reduced dosage frequency, and improved patient convenience.

Executive Summary

The India drug delivery devices market is witnessing robust growth due to factors such as increasing prevalence of chronic diseases, technological advancements in drug delivery systems, rising geriatric population, and growing demand for self-administration devices. Additionally, the COVID-19 pandemic has further propelled the demand for drug delivery devices, especially for vaccines.

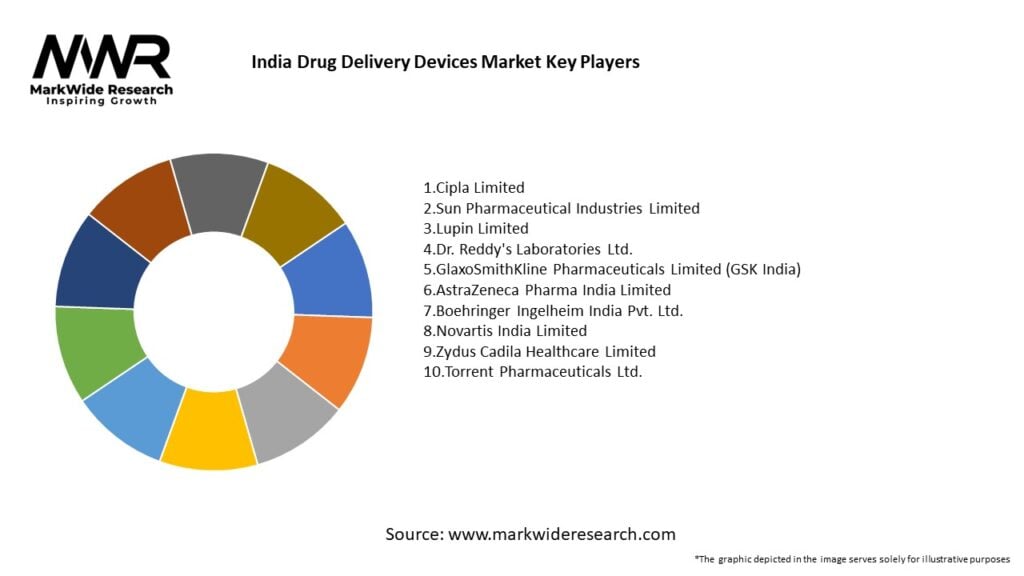

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India drug delivery devices market is highly dynamic, characterized by intense competition and rapid technological advancements. Market players are continuously investing in research and development to introduce innovative and cost-effective products. Strategic collaborations, partnerships, and mergers and acquisitions are prevalent strategies to expand market share and gain a competitive advantage.

Regional Analysis

The drug delivery devices market in India is geographically segmented into North India, South India, East India, and West India. North India dominates the market due to the presence of a large patient population, better healthcare infrastructure, and higher adoption of advanced medical technologies. However, South India is witnessing significant growth due to increasing healthcare investments and a focus on research and development.

Competitive Landscape

Leading Companies in the India Drug Delivery Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

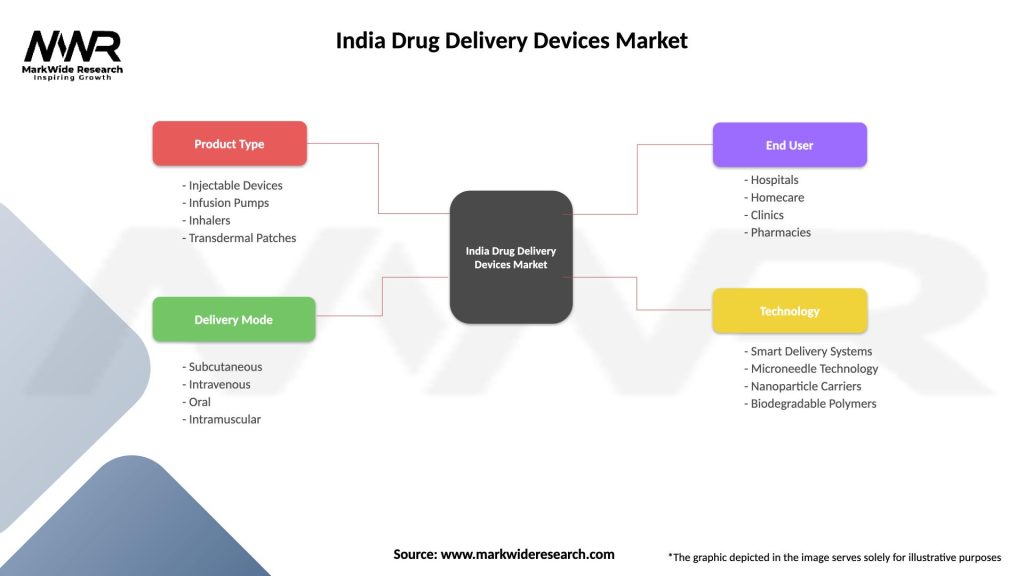

Segmentation

The India drug delivery devices market can be segmented based on product type, application, end-user, and region. Product types include injectable drug delivery devices, inhalers, transdermal patches, and others. Applications encompass diabetes, respiratory diseases, cardiovascular disorders, and others. End-users consist of hospitals, clinics, home healthcare, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the India drug delivery devices market. The urgent need for vaccine administration has driven the demand for devices such as syringes, autoinjectors, and nasal sprays. The government’s mass vaccination campaigns have accelerated the adoption of these devices, leading to a surge in market growth.

Key Industry Developments

1. Advancements in Smart Drug Delivery Devices

Companies are investing in AI-integrated and sensor-based drug delivery devices to improve treatment outcomes and ensure precise medication adherence.

2. Growth in Biologics and Biosimilars Leading to Innovation

The rising adoption of biologics and biosimilars is driving the need for specialized injectables and transdermal delivery systems, promoting innovations in drug administration.

3. Expansion of India’s Pharmaceutical Manufacturing Capabilities

India is strengthening its position as a global pharmaceutical hub, leading to increased production and exports of drug delivery devices.

4. Government Support for Local Medical Device Manufacturing

The Indian government’s initiatives under Make in India and PLI (Production Linked Incentive) schemes are boosting domestic production and reducing dependence on imports.

Analyst Suggestions

Future Outlook

The future of the India drug delivery devices market looks promising, with significant growth opportunities on the horizon. Factors such as the increasing prevalence of chronic diseases, advancements in drug delivery technologies, and the expanding geriatric population are expected to drive market expansion. Additionally, the demand for self-administration devices and the growing trend of home healthcare services will contribute to the market’s growth trajectory.

The industry’s focus on technological advancements, patient-centric approaches, and cost-effective solutions will shape the market’s future landscape. Furthermore, the impact of COVID-19 on the market, particularly the acceleration of vaccine delivery devices, will have a lasting effect on the industry. Overall, the India drug delivery devices market is poised for steady growth and presents favorable prospects for industry participants.

Conclusion

The India drug delivery devices market is witnessing substantial growth driven by factors such as the rising prevalence of chronic diseases, technological advancements, and the increasing focus on patient-centric care. Despite challenges such as affordability concerns and regulatory requirements, the market presents significant opportunities for industry players to innovate and expand their product portfolios.

The market’s future outlook is optimistic, with a continued emphasis on technological advancements, the adoption of smart drug delivery devices, and the expansion of home healthcare services. Collaboration with healthcare providers and patient education initiatives will play a crucial role in driving adoption and improving patient outcomes.

To succeed in this dynamic market, companies should stay at the forefront of innovation, address affordability concerns, and actively collaborate with stakeholders. By embracing these strategies, industry participants can position themselves for success in the evolving India drug delivery devices market.

What is Drug Delivery Devices?

Drug delivery devices are systems or technologies designed to deliver therapeutic agents to patients in a controlled manner. They include various forms such as injectables, inhalers, and transdermal patches, which enhance the efficacy and safety of medications.

What are the key players in the India Drug Delivery Devices Market?

Key players in the India Drug Delivery Devices Market include companies like Baxter International, Becton Dickinson, and Medtronic, which are known for their innovative drug delivery solutions and extensive product portfolios, among others.

What are the growth factors driving the India Drug Delivery Devices Market?

The India Drug Delivery Devices Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in drug formulation technologies, and the growing demand for self-administration devices among patients.

What challenges does the India Drug Delivery Devices Market face?

Challenges in the India Drug Delivery Devices Market include regulatory hurdles, high costs of advanced devices, and the need for extensive clinical trials to ensure safety and efficacy.

What opportunities exist in the India Drug Delivery Devices Market?

Opportunities in the India Drug Delivery Devices Market include the rising focus on personalized medicine, the development of smart drug delivery systems, and the expansion of telehealth services that facilitate remote patient monitoring.

What trends are shaping the India Drug Delivery Devices Market?

Trends in the India Drug Delivery Devices Market include the integration of digital technologies in drug delivery systems, the increasing use of biodegradable materials, and the shift towards patient-centric designs that enhance user experience.

India Drug Delivery Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Injectable Devices, Infusion Pumps, Inhalers, Transdermal Patches |

| Delivery Mode | Subcutaneous, Intravenous, Oral, Intramuscular |

| End User | Hospitals, Homecare, Clinics, Pharmacies |

| Technology | Smart Delivery Systems, Microneedle Technology, Nanoparticle Carriers, Biodegradable Polymers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Drug Delivery Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at