444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India data center physical security market represents a rapidly evolving landscape driven by the nation’s digital transformation initiatives and increasing cybersecurity awareness. Physical security measures for data centers have become paramount as organizations recognize the critical importance of protecting their digital infrastructure from both physical and environmental threats. The market encompasses comprehensive security solutions including access control systems, surveillance technologies, perimeter security, fire suppression systems, and environmental monitoring equipment.

India’s data center sector is experiencing unprecedented growth, with the market expanding at a robust CAGR of 12.5% as enterprises accelerate their digital adoption strategies. The increasing deployment of cloud services, edge computing infrastructure, and hyperscale data centers has created substantial demand for sophisticated physical security solutions. Government initiatives such as Digital India and the growing emphasis on data localization requirements have further amplified the need for secure data center facilities across the country.

Regional distribution shows significant concentration in major metropolitan areas, with Mumbai, Bangalore, and Chennai accounting for approximately 65% of the market share. The emergence of tier-2 cities as data center hubs is creating new opportunities for physical security providers, as organizations seek to establish distributed infrastructure networks to serve India’s diverse geographic regions.

The India data center physical security market refers to the comprehensive ecosystem of security technologies, systems, and services designed to protect data center facilities from physical threats, unauthorized access, and environmental hazards. This market encompasses all tangible security measures that safeguard the physical infrastructure housing critical IT equipment, servers, and networking components essential for digital operations.

Physical security solutions in this context include multi-layered protection systems ranging from perimeter fencing and access control mechanisms to sophisticated biometric authentication systems and environmental monitoring technologies. The market covers both hardware components such as surveillance cameras, motion detectors, and fire suppression systems, as well as integrated software platforms that manage and coordinate these security elements.

Key components of data center physical security include access management systems that control entry to sensitive areas, video surveillance networks providing continuous monitoring capabilities, and environmental controls that maintain optimal operating conditions while detecting potential threats such as fire, flooding, or temperature fluctuations.

India’s data center physical security market is positioned for substantial expansion as the country emerges as a global digital hub. The convergence of increasing data generation, stringent regulatory requirements, and growing security consciousness among enterprises is driving unprecedented demand for comprehensive physical security solutions. Market dynamics indicate a shift toward integrated security platforms that combine traditional physical barriers with advanced technologies such as artificial intelligence and machine learning.

Technology adoption patterns reveal a strong preference for cloud-based security management systems, with approximately 58% of new installations incorporating remote monitoring capabilities. The integration of IoT sensors and smart security devices is transforming traditional data center protection paradigms, enabling predictive maintenance and real-time threat assessment capabilities.

Competitive landscape features both international security technology providers and emerging Indian companies developing localized solutions tailored to specific market requirements. The emphasis on Make in India initiatives is encouraging domestic manufacturing of security equipment, creating opportunities for cost-effective solutions while supporting local economic development.

Strategic market insights reveal several critical trends shaping the India data center physical security landscape:

Primary market drivers propelling the India data center physical security market include the accelerating pace of digital transformation across industries and the corresponding increase in data center deployments. Enterprise digitization initiatives are creating substantial demand for secure infrastructure capable of protecting critical business data and applications. The growing adoption of cloud computing services and the establishment of hyperscale data centers by major technology companies are significantly expanding the addressable market for physical security solutions.

Regulatory compliance requirements serve as a crucial driver, with government policies mandating specific security standards for data centers handling sensitive information. The Personal Data Protection Bill and various sector-specific regulations are compelling organizations to implement comprehensive physical security measures to ensure compliance and avoid potential penalties.

Cybersecurity awareness among Indian enterprises has reached unprecedented levels, with organizations recognizing that physical security forms the foundation of comprehensive data protection strategies. The increasing frequency of security incidents and data breaches has heightened awareness of the need for multi-layered security approaches that address both digital and physical threat vectors.

Investment in digital infrastructure by both private enterprises and government agencies is creating sustained demand for advanced security solutions. The emergence of edge computing and the deployment of distributed data center networks across India’s diverse geographic regions are expanding market opportunities for physical security providers.

Significant market restraints include the substantial capital investment requirements associated with implementing comprehensive physical security systems. Many organizations, particularly small and medium enterprises, face budget constraints that limit their ability to deploy advanced security technologies. The high initial costs of sophisticated surveillance systems, access control mechanisms, and environmental monitoring equipment can create barriers to market adoption.

Technical complexity represents another major restraint, as integrating multiple security systems and ensuring seamless interoperability requires specialized expertise that may not be readily available in all regions. The shortage of skilled security professionals capable of designing, implementing, and maintaining complex physical security infrastructures poses ongoing challenges for market growth.

Legacy infrastructure limitations in existing data centers can complicate the retrofitting of modern security systems, requiring significant modifications to accommodate new technologies. The need to maintain operational continuity while upgrading security systems creates additional complexity and potential service disruptions.

Regulatory uncertainties and evolving compliance requirements can create hesitation among potential buyers who may delay investment decisions until clearer guidelines emerge. The complexity of navigating multiple regulatory frameworks across different states and sectors can slow market adoption rates.

Emerging market opportunities in India’s data center physical security sector are substantial, driven by the country’s position as a global technology hub and the increasing digitization of traditional industries. The expansion of 5G networks and the corresponding need for edge data centers across India’s vast geography presents significant opportunities for security solution providers to establish presence in previously underserved markets.

Government digitization initiatives including smart city projects and e-governance programs are creating new demand for secure data center infrastructure. The emphasis on data sovereignty and localization requirements is driving both domestic and international companies to establish data centers within India, expanding the addressable market for physical security solutions.

Technology innovation opportunities exist in developing cost-effective, locally manufactured security solutions tailored to Indian market conditions. The integration of artificial intelligence and machine learning capabilities into traditional security systems presents opportunities for creating differentiated offerings that provide enhanced threat detection and response capabilities.

Sector-specific opportunities are emerging in industries such as banking, healthcare, and e-commerce, where regulatory requirements and business criticality demand sophisticated physical security measures. The growing adoption of hybrid cloud architectures is creating demand for security solutions that can seamlessly protect both on-premises and cloud-based infrastructure components.

Market dynamics in India’s data center physical security sector are characterized by rapid technological evolution and changing customer expectations. The shift toward integrated security platforms that combine multiple protection layers is transforming traditional approaches to data center security. Organizations are increasingly seeking comprehensive solutions that provide unified management capabilities across diverse security systems.

Competitive dynamics are intensifying as both established international players and emerging domestic companies compete for market share. The emphasis on localization and cost competitiveness is driving innovation in product development and service delivery models. Companies are investing heavily in research and development to create solutions that address specific Indian market requirements while maintaining global technology standards.

Customer behavior patterns indicate a growing preference for managed security services that reduce the operational burden on internal IT teams. The adoption of security-as-a-service models is enabling organizations to access advanced security capabilities without significant upfront capital investments. This trend is particularly pronounced among smaller enterprises that lack the resources to maintain comprehensive in-house security operations.

Technology convergence is creating new market dynamics as traditional physical security systems integrate with IT infrastructure and cybersecurity platforms. The emergence of unified threat management approaches that address both physical and digital security concerns is reshaping customer expectations and vendor positioning strategies.

Comprehensive research methodology employed in analyzing India’s data center physical security market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of insights. Primary research activities include extensive interviews with industry stakeholders, including data center operators, security solution providers, system integrators, and end-user organizations across various industry sectors.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary findings. The research approach includes examination of technology trends, competitive landscapes, and regulatory developments that influence market dynamics.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to ensure consistency and accuracy of market insights. The methodology includes analysis of both quantitative metrics such as market growth rates and adoption percentages, as well as qualitative factors including customer preferences and technology evolution patterns.

Market segmentation analysis employs detailed examination of various customer segments, application areas, and technology categories to provide comprehensive understanding of market structure and growth opportunities. The research methodology ensures representation of diverse geographic regions and industry verticals to capture the full scope of market dynamics.

Regional market distribution across India reveals significant concentration in major metropolitan areas, with distinct patterns of adoption and growth across different geographic zones. Western India, particularly the Mumbai metropolitan region, commands the largest market share at approximately 28%, driven by the presence of major financial institutions, multinational corporations, and established data center infrastructure.

Southern India represents the fastest-growing regional market, with cities like Bangalore, Chennai, and Hyderabad collectively accounting for 35% of market activity. The region’s position as India’s technology capital and the concentration of IT services companies have created substantial demand for advanced data center security solutions. Government initiatives promoting technology innovation and the presence of major cloud service providers are further accelerating market growth in this region.

Northern India, centered around the Delhi National Capital Region, represents approximately 22% of the market and is experiencing steady growth driven by government digitization initiatives and the expansion of e-commerce operations. The region’s strategic importance as the seat of government and major corporate headquarters creates ongoing demand for secure data center infrastructure.

Eastern and Central India represent emerging markets with significant growth potential, though currently accounting for smaller market shares. The development of smart city projects and increasing industrial digitization in these regions are creating new opportunities for physical security solution providers to establish market presence and capture future growth.

Competitive landscape in India’s data center physical security market features a diverse mix of international technology leaders and emerging domestic players, each competing through different value propositions and market strategies. The market structure includes established global security companies, specialized data center solution providers, and innovative startups developing next-generation security technologies.

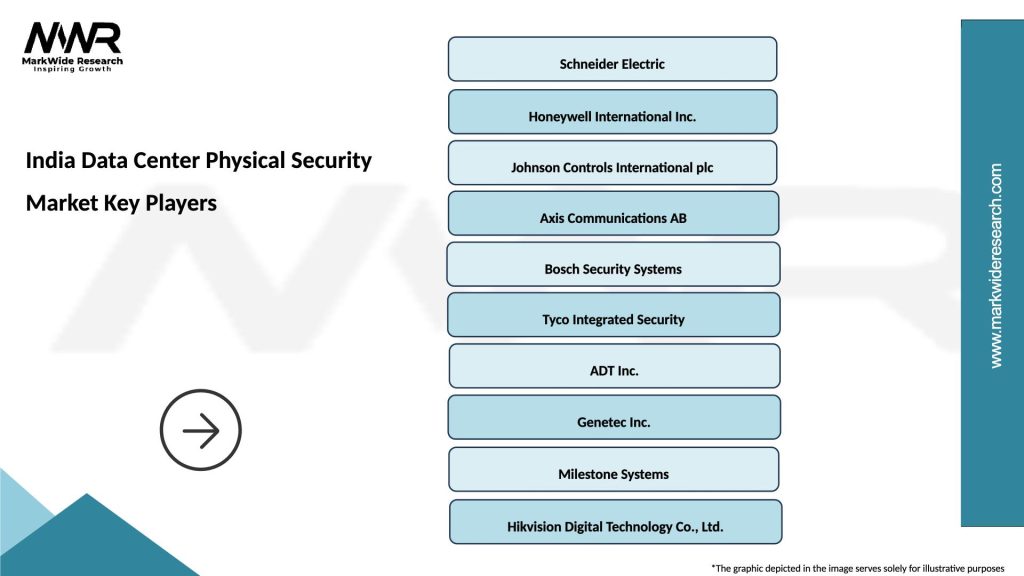

Leading market participants include:

Competitive strategies focus on technology innovation, local manufacturing capabilities, and comprehensive service offerings that address the full spectrum of data center security requirements. Companies are investing in artificial intelligence and machine learning capabilities to differentiate their solutions and provide enhanced threat detection capabilities.

Market segmentation analysis reveals distinct categories based on technology types, application areas, and end-user industries, each exhibiting unique growth patterns and requirements. The segmentation framework provides comprehensive understanding of market structure and opportunities across different customer segments.

By Technology:

By Application:

By End-User Industry:

Access control systems represent the largest technology segment, accounting for approximately 32% of market revenue, driven by increasing adoption of biometric authentication and multi-factor verification technologies. The segment is experiencing rapid growth as organizations implement sophisticated identity management systems that integrate with broader IT security infrastructures. Biometric technologies including fingerprint, facial recognition, and iris scanning are gaining prominence due to their enhanced security capabilities and user convenience.

Video surveillance solutions constitute the second-largest segment, with AI-powered analytics driving significant market expansion. The integration of machine learning algorithms for automated threat detection and behavioral analysis is transforming traditional surveillance approaches. Cloud-based video management platforms are gaining traction as organizations seek scalable solutions that reduce on-premises infrastructure requirements.

Perimeter security systems are experiencing strong growth, particularly in hyperscale data center deployments where comprehensive intrusion detection is critical. The adoption of smart fencing technologies and integrated sensor networks is enabling more sophisticated threat detection capabilities while reducing false alarm rates.

Fire safety and environmental monitoring systems represent essential components of data center security, with increasing emphasis on predictive maintenance and automated response capabilities. The integration of IoT sensors and environmental controls is enabling proactive threat mitigation and optimal facility management.

Data center operators benefit significantly from comprehensive physical security implementations through enhanced operational reliability and reduced risk exposure. Advanced security systems provide continuous monitoring capabilities that enable proactive threat detection and rapid response to potential incidents. The integration of automated systems reduces the need for extensive on-site security personnel while maintaining high levels of protection.

Enterprise customers gain substantial value through improved data protection and regulatory compliance capabilities. Physical security measures provide essential foundations for comprehensive data protection strategies, ensuring that digital assets remain secure from both physical and environmental threats. The implementation of sophisticated access controls and monitoring systems enhances customer confidence in data center services.

Security solution providers benefit from expanding market opportunities and the ability to develop innovative technologies that address evolving customer requirements. The growing market creates opportunities for both established companies and emerging players to capture market share through differentiated offerings and specialized solutions.

Government stakeholders benefit from enhanced national security capabilities and improved protection of critical digital infrastructure. The development of robust data center security ecosystems supports broader digitization initiatives and helps ensure the resilience of essential digital services.

Investment community gains access to a rapidly growing market with strong fundamentals and long-term growth prospects, driven by India’s digital transformation and increasing security awareness among enterprises.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming India’s data center physical security market. AI-powered surveillance systems are enabling automated threat detection, behavioral analysis, and predictive security capabilities that significantly enhance traditional security approaches. Machine learning algorithms are being deployed to analyze video feeds, detect anomalous activities, and provide real-time alerts to security personnel.

Cloud-based security management is gaining substantial traction as organizations seek scalable, cost-effective solutions for managing distributed data center infrastructure. Security-as-a-Service models are enabling smaller enterprises to access advanced security capabilities without significant upfront investments, democratizing access to sophisticated protection technologies.

IoT sensor integration is creating comprehensive environmental monitoring capabilities that extend beyond traditional security functions. Smart sensors are being deployed to monitor temperature, humidity, air quality, and other environmental factors that could impact data center operations, enabling proactive maintenance and threat mitigation.

Biometric authentication advancement is driving adoption of more sophisticated access control systems that provide enhanced security while improving user experience. Multi-modal biometric systems combining multiple authentication factors are becoming standard in high-security data center environments.

Mobile security management platforms are enabling remote monitoring and control capabilities, allowing security personnel to manage multiple facilities from centralized locations. Mobile applications provide real-time access to security systems and enable rapid response to potential threats.

Recent industry developments highlight the dynamic nature of India’s data center physical security market and the continuous evolution of technology solutions. Major cloud service providers have announced significant investments in Indian data center infrastructure, creating substantial opportunities for security solution providers to participate in large-scale deployments.

Regulatory developments including updated data protection guidelines and security standards are shaping market requirements and driving demand for compliant security solutions. The introduction of sector-specific regulations for banking, healthcare, and telecommunications is creating specialized market segments with unique security requirements.

Technology partnerships between international security companies and Indian system integrators are facilitating knowledge transfer and localization of advanced security technologies. These collaborations are enabling the development of solutions tailored to Indian market conditions while maintaining global technology standards.

Investment activities in the Indian data center sector continue to accelerate, with both domestic and international investors recognizing the market’s growth potential. MarkWide Research analysis indicates that venture capital and private equity investments in data center infrastructure companies have increased substantially, providing capital for expansion and technology development.

Innovation initiatives including government-supported research programs and industry collaboration projects are driving development of next-generation security technologies specifically designed for Indian market requirements.

Strategic recommendations for market participants emphasize the importance of developing comprehensive, integrated security solutions that address the full spectrum of data center protection requirements. Solution providers should focus on creating platforms that combine multiple security technologies while providing unified management capabilities that simplify operations for end users.

Technology investment priorities should emphasize artificial intelligence and machine learning capabilities that enable predictive security and automated threat response. Companies should invest in developing cloud-native solutions that can scale efficiently and provide cost-effective alternatives to traditional on-premises security systems.

Market entry strategies for new participants should consider partnerships with established system integrators and local technology companies to leverage existing market relationships and distribution channels. Localization efforts including domestic manufacturing and customization for Indian market conditions will be critical for long-term success.

Customer engagement approaches should emphasize education and consultation services that help organizations understand the value proposition of advanced security technologies. Demonstration facilities and proof-of-concept programs can be effective tools for showcasing technology capabilities and building customer confidence.

Service model innovation should focus on developing managed security services and subscription-based offerings that reduce customer implementation barriers and provide ongoing value through continuous monitoring and maintenance services.

Future market prospects for India’s data center physical security sector remain exceptionally positive, with sustained growth expected across all major market segments. Digital transformation acceleration and the continued expansion of cloud computing adoption will drive ongoing demand for sophisticated security solutions. The market is projected to maintain strong growth momentum with an estimated CAGR of 14.2% over the next five years.

Technology evolution will continue to shape market dynamics, with artificial intelligence, machine learning, and IoT integration becoming standard features in data center security deployments. Edge computing expansion will create new market opportunities as organizations deploy distributed infrastructure networks that require comprehensive security protection.

Regulatory environment developments will continue to influence market requirements, with increasing emphasis on data protection and cybersecurity creating additional demand for physical security solutions. MWR projections suggest that compliance-driven investments will account for approximately 40% of market growth over the forecast period.

Market consolidation activities are expected to increase as companies seek to build comprehensive solution portfolios and expand their geographic reach. Strategic acquisitions and partnerships will likely reshape the competitive landscape as market participants position themselves for long-term growth.

Innovation focus areas will include development of autonomous security systems, enhanced environmental monitoring capabilities, and integration with broader IT infrastructure management platforms. The convergence of physical and cybersecurity solutions will create new market categories and opportunities for differentiation.

India’s data center physical security market represents a compelling growth opportunity driven by the nation’s rapid digital transformation and increasing recognition of the critical importance of comprehensive infrastructure protection. The convergence of technological innovation, regulatory requirements, and growing security awareness is creating a robust foundation for sustained market expansion across all major segments and geographic regions.

Market fundamentals remain strong, with continued investment in data center infrastructure, expanding cloud adoption, and government digitization initiatives providing multiple growth drivers. The evolution toward integrated security platforms that combine artificial intelligence, IoT capabilities, and cloud-based management is transforming traditional approaches to data center protection and creating new value propositions for customers.

Strategic opportunities exist for both established players and emerging companies to capture market share through innovative solutions, strategic partnerships, and localized offerings that address specific Indian market requirements. The emphasis on Make in India initiatives and technology localization creates additional opportunities for domestic manufacturing and customization of security solutions.

Long-term outlook indicates that India’s data center physical security market will continue to evolve rapidly, driven by technological advancement and changing customer expectations. Organizations that invest in comprehensive security strategies and leverage advanced technologies will be best positioned to capitalize on the substantial growth opportunities in this dynamic and expanding market.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

What are the key players in the India Data Center Physical Security Market?

Key players in the India Data Center Physical Security Market include companies like Schneider Electric, Cisco Systems, and Honeywell, which provide various security solutions and technologies for data centers, among others.

What are the main drivers of growth in the India Data Center Physical Security Market?

The growth of the India Data Center Physical Security Market is driven by the increasing demand for data storage, the rise in cyber threats, and the need for compliance with data protection regulations. Additionally, the expansion of cloud services and digital transformation initiatives contribute to this growth.

What challenges does the India Data Center Physical Security Market face?

Challenges in the India Data Center Physical Security Market include the high costs associated with advanced security technologies, the complexity of integrating various security systems, and the evolving nature of security threats. These factors can hinder the implementation of effective security measures.

What opportunities exist in the India Data Center Physical Security Market?

Opportunities in the India Data Center Physical Security Market include the adoption of AI and machine learning for enhanced security analytics, the growth of edge computing, and the increasing focus on sustainability in security practices. These trends can lead to innovative solutions and improved security outcomes.

What trends are shaping the India Data Center Physical Security Market?

Trends shaping the India Data Center Physical Security Market include the integration of IoT devices for real-time monitoring, the use of biometric access controls, and the emphasis on remote management solutions. These innovations are enhancing the overall security posture of data centers.

India Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Equipment |

| End User | Telecommunications, BFSI, Government, Healthcare |

| Technology | Biometric Authentication, Video Analytics, Cloud-Based Security, RFID Solutions |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at