444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India data center cooling market represents a rapidly expanding sector driven by the country’s digital transformation initiatives and increasing demand for cloud computing services. Data center cooling systems have become critical infrastructure components as organizations across India establish robust digital operations to support growing data processing requirements. The market encompasses various cooling technologies including air conditioning systems, liquid cooling solutions, and free cooling mechanisms designed to maintain optimal operating temperatures in data centers.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% as enterprises prioritize energy-efficient cooling solutions. The increasing adoption of hyperscale data centers and edge computing facilities across major Indian cities has created significant demand for advanced cooling technologies. Government initiatives promoting digitalization, including the Digital India program and smart city developments, have further accelerated market expansion.

Regional distribution shows concentrated growth in metropolitan areas, with Mumbai, Bangalore, and Chennai accounting for approximately 65% of market activity. The market benefits from India’s strategic position as a global IT services hub and the increasing preference for colocation services among small and medium enterprises seeking cost-effective data center solutions.

The India data center cooling market refers to the comprehensive ecosystem of cooling technologies, systems, and services specifically designed to maintain optimal temperature and humidity levels within data center facilities across India. Data center cooling encompasses various mechanical and natural cooling methods that prevent overheating of critical IT infrastructure including servers, storage systems, and networking equipment.

Cooling solutions in this market range from traditional computer room air conditioning (CRAC) units to sophisticated liquid cooling systems and innovative free cooling technologies that leverage ambient air conditions. The market includes both hardware components such as chillers, cooling towers, and air handling units, as well as software solutions for monitoring and optimizing cooling efficiency.

Market participants include cooling equipment manufacturers, system integrators, maintenance service providers, and technology consultants who collectively support the growing demand for reliable and energy-efficient cooling solutions in India’s expanding data center landscape.

India’s data center cooling market demonstrates remarkable growth momentum driven by accelerating digital adoption and increasing data generation across various industry sectors. The market has evolved from basic air conditioning solutions to sophisticated cooling architectures that prioritize energy efficiency and environmental sustainability. Key market drivers include the proliferation of cloud services, growing e-commerce activities, and expanding telecommunications infrastructure supporting 5G deployment.

Technology advancement plays a crucial role in market development, with liquid cooling solutions gaining significant traction due to their superior efficiency in high-density computing environments. The market shows strong preference for modular cooling systems that offer scalability and flexibility to accommodate varying workload demands. Energy efficiency improvements of up to 40% are driving adoption of advanced cooling technologies among cost-conscious enterprises.

Competitive landscape features both international cooling technology leaders and emerging Indian companies developing localized solutions. The market benefits from favorable government policies promoting data localization and digital infrastructure development, creating sustained demand for cooling solutions across multiple geographic regions.

Market insights reveal several critical trends shaping the India data center cooling landscape:

Market penetration varies significantly across different industry verticals, with banking and financial services leading adoption at approximately 28% market share, followed by telecommunications and information technology services.

Primary market drivers propelling growth in India’s data center cooling sector include the exponential increase in data generation and processing requirements across various industries. Digital transformation initiatives undertaken by enterprises have created substantial demand for reliable cooling infrastructure capable of supporting mission-critical operations. The rapid expansion of cloud computing services and increasing adoption of software-as-a-service (SaaS) applications require robust cooling systems to maintain optimal performance levels.

Government digitalization programs including the Digital India initiative and smart city projects have accelerated data center development across tier-2 and tier-3 cities, creating new market opportunities for cooling solution providers. E-commerce growth and increasing online transaction volumes drive demand for scalable data center infrastructure with efficient cooling capabilities.

Technological advancement in high-density computing and the deployment of artificial intelligence and machine learning workloads generate significant heat loads requiring sophisticated cooling solutions. The growing adoption of 5G telecommunications infrastructure and Internet of Things (IoT) applications further amplifies cooling requirements across distributed computing environments.

Energy cost considerations motivate organizations to invest in efficient cooling technologies that reduce overall operational expenses while maintaining reliable performance standards.

Market restraints affecting the India data center cooling sector include significant capital investment requirements for implementing advanced cooling technologies, particularly for small and medium enterprises with limited financial resources. Technical complexity associated with designing and maintaining sophisticated cooling systems creates barriers for organizations lacking specialized expertise.

Infrastructure limitations in certain geographic regions, including inadequate power supply and water availability, constrain the deployment of specific cooling technologies. Skilled workforce shortage in cooling system design, installation, and maintenance poses challenges for market expansion and service quality.

Regulatory uncertainties regarding environmental compliance and energy efficiency standards create hesitation among potential investors. Import dependencies for advanced cooling components expose the market to supply chain disruptions and currency fluctuation impacts.

Climate variations across different Indian regions require customized cooling solutions, increasing complexity and costs for standardized deployments. Legacy infrastructure in existing data centers often requires significant modifications to accommodate modern cooling technologies, creating additional financial burdens for facility upgrades.

Market opportunities in India’s data center cooling sector are substantial, driven by the country’s position as a global technology services hub and increasing foreign investment in digital infrastructure. Edge computing deployment presents significant opportunities for compact and efficient cooling solutions designed for distributed computing environments across urban and rural areas.

Sustainability initiatives create demand for innovative cooling technologies that minimize environmental impact while maintaining operational efficiency. Free cooling solutions leveraging India’s diverse climate conditions offer opportunities for energy-efficient cooling in suitable geographic regions.

Artificial intelligence integration in cooling system management presents opportunities for developing predictive maintenance solutions and optimizing energy consumption. Liquid cooling technology adoption in high-performance computing applications offers growth potential as organizations seek superior cooling efficiency.

Government support for domestic manufacturing through initiatives like Make in India creates opportunities for local cooling equipment production and reduced import dependencies. Colocation service expansion drives demand for scalable cooling solutions supporting multiple tenant requirements.

Retrofit market opportunities exist for upgrading existing data center cooling infrastructure with modern, energy-efficient technologies.

Market dynamics in India’s data center cooling sector reflect the interplay between rapidly evolving technology requirements and increasing emphasis on operational efficiency. Supply chain dynamics show growing localization efforts as manufacturers establish production facilities and service centers within India to reduce costs and improve responsiveness.

Competitive dynamics feature intense competition between established international players and emerging Indian companies developing innovative cooling solutions. Technology evolution drives continuous product development, with manufacturers investing heavily in research and development to create more efficient and sustainable cooling systems.

Customer dynamics reveal increasing sophistication in cooling system selection, with organizations prioritizing total cost of ownership over initial capital costs. Partnership dynamics show growing collaboration between cooling solution providers and data center developers to create integrated infrastructure offerings.

Regulatory dynamics influence market development through evolving energy efficiency standards and environmental compliance requirements. Investment dynamics demonstrate strong venture capital and private equity interest in innovative cooling technologies, particularly those addressing sustainability concerns.

Research methodology employed for analyzing India’s data center cooling market incorporates comprehensive primary and secondary research approaches to ensure accurate market assessment. Primary research includes structured interviews with industry executives, cooling technology manufacturers, data center operators, and end-user organizations across various industry sectors.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and technical documentation from cooling equipment manufacturers. Market sizing utilizes bottom-up and top-down approaches, analyzing installation data, capacity additions, and technology adoption rates across different market segments.

Data validation processes include cross-referencing information from multiple sources and conducting expert interviews to verify market trends and growth projections. Quantitative analysis employs statistical modeling to project market growth rates and identify key performance indicators.

Qualitative assessment focuses on understanding market dynamics, competitive positioning, and technology evolution trends through expert opinions and industry observations. Geographic analysis examines regional market variations and growth patterns across different Indian states and metropolitan areas.

Regional analysis of India’s data center cooling market reveals significant geographic concentration in major metropolitan areas, with Western India leading market development due to the presence of Mumbai’s financial district and Pune’s IT corridor. Mumbai region accounts for approximately 25% of market share, driven by extensive banking and financial services infrastructure requiring sophisticated cooling solutions.

Southern India demonstrates strong market presence, particularly in Bangalore and Chennai, benefiting from established IT services clusters and favorable government policies supporting technology infrastructure development. Bangalore represents the largest concentration of data centers outside Mumbai, with significant investments in advanced cooling technologies.

Northern India shows growing market activity centered around Delhi NCR region, supported by government digitalization initiatives and increasing enterprise adoption of cloud services. Hyderabad emerges as a significant market due to its position as a major IT hub and growing pharmaceutical industry data requirements.

Tier-2 cities including Ahmedabad, Kochi, and Indore demonstrate increasing market potential as organizations establish distributed data center infrastructure to serve regional markets. Climate considerations influence cooling technology selection across different regions, with coastal areas favoring free cooling solutions while inland regions require more intensive cooling approaches.

Competitive landscape in India’s data center cooling market features a diverse mix of international technology leaders and emerging domestic players competing across various market segments. Market leaders include:

Competitive strategies focus on technology innovation, local manufacturing capabilities, and comprehensive service offerings. Market differentiation occurs through energy efficiency improvements, modular design approaches, and integrated monitoring capabilities.

Market segmentation analysis reveals distinct categories based on cooling technology, application, and end-user requirements:

By Cooling Technology:

By Application:

By End-User Industry:

Category-wise insights provide detailed understanding of specific market segments and their unique characteristics:

Air-Based Cooling Systems: Continue to dominate the market with approximately 70% market share due to established infrastructure and proven reliability. Computer Room Air Conditioning (CRAC) units remain popular for smaller data centers, while Computer Room Air Handling (CRAH) systems gain preference in larger facilities requiring centralized cooling.

Liquid Cooling Solutions: Experience rapid growth with adoption rates increasing by 35% annually as organizations seek superior cooling efficiency for high-density computing environments. Direct liquid cooling systems appeal to enterprises running intensive workloads, while immersion cooling technologies attract attention for specialized applications.

Free Cooling Technologies: Gain traction in suitable climate zones, offering operational cost reductions of up to 45% compared to traditional mechanical cooling. Indirect evaporative cooling systems show particular promise in dry climate regions across northern and western India.

Hybrid Cooling Approaches: Emerge as preferred solutions for organizations seeking optimal efficiency across varying operational conditions, combining multiple cooling technologies for maximum flexibility and cost-effectiveness.

Industry participants and stakeholders in India’s data center cooling market realize numerous benefits from market participation and technology adoption:

For Data Center Operators:

For Technology Providers:

For End-User Organizations:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping India’s data center cooling landscape reflect evolving technology requirements and sustainability priorities. Liquid cooling adoption accelerates as organizations deploy high-density computing infrastructure requiring superior thermal management capabilities. MarkWide Research analysis indicates that liquid cooling installations have increased by 42% year-over-year in hyperscale data centers.

Artificial intelligence integration transforms cooling system management through predictive analytics and automated optimization. Smart cooling systems utilize machine learning algorithms to anticipate cooling requirements and adjust operations proactively, resulting in energy savings of up to 30%.

Modular cooling architectures gain popularity due to their flexibility and scalability advantages. Containerized cooling solutions enable rapid deployment and easy capacity adjustments based on changing requirements.

Sustainability initiatives drive adoption of environmentally friendly cooling technologies, including natural refrigerants and waste heat recovery systems. Free cooling utilization increases in suitable climate zones, leveraging ambient conditions to reduce mechanical cooling requirements.

Edge computing proliferation creates demand for compact, efficient cooling solutions suitable for distributed deployment scenarios.

Industry developments demonstrate significant innovation and investment activity across India’s data center cooling sector. Technology partnerships between international cooling manufacturers and Indian system integrators have accelerated local market development and customization capabilities.

Manufacturing investments by global cooling technology leaders establish production facilities within India, reducing costs and improving supply chain responsiveness. Research and development initiatives focus on developing cooling solutions optimized for Indian climate conditions and operational requirements.

Acquisition activities consolidate market players and expand technology portfolios, with several international companies acquiring Indian cooling solution providers to strengthen local market presence. Product launches introduce advanced cooling technologies specifically designed for Indian market requirements.

Sustainability certifications become increasingly important, with cooling manufacturers pursuing environmental compliance certifications to meet customer requirements. Training programs address skilled workforce shortages by developing technical expertise in cooling system installation and maintenance.

Government initiatives supporting data center development include infrastructure improvements and policy frameworks encouraging investment in cooling technology innovation.

Analyst recommendations for stakeholders in India’s data center cooling market emphasize strategic positioning and technology investment priorities. Market participants should focus on developing energy-efficient cooling solutions that address both performance requirements and sustainability concerns.

Technology providers are advised to invest in local manufacturing capabilities and service infrastructure to improve competitiveness and customer support. Partnership strategies with data center developers and system integrators can accelerate market penetration and create integrated solution offerings.

End-user organizations should evaluate total cost of ownership when selecting cooling technologies, considering both initial capital costs and long-term operational expenses. Pilot implementations of advanced cooling technologies can help organizations assess benefits before large-scale deployments.

Investment focus should prioritize liquid cooling technologies and AI-driven optimization systems that offer superior efficiency and performance benefits. Geographic expansion strategies should target tier-2 cities where data center development is accelerating.

Regulatory compliance preparation is essential as environmental standards continue evolving, requiring proactive adoption of sustainable cooling practices.

Future outlook for India’s data center cooling market indicates sustained growth driven by continued digital transformation and increasing data processing requirements. Market expansion is projected to maintain robust growth rates exceeding 12% CAGR over the next five years, supported by government digitalization initiatives and enterprise cloud adoption.

Technology evolution will favor liquid cooling solutions and AI-driven optimization systems as organizations prioritize efficiency and performance. MWR projections suggest that liquid cooling adoption will reach 25% market penetration by 2028, driven by high-density computing requirements.

Geographic expansion will extend beyond major metropolitan areas as edge computing deployment accelerates across tier-2 and tier-3 cities. Sustainability requirements will increasingly influence technology selection, favoring solutions that minimize environmental impact.

Innovation focus will emphasize integrated cooling solutions combining multiple technologies for optimal efficiency across varying operational conditions. Market consolidation may occur as larger players acquire specialized technology providers to expand capabilities.

Investment opportunities will emerge in areas such as waste heat recovery, renewable energy integration, and predictive maintenance solutions for cooling systems.

India’s data center cooling market represents a dynamic and rapidly expanding sector positioned for sustained growth driven by the country’s digital transformation journey and increasing data processing requirements. The market demonstrates strong fundamentals with diverse technology options ranging from traditional air-based cooling to innovative liquid cooling solutions, each addressing specific operational requirements and efficiency objectives.

Market dynamics reflect the interplay between technological advancement, sustainability priorities, and cost optimization needs, creating opportunities for both established players and innovative newcomers. The growing emphasis on energy efficiency and environmental sustainability continues to drive adoption of advanced cooling technologies that deliver superior performance while minimizing operational costs.

Strategic positioning in this market requires understanding of regional variations, technology trends, and evolving customer requirements across different industry verticals. Organizations that successfully combine technological innovation with local market expertise and comprehensive service capabilities are best positioned to capitalize on the significant growth opportunities ahead in India’s expanding data center cooling landscape.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data processing environments.

What are the key players in the India Data Center Cooling Market?

Key players in the India Data Center Cooling Market include companies like Schneider Electric, Vertiv, and STULZ, which provide innovative cooling solutions tailored for data centers. These companies focus on energy efficiency and advanced cooling technologies, among others.

What are the main drivers of the India Data Center Cooling Market?

The main drivers of the India Data Center Cooling Market include the rapid growth of data centers due to increasing digitalization, the demand for energy-efficient cooling solutions, and the rising need for reliable IT infrastructure. Additionally, the expansion of cloud computing services contributes significantly to market growth.

What challenges does the India Data Center Cooling Market face?

The India Data Center Cooling Market faces challenges such as high initial investment costs for advanced cooling systems and the need for skilled personnel to manage these technologies. Additionally, fluctuating energy prices can impact operational costs for data center operators.

What opportunities exist in the India Data Center Cooling Market?

Opportunities in the India Data Center Cooling Market include the increasing adoption of green technologies and sustainable cooling solutions, as well as the potential for innovation in cooling methods such as liquid cooling and AI-driven systems. The growing trend of edge computing also presents new avenues for cooling solutions.

What trends are shaping the India Data Center Cooling Market?

Trends shaping the India Data Center Cooling Market include the shift towards modular cooling systems, the integration of IoT for monitoring and optimization, and the focus on sustainability through the use of renewable energy sources. These trends are driving the evolution of cooling technologies in data centers.

India Data Center Cooling Market

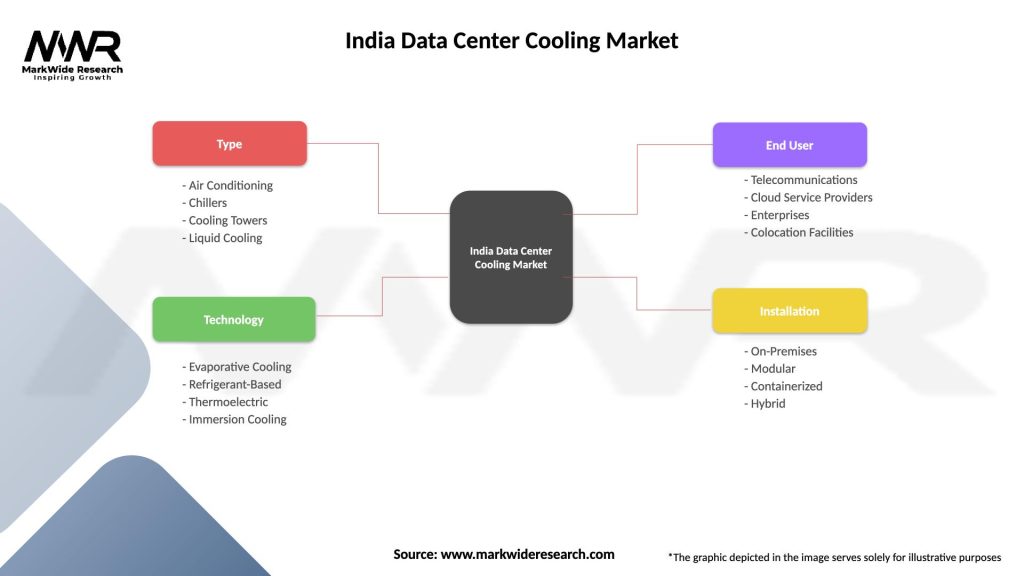

| Segmentation Details | Description |

|---|---|

| Type | Air Conditioning, Chillers, Cooling Towers, Liquid Cooling |

| Technology | Evaporative Cooling, Refrigerant-Based, Thermoelectric, Immersion Cooling |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Colocation Facilities |

| Installation | On-Premises, Modular, Containerized, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at