444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Courier, Express, and Parcel (CEP) market represents one of the fastest-growing logistics segments in the Asia-Pacific region, driven by unprecedented e-commerce expansion and digital transformation initiatives. Market dynamics indicate robust growth momentum with the sector experiencing a compound annual growth rate (CAGR) of 12.5% over the recent forecast period. The Indian CEP landscape encompasses traditional postal services, private courier companies, and innovative last-mile delivery solutions that collectively serve millions of consumers across urban and rural territories.

E-commerce proliferation has fundamentally transformed the CEP ecosystem, with online retail platforms generating approximately 65% of total parcel volumes in metropolitan areas. The market encompasses diverse service categories including same-day delivery, next-day express services, standard courier operations, and specialized logistics solutions for various industry verticals. Digital payment integration and cash-on-delivery options have further accelerated adoption rates, particularly in tier-2 and tier-3 cities where traditional banking infrastructure remains limited.

Infrastructure development across India’s transportation networks has significantly enhanced CEP service capabilities, with improved highway connectivity and expanded air cargo facilities supporting faster delivery timelines. The sector benefits from government initiatives promoting digital India and financial inclusion, creating favorable conditions for sustained market expansion and technological innovation.

The India Courier, Express, and Parcel (CEP) market refers to the comprehensive ecosystem of logistics service providers specializing in time-sensitive delivery of documents, packages, and parcels across domestic and international destinations. This market encompasses traditional courier services, express delivery networks, and parcel distribution systems that facilitate commerce, communication, and supply chain operations throughout the Indian subcontinent.

CEP services distinguish themselves from standard freight and cargo operations through emphasis on speed, reliability, and end-to-end tracking capabilities. These services typically handle smaller shipments with higher value-to-weight ratios, requiring specialized handling procedures and advanced logistics management systems. The market includes both business-to-business (B2B) and business-to-consumer (B2C) delivery segments, with increasing focus on last-mile connectivity and customer experience optimization.

Service categories within the Indian CEP market range from premium same-day delivery options to economical standard courier services, each designed to meet specific customer requirements and budget constraints. The sector has evolved to incorporate advanced technologies including GPS tracking, mobile applications, and automated sorting systems that enhance operational efficiency and service transparency.

Market transformation in India’s CEP sector reflects the broader digitalization of the economy, with traditional logistics providers adapting to meet evolving customer expectations and competitive pressures. The industry has witnessed significant consolidation and strategic partnerships as companies seek to expand geographic coverage and enhance service capabilities. Technology adoption rates have accelerated dramatically, with approximately 78% of major CEP providers implementing advanced tracking and management systems.

E-commerce integration has emerged as a primary growth driver, with online marketplaces and direct-to-consumer brands requiring sophisticated fulfillment and delivery solutions. The sector has responded by developing specialized e-commerce logistics services, including warehousing, inventory management, and flexible delivery options that support diverse business models. Customer preferences increasingly favor convenience and transparency, driving innovation in delivery scheduling, real-time tracking, and customer communication systems.

Regional expansion initiatives have extended CEP services to previously underserved markets, with companies investing in rural connectivity and tier-3 city operations. This geographic diversification has opened new revenue streams while supporting broader economic development objectives. Regulatory compliance and quality standardization efforts have improved service reliability and customer confidence across the sector.

Strategic positioning within India’s CEP market requires understanding of diverse customer segments and their specific logistics requirements. The following insights highlight critical market dynamics:

E-commerce expansion serves as the primary catalyst for CEP market growth, with online retail sales driving unprecedented demand for reliable delivery services. The proliferation of digital marketplaces and direct-to-consumer brands has created a sustained need for sophisticated logistics solutions that can handle diverse product categories and delivery requirements. Consumer behavior shifts toward online shopping have accelerated during recent years, establishing e-commerce as a permanent fixture in the retail landscape.

Digital transformation initiatives across various industry sectors have increased demand for document and parcel delivery services, as businesses adopt paperless operations while maintaining physical distribution requirements. The growth of small and medium enterprises (SMEs) utilizing e-commerce platforms has further expanded the customer base for CEP services. Mobile technology adoption has enabled real-time tracking and communication capabilities that enhance service value propositions.

Infrastructure development programs have improved transportation networks and logistics capabilities, reducing delivery times and expanding service coverage areas. Government initiatives supporting digital payments and financial inclusion have facilitated CEP market growth by enabling secure transaction processing and reducing cash handling complexities. Urbanization trends have concentrated population density in metropolitan areas, creating efficient delivery networks and economies of scale for CEP providers.

Infrastructure limitations in rural and remote areas continue to challenge CEP service expansion, with inadequate road networks and limited transportation options increasing delivery costs and timeframes. The complexity of India’s geographic diversity requires significant investment in logistics infrastructure and local partnerships to achieve comprehensive coverage. Regulatory compliance requirements across different states and territories create operational complexities that impact service efficiency and cost structures.

Price sensitivity among Indian consumers limits premium service adoption, with many customers prioritizing cost over speed and convenience features. This dynamic pressures CEP providers to maintain competitive pricing while investing in service improvements and technology upgrades. Competition intensity has led to margin compression across the sector, requiring companies to achieve operational efficiencies and scale advantages to maintain profitability.

Skilled workforce shortages in logistics and technology sectors impact service quality and operational scalability. The rapid growth of the CEP market has outpaced the development of specialized training programs and professional development initiatives. Security concerns related to package theft and fraud create additional operational costs and customer service challenges that require ongoing investment in prevention and mitigation strategies.

Rural market penetration represents a significant growth opportunity as internet connectivity and smartphone adoption expand beyond urban centers. The development of innovative delivery models tailored to rural infrastructure constraints could unlock substantial market potential while supporting broader economic development objectives. Government initiatives promoting digital inclusion and rural connectivity create favorable conditions for CEP service expansion.

Technology innovation opportunities include artificial intelligence, machine learning, and automation solutions that can optimize routing, reduce operational costs, and improve customer experiences. The integration of Internet of Things (IoT) devices and advanced analytics can enhance package tracking, security, and delivery efficiency. Drone delivery and autonomous vehicle technologies present long-term opportunities for revolutionary service improvements.

Vertical market specialization offers opportunities for CEP providers to develop industry-specific solutions for healthcare, pharmaceuticals, automotive, and other sectors with unique logistics requirements. The growth of cross-border e-commerce creates demand for international CEP services and customs clearance expertise. Sustainability initiatives can differentiate service providers while addressing environmental concerns and regulatory requirements.

Competitive landscape dynamics reflect intense rivalry among established players and emerging technology-driven entrants seeking market share through innovation and service differentiation. Traditional logistics companies are adapting their business models to compete with specialized e-commerce fulfillment providers and technology-enabled startups. Strategic partnerships between CEP providers and e-commerce platforms have become increasingly common as companies seek to optimize service delivery and cost structures.

Customer expectations continue to evolve toward faster delivery times, greater transparency, and enhanced convenience features such as flexible delivery scheduling and alternative pickup locations. According to MarkWide Research analysis, customer satisfaction scores correlate strongly with delivery speed and tracking accuracy, driving operational improvements across the sector. Service differentiation strategies focus on value-added services including packaging, assembly, and installation support.

Technology adoption rates vary significantly across market participants, with larger companies investing heavily in automation and analytics while smaller providers focus on operational efficiency improvements. The integration of artificial intelligence and machine learning technologies is enabling predictive analytics and route optimization capabilities that improve service quality and reduce costs. Market consolidation trends reflect the need for scale advantages and comprehensive service capabilities.

Primary research methodologies employed in analyzing India’s CEP market include comprehensive surveys of industry participants, customer interviews, and expert consultations with logistics professionals and technology providers. Data collection processes encompass both quantitative metrics and qualitative insights to provide a holistic understanding of market dynamics and trends. Industry stakeholders including CEP service providers, e-commerce platforms, and enterprise customers contribute valuable perspectives on market developments and future requirements.

Secondary research components involve analysis of industry reports, government statistics, trade publications, and company financial disclosures to validate primary findings and identify broader market patterns. Regulatory filings and policy documents provide insights into compliance requirements and government initiatives affecting the CEP sector. Market segmentation analysis utilizes multiple data sources to ensure accurate representation of different service categories and customer segments.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends and patterns, and expert review of findings to ensure accuracy and reliability. Forecasting methodologies incorporate historical performance data, current market conditions, and projected economic indicators to develop realistic growth projections. Quality assurance measures ensure that research findings meet professional standards for market analysis and strategic planning applications.

Northern India represents the largest regional market for CEP services, with Delhi NCR serving as a major logistics hub and distribution center for national operations. The region benefits from well-developed transportation infrastructure and high e-commerce penetration rates, generating approximately 28% of national CEP volumes. Industrial clusters in Punjab, Haryana, and Uttar Pradesh create significant B2B demand for express delivery services.

Western India demonstrates strong market performance driven by Mumbai’s commercial importance and Gujarat’s manufacturing base. The region accounts for substantial CEP market share through its concentration of corporate headquarters, financial services, and export-oriented industries. Port connectivity in Mumbai and JNPT supports international courier services and trade-related logistics activities.

Southern India exhibits rapid growth in CEP services, with Bangalore, Chennai, and Hyderabad emerging as technology and automotive industry centers. The region’s IT sector generates significant demand for time-sensitive document and equipment delivery services. E-commerce adoption rates in southern metropolitan areas drive consumer parcel volumes and last-mile delivery innovation.

Eastern India presents emerging opportunities despite infrastructure challenges, with Kolkata serving as the regional logistics center. The region’s industrial development and improving connectivity create growth potential for CEP service expansion. Government initiatives promoting industrial development in eastern states support long-term market growth prospects.

Market leadership in India’s CEP sector is distributed among several major players, each with distinct competitive advantages and service specializations. The competitive environment reflects a mix of international logistics giants, domestic market leaders, and innovative technology-driven entrants.

Competitive strategies emphasize technology integration, service quality improvements, and geographic expansion to capture market share and enhance customer loyalty. Companies are investing in automation, analytics, and customer experience enhancements to differentiate their service offerings.

Service type segmentation divides the Indian CEP market into distinct categories based on delivery speed, service features, and pricing structures. Each segment serves specific customer needs and market requirements:

By Service Type:

By End User:

By Geography:

Express delivery services command premium pricing and higher margins while serving customers with urgent shipping requirements and quality expectations. This segment benefits from corporate demand and international trade activities that prioritize speed and reliability over cost considerations. Service differentiation in express categories focuses on delivery guarantees, tracking capabilities, and customer support quality.

E-commerce logistics represents the fastest-growing segment, driven by online retail expansion and changing consumer shopping behaviors. This category requires specialized capabilities including cash-on-delivery handling, return processing, and last-mile optimization. Volume scalability and operational efficiency are critical success factors for e-commerce-focused CEP providers.

B2B courier services maintain steady demand from corporate customers requiring document delivery, spare parts distribution, and supply chain support. This segment values reliability, security, and professional service quality over speed alone. Industry specialization opportunities exist in sectors such as banking, legal services, and manufacturing with specific logistics requirements.

International courier services benefit from India’s growing trade relationships and cross-border e-commerce activities. This segment requires expertise in customs procedures, regulatory compliance, and global logistics networks. Premium positioning allows international service providers to maintain higher margins while serving sophisticated customer needs.

CEP service providers benefit from India’s expanding digital economy and growing consumer demand for convenient delivery options. The market offers opportunities for revenue growth, geographic expansion, and service diversification across multiple customer segments. Technology investments in automation and analytics can improve operational efficiency while reducing long-term costs and enhancing service quality.

E-commerce platforms gain access to sophisticated logistics capabilities that enable faster delivery times, broader geographic coverage, and improved customer satisfaction scores. Partnership with specialized CEP providers allows online retailers to focus on core business activities while leveraging logistics expertise. Scalability advantages help e-commerce companies manage seasonal demand fluctuations and business growth.

Enterprise customers benefit from reliable supply chain support, reduced inventory requirements, and improved operational efficiency through outsourced logistics services. CEP providers offer specialized solutions for time-sensitive shipments, regulatory compliance, and cost optimization. Service flexibility allows businesses to adapt logistics strategies to changing market conditions and customer requirements.

Consumers enjoy enhanced convenience, faster delivery times, and greater transparency through advanced tracking and communication systems. The competitive market environment drives service improvements and competitive pricing that benefit end users. Payment flexibility and delivery options accommodate diverse preferences and financial capabilities across different customer segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hyperlocal delivery networks are emerging as a critical trend, with CEP providers establishing micro-fulfillment centers and local delivery hubs to reduce last-mile delivery times. This approach enables same-day and even hourly delivery options that meet evolving customer expectations for instant gratification. Urban logistics strategies increasingly focus on optimizing delivery routes and reducing environmental impact through electric vehicles and consolidated delivery systems.

Artificial intelligence integration is transforming operational capabilities through predictive analytics, route optimization, and automated customer service systems. Machine learning algorithms analyze delivery patterns, customer preferences, and operational data to improve efficiency and service quality. Chatbot technology and automated communication systems enhance customer experience while reducing operational costs.

Sustainability initiatives are gaining importance as environmental consciousness increases among consumers and regulatory bodies. CEP providers are investing in electric delivery vehicles, carbon-neutral shipping options, and packaging optimization programs. Green logistics strategies not only address environmental concerns but also create competitive differentiation and cost savings opportunities.

Omnichannel integration reflects the blending of online and offline retail experiences, requiring CEP providers to support diverse fulfillment models including click-and-collect, ship-from-store, and return-to-store services. This trend demands flexible logistics solutions that can adapt to various customer journey scenarios. Inventory optimization across multiple channels requires sophisticated logistics coordination and real-time visibility systems.

Strategic acquisitions and partnerships have reshaped the competitive landscape as companies seek to expand capabilities, geographic coverage, and technology assets. Major logistics providers are acquiring specialized e-commerce fulfillment companies and technology startups to enhance their service portfolios. Consolidation trends reflect the need for scale advantages and comprehensive service capabilities in an increasingly competitive market.

Technology investments in automation, robotics, and artificial intelligence are accelerating across the sector as companies seek operational efficiencies and service improvements. Automated sorting systems, robotic warehouses, and predictive analytics platforms are becoming standard infrastructure components. Digital transformation initiatives encompass customer-facing applications, internal operations systems, and supply chain integration platforms.

Regulatory developments including goods and services tax (GST) implementation and e-commerce regulations have influenced operational strategies and compliance requirements. New policies supporting digital payments and data protection create both opportunities and challenges for CEP providers. Government initiatives promoting logistics infrastructure development and rural connectivity support sector growth objectives.

International expansion activities reflect growing cross-border commerce and the need for global logistics capabilities. Indian CEP providers are establishing international partnerships and service networks to support export businesses and inbound e-commerce. Trade facilitation improvements and customs modernization initiatives enhance international service capabilities and reduce delivery times.

Technology investment should remain a top priority for CEP providers seeking competitive advantages and operational efficiency improvements. Companies should focus on customer-facing technologies that enhance transparency and convenience while implementing backend systems that optimize routing and resource allocation. Data analytics capabilities will become increasingly important for understanding customer behavior and predicting demand patterns.

Geographic expansion strategies should balance growth opportunities with infrastructure requirements and operational complexities. MWR analysis suggests that tier-2 and tier-3 cities offer the best near-term expansion opportunities due to improving connectivity and growing e-commerce adoption. Rural market entry requires innovative delivery models and local partnerships to overcome infrastructure challenges.

Service differentiation through vertical market specialization can create competitive advantages and premium pricing opportunities. Healthcare, pharmaceuticals, and automotive sectors require specialized handling capabilities and compliance expertise that command higher margins. Value-added services including packaging, assembly, and installation support can enhance customer relationships and revenue per shipment.

Sustainability initiatives should be integrated into long-term strategic planning as environmental regulations and customer preferences evolve. Electric vehicle adoption, carbon offset programs, and packaging optimization can create cost savings while addressing environmental concerns. Corporate social responsibility programs can enhance brand reputation and customer loyalty.

Market growth prospects remain robust as India’s digital economy continues expanding and consumer behaviors shift toward online commerce and convenient delivery services. The sector is projected to maintain strong growth momentum with a CAGR of approximately 11.8% over the next five years, driven by e-commerce expansion and technology adoption. Infrastructure improvements and government support for logistics development will create favorable conditions for continued market expansion.

Technology evolution will fundamentally transform CEP operations through automation, artificial intelligence, and Internet of Things integration. Drone delivery trials and autonomous vehicle development suggest revolutionary changes in last-mile logistics capabilities. Customer experience enhancements through predictive delivery, flexible scheduling, and real-time communication will become standard service features rather than competitive differentiators.

Market consolidation trends are expected to continue as companies seek scale advantages and comprehensive service capabilities. Strategic partnerships between CEP providers and e-commerce platforms will deepen, creating integrated logistics ecosystems. International expansion will accelerate as cross-border commerce grows and Indian businesses increase global trade activities.

Regulatory evolution will shape operational requirements and competitive dynamics, with potential impacts on pricing, service standards, and market entry barriers. Environmental regulations and sustainability requirements will influence operational strategies and investment priorities. MarkWide Research projects that companies adapting quickly to regulatory changes and customer expectations will achieve superior market positioning and financial performance.

The India Courier, Express, and Parcel (CEP) market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s digital economy transformation. E-commerce growth and changing consumer behaviors have created unprecedented demand for sophisticated logistics services, driving innovation and investment across the industry. The market’s strong growth trajectory, supported by improving infrastructure and technology adoption, positions it as a key enabler of India’s economic development.

Competitive dynamics continue to intensify as traditional logistics providers, international express companies, and technology-driven startups compete for market share through service differentiation and operational excellence. Success in this environment requires strategic focus on customer experience, technology integration, and operational efficiency while maintaining competitive pricing structures. Market leaders are those companies that successfully balance growth investments with profitability requirements while adapting to evolving customer needs.

Future success in India’s CEP market will depend on companies’ ability to leverage technology for operational improvements, expand geographic coverage to underserved markets, and develop specialized solutions for vertical market segments. The sector’s continued evolution toward sustainability, automation, and customer-centricity will create new opportunities for innovation and growth while challenging existing business models and operational approaches.

What is Courier, Express, and Parcel (CEP)?

Courier, Express, and Parcel (CEP) refers to services that facilitate the rapid delivery of packages and documents. This includes various delivery options such as same-day, next-day, and scheduled deliveries across different sectors including e-commerce, retail, and logistics.

Who are the key players in the India Courier, Express, and Parcel (CEP) Market?

Key players in the India Courier, Express, and Parcel (CEP) Market include Blue Dart, DTDC, and India Post, among others. These companies offer a range of services tailored to meet the needs of businesses and consumers alike.

What are the growth factors driving the India Courier, Express, and Parcel (CEP) Market?

The growth of the India Courier, Express, and Parcel (CEP) Market is driven by the rise of e-commerce, increasing consumer demand for fast delivery services, and advancements in logistics technology. Additionally, urbanization and changing consumer behaviors are contributing to market expansion.

What challenges does the India Courier, Express, and Parcel (CEP) Market face?

The India Courier, Express, and Parcel (CEP) Market faces challenges such as high operational costs, regulatory hurdles, and competition from unorganized players. Additionally, infrastructure limitations in certain regions can hinder service efficiency.

What opportunities exist in the India Courier, Express, and Parcel (CEP) Market?

Opportunities in the India Courier, Express, and Parcel (CEP) Market include the expansion of last-mile delivery services, the integration of technology for improved tracking and customer service, and the potential for partnerships with e-commerce platforms. These factors can enhance service offerings and customer satisfaction.

What trends are shaping the India Courier, Express, and Parcel (CEP) Market?

Trends shaping the India Courier, Express, and Parcel (CEP) Market include the increasing use of automation and AI in logistics, the growth of green logistics initiatives, and the rise of contactless delivery options. These trends are influencing how companies operate and meet customer expectations.

India Courier, Express, and Parcel (CEP) Market

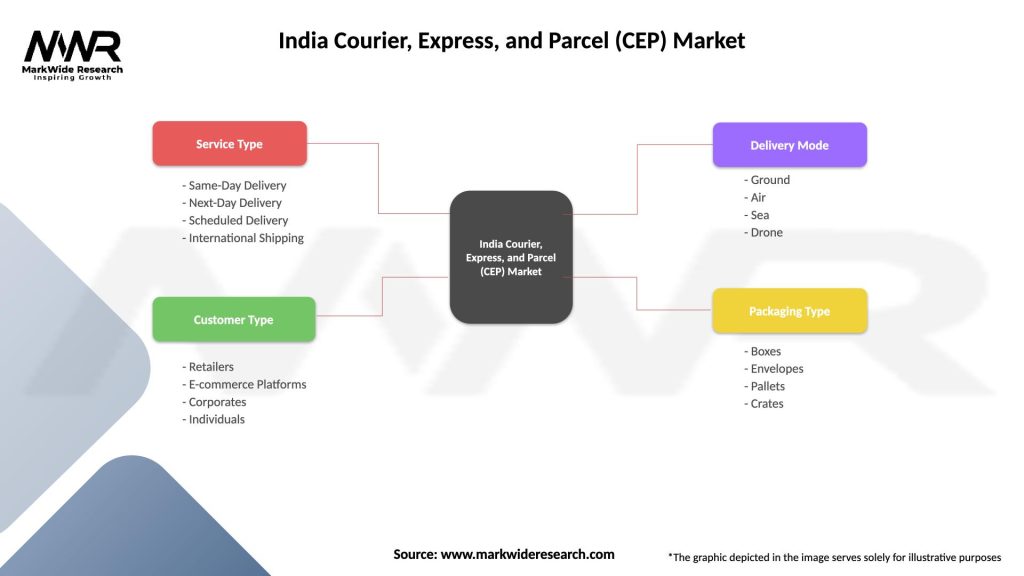

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Scheduled Delivery, International Shipping |

| Customer Type | Retailers, E-commerce Platforms, Corporates, Individuals |

| Delivery Mode | Ground, Air, Sea, Drone |

| Packaging Type | Boxes, Envelopes, Pallets, Crates |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Courier, Express, and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at