444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Contract Manufacturing Organization (CMO) market represents one of the most dynamic and rapidly expanding sectors within the global pharmaceutical and biotechnology landscape. This comprehensive ecosystem encompasses a diverse range of manufacturing services, from active pharmaceutical ingredients (APIs) to finished dosage forms, catering to both domestic and international pharmaceutical companies. India’s strategic position as a global manufacturing hub has been strengthened by its robust regulatory framework, skilled workforce, and cost-effective production capabilities.

Market dynamics indicate that the Indian CMO sector is experiencing unprecedented growth, driven by increasing demand for outsourced manufacturing services from multinational pharmaceutical companies. The sector benefits from significant cost advantages, with manufacturing costs typically 40-60% lower than those in developed markets. This competitive pricing, combined with high-quality standards and regulatory compliance, has positioned India as the preferred destination for contract manufacturing services globally.

Regulatory excellence has become a cornerstone of India’s CMO market success, with the country maintaining one of the world’s largest networks of FDA-approved manufacturing facilities outside the United States. The sector encompasses various specialized segments including sterile manufacturing, oncology products, controlled substances, and complex generics, each requiring distinct expertise and infrastructure investments.

The India Contract Manufacturing Organization (CMO) market refers to the comprehensive ecosystem of third-party pharmaceutical manufacturing service providers that offer production capabilities, regulatory expertise, and supply chain solutions to pharmaceutical and biotechnology companies seeking to outsource their manufacturing operations in the Indian subcontinent.

Contract manufacturing organizations in India provide end-to-end manufacturing services spanning the entire pharmaceutical value chain. These services include formulation development, analytical testing, regulatory support, commercial manufacturing, packaging, and distribution. The CMO model enables pharmaceutical companies to leverage India’s manufacturing expertise while focusing on their core competencies such as research and development, marketing, and commercialization strategies.

Strategic partnerships between global pharmaceutical companies and Indian CMOs have evolved beyond traditional manufacturing relationships to encompass comprehensive development and manufacturing agreements. These partnerships often include technology transfer, process optimization, regulatory filing support, and long-term supply agreements that provide mutual benefits and risk sharing between partners.

India’s Contract Manufacturing Organization market stands as a testament to the country’s transformation into a global pharmaceutical manufacturing powerhouse. The sector has demonstrated remarkable resilience and adaptability, particularly during challenging global circumstances, reinforcing its position as a reliable partner for international pharmaceutical companies. Growth trajectories indicate sustained expansion driven by increasing outsourcing trends, regulatory harmonization, and continuous infrastructure investments.

Key market characteristics include a highly fragmented landscape with numerous specialized players, ranging from large integrated pharmaceutical companies offering CMO services to dedicated contract manufacturing specialists. The market benefits from strong government support through various policy initiatives, including the Production Linked Incentive (PLI) scheme, which has attracted significant investments in manufacturing infrastructure and capabilities.

Competitive advantages of the Indian CMO market include cost competitiveness, regulatory compliance, skilled workforce availability, and established supply chain networks. The sector has successfully navigated complex global regulatory requirements, with Indian CMOs maintaining over 2,000 regulatory approvals from various international regulatory authorities, demonstrating their commitment to quality and compliance standards.

Strategic market positioning reveals several critical insights that define the India CMO market landscape:

Primary growth drivers propelling the India CMO market forward encompass both domestic and international factors that create favorable conditions for sustained expansion. The increasing trend toward pharmaceutical outsourcing globally has created unprecedented opportunities for Indian contract manufacturers to expand their service offerings and client base.

Cost competitiveness remains a fundamental driver, with Indian CMOs offering manufacturing services at significantly lower costs compared to developed markets. This cost advantage extends beyond labor costs to include raw materials, utilities, and operational expenses, enabling pharmaceutical companies to achieve substantial cost savings while maintaining quality standards. Manufacturing cost reductions of up to 50-70% compared to Western markets continue to attract international clients.

Regulatory harmonization and compliance excellence have emerged as critical drivers, with Indian CMOs investing heavily in maintaining international quality standards. The country’s regulatory framework has evolved to align with global standards, facilitating easier market access for products manufactured in India. Government initiatives including the PLI scheme have provided additional momentum by incentivizing investments in pharmaceutical manufacturing infrastructure.

Technological advancement and innovation adoption have become key differentiators, with leading CMOs implementing advanced manufacturing technologies, automation systems, and digital quality management platforms. These investments enhance operational efficiency, reduce manufacturing timelines, and improve overall service quality, making Indian CMOs more attractive to international pharmaceutical companies seeking reliable manufacturing partners.

Regulatory challenges continue to pose significant constraints for the India CMO market, particularly regarding compliance with evolving international regulatory requirements. While Indian manufacturers have made substantial progress in meeting global standards, occasional regulatory observations and compliance issues can impact market confidence and growth prospects. Regulatory complexity across different markets requires continuous investment in compliance infrastructure and expertise.

Quality perception issues occasionally surface in international markets, despite significant improvements in manufacturing standards and regulatory compliance. Historical quality concerns and isolated incidents can create lasting impressions that require sustained efforts to overcome. Building and maintaining trust with international pharmaceutical companies requires consistent demonstration of quality excellence and regulatory compliance.

Infrastructure limitations in certain regions and for specific manufacturing requirements can constrain market growth. While major pharmaceutical hubs have well-developed infrastructure, expanding into specialized manufacturing areas or emerging regions may face infrastructure challenges. Capacity constraints during peak demand periods can also limit growth opportunities for some market segments.

Skilled workforce availability for specialized manufacturing areas represents an ongoing challenge, particularly for complex manufacturing processes and emerging therapeutic areas. While India has a large pool of technical talent, specific expertise in areas such as biologics manufacturing, sterile processing, and advanced drug delivery systems may require additional training and development investments.

Emerging therapeutic areas present substantial growth opportunities for Indian CMOs, particularly in biologics manufacturing, cell and gene therapy, and personalized medicine. The global shift toward complex therapeutic modalities creates demand for specialized manufacturing capabilities that Indian CMOs can develop to capture new market segments. Biologics manufacturing represents a particularly attractive opportunity given the growing demand and limited global capacity.

Market expansion into new geographical regions offers significant growth potential, with Indian CMOs increasingly exploring opportunities in emerging markets across Asia, Africa, and Latin America. These markets offer less competitive landscapes and growing pharmaceutical demand, providing opportunities for Indian CMOs to establish strong market positions. Regional market penetration strategies can leverage India’s cost advantages and regulatory expertise.

Vertical integration opportunities allow CMOs to expand their service offerings along the pharmaceutical value chain, including drug development services, analytical testing, regulatory support, and supply chain management. This comprehensive service approach can strengthen client relationships and increase revenue per client while providing competitive differentiation in the market.

Technology partnerships and collaborations with international pharmaceutical companies can accelerate capability development and market access. Strategic alliances can facilitate technology transfer, joint investments in specialized facilities, and long-term supply agreements that provide mutual benefits and sustainable growth opportunities for Indian CMOs.

Supply and demand dynamics in the India CMO market reflect the complex interplay between global pharmaceutical outsourcing trends and India’s manufacturing capabilities. Demand patterns show increasing preference for outsourcing complex manufacturing processes, driven by pharmaceutical companies’ focus on core competencies and cost optimization strategies. This trend has created sustained demand growth for Indian CMO services across various therapeutic areas and manufacturing complexities.

Competitive dynamics within the market have intensified as more players enter the CMO space and existing companies expand their capabilities. Competition occurs on multiple dimensions including cost, quality, regulatory compliance, technological capabilities, and service breadth. Market consolidation trends are emerging as larger players acquire specialized capabilities and smaller companies to enhance their competitive positioning.

Pricing dynamics reflect the balance between cost competitiveness and quality requirements, with Indian CMOs maintaining pricing advantages while investing in quality improvements and regulatory compliance. Value-based pricing models are increasingly adopted, where pricing reflects the comprehensive value proposition including quality, reliability, and service excellence rather than purely cost-based competition.

Innovation dynamics drive continuous improvement in manufacturing processes, quality systems, and service offerings. Indian CMOs are increasingly investing in research and development capabilities, advanced manufacturing technologies, and digital transformation initiatives to enhance their competitive positioning and meet evolving client requirements.

Comprehensive market analysis for the India CMO market employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework encompasses quantitative analysis of market trends, competitive landscape assessment, and qualitative evaluation of market dynamics and future opportunities.

Primary research activities include extensive interviews with industry executives, regulatory experts, and market participants across the CMO value chain. These interviews provide firsthand insights into market trends, challenges, opportunities, and strategic priorities that shape the industry landscape. Survey methodologies capture quantitative data on market preferences, pricing trends, and growth expectations from key market stakeholders.

Secondary research encompasses comprehensive analysis of industry reports, regulatory filings, company financial statements, and government publications to validate primary research findings and provide broader market context. Data triangulation ensures accuracy and reliability of market insights by cross-referencing multiple data sources and analytical approaches.

Market modeling techniques incorporate various analytical frameworks including Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide comprehensive market understanding. These analytical tools help identify key market drivers, competitive dynamics, and strategic opportunities that influence market development and growth prospects.

Geographic distribution of India’s CMO market reveals distinct regional clusters with specialized capabilities and competitive advantages. Western India, particularly Maharashtra and Gujarat, dominates the market with approximately 45% market share, hosting numerous large-scale pharmaceutical manufacturing facilities and established CMO operations. This region benefits from well-developed infrastructure, proximity to major ports, and concentrated pharmaceutical industry presence.

Southern India represents another significant market cluster, with states like Karnataka, Telangana, and Tamil Nadu contributing around 30% of total CMO capacity. The region has emerged as a hub for biotechnology and specialty pharmaceutical manufacturing, with several companies establishing dedicated biologics and complex generics manufacturing facilities. Bangalore and Hyderabad have become particularly important centers for high-value manufacturing and research activities.

Northern India maintains a substantial presence in the CMO market, with states like Himachal Pradesh and Punjab hosting numerous pharmaceutical manufacturing facilities. The region benefits from favorable state government policies, including tax incentives and infrastructure support, which have attracted significant investments in pharmaceutical manufacturing capabilities.

Eastern India represents an emerging opportunity for CMO market expansion, with states like West Bengal and Odisha developing pharmaceutical manufacturing capabilities. While currently representing a smaller market share, the region offers potential for future growth driven by government initiatives and infrastructure development programs.

Market leadership in the India CMO sector is characterized by a diverse mix of integrated pharmaceutical companies offering contract manufacturing services and dedicated CMO specialists. The competitive landscape reflects varying strategic approaches, from broad-based service offerings to specialized niche capabilities.

Competitive differentiation occurs through various factors including technological capabilities, regulatory compliance, cost competitiveness, and service breadth. Leading players invest continuously in capacity expansion, technology upgrades, and regulatory compliance to maintain competitive advantages and capture market opportunities.

Service-based segmentation of the India CMO market reveals distinct categories based on manufacturing complexity and specialization requirements:

By Service Type:

By Therapeutic Area:

By Client Type:

API Manufacturing segment represents the largest category within the India CMO market, leveraging the country’s strong chemical manufacturing capabilities and cost advantages. This segment benefits from established supply chains, skilled workforce, and regulatory expertise that enable competitive pricing while maintaining quality standards. Growth rates in this segment remain robust, driven by increasing global demand for cost-effective API sourcing.

Finished Dosage Forms manufacturing has emerged as a high-growth category, with Indian CMOs expanding capabilities in complex generics, specialty formulations, and novel drug delivery systems. This segment requires higher technological capabilities and regulatory compliance but offers better margins and stronger client relationships. Investment trends show increasing focus on advanced manufacturing technologies and automation in this category.

Sterile Manufacturing represents a specialized high-value category with significant growth potential. The segment requires substantial infrastructure investments and specialized expertise but offers attractive margins and limited competition. Capacity utilization rates in sterile manufacturing facilities typically exceed 80%, indicating strong demand and limited supply in this specialized segment.

Oncology Manufacturing has become an increasingly important category as global cancer incidence rises and new oncology drugs enter the market. This segment requires specialized containment facilities, trained personnel, and stringent safety protocols, creating barriers to entry but also providing competitive advantages for established players with appropriate capabilities.

Pharmaceutical companies partnering with Indian CMOs realize substantial benefits including significant cost reductions, access to specialized manufacturing capabilities, and improved operational flexibility. These partnerships enable companies to focus resources on core competencies while leveraging India’s manufacturing expertise and cost advantages. Cost savings typically range from 40-60% compared to manufacturing in developed markets.

Risk mitigation represents another key benefit, with CMO partnerships providing supply chain diversification, regulatory expertise, and operational redundancy. Indian CMOs’ strong regulatory compliance track record and established quality systems help pharmaceutical companies meet global regulatory requirements while reducing compliance risks and operational complexities.

Market access facilitation through Indian CMO partnerships enables pharmaceutical companies to enter emerging markets more effectively. Indian CMOs’ understanding of regional regulatory requirements, distribution networks, and market dynamics provides valuable support for companies seeking to expand their global presence, particularly in Asia-Pacific and other emerging markets.

Innovation collaboration opportunities arise through partnerships with Indian CMOs that invest in research and development capabilities. These collaborations can accelerate product development timelines, reduce development costs, and provide access to specialized expertise in areas such as formulation development, process optimization, and analytical method development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation has emerged as a dominant trend in the India CMO market, with companies investing heavily in automation, data analytics, and digital quality management systems. Industry 4.0 adoption is accelerating, with leading CMOs implementing advanced manufacturing execution systems, real-time monitoring capabilities, and predictive maintenance technologies to enhance operational efficiency and quality consistency.

Sustainability initiatives are gaining prominence as environmental consciousness increases among pharmaceutical companies and regulatory authorities. Indian CMOs are implementing green manufacturing practices, waste reduction programs, and renewable energy adoption to meet sustainability requirements and reduce environmental impact. Environmental compliance has become a key differentiator in client selection processes.

Specialized manufacturing capabilities development represents a critical trend, with CMOs investing in niche areas such as controlled substances, high-potency APIs, and complex drug delivery systems. These specialized capabilities command premium pricing and create competitive barriers, enabling CMOs to differentiate themselves in an increasingly competitive market landscape.

Strategic partnerships and long-term collaborations are becoming more prevalent, with pharmaceutical companies seeking deeper relationships with CMO partners beyond traditional manufacturing agreements. These partnerships often include joint investments, technology sharing, and collaborative development programs that create mutual value and strengthen competitive positioning for both parties.

Regulatory milestone achievements have marked significant progress for the India CMO market, with numerous facilities receiving approvals from international regulatory authorities. Recent approvals from FDA, EMA, and other major regulatory bodies have expanded market access opportunities and reinforced confidence in Indian manufacturing quality standards.

Capacity expansion announcements across the industry indicate strong growth confidence, with major CMOs investing in new manufacturing facilities and technology upgrades. MarkWide Research analysis indicates that announced capacity expansions could increase overall industry capacity by 25-30% over the next three years, reflecting strong demand expectations and growth optimism.

Technology partnerships and licensing agreements have accelerated capability development, with Indian CMOs collaborating with international technology providers to access advanced manufacturing technologies and processes. These partnerships enable rapid capability development and help Indian CMOs stay competitive in technologically demanding market segments.

Merger and acquisition activities have increased as companies seek to consolidate capabilities and achieve scale advantages. Strategic acquisitions enable companies to expand therapeutic area expertise, geographic reach, and technological capabilities while achieving operational synergies and market consolidation benefits.

Strategic recommendations for India CMO market participants emphasize the importance of continuous investment in quality systems, regulatory compliance, and technological capabilities. Companies should prioritize building strong quality management systems that exceed international standards and demonstrate consistent compliance with global regulatory requirements. Quality excellence remains the foundation for sustainable competitive advantage in the global CMO market.

Capability diversification strategies should focus on developing specialized manufacturing expertise in high-growth therapeutic areas such as biologics, oncology, and complex generics. These specialized capabilities command premium pricing and create competitive differentiation that enables sustainable growth and profitability improvements. Investment priorities should align with market demand trends and client requirements.

Digital transformation initiatives should be accelerated to enhance operational efficiency, quality consistency, and client service capabilities. Implementation of advanced manufacturing technologies, data analytics platforms, and digital quality management systems can provide significant competitive advantages and operational improvements. Technology adoption should be strategic and aligned with business objectives.

Market expansion strategies should consider both geographic diversification and service portfolio expansion to reduce concentration risks and capture new growth opportunities. Companies should evaluate opportunities in emerging markets while simultaneously developing comprehensive service offerings that provide greater value to clients and strengthen competitive positioning.

Long-term growth prospects for the India CMO market remain highly favorable, driven by sustained global pharmaceutical outsourcing trends, India’s competitive advantages, and continuous capability development investments. Market expansion is expected to continue at robust rates, with growth projections indicating sustained double-digit growth over the next five years across multiple market segments.

Technological evolution will play a crucial role in shaping the future market landscape, with advanced manufacturing technologies, automation systems, and digital platforms becoming standard requirements for competitive participation. Companies that successfully integrate these technologies while maintaining cost competitiveness will capture disproportionate market share and profitability improvements.

Regulatory harmonization trends are expected to facilitate market access and reduce compliance complexities, enabling Indian CMOs to expand their global presence more effectively. Continued alignment between Indian regulatory standards and international requirements will strengthen market confidence and accelerate growth opportunities in regulated markets.

Market consolidation is likely to continue as companies seek scale advantages, capability diversification, and operational synergies. This consolidation will create larger, more capable CMO organizations that can better serve global pharmaceutical companies’ evolving requirements while maintaining competitive pricing and service excellence. MWR projections suggest that market consolidation could result in 15-20% market share concentration among leading players over the next decade.

India’s Contract Manufacturing Organization market stands at a pivotal juncture, with exceptional growth opportunities balanced against evolving challenges and competitive dynamics. The market’s fundamental strengths, including cost competitiveness, regulatory compliance capabilities, and skilled workforce availability, provide a solid foundation for sustained growth and global market leadership.

Strategic success factors for market participants will increasingly center on quality excellence, technological innovation, and comprehensive service capabilities that meet the evolving needs of global pharmaceutical companies. Companies that successfully navigate regulatory complexities while maintaining cost advantages and service quality will capture the most attractive growth opportunities in this dynamic market environment.

Future market development will be shaped by technological advancement, regulatory evolution, and changing client requirements that demand greater specialization and service integration. The India CMO market is well-positioned to meet these challenges while continuing to provide exceptional value to global pharmaceutical companies seeking reliable, cost-effective manufacturing solutions. Sustained investment in capabilities, quality systems, and market development will ensure continued leadership in the global contract manufacturing landscape.

What is Contract Manufacturing Organization (CMO)?

A Contract Manufacturing Organization (CMO) is a company that provides manufacturing services to other companies in the pharmaceutical, biotechnology, and medical device industries. CMOs handle various aspects of production, including formulation, packaging, and quality control.

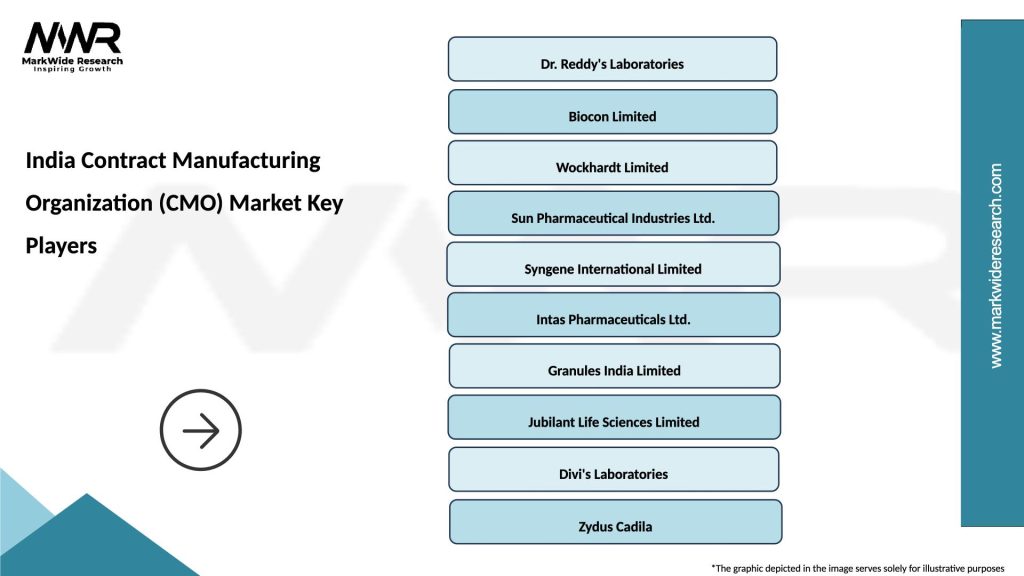

What are the key players in the India Contract Manufacturing Organization (CMO) Market?

Key players in the India Contract Manufacturing Organization (CMO) Market include companies like Jubilant Life Sciences, Syngene International, and Piramal Pharma Solutions, among others. These companies offer a range of services from drug development to commercial manufacturing.

What are the growth factors driving the India Contract Manufacturing Organization (CMO) Market?

The India Contract Manufacturing Organization (CMO) Market is driven by factors such as the increasing demand for cost-effective manufacturing solutions, the rise in outsourcing by pharmaceutical companies, and advancements in technology that enhance production efficiency.

What challenges does the India Contract Manufacturing Organization (CMO) Market face?

The India Contract Manufacturing Organization (CMO) Market faces challenges such as regulatory compliance issues, quality assurance concerns, and competition from other low-cost manufacturing regions. These factors can impact operational efficiency and market growth.

What opportunities exist in the India Contract Manufacturing Organization (CMO) Market?

Opportunities in the India Contract Manufacturing Organization (CMO) Market include the expansion of biopharmaceuticals, increasing investments in research and development, and the growing trend of personalized medicine. These factors are likely to create new avenues for growth.

What trends are shaping the India Contract Manufacturing Organization (CMO) Market?

Trends shaping the India Contract Manufacturing Organization (CMO) Market include the adoption of advanced manufacturing technologies, a focus on sustainability practices, and the increasing integration of digital solutions in production processes. These trends are transforming how CMOs operate.

India Contract Manufacturing Organization (CMO) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Biologics, Small Molecules, Injectables, Oral Solid Dosage |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Contract Research Organizations |

| Service Type | Process Development, Analytical Services, Packaging, Quality Control |

| Technology | Cell Culture, Fermentation, Purification, Lyophilization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Contract Manufacturing Organization (CMO) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at