444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India construction ornamental stone market represents a vibrant and rapidly expanding sector within the country’s construction industry, driven by increasing urbanization, infrastructure development, and growing demand for aesthetic building materials. Natural stone products including granite, marble, sandstone, and limestone have become integral components of modern architectural projects across residential, commercial, and institutional segments. The market encompasses various applications from flooring and wall cladding to decorative facades and landscaping elements.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion is primarily attributed to India’s booming construction sector, rising disposable incomes, and increasing preference for premium building materials. Regional distribution shows significant concentration in states like Rajasthan, Karnataka, Andhra Pradesh, and Tamil Nadu, which serve as major production hubs for ornamental stones.

Technology adoption has revolutionized the industry, with advanced quarrying techniques, precision cutting equipment, and automated processing systems enhancing product quality and operational efficiency. The market benefits from India’s abundant natural stone reserves and established export infrastructure, positioning the country as a global leader in ornamental stone production and supply.

The India construction ornamental stone market refers to the comprehensive ecosystem encompassing extraction, processing, distribution, and application of decorative natural stones used in construction and architectural projects across the Indian subcontinent. This market includes various stone types such as granite, marble, sandstone, limestone, slate, and quartzite that are specifically processed and finished for aesthetic and functional applications in building construction.

Ornamental stones distinguish themselves from regular construction stones through their enhanced visual appeal, superior finish quality, and specialized processing techniques that highlight natural patterns, colors, and textures. These materials serve both structural and decorative purposes, contributing to the architectural beauty while providing durability and longevity to construction projects.

The market encompasses the entire value chain from quarry operations and stone processing facilities to wholesale distribution networks and retail outlets serving architects, builders, contractors, and individual consumers seeking premium building materials for various construction applications.

India’s construction ornamental stone market demonstrates exceptional growth momentum, supported by the country’s expanding construction sector and increasing consumer preference for natural building materials. The market benefits from abundant domestic stone reserves, established processing infrastructure, and growing export opportunities that position India as a global ornamental stone supplier.

Key growth drivers include rapid urbanization, infrastructure development initiatives, rising construction activities in tier-2 and tier-3 cities, and increasing adoption of premium building materials in residential and commercial projects. The market shows 65% concentration in granite and marble segments, with sandstone and limestone gaining traction in heritage restoration and contemporary architectural projects.

Regional analysis reveals strong market presence across major stone-producing states, with Rajasthan leading in sandstone production, Karnataka dominating granite supply, and Rajasthan and Gujarat emerging as major marble processing centers. The market faces challenges related to environmental regulations, mining permissions, and transportation costs, while opportunities exist in export markets, value-added products, and sustainable quarrying practices.

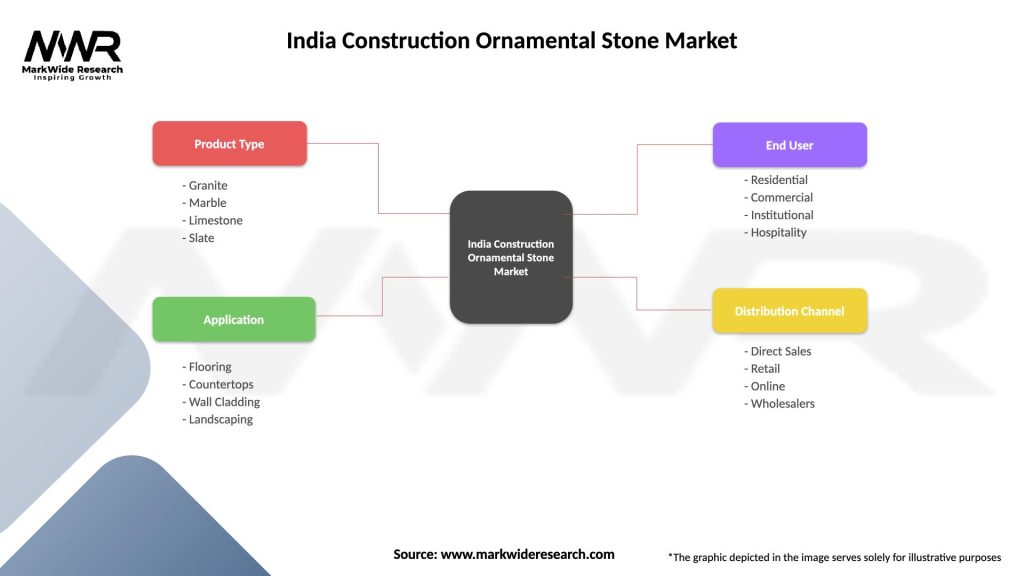

Market segmentation analysis reveals diverse applications and product categories driving growth across the India construction ornamental stone sector:

Consumer preferences show increasing demand for customized stone products, unique finishes, and sustainable sourcing practices. The market demonstrates strong correlation between economic growth and ornamental stone consumption, with premium segments showing resilience during economic fluctuations.

Urbanization and infrastructure development serve as primary catalysts for the India construction ornamental stone market growth. The government’s focus on smart cities, affordable housing, and infrastructure modernization creates substantial demand for quality building materials, including decorative stones for public buildings, commercial complexes, and residential projects.

Rising disposable incomes and changing lifestyle preferences drive consumer demand for premium building materials in residential construction. Homeowners increasingly prioritize aesthetic appeal and durability, leading to higher adoption of natural stones in flooring, wall cladding, and exterior applications. This trend is particularly pronounced in metropolitan areas and emerging urban centers.

Tourism and hospitality sector expansion contributes significantly to market growth, with hotels, resorts, and commercial establishments investing in ornamental stones to create attractive and durable interiors. The heritage tourism segment specifically drives demand for traditional stones like sandstone and marble for restoration and new construction projects.

Export opportunities provide substantial growth potential, with India’s competitive advantage in stone quality, processing capabilities, and cost-effectiveness attracting international buyers. Growing global demand for natural building materials and India’s established export infrastructure support market expansion beyond domestic boundaries.

Environmental regulations and mining restrictions pose significant challenges to market growth, with stricter policies governing quarrying operations, environmental clearances, and sustainable mining practices. These regulations, while necessary for environmental protection, increase operational costs and limit expansion opportunities for stone producers.

Transportation and logistics costs impact market competitiveness, particularly for long-distance shipments and export operations. The heavy nature of stone products requires specialized transportation infrastructure, and rising fuel costs directly affect product pricing and profit margins across the value chain.

Skilled labor shortage affects both quarrying and processing operations, with traditional stone craftsmanship requiring specialized skills that are becoming increasingly scarce. This challenge impacts product quality, production efficiency, and the ability to meet growing market demand for customized and premium stone products.

Competition from alternative materials including engineered stones, ceramic tiles, and composite materials presents ongoing challenges. These alternatives often offer consistent quality, lower maintenance requirements, and competitive pricing, requiring natural stone producers to emphasize unique value propositions and quality advantages.

Value-added product development presents significant opportunities for market expansion, with increasing demand for customized stone products, unique finishes, and application-specific solutions. Manufacturers can capitalize on advanced processing technologies to create differentiated products that command premium pricing and serve niche market segments.

Export market expansion offers substantial growth potential, particularly in emerging economies and regions with growing construction activities. India’s competitive advantages in stone quality, processing capabilities, and cost-effectiveness position the country favorably for international market penetration and long-term export growth.

Sustainable quarrying and processing practices create opportunities for market differentiation and access to environmentally conscious consumer segments. Companies adopting eco-friendly practices can benefit from regulatory compliance, improved brand image, and access to green building certification programs.

Technology integration and automation provide opportunities for operational efficiency improvements, quality enhancement, and cost reduction. Advanced quarrying equipment, precision cutting systems, and automated processing lines can significantly improve productivity and product consistency while reducing labor dependency.

Supply chain dynamics in the India construction ornamental stone market reflect complex interactions between quarry operators, processing facilities, distributors, and end-users. The market demonstrates seasonal variations in demand, with peak construction activities during favorable weather conditions driving higher stone consumption and pricing fluctuations.

Competitive landscape features a mix of large integrated players and numerous small-scale operators, creating diverse market dynamics. Large companies benefit from economies of scale, advanced processing capabilities, and established distribution networks, while smaller players compete through specialized products, local market knowledge, and competitive pricing strategies.

Price volatility remains a significant market characteristic, influenced by factors including raw material availability, transportation costs, regulatory changes, and demand fluctuations. Market participants must navigate these dynamics through strategic planning, inventory management, and flexible pricing strategies to maintain profitability and market position.

Innovation trends focus on product development, processing technology advancement, and sustainable practices. Companies investing in research and development, quality improvement, and environmental compliance demonstrate stronger market positioning and growth potential in the evolving competitive landscape.

Primary research methodology employed comprehensive data collection through structured interviews with industry stakeholders, including quarry operators, processing companies, distributors, architects, and construction professionals. This approach provided firsthand insights into market trends, challenges, opportunities, and future growth prospects across different market segments and geographic regions.

Secondary research analysis incorporated extensive review of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. This methodology ensured comprehensive coverage of market dynamics, competitive landscape, and regulatory environment affecting the ornamental stone sector.

Market sizing and forecasting utilized multiple analytical approaches including top-down and bottom-up methodologies, cross-referencing production data, consumption patterns, and trade statistics to develop accurate market assessments. MarkWide Research analytical frameworks provided robust foundation for market projections and trend analysis.

Data validation processes included triangulation of information sources, expert consultations, and statistical analysis to ensure research accuracy and reliability. The methodology incorporated regional variations, seasonal factors, and market segment differences to provide comprehensive market understanding and actionable insights for industry participants.

Northern India represents a significant market segment, with Rajasthan leading in sandstone and marble production and processing. The region benefits from abundant stone reserves, established quarrying infrastructure, and proximity to major construction markets in Delhi, Punjab, and Haryana. Regional market share accounts for approximately 32% of total production, with strong export orientation and growing domestic demand.

Southern India dominates granite production and processing, with Karnataka, Andhra Pradesh, and Tamil Nadu serving as major production centers. The region’s advanced processing capabilities, port connectivity, and established export infrastructure support both domestic and international market supply. Technology adoption rates in this region exceed 75% for advanced processing equipment.

Western India shows strong market presence in marble processing and distribution, with Gujarat and Maharashtra emerging as important processing and consumption centers. The region benefits from industrial development, urbanization, and proximity to major ports for export operations, contributing significantly to market growth and development.

Eastern and Central India demonstrate growing market potential, with increasing construction activities and infrastructure development driving demand for ornamental stones. These regions offer opportunities for market expansion, particularly in tier-2 and tier-3 cities experiencing rapid urbanization and economic growth.

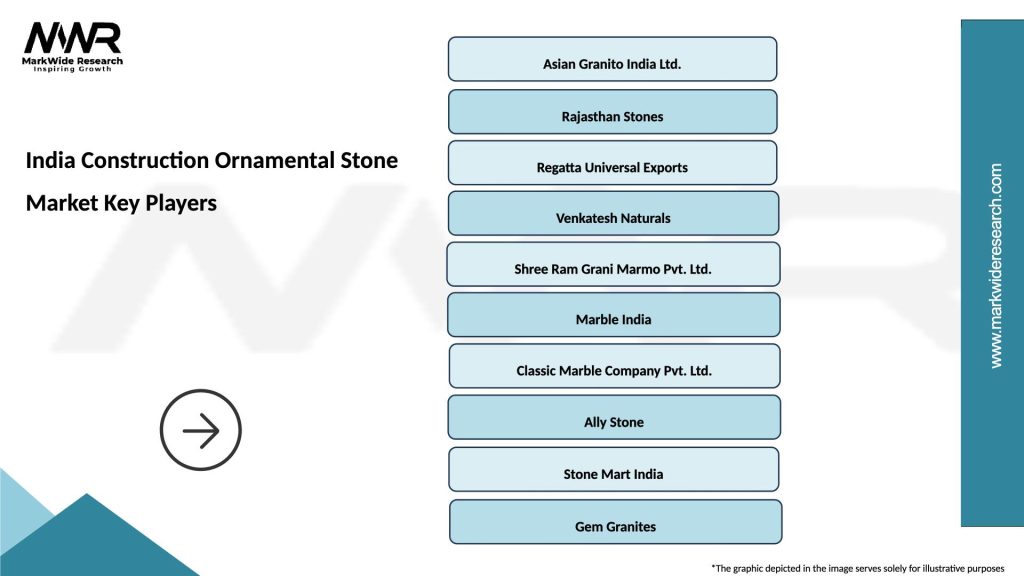

Market leadership in the India construction ornamental stone sector features several prominent companies with strong market positions and comprehensive product portfolios:

Competitive strategies focus on product quality enhancement, processing technology advancement, distribution network expansion, and customer service improvement. Companies are investing in sustainable practices, value-added products, and export market development to maintain competitive advantages and drive long-term growth.

Market consolidation trends show increasing integration along the value chain, with larger companies acquiring quarrying rights, processing facilities, and distribution assets to achieve operational synergies and market control. This consolidation creates opportunities for efficiency improvements and quality standardization across the industry.

By Stone Type:

By Application:

By End-User:

Granite Category Analysis: The granite segment maintains market leadership through superior physical properties, including high durability, scratch resistance, and low maintenance requirements. Product innovations focus on surface finishes, edge treatments, and customized sizing to meet diverse architectural requirements. The category benefits from established processing infrastructure and strong export demand from international markets.

Marble Category Dynamics: The marble segment serves premium market applications with emphasis on aesthetic appeal and luxury positioning. Quality differentiation based on color consistency, veining patterns, and surface finish creates distinct market tiers with varying price points. Italian marble imports compete with domestic varieties, driving quality improvements and processing technology advancement.

Sandstone Category Growth: Traditional sandstone applications in heritage restoration drive steady demand, while contemporary architecture increasingly adopts sandstone for natural texture and thermal properties. Regional varieties from Rajasthan, Madhya Pradesh, and Uttar Pradesh offer distinct characteristics serving different architectural styles and applications.

Emerging Categories: Limestone, slate, and specialty stones demonstrate growing market acceptance through unique properties and applications. These categories benefit from increasing architect awareness, sustainable building trends, and demand for distinctive architectural elements in modern construction projects.

For Quarry Operators: The expanding market provides opportunities for increased production volumes, premium pricing for quality products, and long-term supply contracts with processing companies. Sustainable quarrying practices create competitive advantages through regulatory compliance and environmental certifications that appeal to conscious consumers and export markets.

For Processing Companies: Advanced processing capabilities enable value addition, product differentiation, and access to premium market segments. Technology investments in cutting, polishing, and finishing equipment improve product quality, operational efficiency, and customer satisfaction while reducing waste and production costs.

For Distributors and Retailers: Growing market demand creates opportunities for network expansion, product portfolio diversification, and service enhancement. Digital marketing strategies and online presence development help reach broader customer bases and improve market penetration in emerging urban centers.

For Construction Companies: Access to quality ornamental stones enables project differentiation, customer satisfaction improvement, and premium positioning in competitive construction markets. Supplier partnerships ensure reliable material supply, competitive pricing, and technical support for complex architectural applications.

For Export Companies: India’s competitive advantages in stone quality and processing create substantial export opportunities in global markets. Quality certifications and sustainable practices facilitate market access and premium positioning in environmentally conscious international markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability and Environmental Responsibility emerge as dominant trends, with increasing focus on eco-friendly quarrying practices, waste reduction, and environmental restoration. Companies adopting sustainable practices gain competitive advantages through regulatory compliance, improved brand image, and access to environmentally conscious market segments.

Technology Integration and Automation transform traditional stone processing operations through advanced cutting systems, automated polishing equipment, and digital design tools. These technologies improve product quality, operational efficiency, and customization capabilities while reducing labor dependency and production costs.

Customization and Design Innovation drive market differentiation through unique finishes, specialized cuts, and application-specific solutions. Architectural collaboration between stone suppliers and designers creates innovative applications and premium product categories that command higher margins and customer loyalty.

Digital Marketing and E-commerce Adoption revolutionize customer engagement and sales processes, with online platforms enabling broader market reach, virtual product demonstrations, and direct customer relationships. This trend particularly benefits smaller companies seeking to compete with larger established players.

Quality Certification and Standards gain importance as customers increasingly demand verified product quality, origin authentication, and performance guarantees. International certifications facilitate export market access and premium positioning in quality-conscious market segments.

Technology Advancement Initiatives include major investments in state-of-the-art processing equipment, automated handling systems, and quality control technologies. Leading companies are establishing centers of excellence for stone processing innovation and skill development to maintain competitive advantages and market leadership positions.

Sustainability Programs encompass comprehensive environmental management systems, quarry rehabilitation projects, and renewable energy adoption in processing facilities. MarkWide Research analysis indicates that companies implementing sustainability programs demonstrate improved operational efficiency and market acceptance.

Export Market Expansion strategies focus on emerging economies, premium market segments, and value-added product categories. Companies are establishing international partnerships, distribution networks, and marketing initiatives to capitalize on global demand for Indian ornamental stones.

Industry Consolidation Activities include strategic acquisitions, joint ventures, and vertical integration initiatives aimed at achieving operational synergies, market expansion, and competitive positioning. These developments reshape market dynamics and create opportunities for efficiency improvements and scale advantages.

Regulatory Compliance Enhancements involve proactive adoption of environmental standards, safety protocols, and quality management systems to ensure sustainable operations and market access. Companies investing in compliance infrastructure demonstrate stronger long-term growth prospects and regulatory resilience.

Strategic Focus on Sustainability represents the most critical recommendation for industry participants, with environmental compliance becoming increasingly important for market access and competitive positioning. Companies should invest in eco-friendly quarrying practices, waste management systems, and environmental restoration programs to ensure long-term operational viability.

Technology Investment Priorities should emphasize advanced processing equipment, automation systems, and digital marketing platforms to improve operational efficiency, product quality, and market reach. MWR analysis suggests that technology-forward companies demonstrate superior growth rates and profitability compared to traditional operators.

Market Diversification Strategies should include export market development, value-added product categories, and emerging application segments to reduce dependence on domestic construction cycles and achieve sustainable growth. Companies should leverage India’s competitive advantages while addressing quality and consistency requirements of international markets.

Partnership and Collaboration Opportunities with architects, designers, and construction companies create avenues for product innovation, market development, and customer relationship strengthening. These partnerships facilitate access to premium projects and enable customized solution development that commands higher margins.

Quality and Certification Focus should prioritize international standards adoption, quality management systems implementation, and product certification programs to access premium market segments and export opportunities. Investment in quality infrastructure provides long-term competitive advantages and customer confidence.

Long-term growth prospects for the India construction ornamental stone market remain highly positive, supported by continued urbanization, infrastructure development, and rising consumer preferences for natural building materials. The market is projected to maintain robust growth momentum with CAGR expectations of 8.5% over the next five years, driven by both domestic demand and export opportunities.

Technology transformation will continue reshaping industry operations through advanced processing systems, automation integration, and digital marketing platforms. Companies embracing technological advancement will gain significant competitive advantages in product quality, operational efficiency, and market reach, while traditional operators may face increasing challenges in maintaining market position.

Sustainability requirements will become increasingly stringent, with environmental compliance emerging as a prerequisite for market participation rather than a competitive advantage. Companies proactively adopting sustainable practices will benefit from regulatory compliance, improved brand positioning, and access to environmentally conscious market segments.

Export market expansion presents substantial growth opportunities, with global demand for natural stones continuing to increase across emerging and developed economies. India’s competitive advantages in stone quality, processing capabilities, and cost-effectiveness position the country favorably for international market penetration and long-term export growth.

Market consolidation trends will likely accelerate, with larger companies acquiring smaller operations to achieve scale advantages, operational synergies, and market control. This consolidation will create opportunities for efficiency improvements, quality standardization, and competitive positioning while potentially reducing market fragmentation.

The India construction ornamental stone market represents a dynamic and rapidly evolving sector with substantial growth potential driven by urbanization, infrastructure development, and increasing demand for premium building materials. The market benefits from India’s abundant natural stone reserves, established processing infrastructure, and competitive advantages in quality and cost-effectiveness that support both domestic consumption and export opportunities.

Key success factors for market participants include sustainability adoption, technology integration, quality enhancement, and strategic market positioning to capitalize on emerging opportunities while addressing evolving challenges. Companies that proactively invest in environmental compliance, advanced processing capabilities, and customer relationship development will achieve superior market positioning and long-term growth prospects.

The market outlook remains highly positive, with continued growth expected across all major segments and applications. Strategic recommendations emphasize sustainability focus, technology investment, market diversification, and quality certification as critical elements for competitive success and sustainable growth in the evolving market landscape. Industry participants who align their strategies with these trends and recommendations will be well-positioned to capitalize on the substantial opportunities presented by India’s expanding construction ornamental stone market.

What is Construction Ornamental Stone?

Construction Ornamental Stone refers to natural stones used for decorative purposes in construction, such as marble, granite, and limestone. These stones are valued for their aesthetic appeal and durability in various applications, including flooring, countertops, and facades.

What are the key players in the India Construction Ornamental Stone Market?

Key players in the India Construction Ornamental Stone Market include companies like Pokarna Limited, Rashi Granite, and Aro Granite Industries. These companies are involved in the extraction, processing, and distribution of ornamental stones, among others.

What are the growth factors driving the India Construction Ornamental Stone Market?

The growth of the India Construction Ornamental Stone Market is driven by increasing urbanization, rising disposable incomes, and a growing demand for aesthetically pleasing construction materials. Additionally, the expansion of the real estate sector contributes significantly to market growth.

What challenges does the India Construction Ornamental Stone Market face?

The India Construction Ornamental Stone Market faces challenges such as environmental regulations, high extraction costs, and competition from synthetic materials. These factors can impact the profitability and sustainability of businesses in the sector.

What opportunities exist in the India Construction Ornamental Stone Market?

Opportunities in the India Construction Ornamental Stone Market include the increasing demand for eco-friendly building materials and the potential for export to international markets. Innovations in stone processing technology also present avenues for growth.

What trends are shaping the India Construction Ornamental Stone Market?

Trends in the India Construction Ornamental Stone Market include a growing preference for unique and customized stone designs, as well as the integration of technology in stone processing. Additionally, there is an increasing focus on sustainability and the use of recycled materials in construction.

India Construction Ornamental Stone Market

| Segmentation Details | Description |

|---|---|

| Product Type | Granite, Marble, Limestone, Slate |

| Application | Flooring, Countertops, Wall Cladding, Landscaping |

| End User | Residential, Commercial, Institutional, Hospitality |

| Distribution Channel | Direct Sales, Retail, Online, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Construction Ornamental Stone Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at