444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India concealed cistern market represents a rapidly evolving segment within the country’s bathroom fittings and sanitary ware industry. Concealed cisterns have gained significant traction among Indian consumers seeking modern, space-efficient bathroom solutions that combine functionality with aesthetic appeal. These innovative systems, which hide the water tank behind walls or within specially designed frames, are transforming traditional bathroom designs across urban and semi-urban areas.

Market dynamics indicate robust growth driven by increasing urbanization, rising disposable incomes, and growing awareness of contemporary bathroom designs. The adoption rate of concealed cistern systems has accelerated particularly in metropolitan cities, with penetration reaching approximately 28% in premium residential segments. This growth trajectory reflects changing consumer preferences toward minimalist designs and space optimization in modern Indian homes.

Infrastructure development across India’s tier-1 and tier-2 cities has created substantial demand for advanced plumbing solutions. The market encompasses various product categories including wall-hung systems, floor-mounted concealed units, and dual-flush mechanisms. Premium housing projects and commercial developments increasingly specify concealed cisterns as standard fixtures, contributing to market expansion at a projected CAGR of 12.5% through the forecast period.

The India concealed cistern market refers to the commercial ecosystem encompassing the manufacturing, distribution, and installation of hidden toilet tank systems designed to optimize bathroom space while maintaining superior functionality. Concealed cisterns are plumbing fixtures where the water storage tank is positioned behind walls or within specially designed frames, leaving only the flush mechanism visible to users.

These systems represent a significant departure from traditional exposed cisterns, offering enhanced aesthetic appeal and space utilization. The market includes various configurations such as wall-mounted units, in-wall installations, and furniture-integrated solutions. Key components typically comprise the cistern tank, mounting frame, flush plate, and associated plumbing connections designed for concealed installation.

Market participants include international manufacturers, domestic producers, distributors, retailers, and installation specialists serving residential, commercial, and institutional segments. The ecosystem supports India’s growing demand for modern bathroom solutions that align with contemporary architectural trends and space-conscious design preferences.

India’s concealed cistern market demonstrates exceptional growth potential driven by urbanization, infrastructure development, and evolving consumer preferences for modern bathroom solutions. The market has experienced accelerated adoption across metropolitan areas, with premium residential projects leading demand for space-efficient plumbing fixtures.

Key market drivers include rising construction activity in urban centers, increasing awareness of water conservation technologies, and growing preference for minimalist bathroom designs. The dual-flush technology segment represents approximately 65% of total market adoption, reflecting consumer focus on water efficiency and environmental sustainability.

Regional distribution shows concentrated demand in major cities including Mumbai, Delhi, Bangalore, Chennai, and Pune, with emerging opportunities in tier-2 cities experiencing rapid urban development. The commercial segment, encompassing offices, hotels, and retail spaces, contributes significantly to market growth through large-scale installations.

Competitive dynamics feature both international brands and domestic manufacturers competing on product innovation, pricing strategies, and distribution network expansion. Market challenges include installation complexity, higher initial costs compared to traditional systems, and the need for skilled technicians for proper installation and maintenance.

Strategic market insights reveal several critical factors shaping the India concealed cistern landscape:

Urbanization acceleration serves as the primary catalyst for concealed cistern market growth in India. Rapid urban development across major cities creates substantial demand for space-efficient bathroom solutions that maximize utility in compact living spaces. Metropolitan expansion and the proliferation of high-rise residential complexes drive consistent market demand.

Rising disposable incomes among India’s growing middle class enable increased spending on premium bathroom fixtures and modern home improvements. Consumer willingness to invest in quality plumbing solutions that offer long-term benefits supports market expansion. Lifestyle aspirations toward contemporary living standards further accelerate adoption rates.

Infrastructure development initiatives including smart city projects, affordable housing schemes, and commercial real estate expansion create substantial market opportunities. Government programs promoting modern sanitation facilities and water conservation technologies align with concealed cistern benefits. Construction industry growth provides a robust foundation for market expansion.

Water conservation awareness drives demand for dual-flush and water-efficient cistern systems. Environmental consciousness among consumers and regulatory emphasis on water management support market growth. Sustainability trends position concealed cisterns as environmentally responsible choices for modern bathrooms.

High initial investment costs present significant barriers to widespread market adoption, particularly in price-sensitive segments. Concealed cistern systems typically require substantially higher upfront expenditure compared to traditional exposed tanks, limiting accessibility for budget-conscious consumers and smaller residential projects.

Installation complexity creates challenges requiring specialized technical expertise and modified construction approaches. The need for wall modifications, precise measurements, and professional installation services increases project costs and timelines. Limited availability of skilled technicians in smaller cities constrains market expansion beyond metropolitan areas.

Maintenance accessibility concerns arise from concealed installation configurations that complicate repair and servicing procedures. Potential issues with hidden components may require wall opening or extensive dismantling, creating reluctance among some consumers. Service infrastructure limitations in emerging markets further compound these concerns.

Market awareness gaps persist in tier-2 and tier-3 cities where traditional plumbing solutions remain predominant. Limited exposure to concealed cistern benefits and unfamiliarity with installation requirements slow adoption rates. Conservative preferences in certain market segments favor conventional systems over innovative alternatives.

Tier-2 city expansion represents substantial untapped potential as these urban centers experience rapid development and rising living standards. Growing construction activity in cities like Ahmedabad, Surat, Indore, and Bhubaneswar creates significant opportunities for market penetration. Infrastructure investments in these regions support demand for modern plumbing solutions.

Affordable housing segment presents emerging opportunities as government initiatives promote modern sanitation facilities in mass housing projects. Developing cost-effective concealed cistern variants for budget-conscious segments could unlock substantial market potential. Volume-based strategies can make these systems accessible to broader consumer bases.

Smart technology integration offers differentiation opportunities through sensor-operated flush systems, water usage monitoring, and IoT connectivity features. Tech-savvy consumers increasingly seek intelligent bathroom solutions that provide convenience and efficiency insights. Innovation leadership in smart features can establish competitive advantages.

Retrofit market potential exists in bathroom renovation projects where homeowners upgrade existing facilities with modern fixtures. Growing renovation activity in established residential areas creates demand for space-saving solutions. Replacement cycles for aging plumbing infrastructure support sustained market growth.

Supply chain evolution reflects increasing sophistication in distribution networks connecting international manufacturers with local markets. Import dependencies for premium components create both opportunities and challenges in market dynamics. Domestic manufacturing capabilities are expanding to serve growing demand while reducing costs.

Technology advancement drives continuous product innovation in flush mechanisms, water efficiency features, and installation systems. Research and development investments focus on addressing Indian market-specific requirements including water pressure variations and space constraints. Manufacturing processes increasingly emphasize quality and durability.

Consumer behavior shifts toward premium bathroom experiences influence market dynamics significantly. Design consciousness among urban consumers creates demand for aesthetically superior solutions that complement modern interior themes. Social media influence and lifestyle aspirations accelerate adoption trends.

Regulatory environment increasingly emphasizes water conservation and sustainable building practices, creating favorable conditions for efficient cistern systems. Building codes in major cities progressively incorporate water-saving requirements that benefit concealed cistern adoption. Environmental regulations support market growth through efficiency mandates.

Comprehensive market analysis employs multiple research methodologies to ensure accurate insights into India’s concealed cistern market dynamics. Primary research includes extensive interviews with industry stakeholders, manufacturers, distributors, contractors, and end-users across major metropolitan areas and emerging markets.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements. Market surveys conducted across residential and commercial segments provide quantitative insights into adoption patterns, preferences, and purchasing behaviors.

Data triangulation methods validate findings through cross-referencing multiple information sources and analytical approaches. Statistical modeling techniques project market trends and growth trajectories based on historical data and identified market drivers. Regional analysis ensures comprehensive coverage of diverse market conditions.

Expert consultations with industry professionals, architects, and plumbing specialists provide technical insights and market perspective validation. Field observations in retail outlets, showrooms, and installation sites offer practical understanding of market dynamics and consumer interactions.

Western India leads market adoption with Maharashtra and Gujarat accounting for approximately 38% of national demand. Mumbai’s premium residential projects and commercial developments drive significant volume, while Pune’s IT sector growth creates substantial office building demand. Industrial expansion in Gujarat supports commercial segment growth.

Northern India represents the second-largest market segment, with Delhi NCR contributing 28% of total market share. Rapid urbanization in Gurgaon, Noida, and Faridabad creates consistent demand for modern bathroom solutions. Infrastructure projects and metro expansion support market growth across the region.

Southern India demonstrates strong growth potential with Bangalore, Chennai, and Hyderabad leading adoption rates. The region’s IT industry concentration drives demand for premium office spaces with modern amenities. Residential development in tech corridors supports sustained market expansion.

Eastern India shows emerging opportunities with Kolkata and Bhubaneswar experiencing gradual market development. Infrastructure investments and urban renewal projects create demand for contemporary plumbing solutions. Government initiatives in smart city development support market growth prospects.

Market leadership features a combination of international brands and domestic manufacturers competing across different price segments and distribution channels:

Competitive strategies emphasize product innovation, distribution network expansion, and localized manufacturing to serve diverse market requirements effectively.

By Product Type:

By Flush Technology:

By Application:

Premium Segment Analysis: High-end concealed cisterns featuring advanced flush technologies, designer aesthetics, and superior build quality command significant market share in luxury residential and commercial projects. Brand positioning emphasizes quality, innovation, and aesthetic appeal to justify premium pricing strategies.

Mid-Range Market Dynamics: Value-engineered products balance functionality with affordability, targeting mainstream residential projects and commercial developments with budget constraints. Feature optimization focuses on essential capabilities while maintaining competitive pricing structures.

Budget Segment Opportunities: Entry-level concealed cisterns designed for mass market penetration emphasize basic functionality and cost-effectiveness. Volume strategies enable manufacturers to achieve economies of scale while expanding market accessibility.

Technology Integration Categories: Smart concealed cisterns incorporating IoT connectivity, usage monitoring, and automated features represent emerging high-growth segments. Innovation focus addresses tech-savvy consumers seeking intelligent bathroom solutions with enhanced convenience and efficiency insights.

Manufacturers benefit from expanding market opportunities driven by urbanization and rising consumer preferences for modern bathroom solutions. Product differentiation through innovative features and design aesthetics enables premium positioning and improved profit margins. Market growth supports investment in research and development for next-generation products.

Distributors and Retailers gain access to high-margin product categories with growing demand across multiple market segments. Portfolio expansion with concealed cistern offerings enhances customer value propositions and competitive positioning. Training programs and technical support create additional service revenue opportunities.

Contractors and Installers develop specialized expertise in concealed cistern installation, creating differentiated service offerings and premium pricing opportunities. Skill development in modern plumbing technologies enhances professional capabilities and market positioning. Long-term maintenance contracts provide recurring revenue streams.

End Users achieve space optimization, aesthetic enhancement, and water efficiency benefits through concealed cistern adoption. Property value appreciation results from modern bathroom upgrades that appeal to contemporary buyers and tenants. Reduced maintenance requirements and improved functionality provide long-term ownership benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Bathroom Integration represents a transformative trend with concealed cisterns incorporating IoT connectivity, mobile app controls, and usage analytics. Technology convergence enables remote monitoring, predictive maintenance, and water consumption optimization. Consumer interest in intelligent home systems drives adoption of connected bathroom fixtures.

Sustainability Focus intensifies with manufacturers developing water-efficient flush mechanisms and eco-friendly materials. Environmental regulations increasingly mandate water conservation features in new construction projects. Green building certifications require efficient plumbing fixtures that support sustainability goals.

Customization Demand grows as consumers seek personalized bathroom solutions that reflect individual preferences and space requirements. Modular designs enable flexible installation configurations and aesthetic customization options. Bespoke solutions for unique architectural requirements create premium market opportunities.

Design Minimalism influences product development toward cleaner lines, hidden components, and seamless integration with bathroom aesthetics. Architectural trends emphasize uncluttered spaces and functional beauty that concealed cisterns effectively deliver. Contemporary design preferences drive continuous aesthetic innovation.

Manufacturing Localization initiatives by international brands establish production facilities in India to reduce costs and improve market responsiveness. Investment announcements from major players indicate confidence in long-term market growth potential. Local manufacturing supports competitive pricing and supply chain efficiency.

Distribution Network Expansion accelerates with manufacturers establishing partnerships with regional distributors and retail chains. Market penetration strategies focus on tier-2 cities through dedicated sales teams and technical support programs. Online sales channels complement traditional distribution methods.

Technology Partnerships emerge between cistern manufacturers and smart home technology companies to develop integrated solutions. Collaboration initiatives combine plumbing expertise with digital innovation capabilities. Joint development programs accelerate smart product launches and market introduction.

Skill Development Programs address installation and maintenance expertise gaps through training initiatives for plumbers and contractors. Certification programs ensure proper installation standards and customer satisfaction. Technical education partnerships with trade institutes expand skilled workforce availability.

Market Entry Strategies should prioritize tier-1 cities for initial penetration while developing long-term expansion plans for emerging markets. MarkWide Research analysis indicates that establishing strong distribution networks and technical support capabilities creates sustainable competitive advantages in this growing market.

Product Development Focus should emphasize water efficiency, ease of installation, and aesthetic appeal to address key market requirements. Innovation investments in smart features and sustainable materials position companies for future market leadership. Cost optimization strategies enable broader market accessibility.

Partnership Opportunities with construction companies, architects, and interior designers create direct market access and specification influence. Channel development through specialized bathroom retailers and plumbing distributors expands market reach. Technical training partnerships ensure proper installation and customer satisfaction.

Brand Positioning should emphasize quality, reliability, and long-term value to justify premium pricing in price-sensitive markets. Marketing strategies must educate consumers about concealed cistern benefits and address installation concerns. Digital marketing approaches effectively reach urban target audiences.

Market trajectory indicates sustained growth driven by continued urbanization, infrastructure development, and evolving consumer preferences for modern bathroom solutions. MWR projections suggest the market will maintain robust expansion rates as tier-2 cities experience accelerated development and rising living standards.

Technology evolution will increasingly integrate smart features, water conservation capabilities, and sustainable materials into concealed cistern designs. Innovation cycles are expected to accelerate as manufacturers compete for market leadership through product differentiation. IoT integration and predictive maintenance features will become standard offerings.

Regional expansion beyond metropolitan areas will drive the next phase of market growth as infrastructure development reaches smaller cities. Government initiatives promoting modern sanitation facilities and water conservation will support market expansion. Affordable housing programs create substantial volume opportunities.

Competitive dynamics will intensify as domestic manufacturers develop capabilities to challenge international brands in quality and innovation. Market consolidation may occur through strategic partnerships and acquisitions as companies seek scale advantages. Price competition will drive efficiency improvements and cost optimization initiatives.

India’s concealed cistern market represents a compelling growth opportunity within the country’s evolving bathroom fixtures industry. Market fundamentals including rapid urbanization, rising disposable incomes, and changing lifestyle preferences create a robust foundation for sustained expansion. The transition toward modern bathroom solutions positions concealed cisterns as essential components of contemporary Indian homes and commercial spaces.

Strategic advantages for market participants include the ability to command premium pricing, establish brand differentiation, and build long-term customer relationships through quality and innovation. Success factors emphasize understanding local market requirements, developing appropriate distribution networks, and providing comprehensive technical support to ensure proper installation and customer satisfaction.

Future prospects remain highly favorable as infrastructure development continues across India’s urban centers and emerging cities. Technology integration and sustainability focus will drive next-generation product development, while market expansion into tier-2 cities offers substantial growth potential. Companies that effectively balance innovation, quality, and affordability will capture the greatest market opportunities in this dynamic and expanding sector.

What is Concealed Cistern?

A concealed cistern is a plumbing fixture that is hidden behind a wall or in a cabinet, used to store water for flushing toilets. This design helps to save space and provides a cleaner aesthetic in bathrooms.

What are the key players in the India Concealed Cistern Market?

Key players in the India Concealed Cistern Market include Geberit, Kohler, and Jaquar, which are known for their innovative designs and quality products. These companies focus on enhancing user experience and sustainability in bathroom solutions, among others.

What are the growth factors driving the India Concealed Cistern Market?

The growth of the India Concealed Cistern Market is driven by increasing urbanization, rising demand for modern bathroom fixtures, and a growing emphasis on space-saving solutions. Additionally, the trend towards eco-friendly products is also contributing to market expansion.

What challenges does the India Concealed Cistern Market face?

Challenges in the India Concealed Cistern Market include high installation costs and the need for skilled labor for proper installation. Furthermore, consumer awareness regarding the benefits of concealed cisterns remains limited in some regions.

What opportunities exist in the India Concealed Cistern Market?

The India Concealed Cistern Market presents opportunities for growth through the introduction of smart bathroom technologies and increased focus on sustainable materials. Additionally, expanding e-commerce platforms can enhance product accessibility for consumers.

What trends are shaping the India Concealed Cistern Market?

Trends in the India Concealed Cistern Market include the rising popularity of minimalist bathroom designs and the integration of water-saving technologies. Moreover, manufacturers are increasingly focusing on customization options to meet diverse consumer preferences.

India Concealed Cistern Market

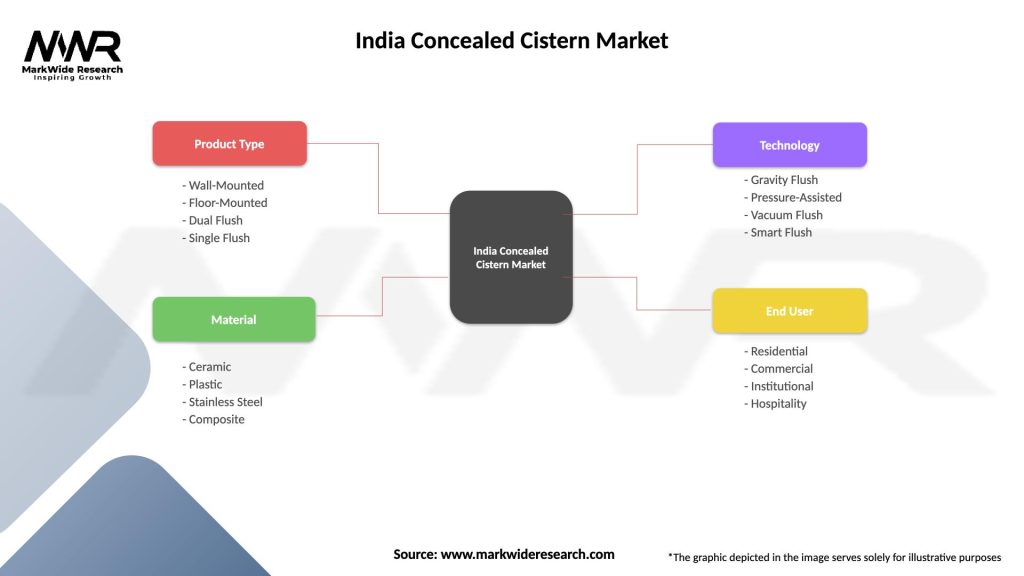

| Segmentation Details | Description |

|---|---|

| Product Type | Wall-Mounted, Floor-Mounted, Dual Flush, Single Flush |

| Material | Ceramic, Plastic, Stainless Steel, Composite |

| Technology | Gravity Flush, Pressure-Assisted, Vacuum Flush, Smart Flush |

| End User | Residential, Commercial, Institutional, Hospitality |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Concealed Cistern Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at