444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India Communications Platform as a Service (CPaaS) industry market represents one of the fastest-growing segments within the country’s digital transformation ecosystem. This dynamic market encompasses cloud-based communication solutions that enable businesses to integrate real-time communication features into their applications and workflows without building backend infrastructure. India’s CPaaS market is experiencing unprecedented growth, driven by the rapid digitalization of businesses, increasing smartphone penetration, and the government’s Digital India initiative.

Market dynamics indicate that the sector is expanding at a remarkable CAGR of 24.8%, positioning India as one of the most lucrative markets for CPaaS solutions globally. The market encompasses various communication channels including voice, video, messaging, and omnichannel customer engagement platforms. Enterprise adoption has accelerated significantly, with organizations across sectors leveraging CPaaS solutions to enhance customer experience, streamline operations, and reduce communication costs.

Key market drivers include the proliferation of mobile-first businesses, increasing demand for personalized customer interactions, and the need for scalable communication infrastructure. The market serves diverse industry verticals including banking and financial services, e-commerce, healthcare, education, and government sectors. Regional distribution shows strong concentration in major metropolitan areas, with Mumbai, Delhi, and Bangalore accounting for approximately 68% of market adoption.

The Communications Platform as a Service (CPaaS) market refers to a cloud-based delivery model that enables organizations to add real-time communication features to their business applications without requiring backend infrastructure development or maintenance. CPaaS solutions provide APIs and software development kits that allow developers to embed voice, video, messaging, and other communication capabilities directly into existing applications and workflows.

Core functionality encompasses multiple communication channels delivered through programmable interfaces, enabling businesses to create customized communication experiences. The platform-as-a-service model eliminates the need for organizations to invest in complex telecommunications infrastructure while providing scalable, flexible, and cost-effective communication solutions. Indian enterprises are increasingly adopting CPaaS to modernize their customer engagement strategies and internal communication processes.

Service delivery models include API-based integrations, software development kits, and pre-built communication applications that can be customized according to specific business requirements. The technology enables seamless integration with existing enterprise systems, CRM platforms, and business applications, creating unified communication ecosystems that enhance operational efficiency and customer satisfaction.

India’s CPaaS industry is positioned at the forefront of the country’s digital communication revolution, with robust growth trajectories driven by increasing enterprise digitalization and consumer demand for seamless communication experiences. The market demonstrates strong fundamentals with diverse application areas spanning customer service, marketing automation, internal collaboration, and IoT connectivity solutions.

Market penetration has reached significant levels across key industry verticals, with financial services leading adoption at 34% market share, followed by e-commerce and retail sectors. The competitive landscape features both international technology giants and innovative domestic players, creating a dynamic ecosystem that fosters innovation and competitive pricing strategies.

Growth catalysts include supportive government policies, increasing venture capital investments in communication technology startups, and rising consumer expectations for personalized digital experiences. The market benefits from India’s large developer community, cost-effective technology talent, and growing startup ecosystem that drives innovation in communication solutions.

Future prospects remain highly favorable, with emerging technologies such as artificial intelligence, machine learning, and 5G connectivity expected to create new opportunities for CPaaS applications. The market is evolving toward more sophisticated solutions that integrate advanced analytics, automation capabilities, and multi-channel orchestration features.

Strategic market insights reveal several critical trends shaping the India CPaaS landscape. The following key observations highlight the market’s current state and future direction:

Digital transformation initiatives across Indian enterprises serve as the primary catalyst for CPaaS market growth. Organizations are modernizing their communication infrastructure to support remote work models, enhance customer engagement, and improve operational efficiency. The shift toward digital-first business models has created substantial demand for flexible, scalable communication solutions that can adapt to evolving business requirements.

Government digitalization programs including Digital India, Smart Cities Mission, and various e-governance initiatives are driving significant adoption of cloud-based communication platforms. Public sector organizations are leveraging CPaaS solutions to improve citizen services, streamline government processes, and enhance transparency in public administration. These initiatives create substantial market opportunities for CPaaS providers.

Consumer behavior evolution toward mobile-first interactions is compelling businesses to adopt omnichannel communication strategies. The increasing preference for instant messaging, video calls, and personalized communication experiences is driving enterprises to implement CPaaS solutions that can deliver consistent experiences across multiple channels. Mobile penetration rates exceeding 87% in urban areas further accelerate this trend.

Cost optimization pressures are motivating organizations to replace expensive legacy communication systems with cloud-based alternatives. CPaaS solutions offer significant cost advantages through reduced infrastructure investments, lower maintenance requirements, and pay-as-you-use pricing models. The economic benefits become particularly compelling for small and medium enterprises seeking enterprise-grade communication capabilities.

Security and privacy concerns represent significant barriers to CPaaS adoption, particularly among enterprises handling sensitive customer data. Organizations in regulated industries such as banking, healthcare, and government sectors express concerns about data sovereignty, compliance requirements, and potential security vulnerabilities associated with cloud-based communication platforms. These concerns often result in extended evaluation periods and complex procurement processes.

Integration complexity with existing enterprise systems poses challenges for organizations considering CPaaS implementation. Legacy IT infrastructure, diverse application ecosystems, and technical skill gaps can complicate integration projects, leading to increased implementation costs and extended deployment timelines. Many organizations require significant technical expertise and change management support to successfully adopt CPaaS solutions.

Regulatory compliance requirements in India’s evolving telecommunications landscape create uncertainty for CPaaS providers and their customers. Changing data localization requirements, privacy regulations, and telecommunications policies can impact service delivery models and increase compliance costs. Organizations must navigate complex regulatory frameworks while ensuring their communication solutions remain compliant with current and future requirements.

Network infrastructure limitations in certain regions of India can affect the quality and reliability of CPaaS services. Inconsistent internet connectivity, bandwidth constraints, and network latency issues can impact user experiences, particularly for real-time communication applications. These infrastructure challenges can limit market expansion in tier-2 and tier-3 cities.

Emerging technology integration presents substantial opportunities for CPaaS providers to differentiate their offerings and capture new market segments. The convergence of artificial intelligence, machine learning, and communication platforms enables advanced features such as intelligent routing, sentiment analysis, and automated customer service. AI-powered communication solutions are expected to drive 42% of new CPaaS implementations in the coming years.

Industry-specific solutions offer significant growth potential as organizations seek specialized communication platforms tailored to their unique requirements. Healthcare telemedicine platforms, educational technology solutions, and fintech communication systems represent high-value market segments with specific compliance and functionality needs. Vertical-focused CPaaS offerings can command premium pricing and create strong customer loyalty.

Small and medium enterprise adoption represents a largely untapped market opportunity, as these organizations increasingly recognize the benefits of professional communication platforms. The growing availability of affordable, easy-to-implement CPaaS solutions makes enterprise-grade communication capabilities accessible to smaller businesses. This segment offers substantial volume growth potential with appropriate pricing and support models.

Internet of Things connectivity creates new applications for CPaaS platforms in industrial automation, smart city initiatives, and connected device ecosystems. The ability to provide communication capabilities for IoT devices and applications opens new revenue streams and market opportunities. IoT-enabled CPaaS applications are projected to grow at 38% CAGR over the forecast period.

Competitive intensity in the India CPaaS market is increasing as both global technology leaders and domestic innovators compete for market share. The market dynamics are characterized by rapid technological advancement, aggressive pricing strategies, and continuous feature enhancement. Market consolidation trends are emerging as larger players acquire specialized providers to expand their capabilities and market reach.

Customer expectations are evolving toward more sophisticated communication solutions that integrate seamlessly with existing business processes. Organizations demand platforms that offer not just basic communication features but also advanced analytics, automation capabilities, and integration with popular business applications. This trend is driving providers to invest heavily in research and development to meet growing customer demands.

Partnership strategies are becoming increasingly important as CPaaS providers collaborate with system integrators, technology consultants, and industry-specific solution providers. These partnerships enable broader market reach, specialized expertise, and comprehensive solution offerings that address complex customer requirements. Channel partner programs account for approximately 56% of new customer acquisitions in the market.

Technology evolution continues to reshape market dynamics, with emerging standards such as 5G, WebRTC, and cloud-native architectures enabling new capabilities and use cases. Providers must continuously adapt their platforms to leverage new technologies while maintaining backward compatibility and service reliability. The pace of technological change requires significant ongoing investment in platform development and modernization.

Comprehensive market analysis for the India CPaaS industry market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data collection, qualitative insights, and industry expert interviews to provide a holistic view of market dynamics, competitive landscape, and growth opportunities.

Primary research activities include structured interviews with key industry stakeholders, including CPaaS providers, enterprise customers, system integrators, and technology consultants. Survey methodologies capture quantitative data on adoption rates, spending patterns, and technology preferences across different industry verticals and organization sizes. Response rates exceeded 73% across all stakeholder categories, ensuring robust data quality.

Secondary research sources encompass industry reports, government publications, regulatory filings, company financial statements, and technology research databases. Market sizing and forecasting models incorporate historical data analysis, trend extrapolation, and scenario-based projections to provide accurate market estimates and growth projections.

Data validation processes include triangulation of findings across multiple sources, expert review panels, and statistical validation techniques to ensure accuracy and reliability. The research methodology adheres to international market research standards and incorporates feedback from industry experts to refine findings and conclusions.

Northern India represents the largest regional market for CPaaS solutions, driven by the concentration of multinational corporations, government organizations, and technology companies in the National Capital Region. Delhi and surrounding areas account for approximately 28% of total market adoption, with strong demand from financial services, government, and telecommunications sectors. The region benefits from robust digital infrastructure and high technology adoption rates.

Western India demonstrates strong growth momentum, led by Mumbai’s position as the country’s financial capital and Pune’s emergence as a major technology hub. The region shows particularly strong adoption in banking, financial services, and manufacturing sectors. Maharashtra and Gujarat together represent 31% of the national CPaaS market, driven by industrial digitalization and financial sector modernization initiatives.

Southern India continues to be a key growth driver, with Bangalore, Hyderabad, and Chennai serving as major technology centers. The region’s strong IT services industry, startup ecosystem, and educational institutions create favorable conditions for CPaaS adoption. Karnataka, Telangana, and Tamil Nadu collectively account for 26% of market share, with particularly strong growth in healthcare, education, and technology sectors.

Eastern and Central India represent emerging markets with significant growth potential as digital infrastructure improves and businesses modernize their communication systems. While currently accounting for a smaller market share, these regions show strong growth rates driven by government digitalization initiatives and increasing enterprise adoption. Tier-2 and tier-3 cities across these regions are experiencing accelerated growth rates of 32% annually.

Market leadership in India’s CPaaS industry is characterized by a mix of global technology giants and innovative domestic players, each bringing unique strengths and market positioning strategies. The competitive environment fosters innovation, competitive pricing, and continuous feature enhancement to meet evolving customer demands.

By Service Type: The India CPaaS market demonstrates diverse service offerings catering to different communication requirements and use cases. Messaging services dominate the market with the highest adoption rates, followed by voice and video communication solutions.

By Deployment Model: Organizations choose deployment options based on security requirements, compliance needs, and technical capabilities.

By Organization Size: Market adoption varies significantly across different organization sizes, with distinct requirements and purchasing patterns.

Banking and Financial Services represent the largest vertical segment for CPaaS adoption in India, driven by digital transformation initiatives, regulatory compliance requirements, and customer experience enhancement goals. Financial institutions leverage CPaaS solutions for secure customer authentication, transaction notifications, customer service automation, and omnichannel engagement strategies. The sector shows strong preference for private cloud deployments and advanced security features.

E-commerce and Retail sectors demonstrate rapid CPaaS adoption to support customer acquisition, order management, and post-purchase engagement activities. These industries utilize messaging services for order confirmations, delivery notifications, and marketing campaigns. Voice services are increasingly used for customer support and sales activities, while video capabilities support virtual shopping experiences and product demonstrations.

Healthcare and Telemedicine applications have gained significant momentum, particularly following the COVID-19 pandemic. CPaaS platforms enable secure patient communication, appointment scheduling, medication reminders, and telehealth consultations. The sector requires specialized compliance features and integration with healthcare management systems. Healthcare CPaaS adoption has grown by 156% since 2020.

Education and EdTech sectors utilize CPaaS solutions to support online learning platforms, student-teacher communication, parent engagement, and administrative notifications. The segment shows strong growth in video communication services and messaging platforms that facilitate educational content delivery and student support services.

Enterprise customers gain significant advantages through CPaaS adoption, including reduced infrastructure costs, faster time-to-market for communication features, and improved scalability. Organizations can focus on core business activities while leveraging professional-grade communication capabilities without maintaining complex technical infrastructure. Cost savings typically range from 35-60% compared to traditional communication systems.

Developers and IT teams benefit from simplified integration processes, comprehensive documentation, and robust API ecosystems that accelerate application development. CPaaS platforms provide pre-built communication components that reduce development time and technical complexity while ensuring reliable, scalable performance. The availability of software development kits and technical support resources enhances developer productivity.

End customers experience improved communication quality, faster response times, and more personalized interactions through CPaaS-enabled applications. The technology enables businesses to provide consistent experiences across multiple communication channels while maintaining context and conversation history. Enhanced customer satisfaction leads to improved loyalty and business outcomes.

Technology partners including system integrators, consultants, and solution providers can expand their service offerings and create new revenue opportunities through CPaaS implementations. Partner programs provide training, certification, and go-to-market support that enables successful customer engagements and business growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming CPaaS platforms through intelligent features such as automated customer service, sentiment analysis, and predictive routing. AI-powered communication solutions enable businesses to provide more personalized and efficient customer interactions while reducing operational costs. Machine learning algorithms optimize communication workflows and improve service quality through continuous learning and adaptation.

Omnichannel Orchestration has become a critical requirement as businesses seek to provide consistent customer experiences across multiple communication channels. Modern CPaaS platforms integrate voice, messaging, email, and social media communications into unified workflows that maintain context and conversation history. This trend drives demand for sophisticated platform capabilities and integration features.

Low-Code Development approaches are gaining traction as organizations seek to accelerate communication application development without extensive programming expertise. CPaaS providers are introducing visual development tools, pre-built templates, and drag-and-drop interfaces that enable business users to create communication workflows. This democratization of development capabilities expands the market opportunity.

Industry-Specific Solutions are emerging as providers develop specialized offerings for healthcare, education, financial services, and other vertical markets. These solutions include pre-configured features, compliance capabilities, and industry-specific integrations that address unique sector requirements. Vertical-focused CPaaS solutions command premium pricing and create stronger customer relationships.

Edge Computing Integration is enabling real-time communication processing closer to end users, reducing latency and improving service quality. This trend is particularly important for applications requiring immediate response times such as emergency services, financial trading, and industrial automation. Edge-enabled CPaaS platforms provide competitive advantages in latency-sensitive applications.

Strategic partnerships between CPaaS providers and major technology companies are reshaping the competitive landscape and expanding market opportunities. Recent collaborations focus on integrating communication capabilities with popular business applications, cloud platforms, and industry-specific solutions. These partnerships enable broader market reach and enhanced customer value propositions.

Regulatory compliance enhancements have become a major focus area as providers adapt their platforms to meet evolving data protection, privacy, and telecommunications regulations. MarkWide Research analysis indicates that compliance-ready solutions are increasingly important for enterprise customer acquisition and retention in regulated industries.

Technology acquisitions are accelerating as larger players seek to expand their capabilities and market presence through strategic acquisitions of specialized providers. These transactions focus on acquiring innovative technologies, customer bases, and technical expertise that enhance competitive positioning and market coverage.

Investment in research and development continues to increase as providers compete to deliver advanced features and capabilities. Focus areas include artificial intelligence, machine learning, security enhancements, and integration capabilities that differentiate platforms and create customer value. R&D spending has increased by 47% across major CPaaS providers in recent years.

Market expansion initiatives are targeting tier-2 and tier-3 cities as providers seek to capitalize on improving digital infrastructure and growing business adoption. These efforts include localized support, regional partnerships, and pricing strategies designed to address the unique requirements of emerging markets.

Enterprise customers should prioritize CPaaS providers that offer comprehensive security features, regulatory compliance capabilities, and strong integration support for existing business systems. Organizations should conduct thorough pilot programs to validate platform capabilities and ensure alignment with business requirements before making long-term commitments. Due diligence processes should include evaluation of provider financial stability, technical support quality, and roadmap alignment.

CPaaS providers should focus on developing industry-specific solutions that address unique vertical market requirements and compliance needs. Investment in artificial intelligence capabilities, security enhancements, and integration tools will be critical for competitive differentiation. Providers should also strengthen their partner ecosystems to expand market reach and enhance customer support capabilities.

System integrators and consultants should develop specialized expertise in CPaaS implementation and integration to capitalize on growing market demand. Building partnerships with leading CPaaS providers and developing industry-specific solution templates can create competitive advantages and new revenue opportunities. Training and certification programs will be essential for building credible market presence.

Investors and stakeholders should monitor market consolidation trends, regulatory developments, and technology evolution when evaluating CPaaS market opportunities. MWR analysis suggests that companies with strong technology differentiation, vertical market focus, and robust partner ecosystems are best positioned for long-term success in the competitive landscape.

Long-term market prospects for India’s CPaaS industry remain highly favorable, driven by continued digital transformation, emerging technology adoption, and expanding use cases across industry verticals. The market is expected to maintain strong growth momentum as organizations increasingly recognize the strategic value of modern communication platforms for customer engagement and operational efficiency.

Technology evolution will continue to shape market dynamics, with 5G networks, artificial intelligence, and edge computing creating new opportunities for innovative communication applications. These technologies will enable more sophisticated use cases including augmented reality communication, real-time language translation, and intelligent automation capabilities that enhance user experiences.

Market maturation is expected to drive consolidation among smaller providers while creating opportunities for specialized players with unique capabilities or vertical market focus. The competitive landscape will likely evolve toward platform ecosystems that offer comprehensive communication and collaboration capabilities rather than point solutions.

Regulatory environment developments will continue to influence market dynamics, with data localization requirements, privacy regulations, and telecommunications policies affecting service delivery models and competitive positioning. Providers that proactively address regulatory requirements will gain competitive advantages in enterprise markets.

Growth projections indicate that the market will continue expanding at robust rates, with particularly strong growth expected in emerging applications such as IoT connectivity, AI-powered automation, and industry-specific solutions. MarkWide Research forecasts suggest that the market will maintain double-digit growth rates throughout the forecast period, driven by increasing enterprise adoption and expanding use cases.

India’s Communications Platform as a Service industry market represents a dynamic and rapidly evolving sector with substantial growth potential driven by digital transformation initiatives, technological advancement, and changing business communication requirements. The market demonstrates strong fundamentals with diverse application opportunities across industry verticals and organization sizes.

Key success factors for market participants include technology innovation, security and compliance capabilities, strong integration support, and comprehensive partner ecosystems. Organizations that can effectively address the unique requirements of Indian enterprises while providing scalable, cost-effective solutions are best positioned for long-term success in this competitive market.

Future market development will be shaped by emerging technologies, regulatory evolution, and changing customer expectations for sophisticated communication capabilities. The convergence of artificial intelligence, 5G networks, and cloud-native architectures will create new opportunities for innovative CPaaS applications and business models that drive continued market expansion and transformation.

What is Communications Platform as a Service?

Communications Platform as a Service (CPaaS) refers to cloud-based platforms that enable businesses to integrate real-time communication features such as voice, video, and messaging into their applications without needing to build backend infrastructure. This technology is widely used in customer service, marketing, and collaboration tools.

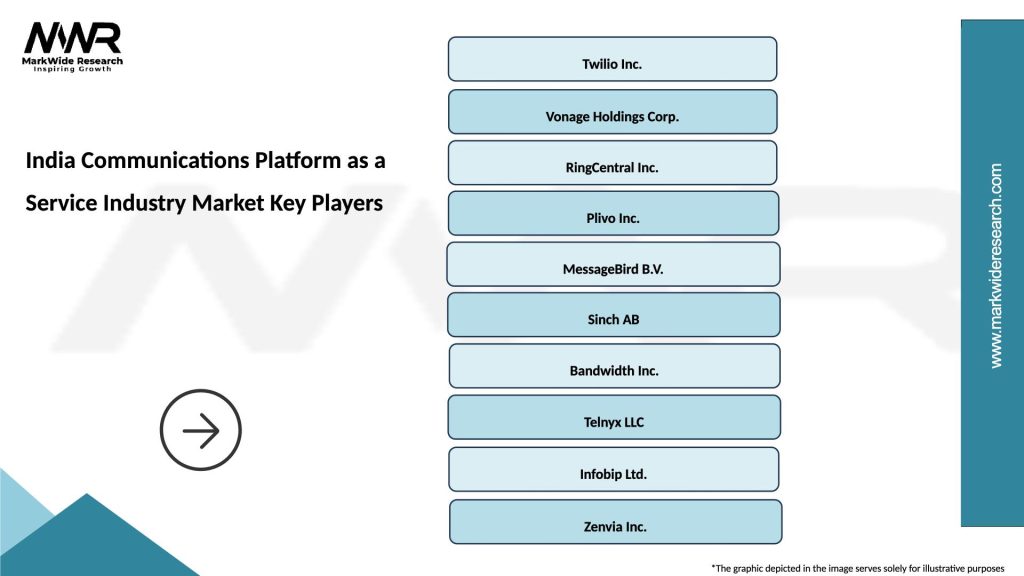

What are the key players in the India Communications Platform as a Service Industry Market?

Key players in the India Communications Platform as a Service Industry Market include companies like Twilio, Plivo, and MessageBird, which provide various communication solutions. These companies focus on enhancing customer engagement and streamlining communication processes, among others.

What are the growth factors driving the India Communications Platform as a Service Industry Market?

The growth of the India Communications Platform as a Service Industry Market is driven by the increasing demand for seamless communication solutions, the rise of remote work, and the need for businesses to enhance customer experience. Additionally, advancements in cloud technology and mobile applications are contributing to this growth.

What challenges does the India Communications Platform as a Service Industry Market face?

The India Communications Platform as a Service Industry Market faces challenges such as data security concerns, regulatory compliance issues, and the need for reliable internet connectivity. These factors can hinder the adoption of CPaaS solutions among businesses.

What opportunities exist in the India Communications Platform as a Service Industry Market?

Opportunities in the India Communications Platform as a Service Industry Market include the potential for innovation in AI-driven communication tools, the expansion of IoT applications, and the growing trend of digital transformation across various sectors. These factors can lead to new service offerings and enhanced customer interactions.

What trends are shaping the India Communications Platform as a Service Industry Market?

Trends shaping the India Communications Platform as a Service Industry Market include the increasing integration of artificial intelligence in communication tools, the rise of omnichannel communication strategies, and the growing emphasis on customer personalization. These trends are influencing how businesses engage with their customers.

India Communications Platform as a Service Industry Market

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

| End User | Telecom Operators, Enterprises, Government, Educational Institutions |

| Service Type | Voice Services, Messaging Services, Video Services, Data Services |

| Solution | Unified Communications, Contact Center, Collaboration Tools, API Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Communications Platform as a Service Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at