444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India commercial vehicle lubricants market represents a dynamic and rapidly evolving sector within the country’s automotive industry. This market encompasses specialized lubricating oils and fluids designed specifically for commercial vehicles including trucks, buses, construction equipment, and agricultural machinery. Market dynamics indicate substantial growth potential driven by India’s expanding logistics sector, infrastructure development initiatives, and increasing commercial vehicle fleet modernization.

Commercial vehicle lubricants play a crucial role in ensuring optimal engine performance, reducing maintenance costs, and extending vehicle lifespan. The market has witnessed significant transformation with the introduction of advanced synthetic and semi-synthetic formulations that offer superior protection under extreme operating conditions. Growth projections suggest the market is expanding at a robust CAGR of 6.2%, reflecting strong demand from various commercial vehicle segments.

Regional distribution shows concentrated demand in major industrial corridors, with states like Maharashtra, Gujarat, Tamil Nadu, and Karnataka accounting for approximately 55% of total consumption. The market benefits from India’s position as one of the world’s largest commercial vehicle manufacturers, creating substantial demand for high-quality lubricants across original equipment manufacturers and aftermarket channels.

The India commercial vehicle lubricants market refers to the comprehensive ecosystem of specialized lubricating products designed, manufactured, and distributed specifically for commercial vehicles operating within the Indian subcontinent. This market encompasses engine oils, transmission fluids, hydraulic oils, gear oils, and other specialized lubricants formulated to meet the demanding operational requirements of heavy-duty commercial vehicles.

Commercial vehicle lubricants differ significantly from passenger car lubricants due to their enhanced viscosity characteristics, superior thermal stability, and extended drain intervals. These products are engineered to withstand extreme operating conditions including high temperatures, heavy loads, frequent stop-start cycles, and prolonged operational hours typical in commercial vehicle applications.

Market scope includes both original equipment manufacturer channels and aftermarket distribution networks, serving diverse vehicle categories from light commercial vehicles to heavy-duty trucks and specialized equipment. The market also encompasses various lubricant technologies ranging from conventional mineral oils to advanced synthetic formulations designed for modern emission-compliant engines.

India’s commercial vehicle lubricants market demonstrates remarkable resilience and growth potential, driven by the country’s expanding transportation and logistics infrastructure. The market benefits from increasing commercial vehicle sales, growing freight movement, and rising awareness about preventive maintenance practices among fleet operators.

Key market drivers include the implementation of BS-VI emission norms, which has accelerated demand for advanced lubricant formulations capable of protecting modern engine technologies. The market has experienced a technological shift with synthetic and semi-synthetic lubricants gaining 35% market share, reflecting fleet operators’ preference for products offering extended drain intervals and superior engine protection.

Competitive landscape features both international oil majors and domestic players competing across price segments. The market structure shows strong presence of organized retail channels, with approximately 68% of sales occurring through authorized dealerships and service centers. Digital transformation initiatives are reshaping distribution strategies, with online platforms and mobile applications gaining traction among commercial vehicle operators.

Future prospects remain positive, supported by government infrastructure investments, e-commerce growth driving logistics demand, and increasing adoption of telematics-based fleet management systems that emphasize optimal lubricant selection and maintenance scheduling.

Market segmentation reveals distinct patterns across vehicle categories, with heavy commercial vehicles representing the largest consumption segment due to their higher lubricant capacity and frequent service requirements. MarkWide Research analysis indicates several critical insights shaping market dynamics:

Infrastructure development initiatives serve as the primary catalyst for India’s commercial vehicle lubricants market growth. The government’s ambitious infrastructure projects including highway expansion, smart cities development, and industrial corridor creation have significantly increased commercial vehicle deployment and operational intensity.

BS-VI emission norms implementation has fundamentally transformed lubricant requirements, necessitating advanced formulations compatible with modern emission control systems. This regulatory shift has created substantial demand for low-ash, low-sulfur lubricants that maintain engine cleanliness while ensuring optimal performance of after-treatment systems.

E-commerce expansion and digitalization of trade have revolutionized logistics demand patterns, creating sustained growth in commercial vehicle utilization. The rise of organized logistics companies and third-party logistics providers has increased focus on fleet efficiency and maintenance optimization, driving demand for premium lubricant solutions.

Fleet modernization trends reflect operators’ increasing preference for newer, more efficient commercial vehicles equipped with advanced engine technologies. These modern vehicles require specialized lubricants designed to maximize fuel efficiency, extend service intervals, and ensure compliance with stringent emission standards.

Total cost of ownership awareness among fleet operators has shifted purchasing decisions from price-focused to value-based selection criteria. This evolution has created opportunities for premium lubricant brands offering superior protection, extended drain intervals, and comprehensive technical support services.

Price sensitivity remains a significant challenge in the Indian commercial vehicle lubricants market, particularly among small and medium fleet operators who prioritize initial cost over long-term benefits. This price-conscious behavior limits premium product adoption and creates pressure on profit margins across the value chain.

Unorganized market presence continues to impact market development, with numerous local and regional players offering low-cost alternatives that may not meet international quality standards. This fragmentation creates challenges for established brands in maintaining market share and pricing discipline.

Counterfeit products pose ongoing threats to market integrity, with spurious lubricants potentially causing engine damage and creating negative perceptions about lubricant quality. The prevalence of counterfeit products particularly affects rural and semi-urban markets where quality verification mechanisms are limited.

Economic volatility and fluctuating crude oil prices create uncertainty in raw material costs, making it challenging for manufacturers to maintain consistent pricing strategies. These fluctuations can impact demand patterns and force frequent price adjustments that affect customer relationships.

Limited technical awareness among smaller fleet operators regarding lubricant technology benefits restricts market expansion for advanced products. Many operators lack understanding of how premium lubricants can reduce total operating costs through improved fuel efficiency and extended maintenance intervals.

Digital transformation presents substantial opportunities for market expansion through innovative distribution models, customer engagement platforms, and data-driven service offerings. Mobile applications and IoT-enabled fleet management systems create new touchpoints for lubricant suppliers to engage directly with end customers.

Rural market penetration offers significant growth potential as agricultural mechanization accelerates and rural connectivity improves. The expanding network of rural roads and increasing adoption of commercial vehicles in tier-3 and tier-4 cities creates new demand centers for lubricant products.

Electric and hybrid commercial vehicles emergence creates opportunities for specialized lubricants designed for electric drivetrains, battery cooling systems, and hybrid powertrains. Early market entry in this segment can establish competitive advantages as the technology gains mainstream adoption.

Value-added services development including predictive maintenance, oil analysis programs, and technical training services can differentiate brands and create additional revenue streams. These services help build stronger customer relationships while demonstrating lubricant performance benefits.

Export market expansion leverages India’s growing reputation as a manufacturing hub to serve neighboring countries and emerging markets. The country’s cost-competitive manufacturing capabilities and technical expertise create opportunities for international market penetration.

Supply chain evolution reflects the market’s adaptation to changing customer expectations and operational requirements. Traditional distribution models are being supplemented by direct delivery services, bulk supply arrangements, and integrated logistics solutions that reduce customer inventory costs and ensure product availability.

Technology convergence between lubricant chemistry and digital solutions is creating new market dynamics. Smart lubricants with embedded sensors, condition monitoring capabilities, and predictive maintenance features represent the next frontier in commercial vehicle maintenance optimization.

Regulatory landscape continues evolving with stricter environmental standards and quality specifications driving product innovation. The alignment with international standards creates opportunities for Indian manufacturers to compete globally while ensuring domestic market products meet world-class quality benchmarks.

Customer behavior patterns show increasing sophistication in lubricant selection criteria, with fleet operators evaluating total cost of ownership, environmental impact, and operational efficiency benefits. This evolution favors brands that can demonstrate measurable value through comprehensive performance data and technical support.

Competitive intensity has increased with new market entrants and existing players expanding their product portfolios. This competition drives innovation, improves service quality, and creates downward pressure on pricing, ultimately benefiting end customers through better value propositions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India commercial vehicle lubricants market. The research framework combines quantitative data collection with qualitative analysis to provide a holistic understanding of market dynamics, competitive landscape, and future trends.

Primary research involves extensive interviews with key stakeholders including lubricant manufacturers, distributors, fleet operators, service providers, and industry experts. These interactions provide firsthand insights into market challenges, opportunities, and emerging trends that shape strategic decision-making across the value chain.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market segments and regional variations.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends, and expert review to ensure accuracy and reliability. The methodology emphasizes transparency in data sources and analytical approaches to maintain research credibility and usefulness for strategic planning.

Market modeling techniques incorporate various scenarios and assumptions to project future market developments under different economic and regulatory conditions. This approach provides stakeholders with robust insights for long-term planning and investment decisions.

Western India dominates the commercial vehicle lubricants market, accounting for approximately 32% of national consumption. States like Maharashtra and Gujarat benefit from extensive industrial activity, major ports, and well-developed transportation infrastructure that drives commercial vehicle deployment and lubricant demand.

Southern India represents another significant market concentration with 28% market share, led by Tamil Nadu, Karnataka, and Andhra Pradesh. The region’s automotive manufacturing clusters, IT industry growth, and agricultural activities create diverse demand patterns across commercial vehicle segments.

Northern India shows strong market presence with 25% consumption share, driven by the National Capital Region’s logistics activities, Punjab’s agricultural sector, and Rajasthan’s mining and construction industries. The region benefits from major highway networks connecting to other parts of the country.

Eastern India accounts for 15% of market demand, with West Bengal leading consumption due to industrial activities and port operations. The region shows growth potential as infrastructure development accelerates and connectivity improves with other economic centers.

Regional preferences vary based on local operating conditions, with coastal areas showing higher demand for corrosion-resistant formulations, while northern plains require lubricants capable of handling extreme temperature variations. These regional characteristics influence product positioning and distribution strategies.

Market leadership is shared among several established players, each bringing unique strengths and market positioning strategies. The competitive environment reflects a mix of international oil majors, domestic companies, and specialized lubricant manufacturers competing across different price segments and customer categories.

Competitive strategies emphasize differentiation through product quality, technical support, distribution reach, and customer service excellence. Companies are investing in research and development, digital platforms, and value-added services to maintain competitive advantages in an increasingly sophisticated market environment.

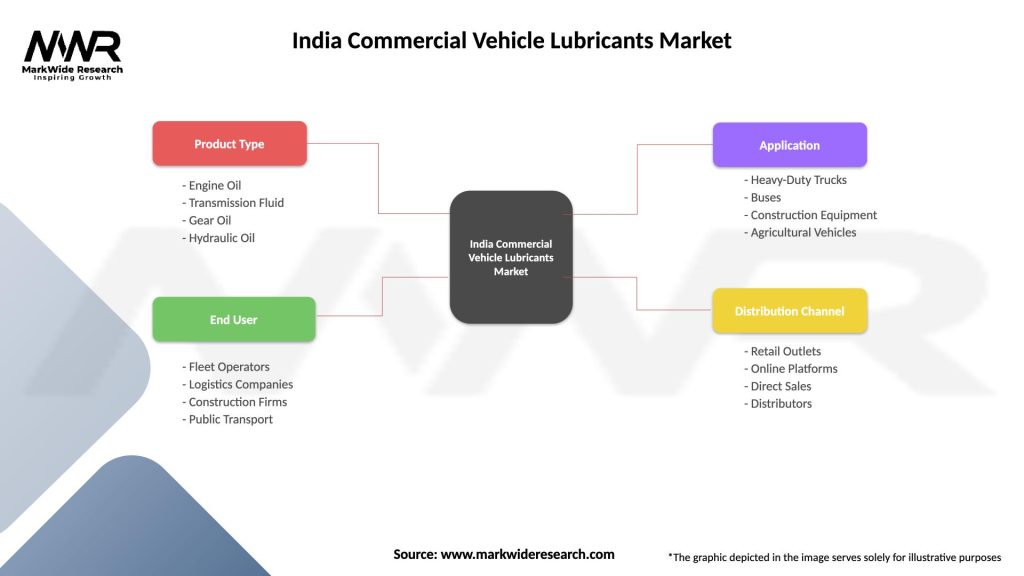

By Product Type: The market segments into engine oils, transmission fluids, hydraulic oils, gear oils, and specialty lubricants. Engine oils represent the largest segment due to frequent change requirements and higher consumption volumes across all commercial vehicle categories.

By Vehicle Type: Segmentation includes light commercial vehicles, medium commercial vehicles, heavy commercial vehicles, and specialty vehicles. Heavy commercial vehicles dominate consumption due to larger lubricant capacities and intensive operational requirements.

By Technology: Market division encompasses conventional mineral oils, semi-synthetic lubricants, and fully synthetic formulations. The technology mix is shifting toward advanced formulations as fleet operators recognize total cost of ownership benefits.

By Distribution Channel: Channels include OEM dealerships, authorized service centers, independent workshops, and direct sales. The distribution landscape is evolving with digital platforms and direct-to-customer models gaining prominence.

By End-User: Market serves fleet operators, individual truck owners, logistics companies, construction firms, and agricultural enterprises. Each segment has distinct requirements regarding product specifications, service levels, and purchasing preferences.

Engine Oil Segment dominates market consumption with diverse viscosity grades catering to different engine types and operating conditions. The segment shows increasing preference for multi-grade oils that provide protection across temperature ranges while meeting modern emission standards.

Transmission Fluid Category experiences growth driven by automatic transmission adoption in commercial vehicles and increasing awareness about transmission maintenance importance. Manual transmission fluids remain significant due to the prevalence of manual gearboxes in Indian commercial vehicles.

Hydraulic Oil Segment serves construction equipment, material handling vehicles, and specialized commercial applications. This category shows strong correlation with infrastructure development activities and construction industry growth patterns.

Gear Oil Applications focus on differential and axle lubrication requirements across commercial vehicle types. The segment emphasizes extreme pressure protection and thermal stability to handle heavy-duty operational demands.

Specialty Lubricants include coolants, brake fluids, and application-specific formulations. This category represents growth opportunities as commercial vehicles become more sophisticated and require specialized maintenance products.

Manufacturers benefit from expanding market opportunities driven by commercial vehicle growth, technology advancement requirements, and increasing quality consciousness among customers. The market offers potential for premium product positioning and value-added service development.

Distributors and Retailers gain from stable demand patterns, recurring purchase cycles, and opportunities to develop long-term customer relationships. The commercial vehicle segment provides predictable business volumes with potential for service-based revenue enhancement.

Fleet Operators realize significant advantages through optimized lubricant selection including reduced maintenance costs, extended vehicle life, improved fuel efficiency, and minimized downtime. Advanced lubricants contribute to total cost of ownership optimization.

Service Providers benefit from increasing complexity in lubricant specifications and maintenance requirements, creating opportunities for specialized services, technical training, and diagnostic capabilities that add value for commercial vehicle operators.

Technology Partners find opportunities in developing innovative formulations, additive packages, and digital solutions that enhance lubricant performance monitoring and maintenance optimization for commercial fleet applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic Lubricant Adoption accelerates as fleet operators recognize long-term cost benefits including extended drain intervals, improved fuel economy, and enhanced engine protection. This trend reflects increasing sophistication in lubricant selection criteria and total cost of ownership awareness.

Digital Integration transforms customer interactions through mobile applications, online ordering platforms, and IoT-enabled monitoring systems. These digital solutions enhance customer convenience while providing valuable data for optimizing maintenance schedules and lubricant performance.

Sustainability Focus drives development of environmentally friendly lubricants with biodegradable formulations, recycled content, and reduced environmental impact. This trend aligns with corporate sustainability goals and regulatory requirements for environmental protection.

Predictive Maintenance adoption increases as fleet operators leverage data analytics and condition monitoring to optimize maintenance timing and lubricant selection. This approach reduces unexpected failures while maximizing lubricant utilization efficiency.

Direct Customer Engagement expands as manufacturers develop closer relationships with end users through technical support, training programs, and customized solutions. This trend bypasses traditional distribution layers to create stronger brand loyalty and customer satisfaction.

BS-VI Compliance Initiatives have driven significant product reformulations across the industry, with manufacturers investing in advanced additive packages and base oil technologies to meet stringent emission standards while maintaining engine protection levels.

Manufacturing Capacity Expansion reflects industry confidence in market growth potential, with several companies announcing new production facilities and capacity upgrades to meet increasing demand for advanced lubricant formulations.

Technology Partnerships between lubricant manufacturers and commercial vehicle OEMs have intensified, focusing on co-developed products optimized for specific engine technologies and operational requirements.

Distribution Network Enhancement includes expansion of authorized service centers, mobile service units, and digital platforms to improve customer accessibility and service quality across urban and rural markets.

Research and Development Investments have increased substantially, with companies focusing on next-generation lubricant technologies including smart fluids, extended drain formulations, and electric vehicle-specific products to maintain competitive advantages.

MWR analysis recommends that market participants focus on building comprehensive value propositions that extend beyond product quality to include technical support, digital services, and customer education programs. This approach can differentiate brands in an increasingly competitive environment.

Investment priorities should emphasize research and development capabilities, particularly in synthetic lubricant technologies and electric vehicle applications. Early positioning in emerging segments can establish competitive advantages as market dynamics evolve.

Distribution strategy optimization requires balancing traditional channels with digital platforms and direct customer engagement models. Companies should invest in omnichannel capabilities that provide seamless customer experiences across all touchpoints.

Customer segmentation strategies should recognize the diverse needs of different fleet operator categories, from large logistics companies seeking premium solutions to small operators prioritizing cost-effectiveness. Tailored approaches can maximize market penetration across segments.

Sustainability initiatives should be integrated into product development and marketing strategies to align with evolving customer expectations and regulatory requirements. Environmental responsibility can become a significant differentiating factor in customer selection processes.

Market trajectory indicates sustained growth driven by India’s expanding economy, infrastructure development, and commercial vehicle modernization trends. The market is expected to maintain robust growth momentum of 6-8% annually over the next five years, supported by favorable macroeconomic conditions and industry developments.

Technology evolution will accelerate with increasing adoption of synthetic lubricants, smart fluids, and condition monitoring systems. These advances will reshape customer expectations and create new opportunities for companies that can deliver innovative solutions addressing evolving market needs.

Regulatory environment will continue evolving with stricter emission standards and environmental regulations driving product innovation and market transformation. Companies that proactively adapt to regulatory changes will gain competitive advantages in the evolving market landscape.

Digital transformation will fundamentally change how lubricant companies interact with customers, deliver services, and optimize operations. The integration of IoT, data analytics, and mobile technologies will create new business models and revenue opportunities.

Market consolidation may accelerate as smaller players struggle to meet technological and regulatory requirements, creating opportunities for established companies to expand market share through acquisitions and strategic partnerships.

India’s commercial vehicle lubricants market presents compelling opportunities for growth and innovation, driven by the country’s expanding transportation infrastructure, evolving regulatory landscape, and increasing sophistication among fleet operators. The market’s transformation from price-focused to value-driven purchasing decisions creates opportunities for companies that can demonstrate measurable benefits through advanced products and comprehensive service offerings.

Strategic success in this market requires balancing product innovation with cost competitiveness, while building strong distribution networks and customer relationships. Companies that invest in research and development, embrace digital transformation, and focus on sustainability will be best positioned to capitalize on emerging opportunities and navigate market challenges.

Future market dynamics will be shaped by technological advancement, regulatory evolution, and changing customer expectations. The transition toward synthetic lubricants, electric vehicle adoption, and digital service delivery models will create new competitive landscapes requiring adaptive strategies and continuous innovation to maintain market leadership positions in India’s dynamic commercial vehicle lubricants market.

What is Commercial Vehicle Lubricants?

Commercial Vehicle Lubricants are specialized oils and fluids designed to reduce friction and wear in the engines and components of commercial vehicles, such as trucks and buses. They play a crucial role in enhancing performance, extending engine life, and improving fuel efficiency.

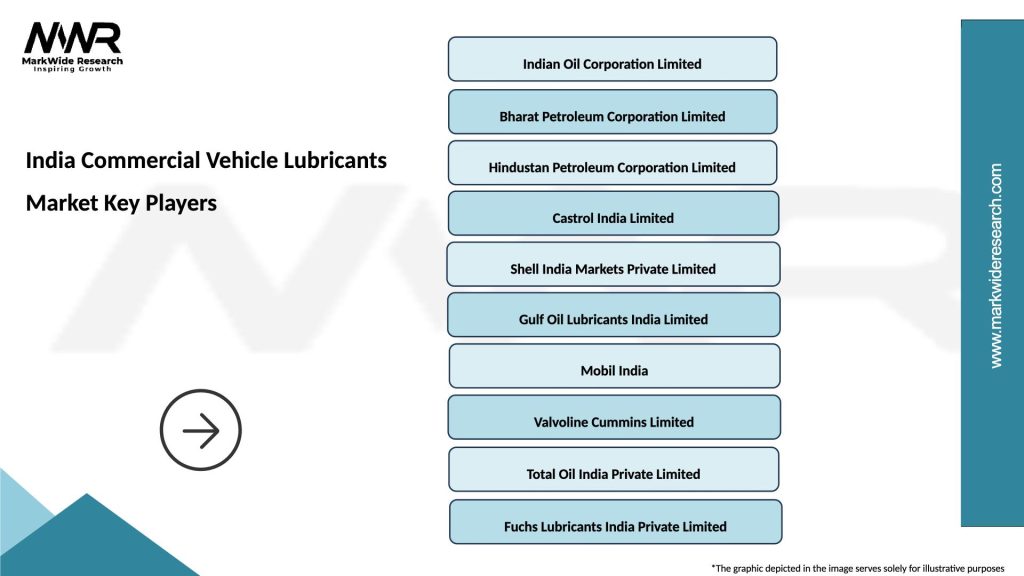

What are the key players in the India Commercial Vehicle Lubricants Market?

Key players in the India Commercial Vehicle Lubricants Market include Indian Oil Corporation, Bharat Petroleum, and Castrol India, among others. These companies are known for their extensive product ranges and strong distribution networks.

What are the growth factors driving the India Commercial Vehicle Lubricants Market?

The growth of the India Commercial Vehicle Lubricants Market is driven by the increasing demand for commercial vehicles, rising freight transportation needs, and advancements in lubricant formulations that enhance engine performance and efficiency.

What challenges does the India Commercial Vehicle Lubricants Market face?

The India Commercial Vehicle Lubricants Market faces challenges such as stringent environmental regulations, the shift towards electric vehicles, and the need for continuous innovation in lubricant technology to meet evolving industry standards.

What opportunities exist in the India Commercial Vehicle Lubricants Market?

Opportunities in the India Commercial Vehicle Lubricants Market include the growing trend of fleet management services, increasing awareness of the benefits of high-quality lubricants, and the potential for expansion in rural and semi-urban markets.

What trends are shaping the India Commercial Vehicle Lubricants Market?

Trends shaping the India Commercial Vehicle Lubricants Market include the development of synthetic lubricants, a focus on sustainability and eco-friendly products, and the integration of advanced technologies for better performance monitoring and maintenance.

India Commercial Vehicle Lubricants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Gear Oil, Hydraulic Oil |

| End User | Fleet Operators, Logistics Companies, Construction Firms, Public Transport |

| Application | Heavy-Duty Trucks, Buses, Construction Equipment, Agricultural Vehicles |

| Distribution Channel | Retail Outlets, Online Platforms, Direct Sales, Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Commercial Vehicle Lubricants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at