444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India city gas distribution market represents one of the most dynamic and rapidly expanding sectors within the country’s energy infrastructure landscape. This comprehensive network encompasses the systematic distribution of natural gas through underground pipelines to residential, commercial, and industrial consumers across urban and semi-urban areas. India’s commitment to cleaner energy alternatives has positioned the city gas distribution sector as a cornerstone of the nation’s energy transition strategy.

Market dynamics indicate robust growth driven by government initiatives promoting natural gas adoption, increasing environmental consciousness, and the expanding coverage of pipeline infrastructure. The sector has witnessed significant expansion with coverage extending to over 400 districts across the country, representing a substantial increase from previous years. Growth trajectories suggest the market is experiencing a compound annual growth rate of approximately 12.5%, reflecting strong demand fundamentals and supportive policy frameworks.

Infrastructure development remains a key catalyst, with extensive pipeline networks being established to connect major gas sources to distribution centers. The market encompasses various consumer segments, including domestic households utilizing piped natural gas for cooking and heating, commercial establishments requiring consistent gas supply, and industrial units seeking cost-effective fuel alternatives. Regional penetration has expanded significantly, with major metropolitan areas achieving 75% coverage while tier-2 and tier-3 cities show accelerating adoption rates.

The India city gas distribution market refers to the organized sector responsible for the retail distribution of natural gas through dedicated pipeline networks to end consumers in urban and semi-urban areas. This market encompasses the entire value chain from gas procurement and transmission to last-mile distribution and customer service operations.

City gas distribution involves the establishment of comprehensive pipeline infrastructure that delivers natural gas directly to consumers’ premises through a network of steel and polyethylene pipelines. The system includes various components such as district regulating stations, pressure reduction stations, and individual consumer connections that ensure safe and reliable gas supply. Market participants include authorized city gas distribution companies that hold exclusive licenses to operate within specific geographical areas.

The sector operates under a regulated framework where companies obtain authorization through competitive bidding processes for specific geographical areas. These entities are responsible for developing the necessary infrastructure, ensuring safety standards, and providing customer services while maintaining competitive pricing structures. Consumer segments include residential users accessing piped natural gas for domestic purposes, commercial establishments requiring gas for various applications, and industrial consumers utilizing natural gas as a fuel source or feedstock.

India’s city gas distribution market stands at a pivotal juncture characterized by unprecedented growth opportunities and transformative policy support. The sector has emerged as a critical component of the country’s energy security strategy, driven by the government’s vision to increase the share of natural gas in the energy mix to 15% by 2030. This ambitious target has catalyzed significant investments in infrastructure development and market expansion initiatives.

Market fundamentals remain exceptionally strong, supported by favorable regulatory frameworks, increasing consumer awareness about clean energy benefits, and expanding pipeline connectivity. The sector has witnessed remarkable progress in geographical coverage, with city gas distribution networks now operational in over 400 districts compared to fewer than 100 districts a decade ago. Consumer adoption rates have accelerated significantly, with residential connections growing at approximately 18% annually in major metropolitan areas.

Investment flows into the sector have intensified, with both public and private entities committing substantial resources to infrastructure development and market expansion. The competitive landscape features established players alongside emerging entities, creating a dynamic environment that fosters innovation and service quality improvements. Technological advancements in pipeline materials, safety systems, and customer service platforms have enhanced operational efficiency and consumer experience across the market.

Strategic market insights reveal several critical factors shaping the India city gas distribution landscape. The sector’s growth trajectory is fundamentally supported by the country’s commitment to reducing carbon emissions and transitioning toward cleaner energy sources. Government initiatives including subsidies for domestic connections and promotional campaigns have significantly accelerated market penetration rates.

Government policy support represents the primary driver propelling the India city gas distribution market forward. The central government’s commitment to increasing natural gas share in the energy mix has resulted in comprehensive policy frameworks that facilitate market expansion and infrastructure development. Regulatory incentives including streamlined approval processes, financial support mechanisms, and promotional campaigns have created an enabling environment for sector growth.

Environmental consciousness among consumers and businesses has emerged as a significant market driver. Growing awareness about air pollution, climate change, and the environmental benefits of natural gas has accelerated adoption rates across consumer segments. Urban air quality concerns particularly in major metropolitan areas have prompted both government initiatives and consumer preferences toward cleaner fuel alternatives, positioning natural gas as an attractive option.

Economic advantages of natural gas compared to traditional fuels continue to drive market expansion. Cost savings for consumers, particularly in residential cooking applications and industrial processes, have made natural gas an economically viable choice. Price stability and supply security offered by pipeline-based distribution systems provide additional economic incentives for consumers to switch from conventional fuels to natural gas.

Infrastructure development initiatives including the expansion of national gas grid connectivity and regional pipeline networks have created the foundational framework necessary for market growth. Investment commitments from both public and private sectors in pipeline infrastructure development have enhanced supply security and expanded market reach to previously underserved regions.

High capital investment requirements for infrastructure development represent a significant restraint for the India city gas distribution market. The establishment of comprehensive pipeline networks, distribution systems, and safety infrastructure requires substantial upfront investments that can strain financial resources of market participants. Return on investment timelines for infrastructure projects often extend over several years, creating financial challenges for companies seeking rapid market expansion.

Regulatory complexities and approval processes can create delays in project implementation and market entry. Multiple regulatory authorities at central, state, and local levels require coordination and compliance, potentially slowing down infrastructure development initiatives. Land acquisition challenges for pipeline laying and facility establishment can further complicate project timelines and increase implementation costs.

Consumer behavior patterns and resistance to change from traditional fuel sources present adoption challenges in certain market segments. Initial connection costs and appliance conversion requirements can deter some consumers from switching to natural gas, particularly in price-sensitive market segments. Educational initiatives and awareness campaigns require ongoing investment to overcome these behavioral barriers.

Supply chain dependencies on natural gas availability and pricing fluctuations can impact market stability. Import dependencies for natural gas supplies expose the market to international price volatilities and supply security concerns, potentially affecting long-term growth sustainability and pricing competitiveness against alternative fuels.

Geographical expansion opportunities present immense potential for the India city gas distribution market. With coverage currently limited to approximately 400 districts out of over 700 districts nationwide, substantial untapped markets exist for infrastructure development and consumer base expansion. Tier-2 and tier-3 cities represent particularly attractive opportunities due to growing urbanization, increasing disposable incomes, and government focus on inclusive development.

Industrial sector penetration offers significant growth prospects as manufacturing units seek cleaner and cost-effective fuel alternatives. Small and medium enterprises transitioning from traditional fuels to natural gas present substantial market opportunities, particularly in sectors such as textiles, ceramics, glass manufacturing, and food processing where natural gas can provide operational advantages.

Transportation sector integration through compressed natural gas applications creates new market dimensions. Public transportation systems and commercial vehicle fleets increasingly adopting CNG present opportunities for city gas distribution companies to diversify their customer base and revenue streams while contributing to urban air quality improvement initiatives.

Technology-driven service enhancements including smart metering, digital payment systems, and IoT-enabled monitoring create opportunities for operational efficiency improvements and enhanced customer experience. Value-added services such as appliance maintenance, energy consulting, and customized industrial solutions can generate additional revenue streams while strengthening customer relationships.

Supply-demand dynamics in the India city gas distribution market reflect a complex interplay of infrastructure capacity, consumer adoption rates, and natural gas availability. Demand growth has consistently outpaced supply infrastructure development in many regions, creating opportunities for market expansion while highlighting the need for accelerated infrastructure investment. Consumer demand patterns show seasonal variations with peak consumption during winter months for residential heating applications.

Competitive dynamics have intensified as the market attracts both established energy companies and new entrants seeking to capitalize on growth opportunities. Market consolidation trends are emerging as companies seek to achieve economies of scale and expand geographical coverage through strategic partnerships and acquisitions. Service quality differentiation has become increasingly important as companies compete for consumer preference and loyalty.

Pricing dynamics remain influenced by natural gas procurement costs, infrastructure investment requirements, and regulatory pricing frameworks. Cost optimization initiatives including operational efficiency improvements and technology adoption help companies maintain competitive pricing while ensuring sustainable business models. Regional pricing variations reflect local market conditions, infrastructure development costs, and competitive landscapes.

Technological dynamics are transforming operational capabilities and service delivery models across the market. Digital transformation initiatives including automated monitoring systems, predictive maintenance capabilities, and customer service platforms are enhancing operational efficiency while reducing costs. Innovation in pipeline materials and installation techniques is reducing infrastructure development costs and improving system reliability.

Comprehensive research methodology employed for analyzing the India city gas distribution market encompasses multiple data collection and analysis techniques to ensure accuracy and reliability of insights. Primary research involves direct engagement with industry stakeholders including city gas distribution companies, regulatory authorities, consumer groups, and technology providers to gather firsthand market intelligence and operational insights.

Secondary research incorporates extensive analysis of government publications, regulatory documents, industry reports, and company financial statements to establish market baselines and identify trends. Data triangulation techniques are employed to validate findings across multiple sources and ensure consistency of market intelligence. Statistical analysis methods are applied to identify correlations and patterns within market data sets.

Market modeling approaches utilize both quantitative and qualitative analysis frameworks to project future market scenarios and growth trajectories. Scenario analysis considers various market conditions including policy changes, economic factors, and technological developments to provide comprehensive market outlook perspectives. Expert interviews and industry consultations provide qualitative insights that complement quantitative data analysis.

Validation processes include peer review of findings, cross-verification of data sources, and stakeholder feedback incorporation to ensure research accuracy and relevance. Continuous monitoring of market developments and regular updates to research findings maintain the currency and applicability of market intelligence for strategic decision-making purposes.

Northern India represents the most mature market for city gas distribution, with states like Delhi, Punjab, and Haryana achieving significant penetration rates. Delhi NCR region leads in terms of infrastructure development and consumer adoption, with residential penetration rates exceeding 60% in many areas. The region benefits from proximity to major gas sources and established pipeline infrastructure that facilitates reliable supply chains.

Western India including Maharashtra, Gujarat, and Rajasthan shows robust growth potential driven by industrial demand and urbanization trends. Mumbai metropolitan area and Pune represent key growth centers with expanding residential and commercial consumer bases. Gujarat’s industrial corridor presents substantial opportunities for industrial gas distribution applications, supported by the state’s pro-business policies and infrastructure development initiatives.

Southern India markets including Karnataka, Andhra Pradesh, and Tamil Nadu are experiencing accelerated growth as infrastructure development expands coverage areas. Bangalore and Chennai metropolitan areas show strong adoption rates, while smaller cities present emerging opportunities. The region’s technology sector concentration creates demand for reliable and clean energy sources, supporting market expansion initiatives.

Eastern India represents an emerging market with significant untapped potential, particularly in West Bengal and Odisha. Kolkata metropolitan area shows growing interest in natural gas adoption, while industrial regions present opportunities for commercial and industrial applications. Infrastructure development in this region is accelerating, supported by government initiatives and private sector investments.

The competitive landscape of India’s city gas distribution market features a diverse mix of established energy companies, joint ventures, and emerging players competing for market share across different geographical regions. Market leadership is distributed among several key players, each with distinct competitive advantages and strategic focus areas.

Competitive strategies focus on infrastructure expansion, service quality enhancement, and customer acquisition through competitive pricing and value-added services. Market differentiation is achieved through technology adoption, safety standards, and customer service excellence, with companies investing in digital platforms and automated systems to improve operational efficiency.

Consumer segment analysis reveals distinct market categories with unique characteristics, growth patterns, and service requirements. Residential consumers represent the largest segment by volume, primarily utilizing piped natural gas for cooking and heating applications. This segment shows consistent growth driven by urbanization, government promotional campaigns, and cost advantages compared to traditional cooking fuels.

By Application:

By Infrastructure Type:

By Geography:

Residential category insights reveal strong growth momentum driven by government initiatives promoting clean cooking fuel adoption. Connection growth rates in this segment average 15-20% annually in major metropolitan areas, with smaller cities showing even higher growth rates as infrastructure expands. Consumer preferences increasingly favor natural gas due to convenience, cost-effectiveness, and environmental benefits compared to LPG cylinders and other traditional cooking fuels.

Commercial segment dynamics show diversified demand patterns across various business categories. Restaurant and hospitality sectors represent significant consumers due to consistent gas requirements and operational cost advantages. Healthcare facilities and educational institutions are increasingly adopting natural gas for heating and operational needs, driven by reliability and environmental considerations.

Industrial category analysis indicates substantial growth potential as manufacturing units seek cleaner and cost-effective fuel alternatives. Small and medium enterprises show increasing interest in natural gas adoption, particularly in sectors such as textiles, ceramics, and food processing where gas provides operational advantages. Large industrial consumers are entering into long-term supply agreements, providing revenue stability for distribution companies.

Transportation segment insights highlight the growing adoption of CNG across various vehicle categories. Public transportation systems are increasingly converting to CNG to reduce emissions and operational costs, while commercial vehicle operators are adopting CNG for economic benefits. Private vehicle CNG adoption is growing in cities with established refueling infrastructure and supportive government policies.

Distribution companies benefit from stable revenue streams generated through regulated pricing frameworks and growing consumer bases. Long-term contracts with industrial and commercial consumers provide predictable cash flows, while residential segment growth ensures sustained demand expansion. Infrastructure investments create barriers to entry and establish competitive advantages in authorized geographical areas.

Consumers realize significant economic benefits through cost savings compared to alternative fuels, particularly in residential cooking applications where natural gas provides substantial savings over LPG cylinders. Convenience factors including uninterrupted supply, elimination of cylinder handling, and automated billing systems enhance user experience and satisfaction levels.

Government stakeholders achieve multiple policy objectives through city gas distribution market development. Environmental benefits include reduced air pollution, lower carbon emissions, and improved urban air quality that align with climate change commitments and sustainable development goals. Energy security improvements through diversified fuel sources and reduced import dependencies strengthen national energy resilience.

Economic stakeholders including equipment manufacturers, construction companies, and service providers benefit from infrastructure development opportunities and ongoing maintenance requirements. Employment generation across various skill levels contributes to economic development, while industrial competitiveness improvements through cleaner and cost-effective fuel access support manufacturing sector growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation trends are reshaping the India city gas distribution market through technology adoption and service innovation. Smart metering systems are being deployed to enable real-time consumption monitoring, automated billing, and improved customer service capabilities. Mobile applications and digital payment platforms are enhancing customer experience while reducing operational costs for distribution companies.

Infrastructure modernization trends focus on safety enhancement and operational efficiency improvements. Advanced pipeline materials and installation techniques are reducing infrastructure costs while improving system reliability and safety standards. Automated monitoring systems and predictive maintenance capabilities are being implemented to minimize service disruptions and optimize operational performance.

Customer service evolution trends emphasize personalized service delivery and value-added offerings. MarkWide Research indicates that companies are developing comprehensive customer service platforms that provide energy consumption insights, appliance maintenance services, and customized billing options. Educational programs and awareness campaigns are being enhanced to accelerate consumer adoption and satisfaction levels.

Sustainability integration trends align market development with environmental objectives and corporate social responsibility initiatives. Carbon footprint reduction programs and green energy certifications are being implemented to enhance market appeal and support climate change mitigation efforts. Circular economy principles are being adopted in infrastructure development and operational practices.

Recent industry developments highlight the dynamic nature of India’s city gas distribution market and the continuous evolution of business models and operational capabilities. Major infrastructure projects including new pipeline networks and distribution systems are being commissioned across various regions, significantly expanding market coverage and consumer access to natural gas services.

Strategic partnerships and joint ventures are being formed between established energy companies and regional players to accelerate market expansion and leverage complementary capabilities. Technology collaborations with international companies are bringing advanced solutions and best practices to the Indian market, enhancing operational efficiency and service quality standards.

Regulatory developments include streamlined approval processes for new projects and enhanced safety standards for distribution operations. Policy initiatives supporting infrastructure development and consumer adoption are being implemented at both central and state government levels, creating favorable conditions for market growth and investment attraction.

Investment announcements from both domestic and international investors demonstrate confidence in market growth prospects and long-term sustainability. Capacity expansion projects and new market entry initiatives are being launched regularly, indicating robust market dynamics and competitive intensity across different geographical regions.

Strategic recommendations for market participants focus on sustainable growth strategies that balance infrastructure investment with market development initiatives. Geographical expansion should prioritize high-potential markets with favorable demographics and supportive local policies while ensuring adequate financial resources for infrastructure development and operational sustainability.

Technology adoption strategies should emphasize digital transformation initiatives that enhance operational efficiency and customer experience. Investment priorities should include smart metering systems, automated monitoring capabilities, and customer service platforms that differentiate service offerings and improve competitive positioning in the market.

Customer acquisition strategies should focus on education and awareness programs that highlight the benefits of natural gas adoption while addressing consumer concerns about safety and reliability. Pricing strategies should maintain competitiveness against alternative fuels while ensuring sustainable business models that support long-term growth and service quality maintenance.

Partnership strategies should leverage collaborations with government agencies, technology providers, and financial institutions to accelerate market development and access specialized capabilities. Risk management approaches should address supply chain dependencies, regulatory changes, and market volatilities through diversification and contingency planning initiatives.

The future outlook for India’s city gas distribution market remains exceptionally positive, supported by strong fundamentals and favorable market conditions. Growth projections indicate continued expansion at robust rates, with market coverage expected to reach over 600 districts within the next five years. Infrastructure development initiatives and government support mechanisms will continue driving market expansion and consumer adoption acceleration.

Technological evolution will transform operational capabilities and service delivery models across the market. Smart infrastructure including IoT-enabled monitoring systems, predictive maintenance capabilities, and automated customer service platforms will become standard features that enhance efficiency and customer satisfaction. Digital payment systems and mobile applications will further improve customer experience and operational efficiency.

Market maturation will lead to service differentiation and value-added offerings as companies compete for customer loyalty and market share. MWR analysis suggests that successful companies will focus on comprehensive service portfolios that include energy consulting, appliance maintenance, and customized solutions for different consumer segments.

Sustainability integration will become increasingly important as environmental regulations strengthen and consumer preferences shift toward cleaner energy sources. Carbon neutrality initiatives and renewable energy integration will create new opportunities for market participants while supporting national climate change objectives and international commitments.

The India city gas distribution market represents a transformative sector that combines significant growth potential with strategic importance for the country’s energy security and environmental objectives. Market fundamentals remain exceptionally strong, supported by government policy initiatives, growing consumer awareness, and expanding infrastructure development that creates sustainable competitive advantages for market participants.

Growth trajectories indicate continued expansion across geographical regions and consumer segments, with particular opportunities in tier-2 cities, industrial applications, and transportation sector integration. Technology adoption and service innovation will differentiate successful companies while enhancing operational efficiency and customer satisfaction levels throughout the market.

Strategic success in this market requires balanced approaches that combine infrastructure investment with customer acquisition initiatives, technology adoption with operational excellence, and growth ambitions with risk management capabilities. Market participants who effectively navigate these requirements while maintaining focus on sustainability and service quality will capture the substantial opportunities presented by India’s evolving energy landscape and achieve long-term competitive success in this dynamic and rapidly expanding market.

What is City Gas Distribution?

City Gas Distribution refers to the infrastructure and processes involved in delivering natural gas to residential, commercial, and industrial consumers in urban areas. It includes the distribution network, metering, and safety measures to ensure efficient gas supply.

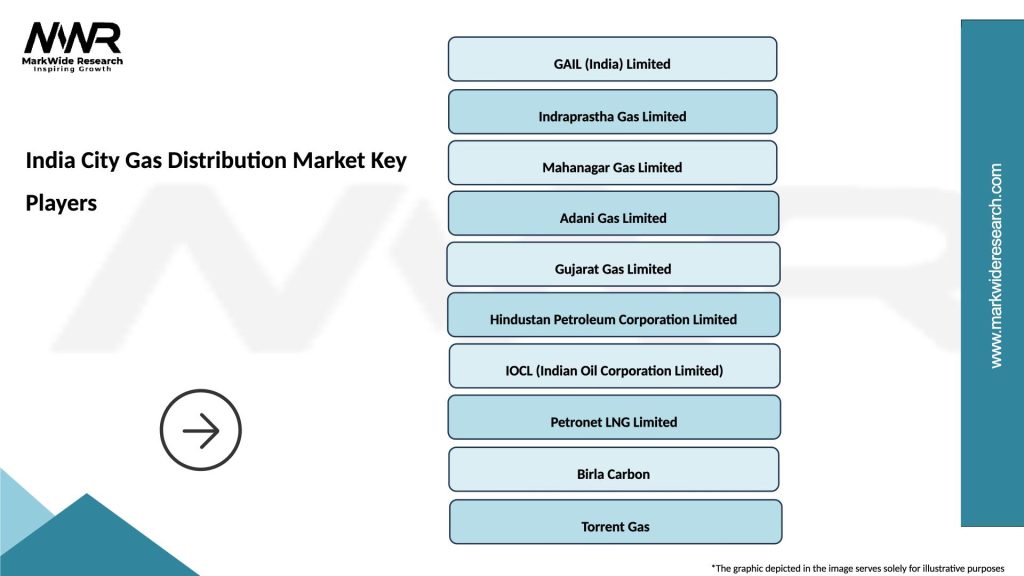

What are the key players in the India City Gas Distribution Market?

Key players in the India City Gas Distribution Market include Indraprastha Gas Limited, Mahanagar Gas Limited, and Gujarat Gas Limited, among others. These companies are involved in the distribution and supply of natural gas to various sectors.

What are the growth factors driving the India City Gas Distribution Market?

The growth of the India City Gas Distribution Market is driven by increasing urbanization, rising demand for cleaner energy sources, and government initiatives promoting natural gas usage. Additionally, the expansion of pipeline infrastructure supports market growth.

What challenges does the India City Gas Distribution Market face?

The India City Gas Distribution Market faces challenges such as regulatory hurdles, high infrastructure costs, and competition from alternative energy sources. These factors can hinder the expansion and efficiency of gas distribution networks.

What opportunities exist in the India City Gas Distribution Market?

Opportunities in the India City Gas Distribution Market include the potential for expanding services to underserved areas, advancements in technology for better safety and efficiency, and increasing investments in renewable energy integration.

What trends are shaping the India City Gas Distribution Market?

Trends in the India City Gas Distribution Market include the adoption of smart metering technologies, increased focus on sustainability, and the integration of digital solutions for monitoring and managing gas distribution systems.

India City Gas Distribution Market

| Segmentation Details | Description |

|---|---|

| Type | Domestic, Commercial, Industrial, Transportation |

| Technology | CNG, PNG, Biogas, LNG |

| End User | Households, Restaurants, Factories, Power Plants |

| Distribution Channel | Direct Supply, Retail Outlets, Online Sales, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India City Gas Distribution Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at