444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India CCTV camera market represents one of the fastest-growing security technology sectors in the Asia-Pacific region, driven by increasing security concerns, urbanization, and government initiatives for smart city development. Digital surveillance systems have become integral to modern security infrastructure across residential, commercial, and industrial applications throughout the country.

Market expansion is fueled by rising crime rates in urban areas, growing awareness about security solutions, and the implementation of comprehensive surveillance programs by both public and private sectors. The market demonstrates robust growth potential with a projected CAGR of 12.8% over the forecast period, reflecting strong demand across multiple application segments.

Technological advancement in video analytics, artificial intelligence integration, and cloud-based storage solutions has revolutionized the traditional CCTV landscape. Modern surveillance systems now offer enhanced features including facial recognition, motion detection, and real-time monitoring capabilities that appeal to diverse customer segments.

Government initiatives such as the Smart Cities Mission and Digital India program have significantly accelerated market adoption. These programs emphasize the deployment of intelligent surveillance systems in public spaces, transportation hubs, and critical infrastructure facilities, creating substantial opportunities for market participants.

The India CCTV camera market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, installation, and maintenance of closed-circuit television surveillance systems across the Indian subcontinent. This market includes various camera technologies, recording equipment, monitoring systems, and associated software solutions designed for security and surveillance applications.

CCTV systems in the Indian context serve multiple purposes including crime prevention, traffic monitoring, industrial security, residential protection, and commercial surveillance. The market encompasses both analog and digital camera technologies, with increasing emphasis on IP-based systems that offer superior image quality and remote monitoring capabilities.

Market participants include international technology providers, domestic manufacturers, system integrators, and service providers who collectively contribute to the development and deployment of surveillance infrastructure. The ecosystem supports various stakeholders from component suppliers to end-user organizations across different industry verticals.

India’s CCTV camera market exhibits exceptional growth momentum driven by escalating security concerns and rapid urbanization across major metropolitan areas. The market benefits from favorable government policies, increasing disposable income, and growing awareness about the importance of surveillance systems in crime prevention and safety management.

Key growth drivers include the expansion of retail chains, industrial facilities, educational institutions, and healthcare infrastructure that require comprehensive security solutions. The market shows strong adoption rates with residential segment growth of 15.2% annually, reflecting increased consumer awareness and affordability of modern surveillance technologies.

Technological innovation remains a critical differentiator, with market leaders investing heavily in AI-powered analytics, cloud integration, and mobile connectivity features. These advancements enable users to access real-time monitoring capabilities and receive intelligent alerts, enhancing the overall value proposition of CCTV systems.

Regional distribution shows concentrated demand in tier-1 cities, with emerging opportunities in tier-2 and tier-3 markets as infrastructure development accelerates. The market demonstrates strong potential for sustained growth supported by favorable demographic trends and increasing security consciousness among consumers.

Market dynamics reveal several critical insights that shape the competitive landscape and growth trajectory of India’s CCTV camera sector:

Consumer behavior indicates strong preference for integrated security solutions that combine CCTV cameras with access control systems, alarm systems, and smart home automation features. This trend creates opportunities for comprehensive security ecosystem providers.

Security concerns represent the primary driver for CCTV camera adoption across India, with rising crime rates in urban areas creating urgent demand for surveillance solutions. Property protection has become a top priority for residential and commercial property owners, driving consistent market expansion.

Government initiatives play a crucial role in market development through large-scale surveillance projects and smart city implementations. The Safe City Project and similar programs have allocated substantial resources for comprehensive surveillance infrastructure development in major cities.

Urbanization trends continue to fuel market growth as expanding cities require enhanced security infrastructure to manage growing populations and increased economic activity. Commercial development in retail, hospitality, and office sectors creates sustained demand for professional surveillance systems.

Technological affordability has improved significantly, making advanced CCTV systems accessible to broader market segments. Cost reduction in camera manufacturing and improved financing options have democratized access to quality surveillance technology.

Insurance requirements increasingly mandate CCTV installations for commercial properties, creating compliance-driven demand. Risk mitigation strategies adopted by businesses include comprehensive surveillance systems as essential security infrastructure.

Awareness campaigns by security associations and government agencies have educated consumers about the benefits of CCTV systems, resulting in increased adoption rates across various demographic segments.

High initial investment remains a significant barrier for small businesses and budget-conscious consumers, particularly for comprehensive surveillance systems with advanced features. Installation costs and ongoing maintenance expenses can deter potential customers from adopting CCTV solutions.

Privacy concerns among consumers create resistance to surveillance system adoption, especially in residential applications where personal privacy considerations influence purchasing decisions. Data security issues related to cloud storage and remote access capabilities raise additional concerns.

Technical complexity of modern CCTV systems can overwhelm non-technical users, creating barriers to adoption and requiring extensive customer education and support services. Integration challenges with existing security infrastructure add complexity to system deployment.

power infrastructure limitations in certain regions affect system reliability and performance, particularly in areas with frequent power outages or unstable electrical supply. Backup power requirements increase overall system costs and complexity.

Skilled technician shortage impacts installation quality and after-sales service delivery, potentially affecting customer satisfaction and market growth. Training requirements for installation and maintenance personnel create additional operational challenges.

Regulatory uncertainties regarding data privacy laws and surveillance regulations create compliance challenges for businesses and system integrators, potentially slowing market adoption in certain segments.

Smart city development presents enormous opportunities for CCTV camera manufacturers and system integrators as government initiatives accelerate infrastructure modernization. Public safety projects require comprehensive surveillance solutions creating substantial business potential.

Tier-2 and tier-3 cities represent untapped markets with significant growth potential as economic development and security awareness increase in these regions. Market penetration in smaller cities offers opportunities for scaled deployment and volume growth.

Industrial automation trends create demand for specialized surveillance solutions in manufacturing facilities, warehouses, and logistics centers. Process monitoring applications extend beyond security to include operational efficiency and quality control.

Retail expansion across India generates consistent demand for loss prevention and customer behavior analysis systems. Chain stores and shopping centers require integrated surveillance solutions for comprehensive security management.

Educational institutions increasingly prioritize campus security, creating opportunities for specialized surveillance solutions designed for academic environments. Student safety concerns drive adoption of comprehensive monitoring systems.

Healthcare facilities require specialized surveillance solutions for patient safety, asset protection, and regulatory compliance. Hospital security applications present opportunities for tailored CCTV solutions with healthcare-specific features.

Transportation infrastructure development creates demand for surveillance systems in airports, railway stations, metro systems, and highway networks. Traffic management applications offer additional revenue streams beyond traditional security applications.

Competitive intensity in the India CCTV camera market continues to increase as both domestic and international players vie for market share. Price competition remains fierce, particularly in the entry-level segment, driving innovation in cost-effective solution development.

Technology evolution shapes market dynamics with rapid advancement in AI capabilities, image quality, and system integration features. Innovation cycles have accelerated, requiring continuous investment in research and development to maintain competitive positioning.

Supply chain dynamics influence market operations with component sourcing, manufacturing efficiency, and distribution network optimization affecting competitive advantage. Local manufacturing initiatives under Make in India program impact cost structures and market accessibility.

Customer expectations continue to evolve toward more sophisticated features and seamless user experiences. Service quality has become a key differentiator with customers demanding reliable installation, maintenance, and technical support services.

Regulatory environment affects market dynamics through data protection laws, quality standards, and certification requirements. Compliance costs and regulatory complexity influence market entry strategies and operational approaches.

Partnership strategies between technology providers, system integrators, and channel partners shape market development and customer reach. Ecosystem collaboration enables comprehensive solution delivery and market expansion.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including manufacturers, distributors, system integrators, and end-users across different market segments. Survey data collection involves structured questionnaires designed to capture market trends, customer preferences, and adoption patterns.

Secondary research incorporates analysis of industry reports, government publications, trade association data, and company financial statements to validate market insights. Data triangulation ensures accuracy and reliability of market intelligence through multiple source verification.

Market sizing methodology utilizes bottom-up and top-down approaches to estimate market dimensions and growth projections. Statistical analysis employs advanced modeling techniques to forecast market trends and identify growth opportunities.

Expert interviews with industry leaders, technology specialists, and market analysts provide qualitative insights into market dynamics and future developments. Focus groups with end-users offer valuable perspectives on product requirements and satisfaction levels.

Database analysis leverages proprietary and public databases to track market performance, competitive positioning, and technological developments. Real-time monitoring of market indicators ensures current and relevant market intelligence.

North India represents the largest regional market with 35% market share, driven by the National Capital Region’s extensive commercial and residential development. Delhi NCR leads in adoption of advanced surveillance technologies with strong government and corporate demand.

West India demonstrates robust growth with 28% market share, primarily concentrated in Maharashtra and Gujarat states. Mumbai metropolitan area shows high adoption rates in commercial and industrial applications, while Pune emerges as a significant IT sector market.

South India accounts for 25% market share with strong growth in Karnataka, Tamil Nadu, and Andhra Pradesh. Bangalore leads in technology adoption with emphasis on AI-enabled surveillance solutions, while Chennai shows strong industrial and port security demand.

East India holds 12% market share with growing opportunities in West Bengal and Odisha. Kolkata demonstrates increasing adoption in commercial and government sectors, supported by smart city initiatives and infrastructure development projects.

Tier-2 cities across all regions show accelerating growth with increasing security awareness and economic development. Market penetration in these cities remains relatively low, presenting significant expansion opportunities for market participants.

Rural markets represent emerging opportunities as connectivity infrastructure improves and security consciousness increases. Agricultural applications and rural commercial establishments create new demand segments for cost-effective surveillance solutions.

Market leadership is distributed among several key players combining international technology providers and domestic manufacturers. Competition intensity varies across different market segments with distinct strategies for premium and value segments.

Competitive strategies focus on product innovation, pricing optimization, channel expansion, and service quality enhancement. Market consolidation trends indicate potential for strategic partnerships and acquisitions as companies seek to strengthen market positions.

By Technology:

By Application:

By Resolution:

Dome cameras dominate the commercial segment due to their discrete design and vandal-resistant features. Installation flexibility and aesthetic appeal make dome cameras preferred choice for retail and office environments.

Bullet cameras show strong adoption in outdoor applications and perimeter security due to their weather-resistant design and long-range capabilities. Deterrent effect of visible bullet cameras appeals to property owners seeking crime prevention.

PTZ cameras serve specialized applications requiring active monitoring and tracking capabilities. Remote control features and zoom functionality make PTZ systems valuable for large area surveillance and security operations.

Hidden cameras address covert surveillance requirements in sensitive applications. Discrete monitoring capabilities serve specific security needs while maintaining aesthetic considerations.

Smart cameras with AI capabilities represent the fastest-growing category with annual growth of 18.5%. Intelligent analytics including facial recognition and behavior analysis create premium value propositions.

Wireless cameras gain popularity for their installation convenience and flexibility. Battery-powered options enable surveillance in locations without electrical infrastructure, expanding application possibilities.

Manufacturers benefit from expanding market opportunities driven by increasing security awareness and government initiatives. Revenue growth potential remains strong across multiple application segments with opportunities for product innovation and market expansion.

System integrators gain from growing demand for comprehensive security solutions and professional installation services. Service revenue streams provide recurring income opportunities through maintenance contracts and system upgrades.

Distributors benefit from market expansion into tier-2 and tier-3 cities as demand grows beyond metropolitan areas. Channel partnerships with manufacturers provide access to diverse product portfolios and market support.

End-users gain enhanced security capabilities, crime deterrence, and operational insights through modern surveillance systems. ROI benefits include reduced security incidents, insurance premium reductions, and improved operational efficiency.

Technology providers benefit from opportunities to integrate AI, cloud services, and mobile connectivity into surveillance solutions. Innovation opportunities create competitive advantages and premium pricing possibilities.

Service providers gain from increasing demand for installation, maintenance, and monitoring services. Recurring revenue models through managed services create sustainable business opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

AI-powered analytics represent the most significant trend transforming CCTV capabilities from passive recording to intelligent monitoring systems. Machine learning algorithms enable automated threat detection, behavior analysis, and predictive security capabilities.

Cloud integration continues gaining momentum as businesses seek scalable storage solutions and remote monitoring capabilities. Hybrid cloud models balance security concerns with operational flexibility and cost optimization.

Mobile connectivity has become essential with users demanding smartphone access to surveillance systems. Real-time alerts and remote monitoring capabilities enhance system value and user engagement.

Edge computing integration reduces bandwidth requirements and improves system responsiveness. Local processing capabilities enable advanced analytics without cloud dependency, addressing privacy and latency concerns.

Thermal imaging integration expands surveillance capabilities beyond visible light spectrum. Temperature monitoring applications gained prominence during health crises and continue finding applications in industrial settings.

Facial recognition technology adoption accelerates in commercial and government applications despite privacy considerations. Access control integration creates comprehensive security ecosystems combining surveillance and authentication.

Cybersecurity enhancement becomes critical as connected systems face increasing security threats. Encryption protocols and secure communication standards address vulnerability concerns in networked surveillance systems.

Government initiatives continue shaping market development through large-scale surveillance projects and regulatory frameworks. Safe City projects in major metropolitan areas drive substantial infrastructure investments and technology deployment.

Manufacturing localization under Make in India program encourages domestic production and reduces import dependencies. Local assembly operations by international manufacturers improve cost competitiveness and market responsiveness.

Technology partnerships between camera manufacturers and AI companies accelerate innovation in intelligent surveillance solutions. Collaborative development enables rapid deployment of advanced analytics capabilities.

Distribution channel expansion includes online platforms and specialized security retailers reaching broader customer segments. E-commerce growth makes CCTV systems more accessible to small businesses and residential customers.

Service model evolution toward managed surveillance services and subscription-based offerings. As-a-Service models reduce upfront investment barriers and provide ongoing support and upgrades.

Standards development for interoperability and cybersecurity ensure system compatibility and security. Industry collaboration on technical standards facilitates market growth and customer confidence.

MarkWide Research analysis indicates that market participants should prioritize AI integration and cloud connectivity to remain competitive in the evolving surveillance landscape. Technology differentiation becomes crucial as price competition intensifies across market segments.

Channel strategy optimization should focus on tier-2 and tier-3 city expansion where market penetration remains low but growth potential is substantial. Local partnerships and distribution network development are essential for market expansion success.

Service capability development represents a critical success factor as customers increasingly demand comprehensive solutions including installation, maintenance, and monitoring services. Recurring revenue models provide business stability and customer relationship strengthening.

Cybersecurity investment should be prioritized to address growing concerns about connected device vulnerabilities. Security certifications and compliance with emerging standards will become competitive advantages.

Customer education programs are essential to overcome technical complexity barriers and demonstrate value propositions of advanced surveillance features. Training initiatives for channel partners and end-users support market adoption.

Product portfolio diversification across different price points and application segments ensures comprehensive market coverage. Specialized solutions for vertical markets create differentiation opportunities and premium pricing potential.

Market growth trajectory remains positive with sustained demand driven by urbanization, security concerns, and technological advancement. Long-term prospects indicate continued expansion across all market segments with particular strength in AI-enabled solutions.

Technology evolution will focus on enhanced AI capabilities, improved image quality, and seamless integration with broader security ecosystems. 5G connectivity will enable new applications and improved system performance, particularly for mobile and remote monitoring.

Market consolidation may accelerate as companies seek scale advantages and comprehensive solution capabilities. Strategic partnerships and acquisitions will shape competitive landscape evolution and market structure.

Regulatory development will continue influencing market dynamics through data privacy laws and security standards. Compliance requirements will drive innovation in privacy-preserving technologies and secure system architectures.

Application expansion beyond traditional security into operational intelligence and business analytics creates new value propositions. Smart building integration and IoT connectivity will expand surveillance system utility and market opportunities.

Geographic expansion into rural and semi-urban markets will drive volume growth as infrastructure development and security awareness increase. MWR projections indicate sustained growth momentum with market penetration increasing to 45% in tier-2 cities over the next five years.

India’s CCTV camera market demonstrates exceptional growth potential driven by fundamental security needs, government initiatives, and technological innovation. Market dynamics favor continued expansion across residential, commercial, and industrial segments with particular opportunities in emerging cities and specialized applications.

Competitive landscape evolution emphasizes the importance of technology differentiation, service capabilities, and channel optimization for sustained success. AI integration and cloud connectivity represent critical capabilities for future market leadership, while cybersecurity and privacy considerations shape product development priorities.

Strategic success factors include comprehensive solution offerings, strong distribution networks, and customer education programs that overcome adoption barriers. Market participants who invest in technology innovation, service capabilities, and geographic expansion are positioned to capitalize on substantial growth opportunities in India’s evolving surveillance market landscape.

What is CCTV Camera?

CCTV Camera refers to a closed-circuit television system used for surveillance and monitoring in various settings, including homes, businesses, and public spaces. These cameras capture video footage that can be viewed in real-time or recorded for later analysis.

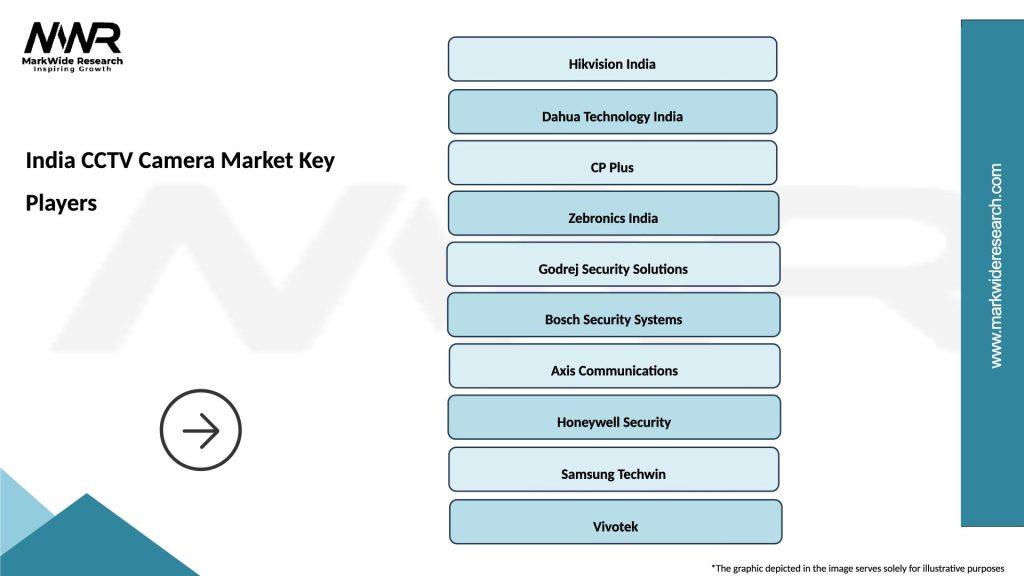

What are the key players in the India CCTV Camera Market?

Key players in the India CCTV Camera Market include Hikvision, Dahua Technology, and CP Plus, which are known for their innovative surveillance solutions and extensive product ranges. These companies compete on technology, pricing, and customer service, among others.

What are the growth factors driving the India CCTV Camera Market?

The growth of the India CCTV Camera Market is driven by increasing security concerns, urbanization, and the rise in crime rates. Additionally, advancements in technology, such as AI integration and cloud storage, are enhancing the appeal of CCTV systems.

What challenges does the India CCTV Camera Market face?

The India CCTV Camera Market faces challenges such as privacy concerns and regulatory compliance issues. Additionally, the high cost of advanced systems can deter small businesses from investing in surveillance technology.

What opportunities exist in the India CCTV Camera Market?

Opportunities in the India CCTV Camera Market include the growing demand for smart city projects and the integration of IoT technology in surveillance systems. Furthermore, the increasing adoption of remote monitoring solutions presents significant growth potential.

What trends are shaping the India CCTV Camera Market?

Trends in the India CCTV Camera Market include the shift towards wireless and IP-based cameras, as well as the incorporation of advanced analytics and facial recognition technologies. These innovations are making surveillance systems more efficient and user-friendly.

India CCTV Camera Market

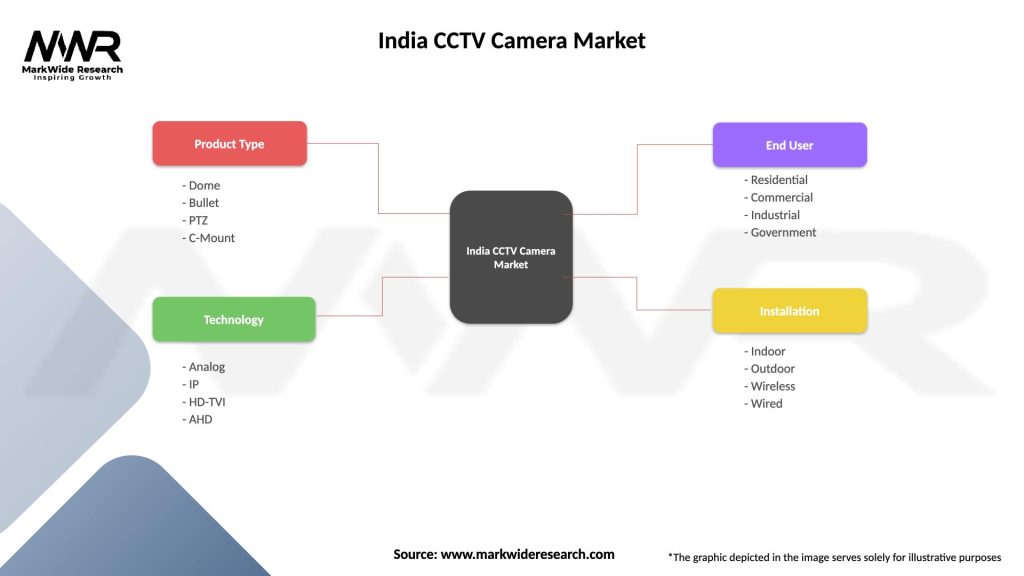

| Segmentation Details | Description |

|---|---|

| Product Type | Dome, Bullet, PTZ, C-Mount |

| Technology | Analog, IP, HD-TVI, AHD |

| End User | Residential, Commercial, Industrial, Government |

| Installation | Indoor, Outdoor, Wireless, Wired |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India CCTV Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at