444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India car rental market represents one of the fastest-growing segments in the country’s transportation and mobility ecosystem. Market dynamics indicate substantial expansion driven by urbanization, changing consumer preferences, and the rise of digital platforms. The sector encompasses traditional car rental services, self-drive options, and app-based mobility solutions that cater to diverse customer segments across metropolitan cities and tier-2 urban centers.

Growth trajectory analysis reveals the market is experiencing robust expansion at a compound annual growth rate (CAGR) of 12.8%, reflecting strong demand fundamentals. Digital transformation has revolutionized service delivery, with online bookings accounting for approximately 78% of total transactions. The integration of technology platforms has enhanced customer experience while enabling operators to optimize fleet utilization and operational efficiency.

Regional distribution shows concentrated activity in major metropolitan areas, with Delhi NCR, Mumbai, Bangalore, and Chennai collectively representing 65% of market activity. However, emerging opportunities in tier-2 cities demonstrate significant potential for market expansion as infrastructure development and consumer awareness continue to grow.

The India car rental market refers to the comprehensive ecosystem of vehicle rental services that provide temporary access to automobiles for personal, business, and leisure transportation needs. This market encompasses various service models including traditional rental agencies, self-drive platforms, chauffeur-driven services, and corporate fleet management solutions that operate across different geographical regions and customer segments.

Service categories within this market include short-term rentals for daily or weekly use, long-term leasing arrangements, airport transfer services, and specialized corporate transportation solutions. Technology integration has transformed traditional rental models, enabling seamless booking experiences, real-time vehicle tracking, and flexible pricing structures that adapt to demand patterns and customer preferences.

Market fundamentals demonstrate strong growth momentum driven by urbanization trends, increasing disposable income, and evolving mobility preferences among Indian consumers. The sector benefits from favorable demographic trends, with millennials and Gen-Z consumers showing 85% preference for flexible mobility solutions over traditional vehicle ownership models.

Competitive landscape features a mix of established international players, domestic operators, and technology-driven startups that compete across different service segments. Digital adoption has accelerated significantly, with mobile applications and online platforms becoming primary customer touchpoints for service discovery and booking processes.

Investment activity remains robust, with venture capital and private equity firms recognizing the sector’s growth potential. Operational efficiency improvements through technology integration have enabled operators to achieve better asset utilization while expanding service coverage to previously underserved markets and customer segments.

Consumer behavior analysis reveals significant shifts in transportation preferences, particularly among urban professionals and business travelers. Key insights highlight the following market characteristics:

Urbanization trends serve as primary growth catalysts, with increasing population density in metropolitan areas creating demand for flexible transportation solutions. Infrastructure development including improved road networks, parking facilities, and digital connectivity supports market expansion across urban and semi-urban regions.

Changing lifestyle preferences among younger demographics favor access-based mobility models over traditional ownership patterns. Economic factors including rising fuel costs, maintenance expenses, and parking challenges make rental services increasingly attractive alternatives for urban consumers.

Business travel growth drives corporate demand for reliable transportation solutions, particularly in technology hubs and commercial centers. Tourism sector expansion creates additional demand streams as domestic and international visitors seek convenient mobility options for sightseeing and business activities.

Technology advancement enables seamless service delivery through mobile applications, GPS tracking, and digital payment systems that enhance customer experience and operational efficiency. Government initiatives supporting digital payments and startup ecosystem development create favorable regulatory environments for market participants.

Regulatory challenges across different states create operational complexities for rental operators seeking to expand their geographical footprint. Licensing requirements and compliance obligations vary significantly between jurisdictions, increasing administrative burden and operational costs for service providers.

Insurance complexities related to vehicle coverage, driver liability, and accident management create operational challenges and cost pressures for rental companies. Traffic congestion in major cities affects vehicle utilization efficiency and customer satisfaction levels during peak travel periods.

Maintenance costs for rental fleets, particularly in challenging road conditions and high-usage scenarios, impact profitability margins for operators. Customer acquisition costs remain elevated due to intense competition and the need for continuous marketing investments to build brand awareness.

Seasonal demand fluctuations create capacity planning challenges, with operators needing to balance fleet size optimization against service availability requirements. Security concerns related to vehicle theft, misuse, and damage incidents require comprehensive risk management strategies and insurance coverage.

Tier-2 city expansion presents significant growth opportunities as infrastructure development and consumer awareness increase in emerging urban centers. Corporate partnerships with multinational companies and domestic enterprises offer stable revenue streams through long-term service agreements and bulk booking arrangements.

Electric vehicle integration creates opportunities for environmentally conscious service offerings that appeal to sustainability-focused consumers and corporate clients. Subscription-based models provide recurring revenue opportunities while offering customers flexible access to vehicles without traditional ownership commitments.

Tourism sector collaboration with hotels, travel agencies, and destination management companies enables integrated service offerings that enhance customer convenience and market reach. Technology partnerships with automotive manufacturers, fintech companies, and mobility platforms create opportunities for innovative service delivery models.

Last-mile connectivity solutions for public transportation networks offer opportunities to address urban mobility gaps while generating additional revenue streams. Specialized services for events, weddings, and corporate functions provide premium pricing opportunities and market differentiation possibilities.

Competitive intensity continues to increase as new entrants leverage technology platforms to challenge established operators. Price competition remains significant, with operators using dynamic pricing strategies and promotional offers to attract and retain customers in highly competitive markets.

Technology adoption accelerates across the industry, with artificial intelligence, machine learning, and data analytics becoming essential tools for demand forecasting, pricing optimization, and customer service enhancement. Customer expectations evolve toward seamless digital experiences, real-time service updates, and personalized offerings that match individual preferences and usage patterns.

Supply chain dynamics affect vehicle procurement, maintenance services, and operational efficiency as rental companies optimize fleet composition and lifecycle management. Partnership strategies become increasingly important as operators seek to expand service coverage, enhance customer value propositions, and achieve operational synergies.

Regulatory evolution influences market structure as government policies adapt to address emerging mobility trends, environmental concerns, and consumer protection requirements. Investment flows continue to support market expansion, with funding directed toward technology development, fleet expansion, and geographical coverage enhancement.

Primary research methodology encompasses comprehensive surveys and interviews with industry stakeholders including rental operators, customers, technology providers, and regulatory authorities. Data collection processes utilize both quantitative and qualitative research techniques to gather insights on market trends, consumer preferences, and operational challenges.

Secondary research involves analysis of industry reports, government publications, company financial statements, and regulatory filings to understand market structure and competitive dynamics. Market sizing methodologies combine top-down and bottom-up approaches to validate market estimates and growth projections.

Expert interviews with industry leaders, technology specialists, and market analysts provide qualitative insights into market trends, challenges, and future opportunities. Consumer surveys across different demographic segments and geographical regions capture usage patterns, preferences, and satisfaction levels with existing services.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, statistical analysis, and expert review procedures. Analytical frameworks incorporate market modeling techniques, trend analysis, and scenario planning to develop comprehensive market assessments and forecasts.

Northern India dominates market activity with Delhi NCR representing the largest regional market, accounting for approximately 28% of total demand. Metropolitan concentration in this region benefits from high population density, corporate presence, and well-developed transportation infrastructure that supports rental service operations.

Western India led by Mumbai and Pune shows strong market presence with 25% market share, driven by commercial activity, international business presence, and high disposable income levels among urban consumers. Industrial corridors in this region create consistent demand for corporate transportation services.

Southern India demonstrates rapid growth with Bangalore, Chennai, and Hyderabad collectively representing 22% of market activity. Technology sector concentration in these cities drives demand for flexible mobility solutions among IT professionals and business travelers.

Eastern and Central India show emerging opportunities with Kolkata and other regional centers experiencing gradual market development. Infrastructure improvements and increasing urbanization in these regions create potential for future market expansion as consumer awareness and service availability increase.

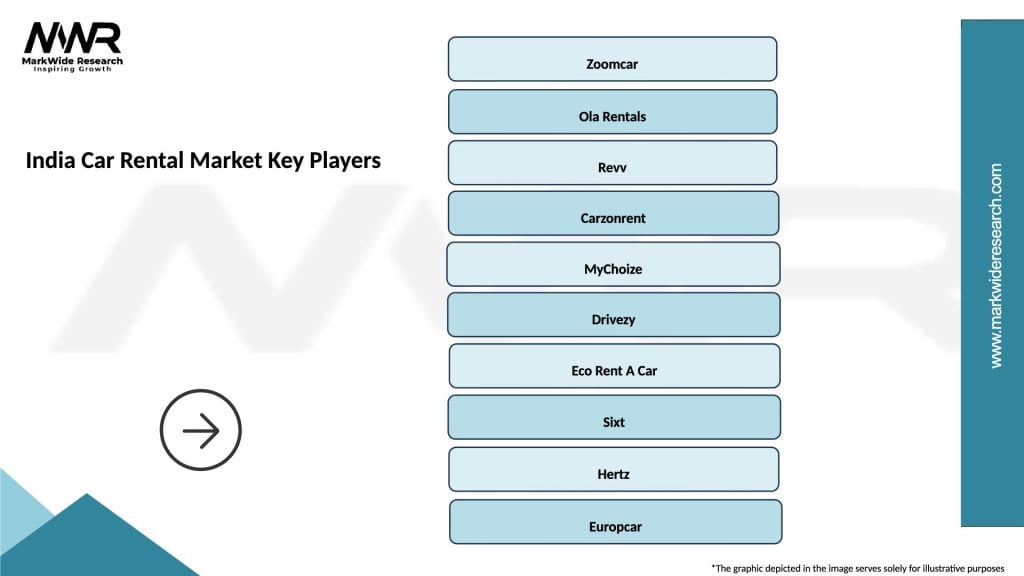

Market structure features diverse competitive dynamics with international players, domestic operators, and technology-driven startups competing across different service segments and geographical markets. Leading companies include:

Competitive strategies focus on technology differentiation, fleet optimization, customer experience enhancement, and geographical expansion to capture market share and build sustainable competitive advantages.

By Service Type: The market segments into self-drive rentals, chauffeur-driven services, and corporate fleet management solutions, each targeting specific customer needs and usage patterns.

By Duration: Rental periods range from hourly bookings for short-term needs to monthly subscriptions for extended usage requirements, with daily and weekly rentals representing significant demand categories.

By Vehicle Type: Fleet composition includes economy cars, premium vehicles, SUVs, and luxury automobiles that cater to different customer segments and budget considerations.

By Customer Segment: Market serves individual consumers, corporate clients, tourists, and business travelers with customized service offerings and pricing structures for each segment.

By Booking Channel: Distribution includes mobile applications, websites, call centers, and physical locations, with digital channels dominating customer interactions and transaction processing.

Self-Drive Segment: Experiences strongest growth momentum with 15.2% annual expansion, driven by younger demographics seeking independent mobility experiences. Technology integration enables seamless booking, vehicle access, and payment processing that appeals to tech-savvy consumers.

Chauffeur-Driven Services: Maintain steady demand among corporate clients and premium customers who prioritize convenience and professional service delivery. Airport transfers and business travel represent primary use cases for this service category.

Corporate Fleet Management: Shows consistent growth as companies seek to optimize transportation costs while providing reliable mobility solutions for employees. Long-term contracts provide revenue stability for rental operators.

Subscription Models: Emerge as innovative service offerings that provide customers with flexible vehicle access without ownership commitments. Monthly subscriptions appeal to urban professionals seeking cost-effective transportation alternatives.

For Customers: Rental services provide flexible mobility solutions without ownership responsibilities, maintenance costs, or long-term financial commitments. Convenience factors include easy booking processes, diverse vehicle options, and professional maintenance standards.

For Operators: Technology platforms enable efficient fleet management, dynamic pricing optimization, and enhanced customer service delivery. Scalability opportunities allow rapid expansion across new markets and customer segments.

For Investors: Market growth potential and recurring revenue models create attractive investment opportunities in the mobility sector. Technology differentiation provides competitive advantages and market positioning benefits.

For Ecosystem Partners: Collaboration opportunities with automotive manufacturers, insurance companies, and technology providers create synergistic business relationships and revenue sharing possibilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation: Comprehensive technology integration transforms customer interactions, operational processes, and service delivery mechanisms across the rental ecosystem. Mobile-first strategies dominate customer engagement approaches as smartphone adoption continues to expand.

Subscription Economy: Flexible subscription models gain popularity among urban consumers seeking predictable transportation costs without ownership commitments. Monthly packages provide alternatives to traditional daily and weekly rental arrangements.

Sustainability Focus: Environmental consciousness drives demand for electric and hybrid vehicle options in rental fleets. Green mobility initiatives appeal to environmentally aware consumers and corporate sustainability programs.

Contactless Services: Digital key technology and contactless pickup/drop-off procedures enhance safety and convenience while reducing operational overhead. Automated processes improve efficiency and customer satisfaction levels.

Integrated Mobility: Partnerships with ride-hailing platforms, public transportation systems, and travel booking services create comprehensive mobility ecosystems. Seamless connectivity between different transportation modes enhances customer value propositions.

Technology Partnerships: Strategic alliances between rental operators and automotive manufacturers enable access to latest vehicle technologies and preferential procurement terms. Innovation collaborations accelerate development of advanced fleet management systems.

Funding Activities: Venture capital investments support expansion plans, technology development, and market penetration strategies for emerging players. Growth capital enables fleet expansion and geographical coverage enhancement.

Regulatory Updates: Government initiatives supporting digital payments, startup ecosystem development, and environmental sustainability create favorable operating conditions. Policy frameworks evolve to address emerging mobility trends and consumer protection requirements.

Market Consolidation: Merger and acquisition activities reshape competitive landscape as operators seek scale advantages and market expansion opportunities. Strategic combinations create stronger market positions and enhanced service capabilities.

MarkWide Research analysis indicates that successful market participants should prioritize technology investment, customer experience enhancement, and strategic partnerships to achieve sustainable growth. Digital capabilities remain crucial for competitive differentiation and operational efficiency improvement.

Geographical expansion strategies should focus on tier-2 cities where infrastructure development and consumer awareness create emerging opportunities. Market entry approaches should consider local partnerships and gradual capacity building to minimize risks and optimize resource allocation.

Fleet optimization through data analytics and predictive maintenance can significantly improve asset utilization and reduce operational costs. Technology integration enables better demand forecasting, pricing optimization, and customer service delivery.

Corporate segment development offers stable revenue opportunities through long-term contracts and bulk booking arrangements. B2B relationships provide predictable cash flows and reduced customer acquisition costs compared to individual consumer segments.

Market evolution indicates continued expansion driven by urbanization, technology adoption, and changing mobility preferences among Indian consumers. Growth projections suggest the sector will maintain robust expansion rates as infrastructure development and consumer awareness increase across tier-2 and tier-3 cities.

Technology advancement will continue reshaping service delivery through artificial intelligence, Internet of Things integration, and autonomous vehicle preparation. Digital transformation will enable more personalized services, predictive maintenance, and optimized fleet management capabilities.

Sustainability initiatives will gain prominence as environmental regulations and consumer preferences drive adoption of electric and hybrid vehicles in rental fleets. Green mobility solutions will become competitive differentiators and regulatory compliance requirements.

Market maturation will likely lead to consolidation activities as operators seek scale advantages and comprehensive service portfolios. Strategic partnerships with automotive manufacturers, technology companies, and mobility platforms will become increasingly important for competitive positioning and market expansion.

The India car rental market demonstrates exceptional growth potential driven by urbanization trends, technology adoption, and evolving consumer mobility preferences. Market dynamics favor operators who successfully integrate digital technologies, optimize fleet management, and develop strategic partnerships across the mobility ecosystem.

Competitive success will increasingly depend on technology differentiation, customer experience excellence, and operational efficiency optimization. MWR analysis suggests that market participants who invest in digital capabilities, expand into emerging markets, and develop sustainable service offerings will achieve the strongest growth trajectories.

Future opportunities remain substantial as infrastructure development, regulatory support, and consumer awareness continue expanding across India’s urban landscape. The India car rental market is positioned for sustained growth as mobility solutions become integral components of modern urban transportation ecosystems.

What is Car Rental?

Car rental refers to the service of renting vehicles for short periods, typically ranging from a few hours to several weeks. This service is popular among travelers and businesses needing temporary transportation solutions.

What are the key players in the India Car Rental Market?

Key players in the India Car Rental Market include companies like Zoomcar, Revv, and Myles, which offer a range of vehicles for rent. These companies cater to both local and tourist customers, providing various rental options and services, among others.

What are the growth factors driving the India Car Rental Market?

The India Car Rental Market is driven by factors such as the increasing number of domestic and international travelers, the rise in urbanization, and the growing preference for convenient transportation options. Additionally, the expansion of online booking platforms has made car rentals more accessible.

What challenges does the India Car Rental Market face?

The India Car Rental Market faces challenges such as regulatory hurdles, high operational costs, and competition from ride-sharing services. These factors can impact profitability and market growth.

What opportunities exist in the India Car Rental Market?

Opportunities in the India Car Rental Market include the potential for growth in electric vehicle rentals, the expansion of services in tier-two and tier-three cities, and partnerships with travel agencies. These trends can enhance service offerings and customer reach.

What trends are shaping the India Car Rental Market?

Trends in the India Car Rental Market include the increasing adoption of technology for seamless booking experiences, the rise of self-drive rentals, and a growing focus on sustainability with eco-friendly vehicle options. These trends are influencing consumer preferences and market dynamics.

India Car Rental Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Luxury |

| Customer Type | Corporate, Leisure, Government, Tourists |

| Booking Channel | Online, Offline, Mobile App, Travel Agency |

| Rental Duration | Short-term, Long-term, Weekend, Monthly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Car Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at