444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India car loan market represents one of the most dynamic and rapidly expanding segments within the country’s financial services landscape. Market dynamics indicate substantial growth driven by increasing disposable income, urbanization trends, and evolving consumer preferences toward vehicle ownership. The automotive financing sector has witnessed remarkable transformation, with traditional banks, non-banking financial companies (NBFCs), and fintech platforms competing to capture market share in this lucrative segment.

Digital transformation has revolutionized the car loan approval process, with online applications and instant approvals becoming increasingly common. The market demonstrates robust growth potential, supported by favorable government policies, infrastructure development, and the expanding middle-class population. Interest rates have remained competitive, with lenders offering attractive financing options to attract customers across various income segments.

Regional penetration varies significantly, with metropolitan cities leading adoption rates while tier-2 and tier-3 cities showing accelerating growth patterns. The market exhibits strong fundamentals, with loan approval rates maintaining healthy levels at approximately 78% for qualified applicants. MarkWide Research analysis indicates that the sector continues to evolve with innovative product offerings and enhanced customer service delivery mechanisms.

The India car loan market refers to the comprehensive ecosystem of financial institutions, lending products, and services that facilitate vehicle purchases through structured financing arrangements. This market encompasses various lending entities including public sector banks, private banks, NBFCs, and emerging fintech companies that provide credit facilities for new and used car purchases.

Car loans typically involve secured lending where the vehicle serves as collateral, enabling lenders to offer competitive interest rates and flexible repayment terms. The market includes diverse product categories such as new car loans, used car loans, car refinancing options, and specialized financing for commercial vehicles. Loan tenures generally range from one to seven years, with varying down payment requirements based on vehicle type and borrower profile.

Market participants utilize sophisticated credit assessment mechanisms, incorporating traditional credit scoring models alongside alternative data sources to evaluate borrower creditworthiness. The ecosystem supports the broader automotive industry by making vehicle ownership accessible to a wider demographic, thereby stimulating economic growth and mobility enhancement across urban and rural regions.

Strategic positioning within the India car loan market reveals significant opportunities for growth and expansion across multiple customer segments. The market demonstrates resilience and adaptability, with lenders continuously innovating to meet evolving consumer demands and regulatory requirements. Digital adoption has accelerated dramatically, with approximately 65% of loan applications now processed through online channels.

Competitive landscape features intense rivalry among established banks and emerging fintech platforms, driving innovation in product design, pricing strategies, and customer experience enhancement. The sector benefits from supportive regulatory frameworks and government initiatives promoting financial inclusion and automotive sector growth. Risk management practices have evolved significantly, incorporating advanced analytics and machine learning algorithms to optimize lending decisions.

Market penetration continues expanding beyond traditional urban centers, with rural and semi-urban markets contributing increasingly to overall growth. The ecosystem supports diverse vehicle categories, from entry-level cars to luxury vehicles, catering to varied customer preferences and financial capabilities. Partnership strategies between lenders and automotive manufacturers have strengthened, creating integrated financing solutions that enhance customer convenience and market reach.

Consumer behavior patterns reveal shifting preferences toward digital-first lending experiences, with customers prioritizing speed, transparency, and convenience in loan processing. The market demonstrates strong correlation between economic growth indicators and car loan demand, reflecting the sector’s sensitivity to macroeconomic conditions.

Economic prosperity and rising disposable income levels serve as primary catalysts for car loan market expansion. The growing middle-class population, coupled with urbanization trends, creates sustained demand for personal mobility solutions. Infrastructure development initiatives, including highway expansion and smart city projects, enhance the value proposition of vehicle ownership.

Government policies supporting the automotive sector, including favorable taxation structures and incentives for electric vehicles, stimulate market growth. The Make in India initiative has strengthened domestic automotive manufacturing, making vehicles more affordable and accessible to consumers. Financial inclusion programs have expanded credit access to previously underserved populations, broadening the potential customer base.

Technological advancement in lending processes has significantly improved customer experience and operational efficiency. Digital platforms enable seamless loan applications, instant approvals, and transparent pricing, attracting tech-savvy consumers. The emergence of fintech companies has introduced innovative lending models and competitive pricing strategies, benefiting consumers through increased choice and better terms.

Changing lifestyle preferences and the aspiration for personal mobility drive consistent demand across demographic segments. Young professionals increasingly view car ownership as essential for career advancement and lifestyle enhancement, supporting sustained market growth.

Economic volatility and fluctuating interest rates create uncertainty in lending decisions and borrower confidence. Inflation pressures on fuel costs and vehicle maintenance expenses may deter potential buyers from taking loans, particularly in price-sensitive segments. Regulatory changes in banking and financial services can impact lending practices and operational costs for market participants.

Credit risk concerns associated with unsecured lending and economic downturns may lead to tighter lending standards and reduced loan approvals. Competition from alternative transportation models, including ride-sharing services and public transportation improvements, may reduce the perceived necessity of vehicle ownership among urban consumers.

Documentation requirements and complex approval processes can discourage potential borrowers, particularly in rural and semi-urban markets where financial literacy levels may be lower. High down payment requirements for certain vehicle categories may limit accessibility for lower-income segments, constraining market expansion.

Environmental concerns and shifting preferences toward sustainable transportation options may impact demand for traditional internal combustion engine vehicles. Insurance costs and mandatory compliance requirements add to the total cost of vehicle ownership, potentially affecting loan demand.

Rural market penetration presents substantial growth opportunities as infrastructure development and income levels improve in non-urban areas. Electric vehicle financing represents an emerging opportunity as government incentives and environmental consciousness drive adoption of sustainable transportation solutions.

Digital lending platforms can capture market share by offering superior customer experiences and faster processing times. Partnership opportunities with automotive manufacturers, dealers, and technology companies can create integrated value propositions that differentiate market participants. Used car financing shows significant potential as the pre-owned vehicle market expands and quality standards improve.

Fintech innovation in areas such as alternative credit scoring, blockchain-based documentation, and artificial intelligence-driven risk assessment can unlock new customer segments and improve operational efficiency. Cross-selling opportunities for insurance, extended warranties, and maintenance services can enhance revenue per customer and strengthen customer relationships.

Government initiatives promoting financial inclusion and digital payments create favorable conditions for market expansion. Corporate lending for fleet financing and employee car loan programs represent untapped opportunities for business-to-business growth.

Supply and demand dynamics in the India car loan market reflect complex interactions between economic conditions, consumer preferences, and lender strategies. Interest rate cycles significantly influence borrowing costs and loan demand, with competitive pricing strategies driving market share battles among lenders.

Regulatory environment shapes market operations through reserve requirements, lending guidelines, and consumer protection measures. Technology adoption continues transforming traditional lending models, with artificial intelligence and machine learning enhancing credit assessment accuracy and operational efficiency.

Customer acquisition costs have increased as competition intensifies, prompting lenders to focus on retention strategies and lifetime value optimization. Risk-return optimization remains critical as lenders balance growth objectives with prudent risk management practices. Market consolidation trends may emerge as smaller players struggle to compete with established institutions having superior technology and capital resources.

Seasonal variations in loan demand correlate with festival seasons, bonus payments, and agricultural cycles, requiring flexible capacity management and marketing strategies. Channel partnerships with automotive dealers and digital platforms continue evolving, influencing customer acquisition patterns and market dynamics.

Comprehensive analysis of the India car loan market employs multiple research methodologies to ensure accuracy and reliability of insights. Primary research involves extensive interviews with industry executives, lending institution representatives, automotive dealers, and consumer focus groups to gather firsthand market intelligence.

Secondary research encompasses analysis of regulatory filings, industry reports, financial statements, and government publications to establish market trends and quantitative benchmarks. Data triangulation techniques validate findings across multiple sources, ensuring consistency and reliability of market assessments.

Statistical modeling and econometric analysis help identify correlations between macroeconomic indicators and market performance metrics. Expert interviews with industry veterans, regulatory officials, and technology specialists provide qualitative insights into market dynamics and future trends.

Market surveys conducted across diverse geographic regions and demographic segments capture consumer preferences, satisfaction levels, and emerging needs. Competitive intelligence gathering through public sources and industry networks provides comprehensive understanding of market positioning and strategic initiatives.

Northern India demonstrates strong market presence with Delhi, Punjab, and Haryana leading in loan origination volumes. Urban centers in this region show high adoption rates for digital lending platforms, with approximately 72% of applications processed online. Agricultural prosperity in Punjab and Haryana supports robust demand for both personal and commercial vehicle financing.

Western India represents the largest market segment, with Maharashtra and Gujarat contributing significantly to overall market growth. Mumbai and Pune serve as major financial hubs, hosting numerous lending institutions and fintech companies. The region benefits from strong industrial presence and higher disposable income levels, supporting premium vehicle financing demand.

Southern India exhibits sophisticated market characteristics with high technology adoption and educated consumer base. Bangalore, Chennai, and Hyderabad lead in fintech innovation and digital lending solutions. The region shows 68% preference for online loan applications, reflecting tech-savvy consumer behavior.

Eastern India presents emerging opportunities with improving economic conditions and infrastructure development. Kolkata and Bhubaneswar show increasing loan demand, though market penetration remains lower compared to other regions. Government initiatives in this region focus on financial inclusion and rural development, creating long-term growth potential.

Market leadership is distributed among several categories of financial institutions, each bringing unique strengths and competitive advantages. Public sector banks maintain significant market share through extensive branch networks and government backing, while private banks compete through superior customer service and innovative products.

Fintech companies are increasingly challenging traditional players through technology-driven solutions and superior customer experiences. Strategic partnerships between banks and fintech firms are becoming common, combining traditional banking strengths with technological innovation.

By Vehicle Type: The market segments into new car loans, used car loans, and refinancing options, each serving distinct customer needs and risk profiles. New car loans dominate market share due to manufacturer partnerships and promotional financing offers. Used car loans show rapid growth as the pre-owned vehicle market expands and quality standards improve.

By Lender Type: Public sector banks, private banks, NBFCs, and fintech companies compete across different market segments. NBFCs often target customers with limited credit history or those seeking faster approval processes. Fintech lenders focus on digital-native customers preferring online experiences.

By Customer Segment: Individual consumers, corporate clients, and small business owners represent distinct market categories with varying financing needs. Individual consumers constitute the largest segment, while corporate fleet financing offers higher ticket sizes and longer-term relationships.

By Geographic Region: Metro cities, tier-2 cities, and rural markets demonstrate different adoption patterns and growth rates. Metro markets show higher penetration but slower growth, while tier-2 and tier-3 cities exhibit accelerating demand and expansion opportunities.

New Car Financing: Represents the largest category with strong manufacturer support and promotional interest rates. Dealer partnerships facilitate seamless customer experiences and higher conversion rates. Down payment requirements typically range from 10-20% of vehicle value, with flexible terms attracting diverse customer segments.

Used Car Financing: Shows exceptional growth potential as organized used car markets expand and vehicle quality certification improves. Interest rates are typically higher than new car loans due to increased risk factors, but growing acceptance among lenders indicates market maturation. Loan tenures are generally shorter, reflecting depreciation considerations.

Commercial Vehicle Financing: Serves small business owners and fleet operators with specialized products addressing cash flow patterns and business cycles. Risk assessment incorporates business performance metrics alongside personal credit profiles. Seasonal financing options accommodate agricultural and transportation industry requirements.

Electric Vehicle Financing: Emerging category with government incentives and environmental consciousness driving adoption. Specialized products address unique characteristics of electric vehicles, including battery warranties and charging infrastructure considerations. Interest rate subsidies and extended warranties make electric vehicle financing increasingly attractive.

Financial institutions benefit from diversified revenue streams and relatively low-risk secured lending opportunities. Car loans typically offer better risk-adjusted returns compared to unsecured lending products, with vehicle collateral providing security. Cross-selling opportunities for insurance, extended warranties, and other financial products enhance customer lifetime value.

Automotive manufacturers gain from increased sales volumes and market expansion through accessible financing options. Partnership arrangements with lenders create competitive advantages and customer loyalty. Inventory management improves as financing availability reduces sales cycle times and enhances dealer cash flows.

Consumers access affordable mobility solutions through competitive interest rates and flexible repayment terms. Digital platforms provide convenient application processes and transparent pricing. Credit building opportunities help establish positive credit histories for future financial needs.

Economic stakeholders benefit from increased automotive sector activity, supporting manufacturing, employment, and ancillary industries. Financial inclusion expands as lending institutions reach previously underserved populations, contributing to economic development and social mobility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-first lending has become the dominant trend, with customers increasingly preferring online applications and instant approvals. Artificial intelligence and machine learning algorithms enhance credit assessment accuracy while reducing processing times. Mobile-first strategies cater to smartphone-dominant user behavior patterns across demographic segments.

Flexible EMI structures including step-up and step-down options accommodate varying income patterns and life stage requirements. Balloon payment schemes and residual value financing provide alternatives for customers seeking lower monthly payments. Seasonal payment options align with agricultural cycles and bonus payment schedules.

Partnership ecosystems between lenders, manufacturers, dealers, and technology companies create integrated customer experiences. Embedded financing at point-of-sale reduces friction and improves conversion rates. White-label solutions enable non-financial companies to offer financing services to their customers.

Sustainability focus drives development of green financing products for electric and hybrid vehicles. Carbon footprint considerations influence lending decisions and product design. ESG compliance becomes increasingly important for institutional lenders and investors.

Regulatory evolution continues shaping market dynamics through updated lending guidelines and consumer protection measures. Reserve Bank of India initiatives promote responsible lending and financial inclusion objectives. Digital lending regulations provide framework for fintech operations while ensuring consumer protection.

Technology partnerships between traditional banks and fintech companies accelerate digital transformation initiatives. API integrations enable seamless data sharing and improved customer experiences. Blockchain applications in documentation and verification processes enhance security and reduce fraud risks.

Market consolidation activities include mergers, acquisitions, and strategic partnerships aimed at achieving scale and competitive advantages. International players entering the market bring global best practices and additional competition. Startup ecosystem continues innovating in areas such as alternative credit scoring and customer experience enhancement.

Product innovation includes subscription-based vehicle access models and usage-based financing options. Insurance integration creates comprehensive mobility solutions addressing customer convenience and risk management needs.

Market participants should prioritize digital transformation initiatives to remain competitive in evolving customer expectations. Investment in technology infrastructure and data analytics capabilities will differentiate successful players from traditional competitors. MWR analysis suggests that institutions focusing on customer experience and operational efficiency will capture disproportionate market share.

Risk management strategies should incorporate alternative data sources and advanced analytics to improve credit assessment accuracy. Diversification across customer segments, geographic regions, and product categories can reduce concentration risks and enhance stability. Partnership strategies with automotive ecosystem players can create competitive moats and improve customer acquisition efficiency.

Rural market expansion requires tailored products and distribution strategies addressing unique customer needs and risk profiles. Local partnerships and community engagement initiatives can accelerate market penetration in underserved areas. Financial literacy programs can expand the addressable market while promoting responsible borrowing practices.

Sustainability initiatives should align with government policies and consumer preferences toward environmentally responsible transportation options. Green financing products can differentiate market positioning while supporting broader environmental objectives.

Long-term prospects for the India car loan market remain highly positive, supported by demographic trends, economic growth, and technological advancement. Market expansion is expected to continue at robust pace, with compound annual growth rates projected to maintain strong momentum over the next five years.

Digital transformation will accelerate further, with artificial intelligence and machine learning becoming standard components of lending operations. Customer expectations for instant, transparent, and personalized services will drive continued innovation in product design and delivery mechanisms. Mobile-first strategies will become essential for market relevance and customer acquisition.

Electric vehicle financing is projected to grow exponentially as government incentives, infrastructure development, and environmental consciousness drive adoption. Specialized products addressing unique characteristics of electric vehicles will create new market opportunities and competitive advantages.

Rural and semi-urban markets will contribute increasingly to overall growth as infrastructure development and income levels improve. Financial inclusion initiatives will expand the addressable market while supporting broader economic development objectives. MarkWide Research projections indicate that tier-2 and tier-3 cities will account for 45% of market growth over the next decade.

The India car loan market stands at an inflection point of tremendous growth and transformation, driven by favorable demographic trends, technological innovation, and supportive government policies. Market dynamics reflect a maturing ecosystem with sophisticated risk management practices, competitive pricing strategies, and enhanced customer experiences.

Digital transformation has fundamentally altered market operations, with online platforms and instant approval processes becoming standard expectations rather than competitive differentiators. Future success will depend on institutions’ ability to leverage technology, data analytics, and partnership strategies to create superior value propositions for diverse customer segments.

Growth opportunities in rural markets, electric vehicle financing, and used car segments present substantial potential for market expansion and revenue diversification. Sustainable practices and responsible lending will become increasingly important as regulatory focus and consumer awareness continue evolving. The market’s trajectory toward continued expansion and innovation positions it as a critical component of India’s broader economic development and financial inclusion objectives.

What is Car Loan?

A car loan is a type of financing that allows individuals to borrow money to purchase a vehicle, which they repay over time with interest. In India, car loans are popular among consumers looking to buy new or used cars, with various options available from banks and financial institutions.

What are the key players in the India Car Loan Market?

Key players in the India Car Loan Market include major banks and financial institutions such as State Bank of India, HDFC Bank, and ICICI Bank. These companies offer a range of car loan products tailored to different customer needs, among others.

What are the growth factors driving the India Car Loan Market?

The growth of the India Car Loan Market is driven by increasing disposable incomes, a growing middle class, and the rising demand for personal vehicles. Additionally, favorable financing options and competitive interest rates contribute to market expansion.

What challenges does the India Car Loan Market face?

The India Car Loan Market faces challenges such as fluctuating interest rates, stringent lending criteria, and economic uncertainties that can affect consumer confidence. Additionally, the rise of alternative transportation options may impact car ownership trends.

What opportunities exist in the India Car Loan Market?

Opportunities in the India Car Loan Market include the potential for digital lending platforms and innovative financing solutions. As technology advances, there is also a growing trend towards electric vehicles, which may create new financing products tailored to eco-friendly cars.

What trends are shaping the India Car Loan Market?

Trends in the India Car Loan Market include the increasing adoption of online loan applications and the integration of technology in the lending process. Additionally, there is a shift towards flexible repayment options and personalized loan products to meet diverse consumer needs.

India Car Loan Market

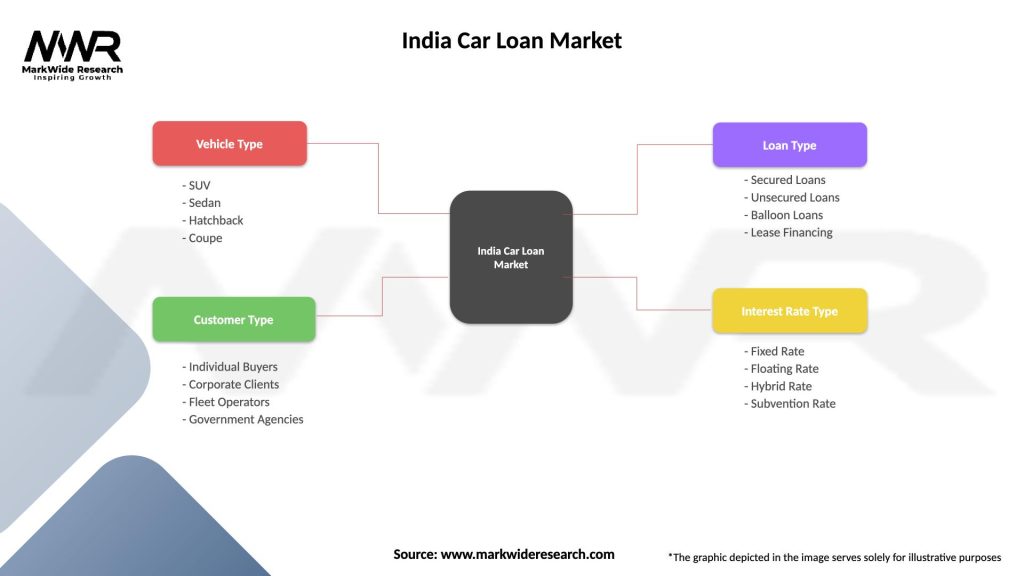

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Coupe |

| Customer Type | Individual Buyers, Corporate Clients, Fleet Operators, Government Agencies |

| Loan Type | Secured Loans, Unsecured Loans, Balloon Loans, Lease Financing |

| Interest Rate Type | Fixed Rate, Floating Rate, Hybrid Rate, Subvention Rate |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Car Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at