444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India breakfast cereal market represents one of the most dynamic and rapidly evolving segments within the country’s food and beverage industry. This market encompasses a diverse range of ready-to-eat cereals, including cornflakes, muesli, oats, granola, and various fortified breakfast options that cater to India’s increasingly health-conscious consumer base. The market has experienced remarkable transformation over the past decade, driven by changing lifestyle patterns, urbanization, and growing awareness about nutritional benefits of convenient breakfast solutions.

Market dynamics indicate substantial growth potential, with the sector expanding at a robust CAGR of 15.2% over the forecast period. This growth trajectory reflects the fundamental shift in Indian consumer preferences toward convenient, nutritious, and time-saving breakfast alternatives. The market encompasses both international brands that have established strong footholds and domestic players who understand local taste preferences and dietary requirements.

Consumer adoption patterns reveal significant regional variations, with metropolitan cities leading consumption trends while tier-2 and tier-3 cities showing accelerating adoption rates. The market benefits from India’s young demographic profile, with approximately 68% of consumers falling within the 18-45 age group, representing the primary target segment for breakfast cereal manufacturers.

The India breakfast cereal market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of ready-to-eat and instant breakfast cereal products specifically designed for the Indian consumer market. This market includes traditional cereals adapted to local tastes, indigenous grain-based products, and international cereal varieties that have been customized for Indian palates and nutritional preferences.

Market scope extends beyond simple grain-based products to include fortified cereals enriched with vitamins and minerals, protein-enhanced variants, organic options, and specialized products targeting specific demographic segments such as children, fitness enthusiasts, and health-conscious adults. The market encompasses various distribution channels including modern retail, traditional trade, e-commerce platforms, and direct-to-consumer models.

Product categories within this market range from basic cornflakes and wheat-based cereals to premium muesli, granola, and specialty health-focused variants. The definition also includes instant oats, flavored cereals, and culturally adapted products that incorporate traditional Indian grains like millets, quinoa, and amaranth.

Strategic market analysis reveals that the India breakfast cereal market stands at a pivotal juncture, characterized by accelerating consumer adoption and expanding product innovation. The market demonstrates exceptional growth momentum, supported by fundamental demographic and lifestyle changes that favor convenient, nutritious breakfast solutions.

Key growth drivers include rapid urbanization, increasing disposable incomes, growing health consciousness, and the rising participation of women in the workforce, which creates demand for quick breakfast preparation options. The market benefits from strong penetration rates of 23% in urban areas, while rural penetration remains an untapped opportunity with significant potential.

Competitive landscape features a mix of established multinational corporations and emerging domestic brands, each pursuing distinct strategies to capture market share. Innovation focuses on product localization, nutritional enhancement, and packaging convenience to meet evolving consumer expectations.

Market challenges include price sensitivity among Indian consumers, competition from traditional breakfast options, and the need for extensive consumer education about cereal benefits. However, these challenges are being addressed through strategic pricing, targeted marketing campaigns, and product diversification initiatives.

Consumer behavior analysis provides crucial insights into market dynamics and future growth potential. The following key insights shape market understanding:

Market penetration analysis indicates substantial room for growth, particularly in rural and semi-urban areas where cereal consumption remains relatively low compared to urban centers.

Urbanization acceleration serves as the primary catalyst driving breakfast cereal market expansion across India. As more families migrate to urban centers and adopt metropolitan lifestyles, demand for convenient breakfast solutions continues to surge. This demographic shift creates favorable conditions for cereal adoption, particularly among working professionals and nuclear families.

Health consciousness trends significantly influence consumer preferences toward nutritionally balanced breakfast options. Growing awareness about the importance of starting the day with proper nutrition drives demand for fortified cereals, high-fiber variants, and protein-enriched products. This trend is particularly pronounced among educated urban consumers who prioritize wellness and preventive healthcare.

Women workforce participation creates substantial market opportunities as working women seek time-efficient breakfast preparation methods. The increasing number of dual-income households generates demand for convenient meal solutions that don’t compromise on nutritional value. This demographic represents a key target segment for cereal manufacturers.

Rising disposable incomes enable consumers to experiment with premium breakfast options and branded cereal products. As household incomes increase, particularly in tier-1 and tier-2 cities, families become more willing to invest in convenient, healthy breakfast alternatives despite higher costs compared to traditional options.

Digital marketing influence and social media exposure educate consumers about global breakfast trends and nutritional benefits of cereals. Online platforms facilitate product discovery and enable brands to communicate directly with target audiences, driving awareness and trial among younger demographics.

Price sensitivity concerns represent the most significant barrier to widespread cereal adoption across Indian households. Many consumers perceive breakfast cereals as expensive compared to traditional breakfast options like parathas, idli, or poha, limiting market penetration among price-conscious segments.

Traditional breakfast preferences remain deeply ingrained in Indian culture, with many families preferring home-cooked meals over packaged alternatives. This cultural resistance to change requires sustained marketing efforts and gradual consumer education to overcome established dietary habits.

Limited rural penetration constrains overall market growth potential, as distribution networks in rural areas remain underdeveloped. Infrastructure challenges and lower purchasing power in rural regions limit accessibility and affordability of cereal products for significant portions of the population.

Nutritional misconceptions persist among some consumer segments who view cereals as less nutritious than traditional Indian breakfast options. Addressing these perceptions requires comprehensive educational campaigns highlighting the nutritional benefits and fortification aspects of modern cereal products.

Supply chain complexities in India’s diverse market landscape create operational challenges for manufacturers. Maintaining product quality, managing inventory across multiple distribution channels, and ensuring consistent availability in remote locations require substantial investment and operational expertise.

Rural market expansion presents enormous untapped potential for breakfast cereal manufacturers. With improving rural infrastructure, rising agricultural incomes, and increasing exposure to urban lifestyle trends, rural areas offer significant growth opportunities for companies willing to adapt their strategies and product offerings.

Product innovation opportunities abound in developing cereals that incorporate traditional Indian grains and flavors. Manufacturers can capitalize on the growing interest in millets, quinoa, and other ancient grains by creating products that combine convenience with familiar taste profiles and enhanced nutritional benefits.

E-commerce channel development enables direct consumer engagement and market expansion beyond traditional retail limitations. Online platforms facilitate targeted marketing, subscription models, and personalized product recommendations, creating new revenue streams and customer relationship opportunities.

Health-focused segmentation allows companies to develop specialized products targeting specific consumer needs such as diabetes management, weight control, sports nutrition, and children’s development. These niche segments often command premium pricing and demonstrate higher brand loyalty.

Private label opportunities emerge as modern retail chains seek to develop their own cereal brands. Partnerships with retailers for private label manufacturing can provide stable revenue streams while reducing marketing costs and enabling market share expansion.

Competitive intensity continues to escalate as both international and domestic players vie for market share in this rapidly growing segment. Established multinational brands leverage their global expertise and marketing capabilities, while local companies capitalize on their understanding of regional preferences and cost advantages.

Innovation cycles accelerate as companies introduce new flavors, formats, and nutritional formulations to differentiate their offerings. Product development focuses on addressing specific Indian consumer needs, including taste preferences, nutritional requirements, and price sensitivity considerations.

Distribution evolution reflects changing retail landscapes, with modern trade channels gaining prominence alongside traditional distribution networks. The rise of organized retail and e-commerce platforms creates new opportunities for brand visibility and consumer engagement.

Consumer education initiatives by industry players aim to increase awareness about cereal benefits and usage occasions. These efforts focus on demonstrating convenience, nutritional value, and versatility of cereal products to accelerate market adoption.

Regulatory environment influences product formulations and marketing practices, with food safety standards and labeling requirements shaping industry operations. Compliance with nutritional guidelines and fortification mandates affects product development strategies and market positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India breakfast cereal market. The research approach combines quantitative and qualitative techniques to provide a holistic understanding of market dynamics, consumer behavior, and competitive landscape.

Primary research activities include extensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions across major Indian cities. These activities capture real-time consumer preferences, purchasing patterns, and brand perceptions to inform market analysis.

Secondary research sources encompass industry reports, government statistics, trade association data, and company financial statements. This information provides historical context, market sizing data, and competitive intelligence essential for comprehensive market understanding.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert consultations, and statistical verification methods. Cross-referencing primary findings with secondary data sources enhances reliability and credibility of market insights.

Analytical frameworks applied include market segmentation analysis, competitive positioning studies, and trend identification methodologies. These frameworks enable systematic evaluation of market opportunities and strategic recommendations for industry participants.

Northern India demonstrates strong breakfast cereal adoption rates, particularly in Delhi NCR, Punjab, and Haryana regions. This area shows highest per capita consumption at 28% of total market volume, driven by urbanization, higher disposable incomes, and exposure to global food trends. Wheat-based cereals and traditional flavors perform exceptionally well in this region.

Western India represents the largest market segment, with Maharashtra and Gujarat leading consumption patterns. Mumbai and Pune serve as key metropolitan markets where premium cereal brands achieve strong penetration. The region accounts for approximately 35% of total market share, benefiting from established retail infrastructure and cosmopolitan consumer preferences.

Southern India shows growing acceptance of breakfast cereals, particularly in Bangalore, Chennai, and Hyderabad. Traditional breakfast preferences remain strong, but younger demographics increasingly adopt cereal consumption. The region demonstrates steady growth rates of 18% annually, with oats and health-focused variants gaining popularity.

Eastern India presents emerging opportunities with Kolkata leading regional adoption trends. Cultural preferences for rice-based breakfasts create unique challenges, but gradual lifestyle changes drive market expansion. The region currently represents 12% of national consumption with significant growth potential.

Tier-2 and Tier-3 cities across all regions show accelerating adoption rates as modern retail expands and consumer awareness increases. These markets offer substantial growth opportunities for companies developing region-specific strategies and affordable product variants.

Market leadership is contested among several key players, each pursuing distinct strategies to capture and retain market share. The competitive environment features both established multinational corporations and emerging domestic brands.

Competitive strategies vary significantly, with multinational companies leveraging global best practices while domestic players capitalize on local market understanding and cost advantages. Innovation, distribution expansion, and consumer education remain key competitive battlegrounds.

Market consolidation trends indicate potential for mergers and acquisitions as companies seek to strengthen market positions and achieve operational synergies.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Ready-to-Eat Cereals dominate market volume, representing the most established category with widespread consumer acceptance. Cornflakes remain the entry point for many first-time cereal consumers, while wheat-based variants appeal to health-conscious segments. This category benefits from extensive distribution and competitive pricing strategies.

Oats and Hot Cereals demonstrate the strongest growth trajectory, driven by increasing health awareness and diabetes management needs. The segment shows annual growth rates exceeding 22%, with both instant and traditional cooking variants gaining popularity among health-focused consumers.

Premium Muesli and Granola segments target affluent urban consumers willing to pay premium prices for superior nutritional profiles. These categories show strong performance in metropolitan markets and among educated demographics seeking convenient healthy breakfast options.

Children’s Cereals represent a crucial growth driver, with manufacturers investing heavily in product development, packaging innovation, and marketing campaigns. Fortification with vitamins and minerals addresses parental concerns about children’s nutrition while appealing flavors ensure acceptance.

Organic and Natural Variants emerge as niche but rapidly growing segments, catering to consumers seeking clean-label products without artificial additives. These categories command premium pricing and demonstrate strong brand loyalty among target demographics.

Manufacturers benefit from expanding market opportunities, diversified revenue streams, and potential for premium pricing in health-focused segments. The growing market enables economies of scale, improved distribution efficiency, and enhanced brand building opportunities across multiple consumer segments.

Retailers gain from higher margin products, increased footfall, and category expansion opportunities. Breakfast cereals typically offer better margins than traditional grocery items while attracting health-conscious consumers who often purchase complementary high-value products.

Distributors capitalize on growing demand, expanded geographic reach, and portfolio diversification opportunities. The cereal market’s growth enables distribution partners to strengthen relationships with retailers while exploring new channel partnerships.

Consumers benefit from convenient, nutritious breakfast options that save preparation time while providing balanced nutrition. The expanding product variety ensures options for different taste preferences, dietary requirements, and budget considerations.

Farmers and Suppliers experience increased demand for grains, packaging materials, and related inputs. The market growth creates opportunities for agricultural value chain participants to develop specialized supply relationships with cereal manufacturers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and Wellness Focus drives product development toward functional cereals with added proteins, probiotics, and superfoods. Manufacturers increasingly emphasize nutritional benefits, fortification, and clean-label ingredients to meet evolving consumer expectations for healthier breakfast options.

Flavor Localization becomes crucial as companies adapt global products to Indian taste preferences. Traditional flavors like cardamom, saffron, and regional spices are incorporated into cereal formulations to increase acceptance among local consumers.

Sustainable Packaging gains importance as environmentally conscious consumers seek eco-friendly options. Companies invest in recyclable materials, reduced packaging waste, and sustainable sourcing practices to appeal to environmentally aware demographics.

Digital Marketing Integration transforms consumer engagement strategies, with brands leveraging social media, influencer partnerships, and content marketing to educate consumers and build brand communities. Digital channels account for 31% of marketing spend among leading cereal brands.

Subscription and Direct-to-Consumer Models emerge as alternative distribution strategies, enabling companies to build direct relationships with consumers while offering convenience and personalization benefits.

Premiumization Trends reflect growing consumer willingness to pay higher prices for superior quality, organic ingredients, and specialized nutritional benefits. Premium segments demonstrate growth rates of 25% annually, outpacing mass market categories.

Manufacturing Capacity Expansion initiatives by major players reflect confidence in long-term market growth potential. Several companies have announced significant investments in new production facilities and technology upgrades to meet growing demand and improve operational efficiency.

Strategic Partnerships between international brands and local distributors facilitate market penetration and cultural adaptation. These collaborations combine global expertise with local market knowledge to accelerate growth and consumer acceptance.

Product Launch Activities intensify as companies introduce innovative formulations targeting specific consumer segments. Recent launches focus on protein-enriched variants, organic options, and regionally adapted flavors to capture emerging market opportunities.

Digital Transformation initiatives encompass supply chain optimization, consumer data analytics, and e-commerce platform development. Companies invest in technology to improve operational efficiency and enhance customer experience across touchpoints.

Regulatory Compliance developments include enhanced food safety standards and nutritional labeling requirements. Industry participants adapt operations and product formulations to meet evolving regulatory expectations while maintaining competitive positioning.

Sustainability Initiatives gain momentum as companies implement environmentally responsible practices throughout their value chains. These efforts include sustainable sourcing, waste reduction, and carbon footprint minimization to meet stakeholder expectations.

Market Entry Strategies should prioritize understanding regional preferences and price sensitivity considerations. MarkWide Research analysis indicates that successful market penetration requires localized product development, competitive pricing, and extensive consumer education initiatives.

Distribution Channel Optimization remains critical for market success, with companies needing to balance modern trade expansion with traditional channel maintenance. Hybrid distribution strategies that combine multiple channels offer the best prospects for comprehensive market coverage.

Innovation Focus Areas should emphasize health benefits, convenience features, and taste localization. Products addressing specific Indian dietary needs and preferences demonstrate higher success rates than direct adaptations of global formulations.

Investment Priorities should include manufacturing capacity, distribution infrastructure, and brand building activities. Companies with strong local presence and consumer understanding are better positioned to capitalize on market growth opportunities.

Partnership Opportunities exist with retailers, e-commerce platforms, and health-focused organizations. Strategic alliances can accelerate market penetration while reducing individual company risks and investment requirements.

Long-term growth prospects remain highly positive, with the India breakfast cereal market positioned for sustained expansion over the next decade. Demographic trends, urbanization patterns, and lifestyle changes create favorable conditions for continued market development and consumer adoption.

Technology integration will increasingly influence product development, manufacturing processes, and consumer engagement strategies. Companies investing in digital capabilities and data analytics will gain competitive advantages in understanding and serving evolving consumer needs.

Market maturation is expected to bring increased competition, product differentiation, and segmentation. As the market evolves, successful companies will be those that can effectively balance innovation, pricing, and distribution strategies to maintain market share.

Regulatory evolution will likely emphasize food safety, nutritional standards, and environmental sustainability. Companies preparing for stricter regulations while maintaining operational efficiency will be better positioned for long-term success.

Consumer sophistication will drive demand for more specialized, premium, and functionally enhanced products. The market is projected to achieve penetration rates of 45% in urban areas within the next five years, according to MWR projections.

The India breakfast cereal market represents a compelling growth opportunity characterized by strong fundamentals, evolving consumer preferences, and substantial untapped potential. The market’s trajectory reflects broader socioeconomic changes including urbanization, rising incomes, health consciousness, and lifestyle modernization that favor convenient, nutritious breakfast solutions.

Strategic success factors include deep understanding of local preferences, competitive pricing strategies, comprehensive distribution networks, and continuous product innovation. Companies that effectively balance global expertise with local market insights are best positioned to capitalize on the market’s growth potential.

Future market development will be shaped by technological advancement, regulatory evolution, and changing consumer expectations. The market’s continued expansion depends on industry participants’ ability to address price sensitivity, cultural preferences, and distribution challenges while maintaining product quality and nutritional benefits.

Investment opportunities abound for companies willing to commit to long-term market development, consumer education, and infrastructure building. The India breakfast cereal market’s growth story is just beginning, with substantial potential for value creation across the entire industry ecosystem.

What is Breakfast Cereal?

Breakfast cereal refers to a variety of processed food products made from grains, typically consumed in the morning. These products can include flakes, puffs, and granola, often fortified with vitamins and minerals.

What are the key players in the India Breakfast Cereal Market?

Key players in the India Breakfast Cereal Market include companies like Nestlé, Kellogg’s, and Britannia. These companies offer a range of products catering to different consumer preferences, including health-focused and traditional options, among others.

What are the growth factors driving the India Breakfast Cereal Market?

The India Breakfast Cereal Market is driven by increasing urbanization, changing lifestyles, and a growing awareness of health and nutrition. Additionally, the rise in disposable incomes has led to a higher demand for convenient and nutritious breakfast options.

What challenges does the India Breakfast Cereal Market face?

Challenges in the India Breakfast Cereal Market include intense competition among brands and fluctuating raw material prices. Additionally, consumer preferences are shifting towards healthier and organic options, which can complicate product development.

What opportunities exist in the India Breakfast Cereal Market?

The India Breakfast Cereal Market presents opportunities for innovation in product offerings, such as gluten-free and high-protein cereals. There is also potential for expansion in rural areas as awareness of breakfast cereals increases.

What trends are shaping the India Breakfast Cereal Market?

Trends in the India Breakfast Cereal Market include a growing preference for natural ingredients and the incorporation of superfoods. Additionally, there is an increasing focus on sustainable packaging and environmentally friendly production methods.

India Breakfast Cereal Market

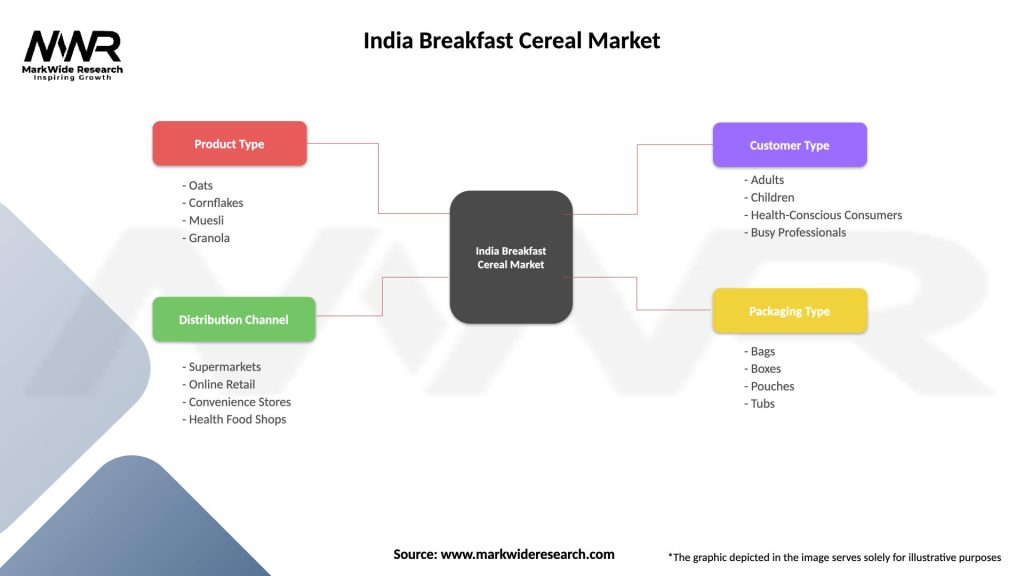

| Segmentation Details | Description |

|---|---|

| Product Type | Oats, Cornflakes, Muesli, Granola |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Health Food Shops |

| Customer Type | Adults, Children, Health-Conscious Consumers, Busy Professionals |

| Packaging Type | Bags, Boxes, Pouches, Tubs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Breakfast Cereal Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at