444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India bottled water market represents one of the most dynamic and rapidly expanding segments within the country’s beverage industry. Market dynamics indicate substantial growth driven by increasing health consciousness, urbanization, and concerns about water quality across diverse geographic regions. The market demonstrates robust expansion with a projected compound annual growth rate of 12.5% CAGR over the forecast period, reflecting strong consumer demand and evolving lifestyle preferences.

Consumer behavior patterns reveal a significant shift toward packaged drinking water as a preferred choice for hydration, particularly in urban centers and among health-conscious demographics. The market encompasses various product categories including natural mineral water, packaged drinking water, flavored water, and premium alkaline water variants. Regional penetration shows concentrated demand in metropolitan areas, with approximately 68% market concentration in tier-1 and tier-2 cities, while rural markets present emerging opportunities for expansion.

Industry transformation is evident through technological advancements in water purification, packaging innovations, and distribution network optimization. The market benefits from increasing disposable income, changing consumer preferences, and growing awareness about waterborne diseases. Competitive landscape features both established multinational corporations and emerging domestic players, creating a diverse ecosystem that caters to various price points and consumer segments.

The India bottled water market refers to the commercial sector encompassing the production, distribution, and sale of packaged drinking water products across various formats, including bottles, pouches, and containers. This market includes natural mineral water sourced from protected underground sources, packaged drinking water treated through advanced purification processes, and specialty water products enhanced with minerals or flavoring.

Market scope extends beyond basic hydration needs to encompass premium water categories, functional beverages, and health-oriented water products. The sector involves comprehensive value chain activities from water sourcing and treatment to packaging, branding, distribution, and retail sales. Regulatory framework governs quality standards, safety protocols, and labeling requirements established by the Food Safety and Standards Authority of India (FSSAI) and Bureau of Indian Standards (BIS).

Consumer segments include households, offices, educational institutions, healthcare facilities, hospitality sector, and retail establishments. The market encompasses both organized and unorganized sectors, with increasing emphasis on quality assurance, brand recognition, and sustainable packaging solutions to meet evolving consumer expectations and environmental considerations.

Market performance demonstrates exceptional growth trajectory driven by fundamental shifts in consumer behavior, urbanization trends, and increasing health awareness across Indian demographics. The bottled water industry has evolved from a convenience product to an essential commodity, particularly in regions facing water quality challenges and infrastructure limitations.

Key growth drivers include rising concerns about tap water quality, with approximately 78% of consumers expressing preference for packaged water due to safety considerations. Urban lifestyle changes, increased travel, and workplace consumption patterns contribute significantly to market expansion. Premium segment growth shows particular strength, with natural mineral water and alkaline water categories experiencing accelerated adoption among affluent consumer groups.

Strategic developments focus on distribution network expansion, product innovation, and sustainable packaging initiatives. Major players are investing in advanced purification technologies, eco-friendly packaging materials, and rural market penetration strategies. Market consolidation trends indicate increasing competition between established brands and emerging regional players, driving innovation and competitive pricing strategies.

Future prospects remain highly favorable, supported by demographic trends, economic growth, and evolving consumer preferences toward health and wellness products. The market is positioned for sustained expansion with opportunities in untapped rural markets, premium product categories, and functional water segments.

Consumer preference analysis reveals significant insights into purchasing behavior and brand loyalty patterns within the Indian bottled water market. Research indicates that quality assurance and brand reputation serve as primary decision-making factors, with 85% of consumers prioritizing certified water sources and established brand credentials.

Market intelligence suggests that seasonal demand fluctuations, regional water quality variations, and demographic shifts significantly influence consumption patterns and growth opportunities across different market segments.

Primary growth catalysts propelling the India bottled water market include fundamental socioeconomic changes, infrastructure challenges, and evolving consumer lifestyle patterns. Urbanization acceleration creates concentrated demand centers where packaged water becomes essential due to inadequate municipal water supply systems and quality concerns.

Health awareness trends significantly influence market expansion as consumers become increasingly conscious of waterborne diseases and contamination risks. Educational campaigns and medical recommendations emphasize the importance of safe drinking water, driving preference toward certified bottled water products. Quality concerns regarding tap water, particularly in industrial areas and regions with groundwater contamination, create sustained demand for reliable packaged alternatives.

Economic prosperity and rising disposable income levels enable broader consumer segments to afford packaged water regularly. The growing middle class demonstrates willingness to pay premium prices for quality assurance and convenience. Lifestyle changes associated with busy work schedules, increased travel, and on-the-go consumption patterns support market growth across urban and semi-urban areas.

Infrastructure limitations in water treatment and distribution systems across many regions create market opportunities for bottled water companies. Seasonal variations in water availability and quality during monsoon and summer periods drive consistent demand for reliable packaged water sources. Additionally, tourism growth and hospitality sector expansion contribute to increased consumption in commercial and institutional segments.

Regulatory challenges pose significant constraints on market growth, including stringent quality standards, licensing requirements, and compliance costs that particularly impact smaller manufacturers. Environmental concerns regarding plastic waste and packaging disposal create regulatory pressures and consumer resistance, necessitating investments in sustainable packaging solutions.

Price competition from unorganized sector players and local manufacturers creates margin pressures for established brands. Raw material costs including packaging materials, transportation, and energy expenses impact profitability, particularly during periods of commodity price volatility. Quality control challenges in maintaining consistent standards across diverse production facilities and distribution networks require substantial investments in infrastructure and monitoring systems.

Consumer price sensitivity in certain market segments limits premium product adoption and constrains revenue growth potential. Seasonal demand fluctuations create inventory management challenges and capacity utilization issues for manufacturers. Distribution complexities in reaching remote and rural markets involve significant logistical costs and infrastructure investments.

Water scarcity concerns in certain regions raise questions about sustainable sourcing practices and long-term resource availability. Regulatory compliance costs for quality testing, certification, and documentation requirements create operational burdens, particularly for smaller market participants seeking to expand their operations.

Rural market penetration presents substantial growth opportunities as infrastructure development and income levels improve in tier-3 cities and rural areas. Untapped demographics in these regions show increasing awareness of health benefits and willingness to adopt packaged water products, creating significant expansion potential for market participants.

Premium product categories offer lucrative opportunities through natural mineral water, alkaline water, and functional beverages enhanced with vitamins and minerals. Health-conscious consumers demonstrate willingness to pay premium prices for specialized water products that offer additional health benefits beyond basic hydration needs.

E-commerce expansion creates new distribution channels and direct-to-consumer opportunities, particularly for bulk purchases and subscription-based delivery models. Digital marketing strategies enable targeted consumer engagement and brand building activities that can drive market share growth and customer loyalty.

Sustainable packaging innovations present opportunities to address environmental concerns while differentiating products in competitive markets. Corporate partnerships with offices, educational institutions, and healthcare facilities create stable demand channels and recurring revenue streams. Export opportunities to neighboring countries and international markets offer additional growth avenues for established Indian brands with quality certifications and production capabilities.

Technology integration in water purification, quality monitoring, and supply chain management creates competitive advantages and operational efficiencies that can drive market leadership positions.

Competitive intensity within the India bottled water market reflects dynamic interactions between established multinational brands, domestic market leaders, and emerging regional players. Market forces include pricing strategies, distribution network expansion, product innovation, and brand positioning initiatives that collectively shape industry evolution and consumer choice patterns.

Supply chain dynamics encompass water sourcing strategies, production capacity optimization, and distribution network efficiency improvements. MarkWide Research analysis indicates that companies achieving superior operational efficiency through integrated supply chain management demonstrate stronger market performance and profitability metrics compared to competitors with fragmented operations.

Consumer behavior shifts toward premium products and health-oriented choices create opportunities for value-added offerings and brand differentiation strategies. Seasonal demand patterns require flexible production planning and inventory management capabilities to optimize capacity utilization and meet peak demand periods effectively.

Regulatory evolution continues to shape market dynamics through quality standards, environmental regulations, and packaging requirements that influence operational strategies and compliance investments. Technology adoption in water treatment, packaging automation, and quality control systems drives operational efficiency improvements and competitive positioning advantages.

Market consolidation trends indicate increasing merger and acquisition activities as companies seek to achieve economies of scale, expand geographic reach, and enhance distribution capabilities in competitive market environments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India bottled water market dynamics, consumer behavior patterns, and competitive landscape characteristics. Primary research activities include structured interviews with industry executives, consumer surveys, and focus group discussions across diverse demographic segments and geographic regions.

Secondary research sources encompass industry reports, government publications, regulatory documents, company financial statements, and trade association data to validate primary research findings and provide comprehensive market context. Data triangulation methods ensure accuracy and reliability through cross-verification of information from multiple independent sources.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing methodologies to project growth trajectories and identify market opportunities. Qualitative research approaches provide insights into consumer motivations, brand perceptions, and purchasing decision factors that influence market dynamics.

Market segmentation analysis examines product categories, consumer demographics, geographic regions, and distribution channels to identify growth opportunities and competitive positioning strategies. Competitive intelligence gathering includes analysis of company strategies, product portfolios, pricing models, and market positioning approaches to understand competitive dynamics and industry trends.

Geographic distribution of the India bottled water market reveals significant regional variations in consumption patterns, growth rates, and competitive dynamics. Northern regions including Delhi, Punjab, and Haryana demonstrate strong market penetration with approximately 32% regional market share, driven by urbanization, industrial development, and water quality concerns in metropolitan areas.

Western India comprising Maharashtra, Gujarat, and Rajasthan represents the largest regional market segment, accounting for 35% of national consumption. This region benefits from high urban population density, industrial activity, and established distribution networks that facilitate market access and brand penetration across diverse consumer segments.

Southern states including Karnataka, Tamil Nadu, Andhra Pradesh, and Kerala show rapid growth momentum with increasing health consciousness and premium product adoption. Regional preferences for natural mineral water and locally sourced products create opportunities for specialized offerings and regional brand positioning strategies.

Eastern regions encompassing West Bengal, Odisha, and northeastern states present emerging market opportunities with improving infrastructure and rising income levels. Rural market potential in these areas shows significant growth prospects as awareness and accessibility improve through expanded distribution networks.

Central India markets demonstrate steady growth supported by industrial development and urban expansion in cities like Bhopal, Indore, and Nagpur. Regional challenges include logistics costs, distribution infrastructure limitations, and price sensitivity that require tailored market entry and expansion strategies.

Market leadership within the India bottled water industry reflects intense competition among established multinational corporations, domestic market leaders, and emerging regional players. Competitive positioning strategies focus on brand recognition, quality assurance, distribution network strength, and pricing competitiveness to capture and retain market share.

Competitive strategies include product innovation, packaging differentiation, distribution network expansion, and strategic partnerships to enhance market reach and consumer engagement. Regional players maintain competitive advantages through local market knowledge, cost-effective operations, and specialized product offerings tailored to regional preferences.

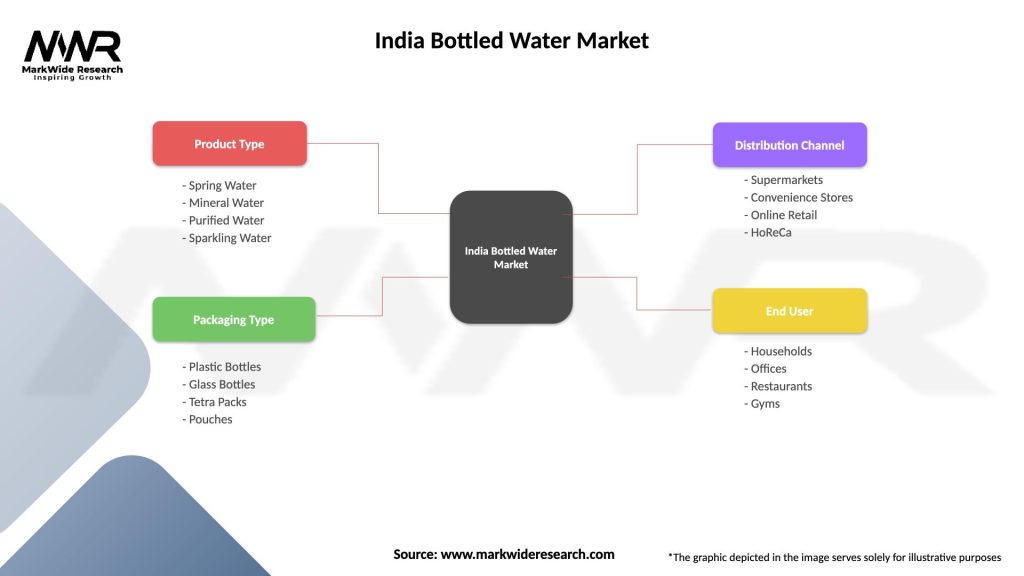

Product category segmentation reveals diverse market segments catering to different consumer needs, preferences, and price points within the India bottled water market. Market classification encompasses various product types, packaging formats, distribution channels, and consumer demographics that influence purchasing decisions and growth opportunities.

By Product Type:

By Packaging Format:

By Distribution Channel:

Packaged drinking water represents the largest market category, accounting for approximately 72% of total market volume, driven by affordability, wide availability, and consistent quality standards. Consumer acceptance remains strong across all demographic segments, with particular strength in urban markets where convenience and safety considerations drive regular consumption patterns.

Natural mineral water demonstrates the highest growth potential within premium segments, appealing to health-conscious consumers seeking natural hydration solutions with mineral supplementation benefits. Premium positioning enables higher profit margins and brand differentiation opportunities, particularly in affluent urban markets and health-focused consumer segments.

Flavored water categories show emerging growth momentum as consumers seek variety and functional benefits beyond basic hydration. Innovation opportunities include fruit-infused variants, vitamin-enhanced formulations, and low-calorie options that cater to diverse taste preferences and health objectives.

Alkaline water segment represents a specialized niche with strong growth potential among wellness-oriented consumers. Market education regarding pH balance benefits and health advantages drives adoption, particularly in metropolitan areas with higher health awareness levels.

Bulk packaging formats serve institutional and commercial markets with cost-effective solutions for high-volume consumption needs. B2B opportunities include corporate partnerships, educational institution contracts, and hospitality sector relationships that provide stable revenue streams and market expansion possibilities.

Market participants benefit from substantial growth opportunities driven by increasing consumer demand, expanding market reach, and product innovation possibilities within the India bottled water industry. Revenue growth potential remains strong across multiple market segments, supported by demographic trends and evolving consumer preferences toward packaged water products.

Manufacturers gain advantages through economies of scale, brand building opportunities, and distribution network expansion that enhance competitive positioning and market share growth. Operational efficiency improvements through technology adoption and supply chain optimization create cost advantages and profitability enhancement opportunities.

Distributors and retailers benefit from consistent consumer demand, attractive profit margins, and diverse product portfolio opportunities that drive sales volume and customer traffic. Partnership opportunities with established brands provide access to marketing support, promotional activities, and brand recognition benefits.

Consumers gain access to safe, convenient, and reliable hydration solutions with quality assurance and diverse product choices that meet varying preferences and needs. Health benefits include reduced risk of waterborne diseases, consistent mineral content, and convenient access to clean drinking water across different locations and situations.

Investors find attractive opportunities in a growing market with strong fundamentals, increasing consumer adoption, and expansion potential in untapped market segments. Stakeholder value creation through sustainable business practices, innovation investments, and market leadership positions provides long-term growth prospects and competitive advantages.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives represent the most significant trend shaping the India bottled water market, with companies investing in eco-friendly packaging materials, recycling programs, and carbon footprint reduction strategies. Consumer awareness regarding environmental impact drives demand for sustainable packaging solutions and responsible sourcing practices that align with environmental consciousness.

Premium product adoption shows accelerating momentum as consumers increasingly seek natural mineral water, alkaline water, and functional beverages that offer health benefits beyond basic hydration. Health positioning becomes crucial for brand differentiation and premium pricing strategies in competitive market environments.

Digital transformation encompasses e-commerce expansion, mobile app development, and digital marketing strategies that enhance consumer engagement and direct-to-consumer sales opportunities. Technology integration in supply chain management, quality monitoring, and customer relationship management creates operational efficiencies and competitive advantages.

Regional brand emergence reflects growing consumer preference for locally sourced products and regional taste preferences. MWR analysis indicates that regional brands achieving quality certifications and effective marketing strategies demonstrate strong growth potential in specific geographic markets.

Functional water innovation includes vitamin-enhanced products, electrolyte-infused variants, and specialized formulations targeting specific health objectives and consumer demographics. Product diversification strategies enable companies to capture additional market segments and reduce dependence on traditional packaged water categories.

Strategic partnerships between bottled water companies and retail chains create enhanced distribution opportunities and market penetration capabilities. Collaboration initiatives focus on exclusive product launches, promotional campaigns, and supply chain optimization that benefit both manufacturers and retail partners through increased sales volume and customer engagement.

Technology investments in advanced water purification systems, automated packaging lines, and quality control equipment enhance operational efficiency and product consistency. Innovation focus includes smart packaging solutions, traceability systems, and sustainable manufacturing processes that address consumer expectations and regulatory requirements.

Acquisition activities demonstrate market consolidation trends as established companies seek to expand geographic reach, acquire regional brands, and enhance distribution capabilities. Strategic acquisitions provide access to local market knowledge, established customer relationships, and operational synergies that accelerate growth and market share expansion.

Regulatory compliance initiatives include investments in quality assurance systems, certification processes, and environmental management practices that ensure adherence to evolving standards and consumer safety requirements. Compliance excellence becomes a competitive differentiator and market access enabler in regulated market environments.

Export expansion activities by Indian bottled water companies target international markets through quality certifications, competitive pricing, and strategic partnerships with overseas distributors and retail chains.

Market entry strategies should prioritize quality assurance, brand building, and distribution network development to establish competitive positioning in the India bottled water market. New entrants benefit from focusing on specific geographic regions or consumer segments where they can achieve differentiation and build market presence effectively.

Investment priorities include sustainable packaging solutions, advanced purification technologies, and digital marketing capabilities that address evolving consumer expectations and regulatory requirements. Technology adoption in supply chain management and quality control systems provides operational advantages and competitive differentiation opportunities.

Product development focus should emphasize premium categories, functional beverages, and health-oriented formulations that command higher margins and appeal to growing health-conscious consumer segments. Innovation strategies require market research, consumer testing, and gradual rollout approaches to minimize risks and optimize market acceptance.

Distribution expansion into rural markets and tier-3 cities presents significant growth opportunities, requiring tailored pricing strategies, local partnerships, and infrastructure investments. Channel diversification through e-commerce platforms and direct delivery services creates additional revenue streams and customer touchpoints.

Sustainability initiatives become essential for long-term market success, requiring investments in eco-friendly packaging, recycling programs, and responsible sourcing practices that align with consumer values and regulatory expectations. Environmental leadership provides brand differentiation and competitive advantages in increasingly conscious market environments.

Growth trajectory for the India bottled water market remains highly positive, supported by demographic trends, urbanization, and increasing health consciousness across diverse consumer segments. Market expansion is projected to continue at robust rates, with particular strength in premium categories and untapped rural markets that offer substantial growth potential.

Technology evolution will drive operational efficiency improvements, product innovation, and sustainable packaging solutions that address environmental concerns while maintaining competitive positioning. Digital transformation initiatives will enhance consumer engagement, distribution efficiency, and market intelligence capabilities that support strategic decision-making and growth optimization.

Regional market development shows promising prospects as infrastructure improvements and income growth in tier-2 and tier-3 cities create new demand centers and expansion opportunities. MarkWide Research projections indicate that rural market penetration could contribute significant incremental growth as awareness and accessibility improve through targeted marketing and distribution strategies.

Premium segment expansion will continue driven by health consciousness, disposable income growth, and consumer willingness to pay for quality and functional benefits. Innovation opportunities in functional waters, sustainable packaging, and personalized nutrition create differentiation possibilities and market leadership positions.

Competitive dynamics will intensify as market growth attracts new entrants and existing players expand their operations. Market consolidation trends may accelerate as companies seek economies of scale and enhanced distribution capabilities to compete effectively in evolving market conditions.

The India bottled water market represents a dynamic and rapidly expanding industry with substantial growth opportunities driven by fundamental demographic, economic, and lifestyle trends. Market fundamentals remain strong, supported by increasing health consciousness, urbanization, water quality concerns, and rising disposable income levels across diverse consumer segments.

Strategic positioning for market success requires focus on quality assurance, brand building, distribution network expansion, and sustainable practices that align with evolving consumer expectations and regulatory requirements. Innovation opportunities in premium products, functional beverages, and eco-friendly packaging create differentiation possibilities and competitive advantages in increasingly competitive market environments.

Future prospects indicate continued robust growth with particular opportunities in rural market penetration, premium category expansion, and digital transformation initiatives that enhance operational efficiency and consumer engagement. Market participants who successfully navigate competitive challenges while addressing sustainability concerns and consumer health priorities will be well-positioned to capture growth opportunities and achieve market leadership positions in this dynamic and promising industry sector.

What is Bottled Water?

Bottled water refers to water that is packaged in bottles for consumption. It can include spring water, mineral water, purified water, and flavored water, catering to various consumer preferences and health trends.

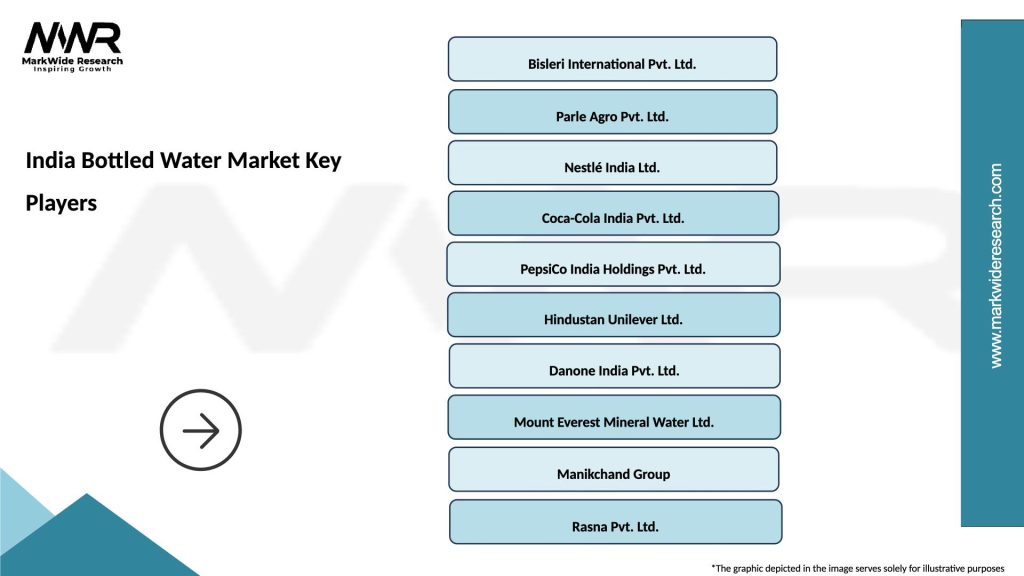

What are the key players in the India Bottled Water Market?

Key players in the India Bottled Water Market include Bisleri International Pvt. Ltd., Coca-Cola India, and Parle Agro, among others. These companies dominate the market through extensive distribution networks and brand recognition.

What are the growth factors driving the India Bottled Water Market?

The India Bottled Water Market is driven by increasing health consciousness among consumers, rising disposable incomes, and the growing demand for convenient hydration options. Additionally, urbanization and the expansion of retail channels contribute to market growth.

What challenges does the India Bottled Water Market face?

The India Bottled Water Market faces challenges such as environmental concerns regarding plastic waste, regulatory hurdles, and competition from tap water and other beverages. These factors can impact consumer choices and market dynamics.

What opportunities exist in the India Bottled Water Market?

Opportunities in the India Bottled Water Market include the introduction of eco-friendly packaging, flavored and functional water products, and expansion into rural areas. Companies can also leverage e-commerce platforms to reach a broader audience.

What trends are shaping the India Bottled Water Market?

Trends in the India Bottled Water Market include a shift towards premium bottled water, increased focus on sustainability, and the rise of health-oriented products. Consumers are increasingly seeking organic and mineral-rich options, influencing product development.

India Bottled Water Market

| Segmentation Details | Description |

|---|---|

| Product Type | Spring Water, Mineral Water, Purified Water, Sparkling Water |

| Packaging Type | Plastic Bottles, Glass Bottles, Tetra Packs, Pouches |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, HoReCa |

| End User | Households, Offices, Restaurants, Gyms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Bottled Water Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at