444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India blood glucose monitoring market represents a rapidly expanding healthcare segment driven by the country’s escalating diabetes epidemic and increasing health awareness among consumers. India currently hosts the second-largest diabetic population globally, creating substantial demand for reliable blood glucose monitoring solutions across urban and rural regions. The market encompasses traditional glucometers, continuous glucose monitoring systems, test strips, lancets, and emerging smart monitoring technologies that integrate with mobile applications and cloud-based platforms.

Market dynamics indicate robust growth potential with the sector experiencing a compound annual growth rate (CAGR) of 8.2% as healthcare infrastructure modernizes and diabetes management protocols become more sophisticated. Government initiatives promoting diabetes awareness, coupled with rising disposable incomes and expanding healthcare access, are propelling market expansion across tier-1, tier-2, and tier-3 cities throughout India.

Technological advancement in glucose monitoring devices, including the introduction of painless monitoring systems and smartphone-integrated solutions, is reshaping consumer preferences and driving adoption rates. The market benefits from increasing penetration of digital health platforms and telemedicine services that complement traditional glucose monitoring approaches.

The India blood glucose monitoring market refers to the comprehensive ecosystem of medical devices, consumables, and digital solutions designed to measure and track blood sugar levels in diabetic and pre-diabetic patients across the Indian subcontinent. This market encompasses traditional fingerstick glucometers, advanced continuous glucose monitoring (CGM) systems, associated consumables like test strips and lancets, and emerging smart monitoring technologies that provide real-time glucose data to patients and healthcare providers.

Blood glucose monitoring serves as the cornerstone of effective diabetes management, enabling patients to make informed decisions about medication timing, dietary choices, and lifestyle modifications. The market includes both prescription-based monitoring systems recommended by healthcare professionals and over-the-counter devices available through pharmacies and online platforms.

Modern glucose monitoring solutions integrate advanced features such as data storage, trend analysis, smartphone connectivity, and cloud-based reporting systems that facilitate comprehensive diabetes management and enable healthcare providers to monitor patient compliance and treatment effectiveness remotely.

India’s blood glucose monitoring market stands at a pivotal juncture, characterized by unprecedented growth opportunities driven by the nation’s diabetes burden and evolving healthcare landscape. Market expansion is fueled by increasing diabetes prevalence, growing health consciousness, technological innovations, and supportive government policies promoting diabetes care accessibility.

Key market drivers include the rising incidence of Type 2 diabetes, increasing awareness about preventive healthcare, expanding healthcare infrastructure, and the growing adoption of digital health solutions. Consumer preferences are shifting toward user-friendly, accurate, and cost-effective monitoring solutions that integrate seamlessly with modern lifestyle requirements.

Competitive landscape features both international medical device manufacturers and domestic companies offering diverse product portfolios ranging from basic glucometers to sophisticated continuous monitoring systems. Market penetration varies significantly between urban and rural areas, with urban centers showing higher adoption rates of advanced monitoring technologies.

Future growth prospects remain highly favorable, supported by demographic trends, increasing healthcare spending, technological advancement, and expanding insurance coverage for diabetes management devices. The market is expected to witness continued innovation in monitoring accuracy, user experience, and data integration capabilities.

Strategic market analysis reveals several critical insights shaping the India blood glucose monitoring landscape:

Primary market drivers propelling the India blood glucose monitoring market include the escalating diabetes epidemic, with diabetes prevalence rates reaching 8.9% among the adult population and continuing to rise due to lifestyle changes, urbanization, and dietary transitions. Demographic factors such as an aging population and increasing life expectancy contribute to higher diabetes incidence rates across all age groups.

Healthcare awareness campaigns initiated by government agencies and healthcare organizations are educating consumers about the importance of regular glucose monitoring for effective diabetes management. Rising disposable incomes in urban and semi-urban areas enable consumers to invest in quality monitoring devices and consumables for long-term health management.

Technological advancement in glucose monitoring devices, including improved accuracy, reduced testing time, and enhanced user experience, is driving consumer adoption and market expansion. Digital health integration capabilities that connect monitoring devices with smartphones and healthcare platforms are attracting tech-savvy consumers seeking comprehensive health management solutions.

Government initiatives promoting diabetes care accessibility through public health programs and subsidized medical device availability are expanding market reach to underserved populations. Healthcare infrastructure development across rural and remote areas is improving access to diabetes care services and monitoring device availability.

Significant market restraints include the high cost of advanced glucose monitoring systems and associated consumables, which limit accessibility for price-sensitive consumers, particularly in rural and low-income segments. Limited insurance coverage for glucose monitoring devices and consumables creates financial barriers for many patients requiring regular monitoring.

Healthcare infrastructure gaps in remote and rural areas restrict access to glucose monitoring services and device maintenance support. Lack of awareness about proper glucose monitoring techniques and the importance of regular testing among certain population segments hampers market penetration and effective diabetes management.

Regulatory challenges related to medical device approval processes and quality standards can delay the introduction of innovative monitoring technologies. Supply chain complexities in reaching remote markets and ensuring consistent product availability pose operational challenges for market participants.

Cultural barriers and traditional healthcare practices in some regions may resist the adoption of modern glucose monitoring technologies. Technical literacy limitations among certain user segments, particularly elderly patients, can impede the adoption of advanced digital monitoring solutions.

Substantial market opportunities exist in expanding glucose monitoring accessibility to underserved rural populations through affordable device offerings and innovative distribution strategies. Telemedicine integration presents opportunities to connect remote patients with healthcare providers for comprehensive diabetes management support.

Continuous glucose monitoring (CGM) technology adoption represents a significant growth opportunity as awareness increases and costs become more accessible to mainstream consumers. Artificial intelligence integration in glucose monitoring systems offers opportunities for predictive analytics and personalized diabetes management recommendations.

Partnership opportunities with healthcare providers, insurance companies, and government health programs can expand market reach and improve product accessibility. Mobile health applications and digital platforms present opportunities for comprehensive diabetes management ecosystems that extend beyond basic glucose monitoring.

Preventive healthcare focus creates opportunities to expand the target market beyond diagnosed diabetics to include pre-diabetic and at-risk populations seeking proactive health monitoring. Corporate wellness programs represent emerging opportunities for bulk device procurement and employee health management initiatives.

Market dynamics in the India blood glucose monitoring sector are characterized by the interplay of demographic trends, technological innovation, healthcare policy evolution, and changing consumer behavior patterns. Demand-side dynamics are primarily driven by India’s growing diabetic population, which demonstrates a 12.1% annual growth rate in newly diagnosed cases, creating sustained demand for monitoring solutions.

Supply-side dynamics involve increasing competition among domestic and international manufacturers, leading to product innovation, price optimization, and improved distribution strategies. Technology adoption cycles show varying patterns across different market segments, with urban consumers adopting advanced solutions faster than rural counterparts.

Regulatory dynamics include evolving medical device regulations, quality standards, and import policies that shape market entry strategies and product development approaches. Economic dynamics such as healthcare spending patterns, insurance coverage expansion, and government health program funding influence market accessibility and growth potential.

Competitive dynamics feature intense rivalry among established players and emerging companies, driving innovation in product features, pricing strategies, and market positioning approaches. Distribution dynamics are evolving with the growth of online platforms, pharmacy chains, and direct-to-consumer sales channels.

Comprehensive research methodology employed for analyzing the India blood glucose monitoring market incorporates both primary and secondary research approaches to ensure data accuracy and market insight reliability. Primary research includes structured interviews with healthcare professionals, diabetes specialists, medical device distributors, and end-users across various geographic regions and demographic segments.

Secondary research encompasses analysis of government health statistics, medical device industry reports, healthcare policy documents, and diabetes prevalence studies from recognized medical institutions. Market sizing methodologies utilize bottom-up and top-down approaches, considering device penetration rates, patient population data, and consumption patterns.

Data validation processes include cross-referencing multiple sources, expert opinion verification, and statistical analysis to ensure research findings accuracy and reliability. Regional analysis covers major metropolitan areas, tier-2 cities, and rural regions to capture market variations and growth patterns across different geographic segments.

Trend analysis incorporates historical data review, current market assessment, and future projection modeling based on demographic trends, technological advancement, and healthcare policy evolution. Competitive intelligence gathering includes company financial analysis, product portfolio assessment, and market positioning evaluation.

Regional market analysis reveals significant variations in blood glucose monitoring adoption and growth patterns across different Indian states and territories. Northern India demonstrates strong market presence with 28% market share, driven by high diabetes prevalence in states like Punjab, Haryana, and Delhi, supported by robust healthcare infrastructure and higher disposable incomes.

Western India represents the largest regional market segment with 35% market share, led by Maharashtra, Gujarat, and Rajasthan, where urbanization, lifestyle changes, and established healthcare systems contribute to higher glucose monitoring device adoption rates. Mumbai and Pune serve as major distribution hubs for medical devices across the western region.

Southern India accounts for 22% market share, with Karnataka, Tamil Nadu, and Andhra Pradesh showing strong growth potential driven by expanding IT sector employment, changing dietary patterns, and increasing health awareness among educated populations. Bangalore and Chennai emerge as key markets for advanced monitoring technologies.

Eastern India holds 15% market share, with West Bengal and Odisha representing emerging markets where government health programs and increasing diabetes awareness are driving gradual market expansion. Rural market penetration remains limited but shows promising growth potential as healthcare infrastructure develops and device affordability improves.

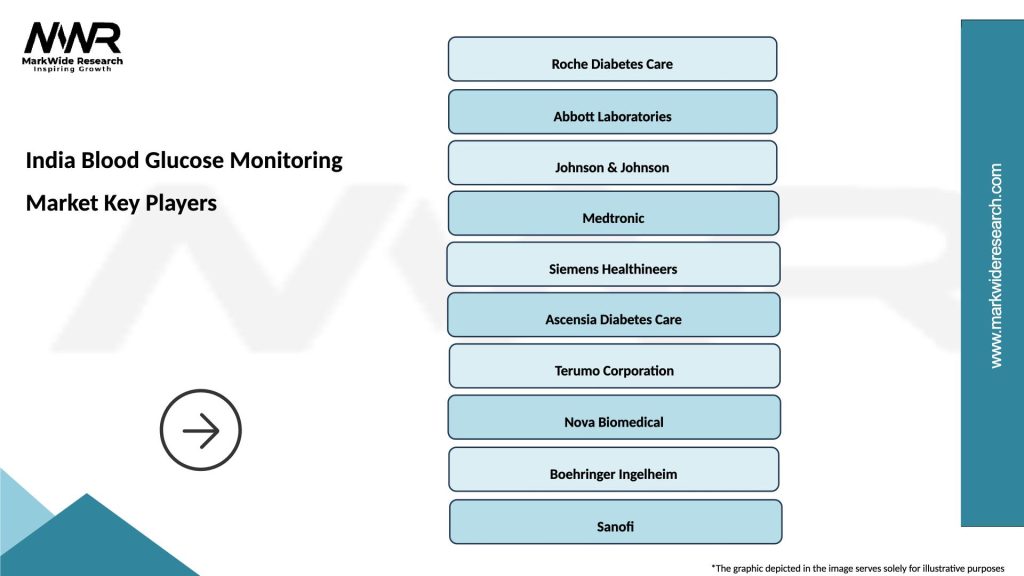

Competitive landscape in the India blood glucose monitoring market features a diverse mix of international medical device giants and domestic manufacturers competing across different price segments and technology categories. Market leadership is distributed among several key players, each focusing on specific market segments and geographic regions.

Competitive strategies include product differentiation, pricing optimization, distribution network expansion, and strategic partnerships with healthcare providers and pharmacy chains. Innovation focus areas include device accuracy improvement, user experience enhancement, and digital health integration capabilities.

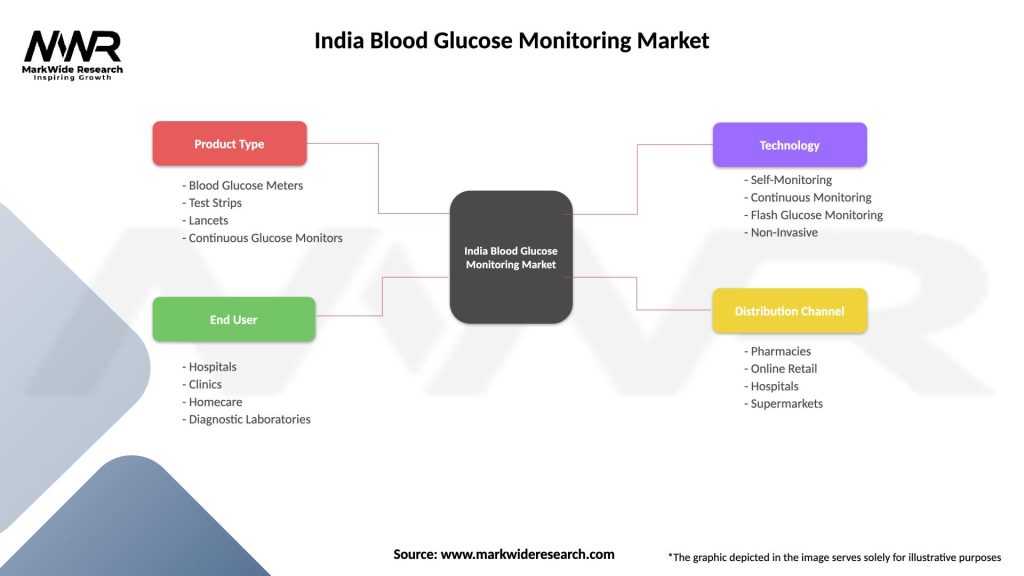

Market segmentation analysis reveals distinct categories based on product type, technology, end-user, and distribution channels, each demonstrating unique growth patterns and consumer preferences.

By Product Type:

By Technology:

Traditional glucometers continue to dominate the market with 68% segment share, driven by affordability, ease of use, and widespread availability through pharmacy channels. Consumer preferences in this category focus on accuracy, testing speed, and strip cost considerations, with price sensitivity remaining a primary purchase decision factor.

Continuous glucose monitoring systems represent the fastest-growing category with annual growth rates exceeding 15%, driven by increasing awareness of advanced diabetes management benefits and improving affordability. Early adopters include urban professionals, severe diabetics, and health-conscious consumers seeking comprehensive glucose tracking capabilities.

Test strips segment generates substantial recurring revenue with consistent demand patterns driven by regular testing requirements among diabetic patients. Brand loyalty in this category is influenced by glucometer compatibility, accuracy standards, and cost-per-test considerations.

Smart glucose monitoring devices with smartphone connectivity are gaining traction among younger demographics and tech-savvy consumers seeking integrated health management solutions. Digital health features such as data sharing, trend analysis, and medication reminders are becoming increasingly important purchase decision factors.

Healthcare providers benefit from improved patient monitoring capabilities, enhanced treatment compliance tracking, and better diabetes management outcomes through advanced glucose monitoring technologies. Remote patient monitoring capabilities enable healthcare professionals to provide more effective care while optimizing resource utilization.

Patients and caregivers gain access to accurate, convenient, and increasingly affordable glucose monitoring solutions that enable better diabetes self-management and improved quality of life. Technology integration provides comprehensive health data tracking and facilitates informed decision-making about diet, medication, and lifestyle choices.

Medical device manufacturers benefit from expanding market opportunities, recurring revenue streams from consumables, and potential for innovation-driven market differentiation. Market growth provides opportunities for both premium and value-segment positioning strategies.

Government health programs benefit from improved diabetes management outcomes, reduced long-term healthcare costs, and better population health monitoring capabilities. Preventive healthcare focus enabled by accessible glucose monitoring contributes to reduced healthcare system burden and improved public health outcomes.

Insurance providers benefit from reduced long-term diabetes complication costs through improved patient monitoring and management, justifying coverage expansion for glucose monitoring devices and consumables.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital health integration emerges as the dominant trend, with glucose monitoring devices increasingly incorporating smartphone connectivity, cloud-based data storage, and artificial intelligence-powered analytics. Connected health ecosystems are transforming diabetes management from isolated monitoring to comprehensive health tracking and management platforms.

Continuous glucose monitoring adoption is accelerating among Indian consumers, driven by improving affordability and growing awareness of advanced monitoring benefits. Real-time glucose tracking capabilities are becoming increasingly important for effective diabetes management and lifestyle optimization.

Telemedicine integration is reshaping glucose monitoring by enabling remote patient monitoring, virtual consultations, and automated health data sharing with healthcare providers. Remote care delivery models are particularly valuable for managing diabetes in rural and underserved areas.

Artificial intelligence applications in glucose monitoring include predictive analytics, personalized recommendations, and automated pattern recognition for improved diabetes management outcomes. Machine learning algorithms are enhancing monitoring accuracy and providing actionable insights for patients and healthcare providers.

Preventive healthcare focus is expanding the market beyond diagnosed diabetics to include pre-diabetic and at-risk populations seeking proactive health monitoring. Early intervention strategies enabled by accessible glucose monitoring are gaining recognition for their long-term health benefits.

Recent industry developments include the launch of next-generation continuous glucose monitoring systems with improved accuracy and extended wear time, addressing key consumer concerns about device reliability and convenience. Major manufacturers are investing in research and development to enhance monitoring precision and user experience.

Strategic partnerships between medical device companies and healthcare providers are expanding access to glucose monitoring services through integrated care delivery models. Collaboration initiatives focus on improving patient outcomes while optimizing healthcare costs and resource utilization.

Government initiatives include the expansion of diabetes care programs under national health missions, providing subsidized access to glucose monitoring devices for economically disadvantaged populations. Policy developments aim to improve diabetes care accessibility and reduce long-term healthcare burden.

Technology advancement includes the development of non-invasive glucose monitoring solutions that eliminate the need for blood sampling, representing a significant breakthrough in diabetes care convenience. Innovation focus areas include painless monitoring, extended device life, and improved data accuracy.

Market consolidation activities include mergers and acquisitions among medical device companies seeking to strengthen market position and expand product portfolios. Strategic acquisitions focus on technology capabilities, distribution networks, and market access enhancement.

MarkWide Research recommends that market participants focus on developing affordable, user-friendly glucose monitoring solutions tailored to Indian consumer preferences and economic conditions. Product development strategies should prioritize accuracy, ease of use, and cost-effectiveness to capture price-sensitive market segments.

Distribution strategy optimization should include expanding pharmacy partnerships, developing online sales channels, and establishing rural distribution networks to improve market penetration. Channel diversification enables broader market reach and improved customer accessibility across different geographic regions.

Technology integration initiatives should focus on smartphone connectivity, data analytics capabilities, and telemedicine integration to meet evolving consumer expectations for connected health solutions. Digital health features are becoming increasingly important for competitive differentiation and market positioning.

Partnership development with healthcare providers, insurance companies, and government health programs can expand market access and improve product affordability for target consumers. Collaborative approaches enable comprehensive diabetes care delivery and improved patient outcomes.

Market education initiatives should focus on increasing awareness about proper glucose monitoring techniques, the importance of regular testing, and the benefits of advanced monitoring technologies. Consumer education is essential for market development and effective diabetes management adoption.

Future market prospects for India’s blood glucose monitoring sector remain highly favorable, with sustained growth expected driven by demographic trends, technological advancement, and improving healthcare accessibility. Market expansion is projected to continue at a robust CAGR of 8.5% over the next five years, supported by increasing diabetes prevalence and growing health consciousness.

Technology evolution will focus on non-invasive monitoring solutions, artificial intelligence integration, and comprehensive diabetes management platforms that extend beyond basic glucose tracking. Innovation priorities include improved accuracy, enhanced user experience, and seamless healthcare system integration.

Market accessibility is expected to improve significantly through government health program expansion, insurance coverage enhancement, and innovative pricing strategies targeting different economic segments. Rural market penetration will accelerate as healthcare infrastructure develops and distribution networks expand.

Competitive landscape evolution will feature increased focus on digital health capabilities, strategic partnerships, and comprehensive diabetes care solutions. Market consolidation may occur as companies seek to strengthen market position and expand technological capabilities.

Regulatory environment development will likely include enhanced quality standards, improved market oversight, and supportive policies promoting diabetes care innovation and accessibility. Policy support will continue to play a crucial role in market development and public health improvement.

India’s blood glucose monitoring market represents a dynamic and rapidly evolving healthcare segment with substantial growth potential driven by the nation’s diabetes epidemic and advancing healthcare landscape. Market fundamentals remain strong, supported by increasing disease prevalence, growing health awareness, technological innovation, and supportive government policies promoting diabetes care accessibility.

Key success factors for market participants include developing affordable and user-friendly solutions, establishing comprehensive distribution networks, integrating digital health capabilities, and forming strategic partnerships with healthcare stakeholders. Market opportunities are particularly significant in rural and underserved segments where healthcare access is improving and diabetes awareness is growing.

Technology advancement will continue to reshape the market landscape, with continuous glucose monitoring, artificial intelligence integration, and non-invasive monitoring solutions driving future growth and innovation. Consumer preferences are evolving toward comprehensive health management platforms that provide actionable insights and seamless healthcare integration.

Long-term market outlook remains highly positive, with sustained growth expected across all market segments and geographic regions. Strategic positioning in this expanding market requires a deep understanding of consumer needs, technological capabilities, and healthcare system dynamics to deliver effective diabetes management solutions that improve patient outcomes and quality of life.

What is Blood Glucose Monitoring?

Blood Glucose Monitoring refers to the methods and devices used to measure the concentration of glucose in the blood, primarily for managing diabetes. This includes various technologies such as glucometers, continuous glucose monitors, and test strips.

What are the key players in the India Blood Glucose Monitoring Market?

Key players in the India Blood Glucose Monitoring Market include Abbott Laboratories, Roche Diagnostics, and Johnson & Johnson, among others. These companies are known for their innovative products and extensive distribution networks.

What are the growth factors driving the India Blood Glucose Monitoring Market?

The growth of the India Blood Glucose Monitoring Market is driven by the increasing prevalence of diabetes, rising health awareness, and advancements in monitoring technologies. Additionally, government initiatives promoting diabetes management contribute to market expansion.

What challenges does the India Blood Glucose Monitoring Market face?

The India Blood Glucose Monitoring Market faces challenges such as high costs of advanced monitoring devices and a lack of awareness in rural areas. Furthermore, regulatory hurdles can also impede the introduction of new products.

What opportunities exist in the India Blood Glucose Monitoring Market?

Opportunities in the India Blood Glucose Monitoring Market include the development of affordable and user-friendly devices, as well as the integration of digital health solutions. The growing trend of telemedicine also presents avenues for remote monitoring.

What trends are shaping the India Blood Glucose Monitoring Market?

Trends in the India Blood Glucose Monitoring Market include the rise of continuous glucose monitoring systems and the use of mobile applications for data tracking. Additionally, there is a growing focus on personalized diabetes management solutions.

India Blood Glucose Monitoring Market

| Segmentation Details | Description |

|---|---|

| Product Type | Blood Glucose Meters, Test Strips, Lancets, Continuous Glucose Monitors |

| End User | Hospitals, Clinics, Homecare, Diagnostic Laboratories |

| Technology | Self-Monitoring, Continuous Monitoring, Flash Glucose Monitoring, Non-Invasive |

| Distribution Channel | Pharmacies, Online Retail, Hospitals, Supermarkets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Blood Glucose Monitoring Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at