444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India bike rental market represents a rapidly expanding segment within the country’s transportation and tourism ecosystem. This dynamic market encompasses various rental models including traditional bicycle rentals, electric bike sharing systems, and premium motorcycle rental services across urban and tourist destinations. Market dynamics indicate substantial growth driven by increasing urbanization, environmental consciousness, and the rising popularity of adventure tourism throughout India.

Urban mobility solutions have gained significant traction as cities grapple with traffic congestion and pollution concerns. The bike rental sector offers an eco-friendly alternative to traditional transportation methods, with adoption rates increasing by 35% annually in major metropolitan areas. Tourist destinations across India have witnessed particularly strong demand, with rental services expanding beyond conventional bicycles to include electric bikes, scooters, and premium motorcycles.

Technology integration has revolutionized the rental experience through mobile applications, GPS tracking, and digital payment systems. MarkWide Research analysis indicates that app-based rental platforms now account for 60% of total bookings in urban markets, demonstrating the sector’s rapid digital transformation. The market encompasses diverse customer segments ranging from daily commuters and tourists to adventure enthusiasts seeking premium motorcycle experiences.

The India bike rental market refers to the comprehensive ecosystem of businesses and services that provide temporary access to bicycles, electric bikes, scooters, and motorcycles for various purposes including commuting, tourism, recreation, and adventure activities. This market encompasses both traditional rental shops and modern technology-enabled sharing platforms that facilitate short-term and long-term vehicle access across urban and rural areas.

Service models within this market range from hourly bicycle rentals in city centers to multi-day motorcycle rental packages for touring enthusiasts. The sector includes various stakeholders such as independent rental operators, franchise networks, technology platforms, and integrated mobility service providers. Customer segments span from budget-conscious students and daily commuters to premium tourists seeking luxury motorcycle experiences.

Market scope extends beyond simple vehicle rental to include value-added services such as guided tours, maintenance support, insurance coverage, and route planning assistance. The integration of digital technologies has transformed traditional rental models into sophisticated sharing economies that optimize vehicle utilization and enhance customer convenience through seamless booking and payment processes.

Strategic positioning of the India bike rental market reflects the convergence of multiple growth drivers including urbanization trends, environmental awareness, tourism expansion, and technological advancement. The market demonstrates robust expansion across diverse segments, with electric bike rentals experiencing 45% year-over-year growth as consumers increasingly prioritize sustainable transportation options.

Competitive landscape features a mix of established players and emerging startups, with technology-enabled platforms gaining significant market share through superior customer experience and operational efficiency. Regional variations show strong performance in tourist destinations such as Goa, Rajasthan, and hill stations, while metropolitan areas like Delhi, Mumbai, and Bangalore drive urban commuting demand.

Investment activity in the sector has intensified, with venture capital funding supporting platform development, fleet expansion, and technology enhancement initiatives. The market benefits from favorable government policies promoting sustainable transportation and the growing acceptance of sharing economy models among Indian consumers. Future prospects indicate continued expansion driven by infrastructure development, increasing disposable income, and evolving mobility preferences.

Market segmentation reveals distinct patterns across different rental categories and geographic regions. The following key insights highlight the market’s current dynamics:

Operational insights demonstrate the importance of strategic location selection, fleet management efficiency, and customer service quality in driving business success. Market leaders focus on building comprehensive service networks while maintaining competitive pricing structures that appeal to diverse customer segments.

Urbanization trends serve as the primary catalyst for bike rental market expansion, with rapid city growth creating substantial demand for flexible transportation solutions. Traffic congestion in major metropolitan areas has reached critical levels, prompting consumers to seek alternative mobility options that offer convenience and time efficiency. The bike rental sector directly addresses these urban challenges by providing accessible, cost-effective transportation alternatives.

Environmental consciousness among Indian consumers has significantly increased, driving demand for eco-friendly transportation options. Government initiatives promoting sustainable mobility, including electric vehicle adoption incentives and pollution control measures, create favorable market conditions for bike rental services. Corporate sustainability programs increasingly encourage employees to use environmentally responsible commuting options, further boosting market demand.

Tourism industry growth represents another crucial driver, with domestic and international travelers seeking authentic, flexible exploration options. Adventure tourism popularity has surged, particularly motorcycle touring in scenic destinations like Ladakh, Himachal Pradesh, and the Western Ghats. Digital transformation has simplified rental processes through mobile applications, making services more accessible to tech-savvy consumers who value convenience and seamless user experiences.

Economic factors including rising disposable income and changing lifestyle preferences support market expansion. Cost considerations make rental options attractive compared to vehicle ownership, particularly for occasional users and urban residents facing parking constraints and maintenance costs.

Infrastructure limitations pose significant challenges to market growth, particularly inadequate cycling infrastructure and safety concerns in many Indian cities. Road conditions and traffic patterns often discourage bike usage, limiting market penetration in certain geographic areas. Parking facilities for rental bikes remain insufficient in many urban centers, creating operational difficulties for service providers.

Regulatory complexities across different states and municipalities create compliance challenges for operators seeking to expand their geographic footprint. Licensing requirements and permit procedures vary significantly, increasing operational costs and complexity for multi-city operators. Insurance and liability concerns present ongoing challenges, particularly for motorcycle rental services where accident risks are higher.

Seasonal demand fluctuations create revenue volatility, with monsoon seasons significantly impacting rental volumes across most regions. Maintenance costs and vehicle depreciation rates can be substantial, particularly in harsh operating environments with heavy usage patterns. Competition from alternative transportation modes including ride-sharing services, public transportation improvements, and personal vehicle ownership continues to present market challenges.

Customer behavior patterns show resistance to bike rental adoption in certain demographic segments and geographic regions where cultural preferences favor other transportation modes. Security concerns regarding vehicle theft and damage impact operational costs and customer confidence in rental services.

Electric vehicle integration presents substantial growth opportunities as battery technology improves and charging infrastructure expands across Indian cities. Government support for electric mobility through subsidies and policy incentives creates favorable conditions for electric bike rental services. Corporate partnerships with employers seeking to provide sustainable commuting options for employees represent significant revenue potential.

Technology advancement opportunities include IoT integration for fleet management, artificial intelligence for demand prediction, and blockchain for secure transactions. Smart city initiatives across India create opportunities for integrated mobility solutions that combine bike rentals with other transportation modes. Tourism circuit development by state governments opens new markets for specialized rental services catering to domestic and international travelers.

Rural market penetration offers untapped potential as internet connectivity improves and smartphone adoption increases in smaller towns and villages. Subscription-based models targeting regular commuters provide opportunities for recurring revenue streams and improved customer retention. Partnership opportunities with hotels, tourist attractions, and transportation hubs can expand market reach and improve service accessibility.

International expansion potential exists for successful Indian operators to leverage their experience in similar markets across South Asia and other developing regions. Value-added services including guided tours, maintenance packages, and insurance products create additional revenue streams while enhancing customer value propositions.

Competitive intensity continues to increase as new players enter the market and existing operators expand their service offerings. Price competition remains significant, particularly in urban markets where multiple operators compete for the same customer segments. Service differentiation has become crucial for market success, with operators focusing on fleet quality, technology features, and customer service excellence.

Customer acquisition costs have risen as digital marketing becomes more competitive and customer expectations increase. Operational efficiency improvements through technology adoption and process optimization have become essential for maintaining profitability in competitive markets. Fleet management sophistication continues to evolve with GPS tracking, predictive maintenance, and automated rebalancing systems.

Partnership strategies are reshaping market dynamics as operators collaborate with complementary service providers, technology companies, and infrastructure developers. Consolidation trends may emerge as smaller operators struggle with operational costs and larger players seek to expand market share through acquisitions. Regulatory evolution continues to influence market structure as governments develop frameworks for sharing economy businesses.

Innovation cycles accelerate as operators invest in new technologies, service models, and customer experience enhancements. Market maturation in tier-1 cities is driving expansion into smaller markets where competition is less intense and growth potential remains substantial.

Primary research methodologies employed in analyzing the India bike rental market include comprehensive surveys of rental operators, customer interviews, and stakeholder consultations across multiple geographic regions. Data collection processes encompass both quantitative metrics such as rental volumes, pricing trends, and fleet utilization rates, as well as qualitative insights regarding customer preferences, operational challenges, and market trends.

Secondary research incorporates analysis of industry reports, government statistics, tourism data, and transportation studies to provide comprehensive market context. Market sizing methodologies combine bottom-up analysis of operator revenues with top-down assessment of addressable market potential across different segments and regions. Competitive analysis includes detailed evaluation of major market players, their service offerings, geographic presence, and strategic positioning.

Validation processes ensure data accuracy through cross-referencing multiple sources, expert consultations, and triangulation of findings across different research methodologies. Trend analysis incorporates historical data patterns, current market indicators, and forward-looking assessments based on identified growth drivers and market dynamics. Regional analysis methodology accounts for significant variations in market conditions, regulatory environments, and customer preferences across different Indian states and cities.

Technology assessment includes evaluation of digital platforms, mobile applications, and emerging technologies that influence market development and operational efficiency. Stakeholder engagement encompasses interactions with rental operators, customers, government officials, and industry experts to ensure comprehensive market understanding.

Northern India demonstrates strong market potential led by Delhi NCR, where urban congestion and pollution concerns drive significant demand for bike rental services. Tourist circuits including Rajasthan and Himachal Pradesh show robust growth in motorcycle rental segments, with adventure tourism accounting for 30% of regional demand. Infrastructure development in cities like Chandigarh and Jaipur supports market expansion through improved cycling facilities and smart city initiatives.

Western India represents the most mature regional market, with Mumbai and Pune leading in urban commuting applications while Goa dominates the tourism segment. Maharashtra’s market share accounts for approximately 25% of national rental volumes, driven by strong urban demand and established tourism infrastructure. Gujarat’s emerging markets show promising growth potential as industrial cities develop sustainable transportation initiatives.

Southern India exhibits diverse market characteristics with Bangalore leading in technology-enabled rental services and Kerala showing strong tourism-related demand. Corporate adoption in IT hubs like Hyderabad and Chennai drives weekday rental volumes, while weekend leisure demand supports market stability. Tamil Nadu’s coastal regions and Karnataka’s hill stations contribute significantly to seasonal tourism revenue.

Eastern India presents emerging opportunities with Kolkata showing increasing urban rental adoption and northeastern states developing adventure tourism potential. Market penetration remains relatively low compared to other regions, indicating substantial growth potential as infrastructure and awareness improve. Government initiatives promoting sustainable transportation in eastern cities create favorable conditions for market development.

Market leadership is distributed among several key players operating across different segments and geographic regions. The competitive environment features both technology-focused platforms and traditional rental operators adapting to digital transformation trends.

Competitive strategies focus on technology differentiation, fleet expansion, geographic coverage, and customer experience enhancement. Market consolidation trends may emerge as operators seek scale advantages and operational efficiency improvements. Innovation leadership becomes increasingly important as customer expectations evolve and new technologies enable enhanced service delivery.

By Vehicle Type: The market segments into distinct categories based on vehicle specifications and target applications. Bicycle rentals serve urban commuting and recreational needs, while electric bikes address environmental concerns and extended range requirements. Scooter rentals provide convenient urban transportation, and motorcycle rentals cater to tourism and adventure travel segments.

By Application: Market applications span daily commuting needs in urban areas, tourism and leisure activities across popular destinations, last-mile connectivity solutions for public transportation users, and recreational cycling for fitness and entertainment purposes. Each application segment demonstrates distinct demand patterns and pricing structures.

By Rental Duration: Services range from hourly rentals for short-term urban mobility to daily rentals for tourist applications and weekly or monthly subscriptions for regular commuters. Long-term rentals serve customers seeking extended access without ownership commitments.

By Technology Platform: The market divides between app-based platforms offering digital booking and payment systems and traditional rental shops providing conventional service models. Hybrid models combine digital convenience with physical service locations for comprehensive customer support.

By Customer Segment: Primary segments include urban professionals seeking commuting solutions, tourists requiring flexible transportation, students needing affordable mobility options, and adventure enthusiasts pursuing recreational experiences.

Urban Commuting Category represents the largest and fastest-growing segment, driven by increasing traffic congestion and environmental awareness in major cities. Customer behavior in this category shows preference for reliable, affordable, and convenient rental options with minimal booking complexity. Peak usage patterns align with office hours and public transportation schedules, creating predictable demand cycles that enable efficient fleet management.

Tourism and Leisure Category generates the highest revenue per rental due to premium pricing and longer rental durations. Seasonal variations significantly impact this category, with peak demand during winter months and festival seasons. Customer expectations include well-maintained vehicles, comprehensive insurance coverage, and value-added services such as route guidance and emergency support.

Electric Vehicle Category shows exceptional growth potential as battery technology improves and charging infrastructure expands. Customer adoption is driven by environmental consciousness, government incentives, and operational cost advantages. Operational challenges include charging infrastructure requirements and higher initial investment costs offset by lower maintenance expenses.

Premium Motorcycle Category serves adventure tourism and luxury travel segments with specialized vehicles and comprehensive service packages. Market dynamics in this category emphasize vehicle quality, brand reputation, and customer service excellence over price competition. Geographic concentration in popular touring destinations creates opportunities for specialized operators.

Rental Operators benefit from growing market demand, diverse revenue streams, and scalable business models that leverage technology for operational efficiency. Asset utilization optimization through dynamic pricing and demand prediction enables improved profitability. Market expansion opportunities exist across geographic regions and customer segments with varying service requirements.

Customers gain access to flexible, cost-effective transportation solutions without the responsibilities and costs associated with vehicle ownership. Convenience factors include on-demand availability, digital booking processes, and maintenance-free usage experiences. Environmental benefits align with sustainability goals while providing practical mobility solutions.

Government Stakeholders achieve sustainable transportation objectives, reduced urban congestion, and improved air quality through bike rental market development. Economic benefits include job creation, tourism revenue enhancement, and reduced infrastructure strain from private vehicle usage. Policy alignment with smart city initiatives and environmental goals creates mutual benefits.

Technology Providers find opportunities in platform development, IoT integration, mobile applications, and data analytics services supporting rental operations. Innovation potential exists in areas such as autonomous vehicle management, predictive maintenance, and customer experience enhancement through emerging technologies.

Tourism Industry benefits from enhanced visitor experiences, extended stay durations, and increased spending through convenient transportation options. Destination marketing advantages include positioning as eco-friendly and accessible locations that support sustainable tourism practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electric Vehicle Integration represents the most significant trend reshaping the bike rental landscape, with operators increasingly adding electric bikes and scooters to their fleets. Battery technology improvements and expanding charging infrastructure make electric options more viable for both operators and customers. Government incentives supporting electric vehicle adoption accelerate this transition across the rental industry.

Subscription-Based Models are gaining traction as operators seek recurring revenue streams and improved customer retention. Monthly and annual subscriptions appeal to regular commuters while providing operators with predictable revenue and better demand forecasting capabilities. Flexible subscription tiers accommodate varying usage patterns and customer preferences.

Technology-Enabled Operations continue advancing through IoT integration, artificial intelligence, and data analytics applications. Smart locks and GPS tracking improve security and fleet management efficiency. Predictive maintenance systems reduce operational costs and improve vehicle availability. Dynamic pricing algorithms optimize revenue based on demand patterns and market conditions.

Integrated Mobility Solutions emerge as operators partner with public transportation systems, ride-sharing platforms, and other mobility service providers. Multi-modal transportation apps combine various options for seamless customer experiences. Last-mile connectivity solutions address gaps in public transportation networks.

Sustainability Focus intensifies as environmental concerns drive customer preferences and corporate policies. Carbon footprint reduction initiatives appeal to environmentally conscious consumers. Corporate sustainability programs increasingly include bike rental partnerships for employee transportation options.

Platform Consolidation activities have increased as larger operators acquire smaller regional players to expand geographic coverage and achieve operational scale. Strategic partnerships between rental operators and technology companies enhance service capabilities and customer experience. Investment rounds continue supporting fleet expansion, technology development, and market penetration initiatives.

Regulatory Framework Development progresses as governments establish guidelines for bike-sharing operations, safety standards, and urban planning integration. Smart city initiatives increasingly incorporate bike rental systems as components of comprehensive urban mobility strategies. Parking infrastructure development in major cities creates better operating conditions for rental services.

Technology Innovations include advanced mobile applications with enhanced user interfaces, improved GPS accuracy, and integrated payment systems. IoT deployment enables real-time fleet monitoring, predictive maintenance, and automated rebalancing systems. Blockchain applications explore secure transaction processing and decentralized sharing economy models.

Corporate Partnerships expand as companies seek sustainable employee transportation solutions and tourism businesses integrate rental services into their offerings. Hotel partnerships provide guests with convenient mobility options while creating additional revenue streams for rental operators. Educational institution collaborations serve student transportation needs in campus environments.

International Expansion efforts by successful Indian operators explore opportunities in similar markets across South Asia and other developing regions. Knowledge transfer and operational expertise developed in India’s diverse market conditions provide competitive advantages in international markets.

Market Entry Strategies should focus on specific geographic regions and customer segments where competitive intensity remains manageable and growth potential is substantial. Technology investment in mobile platforms, fleet management systems, and customer experience enhancement represents essential success factors. Partnership development with complementary service providers can accelerate market penetration and reduce customer acquisition costs.

Operational Excellence requires sophisticated fleet management systems, predictive maintenance capabilities, and efficient customer service processes. Data analytics applications enable demand forecasting, pricing optimization, and operational efficiency improvements. Quality control systems ensure vehicle maintenance standards and customer satisfaction levels that support brand reputation and repeat usage.

Customer Acquisition strategies should leverage digital marketing channels while building strategic partnerships that provide access to target customer segments. Referral programs and loyalty initiatives can reduce acquisition costs while improving customer retention rates. Corporate sales efforts targeting employee transportation programs offer opportunities for bulk customer acquisition.

Financial Management considerations include optimizing fleet utilization rates, managing seasonal demand variations, and controlling operational costs through technology and process improvements. Revenue diversification through value-added services and multiple customer segments reduces business risk and improves financial stability.

Regulatory Compliance requires proactive engagement with government stakeholders and industry associations to influence policy development and ensure operational compliance. Safety protocols and insurance coverage must meet or exceed regulatory requirements while protecting both customers and business operations.

Market expansion prospects remain robust driven by continued urbanization, environmental awareness, and technology adoption across India. MWR projections indicate sustained growth momentum with compound annual growth rates exceeding 20% in key market segments over the next five years. Geographic expansion into tier-2 and tier-3 cities presents significant opportunities as infrastructure development and smartphone penetration increase.

Technology evolution will continue reshaping market dynamics through autonomous vehicle integration, advanced analytics, and enhanced customer experience platforms. Electric vehicle adoption is expected to accelerate significantly, with electric bikes potentially comprising 40% of rental fleets by 2028. Artificial intelligence applications in demand prediction, route optimization, and customer service will become standard operational tools.

Market maturation in established segments will drive operators toward service differentiation, operational efficiency improvements, and value-added service development. Consolidation trends may emerge as successful operators acquire smaller players to achieve scale advantages and expand market coverage. International expansion opportunities will develop as Indian operators leverage their experience in diverse market conditions.

Regulatory environment evolution will likely favor organized operators with strong safety records and technology capabilities. Government support for sustainable transportation initiatives will continue creating favorable market conditions. Infrastructure development including dedicated cycling lanes and charging stations will enhance market growth potential across urban areas.

Customer behavior trends indicate increasing acceptance of sharing economy models and growing preference for sustainable transportation options. Corporate adoption of bike rental programs for employee transportation will expand as sustainability initiatives gain importance in business strategies.

The India bike rental market represents a dynamic and rapidly evolving sector with substantial growth potential driven by urbanization, environmental consciousness, and technological advancement. Market fundamentals remain strong across diverse segments including urban commuting, tourism applications, and emerging electric vehicle categories. The convergence of favorable government policies, improving infrastructure, and changing consumer preferences creates an attractive environment for continued market expansion.

Competitive dynamics favor operators that successfully integrate technology capabilities with operational excellence and customer service quality. Strategic positioning requires careful consideration of geographic markets, customer segments, and service differentiation opportunities. The market’s evolution toward sustainability and technology integration presents both opportunities and challenges that will shape future industry structure.

Investment prospects remain attractive for stakeholders who understand the market’s complexity and can execute effective strategies for customer acquisition, operational efficiency, and regulatory compliance. Long-term outlook indicates continued growth momentum supported by fundamental demographic and economic trends that favor flexible, sustainable transportation solutions. Success in this market requires adaptability, innovation, and commitment to customer value creation in an increasingly competitive environment.

What is Bike Rental?

Bike rental refers to the service of renting bicycles or motorcycles for short-term use, allowing individuals to explore areas without the need for ownership. This service is popular in urban areas and tourist destinations, providing an eco-friendly transportation option.

What are the key players in the India Bike Rental Market?

Key players in the India Bike Rental Market include companies like Bounce, Yulu, and Rentomojo, which offer various bike rental services across different cities. These companies focus on providing convenient and affordable transportation solutions for urban commuters and tourists, among others.

What are the growth factors driving the India Bike Rental Market?

The India Bike Rental Market is driven by factors such as increasing urbanization, rising fuel prices, and a growing preference for sustainable transportation options. Additionally, the expansion of bike-sharing programs and the convenience of mobile apps for booking rentals contribute to market growth.

What challenges does the India Bike Rental Market face?

The India Bike Rental Market faces challenges such as regulatory hurdles, safety concerns, and competition from other modes of transport like ride-sharing services. Additionally, maintaining the quality and availability of bikes can be a logistical challenge for rental companies.

What opportunities exist in the India Bike Rental Market?

Opportunities in the India Bike Rental Market include the potential for expansion into smaller cities, partnerships with tourism companies, and the introduction of electric bikes. As environmental awareness grows, there is also an increasing demand for eco-friendly transportation solutions.

What trends are shaping the India Bike Rental Market?

Trends shaping the India Bike Rental Market include the rise of electric bike rentals, integration of smart technology for tracking and maintenance, and the growth of subscription-based rental models. These trends reflect changing consumer preferences towards convenience and sustainability.

India Bike Rental Market

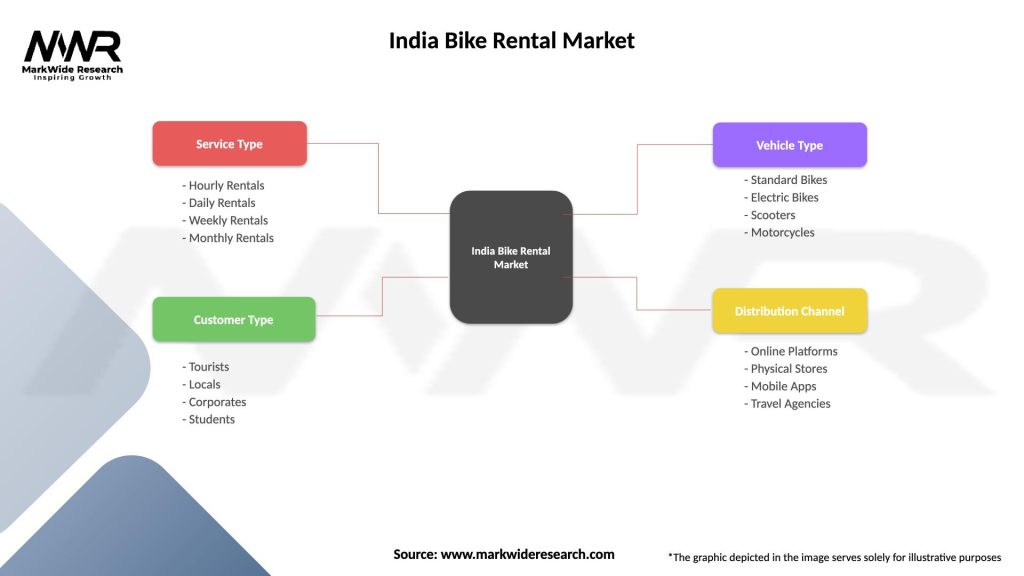

| Segmentation Details | Description |

|---|---|

| Service Type | Hourly Rentals, Daily Rentals, Weekly Rentals, Monthly Rentals |

| Customer Type | Tourists, Locals, Corporates, Students |

| Vehicle Type | Standard Bikes, Electric Bikes, Scooters, Motorcycles |

| Distribution Channel | Online Platforms, Physical Stores, Mobile Apps, Travel Agencies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Bike Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at