444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India big data analytics market represents one of the most dynamic and rapidly evolving technology sectors in the Asia-Pacific region. Digital transformation initiatives across industries have positioned India as a global hub for data-driven decision making and advanced analytics solutions. The market encompasses a comprehensive ecosystem of technologies, platforms, and services designed to extract meaningful insights from vast volumes of structured and unstructured data.

Market dynamics indicate robust growth driven by increasing data generation, government digitization initiatives, and enterprise adoption of cloud-based analytics platforms. The sector benefits from India’s strong IT infrastructure, skilled workforce, and supportive regulatory environment that encourages innovation in data science and artificial intelligence applications. Growth projections suggest the market will expand at a CAGR of 23.8% over the forecast period, reflecting strong demand across multiple industry verticals.

Industry adoption spans diverse sectors including banking and financial services, healthcare, retail, manufacturing, telecommunications, and government services. Organizations are increasingly leveraging big data analytics to enhance operational efficiency, improve customer experiences, and drive strategic business outcomes. The market’s evolution is characterized by the integration of advanced technologies such as machine learning, artificial intelligence, and real-time processing capabilities.

The India big data analytics market refers to the comprehensive ecosystem of technologies, platforms, services, and solutions designed to collect, process, analyze, and derive actionable insights from large volumes of structured and unstructured data within the Indian business landscape. This market encompasses various analytical tools, software platforms, consulting services, and infrastructure solutions that enable organizations to transform raw data into strategic business intelligence.

Big data analytics in the Indian context involves the application of advanced statistical methods, machine learning algorithms, and computational techniques to extract patterns, trends, and correlations from datasets that are too large, complex, or rapidly changing for traditional data processing methods. The market includes both on-premises and cloud-based solutions, spanning descriptive, predictive, and prescriptive analytics capabilities.

Market scope extends beyond technology provision to include professional services, training, implementation support, and ongoing maintenance. The ecosystem supports various data types including transactional data, social media content, sensor data, multimedia files, and real-time streaming information from diverse sources across industries.

Strategic positioning of India’s big data analytics market reflects the country’s emergence as a global technology leader and data processing hub. The market demonstrates exceptional growth potential driven by digital India initiatives, increasing smartphone penetration, and rapid adoption of Internet of Things technologies across urban and rural markets. Enterprise investment in analytics solutions has accelerated significantly, with organizations recognizing data as a critical strategic asset.

Technology advancement in areas such as artificial intelligence, machine learning, and natural language processing has enhanced the sophistication of analytics solutions available in the Indian market. Cloud computing adoption has democratized access to advanced analytics capabilities, enabling small and medium enterprises to leverage sophisticated data processing tools previously available only to large corporations.

Government initiatives including Digital India, Smart Cities Mission, and various e-governance programs have created substantial demand for big data analytics solutions. Public sector adoption represents approximately 28% of total market demand, reflecting the government’s commitment to data-driven policy making and service delivery improvements.

Investment landscape shows strong venture capital and private equity interest in Indian analytics companies, with funding focused on innovative startups developing sector-specific solutions and advanced analytics platforms. The market benefits from India’s position as a global IT services hub, providing cost-effective analytics solutions to international clients while serving domestic demand.

Market segmentation reveals diverse applications across multiple industry verticals, with banking and financial services leading adoption followed by retail, healthcare, and manufacturing sectors. The following key insights characterize the current market landscape:

Competitive dynamics show a mix of global technology giants, domestic IT services companies, and specialized analytics startups competing across different market segments. The ecosystem benefits from strong collaboration between technology providers, system integrators, and end-user organizations.

Digital transformation initiatives across Indian enterprises serve as the primary catalyst for big data analytics adoption. Organizations are modernizing their technology infrastructure and business processes, creating substantial demand for advanced analytics capabilities to support data-driven decision making and operational optimization.

Government digitization programs including Digital India, Aadhaar implementation, and various e-governance initiatives have generated massive datasets requiring sophisticated analytics solutions. Public sector demand for citizen service improvements, policy optimization, and administrative efficiency drives significant market growth opportunities.

Smartphone proliferation and increasing internet penetration have created unprecedented volumes of digital data from mobile applications, social media platforms, and online transactions. This data explosion necessitates advanced analytics tools to extract meaningful insights and support business intelligence requirements.

Industry 4.0 adoption in manufacturing sectors drives demand for predictive maintenance, quality optimization, and supply chain analytics solutions. Smart manufacturing initiatives require real-time data processing capabilities and advanced analytics to optimize production efficiency and reduce operational costs.

Financial inclusion initiatives and the growth of digital payments have created substantial datasets in the banking and financial services sector. Analytics solutions support risk management, fraud detection, customer segmentation, and regulatory compliance requirements across financial institutions.

Healthcare digitization and telemedicine adoption generate significant demand for medical data analytics, population health management, and clinical decision support systems. The COVID-19 pandemic has accelerated healthcare analytics adoption for epidemiological tracking and resource optimization.

Skills shortage in data science and analytics represents a significant constraint on market growth. Despite India’s large IT workforce, specialized expertise in advanced analytics, machine learning, and artificial intelligence remains limited, creating talent acquisition challenges for organizations implementing big data solutions.

Data quality issues pose substantial challenges for analytics implementations across Indian organizations. Inconsistent data formats, incomplete datasets, and lack of standardized data governance practices can limit the effectiveness of analytics initiatives and reduce return on investment.

Infrastructure limitations in certain regions and sectors constrain the deployment of sophisticated analytics solutions. Bandwidth constraints, power reliability issues, and legacy system integration challenges can impede the adoption of cloud-based and real-time analytics platforms.

Privacy and security concerns surrounding data collection, storage, and processing create hesitation among organizations considering analytics implementations. Regulatory uncertainty and evolving data protection requirements add complexity to analytics project planning and execution.

High implementation costs associated with comprehensive analytics solutions can be prohibitive for small and medium enterprises. Initial investment requirements for technology platforms, professional services, and staff training may limit adoption among cost-sensitive organizations.

Cultural resistance to data-driven decision making in traditional business environments can slow analytics adoption. Organizations with established decision-making processes may require significant change management efforts to embrace analytics-driven approaches.

Artificial intelligence integration presents substantial opportunities for analytics solution providers to develop next-generation platforms incorporating machine learning, natural language processing, and automated insight generation capabilities. AI-powered analytics solutions can address the skills shortage by automating complex analytical tasks.

Sector-specific solutions offer significant growth potential as industries seek specialized analytics capabilities tailored to their unique requirements. Healthcare analytics, agricultural technology, and smart city solutions represent particularly promising opportunity areas with substantial market potential.

Small and medium enterprise market penetration represents a largely untapped opportunity segment. Cloud-based analytics platforms and software-as-a-service models can make advanced analytics accessible to smaller organizations with limited IT resources and budgets.

Rural market expansion driven by increasing digital connectivity and government rural development initiatives creates new demand for analytics solutions supporting agricultural optimization, rural banking, and social program delivery. Mobile-first analytics solutions are particularly well-suited for rural market requirements.

Export opportunities leverage India’s cost advantages and technical expertise to serve international markets. Indian analytics companies can expand globally by offering specialized solutions and services to organizations worldwide seeking cost-effective analytics capabilities.

Edge analytics and Internet of Things integration present emerging opportunities as organizations seek real-time processing capabilities for industrial automation, smart infrastructure, and connected device management. Edge computing analytics can address latency and bandwidth constraints in distributed environments.

Competitive intensity in the India big data analytics market continues to increase as global technology companies, domestic IT services providers, and specialized startups compete for market share. Market consolidation through mergers and acquisitions is reshaping the competitive landscape, with larger players acquiring specialized capabilities and customer bases.

Technology evolution drives continuous innovation in analytics platforms and solutions. The integration of artificial intelligence, machine learning, and automated analytics capabilities is transforming traditional business intelligence approaches and creating new value propositions for end-user organizations.

Customer expectations are evolving toward more sophisticated, user-friendly, and self-service analytics capabilities. Organizations seek solutions that enable business users to perform complex analyses without extensive technical expertise, driving demand for intuitive interfaces and automated insight generation.

Pricing pressures result from increased competition and customer cost sensitivity. Solution providers are developing flexible pricing models including subscription-based services, pay-per-use options, and outcome-based pricing to address diverse customer requirements and budget constraints.

Partnership ecosystems are becoming increasingly important as no single vendor can address all customer requirements independently. Strategic alliances between technology providers, system integrators, and consulting firms enable comprehensive solution delivery and market expansion.

Regulatory evolution surrounding data privacy, security, and cross-border data transfer continues to influence market dynamics. Organizations must balance analytics capabilities with compliance requirements, creating demand for solutions that incorporate privacy-preserving analytics techniques.

Primary research methodologies employed in analyzing the India big data analytics market include comprehensive surveys of end-user organizations, technology vendors, system integrators, and industry experts. In-depth interviews with key stakeholders provide qualitative insights into market trends, challenges, and growth opportunities across different industry segments.

Secondary research encompasses analysis of industry reports, company financial statements, government publications, and academic research papers related to big data analytics adoption in India. Market sizing and forecasting utilize multiple data sources to ensure accuracy and reliability of projections.

Data validation processes include cross-referencing information from multiple sources, conducting expert interviews for verification, and applying statistical methods to ensure data consistency and reliability. Market estimates undergo rigorous review processes to maintain analytical integrity.

Segmentation analysis employs both top-down and bottom-up approaches to accurately assess market size and growth potential across different technology categories, industry verticals, and geographic regions. Regional analysis considers local market conditions, regulatory environments, and competitive dynamics.

Competitive intelligence gathering includes analysis of vendor capabilities, market positioning, pricing strategies, and customer feedback. Technology assessment evaluates solution features, performance characteristics, and integration capabilities across different analytics platforms.

Trend analysis incorporates both quantitative and qualitative research methods to identify emerging market opportunities, technology developments, and evolving customer requirements. Forward-looking analysis considers potential market disruptions and technology innovations that may impact future growth trajectories.

Mumbai metropolitan region leads the India big data analytics market with approximately 32% market share, driven by the concentration of financial services organizations, multinational corporations, and technology companies. The region benefits from advanced IT infrastructure, skilled workforce availability, and strong venture capital ecosystem supporting analytics innovation.

Bangalore technology hub represents the second-largest market segment, accounting for 28% of total demand. The city’s position as India’s Silicon Valley attracts global technology companies and fosters a thriving startup ecosystem focused on advanced analytics and artificial intelligence solutions.

National Capital Region including Delhi, Gurgaon, and Noida contributes 22% of market activity, primarily driven by government sector demand, large enterprise headquarters, and growing startup community. Government digitization initiatives and smart city projects create substantial analytics requirements in this region.

Chennai and Hyderabad collectively represent 12% of market share, with strong growth in healthcare analytics, automotive industry applications, and biotechnology sectors. These regions benefit from established IT services industry presence and growing focus on specialized analytics applications.

Pune and Kolkata account for the remaining 6% of market activity, with emerging opportunities in manufacturing analytics, educational technology, and government services. These regions show strong growth potential as digital transformation initiatives expand beyond tier-one cities.

Rural and tier-two cities represent significant untapped market potential as digital connectivity improves and government rural development programs create demand for analytics solutions supporting agriculture, rural banking, and social service delivery.

Market leadership in the India big data analytics sector is distributed among global technology giants, domestic IT services companies, and specialized analytics providers. The competitive landscape reflects diverse customer requirements and varying solution approaches across different market segments.

Competitive strategies include technology innovation, strategic partnerships, industry specialization, and geographic expansion. Companies are investing heavily in artificial intelligence capabilities, cloud platform development, and sector-specific solution development to differentiate their offerings.

Market positioning varies from comprehensive platform providers to specialized niche players focusing on specific industries or technology areas. The ecosystem supports both large-scale enterprise implementations and smaller, targeted analytics projects across different customer segments.

By Technology Type:

By Deployment Model:

By Industry Vertical:

Software platforms represent the largest market category, encompassing comprehensive analytics suites, specialized tools, and cloud-based services. This segment benefits from increasing preference for integrated platforms that combine multiple analytics capabilities in unified environments. Platform adoption is driven by the need for scalability, ease of use, and reduced total cost of ownership.

Professional services constitute a significant market component, including consulting, implementation, training, and ongoing support services. The complexity of analytics implementations and the skills shortage in the market create substantial demand for expert services to ensure successful project outcomes and maximize return on investment.

Infrastructure and hardware requirements for big data analytics include high-performance computing systems, storage solutions, and networking equipment. Cloud computing adoption is reducing on-premises infrastructure demand, but specialized hardware for edge analytics and high-performance computing applications continues to show growth.

Data management solutions encompass data integration, quality management, and governance tools essential for successful analytics implementations. Organizations recognize that data preparation and management typically consume 70-80% of analytics project effort, driving demand for automated data management capabilities.

Industry-specific solutions are gaining market traction as organizations seek analytics capabilities tailored to their unique business requirements. Vertical solutions offer pre-built models, industry-specific metrics, and regulatory compliance features that accelerate implementation and improve outcomes.

Artificial intelligence integration is transforming traditional analytics categories by adding automated insight generation, natural language processing, and machine learning capabilities. AI-powered analytics solutions address the skills shortage by enabling business users to perform sophisticated analyses without extensive technical expertise.

Enterprise organizations benefit from improved decision-making capabilities, operational efficiency gains, and competitive advantages through data-driven insights. Analytics implementations typically deliver 15-25% improvement in operational efficiency and enable more accurate forecasting and planning processes.

Technology vendors gain access to a rapidly growing market with substantial revenue opportunities across software, services, and infrastructure categories. The Indian market offers cost advantages, skilled workforce availability, and opportunities for global expansion using India as a development and delivery hub.

System integrators benefit from increased demand for analytics implementation services, ongoing support, and consulting engagements. The complexity of analytics projects and integration requirements create substantial professional services opportunities for experienced providers.

Government agencies achieve improved citizen service delivery, policy effectiveness, and administrative efficiency through analytics-driven insights. Data-driven governance enables better resource allocation, program optimization, and evidence-based policy making.

Small and medium enterprises gain access to advanced analytics capabilities previously available only to large corporations through cloud-based solutions and software-as-a-service models. This democratization of analytics enables competitive advantages and growth opportunities for smaller organizations.

Educational institutions benefit from growing demand for data science and analytics education programs. Universities and training providers can develop specialized curricula and certification programs to address the skills shortage in the market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence convergence represents the most significant trend reshaping the India big data analytics market. Organizations are increasingly seeking analytics solutions that incorporate machine learning, natural language processing, and automated insight generation capabilities to address skills shortages and improve analytical productivity.

Cloud-first strategies are becoming standard practice as organizations prioritize scalability, cost-effectiveness, and rapid deployment capabilities. Cloud-based analytics platforms enable organizations to access advanced capabilities without substantial upfront infrastructure investments, democratizing analytics across different organization sizes.

Real-time analytics adoption is accelerating across industries as organizations seek immediate insights for operational decision making. Streaming data processing and edge analytics capabilities are becoming essential requirements for applications in manufacturing, financial services, and digital commerce.

Self-service analytics tools are gaining popularity as organizations seek to empower business users with analytical capabilities without requiring extensive technical expertise. Intuitive interfaces, automated data preparation, and guided analytics workflows are making sophisticated analyses accessible to broader user communities.

Industry specialization is driving the development of vertical-specific analytics solutions tailored to unique sector requirements. Healthcare analytics, financial risk management, and manufacturing optimization solutions offer pre-built models and industry-specific metrics that accelerate implementation and improve outcomes.

Data democratization initiatives are expanding analytics access throughout organizations, moving beyond traditional IT and analyst roles to include business users, executives, and operational staff. This trend requires solutions that balance ease of use with governance and security requirements.

Strategic acquisitions are reshaping the competitive landscape as larger technology companies acquire specialized analytics startups and niche solution providers. Recent acquisitions focus on artificial intelligence capabilities, industry-specific solutions, and innovative analytics platforms that complement existing product portfolios.

Government initiatives including the National Data Governance Framework and various digital transformation programs are creating substantial market opportunities while establishing data management and privacy standards. These initiatives influence solution requirements and market development priorities.

Partnership announcements between global technology companies and Indian system integrators are expanding market reach and solution capabilities. Strategic alliances enable comprehensive solution delivery combining global technology platforms with local implementation expertise and market knowledge.

Investment rounds in Indian analytics startups continue to attract significant venture capital and private equity funding. Recent investments focus on artificial intelligence applications, sector-specific solutions, and innovative analytics platforms addressing unique market requirements.

Technology launches by major vendors include cloud-native analytics platforms, artificial intelligence-powered tools, and industry-specific solutions designed for the Indian market. These launches reflect growing market maturity and increasing sophistication of customer requirements.

Regulatory developments including data protection legislation and industry-specific compliance requirements are influencing solution design and implementation approaches. Vendors are incorporating privacy-preserving analytics techniques and compliance automation features to address regulatory requirements.

MarkWide Research recommends that organizations prioritize data governance and quality management as foundational elements of successful analytics implementations. Investing in data management capabilities and establishing clear governance frameworks will maximize the value of analytics investments and ensure sustainable outcomes.

Technology vendors should focus on developing user-friendly, self-service analytics capabilities that address the skills shortage in the Indian market. Solutions that enable business users to perform sophisticated analyses without extensive technical training will gain competitive advantages and broader market adoption.

Enterprise customers are advised to adopt cloud-first strategies for analytics implementations to achieve scalability, cost-effectiveness, and access to latest technology innovations. Cloud-based solutions offer flexibility and reduced total cost of ownership compared to traditional on-premises deployments.

Investment in skills development through training programs, certification courses, and partnerships with educational institutions will be critical for organizations seeking to maximize analytics value. Building internal capabilities reduces dependence on external consultants and enables sustainable analytics programs.

Industry specialization represents a significant opportunity for solution providers to differentiate their offerings and command premium pricing. Developing deep expertise in specific sectors and creating tailored solutions will be more valuable than generic analytics platforms.

Regulatory compliance should be integrated into analytics solution design from the beginning rather than added as an afterthought. Organizations that proactively address data privacy and security requirements will be better positioned for long-term success in the evolving regulatory environment.

Market evolution over the next five years will be characterized by increasing sophistication of analytics applications, broader adoption across industry sectors, and integration of emerging technologies such as artificial intelligence and edge computing. The market is expected to maintain strong growth momentum driven by digital transformation initiatives and increasing recognition of data as a strategic asset.

Technology advancement will focus on artificial intelligence integration, automated analytics capabilities, and real-time processing solutions. MWR projects that AI-powered analytics solutions will account for 45% of new implementations by 2028, reflecting growing demand for automated insight generation and predictive capabilities.

Geographic expansion will extend analytics adoption beyond major metropolitan areas to tier-two cities and rural markets as digital infrastructure improves and government digitization programs expand. This expansion will create new market opportunities and require solutions adapted to local requirements and constraints.

Industry penetration will deepen as sector-specific solutions mature and demonstrate clear return on investment. Healthcare, agriculture, and government sectors represent particularly significant growth opportunities with substantial untapped potential for analytics applications.

Competitive dynamics will continue evolving through mergers and acquisitions, strategic partnerships, and new market entrants. The market will likely see consolidation among smaller players while new startups emerge to address specialized requirements and emerging technology opportunities.

Skills development initiatives will expand through government programs, educational institution partnerships, and private sector training investments. Addressing the talent shortage will be critical for sustaining market growth and enabling broader analytics adoption across organizations.

The India big data analytics market represents one of the most promising technology sectors in the global economy, driven by strong fundamentals including government support, technical expertise, cost advantages, and substantial domestic demand. Market growth prospects remain robust with expanding applications across diverse industry sectors and increasing recognition of analytics as essential for competitive success.

Strategic opportunities exist for technology vendors, system integrators, and end-user organizations to capitalize on the market’s growth trajectory through innovative solutions, strategic partnerships, and focused investments in capabilities and skills development. The convergence of artificial intelligence, cloud computing, and big data analytics creates unprecedented opportunities for value creation and market expansion.

Success factors for market participants include addressing the skills shortage through training and user-friendly solutions, focusing on industry specialization and vertical solutions, embracing cloud-first strategies, and proactively addressing regulatory compliance requirements. Organizations that align their strategies with these factors will be best positioned for long-term success in this dynamic market environment.

What is Big Data Analytics?

Big Data Analytics refers to the process of examining large and varied data sets to uncover hidden patterns, correlations, and insights. It is used across various sectors, including finance, healthcare, and retail, to enhance decision-making and operational efficiency.

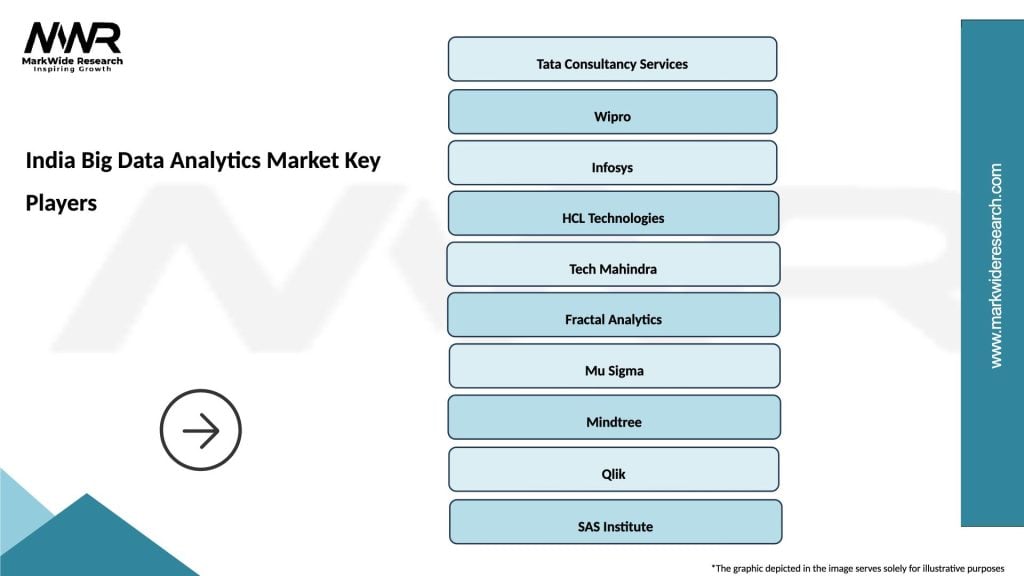

What are the key players in the India Big Data Analytics Market?

Key players in the India Big Data Analytics Market include companies like TCS, Wipro, and Infosys, which provide a range of analytics solutions. Other notable companies include IBM and Microsoft, among others.

What are the main drivers of the India Big Data Analytics Market?

The main drivers of the India Big Data Analytics Market include the increasing volume of data generated by businesses, the growing need for data-driven decision-making, and advancements in cloud computing technologies. Additionally, the rise of IoT devices contributes significantly to data generation.

What challenges does the India Big Data Analytics Market face?

The India Big Data Analytics Market faces challenges such as data privacy concerns, a shortage of skilled professionals, and the complexity of integrating analytics into existing business processes. These factors can hinder the effective implementation of analytics solutions.

What opportunities exist in the India Big Data Analytics Market?

Opportunities in the India Big Data Analytics Market include the expansion of AI and machine learning technologies, which can enhance predictive analytics capabilities. Additionally, sectors like e-commerce and healthcare are increasingly adopting analytics to improve customer experiences and operational efficiency.

What trends are shaping the India Big Data Analytics Market?

Trends shaping the India Big Data Analytics Market include the growing adoption of real-time analytics, the integration of AI and machine learning, and the increasing focus on data governance and security. These trends are driving innovation and improving the effectiveness of analytics solutions.

India Big Data Analytics Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud, Hybrid, Multi-Cloud |

| End User | Retail, Healthcare, Telecommunications, Manufacturing |

| Solution | Data Mining, Predictive Analytics, Data Visualization, Machine Learning |

| Application | Fraud Detection, Customer Segmentation, Risk Management, Supply Chain Optimization |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Big Data Analytics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at