444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India battery e-commerce market represents a rapidly evolving segment within the country’s digital commerce ecosystem, driven by increasing consumer demand for convenient battery purchasing solutions and the proliferation of electronic devices. Digital transformation has fundamentally reshaped how Indian consumers approach battery procurement, with online platforms offering unprecedented accessibility to diverse battery types ranging from automotive and industrial applications to consumer electronics and renewable energy storage systems.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 18.2% as consumers increasingly embrace digital purchasing channels. The convergence of smartphone penetration, improved internet infrastructure, and changing consumer preferences has created a fertile environment for battery e-commerce platforms to flourish across urban and semi-urban markets throughout India.

Consumer behavior patterns reveal a significant shift toward online battery purchasing, particularly among tech-savvy demographics who value convenience, competitive pricing, and product variety. The market encompasses various battery categories including automotive batteries, inverter batteries, mobile phone batteries, and industrial battery solutions, each contributing to the overall expansion of digital commerce in this specialized sector.

The India battery e-commerce market refers to the digital marketplace ecosystem where consumers and businesses purchase various types of batteries through online platforms, mobile applications, and digital channels. This market encompasses B2C and B2B transactions involving automotive batteries, consumer electronics batteries, industrial power solutions, and renewable energy storage systems sold through dedicated e-commerce websites, marketplace platforms, and manufacturer direct-to-consumer channels.

Digital battery commerce includes comprehensive services such as online product catalogs, technical specifications comparison, installation services, warranty management, and after-sales support delivered through digital touchpoints. The market integrates traditional battery manufacturing with modern e-commerce infrastructure, creating seamless purchasing experiences that bridge the gap between complex technical products and consumer accessibility.

India’s battery e-commerce landscape demonstrates remarkable growth momentum, fueled by digital adoption rates exceeding 42% annually among battery purchasers. The market benefits from increasing smartphone penetration, expanding internet connectivity, and evolving consumer preferences toward convenient online shopping experiences for technical products traditionally purchased through physical retail channels.

Key market drivers include the rapid expansion of India’s automotive sector, growing demand for uninterrupted power supply solutions, and increasing adoption of renewable energy systems requiring specialized battery storage solutions. E-commerce platforms have successfully addressed traditional pain points such as product authenticity verification, technical specification clarity, and professional installation services through innovative digital solutions.

Competitive landscape features established e-commerce giants expanding into battery categories alongside specialized battery retailers developing robust online presence. The market shows strong regional variations, with metropolitan areas leading adoption while tier-2 and tier-3 cities demonstrate accelerating growth rates in online battery purchases.

Strategic market analysis reveals several critical insights shaping the India battery e-commerce sector’s trajectory:

Digital infrastructure development serves as a fundamental driver, with improved internet connectivity and smartphone adoption enabling broader market access. The expansion of 4G and 5G networks across Indian cities and rural areas has created the technological foundation necessary for seamless battery e-commerce experiences, allowing consumers to research, compare, and purchase complex technical products online.

Automotive sector growth significantly impacts battery e-commerce demand, as India’s expanding vehicle population requires regular battery replacement and maintenance. The rise of electric vehicle adoption creates additional opportunities for specialized battery e-commerce platforms to serve emerging market segments with advanced lithium-ion and alternative battery technologies.

Power infrastructure challenges drive consumer demand for backup power solutions, creating substantial market opportunities for inverter batteries, UPS systems, and solar energy storage solutions sold through e-commerce channels. Frequent power outages in various regions motivate consumers to seek reliable online sources for power backup equipment and replacement batteries.

Convenience and time-saving benefits attract busy urban consumers who prefer online battery shopping over traditional retail visits. E-commerce platforms offer 24/7 availability, detailed product comparisons, customer reviews, and home delivery services that eliminate the inconvenience of visiting physical battery stores during business hours.

Product authenticity concerns represent a significant challenge, as consumers worry about counterfeit batteries sold through online channels. The technical nature of battery products makes quality verification difficult for average consumers, leading to hesitation in online purchases, particularly for critical applications like automotive and industrial use cases.

Installation and technical support limitations constrain market growth, as many battery types require professional installation and ongoing maintenance services. Traditional retail channels offer immediate technical assistance and installation services that online platforms struggle to replicate consistently across diverse geographic markets.

Logistics and safety regulations create operational challenges for battery e-commerce platforms, as battery transportation involves specific safety protocols, hazardous material handling requirements, and regulatory compliance issues. These constraints increase operational costs and limit delivery options for certain battery categories.

Price transparency and competition from local retailers impact online platform profitability, as consumers can easily compare online prices with local market rates. Traditional battery dealers often offer competitive pricing, immediate availability, and established customer relationships that challenge e-commerce platform value propositions.

Rural market expansion presents substantial growth opportunities as internet penetration and digital payment adoption increase in tier-3 cities and rural areas. These markets often lack comprehensive battery retail infrastructure, creating opportunities for e-commerce platforms to serve underserved consumer segments with diverse battery requirements.

Electric vehicle market growth creates emerging opportunities for specialized battery e-commerce platforms focusing on EV battery sales, replacement, and recycling services. As India’s electric mobility ecosystem expands, demand for specialized lithium-ion batteries and charging infrastructure components will drive new market segments.

Industrial and commercial segment digitization offers significant B2B e-commerce opportunities, as businesses increasingly adopt digital procurement processes for battery and power solution purchases. Industrial customers value detailed technical specifications, bulk ordering capabilities, and integrated service offerings available through specialized e-commerce platforms.

Renewable energy integration drives demand for energy storage solutions, creating opportunities for battery e-commerce platforms to serve the growing solar and wind energy markets. Home and commercial solar installations require specialized battery systems that benefit from online sales channels offering technical expertise and competitive pricing.

Supply chain evolution demonstrates significant transformation as traditional battery distributors adapt to e-commerce requirements. Manufacturers increasingly develop direct-to-consumer channels while maintaining relationships with established e-commerce platforms, creating complex multi-channel distribution strategies that serve diverse customer segments effectively.

Consumer education initiatives play crucial roles in market development, as e-commerce platforms invest in content marketing, technical guides, and educational resources to help consumers make informed battery purchasing decisions. These efforts address knowledge gaps and build consumer confidence in online battery purchases for technical applications.

Technology integration enhances user experiences through advanced search algorithms, compatibility verification tools, and augmented reality features that help consumers identify correct battery specifications for their specific applications. AI-powered recommendation systems improve product discovery and cross-selling opportunities across platform ecosystems.

Competitive pricing strategies drive market dynamics as platforms leverage economies of scale, direct manufacturer relationships, and operational efficiencies to offer competitive pricing compared to traditional retail channels. Dynamic pricing algorithms and promotional campaigns create additional value propositions for price-conscious consumers.

Comprehensive market analysis employs multiple research methodologies including primary consumer surveys, industry expert interviews, and secondary data analysis from reliable market sources. The research approach combines quantitative market sizing with qualitative insights to provide holistic understanding of India’s battery e-commerce market dynamics and growth prospects.

Primary research activities include structured interviews with battery manufacturers, e-commerce platform executives, logistics providers, and end consumers across different demographic segments and geographic regions. Survey methodologies capture consumer preferences, purchasing behaviors, and satisfaction levels with existing battery e-commerce offerings.

Secondary research integration incorporates industry reports, government statistics, trade association data, and company financial disclosures to validate primary research findings and establish market benchmarks. Data triangulation ensures research accuracy and reliability across multiple information sources and analytical perspectives.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project future market developments and identify emerging opportunities. Analytical frameworks consider macroeconomic factors, technological developments, and regulatory changes impacting battery e-commerce market evolution in India.

Northern India demonstrates strong battery e-commerce adoption, with Delhi NCR leading market penetration at 45% of regional online battery sales. The region benefits from robust logistics infrastructure, high smartphone penetration, and established e-commerce ecosystems that facilitate battery purchasing through digital channels. Urban centers show particular strength in automotive and consumer electronics battery segments.

Western India represents the largest regional market, with Maharashtra and Gujarat contributing significantly to overall battery e-commerce growth. Mumbai and Pune serve as major consumption centers, while industrial areas drive B2B battery procurement through online platforms. The region shows 28% annual growth in industrial battery e-commerce adoption.

Southern India exhibits sophisticated market development with Bangalore, Chennai, and Hyderabad leading technology adoption in battery e-commerce. The region’s strong IT sector presence correlates with higher digital payment adoption and online shopping preferences for technical products including specialized battery solutions.

Eastern India shows emerging growth potential with Kolkata and Bhubaneswar demonstrating increasing battery e-commerce adoption. While currently representing smaller market share, the region exhibits 22% year-over-year growth in online battery purchases, indicating substantial future opportunities for market expansion.

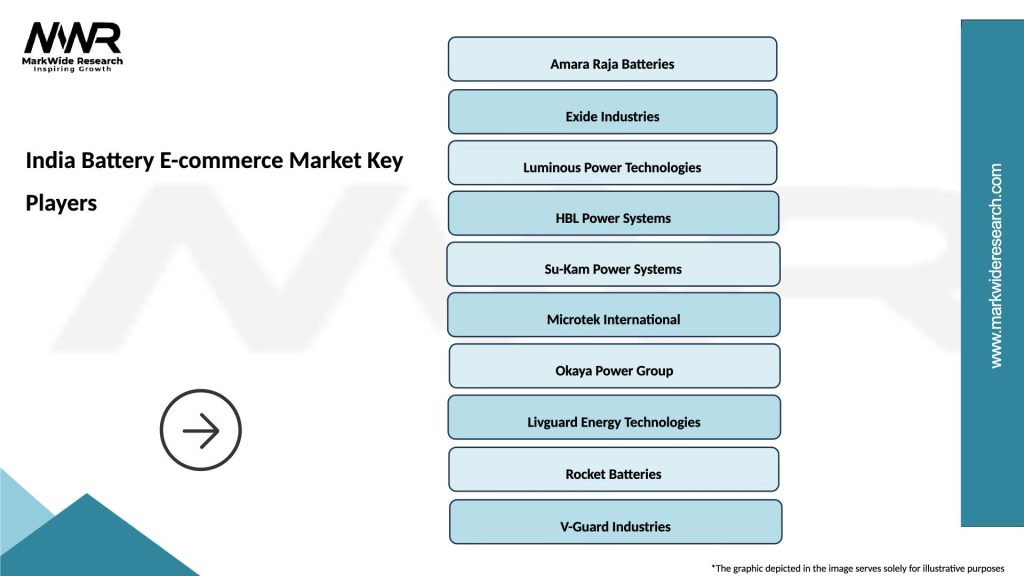

Market leadership features diverse players ranging from established e-commerce giants to specialized battery retailers developing comprehensive online presence:

Competitive strategies emphasize service differentiation, technical expertise, and integrated customer support to distinguish platforms in an increasingly crowded marketplace. Leading players invest heavily in logistics infrastructure, customer education, and technology platforms to maintain competitive advantages.

By Product Type:

By Customer Type:

By Geography:

Automotive battery segment dominates the e-commerce market with 52% market share, driven by India’s expanding vehicle population and regular replacement cycles. Online platforms successfully address traditional pain points including product authenticity, competitive pricing, and convenient home delivery services that appeal to busy vehicle owners seeking hassle-free battery replacement solutions.

Inverter battery category shows strong growth momentum as power infrastructure challenges drive consumer demand for reliable backup power solutions. E-commerce platforms offer comprehensive product comparisons, technical specifications, and installation services that help consumers select appropriate inverter batteries for their specific power requirements and budget constraints.

Consumer electronics batteries benefit from smartphone proliferation and device replacement trends, creating steady demand for mobile phone, laptop, and tablet batteries through online channels. The segment shows particular strength in metropolitan areas where consumers value convenience and competitive pricing for electronic device maintenance.

Industrial battery segment demonstrates increasing B2B e-commerce adoption as businesses digitize procurement processes. Online platforms offer bulk ordering capabilities, technical specifications, and integrated service offerings that appeal to industrial customers seeking efficient battery procurement solutions for UPS systems, telecommunications equipment, and manufacturing applications.

Manufacturers benefit from expanded market reach and direct consumer relationships through e-commerce channels, enabling better demand forecasting, inventory management, and customer feedback collection. Digital platforms provide valuable consumer insights and market intelligence that inform product development and marketing strategies for battery manufacturers.

Consumers gain access to comprehensive product selections, competitive pricing, detailed specifications, and convenient purchasing experiences that traditional retail channels often cannot match. Online platforms offer 24/7 availability, customer reviews, and comparison tools that empower informed purchasing decisions for complex technical products.

E-commerce platforms capture growing market opportunities in the expanding battery sector while leveraging existing logistics and customer service infrastructure. Battery categories offer attractive margins, repeat purchase patterns, and cross-selling opportunities that enhance overall platform profitability and customer lifetime value.

Service providers including installation technicians, logistics companies, and warranty service organizations benefit from increased business volumes generated through e-commerce platform partnerships. Digital channels create new revenue streams and customer acquisition opportunities for traditional battery service ecosystems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile-first commerce dominates the battery e-commerce landscape, with mobile applications accounting for 72% of total transactions. Consumers increasingly prefer smartphone-based shopping experiences that offer intuitive interfaces, quick checkout processes, and integrated payment solutions optimized for mobile device usage patterns.

Subscription-based models emerge as innovative approaches to battery replacement services, offering consumers predictable pricing and automatic replacement schedules for vehicles and backup power systems. These models create recurring revenue streams while providing convenience benefits that appeal to busy urban consumers.

Augmented reality integration enhances online shopping experiences by helping consumers verify battery compatibility and visualize installation processes. AR technology addresses traditional e-commerce limitations in technical product categories by providing interactive product demonstrations and compatibility verification tools.

Sustainability focus drives demand for eco-friendly battery options and recycling services integrated with e-commerce platforms. Consumers increasingly consider environmental impact in purchasing decisions, creating opportunities for platforms that offer sustainable battery solutions and responsible disposal services.

Voice commerce adoption shows emerging potential as smart speakers and voice assistants become more prevalent in Indian households. Voice-activated battery ordering and reordering services offer additional convenience layers that appeal to tech-savvy consumers seeking seamless purchasing experiences.

Strategic partnerships between battery manufacturers and e-commerce platforms create exclusive product launches, promotional campaigns, and integrated service offerings. MarkWide Research analysis indicates these collaborations enhance market reach while providing consumers with authentic products and comprehensive warranty support through trusted digital channels.

Logistics infrastructure investments focus on specialized battery transportation capabilities, including temperature-controlled storage, safety compliance protocols, and last-mile delivery solutions designed for technical products. Leading platforms develop dedicated logistics networks to handle battery-specific requirements and regulatory compliance issues.

Technology platform enhancements include AI-powered recommendation engines, advanced search filters, and compatibility verification tools that improve user experiences and reduce purchase errors. These developments address traditional challenges in online technical product sales by providing intelligent product matching and customer support capabilities.

Service integration initiatives expand beyond product sales to include installation, maintenance, and warranty services delivered through platform ecosystems. Companies develop comprehensive service networks that bridge the gap between online product sales and traditional retail service offerings.

Platform differentiation strategies should focus on service integration, technical expertise, and customer education to build competitive advantages in an increasingly crowded marketplace. Successful platforms will combine product sales with comprehensive service offerings that address the complete customer journey from selection through installation and maintenance.

Rural market expansion requires tailored approaches including regional language support, simplified user interfaces, and flexible payment options that accommodate diverse consumer preferences. Platforms should invest in local partnerships and distribution networks to effectively serve tier-3 cities and rural markets with significant growth potential.

Technology investments in mobile optimization, AI-powered recommendations, and augmented reality features will become essential for maintaining competitive positions. MWR analysis suggests that platforms prioritizing user experience innovation will capture disproportionate market share as consumer expectations continue evolving.

Sustainability initiatives including battery recycling programs, eco-friendly product options, and carbon-neutral delivery services will increasingly influence consumer purchasing decisions. Forward-thinking platforms should integrate environmental considerations into their value propositions to appeal to environmentally conscious consumers.

Market expansion prospects remain highly favorable, with projected growth rates of 16.5% annually driven by continued digital adoption, expanding vehicle populations, and increasing demand for backup power solutions. The convergence of technological advancement and changing consumer preferences creates sustained growth momentum for battery e-commerce platforms across diverse market segments.

Electric vehicle integration will create substantial new market opportunities as India’s EV ecosystem expands rapidly. Specialized battery e-commerce platforms focusing on lithium-ion batteries, charging infrastructure, and EV maintenance will capture emerging market segments with significant growth potential and higher value transactions.

Rural market penetration represents the next major growth frontier, with improving internet infrastructure and increasing smartphone adoption creating opportunities to serve previously underserved consumer segments. Successful rural expansion will require localized strategies, simplified user experiences, and innovative logistics solutions.

Technology evolution including 5G networks, IoT integration, and advanced analytics will enable more sophisticated e-commerce experiences with predictive maintenance, automated reordering, and enhanced customer support capabilities. These technological advances will further differentiate online channels from traditional retail alternatives.

India’s battery e-commerce market demonstrates exceptional growth potential driven by digital transformation, expanding consumer electronics usage, and evolving purchasing preferences toward convenient online channels. The market successfully addresses traditional retail limitations while creating new value propositions through competitive pricing, comprehensive product selections, and integrated service offerings that appeal to diverse consumer segments.

Strategic opportunities abound for platforms that can effectively combine product expertise, service integration, and technology innovation to serve the complex requirements of battery purchasers across automotive, industrial, and consumer applications. The convergence of mobile commerce, rural expansion, and electric vehicle adoption creates multiple growth vectors that will sustain market momentum throughout the forecast period.

Success factors will increasingly center on customer education, service quality, and technology differentiation as the market matures and competition intensifies. Platforms that invest in comprehensive customer experiences, authentic product offerings, and innovative service delivery models will capture disproportionate market share in this rapidly evolving sector. MarkWide Research projects continued robust growth as digital adoption accelerates and consumer confidence in online technical product purchases strengthens across India’s diverse market landscape.

What is Battery E-commerce?

Battery E-commerce refers to the online retailing of batteries for various applications, including automotive, consumer electronics, and industrial uses. This sector has grown significantly due to the increasing demand for portable power solutions and the convenience of online shopping.

What are the key players in the India Battery E-commerce Market?

Key players in the India Battery E-commerce Market include companies like Exide Industries, Amaron, and Luminous Power Technologies, which offer a range of battery products for different applications. These companies compete on factors such as product quality, pricing, and customer service, among others.

What are the growth factors driving the India Battery E-commerce Market?

The growth of the India Battery E-commerce Market is driven by the increasing adoption of electric vehicles, the rise in consumer electronics usage, and the growing demand for renewable energy storage solutions. Additionally, the convenience of online shopping is attracting more consumers to purchase batteries online.

What challenges does the India Battery E-commerce Market face?

The India Battery E-commerce Market faces challenges such as logistical issues related to the safe transportation of batteries, regulatory compliance regarding hazardous materials, and intense competition among online retailers. These factors can impact the efficiency and profitability of e-commerce operations.

What opportunities exist in the India Battery E-commerce Market?

Opportunities in the India Battery E-commerce Market include the expansion of electric vehicle infrastructure, the increasing demand for smart home devices, and the potential for innovative battery technologies. These trends can lead to new product offerings and market segments for e-commerce platforms.

What trends are shaping the India Battery E-commerce Market?

Trends shaping the India Battery E-commerce Market include the rise of subscription services for battery replacements, the integration of smart technology in batteries, and a growing focus on sustainability and eco-friendly products. These trends are influencing consumer preferences and purchasing behaviors.

India Battery E-commerce Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Lead-acid, Nickel-metal Hydride, Alkaline |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Distribution Channel | Online Retail, Direct Sales, Wholesalers, Third-party Marketplaces |

| Technology | Fast Charging, Smart Battery Management, Energy Density, Battery Recycling |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Battery E-commerce Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at