444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India B2B events market represents a dynamic and rapidly evolving sector that serves as a crucial platform for business networking, knowledge exchange, and commercial partnerships across diverse industries. Business-to-business events in India encompass trade shows, conferences, exhibitions, seminars, and corporate meetings that facilitate meaningful connections between companies, industry professionals, and stakeholders. The market has experienced remarkable transformation, particularly following the digital acceleration triggered by recent global changes, with hybrid and virtual event formats gaining substantial traction alongside traditional in-person gatherings.

Market dynamics indicate robust growth potential driven by India’s expanding economy, increasing corporate investments, and the rising importance of face-to-face business interactions in building trust and fostering long-term partnerships. The sector benefits from India’s position as a global business hub, attracting international participants and exhibitors seeking to tap into the vast Indian market. Growth projections suggest the market is expanding at a compound annual growth rate of 12.5%, reflecting strong demand across sectors including technology, healthcare, manufacturing, and financial services.

Regional distribution shows significant concentration in major metropolitan areas, with Mumbai, Delhi, Bangalore, and Chennai accounting for approximately 70% of total event activity. The market encompasses various event formats, from large-scale international trade fairs to specialized industry conferences, each serving distinct business objectives and target audiences. Technology integration has become increasingly important, with event organizers investing heavily in digital platforms, mobile applications, and data analytics to enhance attendee experiences and measure event effectiveness.

The India B2B events market refers to the comprehensive ecosystem of business-focused gatherings, exhibitions, conferences, and networking platforms designed to facilitate commercial interactions, knowledge sharing, and partnership development between companies operating in the Indian subcontinent. This market encompasses both domestic and international events that serve various industries, providing venues for product launches, business negotiations, industry insights, and professional development opportunities.

Event categories within this market include trade exhibitions where companies showcase products and services, industry conferences featuring thought leadership and educational content, corporate meetings and incentive programs, and specialized networking events targeting specific business sectors. The market also incorporates hybrid and virtual event formats that combine physical and digital elements to maximize reach and engagement while accommodating diverse participant preferences and logistical requirements.

Stakeholder participation involves event organizers, venue providers, technology suppliers, exhibitors, sponsors, and attendees who collectively contribute to the market’s value chain. The sector plays a vital role in India’s business ecosystem by enabling companies to expand their networks, explore new markets, launch products, and stay informed about industry trends and regulatory developments that impact their operations.

Market performance in India’s B2B events sector demonstrates strong resilience and adaptability, with the industry successfully navigating challenges while embracing innovative approaches to event delivery and attendee engagement. The market has evolved significantly, incorporating advanced technologies and flexible formats to meet changing business needs and participant expectations in an increasingly digital-first environment.

Key growth drivers include India’s expanding corporate sector, increasing foreign investment, and the growing recognition of events as essential marketing and business development tools. The market benefits from strong government support for trade promotion and business facilitation, with initiatives encouraging international participation and investment in event infrastructure. Digital transformation has accelerated adoption of hybrid event models, with approximately 45% of events now incorporating virtual elements to enhance accessibility and reach.

Industry segments showing particular strength include technology and software, healthcare and pharmaceuticals, manufacturing and engineering, and financial services, each driving demand for specialized events and conferences. The market’s future trajectory appears positive, supported by India’s economic growth, increasing business sophistication, and the continued importance of face-to-face interactions in building trust and facilitating complex business transactions.

Strategic insights reveal several critical factors shaping the India B2B events market landscape and influencing participant behavior and organizer strategies:

Economic expansion serves as the primary catalyst driving India’s B2B events market growth, with the country’s robust GDP growth and increasing business investments creating demand for platforms that facilitate commercial interactions and partnership development. The expanding corporate sector, particularly in technology, manufacturing, and services, generates continuous need for networking opportunities, product launches, and industry knowledge sharing that events uniquely provide.

Digital transformation initiatives across Indian businesses have created substantial demand for events focused on technology adoption, digital strategy, and innovation. Companies seek platforms to learn about emerging technologies, connect with solution providers, and share best practices in digital implementation. This trend has particularly benefited technology conferences, fintech events, and digital marketing summits that address these evolving business needs.

Government support through various trade promotion schemes, infrastructure development, and business facilitation policies has significantly boosted the events sector. Initiatives like “Make in India” and “Digital India” have encouraged international participation in Indian events while promoting domestic industry development. Foreign direct investment policies have attracted global companies seeking to establish Indian operations, driving demand for market entry events and industry introductions.

Globalization trends have positioned India as a crucial market for international businesses, leading to increased participation in Indian B2B events by foreign companies seeking local partnerships, market insights, and business opportunities. This international interest has elevated event quality standards and attracted premium sponsors and exhibitors, creating a positive cycle of market development and growth.

Infrastructure limitations in certain regions continue to pose challenges for event organizers, particularly regarding venue availability, transportation connectivity, and accommodation capacity. While major metropolitan areas offer world-class facilities, expanding events to emerging markets often requires significant infrastructure investments and logistical planning that can increase costs and complexity.

Economic volatility and budget constraints affect corporate participation in events, with companies often reducing travel and event budgets during uncertain economic periods. This sensitivity to economic cycles can impact attendance numbers, sponsorship revenues, and overall event viability, requiring organizers to develop flexible pricing models and value propositions that justify participation investments.

Regulatory complexities surrounding event organization, international participation, and business facilitation can create barriers for both organizers and participants. Compliance requirements, permit processes, and documentation needs may discourage some companies from participating or organizing events, particularly smaller businesses with limited administrative resources.

Competition from digital alternatives poses ongoing challenges as virtual meeting platforms, online networking tools, and digital marketing channels offer cost-effective alternatives to physical events. While hybrid models address some concerns, organizers must continuously demonstrate the unique value proposition of in-person interactions and experiences that cannot be replicated digitally.

Emerging sectors present significant growth opportunities for specialized B2B events, particularly in areas like renewable energy, electric vehicles, biotechnology, and artificial intelligence. These rapidly developing industries require dedicated platforms for knowledge sharing, partnership development, and market education, creating opportunities for organizers to develop niche events with strong growth potential.

Tier-2 and tier-3 cities represent untapped markets for B2B events as these regions experience economic growth and business development. Expanding event offerings to cities like Pune, Hyderabad, Ahmedabad, and Kochi can capture local business communities while offering cost advantages and reduced competition compared to traditional metropolitan markets.

International expansion opportunities exist for Indian event organizers to develop events targeting South Asian markets, Middle Eastern businesses, and Southeast Asian companies seeking Indian partnerships. This regional expansion can leverage India’s growing influence and business relationships across these markets while diversifying revenue sources and participant bases.

Technology integration offers numerous opportunities for innovation in event delivery, participant engagement, and data analytics. Advanced technologies like artificial intelligence, virtual reality, and blockchain can create differentiated event experiences while providing valuable insights for participants and organizers. MarkWide Research analysis suggests that technology-enhanced events show 35% higher participant satisfaction rates compared to traditional formats.

Supply and demand dynamics in the India B2B events market reflect the complex interplay between growing business needs for networking and knowledge sharing versus capacity constraints and competitive pressures. The market experiences seasonal fluctuations with peak activity during favorable weather months and business calendar periods, requiring organizers to optimize scheduling and resource allocation strategies.

Competitive intensity has increased significantly as more players enter the market, including international event companies, technology platforms, and specialized organizers targeting niche sectors. This competition drives innovation in event formats, technology integration, and value proposition development while potentially pressuring margins and requiring differentiation strategies.

Participant expectations continue to evolve, with attendees demanding higher-quality content, better networking opportunities, and measurable returns on their event investments. This trend pushes organizers to invest in premium speakers, advanced technology platforms, and sophisticated matchmaking systems that can demonstrate clear value to participants and justify participation costs.

Technology disruption creates both opportunities and challenges as digital platforms enable new event formats while potentially replacing traditional approaches. The market is experiencing a shift toward hybrid models that combine physical and virtual elements, requiring organizers to develop new capabilities and investment in technology infrastructure while maintaining the human connection that drives business relationships.

Primary research methodologies employed in analyzing the India B2B events market include comprehensive surveys of event organizers, venue providers, exhibitors, and attendees to gather firsthand insights into market trends, challenges, and opportunities. In-depth interviews with industry leaders, association representatives, and key stakeholders provide qualitative insights into market dynamics and future projections.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial information to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market segments, regional variations, and competitive landscape dynamics that influence market development and growth patterns.

Data collection processes involve systematic gathering of information from multiple sources including event attendance records, exhibitor participation data, venue utilization statistics, and economic indicators that impact business event demand. Market sizing and segmentation analysis utilize both quantitative and qualitative data to provide accurate market characterization and growth projections.

Analytical frameworks applied include SWOT analysis, Porter’s Five Forces assessment, and market segmentation analysis to provide structured insights into competitive dynamics, market attractiveness, and strategic opportunities. These methodologies ensure robust analysis that supports strategic decision-making for market participants and stakeholders seeking to understand and capitalize on market opportunities.

Western India dominates the B2B events landscape, with Mumbai and Pune serving as primary hubs for financial services, manufacturing, and technology events. The region benefits from excellent infrastructure, international connectivity, and a concentration of corporate headquarters that drive consistent demand for high-quality business events. Market share analysis indicates Western India accounts for approximately 35% of total event activity, reflecting its economic importance and business density.

Northern India centered around Delhi and the National Capital Region represents the second-largest market segment, leveraging government proximity, diplomatic presence, and diverse industrial base. The region excels in hosting policy-focused events, international trade missions, and government-industry interactions that benefit from its political and administrative significance. Infrastructure developments and improved connectivity continue to strengthen its position as a major event destination.

Southern India has emerged as a technology and innovation hub, with Bangalore, Chennai, and Hyderabad hosting numerous IT, biotechnology, and engineering events. The region’s strength in technology services, research and development, and manufacturing has attracted international events and conferences seeking to tap into India’s innovation ecosystem. Growth rates in Southern India show 15% annual expansion in technology-focused events.

Eastern India presents emerging opportunities with Kolkata serving as a gateway to Southeast Asian markets and a center for traditional industries like jute, tea, and mining. While smaller in scale compared to other regions, Eastern India offers unique positioning for events targeting regional trade, cultural exchanges, and traditional industry modernization initiatives.

Market leadership in India’s B2B events sector is distributed among several key categories of organizers, each bringing distinct capabilities and market positioning to serve diverse client needs and industry segments.

Competitive strategies focus on differentiation through specialized content, technology integration, international partnerships, and value-added services that enhance participant experiences and demonstrate measurable returns on investment.

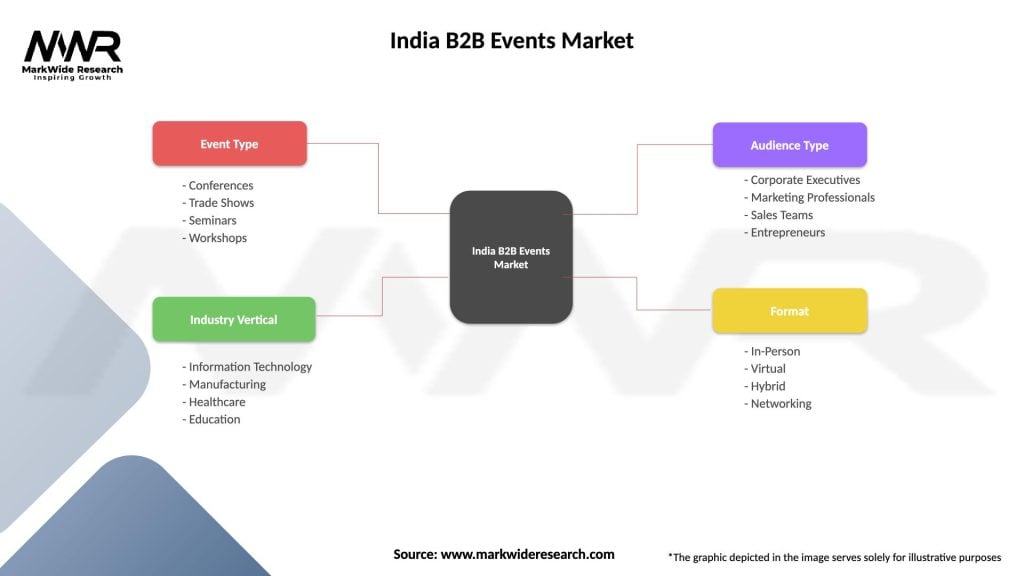

By Event Type: The market segments into trade exhibitions, conferences and seminars, corporate meetings, networking events, and hybrid/virtual events, each serving distinct business objectives and participant needs.

By Industry Vertical: Key segments include information technology and software, healthcare and pharmaceuticals, manufacturing and engineering, financial services, automotive, textiles and apparel, food and beverages, and renewable energy sectors.

By Event Size: Classification ranges from large-scale international events with thousands of participants to intimate executive roundtables and specialized workshops targeting specific business communities and professional groups.

By Geographic Scope: Events are categorized as local/regional, national, and international based on their participant base and market reach, with each category serving different business development and networking objectives.

By Duration: Market segments include single-day events, multi-day conferences, and extended programs that may span weeks or include follow-up activities and ongoing engagement components.

By Delivery Format: Traditional in-person events, virtual/online events, and hybrid formats that combine physical and digital elements to maximize reach and engagement while accommodating diverse participant preferences and logistical requirements.

Technology Events represent the fastest-growing segment, driven by India’s position as a global IT services hub and increasing focus on digital transformation across industries. These events typically feature high-quality content, international speakers, and strong networking opportunities that attract premium participants and sponsors. Participation rates in technology events show 20% annual growth, reflecting strong industry demand.

Healthcare and Pharmaceutical Events have gained significant momentum, particularly following increased focus on healthcare infrastructure and medical innovation. These events serve as crucial platforms for product launches, regulatory updates, and professional education, attracting both domestic and international participants seeking market opportunities and partnerships.

Manufacturing and Engineering Events benefit from India’s “Make in India” initiative and growing industrial base, providing platforms for technology transfer, supplier networking, and market development. These events often feature live demonstrations, technical sessions, and business matchmaking that facilitate concrete business outcomes and partnership development.

Financial Services Events address the rapidly evolving fintech landscape, regulatory changes, and digital banking transformation occurring across India’s financial sector. These events attract senior executives, regulators, and technology providers seeking to understand and capitalize on market opportunities in India’s dynamic financial services environment.

Business Development Opportunities represent the primary value proposition for event participants, providing access to qualified prospects, potential partners, and market intelligence that would be difficult and expensive to obtain through other channels. Events enable face-to-face interactions that build trust and facilitate complex business negotiations more effectively than digital alternatives.

Knowledge Acquisition through expert presentations, panel discussions, and peer interactions helps participants stay current with industry trends, regulatory changes, and best practices that impact their business operations. This educational component often justifies participation costs and provides measurable value through improved decision-making and strategic planning.

Brand Visibility and market positioning benefits allow companies to showcase their capabilities, launch new products, and establish thought leadership within their industries. Events provide concentrated exposure to target audiences and media coverage that amplifies marketing messages and builds brand recognition in competitive markets.

Market Intelligence gathered through event participation includes competitor analysis, customer feedback, and industry insights that inform strategic planning and business development initiatives. MWR research indicates that 78% of event participants report gaining valuable market intelligence that influences their business strategies and investment decisions.

Professional Networking creates lasting relationships that extend beyond event duration, leading to ongoing business collaborations, career opportunities, and industry connections that provide long-term value for individual participants and their organizations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Hybrid Event Models have become the dominant trend, combining physical and virtual elements to maximize reach, reduce costs, and accommodate diverse participant preferences. This approach enables organizers to expand their audience beyond geographical constraints while maintaining the personal connections that drive business relationships and deal-making activities.

Sustainability Focus is increasingly influencing event planning and execution, with organizers implementing green practices, sustainable venue choices, and carbon offset programs to address environmental concerns and corporate sustainability commitments. This trend reflects growing awareness of environmental impact and participant expectations for responsible event management.

Data Analytics Integration enables sophisticated measurement of event effectiveness, participant engagement, and return on investment through advanced tracking technologies and analytics platforms. Organizers use this data to optimize event design, improve participant experiences, and demonstrate value to sponsors and exhibitors seeking measurable outcomes.

Personalization Technologies allow for customized event experiences based on participant profiles, interests, and business objectives. AI-powered matchmaking systems, personalized content recommendations, and targeted networking opportunities enhance participant satisfaction and business outcomes while differentiating events in competitive markets.

Industry Specialization continues to drive market segmentation as participants seek more targeted, relevant experiences that address specific industry challenges and opportunities. This trend favors organizers who develop deep sector expertise and can deliver high-quality, specialized content that justifies premium participation fees.

Technology Infrastructure Investments by major event organizers have accelerated the adoption of advanced platforms for registration, networking, content delivery, and analytics. These investments enable enhanced participant experiences while providing valuable data insights that improve event effectiveness and demonstrate ROI to stakeholders.

International Partnership Expansion has seen Indian event organizers forming strategic alliances with global companies to bring international events to India and expand Indian events to overseas markets. These partnerships leverage complementary strengths and market access to create growth opportunities for all parties involved.

Venue Development Projects across major Indian cities have added significant capacity and capability to support large-scale international events. New convention centers, exhibition halls, and integrated facilities provide world-class infrastructure that attracts premium events and international participants to Indian markets.

Government Initiative Support through various schemes and policies has created favorable conditions for event industry growth, including simplified regulations, infrastructure investments, and promotional activities that encourage international participation and business development through events.

Digital Platform Integration has become standard practice among leading event organizers, with mobile applications, virtual networking tools, and online content platforms becoming essential components of comprehensive event experiences that extend engagement beyond physical event duration.

Technology Investment should be prioritized by event organizers seeking to remain competitive and meet evolving participant expectations. Investment in mobile applications, virtual reality experiences, AI-powered networking, and comprehensive analytics platforms will differentiate events and provide measurable value to participants and sponsors.

Regional Market Development presents significant opportunities for growth-oriented organizers willing to invest in emerging markets beyond traditional metropolitan centers. MarkWide Research analysis suggests that tier-2 cities show 25% higher growth potential compared to saturated metropolitan markets, offering first-mover advantages for well-executed expansion strategies.

Sector Specialization strategies should focus on developing deep expertise in high-growth industries like renewable energy, biotechnology, artificial intelligence, and electric vehicles. These emerging sectors require specialized knowledge and networks that create barriers to entry and support premium pricing for quality events.

International Expansion opportunities should be evaluated for organizers with strong domestic market positions, particularly targeting South Asian, Middle Eastern, and Southeast Asian markets where Indian business relationships and expertise provide competitive advantages.

Sustainability Integration should become a core component of event planning and marketing strategies, as corporate participants increasingly prioritize environmental responsibility and seek events that align with their sustainability commitments and values.

Market trajectory for India’s B2B events sector appears strongly positive, supported by continued economic growth, increasing business sophistication, and the enduring importance of face-to-face interactions in building trust and facilitating complex business relationships. The market is expected to benefit from India’s rising global profile and increasing foreign investment interest.

Technology evolution will continue to reshape event experiences and business models, with artificial intelligence, virtual reality, and advanced analytics becoming standard features rather than differentiators. Successful organizers will be those who effectively integrate technology to enhance rather than replace human connections and business relationship building.

Geographic expansion beyond traditional metropolitan centers will accelerate as tier-2 and tier-3 cities develop business ecosystems that support and demand professional events. This expansion will create new opportunities while potentially reducing costs and competition compared to saturated major markets.

Industry convergence trends suggest that traditional sector boundaries will blur as digital transformation, sustainability concerns, and globalization create common challenges and opportunities across industries. Events that address these cross-sector themes may find broader appeal and market opportunities.

Growth projections indicate the market will continue expanding at a robust pace of 12-15% annually, driven by economic growth, business development needs, and the unique value proposition that well-executed events provide in an increasingly digital business environment where personal connections remain crucial for success.

The India B2B events market represents a dynamic and rapidly evolving sector that plays a crucial role in facilitating business development, knowledge sharing, and partnership formation across India’s diverse economy. The market has demonstrated remarkable resilience and adaptability, successfully integrating new technologies and formats while maintaining the fundamental value proposition of enabling meaningful business connections and relationships.

Growth prospects remain strong, supported by India’s continued economic expansion, increasing business sophistication, and the growing recognition of events as essential tools for market development and business growth. The successful integration of hybrid models, advanced technologies, and sustainability practices positions the market well for continued expansion and evolution in response to changing business needs and participant expectations.

Strategic opportunities exist for organizers who can effectively combine traditional event strengths with innovative approaches to content delivery, participant engagement, and value measurement. The market’s future success will depend on continued investment in technology, infrastructure, and professional capabilities that enable high-quality experiences and measurable business outcomes for all stakeholders involved in India’s vibrant B2B events ecosystem.

What is B2B Events?

B2B Events refer to business-to-business gatherings where companies engage with each other to promote products, share knowledge, and network. These events can include trade shows, conferences, and seminars aimed at fostering business relationships.

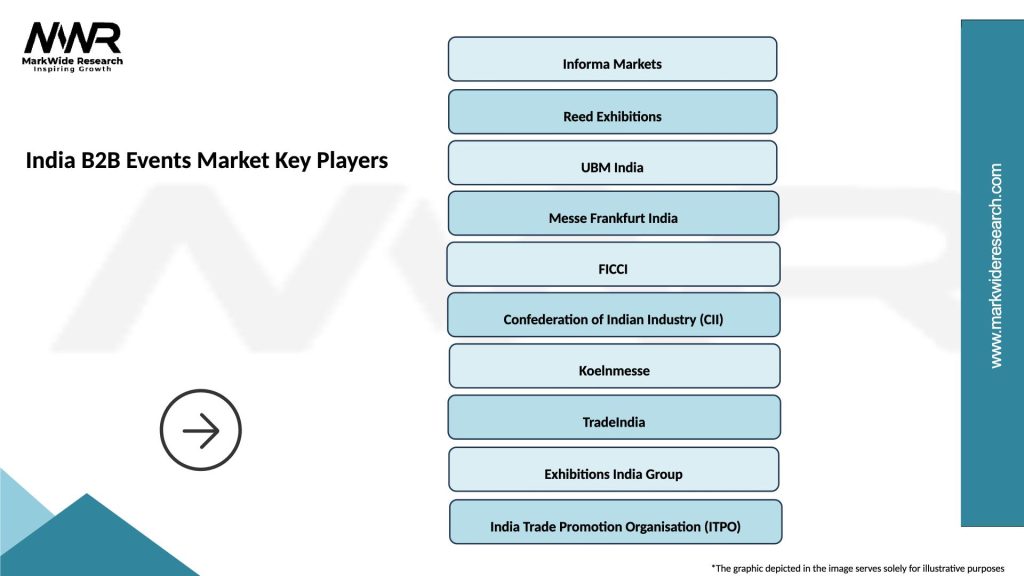

What are the key players in the India B2B Events Market?

Key players in the India B2B Events Market include Informa Markets, Messe Frankfurt, and UBM India, which organize various trade shows and conferences across different industries, among others.

What are the growth factors driving the India B2B Events Market?

The growth of the India B2B Events Market is driven by increasing globalization, the rise of digital marketing, and the need for businesses to network and collaborate. Additionally, sectors like technology and manufacturing are increasingly leveraging these events for visibility.

What challenges does the India B2B Events Market face?

The India B2B Events Market faces challenges such as fluctuating economic conditions, competition from virtual events, and logistical issues related to organizing large-scale gatherings. These factors can impact attendance and overall event success.

What opportunities exist in the India B2B Events Market?

Opportunities in the India B2B Events Market include the growing demand for hybrid events, increased investment in event technology, and the potential for niche events targeting specific industries. These trends can enhance engagement and reach.

What trends are shaping the India B2B Events Market?

Trends shaping the India B2B Events Market include the integration of technology such as virtual reality and AI in event planning, a focus on sustainability, and the rise of personalized attendee experiences. These innovations are transforming how events are organized and experienced.

India B2B Events Market

| Segmentation Details | Description |

|---|---|

| Event Type | Conferences, Trade Shows, Seminars, Workshops |

| Industry Vertical | Information Technology, Manufacturing, Healthcare, Education |

| Audience Type | Corporate Executives, Marketing Professionals, Sales Teams, Entrepreneurs |

| Format | In-Person, Virtual, Hybrid, Networking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India B2B Events Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at