444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The India automotive stamping market is a crucial sector within the automotive industry. Automotive stamping involves the manufacturing of metal components used in automobiles through a process of cutting, bending, and shaping metal sheets. These stamped components are integral to the structural integrity, safety, and functionality of vehicles. The Indian automotive market is one of the largest in the world, and with the growing demand for automobiles, there is a parallel need for automotive stamping services. In this comprehensive article, we will explore the India automotive stamping market, its meaning, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding note.

The India automotive stamping market refers to the sector involved in the manufacturing and production of stamped metal components used in automobiles. Stamping is a process that involves cutting, bending, and shaping metal sheets to create intricate parts and components that form the structural framework of vehicles. These stamped components include body panels, chassis parts, interior parts, and various other critical components that are essential for the functioning and aesthetics of automobiles.

Executive Summary

The India automotive stamping market has witnessed significant growth over the years, driven by the expanding automotive industry and the need for high-quality stamped components. As the demand for vehicles continues to rise in India, automotive manufacturers are increasingly relying on stamped metal parts to ensure structural integrity, safety, and performance. This executive summary provides an overview of the India automotive stamping market, highlighting key market insights, drivers, restraints, opportunities, and trends that shape this dynamic industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

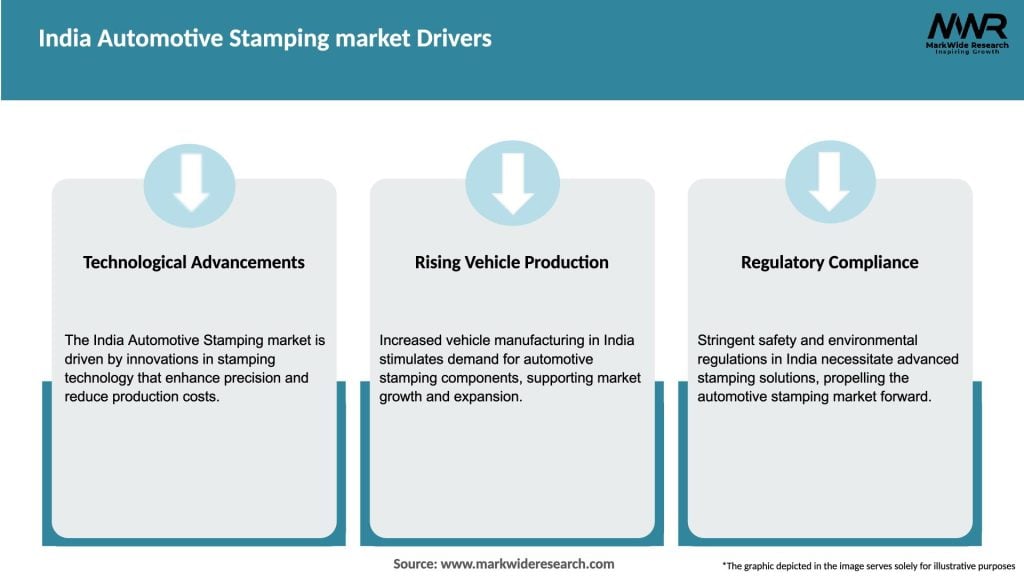

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India automotive stamping market operates in a dynamic environment influenced by various factors such as automotive industry trends, technological advancements, government policies, and market competition. Understanding the dynamics of this market is crucial for stakeholders to adapt, innovate, and remain competitive. Key dynamics include:

Regional Analysis

The India automotive stamping market exhibits regional variations influenced by factors such as automotive manufacturing clusters, infrastructure, and market demand. While the market is spread across the country, certain regions have witnessed significant growth and present unique opportunities for industry participants. A comprehensive regional analysis provides insights into:

Competitive Landscape

Leading Companies in the India Automotive Stamping Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India automotive stamping market can be segmented based on various criteria, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis examines the strengths, weaknesses, opportunities, and threats in the India automotive stamping market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the automotive industry, including the automotive stamping market. The pandemic led to disruptions in manufacturing operations, supply chain challenges, and reduced consumer demand for vehicles. However, as the automotive industry gradually recovers, the demand for stamped components is expected to rebound. The recovery will be driven by the resumption of vehicle production, the focus on vehicle safety and performance, and the shift towards electric and lightweight vehicles. The industry will continue to adapt to changing market conditions and ensure the health and safety of its workforce.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the India automotive stamping market looks promising, driven by the growth of the automotive industry, increasing demand for lightweight vehicles, and technological advancements in stamping processes. Opportunities exist in the electric vehicle market, localization efforts, and collaboration with automotive manufacturers. Industry participants should focus on adopting advanced technologies, developing a skilled workforce, embracing sustainability, and investing in research and development to remain competitive. As the automotive industry continues to evolve, the India automotive stamping market will play a crucial role in providing high-quality stamped components that ensure the structural integrity, safety, and performance of vehicles.

Conclusion

The India automotive stamping market is an essential sector within the automotive industry, catering to the growing demand for high-quality stamped components used in vehicles. The market offers opportunities for innovation, collaboration, and growth, driven by factors such as lightweighting initiatives, technological advancements, and localization efforts. The future outlook is optimistic, with the continued growth of the automotive industry and the increasing emphasis on electric and lightweight vehicles. As stakeholders focus on technological advancements, collaboration, sustainability, and research and development, the India automotive stamping market will remain vital in shaping the future of the automotive industry.

What is Automotive Stamping?

Automotive stamping refers to the process of shaping and forming metal sheets into specific parts used in vehicles, such as body panels, frames, and structural components. This process is essential in the automotive manufacturing industry for producing durable and precise components.

What are the key players in the India Automotive Stamping market?

Key players in the India Automotive Stamping market include Tata AutoComp Systems, Mahindra & Mahindra, and Bharat Forge, among others. These companies are involved in producing a variety of stamped components for different automotive applications.

What are the growth factors driving the India Automotive Stamping market?

The growth of the India Automotive Stamping market is driven by the increasing demand for lightweight vehicles, advancements in manufacturing technologies, and the rising production of electric vehicles. Additionally, the push for fuel efficiency and safety standards is also contributing to market expansion.

What challenges does the India Automotive Stamping market face?

The India Automotive Stamping market faces challenges such as fluctuating raw material prices, the need for skilled labor, and stringent regulatory requirements. These factors can impact production costs and operational efficiency.

What opportunities exist in the India Automotive Stamping market?

Opportunities in the India Automotive Stamping market include the growing trend of electric vehicles, which require specialized stamped components, and the potential for automation in manufacturing processes. Additionally, increasing investments in infrastructure and automotive production facilities present further growth avenues.

What trends are shaping the India Automotive Stamping market?

Trends in the India Automotive Stamping market include the adoption of advanced materials like high-strength steel and aluminum, as well as the integration of Industry Four-point-zero technologies. These innovations aim to enhance production efficiency and reduce environmental impact.

India Automotive Stamping market

| Segmentation Details | Description |

|---|---|

| Product Type | Body Panels, Chassis Components, Engine Parts, Transmission Housings |

| Material | Steel, Aluminum, Composite Materials, Magnesium |

| Manufacturing Stage | Stamping, Assembly, Finishing, Quality Control |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Automotive Stamping Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at