444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The India automotive lubricants market has experienced significant growth in recent years. Lubricants play a crucial role in ensuring the smooth operation of vehicles by reducing friction, heat, and wear between moving parts. They also provide protection against rust and corrosion, extend the lifespan of engine components, and improve fuel efficiency. The demand for automotive lubricants in India is driven by the rapid growth of the automotive industry, increasing vehicle sales, and the need for better engine performance and longevity. The market is highly competitive, with several domestic and international players vying for market share.

Automotive lubricants are specially formulated substances used to reduce friction and heat between moving parts of vehicles. They are essential for maintaining the optimal performance and longevity of engines, transmissions, and other automotive components. Lubricants are available in various forms, including engine oils, transmission fluids, gear oils, and greases. They are designed to withstand high temperatures, pressure, and heavy loads, ensuring smooth operation and protecting against wear and tear. The quality and performance of lubricants are critical factors in maximizing the efficiency and lifespan of vehicles, making them indispensable in the automotive industry.

Executive Summary

The India automotive lubricants market has witnessed robust growth in recent years, driven by factors such as the expanding automotive industry, rising vehicle sales, and increasing consumer awareness regarding the importance of regular maintenance and lubrication. The market is highly competitive, with both domestic and international players offering a wide range of lubricant products. Engine oils account for the largest share of the market, followed by transmission fluids and greases. The market is expected to continue growing at a steady pace in the coming years, fueled by the growing demand for passenger and commercial vehicles, as well as the increasing focus on fuel efficiency and environmental sustainability.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

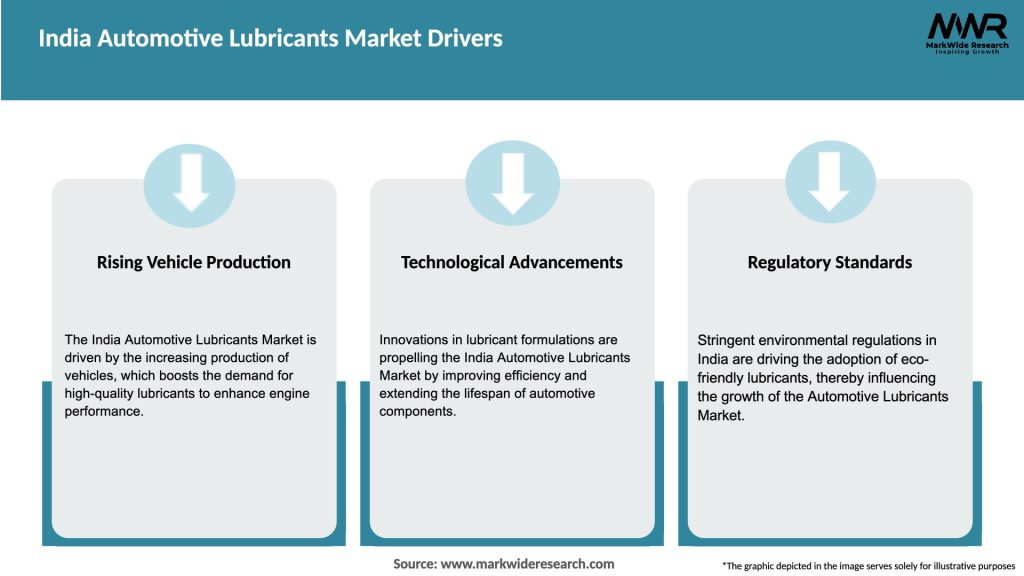

Market Drivers

Several factors are driving the growth of the India automotive lubricants market:

Market Restraints

While the India automotive lubricants market has immense growth potential, certain factors pose challenges to its development:

Market Opportunities

The India automotive lubricants market presents several opportunities for industry participants:

Market Dynamics

The India automotive lubricants market is characterized by dynamic factors that shape its growth and competitiveness. Key dynamics include:

Regional Analysis

The India automotive lubricants market can be analyzed based on regional dynamics:

Regional variations in vehicle density, industrial activity, and economic development contribute to varying demand patterns for automotive lubricants across India. Manufacturers and distributors need to tailor their strategies to cater to the specific needs and dynamics of each region.

Competitive Landscape

Leading Companies in the India Automotive Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India automotive lubricants market can be segmented based on various factors:

Segmentation allows lubricant manufacturers to target specific customer segments, customize their product offerings, and optimize their marketing and distribution strategies.

Category-wise Insights

Each category requires specific formulations and characteristics to cater to the unique requirements of different automotive components.

Key Benefits for Industry Participants and Stakeholders

Participating in the India automotive lubricants market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of the India automotive lubricants market provides insights into the market’s internal and external factors:

Understanding these factors helps industry participants formulate effective strategies, capitalize on opportunities, and address potential challenges.

Market Key Trends

Key trends shaping the India automotive lubricants market include:

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the India automotive lubricants market. The restrictions imposed during lockdowns resulted in reduced vehicle usage, leading to a temporary decline in lubricant demand. However, the market showed resilience, with a gradual recovery as lockdown measures eased and economic activities resumed. The market’s recovery was driven by pent-up demand, increasing vehicle sales, and the resumption of industrial activities. Manufacturers focused on online sales, contactless delivery, and implementing stringent health and safety protocols to ensure business continuity. The pandemic served as a reminder of the importance of regular vehicle maintenance and lubrication for optimal performance and longevity.

Key Industry Developments

Recent industry developments in the India automotive lubricants market include:

Analyst Suggestions

Based on market trends and insights, analysts provide the following suggestions for industry participants:

Future Outlook

The India automotive lubricants market is expected to continue its growth trajectory in the coming years. Factors such as the expanding automotive industry, increasing vehicle sales, and the focus on fuel efficiency and sustainability will drive market growth. The rise of electric vehicles, technological advancements in lubricant formulations, and the shift towards synthetic and eco-friendly lubricants will shape the market’s future. Manufacturers that invest in research and development, strengthen distribution networks, and adapt to digitalization trends will be well-positioned to capitalize on the opportunities presented by the evolving automotive lubricants market.

Conclusion

In conclusion, the India automotive lubricants market presents immense growth potential driven by the expanding automotive industry, rising vehicle sales, and increasing consumer awareness regarding the importance of regular maintenance and lubrication. The market is highly competitive, with a wide range of lubricant products available from domestic and international players. Key trends include the shift towards synthetic lubricants, a focus on eco-friendly products, digital transformation, and strategic partnerships. While challenges such as fluctuating raw material prices and counterfeit products exist, opportunities lie in the rising demand for specialized lubricants, expanding aftermarket sales, and the growing adoption of electric vehicles. With strategic investments, product innovation, and compliance with environmental regulations, industry participants can thrive in the dynamic India automotive lubricants market.

What is Automotive Lubricants?

Automotive lubricants are substances used to reduce friction between moving parts in vehicles, enhancing performance and longevity. They include engine oils, transmission fluids, and greases, which are essential for the smooth operation of automotive systems.

What are the key players in the India Automotive Lubricants Market?

Key players in the India Automotive Lubricants Market include Indian Oil Corporation, Bharat Petroleum, and Castrol India, among others. These companies are known for their extensive product ranges and strong distribution networks.

What are the growth factors driving the India Automotive Lubricants Market?

The growth of the India Automotive Lubricants Market is driven by increasing vehicle production, rising consumer awareness about vehicle maintenance, and the growing demand for high-performance lubricants. Additionally, the expansion of the automotive sector contributes significantly to market growth.

What challenges does the India Automotive Lubricants Market face?

The India Automotive Lubricants Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and compliance for manufacturers in the industry.

What opportunities exist in the India Automotive Lubricants Market?

Opportunities in the India Automotive Lubricants Market include the increasing adoption of electric vehicles and the demand for bio-based lubricants. These trends present avenues for innovation and expansion in product offerings.

What trends are shaping the India Automotive Lubricants Market?

Trends shaping the India Automotive Lubricants Market include the shift towards synthetic lubricants and the integration of advanced additives for improved performance. Additionally, the focus on sustainability is driving the development of eco-friendly lubricant options.

India Automotive Lubricants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Engine Oil, Transmission Fluid, Brake Fluid, Grease |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Fleet Operators |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Heavy-Duty Trucks |

| Distribution Channel | Retail, Online, Wholesalers, Service Stations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Automotive Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at