444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India aesthetic medicine market represents one of the fastest-growing segments within the country’s healthcare landscape, driven by increasing disposable income, growing beauty consciousness, and rising acceptance of cosmetic procedures. Market dynamics indicate significant expansion across both surgical and non-surgical aesthetic treatments, with urban centers leading the adoption of advanced cosmetic technologies. The market encompasses a comprehensive range of services including facial rejuvenation, body contouring, hair restoration, and minimally invasive procedures.

Consumer preferences have shifted dramatically toward preventive and corrective aesthetic treatments, with millennials and Gen Z demographics driving substantial demand growth. The market experiences robust expansion at approximately 15.2% CAGR, reflecting the increasing integration of aesthetic medicine into mainstream healthcare. Technology adoption accelerates across major metropolitan areas, with advanced laser systems, injectables, and energy-based devices gaining widespread acceptance among both practitioners and patients.

Regional distribution shows concentrated growth in tier-1 cities, with approximately 68% market concentration in Mumbai, Delhi, Bangalore, Chennai, and Hyderabad. The market benefits from improved healthcare infrastructure, increasing medical tourism, and growing awareness about aesthetic procedures through digital platforms and social media influence.

The India aesthetic medicine market refers to the comprehensive ecosystem of medical and cosmetic procedures designed to enhance, restore, or maintain physical appearance through both surgical and non-surgical interventions. This market encompasses various treatment modalities including dermatological procedures, plastic surgery, minimally invasive treatments, and advanced cosmetic technologies aimed at addressing aesthetic concerns.

Aesthetic medicine in the Indian context includes facial treatments such as botulinum toxin injections, dermal fillers, chemical peels, and laser therapies, alongside body contouring procedures, hair transplantation, and skin rejuvenation treatments. The market integrates traditional dermatological practices with modern cosmetic medicine, creating a unique blend of evidence-based treatments tailored to diverse skin types and aesthetic preferences prevalent in the Indian population.

Market expansion in India’s aesthetic medicine sector demonstrates exceptional momentum, driven by demographic shifts, urbanization, and evolving beauty standards. The market experiences unprecedented growth across multiple treatment categories, with non-surgical procedures accounting for approximately 72% of total treatments performed annually. Consumer demographics reveal increasing participation from younger age groups, with individuals aged 25-40 representing the largest patient segment.

Technology integration accelerates market development, with advanced laser systems, radiofrequency devices, and injectable treatments gaining widespread adoption. The market benefits from improved practitioner training, standardized treatment protocols, and enhanced safety measures that build consumer confidence. Investment flows into aesthetic medicine clinics and medical spas increase substantially, reflecting strong investor confidence in the sector’s growth potential.

Regulatory developments support market expansion through clearer guidelines for aesthetic procedures and practitioner certification requirements. The market demonstrates resilience and adaptability, with telemedicine consultations and digital marketing strategies enhancing patient accessibility and engagement across diverse geographic regions.

Treatment preferences reveal distinct patterns in the Indian aesthetic medicine landscape, with several key insights shaping market development:

Economic prosperity serves as a fundamental driver for India’s aesthetic medicine market expansion, with rising disposable incomes enabling greater spending on elective cosmetic procedures. The growing middle class demonstrates increased willingness to invest in appearance enhancement, viewing aesthetic treatments as essential lifestyle choices rather than luxury services. Urbanization trends contribute significantly to market growth, as metropolitan populations exhibit higher acceptance rates for cosmetic procedures.

Social media influence plays a crucial role in driving market demand, with platforms like Instagram and TikTok creating awareness about aesthetic treatments and normalizing cosmetic procedures among younger demographics. The proliferation of beauty influencers and celebrity endorsements further accelerates treatment adoption rates. Professional requirements in corporate environments increasingly emphasize personal grooming and appearance, driving demand for aesthetic treatments among working professionals.

Technological advancements make procedures safer, more effective, and less invasive, reducing patient concerns about complications and recovery time. The availability of FDA-approved treatments and internationally certified equipment enhances consumer confidence in aesthetic procedures. Medical tourism initiatives position India as a cost-effective destination for international patients, contributing to overall market expansion and infrastructure development.

Regulatory challenges present significant constraints for the Indian aesthetic medicine market, with inconsistent guidelines across different states creating operational complexities for practitioners and clinics. The lack of standardized certification requirements for aesthetic medicine practitioners raises concerns about treatment quality and patient safety. Cost sensitivity among certain demographic segments limits market penetration, particularly in tier-2 and tier-3 cities where disposable incomes remain constrained.

Cultural barriers continue to influence market adoption, with traditional attitudes toward cosmetic procedures creating resistance in conservative communities. The stigma associated with aesthetic treatments, particularly surgical procedures, limits market expansion in certain regions. Safety concerns arising from unqualified practitioners and substandard facilities damage market reputation and consumer confidence.

Insurance limitations restrict market growth, as most aesthetic procedures remain excluded from health insurance coverage, making treatments entirely out-of-pocket expenses. The lack of standardized pricing structures across different providers creates market confusion and price sensitivity among potential patients. Economic volatility impacts discretionary spending on aesthetic treatments, making the market vulnerable to economic downturns and reduced consumer confidence.

Tier-2 city expansion presents substantial growth opportunities for the Indian aesthetic medicine market, with improving healthcare infrastructure and rising affluence creating new patient bases. The development of franchise models and satellite clinics enables established providers to penetrate emerging markets cost-effectively. Technology democratization through more affordable equipment and treatment options opens opportunities for broader market accessibility.

Male aesthetics represents an underexplored market segment with significant growth potential, particularly in hair restoration, facial treatments, and body contouring procedures. The increasing acceptance of male grooming and aesthetic treatments creates new revenue streams for providers. Preventive aesthetics targeting younger demographics offers opportunities for long-term patient relationships and recurring revenue models.

Medical tourism expansion provides opportunities for international patient acquisition, leveraging India’s cost advantages and skilled practitioners. The development of comprehensive aesthetic tourism packages combining treatments with hospitality services creates competitive differentiation. Digital health integration enables telemedicine consultations, virtual treatment planning, and enhanced patient engagement through mobile applications and online platforms.

Supply-demand equilibrium in India’s aesthetic medicine market demonstrates dynamic shifts influenced by practitioner availability, technology accessibility, and patient awareness levels. The market experiences seasonal fluctuations, with peak demand during wedding seasons and festival periods when appearance enhancement becomes particularly important. Competitive intensity increases as new players enter the market, driving innovation in treatment offerings and service delivery models.

Price dynamics reflect the balance between premium positioning and accessibility, with providers developing tiered pricing strategies to capture different market segments. The market witnesses approximately 23% annual growth in treatment volumes, indicating strong underlying demand despite economic uncertainties. Technology cycles influence market dynamics, with newer treatment modalities commanding premium pricing before becoming mainstream offerings.

Regulatory evolution shapes market dynamics through changing compliance requirements and safety standards that influence operational costs and market entry barriers. The market demonstrates resilience through economic cycles, with essential treatments maintaining demand while discretionary procedures show more volatility. Consumer behavior shifts toward research-driven decision making, with patients increasingly comparing providers, technologies, and outcomes before selecting treatments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate representation of India’s aesthetic medicine market landscape. Primary research involves extensive interviews with leading practitioners, clinic owners, and industry stakeholders across major metropolitan areas and emerging markets. Data collection encompasses quantitative surveys targeting both providers and consumers to understand market trends, preferences, and growth drivers.

Secondary research incorporates analysis of industry reports, regulatory filings, and academic publications to validate primary findings and identify market patterns. The methodology includes examination of import-export data for aesthetic equipment and products, providing insights into market size and growth trajectories. Market segmentation analysis utilizes demographic data, treatment volume statistics, and revenue distribution across different procedure categories.

Validation processes ensure data accuracy through cross-referencing multiple sources and expert consultations with industry leaders. The research methodology incorporates regional analysis covering tier-1, tier-2, and tier-3 cities to provide comprehensive market coverage. Trend analysis utilizes historical data spanning five years to identify growth patterns and project future market developments with statistical confidence.

Northern India demonstrates robust market development centered around Delhi NCR, with approximately 28% regional market share driven by high disposable incomes and cosmopolitan lifestyle preferences. The region benefits from excellent healthcare infrastructure and concentration of skilled practitioners specializing in aesthetic medicine. Western India leads market expansion with Mumbai and Pune serving as major hubs, accounting for significant treatment volumes in both surgical and non-surgical procedures.

Southern India shows exceptional growth potential, with Bangalore, Chennai, and Hyderabad emerging as key markets for aesthetic treatments. The region’s IT industry concentration creates a tech-savvy patient base with higher acceptance of advanced aesthetic technologies. Eastern India represents an emerging market with Kolkata leading regional development, though growth rates remain below national averages due to cultural and economic factors.

Tier-2 cities across all regions demonstrate increasing market penetration, with cities like Ahmedabad, Jaipur, Lucknow, and Kochi showing substantial growth in aesthetic medicine adoption. The regional distribution indicates approximately 45% market concentration in top-5 metropolitan areas, with remaining markets distributed across emerging urban centers. Medical tourism contributes significantly to regional market dynamics, with certain cities developing specialized aesthetic tourism infrastructure.

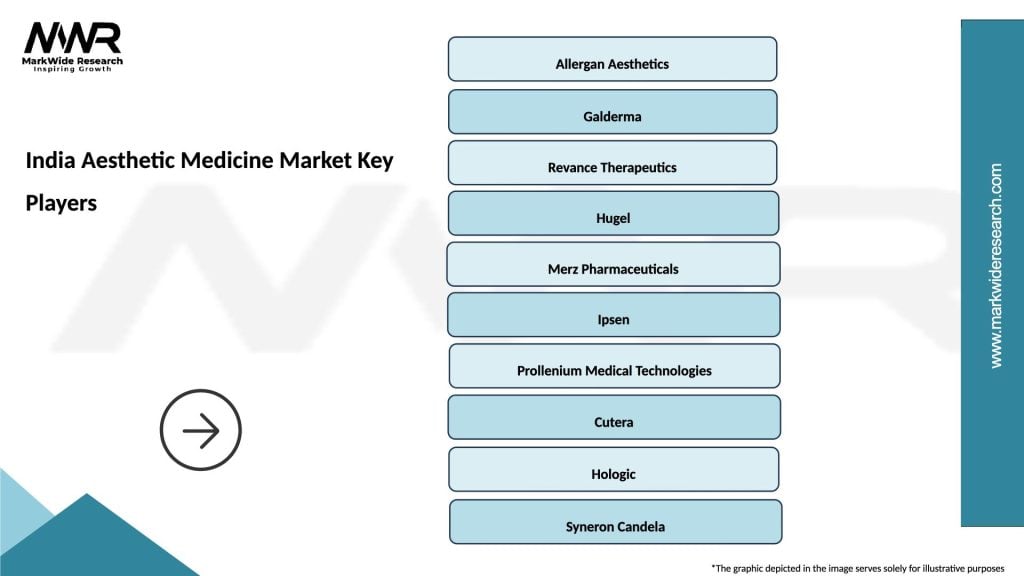

Market leadership in India’s aesthetic medicine sector features a diverse mix of international brands, domestic companies, and individual practitioners creating a highly competitive environment. Leading players demonstrate strong market positioning through comprehensive service offerings and advanced technology adoption:

Competitive strategies emphasize technology differentiation, service quality, and brand building through digital marketing and patient testimonials. The market experiences consolidation trends with larger players acquiring smaller clinics to expand geographic coverage and service capabilities.

Treatment-based segmentation reveals distinct market categories with varying growth rates and patient preferences:

By Procedure Type:

By Demographics:

By Geographic Distribution:

Facial Aesthetics dominates the Indian market with approximately 52% treatment volume share, driven by high demand for botulinum toxin injections, dermal fillers, and laser skin resurfacing procedures. This category benefits from minimal downtime requirements and immediate visible results that appeal to working professionals. Hair Restoration represents the second-largest category, with hair transplantation procedures experiencing exceptional growth among both male and female patients.

Body Contouring shows significant growth potential, particularly non-invasive fat reduction treatments using cryolipolysis and radiofrequency technologies. The category attracts patients seeking alternatives to surgical liposuction with reduced recovery time. Skin Rejuvenation treatments including chemical peels, microneedling, and laser therapies maintain steady demand across all age groups.

Anti-aging treatments experience robust growth as preventive aesthetics gain acceptance among younger demographics. The category includes combination therapies targeting multiple signs of aging through integrated treatment approaches. Acne and scar treatments represent a specialized segment with consistent demand, particularly among younger patients seeking long-term skin improvement solutions.

Healthcare providers benefit from aesthetic medicine integration through diversified revenue streams and improved patient retention rates. The high-margin nature of aesthetic procedures enhances overall practice profitability while building stronger patient relationships through elective care services. Technology suppliers experience substantial growth opportunities through equipment sales, training programs, and ongoing technical support services.

Patients gain access to advanced aesthetic treatments with improved safety profiles and predictable outcomes through standardized protocols and certified practitioners. The market expansion increases treatment accessibility and competitive pricing across different service levels. Investors benefit from attractive returns in a growing market with strong demographic tailwinds and increasing consumer acceptance.

Medical professionals expand career opportunities through aesthetic medicine specialization, accessing higher income potential and professional satisfaction through elective procedures. The field offers continuous learning opportunities through new technologies and treatment techniques. Regulatory bodies benefit from increased healthcare sector development and improved medical tourism positioning for India in the global market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Minimally invasive procedures dominate market trends, with patients increasingly preferring treatments requiring minimal downtime and offering natural-looking results. The trend toward “tweakments” rather than dramatic transformations reflects changing aesthetic preferences among Indian consumers. Combination therapies gain popularity as practitioners develop integrated treatment approaches addressing multiple aesthetic concerns simultaneously.

Digital transformation accelerates across the aesthetic medicine sector, with virtual consultations, AI-powered treatment planning, and mobile applications enhancing patient experience and engagement. Social media marketing becomes essential for practice growth, with before-and-after content driving patient acquisition. Personalized medicine approaches gain traction through genetic testing and customized treatment protocols tailored to individual patient characteristics.

Preventive aesthetics emerges as a significant trend, with younger patients seeking early intervention treatments to prevent aging signs rather than correcting existing concerns. The market witnesses approximately 35% growth in preventive treatment adoption among patients aged 25-35 years. Male aesthetics experiences substantial growth, with men increasingly accepting hair restoration, facial treatments, and body contouring procedures.

Regulatory advancements include the development of clearer guidelines for aesthetic medicine practice and practitioner certification requirements by medical boards across different states. The introduction of standardized safety protocols and equipment certification processes enhances market credibility and patient confidence. Technology launches bring advanced laser systems, radiofrequency devices, and injectable products specifically designed for Indian skin types and aesthetic preferences.

Market consolidation accelerates through strategic acquisitions and partnerships, with larger players expanding geographic coverage and service capabilities through smaller clinic acquisitions. International brands establish stronger presence in India through joint ventures and direct investments in clinic networks. Training initiatives expand through specialized aesthetic medicine courses and certification programs offered by leading medical institutions.

Infrastructure development includes the establishment of dedicated aesthetic medicine centers and medical spas in tier-2 cities, expanding market accessibility. According to MarkWide Research analysis, the market witnesses significant investment in state-of-the-art facilities and equipment upgrades across major metropolitan areas. Digital health integration advances through telemedicine platforms and mobile applications facilitating patient consultations and treatment planning.

Market entry strategies should focus on tier-2 city expansion where competition remains limited and growth potential appears substantial. New entrants should prioritize technology differentiation and safety protocols to build competitive advantages in an increasingly crowded market. Investment priorities should emphasize advanced equipment acquisition, practitioner training, and digital marketing capabilities to capture market share effectively.

Service diversification recommendations include developing comprehensive aesthetic medicine portfolios combining surgical and non-surgical procedures to maximize patient lifetime value. Providers should consider male-focused services and preventive treatment packages targeting younger demographics. Partnership opportunities exist with international technology suppliers and training organizations to enhance service quality and market positioning.

Regulatory compliance should remain a top priority, with providers investing in quality management systems and safety protocols that exceed minimum requirements. MWR suggests focusing on patient education and transparent communication to build trust and manage expectations effectively. Technology adoption should prioritize proven treatments with strong safety profiles rather than experimental procedures that may compromise patient safety and market reputation.

Market trajectory indicates continued robust expansion over the next five years, with growth rates expected to maintain momentum despite potential economic headwinds. The market should experience approximately 18% annual growth in treatment volumes, driven by increasing acceptance and accessibility of aesthetic procedures. Technology evolution will introduce more sophisticated treatment options with improved safety profiles and enhanced patient outcomes.

Demographic shifts suggest expanding patient base as younger generations demonstrate higher acceptance of aesthetic treatments and preventive care approaches. The market should witness increased male participation, potentially reaching 30% of total patients within the forecast period. Geographic expansion into tier-2 and tier-3 cities will drive market growth as healthcare infrastructure improves and disposable incomes rise.

Regulatory environment should evolve toward more standardized guidelines and certification requirements, enhancing market credibility and patient safety. MarkWide Research projects continued investment in practitioner training and facility upgrades to meet growing quality expectations. International positioning of India as a medical tourism destination for aesthetic treatments should strengthen, contributing to overall market expansion and foreign exchange earnings.

India’s aesthetic medicine market represents a dynamic and rapidly expanding sector with exceptional growth potential driven by favorable demographics, increasing disposable incomes, and evolving beauty consciousness. The market demonstrates resilience through economic cycles while adapting to changing consumer preferences and technological advancements. Strategic opportunities exist across multiple dimensions including geographic expansion, demographic targeting, and service diversification.

Success factors in this market emphasize quality service delivery, safety protocols, and patient education combined with effective digital marketing and brand building strategies. The market rewards providers who invest in advanced technologies, practitioner training, and comprehensive patient care approaches. Future growth depends on continued regulatory support, infrastructure development, and maintaining high safety standards that build consumer confidence in aesthetic medicine treatments.

The India aesthetic medicine market stands positioned for sustained expansion, offering attractive opportunities for healthcare providers, technology suppliers, and investors willing to commit to quality, safety, and patient-centric service delivery in this evolving and promising sector.

What is Aesthetic Medicine?

Aesthetic Medicine refers to a branch of medicine focused on improving cosmetic appearance through various procedures, including surgical and non-surgical techniques. It encompasses treatments such as Botox, dermal fillers, laser therapies, and skin rejuvenation.

What are the key players in the India Aesthetic Medicine Market?

Key players in the India Aesthetic Medicine Market include Allergan, Galderma, Merz Pharmaceuticals, and Revance Therapeutics, among others. These companies are known for their innovative products and services in the aesthetic field.

What are the growth factors driving the India Aesthetic Medicine Market?

The growth of the India Aesthetic Medicine Market is driven by increasing consumer awareness about aesthetic procedures, rising disposable incomes, and the growing influence of social media on beauty standards. Additionally, advancements in technology and techniques are making these procedures more accessible.

What challenges does the India Aesthetic Medicine Market face?

The India Aesthetic Medicine Market faces challenges such as regulatory hurdles, the high cost of advanced treatments, and a lack of skilled professionals. These factors can hinder market growth and limit access to aesthetic services.

What opportunities exist in the India Aesthetic Medicine Market?

Opportunities in the India Aesthetic Medicine Market include the expansion of telemedicine for consultations, the introduction of new and innovative products, and the increasing demand for minimally invasive procedures. These trends are likely to shape the future of the market.

What trends are shaping the India Aesthetic Medicine Market?

Trends in the India Aesthetic Medicine Market include a growing preference for non-surgical treatments, the rise of personalized aesthetic solutions, and the integration of technology such as AI in treatment planning. These trends reflect changing consumer preferences and advancements in the field.

India Aesthetic Medicine Market

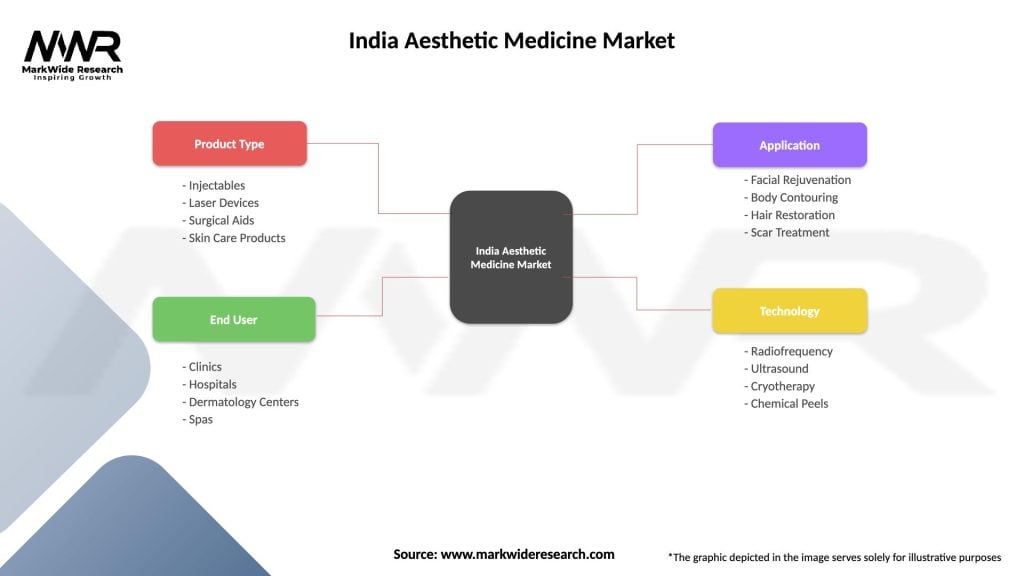

| Segmentation Details | Description |

|---|---|

| Product Type | Injectables, Laser Devices, Surgical Aids, Skin Care Products |

| End User | Clinics, Hospitals, Dermatology Centers, Spas |

| Application | Facial Rejuvenation, Body Contouring, Hair Restoration, Scar Treatment |

| Technology | Radiofrequency, Ultrasound, Cryotherapy, Chemical Peels |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Aesthetic Medicine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at