444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India Active Pharmaceutical Ingredients (API) market is a crucial sector in the pharmaceutical industry, playing a vital role in the production of drugs and medications. API refers to the active substances that are responsible for the therapeutic effects of pharmaceutical products. These ingredients are the primary components that impart the desired pharmacological activity to drugs. The Indian API market has witnessed significant growth in recent years, driven by factors such as the increasing demand for affordable medicines, the availability of skilled labor, and favorable government initiatives.

Meaning

Active Pharmaceutical Ingredients (APIs) are the chemical substances responsible for the therapeutic effect of a drug. They are biologically active components that provide the desired pharmacological activity in pharmaceutical formulations. APIs can be sourced from various materials, including plant, animal, or chemical synthesis. They are the core elements in drug development and play a crucial role in ensuring the safety, efficacy, and quality of medications.

Executive Summary

The India Active Pharmaceutical Ingredients (API) market has experienced substantial growth over the years, driven by factors such as the rising demand for generic drugs, a large pool of skilled labor, and favorable government initiatives promoting pharmaceutical manufacturing. The market is characterized by the presence of both domestic and multinational companies, offering a wide range of APIs to cater to the domestic and global demand. However, the industry also faces challenges such as regulatory compliance, increasing competition, and the need for continuous innovation.

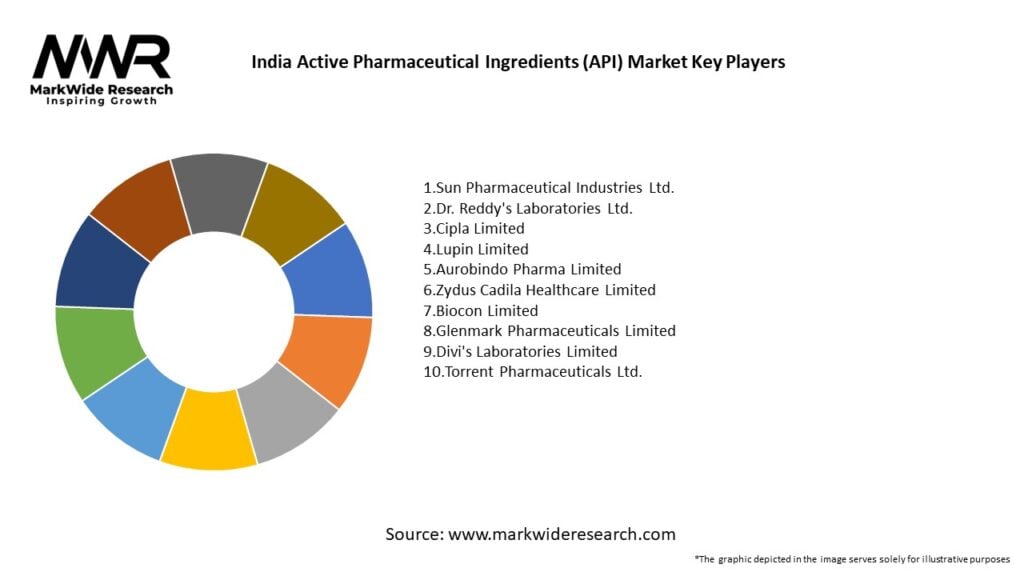

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India API market operates in a dynamic environment influenced by various factors, including government policies, regulatory landscape, healthcare trends, and global market dynamics. The industry’s growth is driven by increasing healthcare expenditure, demand for generic drugs, and favorable government initiatives. However, it also faces challenges such as regulatory compliance, competition, and the need for continuous innovation. The market offers opportunities for expansion through exports, contract manufacturing, R&D, specialty APIs, and collaborations.

Regional Analysis

The India API market exhibits regional variations in terms of production, consumption, and market dynamics. Key regions for API manufacturing include Maharashtra, Gujarat, Andhra Pradesh, Telangana, and Tamil Nadu, which have well-established pharmaceutical clusters. These regions benefit from infrastructure, skilled labor, and supportive government policies. Major pharmaceutical hubs such as Mumbai, Hyderabad, and Ahmedabad are home to several API manufacturers. The southern region of India also contributes significantly to API production. The demand for APIs is not limited to domestic consumption, as Indian manufacturers export to various regions worldwide, including North America, Europe, and Asia-Pacific.

Competitive Landscape

Leading Companies in the India Active Pharmaceutical Ingredients (API) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India API market can be segmented based on various factors, including type, synthesis process, therapeutic area, and customer base. The following are some common segmentation criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The India API market offers several benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the India API market. The global demand for pharmaceutical products, including APIs, surged during the pandemic, driven by the need for treatments and vaccines. Indian API manufacturers played a crucial role in supplying essential drugs and APIs to both domestic and international markets. However, the pandemic also exposed vulnerabilities in the supply chain, highlighting the need for self-sufficiency and reducing dependence on imports for critical APIs. The industry witnessed disruptions in raw material supply, logistics, and manufacturing operations due to lockdowns and restrictions. This led to increased focus on building resilient supply chains, enhancing manufacturing capabilities, and accelerating research and development efforts.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the India API market looks promising, driven by factors such as the increasing demand for generic drugs, government initiatives promoting domestic manufacturing, and the country’s cost competitiveness. The industry is expected to witness continued growth, with a focus on innovation, quality control, and compliance. Investments in R&D, digital transformation, and sustainability will be key drivers of success. Additionally, the industry will continue to explore export opportunities and collaborations with global partners. However, challenges such as regulatory compliance, intellectual property concerns, and global competition will need to be addressed to sustain growth and maintain a competitive edge.

Conclusion

The India Active Pharmaceutical Ingredients (API) market plays a critical role in the pharmaceutical industry, providing the essential active substances responsible for the therapeutic effects of drugs. The market has witnessed significant growth, driven by factors such as the increasing demand for affordable medicines, favorable government initiatives, and cost competitiveness. However, the industry faces challenges such as regulatory compliance, increasing competition, and the need for continuous innovation. Opportunities lie in expanding exports, contract manufacturing, research and development, specialty APIs, and collaborations. The future outlook for the Indian API market is positive, with a focus on quality, innovation, and sustainability. By addressing challenges and leveraging opportunities, the industry can continue to thrive and contribute to the healthcare needs of India and the global market.

What is Active Pharmaceutical Ingredients (API)?

Active Pharmaceutical Ingredients (API) are the biologically active components in pharmaceutical drugs that are responsible for their therapeutic effects. They are essential in the formulation of medications and can be derived from natural or synthetic sources.

What are the key players in the India Active Pharmaceutical Ingredients (API) Market?

Key players in the India Active Pharmaceutical Ingredients (API) Market include Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, and Cipla, among others. These companies are involved in the production and supply of various APIs for different therapeutic areas.

What are the growth factors driving the India Active Pharmaceutical Ingredients (API) Market?

The growth of the India Active Pharmaceutical Ingredients (API) Market is driven by increasing demand for generic drugs, rising healthcare expenditures, and advancements in pharmaceutical research and development. Additionally, the growing prevalence of chronic diseases is contributing to market expansion.

What challenges does the India Active Pharmaceutical Ingredients (API) Market face?

The India Active Pharmaceutical Ingredients (API) Market faces challenges such as stringent regulatory requirements, high production costs, and competition from low-cost manufacturers in other countries. These factors can impact the profitability and sustainability of API production.

What opportunities exist in the India Active Pharmaceutical Ingredients (API) Market?

Opportunities in the India Active Pharmaceutical Ingredients (API) Market include the increasing focus on biopharmaceuticals, the expansion of contract manufacturing organizations, and the potential for export growth to emerging markets. These factors can enhance the market’s growth trajectory.

What trends are shaping the India Active Pharmaceutical Ingredients (API) Market?

Trends shaping the India Active Pharmaceutical Ingredients (API) Market include the shift towards sustainable manufacturing practices, the adoption of advanced technologies like AI in drug development, and the growing emphasis on quality and compliance in API production. These trends are influencing how companies operate in the market.

India Active Pharmaceutical Ingredients (API) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Generic APIs, Specialty APIs, Biologics, Contract Manufacturing |

| End User | Pharmaceutical Companies, Contract Research Organizations, Biotechnology Firms, Academic Institutions |

| Application | Cardiovascular, Oncology, Neurology, Infectious Diseases |

| Form | Tablets, Injectables, Powders, Granules |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Active Pharmaceutical Ingredients (API) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at