444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The In-Flight Connectivity market refers to the provision of internet connectivity and communication services to passengers on board an aircraft. With the increasing reliance on digital devices and the need for constant connectivity, the demand for in-flight connectivity has been steadily rising. This market analysis aims to provide a comprehensive understanding of the in-flight connectivity industry, including its meaning, key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, industry trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

In-Flight Connectivity enables passengers to stay connected to the internet, access emails, browse the web, and use social media platforms during their flight. This connectivity is made possible through various technologies, including satellite-based systems, air-to-ground networks, and hybrid solutions. In-flight connectivity enhances the passenger experience, improves operational efficiency, and opens up new revenue streams for airlines.

Executive Summary

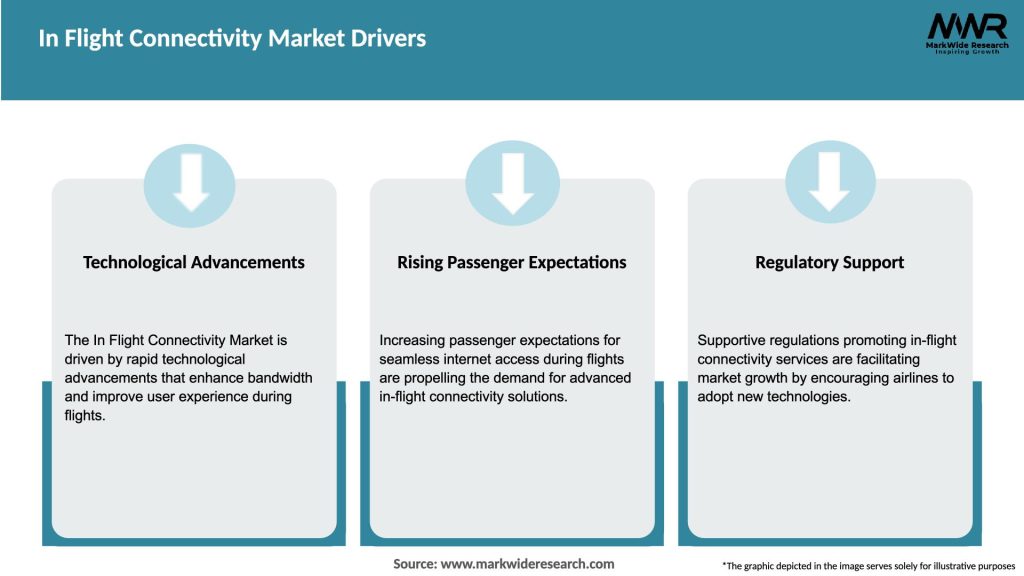

The in-flight connectivity market has experienced significant growth in recent years, driven by the increasing demand for seamless internet connectivity, the rise of connected aircraft, and advancements in satellite communication technologies. This analysis provides valuable insights into the market, including key statistics, trends, challenges, and growth opportunities.

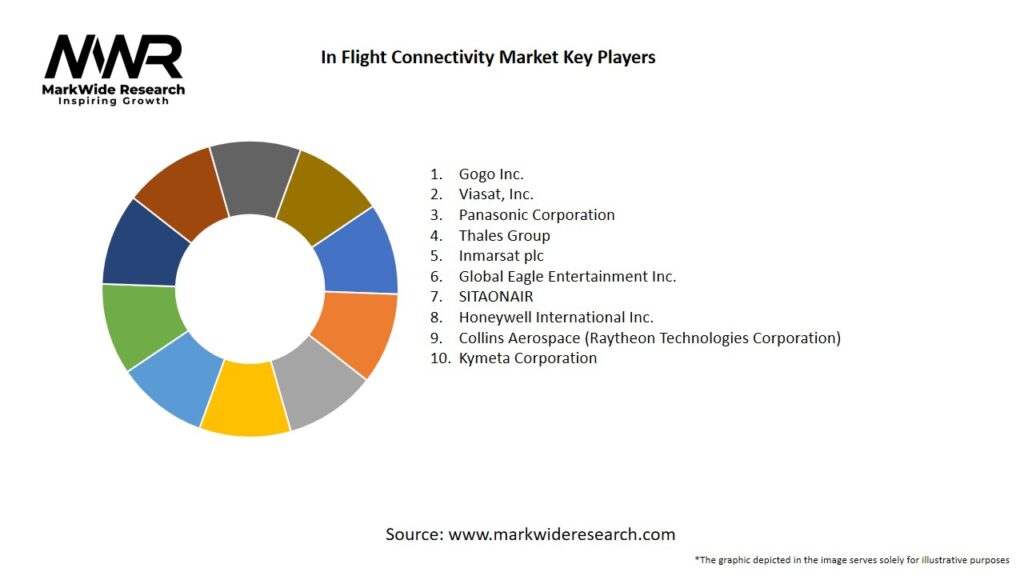

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The in-flight connectivity market is dynamic and influenced by various factors, including technological advancements, changing consumer expectations, regulatory frameworks, and market competition. The industry is witnessing intense competition among satellite providers, telecommunication companies, and connectivity service providers. Companies are investing in research and development to enhance the speed, reliability, and coverage of in-flight connectivity solutions.

Regional Analysis

The market for in-flight connectivity is geographically diverse, with North America leading in terms of market share, followed by Europe and the Asia Pacific. North America has a high adoption rate of in-flight connectivity services, driven by the presence of major airlines, advanced technology infrastructure, and the willingness of passengers to pay for connectivity. Europe is also witnessing significant growth, supported by regulatory initiatives promoting in-flight connectivity and the increasing number of low-cost carriers. The Asia Pacific region holds immense growth potential due to the rising air passenger traffic and increasing disposable income of the population.

Competitive Landscape

Leading companies in the In-Flight Connectivity Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

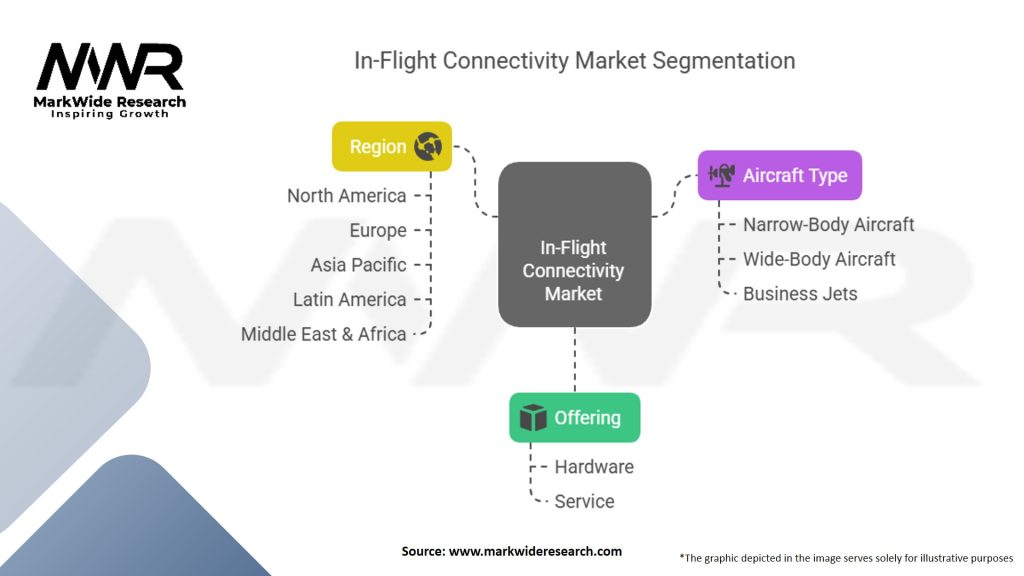

Segmentation

The market can be segmented based on connectivity type, hardware, service, and aircraft type. The connectivity types include satellite-based and air-to-ground networks. Hardware components include antennas, modems, routers, and access points. Services comprise of passenger connectivity, crew connectivity, and operational connectivity. Aircraft types include commercial, business, and general aviation.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic severely impacted the aviation industry, leading to a significant decline in air travel and reduced demand for in-flight connectivity. However, as the industry recovers, the demand for connectivity services is expected to rebound, driven by the growing emphasis on health and safety measures, contactless services, and the need for digital communication during flights.

Key Industry Developments

Analyst Suggestions

Future Outlook

The in-flight connectivity market is poised for significant growth in the coming years. As the aviation industry recovers from the impact of the pandemic, the demand for seamless connectivity, enhanced passenger experiences, and operational efficiency will drive the market. Advancements in satellite technology, the integration of 5G and IoT, and the development of hybrid connectivity solutions will shape the future of in-flight connectivity. The industry is expected to witness increased competition, innovation, and collaborations, leading to improved connectivity options and expanded service coverage.

Conclusion

In-flight connectivity has become an essential feature in the aviation industry, providing passengers with internet access and communication services during their flights. This market analysis has explored various aspects of the in-flight connectivity market, including its meaning, key insights, market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, industry trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

The market is poised for growth, driven by technological advancements, increasing demand for connectivity, and the potential for ancillary revenue generation. As the industry evolves, the focus will be on delivering seamless, reliable, and secure connectivity solutions that enhance the overall passenger experience.

What is in flight connectivity?

In flight connectivity refers to the ability of passengers to access the internet and other communication services while on an aircraft. This includes Wi-Fi, mobile data services, and entertainment options that enhance the travel experience.

Who are the key players in the in flight connectivity market?

Key players in the in flight connectivity market include Gogo, Viasat, and Inmarsat, which provide various connectivity solutions for airlines. These companies are known for their innovative technologies and partnerships with airlines to enhance passenger experience, among others.

What are the main drivers of growth in the in flight connectivity market?

The main drivers of growth in the in flight connectivity market include increasing passenger demand for internet access during flights, advancements in satellite technology, and the rising trend of digitalization in the aviation industry. Airlines are also recognizing the importance of connectivity for customer satisfaction.

What challenges does the in flight connectivity market face?

The in flight connectivity market faces challenges such as high installation and maintenance costs, regulatory hurdles, and varying levels of service quality across different airlines. Additionally, competition among service providers can impact pricing and service offerings.

What opportunities exist in the in flight connectivity market?

Opportunities in the in flight connectivity market include the expansion of 5G technology, which can enhance connectivity speeds, and the growing demand for personalized in-flight entertainment options. There is also potential for partnerships between airlines and tech companies to innovate services.

What trends are shaping the in flight connectivity market?

Trends shaping the in flight connectivity market include the increasing integration of IoT devices, the rise of streaming services for in-flight entertainment, and the focus on improving user experience through faster and more reliable internet connections. Sustainability initiatives are also influencing technology choices.

In-Flight Connectivity Market

| Segmentation Details | Information |

|---|---|

| Offering | Hardware, Service |

| Aircraft Type | Narrow-Body Aircraft, Wide-Body Aircraft, Business Jets |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the In-Flight Connectivity Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at