444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The in-dash navigation system market represents a rapidly evolving segment within the automotive technology industry, driven by increasing consumer demand for advanced driver assistance and connectivity features. These integrated systems have transformed from basic GPS functionality to sophisticated platforms that combine navigation, entertainment, communication, and vehicle management capabilities. Market dynamics indicate substantial growth potential as automotive manufacturers increasingly adopt these systems as standard equipment rather than optional features.

Consumer preferences have shifted dramatically toward vehicles equipped with comprehensive infotainment systems that seamlessly integrate with smartphones and provide real-time traffic updates, voice recognition, and intuitive touchscreen interfaces. The market encompasses various technology types including embedded systems, smartphone integration platforms, and hybrid solutions that combine multiple connectivity options. Growth projections suggest the market will expand at a CAGR of 8.2% through the forecast period, driven by technological advancements and increasing vehicle production globally.

Regional variations in adoption rates reflect different consumer preferences, regulatory requirements, and infrastructure development levels. North America and Europe currently dominate market share due to higher vehicle penetration rates and consumer willingness to invest in advanced automotive technologies. However, emerging markets in Asia-Pacific are experiencing rapid growth as disposable incomes rise and automotive manufacturing expands in these regions.

The in-dash navigation system market refers to the comprehensive ecosystem of integrated automotive infotainment and navigation solutions that are permanently installed within vehicle dashboards, providing drivers with GPS navigation, multimedia entertainment, connectivity features, and vehicle information management through centralized touchscreen interfaces and voice control systems.

These systems encompass a broad range of technologies including GPS receivers, digital mapping software, wireless connectivity modules, audio processing units, and user interface components. Modern in-dash navigation systems extend far beyond simple route guidance to include features such as real-time traffic monitoring, weather updates, smartphone integration, hands-free calling, music streaming, and vehicle diagnostics. Integration capabilities with platforms like Apple CarPlay and Android Auto have become essential features that consumers expect in contemporary vehicles.

Market participants include automotive original equipment manufacturers (OEMs), tier-one suppliers, software developers, mapping service providers, and semiconductor manufacturers who collectively contribute to the development and deployment of these sophisticated systems. The market also encompasses aftermarket solutions that can be installed in older vehicles, though the primary focus remains on factory-installed systems that offer seamless integration with vehicle electronics and safety systems.

The in-dash navigation system market demonstrates robust growth momentum driven by technological innovation, changing consumer expectations, and increasing automotive production worldwide. Key market drivers include the proliferation of connected vehicles, advancement in artificial intelligence and machine learning technologies, and growing emphasis on driver safety and convenience features. Market penetration rates have reached approximately 72% in premium vehicle segments and continue expanding into mid-range and economy vehicle categories.

Technological convergence represents a defining characteristic of the current market landscape, with navigation systems increasingly integrated with advanced driver assistance systems (ADAS), vehicle-to-everything (V2X) communication, and autonomous driving technologies. Major automotive manufacturers are investing heavily in developing proprietary infotainment platforms while simultaneously partnering with technology companies to enhance system capabilities and user experiences.

Competitive dynamics involve traditional automotive suppliers competing with technology giants and specialized software companies. The market structure continues evolving as new entrants introduce innovative solutions and established players expand their technological capabilities through strategic acquisitions and partnerships. Consumer adoption patterns indicate strong preference for systems offering seamless smartphone integration, voice control, and over-the-air update capabilities.

Market analysis reveals several critical insights that shape the current and future landscape of in-dash navigation systems. The following key insights provide comprehensive understanding of market dynamics:

Several key factors drive the expansion and evolution of the in-dash navigation system market, creating sustained demand and encouraging continued innovation. Consumer expectations for connected and intelligent vehicle experiences represent the primary driver, as buyers increasingly view advanced infotainment systems as essential rather than luxury features.

Technological advancement in semiconductor technology, wireless communication, and software development enables manufacturers to offer more sophisticated systems at competitive price points. The proliferation of 5G networks enhances connectivity capabilities, enabling real-time data exchange and cloud-based services that significantly improve navigation accuracy and functionality. Integration opportunities with smart home systems, personal digital assistants, and mobile applications create ecosystem benefits that encourage adoption.

Regulatory initiatives promoting vehicle safety and reducing driver distraction support market growth by encouraging hands-free operation and voice-controlled interfaces. Government mandates for emergency calling systems and vehicle tracking capabilities in various regions create additional demand for connected navigation systems. Automotive industry trends toward electrification and autonomous driving create new opportunities for advanced navigation systems that can optimize energy consumption and support self-driving capabilities.

Economic factors including rising disposable incomes in emerging markets and increasing vehicle ownership rates contribute to market expansion. The growing popularity of ride-sharing and fleet management services creates demand for commercial-grade navigation systems with advanced tracking and optimization capabilities.

Despite strong growth potential, the in-dash navigation system market faces several challenges that may limit expansion or create implementation difficulties. High development costs associated with creating sophisticated infotainment systems can strain manufacturer budgets, particularly for smaller automotive companies or those operating in price-sensitive market segments.

Technical complexity presents ongoing challenges as systems become more sophisticated and integrate with multiple vehicle systems. Ensuring reliable operation, minimizing software bugs, and maintaining compatibility across different hardware platforms requires significant engineering resources and expertise. Cybersecurity concerns have become increasingly important as connected systems create potential vulnerabilities that could compromise vehicle safety or user privacy.

Consumer resistance to complex interfaces and learning curves associated with advanced systems may limit adoption rates, particularly among older demographics or users who prefer simpler solutions. The rapid pace of technological change can result in systems becoming outdated quickly, creating concerns about long-term value and upgrade paths. Infrastructure limitations in certain regions may restrict the effectiveness of connected features and real-time services.

Regulatory compliance requirements vary significantly across different markets, creating additional complexity and costs for manufacturers seeking global distribution. Privacy regulations and data protection requirements may limit the collection and use of user data that could enhance system functionality and personalization capabilities.

Emerging opportunities within the in-dash navigation system market present significant potential for growth and innovation. Artificial intelligence integration offers possibilities for predictive routing, personalized recommendations, and adaptive interfaces that learn from user behavior patterns. Machine learning algorithms can optimize route selection based on historical traffic patterns, weather conditions, and individual preferences.

Autonomous vehicle development creates new market segments requiring advanced navigation systems capable of supporting self-driving capabilities. These systems must provide precise positioning, detailed mapping data, and seamless integration with vehicle sensors and control systems. Electric vehicle adoption presents opportunities for specialized navigation features including charging station location, range optimization, and energy-efficient routing.

Augmented reality integration represents a frontier technology that could transform navigation interfaces by overlaying digital information onto real-world views through windshield displays or camera systems. Voice technology advancement continues creating opportunities for more natural and intuitive user interactions, reducing the need for manual input and enhancing safety.

Commercial vehicle applications offer substantial growth potential as fleet operators seek advanced navigation and tracking capabilities to optimize operations, reduce fuel consumption, and improve driver safety. Aftermarket opportunities exist for upgrading older vehicles with modern navigation capabilities, particularly in regions with large populations of aging vehicle fleets.

The in-dash navigation system market operates within a complex ecosystem of interconnected factors that influence growth patterns, competitive positioning, and technological development. Supply chain dynamics involve multiple tiers of suppliers providing components ranging from semiconductor chips and displays to software platforms and mapping data. According to MarkWide Research analysis, supply chain optimization has improved system cost-effectiveness by approximately 15% over the past three years.

Competitive pressures drive continuous innovation as manufacturers seek to differentiate their offerings through unique features, superior user experiences, and advanced technological capabilities. The market exhibits characteristics of both horizontal and vertical integration, with some companies focusing on specific components while others develop comprehensive end-to-end solutions.

Technology adoption cycles influence market dynamics as new innovations gradually penetrate different vehicle segments and price points. Premium vehicles typically introduce cutting-edge features that eventually cascade to mainstream and economy segments as costs decrease and manufacturing scales increase. Consumer feedback loops play crucial roles in shaping product development priorities and feature enhancement strategies.

Partnership dynamics between automotive manufacturers, technology companies, and service providers create complex relationships that influence market structure and competitive advantages. Strategic alliances enable companies to leverage complementary strengths while sharing development costs and risks associated with advanced technology implementation.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves direct engagement with industry stakeholders including automotive manufacturers, system suppliers, technology providers, and end-users through structured interviews, surveys, and focus groups. This approach provides firsthand insights into market trends, challenges, and opportunities from various perspectives.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, regulatory documents, and trade publications to gather quantitative data and validate primary research findings. Market modeling techniques utilize statistical analysis and forecasting algorithms to project future market trends and identify growth opportunities across different segments and regions.

Technology assessment involves evaluation of current and emerging technologies, their maturity levels, adoption rates, and potential impact on market dynamics. This includes analysis of patent landscapes, research and development investments, and technology roadmaps published by major industry participants. Competitive intelligence gathering provides insights into competitor strategies, product portfolios, and market positioning approaches.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. Regular updates and revisions maintain research currency as market conditions evolve and new information becomes available.

North America maintains a leading position in the in-dash navigation system market, accounting for approximately 35% of global market share. The region benefits from high vehicle penetration rates, consumer willingness to adopt advanced technologies, and presence of major automotive manufacturers and technology companies. United States market dynamics are particularly influenced by consumer preferences for large vehicles with comprehensive infotainment systems and strong smartphone integration capabilities.

Europe represents a significant market segment with approximately 30% market share, characterized by stringent safety regulations, environmental consciousness, and preference for premium automotive features. German automotive manufacturers lead innovation in integrated navigation systems, while regulatory requirements for emergency calling systems drive adoption across the region. Nordic countries demonstrate particularly high adoption rates due to advanced infrastructure and technology-forward consumer preferences.

Asia-Pacific emerges as the fastest-growing regional market, with growth rates exceeding 12% annually in several key countries. China’s automotive market expansion drives significant demand for navigation systems, while local manufacturers increasingly develop proprietary solutions tailored to regional preferences and requirements. Japan and South Korea contribute advanced technology development and manufacturing capabilities.

Emerging markets in Latin America, Middle East, and Africa present substantial long-term growth potential as vehicle ownership rates increase and consumer preferences evolve toward connected automotive experiences. However, infrastructure limitations and price sensitivity create unique challenges requiring adapted product strategies and business models.

The competitive landscape encompasses diverse participants ranging from traditional automotive suppliers to technology giants and specialized software companies. Market leadership positions are held by companies that successfully combine hardware manufacturing capabilities with software development expertise and strategic partnerships.

Competitive strategies focus on technological differentiation, strategic partnerships, and vertical integration to create comprehensive solutions that address evolving consumer needs and automotive industry requirements.

Market segmentation provides detailed analysis of different product categories, applications, and distribution channels within the in-dash navigation system market. Technology-based segmentation distinguishes between embedded systems, smartphone integration platforms, and hybrid solutions that combine multiple connectivity options.

By Technology:

By Vehicle Type:

By Sales Channel:

Embedded navigation systems continue dominating the premium vehicle segment due to their seamless integration with vehicle electronics and superior performance characteristics. These systems offer advantages including faster startup times, dedicated processing power, and integration with vehicle sensors and safety systems. Market share for embedded systems remains strong at approximately 55% of total installations, though smartphone integration platforms are gaining ground rapidly.

Smartphone integration platforms experience the fastest growth rates, particularly in mid-range and economy vehicle segments where cost considerations are paramount. Apple CarPlay and Android Auto adoption has reached 78% of new vehicle models globally, reflecting consumer demand for familiar interfaces and seamless connectivity with personal devices. These platforms offer advantages including regular software updates, access to latest applications, and reduced development costs for automotive manufacturers.

Commercial vehicle applications represent a specialized but growing market segment with unique requirements including fleet management integration, driver behavior monitoring, and regulatory compliance features. Growth rates in this segment exceed 10% annually as businesses increasingly recognize the value of advanced navigation and tracking capabilities for operational efficiency and cost reduction.

Electric vehicle integration creates new opportunities for specialized navigation features that optimize energy consumption, locate charging stations, and provide range predictions based on driving conditions and battery status. This emerging category demonstrates significant potential as electric vehicle adoption accelerates globally.

Automotive manufacturers benefit from in-dash navigation systems through enhanced product differentiation, increased customer satisfaction, and opportunities for recurring revenue through connected services and software updates. Integration advantages include improved vehicle safety through hands-free operation, enhanced brand image through advanced technology offerings, and potential cost savings through platform standardization across vehicle models.

Technology suppliers gain access to the large and growing automotive market while leveraging their expertise in software development, semiconductor design, and connectivity solutions. Partnership opportunities with automotive manufacturers provide stable revenue streams and platforms for innovation, while the automotive industry’s emphasis on quality and reliability drives technological advancement and manufacturing excellence.

Consumers receive significant value through improved driving experiences, enhanced safety features, and access to real-time information and entertainment options. Convenience benefits include reduced driver distraction, optimized routing, and seamless integration with personal digital ecosystems. Long-term value comes from over-the-air updates that continuously improve functionality and add new features.

Fleet operators achieve operational benefits including reduced fuel consumption through optimized routing, improved driver safety through hands-free communication, and enhanced asset tracking and management capabilities. Cost savings result from reduced administrative overhead, improved maintenance scheduling, and better resource utilization through data-driven insights.

Strengths:

Weaknesses:

Opportunities:

Threats:

Voice control technology represents one of the most significant trends transforming user interaction with in-dash navigation systems. Natural language processing advancement enables more intuitive communication, while AI-powered assistants provide contextual responses and proactive suggestions. This trend reduces driver distraction and improves accessibility for users with different technical comfort levels.

Over-the-air update capabilities are becoming standard features that enable continuous system improvement without requiring physical service visits. Software-defined vehicles concept drives this trend as manufacturers seek to maintain customer relationships beyond the initial sale and provide ongoing value through feature additions and performance enhancements.

Augmented reality integration emerges as a next-generation interface technology that overlays digital navigation information onto real-world views through windshield displays or camera systems. Early implementations focus on turn-by-turn directions and point-of-interest identification, with future developments expected to include hazard warnings and advanced driver assistance integration.

Personalization and machine learning enable systems to adapt to individual user preferences, driving patterns, and behavioral characteristics. Predictive capabilities anticipate user needs and provide proactive suggestions for routes, destinations, and services based on historical data and current context.

Cloud connectivity expansion enables access to vast databases of real-time information including traffic conditions, weather updates, parking availability, and points of interest. Edge computing integration balances cloud capabilities with local processing to ensure responsive performance and maintain functionality during connectivity interruptions.

Strategic partnerships between automotive manufacturers and technology companies continue reshaping the competitive landscape. Recent collaborations focus on developing integrated platforms that combine navigation, entertainment, and vehicle management functions while ensuring seamless user experiences across different touchpoints.

Acquisition activities demonstrate industry consolidation as companies seek to acquire complementary technologies and expertise. Notable transactions include automotive suppliers acquiring software companies and technology giants investing in automotive-focused startups to accelerate their entry into the connected vehicle market.

Regulatory developments influence product requirements and market dynamics, particularly regarding cybersecurity standards, privacy protection, and driver distraction guidelines. Government initiatives promoting vehicle safety and emergency response capabilities create new requirements for navigation system functionality and connectivity.

Technology breakthroughs in areas such as 5G connectivity, edge computing, and artificial intelligence enable new capabilities and use cases for in-dash navigation systems. Research investments focus on improving positioning accuracy, reducing power consumption, and enhancing user interface design.

Market expansion into new geographic regions and vehicle segments creates opportunities for growth and diversification. Localization efforts adapt systems to regional preferences, languages, and regulatory requirements while maintaining core functionality and user experience standards.

Industry participants should prioritize investment in artificial intelligence and machine learning capabilities to create differentiated user experiences and maintain competitive advantages. MWR analysis indicates that companies implementing advanced AI features achieve 23% higher customer satisfaction rates compared to those offering basic navigation functionality.

Strategic partnerships with technology companies, mapping service providers, and connectivity specialists are essential for accessing required expertise and reducing development costs. Collaboration approaches should focus on creating integrated ecosystems rather than standalone products, enabling comprehensive solutions that address multiple user needs simultaneously.

Cybersecurity investment must be prioritized as connected systems create potential vulnerabilities that could compromise user safety and privacy. Security-by-design principles should be implemented from the earliest development stages, with regular security audits and update mechanisms to address emerging threats.

User experience optimization requires continuous research and development to ensure interfaces remain intuitive and accessible across different demographic groups and technical comfort levels. Testing methodologies should include diverse user groups and real-world driving scenarios to validate system performance and usability.

Market expansion strategies should consider regional preferences, infrastructure limitations, and regulatory requirements when entering new geographic markets. Localization efforts must extend beyond language translation to include cultural preferences, driving patterns, and local service integration.

The in-dash navigation system market is positioned for continued expansion driven by technological advancement, increasing vehicle connectivity, and evolving consumer expectations. Growth projections indicate the market will maintain robust expansion with projected CAGR of 8.5% through the next five years, supported by increasing adoption in emerging markets and advancement in autonomous vehicle technologies.

Autonomous vehicle development will create new requirements for navigation systems capable of supporting self-driving capabilities while maintaining human-machine interface functionality for mixed-mode operation. Technology convergence between navigation, advanced driver assistance systems, and vehicle control platforms will create comprehensive mobility solutions that extend beyond traditional navigation functions.

Artificial intelligence integration will enable predictive capabilities, personalized experiences, and proactive assistance that anticipates user needs and optimizes travel experiences. Machine learning algorithms will continuously improve system performance based on user behavior patterns, traffic data, and environmental conditions.

Connectivity evolution through 5G networks and edge computing will enable real-time data processing, enhanced mapping accuracy, and new service capabilities that require high-bandwidth, low-latency communication. Vehicle-to-everything (V2X) communication will integrate navigation systems with smart infrastructure and other vehicles to optimize traffic flow and enhance safety.

Market maturation will likely result in industry consolidation as smaller players are acquired by larger companies seeking to expand their technological capabilities and market reach. Standardization efforts may emerge to ensure interoperability between different systems and platforms while maintaining competitive differentiation through user experience and feature innovation.

The in-dash navigation system market represents a dynamic and rapidly evolving sector within the automotive technology industry, characterized by continuous innovation, increasing consumer adoption, and expanding integration with vehicle systems and external services. Market fundamentals remain strong with sustained growth driven by technological advancement, changing consumer preferences, and increasing vehicle connectivity requirements.

Key success factors for market participants include investment in advanced technologies such as artificial intelligence and machine learning, development of strategic partnerships with complementary companies, and focus on user experience optimization across diverse demographic groups and use cases. Competitive advantages will increasingly depend on the ability to create integrated ecosystems that combine navigation, entertainment, communication, and vehicle management functions seamlessly.

Future market development will be shaped by autonomous vehicle adoption, 5G connectivity deployment, and continued advancement in artificial intelligence and machine learning technologies. Industry participants who successfully navigate these technological transitions while maintaining focus on user needs and safety requirements will be best positioned to capture growth opportunities and maintain market leadership positions in this evolving landscape.

What is In-dash Navigation System?

In-dash Navigation Systems are integrated devices within vehicles that provide navigation assistance, including GPS functionality, route planning, and real-time traffic updates. They enhance the driving experience by offering features such as voice commands and multimedia integration.

What are the key players in the In-dash Navigation System Market?

Key players in the In-dash Navigation System Market include Garmin, TomTom, and Bosch, which are known for their innovative navigation solutions and technology advancements. These companies focus on enhancing user experience and integrating advanced features into their systems, among others.

What are the main drivers of growth in the In-dash Navigation System Market?

The growth of the In-dash Navigation System Market is driven by increasing demand for advanced driver assistance systems, rising smartphone integration, and the growing emphasis on safety and convenience in vehicles. Additionally, the expansion of smart cities and connected vehicles contributes to market growth.

What challenges does the In-dash Navigation System Market face?

The In-dash Navigation System Market faces challenges such as high development costs, rapid technological changes, and competition from smartphone navigation applications. Additionally, consumer preferences for mobile solutions can impact the adoption of in-dash systems.

What opportunities exist in the In-dash Navigation System Market?

Opportunities in the In-dash Navigation System Market include the integration of artificial intelligence for personalized navigation experiences and the potential for partnerships with tech companies to enhance functionality. The rise of electric and autonomous vehicles also presents new avenues for innovation.

What trends are shaping the In-dash Navigation System Market?

Trends in the In-dash Navigation System Market include the increasing use of cloud-based services for real-time updates, the incorporation of augmented reality for navigation, and the growing focus on user-friendly interfaces. These trends aim to improve the overall driving experience and safety.

In-dash Navigation System Market

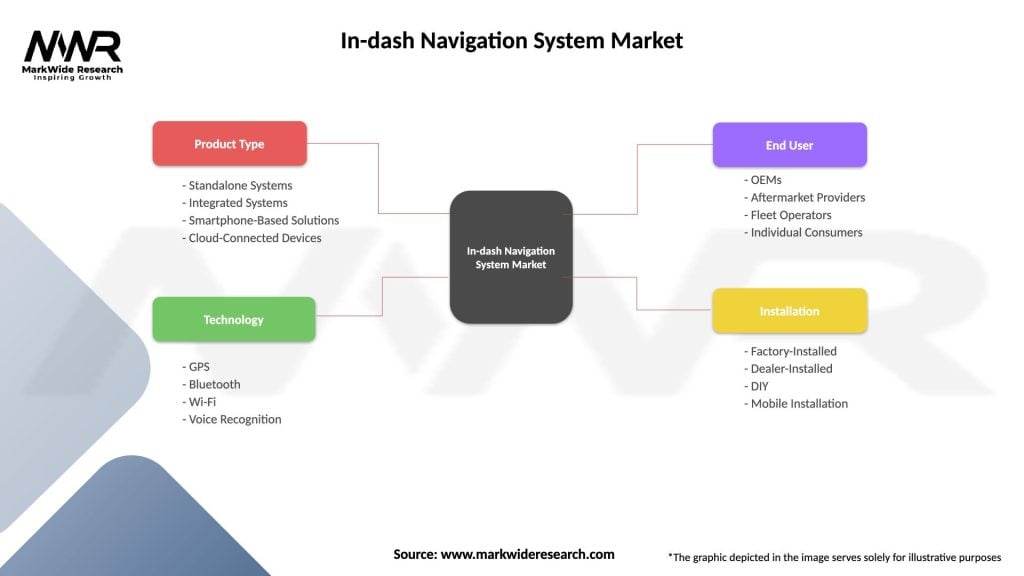

| Segmentation Details | Description |

|---|---|

| Product Type | Standalone Systems, Integrated Systems, Smartphone-Based Solutions, Cloud-Connected Devices |

| Technology | GPS, Bluetooth, Wi-Fi, Voice Recognition |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Individual Consumers |

| Installation | Factory-Installed, Dealer-Installed, DIY, Mobile Installation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the In-dash Navigation System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at