444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The in car infotainment system market represents a rapidly evolving segment of the automotive technology industry, characterized by sophisticated integration of entertainment, navigation, communication, and vehicle control systems. Modern infotainment systems have transformed from basic radio units into comprehensive digital platforms that serve as the central hub for driver and passenger interaction with vehicle functions and external connectivity.

Market dynamics indicate robust growth driven by increasing consumer demand for connected vehicle experiences and advanced driver assistance features. The industry is experiencing significant expansion with a projected CAGR of 8.2% through the forecast period, reflecting strong adoption across both premium and mass-market vehicle segments. Technology integration continues to advance with artificial intelligence, voice recognition, and smartphone connectivity becoming standard features.

Regional distribution shows North America and Europe maintaining leadership positions, while Asia-Pacific emerges as the fastest-growing market with 42% of global adoption expected by 2030. Automotive manufacturers are increasingly prioritizing infotainment capabilities as key differentiators in competitive markets, driving innovation in user interface design, processing power, and connectivity options.

The in car infotainment system market refers to the comprehensive ecosystem of integrated digital platforms, hardware components, software applications, and connectivity solutions designed to provide entertainment, information, navigation, and communication services within automotive environments. These systems combine traditional automotive functions with modern digital technologies to create seamless user experiences.

Core components include touchscreen displays, audio systems, navigation modules, connectivity interfaces, and control units that work together to deliver multimedia content, real-time information, and vehicle management capabilities. Modern infotainment systems integrate with smartphones, cloud services, and vehicle sensors to provide personalized experiences and enhanced functionality.

System architecture encompasses both embedded solutions built into vehicle platforms and aftermarket solutions that can be installed in existing vehicles. Integration capabilities extend to climate control, lighting systems, seat adjustments, and advanced driver assistance systems, creating unified control interfaces for comprehensive vehicle management.

Market expansion in the in car infotainment system sector reflects fundamental shifts in consumer expectations and automotive technology capabilities. Digital transformation within the automotive industry has positioned infotainment systems as critical components for vehicle differentiation and customer satisfaction, with 78% of consumers considering advanced infotainment features essential in vehicle purchasing decisions.

Technology convergence between automotive systems and consumer electronics continues to drive innovation, with artificial intelligence, machine learning, and cloud connectivity enabling personalized user experiences. Market segmentation reveals strong growth across embedded systems, aftermarket solutions, and integrated platforms, with embedded systems maintaining the largest market share due to OEM preferences.

Competitive dynamics feature established automotive suppliers, technology companies, and emerging startups competing to deliver next-generation solutions. Strategic partnerships between automotive manufacturers and technology providers are becoming increasingly common, facilitating rapid innovation and market penetration across diverse vehicle segments and geographic regions.

Market evolution demonstrates several critical insights that shape industry development and strategic planning:

Consumer expectations serve as the primary catalyst for in car infotainment system market expansion, with modern drivers demanding seamless integration between their digital lives and automotive experiences. Smartphone proliferation has established new standards for user interface design, response times, and connectivity capabilities that automotive systems must match or exceed.

Technological advancement in processing power, display technology, and wireless communication enables increasingly sophisticated infotainment capabilities. 5G connectivity deployment provides the bandwidth necessary for real-time streaming, cloud-based applications, and vehicle-to-everything communication, expanding the scope of possible infotainment features and services.

Regulatory support for connected vehicle technologies and safety features creates favorable conditions for infotainment system adoption. Government initiatives promoting intelligent transportation systems and vehicle connectivity standards provide framework for industry development and consumer confidence in advanced automotive technologies.

Automotive industry transformation toward electric and autonomous vehicles creates new opportunities for infotainment system integration and functionality expansion. Vehicle electrification enables more sophisticated electrical architectures that support advanced infotainment capabilities without compromising vehicle performance or efficiency.

High implementation costs present significant challenges for both automotive manufacturers and consumers, particularly in mass-market vehicle segments where price sensitivity remains a critical factor. Advanced infotainment systems require substantial investment in hardware, software development, and ongoing support infrastructure, impacting vehicle pricing and profitability margins.

Technical complexity associated with integrating multiple systems, ensuring cybersecurity, and maintaining reliability creates development challenges and potential failure points. System integration difficulties can lead to performance issues, user frustration, and increased warranty costs for automotive manufacturers.

Cybersecurity concerns regarding connected vehicle systems and personal data protection create consumer hesitation and regulatory scrutiny. Security vulnerabilities in infotainment systems can potentially compromise vehicle safety systems and personal information, requiring ongoing investment in security measures and updates.

Rapid technology evolution creates challenges in maintaining current capabilities and avoiding obsolescence, particularly for embedded systems with longer development cycles than consumer electronics. Technology refresh cycles in automotive applications typically span 5-7 years, while consumer technology evolves much more rapidly.

Emerging markets present substantial growth opportunities as automotive adoption increases and consumer preferences shift toward connected vehicle experiences. Developing economies with growing middle-class populations represent untapped potential for both OEM and aftermarket infotainment solutions, particularly in Asia-Pacific and Latin American regions.

Autonomous vehicle development creates entirely new categories of infotainment applications and user experiences, as passengers gain freedom from driving tasks. Self-driving capabilities enable more immersive entertainment options, productivity applications, and social interaction features that transform vehicle interiors into mobile living spaces.

Subscription service models offer recurring revenue opportunities through premium content, advanced features, and cloud-based services. Software-defined vehicles enable ongoing feature updates and capability expansion, creating long-term customer relationships beyond initial vehicle purchases.

Integration partnerships with technology companies, content providers, and service platforms create opportunities for enhanced functionality and market differentiation. Ecosystem development around infotainment platforms can generate additional revenue streams and strengthen customer loyalty through comprehensive digital experiences.

Competitive forces within the in car infotainment system market reflect the convergence of automotive and technology industries, creating dynamic interactions between traditional suppliers and innovative newcomers. Market consolidation trends show established automotive suppliers acquiring technology companies to enhance their capabilities, while tech giants partner with automakers to gain market access.

Innovation cycles are accelerating as companies compete to deliver next-generation features and capabilities. Development timelines are compressing from traditional automotive cycles to more technology-industry-like rapid iteration, with 65% of manufacturers now implementing annual software updates for infotainment systems.

Supply chain dynamics involve complex relationships between semiconductor manufacturers, software developers, system integrators, and automotive OEMs. Component shortages and supply chain disruptions have highlighted the importance of diversified sourcing strategies and local manufacturing capabilities for critical infotainment components.

Customer feedback loops are becoming more immediate and influential in product development, with over-the-air update capabilities enabling rapid response to user preferences and issue resolution. Data analytics from connected systems provide insights into usage patterns and feature preferences that guide future development priorities.

Comprehensive analysis of the in car infotainment system market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, automotive manufacturers, technology providers, and end-users to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, patent filings, regulatory documents, and financial statements from key market participants. Data triangulation methods verify findings across multiple sources to ensure reliability and reduce bias in market assessments and projections.

Market modeling utilizes statistical analysis, trend extrapolation, and scenario planning to develop accurate forecasts and identify potential market developments. Quantitative analysis combines historical data with current market indicators to project future growth patterns and market dynamics.

Expert validation processes involve review by industry specialists and academic researchers to ensure technical accuracy and market relevance. Continuous monitoring of market developments enables real-time updates to research findings and maintains currency of market intelligence.

North American markets demonstrate strong adoption of advanced infotainment systems, driven by consumer preferences for connectivity and premium vehicle features. United States leadership in technology innovation and early adoption creates favorable conditions for infotainment system development and deployment, with 35% market share globally.

European markets emphasize safety, environmental sustainability, and regulatory compliance in infotainment system design and implementation. German automotive manufacturers lead in premium infotainment system integration, while Scandinavian countries show highest adoption rates for electric vehicle-specific infotainment features.

Asia-Pacific region represents the fastest-growing market segment, with China and India driving volume growth through expanding automotive production and rising consumer incomes. Japanese manufacturers focus on reliability and user experience optimization, while South Korean companies emphasize display technology and connectivity features.

Emerging markets in Latin America, Middle East, and Africa show increasing interest in infotainment capabilities, though price sensitivity remains a significant factor. Local partnerships and adapted product offerings enable market penetration in these regions, with 18% growth rate expected over the forecast period.

Market leadership in the in car infotainment system sector involves diverse players ranging from traditional automotive suppliers to technology giants and specialized software companies. Competitive positioning depends on technological capabilities, manufacturing scale, customer relationships, and innovation speed.

Strategic alliances between automotive manufacturers and technology companies are reshaping competitive dynamics, with partnerships enabling rapid capability development and market access. Innovation focus areas include artificial intelligence integration, voice recognition advancement, and seamless smartphone connectivity.

Market segmentation analysis reveals distinct categories based on technology type, vehicle integration level, and target market segments. Segmentation strategies enable targeted product development and marketing approaches for diverse customer needs and preferences.

By Technology:

By Vehicle Type:

By Price Range:

Embedded infotainment systems maintain market leadership due to superior integration capabilities and OEM preferences for controlled user experiences. Deep integration with vehicle systems enables advanced features like climate control, seat adjustment, and driver assistance system interaction, creating comprehensive cockpit management solutions.

Aftermarket solutions serve existing vehicle populations and price-conscious consumers seeking infotainment upgrades. Retrofit capabilities enable older vehicles to access modern connectivity and entertainment features, with 25% market penetration in vehicles over five years old.

Display technology evolution drives user experience improvements, with larger screens, higher resolutions, and touch responsiveness becoming standard expectations. Multi-screen configurations are gaining popularity in premium vehicles, providing dedicated displays for different functions and passenger zones.

Voice control systems represent rapidly growing functionality, with natural language processing and AI integration enabling more intuitive user interactions. Hands-free operation addresses safety concerns while providing convenient access to infotainment features and vehicle functions.

Automotive manufacturers benefit from infotainment systems as key differentiators in competitive markets, enabling premium pricing and enhanced customer satisfaction. Brand positioning advantages arise from advanced technology integration and superior user experiences that influence purchasing decisions and customer loyalty.

Technology suppliers gain access to large-scale automotive markets with long-term partnership opportunities and recurring revenue potential. Innovation platforms provided by infotainment systems enable technology companies to showcase capabilities and develop new applications for automotive environments.

Consumers benefit from enhanced driving experiences, improved safety through hands-free operation, and seamless integration with digital lifestyles. Convenience features like navigation, communication, and entertainment access improve overall vehicle utility and satisfaction.

Service providers including content creators, app developers, and connectivity services gain new distribution channels and revenue opportunities through infotainment platforms. Ecosystem development creates multiple touchpoints for customer engagement and service delivery.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping infotainment system development, with machine learning algorithms enabling personalized user experiences and predictive functionality. AI capabilities include voice recognition improvement, user preference learning, and intelligent content recommendation systems.

Cloud connectivity expansion enables real-time data processing, over-the-air updates, and access to vast content libraries and services. Edge computing integration reduces latency and improves response times while maintaining cloud connectivity benefits for comprehensive functionality.

Augmented reality integration in navigation and information display creates more intuitive and informative user experiences. AR applications overlay digital information onto real-world views, enhancing navigation accuracy and providing contextual information about surroundings.

Biometric authentication and health monitoring capabilities are emerging as differentiating features, with systems capable of recognizing users and monitoring driver alertness. Wellness integration includes stress detection, fatigue monitoring, and personalized comfort adjustments based on biometric data.

Strategic partnerships between automotive manufacturers and technology companies continue to reshape industry dynamics, with MarkWide Research analysis indicating increasing collaboration frequency and scope. Joint ventures enable rapid capability development and market access for both automotive and technology partners.

Open platform initiatives are gaining momentum as manufacturers seek to create ecosystems that attract third-party developers and content providers. Standardization efforts aim to improve interoperability and reduce development costs while maintaining competitive differentiation.

5G network deployment enables new categories of infotainment applications requiring high bandwidth and low latency connectivity. Vehicle-to-everything communication capabilities create opportunities for enhanced navigation, safety features, and traffic management integration.

Sustainability focus drives development of energy-efficient infotainment systems and environmentally responsible manufacturing processes. Circular economy principles influence design decisions regarding repairability, upgradability, and end-of-life recycling considerations.

Investment priorities should focus on artificial intelligence capabilities, cybersecurity infrastructure, and cloud connectivity platforms to maintain competitive positioning. Technology roadmaps must balance innovation speed with reliability requirements and cost considerations for mass-market adoption.

Partnership strategies require careful evaluation of technology capabilities, market access, and cultural compatibility to ensure successful collaboration outcomes. Ecosystem development should prioritize developer-friendly platforms and clear monetization models to attract third-party participation.

Market entry approaches in emerging regions should consider local preferences, regulatory requirements, and price sensitivity while maintaining core technology advantages. Localization strategies must address language, cultural, and infrastructure differences to achieve market success.

Risk management protocols should address cybersecurity threats, supply chain vulnerabilities, and technology obsolescence through diversified strategies and contingency planning. Regulatory compliance preparation requires proactive engagement with policymakers and industry standards organizations.

Market evolution toward software-defined vehicles will fundamentally transform infotainment system architectures and business models, with MWR projections indicating 72% of new vehicles will feature over-the-air update capabilities by 2028. Continuous improvement through software updates will become standard expectations rather than premium features.

Autonomous vehicle integration will create entirely new categories of infotainment applications as passengers gain freedom from driving tasks. Immersive experiences including virtual reality, gaming, and productivity applications will transform vehicle interiors into mobile entertainment and workspace environments.

Sustainability requirements will drive development of more energy-efficient systems and environmentally responsible manufacturing processes. Lifecycle management approaches will emphasize repairability, upgradability, and recycling to meet circular economy objectives and regulatory requirements.

Global market expansion will continue with emerging economies driving volume growth while developed markets focus on premium features and capabilities. Technology democratization will make advanced infotainment features accessible across broader vehicle price ranges, expanding total addressable market significantly.

The in car infotainment system market stands at a pivotal point in its evolution, driven by converging trends in automotive electrification, connectivity advancement, and changing consumer expectations. Market dynamics reflect the successful integration of consumer electronics capabilities with automotive reliability and safety requirements, creating compelling value propositions for manufacturers and consumers alike.

Technology advancement continues to accelerate, with artificial intelligence, cloud connectivity, and advanced user interfaces becoming standard features rather than premium options. Competitive landscape evolution shows increasing collaboration between traditional automotive suppliers and technology companies, fostering innovation and market expansion across diverse geographic regions and vehicle segments.

Future growth prospects remain robust, supported by emerging market expansion, autonomous vehicle development, and continuous feature enhancement through software-defined architectures. Strategic success will depend on balancing innovation speed with reliability requirements, managing cybersecurity risks, and developing sustainable business models that serve diverse customer needs while maintaining profitability and competitive positioning in this dynamic and rapidly evolving market environment.

What is In Car Infotainment System?

In Car Infotainment System refers to integrated multimedia systems in vehicles that provide entertainment, navigation, and communication features. These systems enhance the driving experience by offering connectivity options and access to various applications.

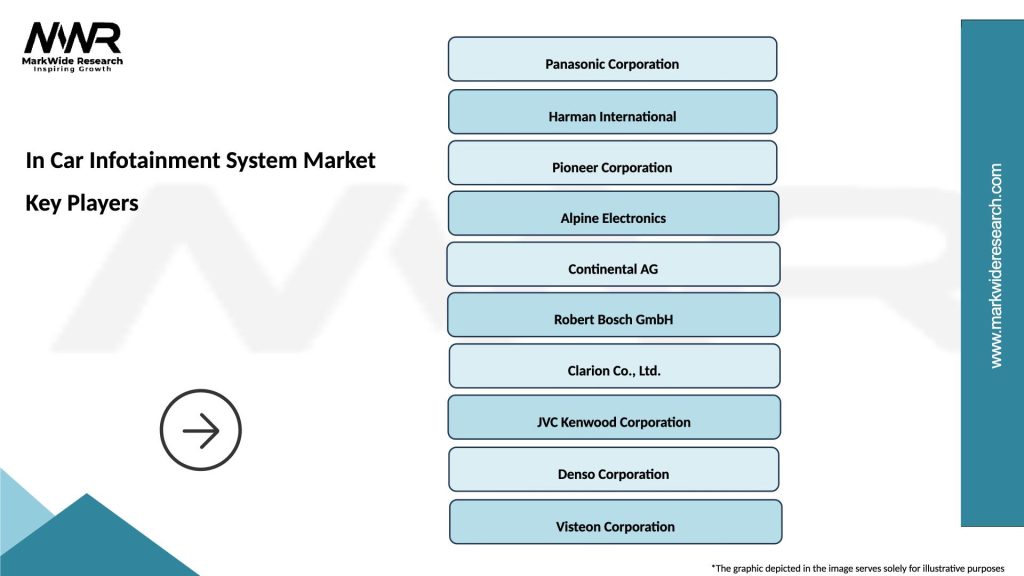

What are the key players in the In Car Infotainment System Market?

Key players in the In Car Infotainment System Market include companies like Bosch, Panasonic, and Harman International, which are known for their innovative technologies and solutions in automotive infotainment, among others.

What are the main drivers of growth in the In Car Infotainment System Market?

The growth of the In Car Infotainment System Market is driven by increasing consumer demand for advanced connectivity features, the rise of smartphone integration, and the growing trend of autonomous driving technologies.

What challenges does the In Car Infotainment System Market face?

Challenges in the In Car Infotainment System Market include the rapid pace of technological change, high development costs, and concerns regarding cybersecurity and data privacy in connected vehicles.

What opportunities exist in the In Car Infotainment System Market?

Opportunities in the In Car Infotainment System Market include the integration of artificial intelligence for personalized user experiences, the expansion of electric vehicles, and the potential for new partnerships with tech companies for enhanced features.

What trends are shaping the In Car Infotainment System Market?

Trends in the In Car Infotainment System Market include the increasing adoption of voice recognition technology, the shift towards cloud-based services for updates and applications, and the growing emphasis on user interface design for better driver interaction.

In Car Infotainment System Market

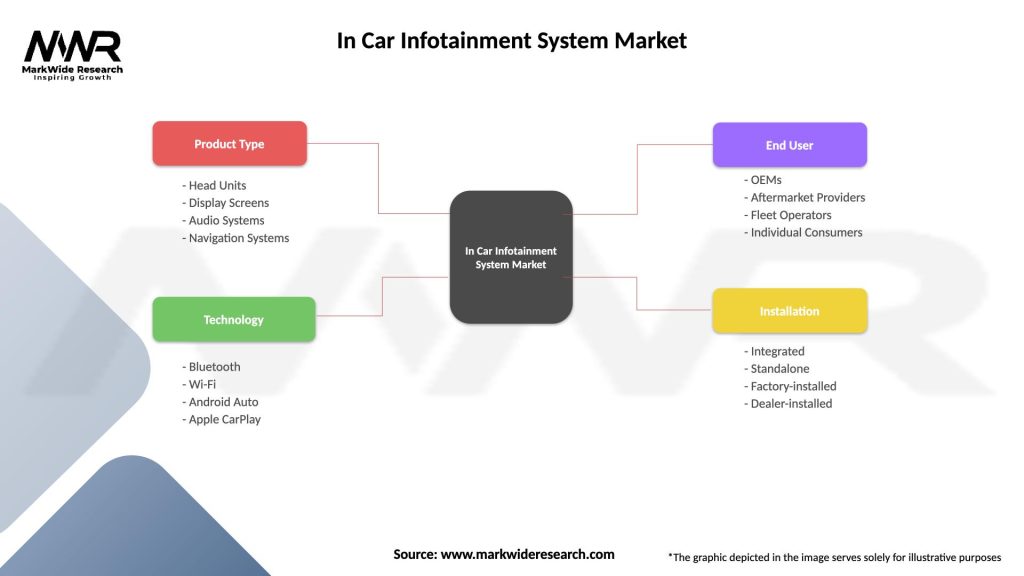

| Segmentation Details | Description |

|---|---|

| Product Type | Head Units, Display Screens, Audio Systems, Navigation Systems |

| Technology | Bluetooth, Wi-Fi, Android Auto, Apple CarPlay |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Individual Consumers |

| Installation | Integrated, Standalone, Factory-installed, Dealer-installed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the In Car Infotainment System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at