444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The implantable hearing devices market stands at the forefront of audiology, offering innovative solutions for individuals with hearing loss. Implantable hearing devices, including cochlear implants and bone-anchored hearing aids, address a wide spectrum of hearing impairments, providing improved auditory outcomes and enhanced quality of life for patients.

Meaning

Implantable hearing devices encompass a range of surgically implanted devices designed to address hearing loss by bypassing or augmenting damaged auditory structures. These devices utilize advanced technology to stimulate auditory pathways, enabling sound perception and speech comprehension in individuals with sensorineural, conductive, or mixed hearing loss.

Executive Summary

The implantable hearing devices market has witnessed significant growth driven by technological advancements, expanding indications, and rising demand for personalized hearing solutions. With an aging population and increasing prevalence of hearing loss, implantable hearing devices play a crucial role in restoring auditory function and improving communication outcomes for patients worldwide.

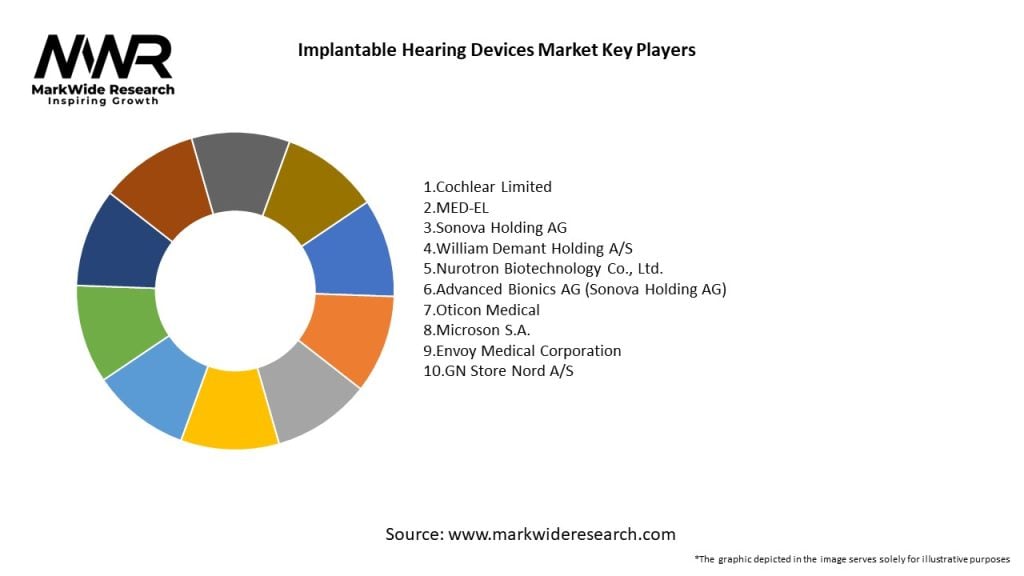

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The implantable hearing devices market operates within a dynamic ecosystem shaped by factors such as technological innovation, regulatory frameworks, reimbursement policies, and patient preferences. Market players must navigate these dynamics strategically to capitalize on growth opportunities, address market challenges, and maintain competitive advantage.

Regional Analysis

The implantable hearing devices market exhibits regional variations influenced by demographic trends, healthcare infrastructure, regulatory frameworks, and socio-economic factors. Let’s explore the market dynamics across key regions:

Competitive Landscape

Leading Companies in Implantable Hearing Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

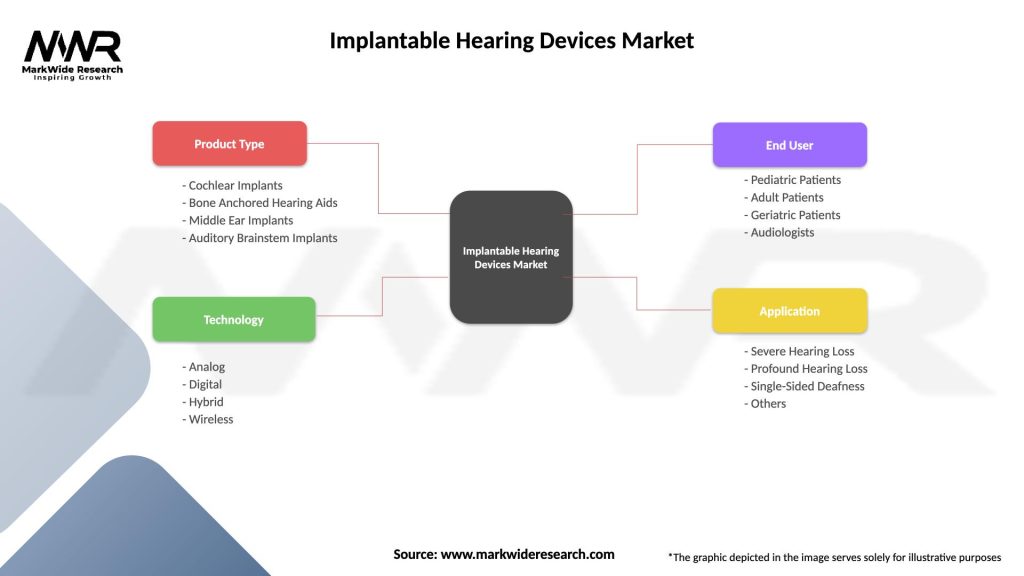

Segmentation

The implantable hearing devices market can be segmented based on various factors, including:

Segmentation enables market players to target specific patient populations, tailor marketing strategies, and optimize product offerings to meet diverse clinical needs and market demands.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis offers valuable insights into the implantable hearing devices market’s strengths, weaknesses, opportunities, and threats, guiding strategic decision-making for industry stakeholders:

Understanding these factors enables market players to leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats, thereby enhancing market competitiveness and resilience.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic exerted significant effects on the implantable hearing devices market, reshaping patient preferences, clinical practices, and healthcare delivery models. Key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The implantable hearing devices market is poised for sustained growth driven by advancing technology, expanding indications, and increasing patient awareness about hearing health. Despite challenges such as high treatment costs and surgical risks, strategic investments in research and development, market expansion initiatives, and patient-centric care models position industry stakeholders for success in the dynamic global market landscape.

Conclusion

In conclusion, the implantable hearing devices market represents a dynamic and evolving ecosystem, driven by technological innovation, regulatory advancements, and patient-centric care models. With a growing prevalence of hearing loss and increasing demand for personalized treatment solutions, implantable hearing devices play a crucial role in restoring auditory function and improving quality of life for patients worldwide. By embracing innovation, fostering strategic partnerships, and prioritizing patient care, industry stakeholders can navigate market challenges, capitalize on growth opportunities, and contribute to transformative advancements in hearing healthcare.

What is Implantable Hearing Devices?

Implantable hearing devices are medical devices designed to improve hearing for individuals with hearing loss. These devices include cochlear implants and bone-anchored hearing aids, which are surgically placed in the body to provide a more effective solution than traditional hearing aids.

What are the key companies in the Implantable Hearing Devices Market?

Key companies in the Implantable Hearing Devices Market include Cochlear Limited, MED-EL, and Oticon Medical, which are known for their innovative products and technologies in hearing restoration, among others.

What are the drivers of growth in the Implantable Hearing Devices Market?

The growth of the Implantable Hearing Devices Market is driven by the increasing prevalence of hearing loss, advancements in technology, and rising awareness about the benefits of early intervention. Additionally, the aging population contributes significantly to the demand for these devices.

What challenges does the Implantable Hearing Devices Market face?

The Implantable Hearing Devices Market faces challenges such as high surgical costs, potential complications from surgery, and limited awareness among patients regarding available options. These factors can hinder market growth and adoption rates.

What opportunities exist in the Implantable Hearing Devices Market?

Opportunities in the Implantable Hearing Devices Market include the development of advanced technologies, such as wireless connectivity and improved sound processing, as well as expanding into emerging markets where access to hearing solutions is limited. These advancements can enhance user experience and broaden market reach.

What trends are shaping the Implantable Hearing Devices Market?

Trends in the Implantable Hearing Devices Market include the integration of artificial intelligence for personalized hearing experiences, the rise of telehealth services for remote consultations, and the growing focus on patient-centered care. These trends are transforming how hearing loss is managed and treated.

Implantable Hearing Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cochlear Implants, Bone Anchored Hearing Aids, Middle Ear Implants, Auditory Brainstem Implants |

| Technology | Analog, Digital, Hybrid, Wireless |

| End User | Pediatric Patients, Adult Patients, Geriatric Patients, Audiologists |

| Application | Severe Hearing Loss, Profound Hearing Loss, Single-Sided Deafness, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Implantable Hearing Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at